US Automotive Chassis Market Outlook to 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11471

December 2024

96

About the Report

US Automotive Chassis Market Overview

- The US automotive chassis market has demonstrated robust growth, achieving a valuation of USD 21.89 billion. This growth is primarily driven by advancements in materials science and manufacturing technologies that enable the production of lightweight yet durable chassis. Increasing demand for electric vehicles (EVs) and autonomous vehicles (AVs) is further propelling the market as these segments require chassis solutions that support their unique engineering demands. The focus on reducing vehicle weight to improve fuel efficiency and lower emissions has also fueled growth.

- California, Texas, and Michigan are leading markets for automotive chassis due to their well-established automotive industries, technological innovation hubs, and high demand for EVs and AVs. California, known for its stringent emission regulations and environmentally conscious consumers, supports a significant EV market. Texas and Michigan are dominant due to the presence of major automotive manufacturing facilities and a skilled workforce, strengthening their competitive advantage in the automotive chassis industry.

- The U.S. government has allocated funds to support research in advanced vehicle design, including modular and lightweight chassis systems, through grants from the Department of Energy's Vehicle Technologies Office. These funds are directed toward automotive research institutions and companies focusing on innovative designs that improve fuel efficiency and reduce emissions, aiding in the broader transition to sustainable transportation.

