U.S. Automotive Active Safety Systems Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11445

November 2024

82

About the Report

U.S. Automotive Active Safety Systems Market Overview

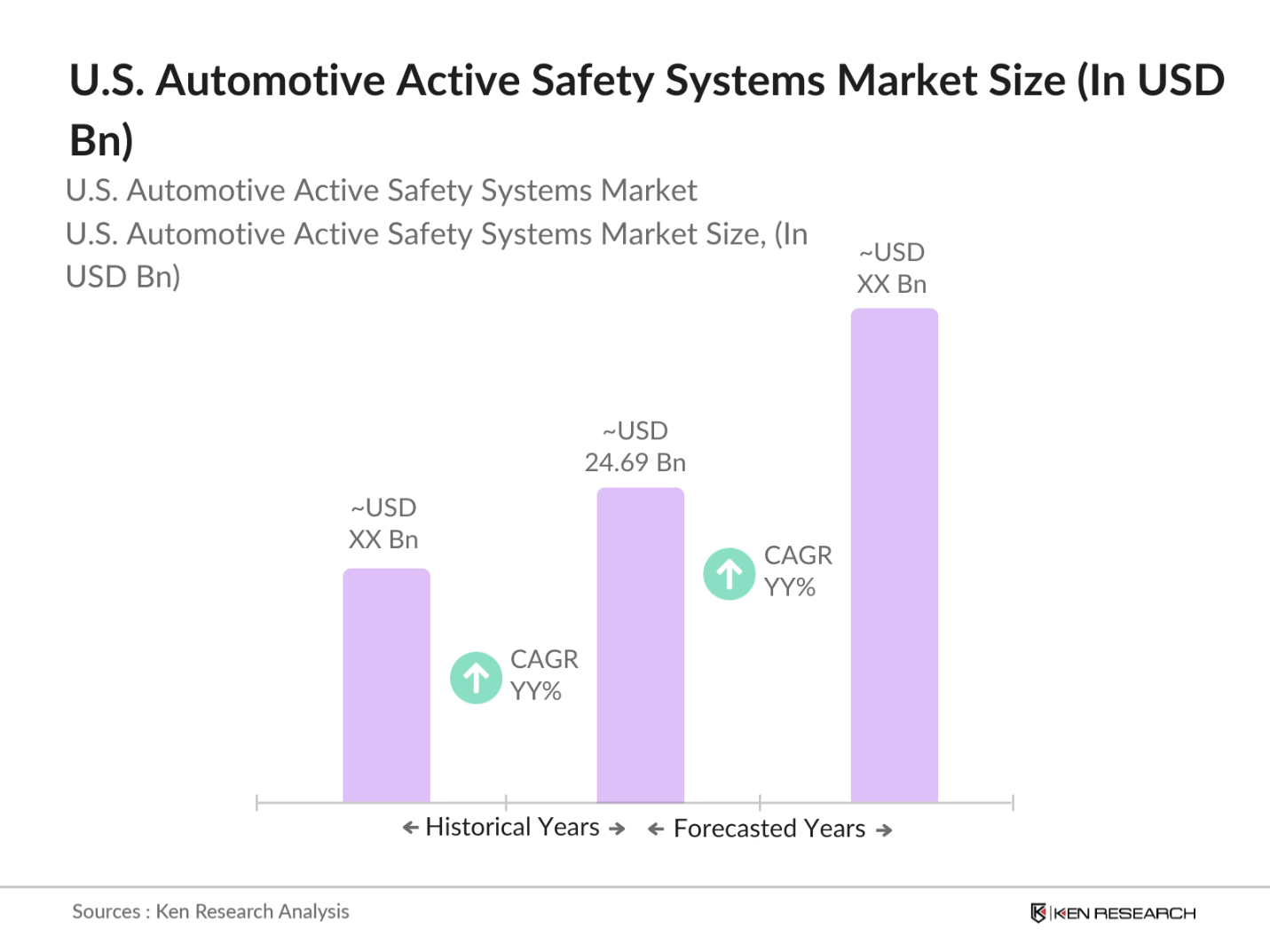

- The U.S. automotive active safety systems market is valued at USD 24.69 billion. This market growth is driven by the continuous evolution of Advanced Driver Assistance Systems (ADAS) technologies, including lane-keeping assist, adaptive cruise control, and automatic emergency braking. Consumer demand for improved vehicle safety, combined with government regulations requiring advanced safety features in new vehicles, fuels this market's expansion. Additionally, the growing inclination toward semi-autonomous and autonomous driving technologies is a key factor driving demand for active safety systems in the U.S. automotive sector.

