US Automotive Air Filters Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD9790

December 2024

91

About the Report

US Automotive Air Filters Market Overview

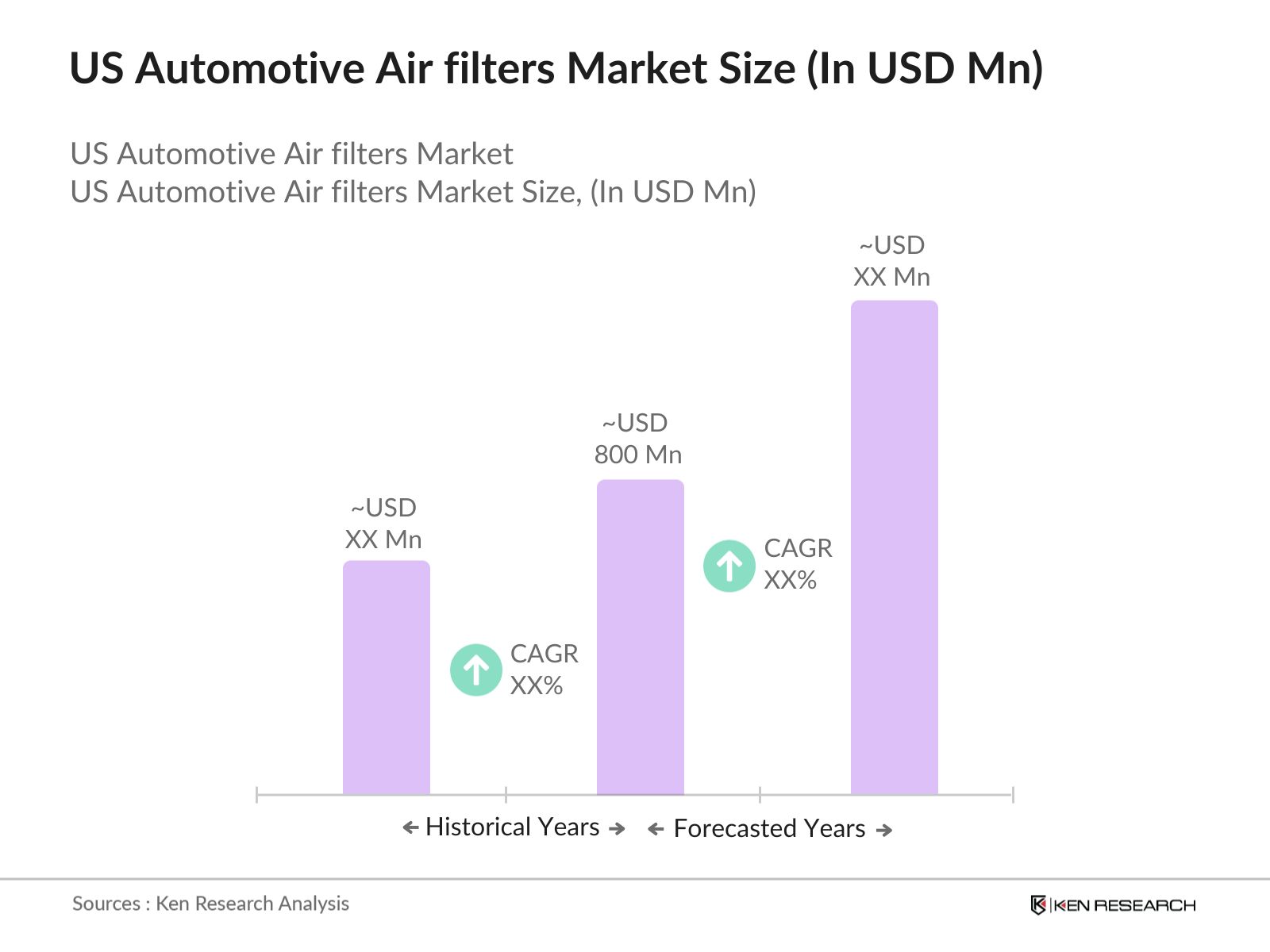

- The US automotive air filters market is valued at USD 800 million, primarily driven by increasing vehicle production, a rise in consumer awareness regarding air quality, and stringent government emission regulations. The surge in automobile sales, especially in urban regions, has increased the demand for engine air filters and cabin air filters. The market is further fueled by a growing aftermarket segment as consumers continue to invest in maintenance and replacement of air filters for better fuel efficiency and vehicle longevity.

