US Automotive Service Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD1695

August 2024

100

About the Report

US Automotive Service Market Overview

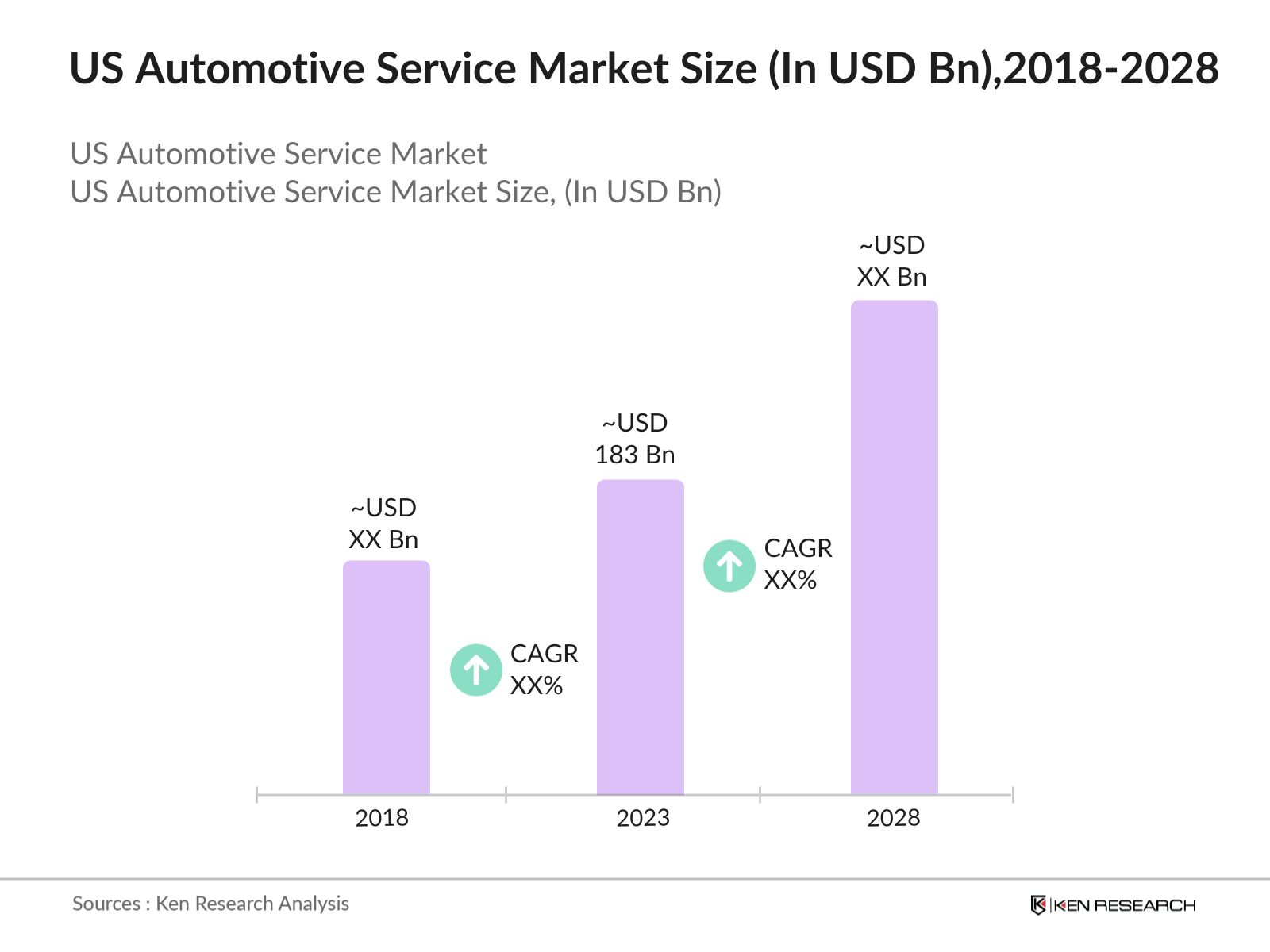

- US Automotive Service Market experienced significant growth from 2018 to 2023. The market was valued at USD 183 billion in 2023, driven by the increasing number of vehicles on the road, advancements in automotive technology requiring specialized maintenance & the rising average age of vehicles.