- The U.S. automotive active safety systems market is dominated by key automotive hubs such as Detroit, Michigan, and California, the latter being a leader in automotive innovation and electric vehicles. These cities are home to major automotive manufacturers and technology companies focusing on safety systems integration. The dominance of these regions is bolstered by strong partnerships between automakers and technology firms, government initiatives supporting autonomous vehicle technology, and increasing consumer demand for vehicles with advanced safety features. Regulatory standards such as the NHTSA's crashworthiness ratings and the push for ADAS integration further fuel the market's growth.

- The National Highway Traffic Safety Administration (NHTSA) plays a crucial role in establishing and enforcing safety standards in the U.S. automotive industry. In 2022, NHTSA introduced guidelines for vehicle manufacturers to enhance safety technologies such as automatic emergency braking, lane-keeping assist, and blind-spot monitoring. These guidelines aim to reduce traffic accidents and fatalities by encouraging automakers to integrate advanced safety features into vehicles. The NHTSA has also been instrumental in promoting the adoption of autonomous vehicle technologies, ensuring that safety protocols evolve in line with new innovations.

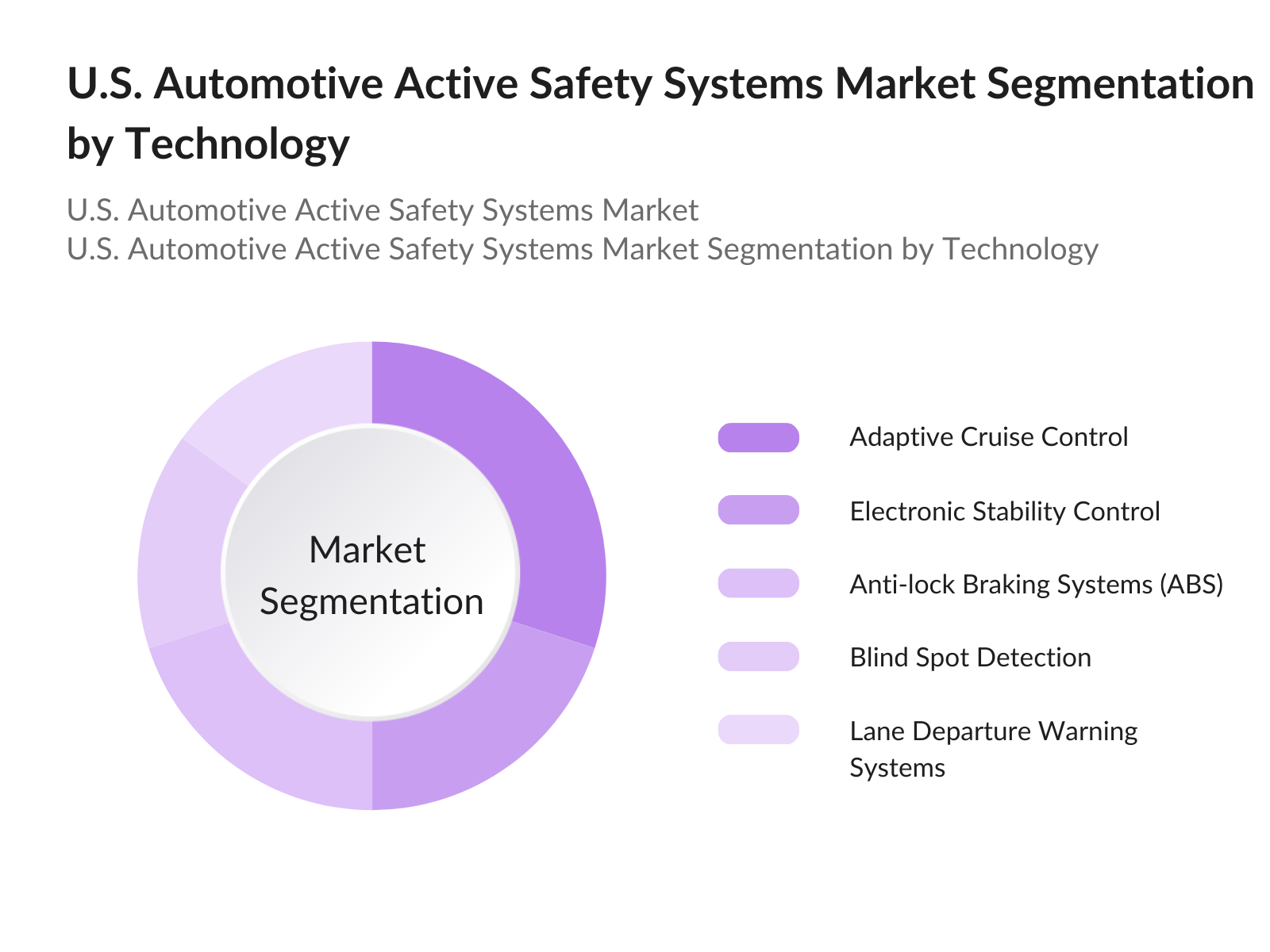

U.S. Automotive Active Safety Systems Market Segmentation

- By Technology: The U.S. automotive active safety systems market is segmented by technology into Anti-lock Braking Systems (ABS), Lane Departure Warning Systems, Adaptive Cruise Control, Electronic Stability Control, and Blind Spot Detection. The Adaptive Cruise Control (ACC) segment dominates the market due to the growing demand for semi-autonomous driving features. ACC, which allows vehicles to maintain a safe distance from the vehicle ahead and adjust speed autonomously, has become a crucial safety feature in many premium and mid-tier vehicles. This segment is highly driven by consumer preference for enhanced driving convenience and safety. As vehicle manufacturers and technology providers continue to improve sensor technologies and integration capabilities, the ACC segment is expected to maintain its leading position.