US Automotive Chassis Market Segmentation

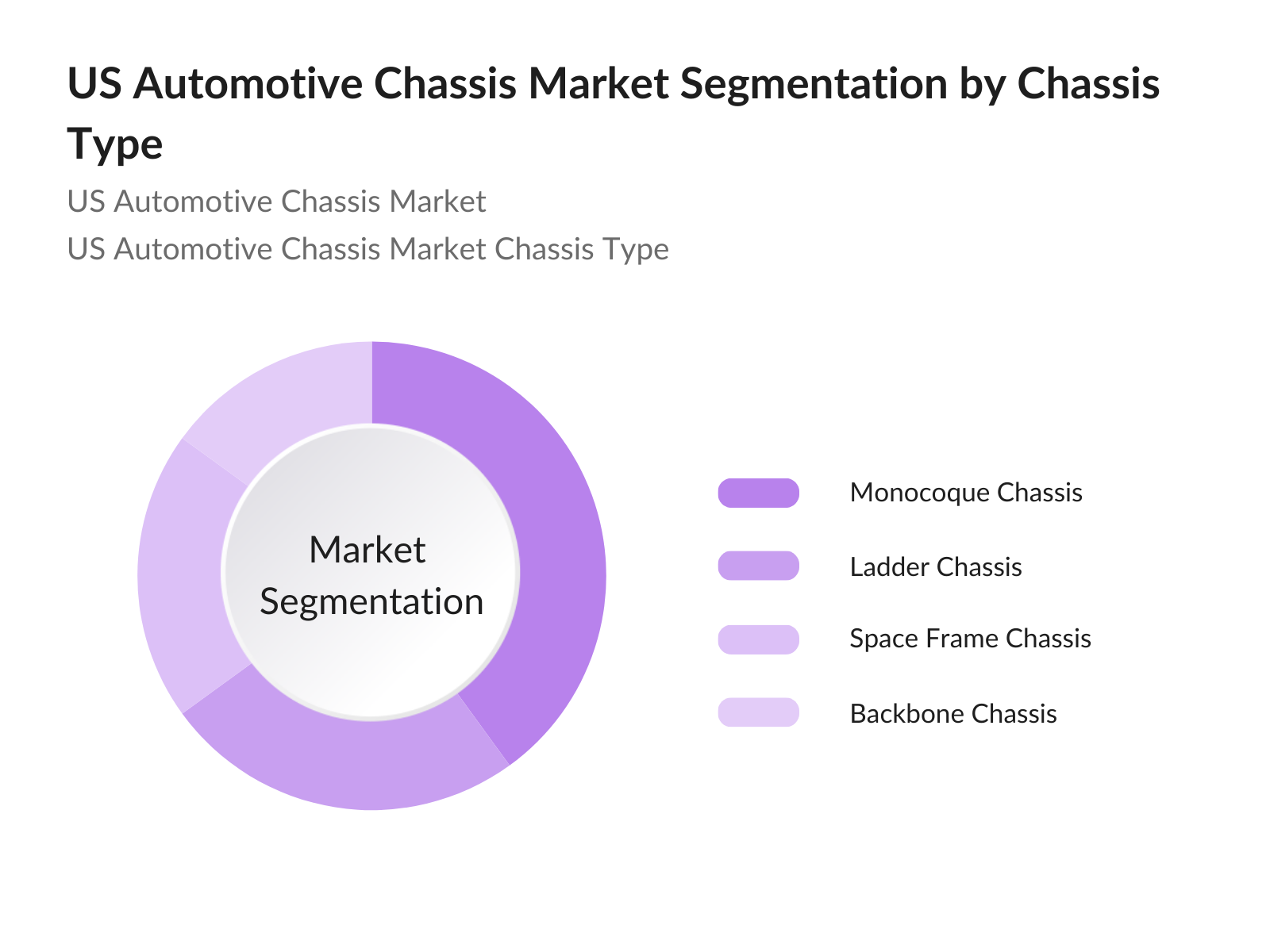

- By Chassis Type: The US automotive chassis market is segmented by chassis type into backbone chassis, ladder chassis, monocoque chassis, and space frame chassis. Among these, monocoque chassis holds a dominant market share due to its widespread use in passenger vehicles and its ability to reduce weight while maintaining structural integrity. This type of chassis supports fuel efficiency and is a popular choice among automotive manufacturers due to its cost-effectiveness and ease of production. Monocoque design also enhances vehicle stability and crash safety, which are increasingly prioritized in modern vehicle design.