- Prominent companies include AutoNation Inc., Jiffy Lube International, Inc., Midas, Inc., Pep Boys, and Monro Muffler Brake, Inc. These companies have established extensive networks of service centers across the country, offering a wide range of maintenance and repair services.

- In November 2023, Porsche introduced its new Cayenne SUV line in the US market, featuring a twin-turbo four-liter V8 engine paired with a 200-horsepower electric motor. Their combined fuel consumption is 1.7 - 1.4 l/100 km (WLTP).

US Automotive Service Current Market Analysis

- The total number of registered vehicles in the US crossed 286 million, reflecting a steady increase in the vehicle population. This trend underscores the rising demand for regular maintenance and repair services, driven by the need to ensure vehicle reliability and safety.

- Increasing focus on vehicle longevity and performance has significantly impacted the automotive service market. Consumers are more inclined to invest in regular maintenance to avoid costly repairs and ensure their vehicles run efficiently.

- California stands out as a dominant region in the US automotive service market. In 2023, California accounted for a substantial portion of the total market share, driven by the state's large vehicle population and high consumer spending on automotive services.

US Automotive Service Market Segmentation

The US Automotive Service Market can be segmented based on several factors:

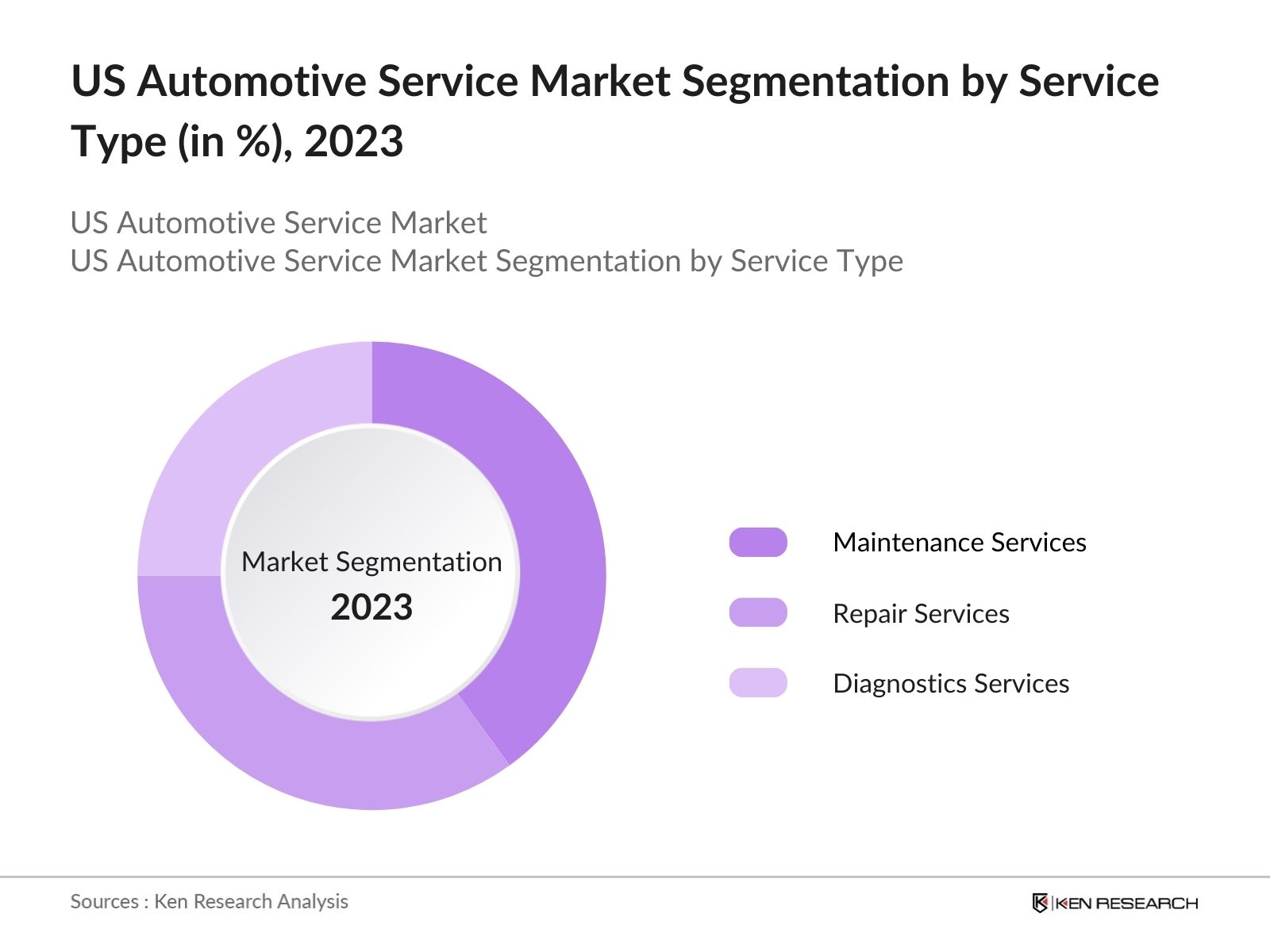

By Service Type: US Automotive Service Market is segmented by Service Type into Maintenance Services, Repair Services & Diagnostics Services. In 2023, Maintenance services reign as the most dominant sub-segment, holding a substantial market share. This dominance is due to the consistent demand for routine services such as oil changes, tire rotations, and brake inspections, which are essential for ensuring vehicle longevity and performance.