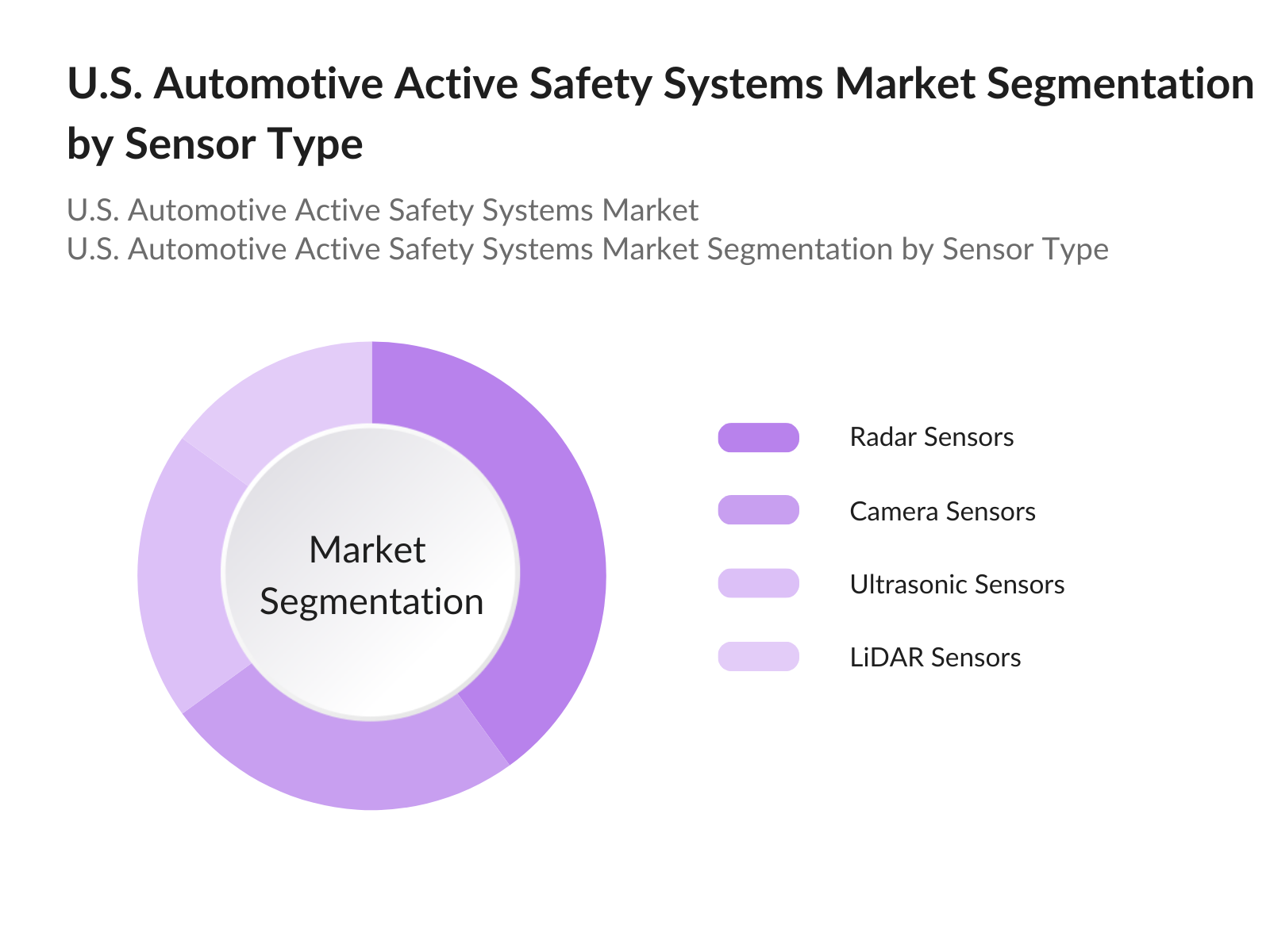

- By Sensor Type: The market is also segmented by sensor type, including Radar Sensors, LiDAR Sensors, Camera Sensors, and Ultrasonic Sensors. Radar sensors dominate this segment due to their reliability in various weather conditions, which is crucial for active safety systems. These sensors provide essential data for several ADAS features, including adaptive cruise control, emergency braking, and collision avoidance. Radar sensors' growing adoption is driven by their high accuracy and affordability compared to other sensor types. As vehicle manufacturers increasingly adopt radar sensors for new vehicles, this segment will continue to hold a substantial market share.

U.S. Automotive Active Safety Systems Market Competitive Landscape

The U.S. automotive active safety systems market is competitive, with several global players leading the way in innovation and market share. The market is dominated by major automotive suppliers such as Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, and Autoliv Inc. These companies have established a strong foothold due to their advanced safety technologies and long-standing relationships with automotive OEMs. With continuous advancements in sensor technology, software algorithms, and connectivity solutions, these companies are positioned to maintain dominance in the market.

U.S. Automotive Active Safety Systems Market Analysis

Market Growth Drivers

- Advanced Driver Assistance Systems (ADAS) Integration: ADAS technologies, such as lane-keeping assist, adaptive cruise control, and collision detection, are becoming increasingly integrated into vehicles. In 2022, the U.S. automotive industry saw more than 20 million vehicles equipped with ADAS technologies. The demand for these systems is expected to grow as automakers seek to enhance vehicle safety, with features such as automatic emergency braking being critical in reducing road fatalities. According to the National Highway Traffic Safety Administration (NHTSA), advanced safety technologies could prevent thousands of crashes annually, highlighting the markets significant growth potential.

- Government Safety Regulations (Federal Motor Vehicle Safety Standards): The U.S. government has established strict regulations under the Federal Motor Vehicle Safety Standards (FMVSS) to ensure vehicle safety. In 2022, FMVSS mandated all new vehicles to include rearview cameras and automatic emergency braking systems, which directly support the market for automotive active safety systems. The U.S. Department of Transportation aims to reduce road traffic accidents and fatalities by introducing regulations that require advanced safety features, driving up demand for ADAS. In addition, the NHTSA enforces regulations requiring improved crash test standards, encouraging manufacturers to adopt advanced safety systems in vehicles.