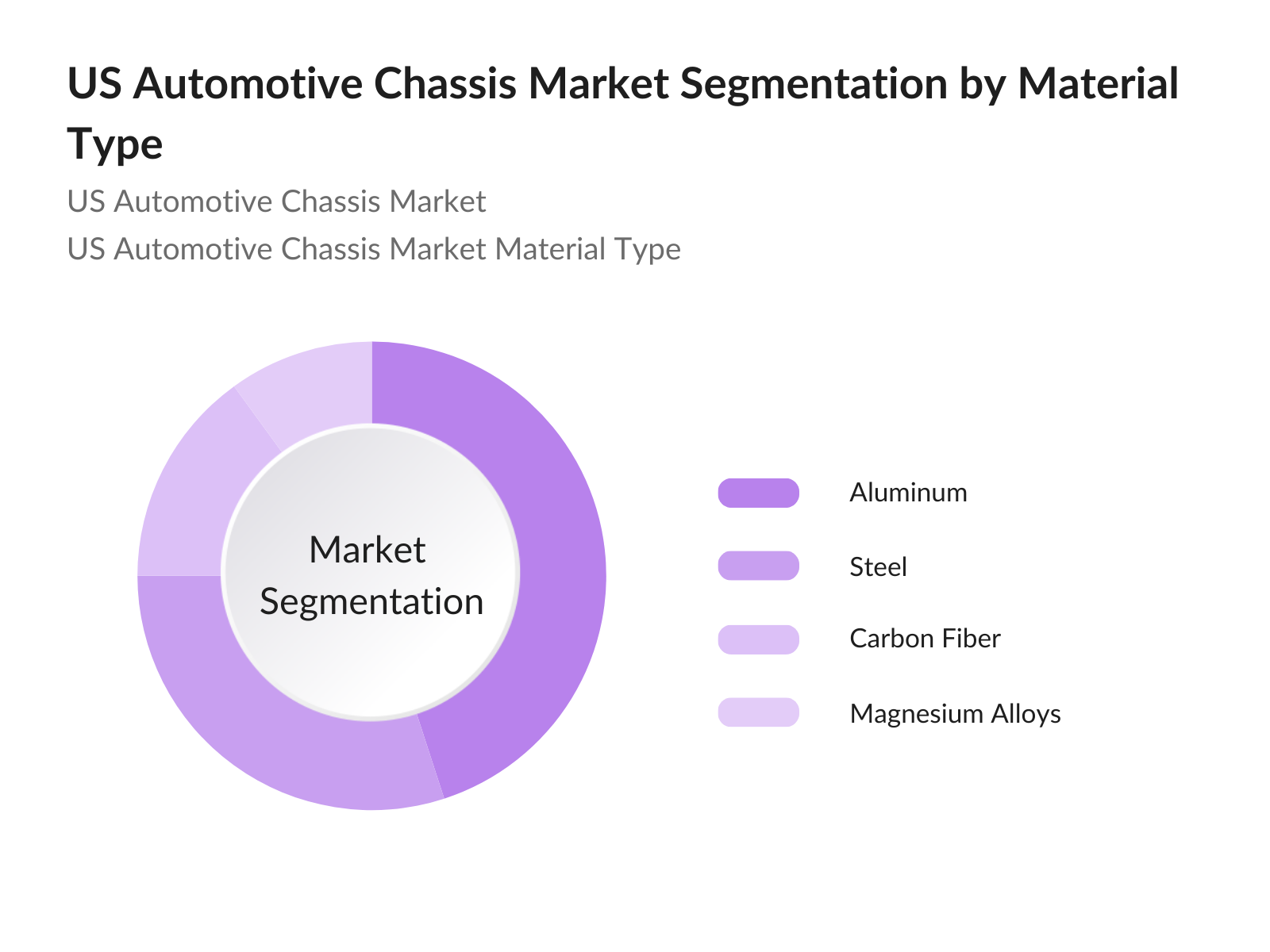

By Material Type: The market is also segmented by material type, including steel, aluminum, carbon fiber, and magnesium alloys. Aluminum is the leading material in terms of market share due to its favorable strength-to-weight ratio, which is essential for manufacturing lightweight chassis. The increasing shift toward electric and hybrid vehicles has further pushed demand for aluminum as it allows manufacturers to offset the added battery weight, enhancing vehicle efficiency. Aluminum's recyclability and regulatory compliance make it an attractive choice for automotive manufacturers focused on sustainability.

By Material Type: The market is also segmented by material type, including steel, aluminum, carbon fiber, and magnesium alloys. Aluminum is the leading material in terms of market share due to its favorable strength-to-weight ratio, which is essential for manufacturing lightweight chassis. The increasing shift toward electric and hybrid vehicles has further pushed demand for aluminum as it allows manufacturers to offset the added battery weight, enhancing vehicle efficiency. Aluminum's recyclability and regulatory compliance make it an attractive choice for automotive manufacturers focused on sustainability.

US Automotive Chassis Market Competitive Landscape

The US automotive chassis market is dominated by a few major players who leverage their technological expertise and extensive distribution networks to capture market share. Companies like Magna International and ZF Friedrichshafen AG lead the market due to their advanced R&D capabilities and established relationships with OEMs.

US Automotive Chassis Market Analysis

Market Growth Drivers

- Shift towards Lightweight Chassis Materials (e.g., Aluminum, Carbon Fiber): The U.S. automotive industry is increasingly adopting lightweight materials such as aluminum and carbon fiber to enhance fuel efficiency and reduce emissions. This shift is driven by the need to meet Corporate Average Fuel Economy (CAFE) standards set by the National Highway Traffic Safety Administration (NHTSA), which require manufacturers to improve fuel efficiency. Lightweight materials help manufacturers address regulatory demands and environmental concerns while enhancing vehicle performance.

- Technological Advancements in Chassis Design: Advancements in chassis design, including the integration of active suspension systems and electronic stability control, are enhancing vehicle performance and safety. The National Highway Traffic Safety Administration (NHTSA) reports that electronic stability control systems have substantially reduced single-vehicle crashes. Additionally, the adoption of advanced driver-assistance systems (ADAS) is becoming more prevalent, with the Insurance Institute for Highway Safety (IIHS) noting that vehicles equipped with forward collision warning and automatic emergency braking experience significantly fewer front-to-rear crashes.

- Rising Demand for Electric Vehicles (EVs): The U.S. is experiencing a surge in electric vehicle adoption, with over 1.8 million EVs on the road as of 2023, according to the U.S. Department of Energy. This growth is supported by federal incentives, such as the $7,500 tax credit for EV purchases, and state-level programs promoting zero-emission vehicles. The Environmental Protection Agency (EPA) has also set ambitious targets to reduce greenhouse gas emissions, further driving the shift towards EVs. This transition necessitates advancements in chassis design to accommodate battery packs and electric drivetrains, influencing the automotive chassis market.