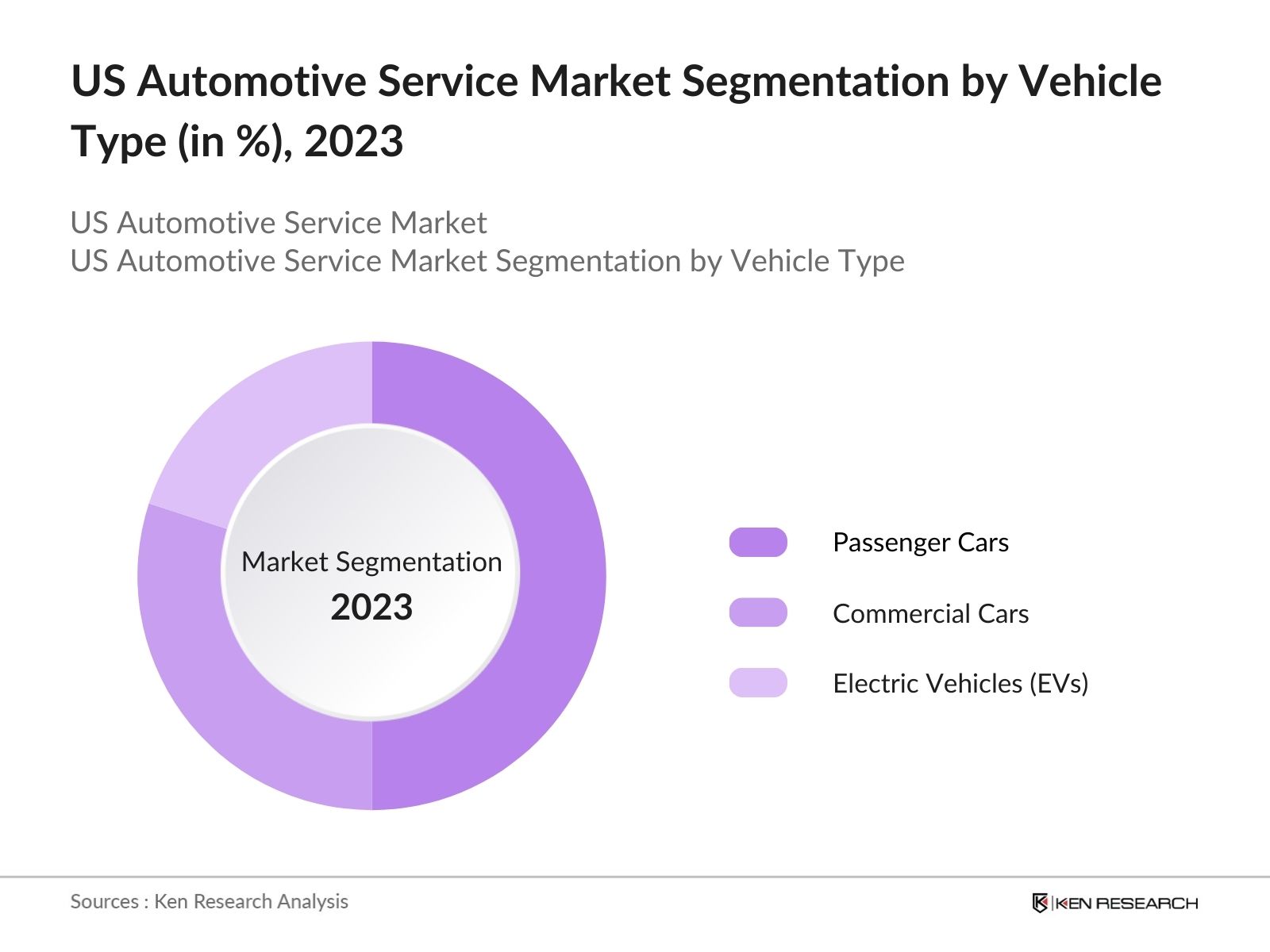

By Vehicle Type: US Automotive Service Market is segmented by Vehicle Type into Passenger Cars, Commercial Cars & Electric Vehicles (EVs). In 2023, Passenger cars emerge as the most dominant sub-segment, commanding a significant percentage of the market share. This dominance is due to the large number of privately-owned cars and the high frequency of usage drive the demand for regular maintenance and repair services.

By Region: US Automotive Service Market is segmented into North, South, East & West. In 2023, South region is the dominant segment with a significant percentage of market share. The presence of large metropolitan areas, such as Texas and Florida, with substantial vehicle ownership and usage drives the demand for automotive services.

US Automotive Service Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

AutoNation Inc. |

1996 |

Fort Lauderdale, FL |

|

Jiffy Lube International, Inc. |

1979 |

Houston, TX |

|

Midas, Inc. |

1956 |

Palm Beach Gardens, FL |

|

Pep Boys |

1921 |

Philadelphia, PA |

|

Monro Muffler Brake, Inc. |

1957 |

Rochester, NY |

- Pep Boys: In 2023, Pep Boys announced the expansion of its service centers in key urban areas like Indianopolis, New Orleans and Raleigh. This expansion is expected to boost the company's market share and enhance its service delivery capabilities​.

- Midas Inc.: In 2023, Midas, Inc. introduced a new line of eco-friendly automotive products and services, including biodegradable engine oils and environmentally sustainable tire options. This innovation aligns with the industry's shift towards green practices and is anticipated to attract environmentally conscious consumers.

- AutoNation Inc.: In 2022, AutoNation Inc., one of America's largest automotive retailers, announced the acquisition of RepairSmith, a full-service mobile solution for automotive repair and maintenance headquartered in Los Angeles, CA. The acquisition was worth $190 million with a significant operational footprint in the southern and western United States.

US Automotive Service Industry Analysis

US Automotive Service Market Growth Drivers:

- Shift to Electric Vehicles (EVs): In 2022, there were 2.4 million EVs registered in the country. As EV technology advances, there's a growing need for technicians skilled in EV maintenance, battery management, and software diagnostics, driving the expansion of service centers tailored to EV requirements.

- Aging Vehicle Fleet: The average age of vehicles on American roads has been steadily increasing, reaching 12.5 years in 2023. Older vehicles generally require more frequent and extensive maintenance and repair services, leading to a higher demand for automotive service providers equipped to handle the diverse needs of an aging vehicle fleet.

- Adoption of Advanced Diagnostic Tools: The automotive service industry is witnessing a significant shift towards the adoption of advanced diagnostic tools. In 2023, the investment in automotive diagnostic tools in the US was $2.5 billion, reflecting the industry's focus on leveraging technology to improve service quality and customer satisfaction.