- Increasing Demand for Autonomous Driving Capabilities: The demand for autonomous driving capabilities in the U.S. is growing steadily. In 2022, over 50,000 autonomous test miles were logged in California alone, according to the California Department of Motor Vehicles (DMV). The U.S. government has also indicated support for autonomous vehicle development, with over 20 states having introduced legislation to enable autonomous vehicle testing on public roads. Autonomous driving features rely heavily on automotive active safety systems, which are essential for vehicle control and passenger safety.

Market Challenges:

- High Development Costs (LiDAR, Radar, Cameras): The cost of developing and integrating advanced safety systems, such as LiDAR sensors, radar, and cameras, remains a significant barrier to widespread adoption, particularly for lower-end vehicle segments. The total cost of LiDAR sensors alone for each vehicle can exceed $1,000. Additionally, radar systems and cameras, necessary for autonomous driving, add substantial costs. In 2022, the average cost of these technologies for automakers was estimated to range from $2,000 to $5,000 per vehicle, increasing the price of vehicles with advanced safety features. Despite this, the demand for safety-enhancing technologies is expected to drive down costs over time.

- Cybersecurity Risks and Data Privacy Concerns: As more vehicles become connected and autonomous, the risk of cybersecurity threats increases. In 2022, the U.S. saw a rise in cyberattacks targeting connected vehicles, highlighting vulnerabilities in communication systems. The increase in data generation by connected vehicles, including location, behavior, and vehicle status data, has raised concerns about data privacy. The U.S. government is working on regulatory frameworks to protect consumer data, but unresolved issues of cybersecurity remain a challenge in the automotive active safety systems market.

U.S. Automotive Active Safety Systems Market Future Outlook

The U.S. automotive active safety systems market is poised for substantial growth over the next few years. As ADAS technologies become more advanced and integrated into vehicle models across various price segments, demand is expected to rise significantly. Key drivers of this growth include the continuous push for enhanced vehicle safety standards, increasing consumer awareness about road safety, and government regulations requiring active safety features in new vehicles. Additionally, the rise of semi-autonomous vehicles and advancements in AI technologies are likely to boost the adoption of active safety systems. The market's future will also see a greater emphasis on connected vehicle technologies and vehicle-to-everything (V2X) communications, which will further enhance the effectiveness of active safety systems.

Market Opportunities:

- Expanding Electric Vehicle Market Integration: The growing popularity of electric vehicles (EVs) presents a significant opportunity for the integration of active safety systems. In 2022, over 800,000 EVs were sold in the U.S., marking a 65% increase from 2021. EVs are often equipped with advanced safety systems as standard due to their focus on modern, sustainable technologies. As the EV market continues to grow, automakers are likely to further integrate safety technologies, creating new growth avenues for the automotive active safety systems market. The Biden administrations push for EV adoption and infrastructure development is also expected to catalyze this growth.

- Potential in Aftermarket Solutions for Older Vehicle Models: There is growing potential for aftermarket solutions for vehicles that were not initially equipped with advanced safety systems. In 2022, the aftermarket sales for ADAS components like parking sensors, collision avoidance, and lane departure systems grew to $1.8 billion. This market is expected to continue expanding as vehicle owners seek to upgrade their older models with safety technologies. As vehicles age, the market for retrofitting active safety systems will grow, representing a substantial opportunity for both manufacturers and suppliers in the automotive safety space.

Scope of the Report

|

By Technology |

Anti-Lock Braking Systems (ABS) Lane Departure Warning Systems Adaptive Cruise Control Electronic Stability Control Blind Spot Detection |

|

By Sensor Type |

Radar Sensors |

|

By Vehicle Type |

Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles |

|

By Component |

Hardware (Sensors, Processors) |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive OEMs

Automotive Tier 1 Suppliers

Vehicle Manufacturers and Developers

ADAS Technology Providers

Automotive Safety Regulatory Bodies (National Highway Traffic Safety Administration - NHTSA)

Insurance Companies

Investment and Venture Capital Firms

Government and Regulatory Bodies (Department of Transportation, NHTSA)

Companies

Players mentioned in the report

Robert Bosch GmbH

Continental AG

Denso Corporation

ZF Friedrichshafen AG

Autoliv Inc.