Market Challenges:

- High Manufacturing Costs of Advanced Materials: The integration of advanced materials like carbon fiber and high-strength aluminum in chassis manufacturing significantly increases production costs. The U.S. Department of Energy notes that carbon fiber composites can cost up to $10 per pound, compared to $0.50 per pound for steel. This substantial cost difference poses a challenge for manufacturers aiming to produce lightweight vehicles while maintaining affordability for consumers.

- Complexity in Multi-material Joining: The use of multiple materials in chassis construction, such as combining steel, aluminum, and composites, introduces challenges in joining techniques. The American Welding Society highlights that traditional welding methods may not be suitable for dissimilar materials, necessitating the development of advanced joining technologies. This complexity can lead to increased production time and costs, impacting the overall efficiency of manufacturing processes.

US Automotive Chassis Market Future Outlook

Over the coming years, the US automotive chassis market is expected to expand further, driven by continuous technological advancements, rising demand for EVs, and stringent regulatory requirements focusing on vehicle efficiency and safety. The increased adoption of modular chassis designs, enabling flexibility across multiple vehicle models, and the integration of smart technology for real-time vehicle monitoring are anticipated to shape the market's trajectory.

Market Opportunities:

- Adoption of Modular Chassis Design: The automotive industry is increasingly embracing modular chassis designs, which allow for greater flexibility and scalability in vehicle production. The U.S. Department of Energy highlights that modular designs can significantly reduce manufacturing costs and decrease assembly time. This approach enables manufacturers to produce multiple vehicle models using a single platform, enhancing production efficiency and reducing time-to-market, making it a valuable strategy for optimizing resources and meeting varied consumer demands.

- Government Incentives for EV Development: The U.S. government offers various incentives to promote electric vehicle development, including tax credits, grants, and funding for research and development. The Inflation Reduction Act of 2022 allocated $7.5 billion for EV charging infrastructure and $2.5 billion for zero-emission school buses. These initiatives encourage manufacturers to invest in EV technologies, including advanced chassis systems tailored for electric powertrains.

Scope of the Report

|

By Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles Autonomous Vehicles |

|

By Chassis Type |

Backbone Chassis Ladder Chassis Monocoque Chassis Space Frame Chassis |

|

By Material Type |

Steel Aluminum Carbon Fiber Magnesium Alloys |

|

By Manufacturing Process |

Stamping Welding Composite Molding Casting |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive OEMs

Electric Vehicle Manufacturers

Autonomous Vehicle Developers

Chassis Component Suppliers

Automotive Dealerships and Distributors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., National Highway Traffic Safety Administration, Environmental Protection Agency)

Material Suppliers

Companies

Players Mentioned in the report

Magna International Inc.

ZF Friedrichshafen AG

Aisin Seiki Co., Ltd.

Hyundai Mobis

Benteler Automotive

Bosch Automotive Steering GmbH

American Axle & Manufacturing Inc.

Denso Corporation

Thyssenkrupp AG

Autokiniton Global Group

Continental AG

CIE Automotive

Faurecia SA

Dana Incorporated

Tenneco Inc.

Table of Contents

1. US Automotive Chassis Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Key Market Developments and Trends

2. US Automotive Chassis Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Major Market Milestones and Announcements

3. US Automotive Chassis Market Dynamics

3.1 Growth Drivers

3.1.1 Shift towards Lightweight Chassis Materials (e.g., Aluminum, Carbon Fiber)

3.1.2 Technological Advancements in Chassis Design

3.1.3 Rising Demand for Electric Vehicles (EVs)

3.1.4 Increasing Focus on Vehicle Safety and Stability

3.2 Market Challenges

3.2.1 High Manufacturing Costs of Advanced Materials

3.2.2 Limited Availability of Skilled Labor

3.2.3 Complexity in Multi-material Joining

3.3 Opportunities

3.3.1 Adoption of Modular Chassis Design

3.3.2 Government Incentives for EV Development

3.3.3 Expansion of Aftermarket Services

3.4 Market Trends

3.4.1 Integration of Smart Chassis Technology (e.g., IoT-enabled systems)

3.4.2 Emphasis on Weight Reduction Strategies

3.4.3 Increased Adoption of Composite Materials

3.5 Regulatory Landscape

3.5.1 Emission Standards and Fuel Efficiency Mandates

3.5.2 Safety Regulations

3.5.3 Government Funding for R&D in Lightweight Materials

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. US Automotive Chassis Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Passenger Cars