- In terms of geographic dominance, cities like Detroit, Los Angeles, and Houston are key players in the US automotive air filters market. Detroits dominance is attributed to its role as the heart of the US automotive industry, housing major manufacturers and a large-scale production network. Los Angeles and Houston, on the other hand, lead due to high vehicle ownership rates and strict state-level emission regulations like those from the California Air Resources Board (CARB), making these regions substantial contributors to the market.

- The U.S. Environmental Protection Agency (EPA) has set stringent emission regulations that significantly impact the automotive air filter market. These regulations, aimed at reducing greenhouse gas emissions from vehicles, push automakers to incorporate more efficient air filtration systems to meet emission targets. In 2023, the EPA tightened vehicle emission standards, requiring a 7% annual reduction in CO2 emissions from passenger vehicles. This has spurred demand for advanced air filtration solutions, especially in internal combustion engine vehicles, to ensure compliance with these regulations.

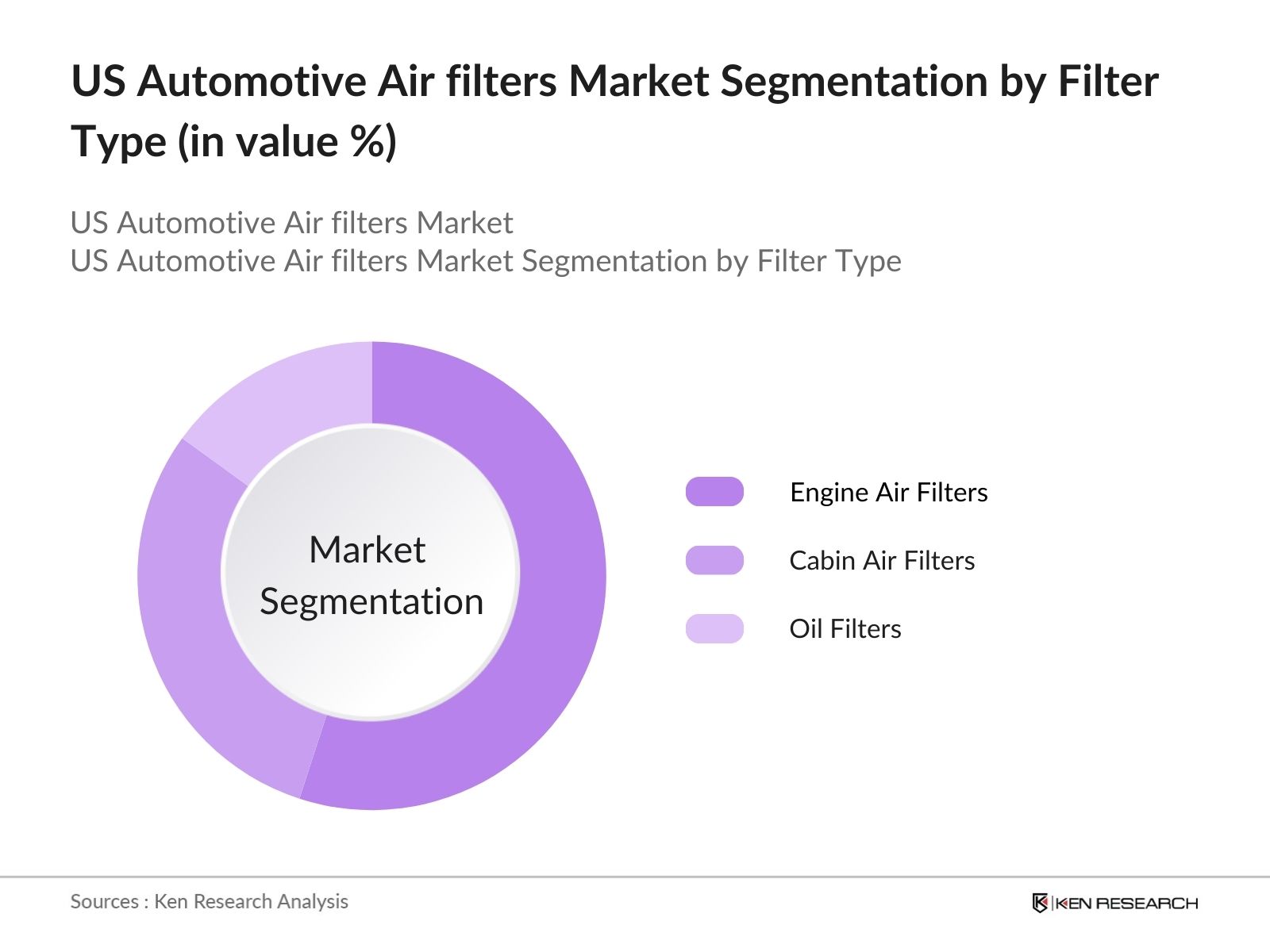

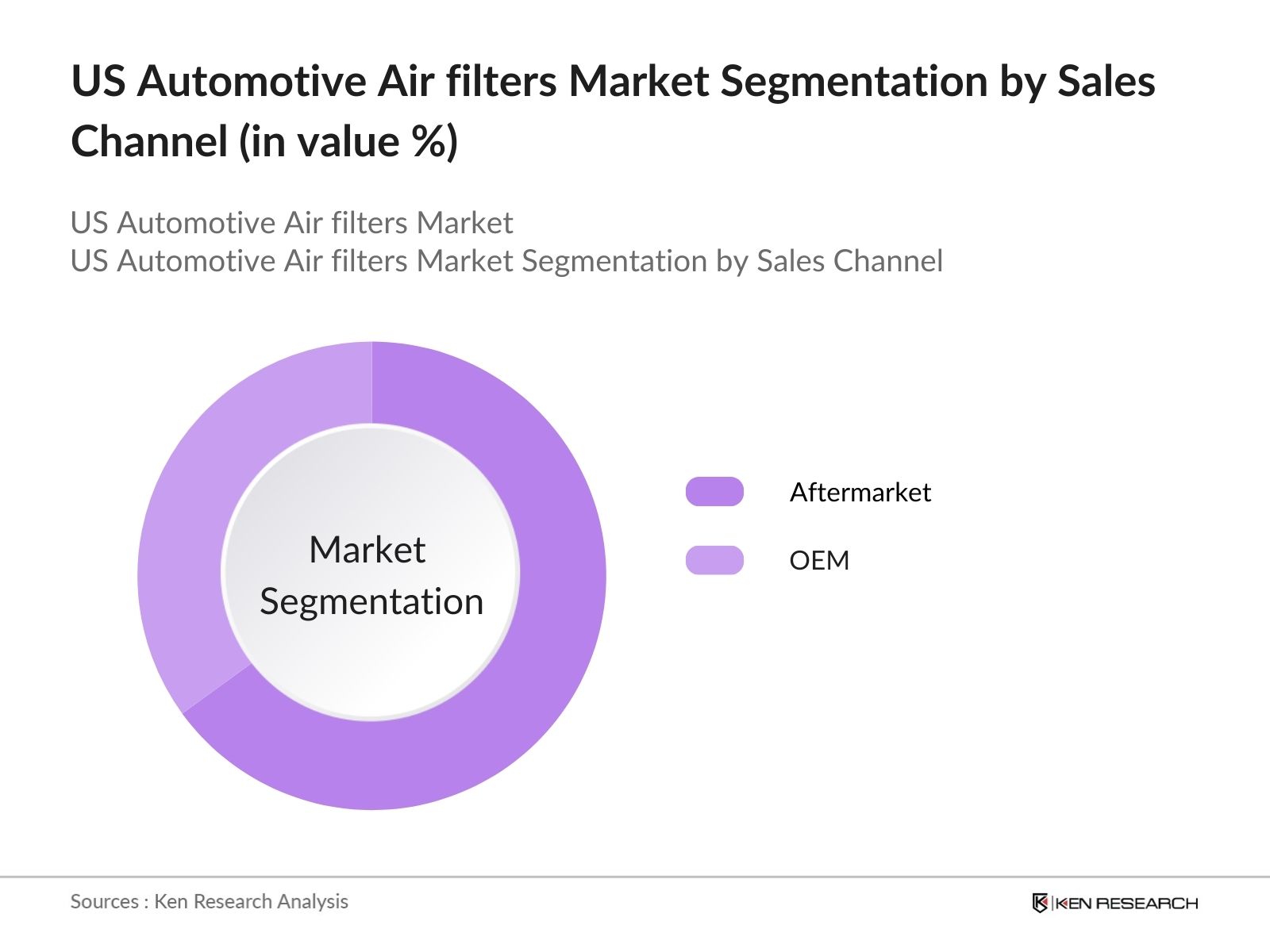

US Automotive Air Filters Market Segmentation

The US automotive air filters market is segmented by filter type and by sales channels.