Magna International

Valeo SA

Aptiv PLC

HARMAN International

NVIDIA Corporation

Mobileye (Intel Corporation)

Hyundai Mobis

Hitachi Automotive Systems

Veoneer Inc.

Texas Instruments Incorporated

Table of Contents

1. U.S. Automotive Active Safety Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Automotive Active Safety Systems Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Automotive Active Safety Systems Market Analysis

3.1. Growth Drivers

- Advanced Driver Assistance Systems (ADAS) Integration

- Government Safety Regulations (Federal Motor Vehicle Safety Standards)

- Rising Consumer Awareness on Road Safety

- Increasing Demand for Autonomous Driving Capabilities

3.2. Market Challenges

- High Development Costs (LiDAR, radar, cameras)

- Limited Consumer Awareness in Lower-End Segments

- Cybersecurity Risks and Data Privacy Concerns

3.3. Opportunities

- Expanding Electric Vehicle Market Integration

- Advancements in AI and Machine Learning for Real-Time Analysis

- Potential in Aftermarket Solutions for Older Vehicle Models

3.4. Trends

- Integration of Vehicle-to-Everything (V2X) Communication

- Development of 5G-Enabled Safety Systems

- Expansion of Over-the-Air (OTA) Updates for Safety Features

3.5. Regulatory Landscape

- National Highway Traffic Safety Administration (NHTSA) Guidelines

- Corporate Average Fuel Economy (CAFE) Standards

- Federal and State-Level Compliance Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. U.S. Automotive Active Safety Systems Market Segmentation

4.1. By Technology (In Value %)

- Anti-Lock Braking Systems (ABS)

- Lane Departure Warning Systems

- Adaptive Cruise Control

- Electronic Stability Control

- Blind Spot Detection

4.2. By Sensor Type (In Value %)

- Radar Sensors

- LiDAR Sensors

- Camera Sensors

- Ultrasonic Sensors

4.3. By Vehicle Type (In Value %)

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

4.4. By Component (In Value %)

- Hardware (Sensors, Processors)

- Software (ADAS, AI Algorithms)

4.5. By Sales Channel (In Value %)

- OEM

- Aftermarket

5. U.S. Automotive Active Safety Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International

- Autoliv Inc.

- Valeo SA

- Aptiv PLC

- HARMAN International

- NVIDIA Corporation

- Mobileye (Intel Corporation)

- Hyundai Mobis

- Hitachi Automotive Systems

- Veoneer Inc.

- Texas Instruments Incorporated

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share, Product Portfolio, Technological Advancements, Partnerships, Market Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. R&D Expenditure

5.8. Joint Ventures and Collaborations

6. U.S. Automotive Active Safety Systems Market Regulatory Framework

6.1. Safety Standards and Compliance Requirements

6.2. Certification Processes (ISO 26262, FMVSS)

6.3. Impact of Regulatory Changes on Market Growth

7. U.S. Automotive Active Safety Systems Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Automotive Active Safety Systems Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Sensor Type (In Value %)

8.3. By Vehicle Type (In Value %)

8.4. By Component (In Value %)

8.5. By Sales Channel (In Value %)

9. U.S. Automotive Active Safety Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. Strategic Partnership Recommendations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. automotive active safety systems market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the U.S. automotive active safety systems market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple automotive manufacturers and technology providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. automotive active safety systems market.

Frequently Asked Questions

01. How big is the U.S. Automotive Active Safety Systems Market?

The U.S. automotive active safety systems market is valued at USD 24.69 billion, driven by advancements in ADAS technologies and government regulations requiring enhanced vehicle safety features.

02. What are the key drivers of growth in the U.S. Automotive Active Safety Systems Market?

Key growth drivers include increasing demand for semi-autonomous vehicles, government safety regulations, consumer awareness of road safety, and technological innovations in active safety systems.

03. Who are the major players in the U.S. Automotive Active Safety Systems Market?

The major players include Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, and Autoliv Inc., which dominate due to their strong technological innovations and strategic partnerships with OEMs.

04. What are the challenges faced by the U.S. Automotive Active Safety Systems Market?

Challenges include high development costs for advanced sensors, cybersecurity risks, and regulatory hurdles, especially concerning data privacy and safety standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.