4.1.2 Light Commercial Vehicles

4.1.3 Heavy Commercial Vehicles

4.1.4 Electric Vehicles

4.1.5 Autonomous Vehicles

4.2 By Chassis Type (In Value %)

4.2.1 Backbone Chassis

4.2.2 Ladder Chassis

4.2.3 Monocoque Chassis

4.2.4 Space Frame Chassis

4.3 By Material Type (In Value %)

4.3.1 Steel

4.3.2 Aluminum

4.3.3 Carbon Fiber

4.3.4 Magnesium Alloys

4.4 By Manufacturing Process (In Value %)

4.4.1 Stamping

4.4.2 Welding

4.4.3 Composite Molding

4.4.4 Casting

4.5 By Sales Channel (In Value %)

4.5.1 OEM

4.5.2 Aftermarket

5. Competitive Analysis of US Automotive Chassis Market

5.1 In-Depth Profiles of Key Players

5.1.1 Magna International Inc.

5.1.2 ZF Friedrichshafen AG

5.1.3 Aisin Seiki Co., Ltd.

5.1.4 Hyundai Mobis

5.1.5 Bosch Automotive Steering GmbH

5.1.6 Benteler Automotive

5.1.7 American Axle & Manufacturing Inc.

5.1.8 Denso Corporation

5.1.9 Thyssenkrupp AG

5.1.10 Autokiniton Global Group

5.1.11 Continental AG

5.1.12 CIE Automotive

5.1.13 Faurecia SA

5.1.14 Dana Incorporated

5.1.15 Tenneco Inc.

5.2 Cross Comparison Parameters (Market Share %, Manufacturing Capacity, Revenue, R&D Investment, Product Portfolio, Geographical Presence, Strategic Initiatives, Employee Strength)

5.3 Market Share Analysis (In Value %)

5.4 Strategic Initiatives and Developments

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government and Private Grants

6. US Automotive Chassis Market Regulatory Framework

6.1 Emission Standards and Compliance Requirements

6.2 Vehicle Safety Regulations

6.3 Material Usage Standards

6.4 Certification and Testing Processes

7. Future Market Size of the US Automotive Chassis Market (In USD Billion)

7.1 Projected Market Size

7.2 Key Growth Indicators for Future Market Expansion

8. Future Market Segmentation of US Automotive Chassis Market

8.1 By Vehicle Type (In Value %)

8.2 By Chassis Type (In Value %)

8.3 By Material Type (In Value %)

8.4 By Manufacturing Process (In Value %)

8.5 By Sales Channel (In Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Segment Prioritization

9.3 Recommended Market Entry Strategies

9.4 White Space Analysis and Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders across the automotive chassis industry, including major OEMs, suppliers, and regulatory bodies. Desk research using secondary sources and proprietary databases identifies primary variables influencing market growth, such as material trends, regulatory standards, and technology advancements.

Step 2: Market Analysis and Construction

This phase includes analyzing historical data for the automotive chassis market, focusing on manufacturing trends, vehicle production rates, and revenue streams. Quality assessments of supplier-manufacturer relationships aid in validating growth estimations and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings are corroborated through structured interviews with industry experts, including manufacturing and technology specialists. This step provides insights into operational efficiencies and technical challenges, refining data accuracy.

Step 4: Research Synthesis and Final Output

The synthesis phase compiles data from primary and secondary sources, offering a comprehensive, validated market outlook. Engagement with leading manufacturers further ensures the analysis reflects current industry trends, challenges, and growth opportunities.

Frequently Asked Questions

01. How big is the US Automotive Chassis Market?

The US automotive chassis market is valued at USD 21.89 billion, driven by demand for lightweight materials and advancements in chassis engineering.

02. What are the main growth drivers of the US Automotive Chassis Market?

Key growth drivers include the rise in electric vehicle adoption, focus on fuel efficiency, and the increasing demand for autonomous vehicles requiring specialized chassis.

03. What challenges does the US Automotive Chassis Market face?

The market faces challenges related to high production costs for advanced materials and complex manufacturing processes, as well as regulatory requirements for safety and emissions.

04. Which companies lead the US Automotive Chassis Market?

Leading companies include Magna International, ZF Friedrichshafen, and Aisin Seiki, known for their extensive R&D investments, OEM partnerships, and advanced manufacturing capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.