- By Filter Type: The US automotive air filters market is segmented by filter type into engine air filters, cabin air filters, and oil filters. Engine air filters dominate this segment due to their crucial role in maintaining engine performance and protecting components from debris. The increasing use of vehicles and the need for frequent engine air filter replacements in high-mileage regions contribute to their market share. Engine air filters also support better fuel efficiency, making them a preferred choice in both the OEM and aftermarket segments.

- By Sales Channel: The market is further segmented by sales channels into Original Equipment Manufacturer (OEM) and aftermarket channels. The aftermarket channel holds the dominant share due to the rising consumer awareness of regular vehicle maintenance and the availability of a wide range of filter options. Consumers often prefer aftermarket solutions due to their affordability and ease of accessibility compared to OEM filters, especially in high-traffic regions where vehicles undergo frequent servicing.

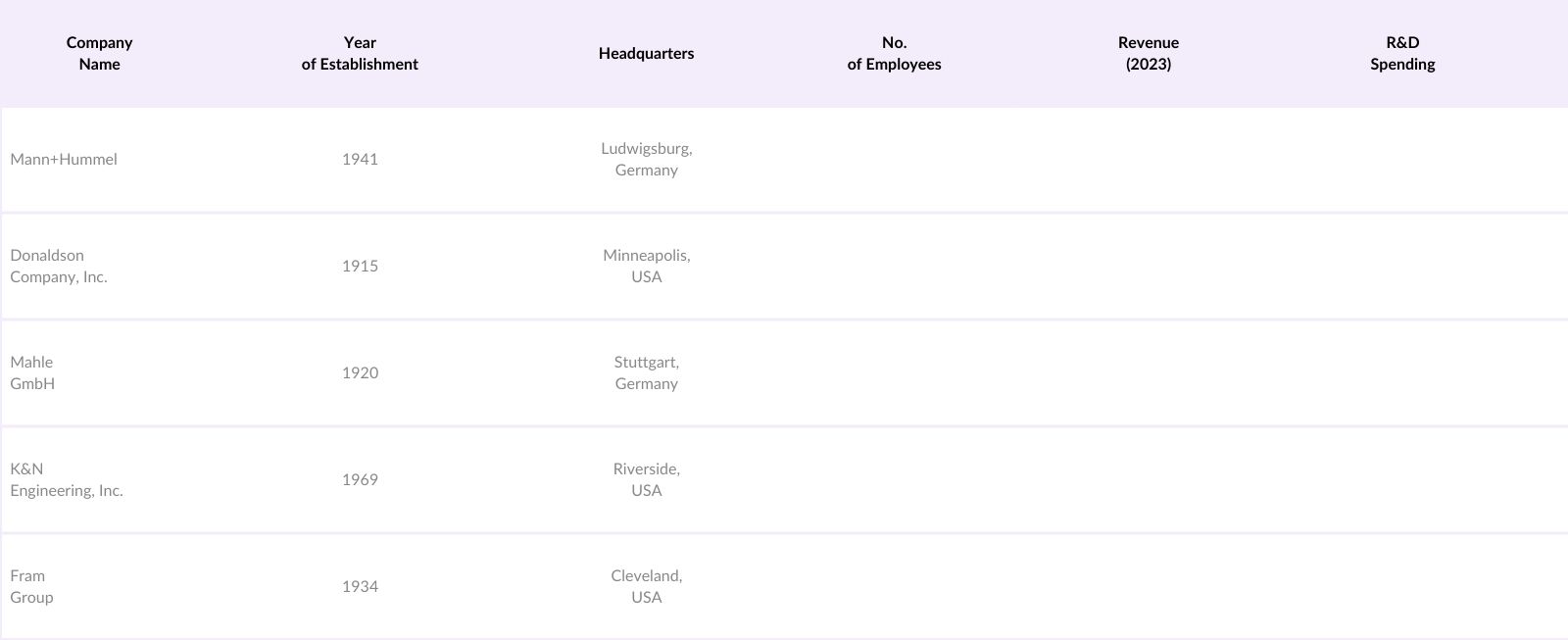

US Automotive Air Filters Market Competitive Landscape

The US automotive air filters market is characterized by a mix of global and local players, each competing on the basis of technological advancements, product innovation, and market reach. The consolidation of major brands has strengthened the competitive landscape, with the focus being on expanding aftermarket services and developing filters suited for electric and hybrid vehicles.

The US automotive air filters market is dominated by industry giants like Mann+Hummel, Donaldson Company, and Mahle GmbH. These companies have a strong market presence due to their robust distribution networks and continuous investment in R&D to improve filter efficiency. The increasing demand for advanced filtration technologies, particularly for electric vehicles (EVs) and cabin air filters, is pushing these companies to innovate and remain competitive.

US Automotive Air Filters Industry Analysis

Growth Drivers

- Stringent Emission Regulations (US EPA Regulations, CAFE Standards): The U.S. Environmental Protection Agency (EPA) continues to enforce strict regulations to curb vehicular emissions, targeting reductions in nitrogen oxides, carbon monoxide, and particulate matter. The EPAs Tier 3 standards mandate sulfur reductions in gasoline to 10 parts per million, significantly impacting air filter technology. Additionally, the Corporate Average Fuel Economy (CAFE) standards require vehicle manufacturers to meet specific efficiency requirements, encouraging better engine filtration systems. According to the EPA, light-duty vehicles contribute nearly 60% of U.S. transportation-related emissions, necessitating high-performance air filters. These regulations create an ongoing demand for advanced air filtration technologies.

- Increasing Vehicle Sales (New Vehicle Registrations, Fleet Size Growth): In 2023, U.S. new vehicle registrations reached over 15 million units, highlighting continued growth in the automotive market. The total U.S. vehicle fleet exceeded 290 million units, driven by increased demand for personal and commercial vehicles. With every new vehicle, the demand for OEM and aftermarket air filters rises, supporting maintenance and replacement cycles. Growing vehicle registrations, particularly for trucks and SUVs, contribute to the steady demand for engine and cabin air filters, bolstering the market for automotive air filtration systems.

- Rising Consumer Awareness for Cabin Air Quality: Consumer awareness around the health impacts of poor cabin air quality has grown significantly, driven by concerns over airborne pollutants, allergens, and health risks, such as respiratory illnesses. U.S. residents spend approximately 8.5 hours daily in vehicles, leading to increased focus on improving air quality inside cars. With air pollutants like dust and pollen rising in metropolitan areas, the U.S. cabin air filtration market sees heightened demand for premium filters, with HEPA filters becoming a standard in certain vehicles. Automotive manufacturers have responded by integrating advanced filtration systems to meet consumer needs for healthier cabin environments.

Market Challenges

- Availability of Low-Cost Substitutes: The availability of low-cost air filters, primarily imported from countries like China and India, poses a significant challenge to premium filter manufacturers in the U.S. These cheaper alternatives, often made from lower-quality materials, offer short-term cost savings for consumers but may underperform in terms of efficiency and durability. U.S. Customs data shows that imports of automotive parts, including filters, reached nearly $60 billion in 2023, pressuring domestic manufacturers to innovate or reduce costs. Despite their lower quality, the widespread availability of these substitutes creates stiff competition for U.S.-made high-performance filters.

- Fluctuations in Raw Material Prices (Steel, Plastic Components): The volatility in raw material prices, particularly for steel and plastics, has been a persistent challenge for the automotive air filter market. In 2023, the price of steel in the U.S. reached approximately $1,200 per ton, while global plastic prices experienced similar fluctuations due to supply chain disruptions. These cost pressures impact manufacturers ability to maintain profitability without passing costs on to consumers. With automotive air filters relying on these materials for structural components, price volatility directly affects production costs and market competitiveness.

US Automotive Air Filters Market Future Outlook

Over the next five years, the US automotive air filters market is expected to grow steadily, driven by advancements in filter technology, increasing vehicle ownership, and heightened awareness of air quality in cabins. The growing trend of electric vehicles (EVs) will also influence the market, as specialized air filters are developed to suit the unique requirements of EV cabins. Furthermore, strict government regulations concerning vehicle emissions and environmental sustainability will encourage both consumers and manufacturers to adopt newer filtration technologies.

Market Opportunities

- Electrification of Vehicles (EV Penetration, Hybrid Market Impact): The rapid electrification of the U.S. vehicle market presents significant opportunities for air filter manufacturers, particularly as cabin air filtration becomes a primary focus in EVs and hybrid vehicles. By 2023, over 2.5 million electric vehicles were operating in the U.S., with further penetration expected in urban areas where air quality is a concern. As EV adoption grows, demand for advanced filtration systemsespecially cabin air filters that target particulate matter and allergenswill increase. Air filter manufacturers are well-positioned to innovate solutions specifically designed for EV platforms, particularly in urbanized and high-pollution regions.

- Advancements in Filtration Technology (Nanotechnology, HEPA Filters): Technological advancements, particularly in nanotechnology, are revolutionizing the U.S. automotive air filter market. Filters using nanofibers can capture particles as small as 0.3 microns, providing superior protection against pollutants. HEPA filters, commonly used in high-end vehicles, are becoming more widely adopted as a standard feature across vehicle classes. The integration of these advanced filtration technologies has led to greater market opportunities for high-performance filters. The increasing focus on air quality standards in automotive cabins further drives the need for innovations in this field, particularly for health-conscious consumers.

Scope of the Report

|

Cabin Air Filters Engine Air Filters Oil Filters |

|

|

By Vehicle Type |

Passenger Cars |

|

By Sales Channel |

OEM |

|

By Filter Media |

Cellulose Filters |

|

By Region |

North East West South |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Aftermarket Distributors and Dealers

Automotive Repair and Maintenance Centers

Fleet Management Companies

Government and Regulatory Bodies (US EPA, California Air Resources Board)

Automotive Parts Suppliers

Investments and Venture Capitalist Firms

Environmental Protection Organizations

Companies

Major Players in the US Automotive Air Filters Market

Mann+Hummel

Donaldson Company, Inc.

Mahle GmbH

K&N Engineering, Inc.

Fram Group

Sogefi Group

Ahlstrom-Munksj

Denso Corporation

Cummins Inc.

Parker Hannifin Corporation

Hengst SE

Robert Bosch GmbH

Freudenberg Group

AC Delco (General Motors)

UFI Filters

Table of Contents

1. US Automotive Air Filters Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Filter Demand Growth, Industry Expansion Rate)

1.4. Market Segmentation Overview (Filter Type, Vehicle Type, Sales Channel, Filter Media, Region)

2. US Automotive Air Filters Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (OEM Partnerships, Technological Advancements)

3. US Automotive Air Filters Market Analysis

3.1. Growth Drivers

3.1.1. Stringent Emission Regulations (US EPA Regulations, CAFE Standards)

3.1.2. Increasing Vehicle Sales (New Vehicle Registrations, Fleet Size Growth)

3.1.3. Rising Consumer Awareness for Cabin Air Quality

3.1.4. Aftermarket Sales Growth (DIY Installation, Maintenance Trends)

3.2. Market Challenges

3.2.1. Availability of Low-Cost Substitutes

3.2.2. Fluctuations in Raw Material Prices (Steel, Plastic Components)

3.2.3. Decline in Internal Combustion Engine (ICE) Vehicles

3.3. Opportunities

3.3.1. Electrification of Vehicles (EV Penetration, Hybrid Market Impact)

3.3.2. Advancements in Filtration Technology (Nanotechnology, HEPA Filters)

3.3.3. Sustainable and Eco-Friendly Filters (Recyclable Materials, Biodegradable Components)

3.4. Trends

3.4.1. Integration of Smart Filters (IOT-enabled Filters, Air Quality Sensors)

3.4.2. Lightweight and Compact Filters for EVs (EV Adaptation)

3.4.3. Growing Focus on Cabin Air Quality (Health Concerns, Airborne Allergens)

3.5. Government Regulations

3.5.1. EPA Regulations on Automotive Emissions

3.5.2. CAFE Standards

3.5.3. US Federal Motor Vehicle Safety Standards (FMVSS)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Aftermarket Players, Raw Material Suppliers)

3.8. Porters Five Forces

3.9. Competitive Landscape Analysis

4. US Automotive Air Filters Market Segmentation

4.1. By Filter Type (in Value %)

4.1.1. Cabin Air Filters

4.1.2. Engine Air Filters

4.1.3. Oil Filters

4.2. By Vehicle Type (in Value %)

4.2.1. Passenger Cars

4.2.2. Light Commercial Vehicles (LCVs)

4.2.3. Heavy Commercial Vehicles (HCVs)

4.3. By Sales Channel (in Value %)

4.3.1. Original Equipment Manufacturer (OEM)

4.3.2. Aftermarket

4.4. By Filter Media (in Value %)

4.4.1. Cellulose Filters

4.4.2. Synthetic Filters

4.4.3. Activated Carbon Filters

4.4.4. Others (Nanofiber, Glass Fiber)

4.5. By Region (in Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. US Automotive Air Filters Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Mann+Hummel

5.1.2. Donaldson Company, Inc.

5.1.3. K&N Engineering, Inc.

5.1.4. Sogefi Group

5.1.5. Mahle GmbH

5.1.6. Ahlstrom-Munksj

5.1.7. Denso Corporation

5.1.8. Cummins Inc.

5.1.9. Parker Hannifin Corporation

5.1.10. Hengst SE

5.1.11. Robert Bosch GmbH

5.1.12. Freudenberg Group

5.1.13. Fram Group

5.1.14. AC Delco (General Motors)

5.1.15. UFI Filters

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Global Presence, R&D Spend, Market Share, Product Portfolio, Technological Capability)

5.3. Market Share Analysis (OEM vs Aftermarket)

5.4. Strategic Initiatives (Product Innovations, Partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. US Automotive Air Filters Market Regulatory Framework

6.1. Environmental Protection Agency (EPA) Standards

6.2. California Air Resources Board (CARB) Regulations

6.3. US Department of Transportation Standards

6.4. Compliance Requirements (Vehicle Emissions, Product Safety)

6.5. Certification Processes (SAE, ISO Certifications)

7. US Automotive Air Filters Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. US Automotive Air Filters Future Market Segmentation

8.1. By Filter Type (in Value %)

8.2. By Vehicle Type (in Value %)

8.3. By Sales Channel (in Value %)

8.4. By Filter Media (in Value %)

8.5. By Region (in Value %)

9. US Automotive Air Filters Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify the critical variables influencing the US automotive air filters market, such as government regulations, automotive sales trends, and consumer preferences. We gather insights from multiple stakeholders, including manufacturers, distributors, and regulatory bodies. The objective is to capture the factors that drive demand and supply in the market.

Step 2: Market Analysis and Construction

In this phase, we assess the historical market data and trends related to automotive air filters. The data is gathered from industry reports and validated sources such as government databases and industry trade associations. This helps in building a comprehensive understanding of market performance and the key drivers influencing growth.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses that are validated through in-depth interviews with industry experts. These consultations provide operational insights and financial data that help to verify our findings and refine the analysis. This ensures that our data is accurate and relevant to current market dynamics.

Step 4: Research Synthesis and Final Output

In the final step, we synthesize all the gathered information into a comprehensive report. The synthesis includes data verification through cross-referencing multiple sources, ensuring that the output is both accurate and actionable for our clients.

Frequently Asked Questions

01. How big is the US Automotive Air Filters Market?

The US automotive air filters market was valued at USD 800 million, driven by the increasing demand for vehicle maintenance, government regulations, and growing consumer awareness regarding air quality.

02. What are the challenges in the US Automotive Air Filters Market?

Challenges in US automotive air filters market include the rise of low-cost substitutes, fluctuations in raw material prices, and the transition to electric vehicles, which require different types of filters. Additionally, competition from global players adds pressure to local manufacturers.

03. Who are the major players in the US Automotive Air Filters Market?

Key players in the US automotive air filters market include Mann+Hummel, Donaldson Company, Mahle GmbH, K&N Engineering, and Fram Group. These companies dominate due to their extensive product portfolios, strong OEM partnerships, and continuous investment in R&D.

04. What are the growth drivers of the US Automotive Air Filters Market?

The US automotive air filters market is propelled by factors such as rising vehicle ownership, increasing regulatory pressure on emissions, and consumer demand for better in-cabin air quality. The aftermarket segment is also growing due to higher vehicle maintenance.

05. What are the key opportunities in the US Automotive Air Filters Market?

Key opportunities in US automotive air filters market include the development of filters for electric vehicles, innovations in filtration technology, and the introduction of sustainable filter materials. The aftermarket also presents significant growth opportunities due to the increasing number of vehicles on the road.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.