US Automotive Service Market Challenges:

- Shortage of Skilled Technicians: The US automotive service industry faced a shortfall of technicians in 2023. This shortage is driven by the rapid advancements in automotive technology, which require specialized skills and training. Addressing this challenge involves enhancing training programs and attracting new talent to the industry.

- Increasing Complexity of Automotive Systems: Modern vehicles are becoming increasingly complex by including advanced technologies such as electric drivetrains, autonomous systems, and sophisticated electronics. This complexity poses a challenge for service providers, requiring significant investment in training and equipment.

- Rising Cost of Automotive Parts: The cost of automotive parts has been steadily increasing, driven by supply chain disruptions and rising raw material costs. This rise in parts costs directly impacts service providers' operational expenses and pricing strategies.

- Increasing Complexity of Automotive Systems: Modern vehicles are becoming increasingly complex, incorporating advanced technologies such as electric drivetrains, autonomous systems, and sophisticated electronics. This requires significant investment in training and equipment.

US Automotive Service Market Government Initiatives:

- Promotion of Green Vehicles by EPA: EPA provides information and resources to help private companies, non-profits, state/local governments, and citizens promote the adoption of green, fuel-efficient vehicles. It includes provision of promotional materials to raise awareness about the Green Vehicle Guide and SmartWay certified vehicles.

- Workforce Development Programs: The U.S. Department of Labor awarded $94 million in grants to train and prepare a diverse workforce for jobs created by the "Investing in America" agenda. This ensures that new technicians are equipped with the necessary skills to handle modern automotive technologies.

- Incentives for Electric Vehicle (EV) Maintenance: As part of the broader push towards electric mobility, the US government introduced incentives for EV maintenance in 2023 like a tax credit of up to $7,500 for purchasing a new electric vehicle. The program aims to encourage service providers to expand their capabilities to cater to the growing EV market.

US Automotive Service Future Market Outlook

The US Automotive Service Market is expected to grow during the period of 2023-2028, driven by growth in EV maintenance, advancements in predictive maintenance and focus on sustainability.

Future Trends

- Growth in Electric Vehicle Maintenance: Over the next five years, the demand for electric vehicle (EV) maintenance services is expected to grow significantly. The number of EVs on US roads is projected to exceed 5 million by 2028, driven by government incentives and increasing consumer adoption.

- Advancements in Predictive Maintenance: The adoption of predictive maintenance technologies is expected to rise, driven by advancements in AI and IoT. By 2028, it is estimated that service centers will integrate predictive maintenance solutions, enhancing service efficiency and customer satisfaction.

- Increased Focus on Sustainability: The focus on sustainability will continue to shape the automotive service market. Service centers will adopt eco-friendly practices, such as recycling and using biodegradable products, to meet regulatory requirements and consumer preferences.

Scope of the Report

|

By Service Type |

Maintenance Services Repair Services Diagnostics Services |

|

By Vehicle Type |

Passenger Cars Commercial Cars Electric Vehicles (EVs) |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Automotive Parts Suppliers

Fleet Managers

Aftermarket Service Providers

Auto Parts Retailers

Vehicle Leasing Companies

Banks & Financial Institutions

Investors & VC Firms

Government & Regulatory Bodies (Department of Transportation, Environmental Protection Agency etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

AutoNation Inc.

Jiffy Lube International, Inc.

Midas, Inc.

Pep Boys

Monro Muffler Brake, Inc.

Firestone Complete Auto Care

Goodyear Tire & Service Network

Valvoline Instant Oil Change

Meineke Car Care Centers

Sears Auto Center

AAMCO Transmissions and Total Car Care

Christian Brothers Automotive

Big O Tires

Tuffy Tire & Auto Service

Precision Tune Auto Care

Table of Contents

1. US Automotive Service Market Overview

1.1 US Automotive Service Market Taxonomy

2. US Automotive Service Market Size (in USD Bn), 2018-2023

3. US Automotive Service Market Analysis

3.1 US Automotive Service Market Growth Drivers

3.2 US Automotive Service Market Challenges and Issues

3.3 US Automotive Service Market Trends and Development

3.4 US Automotive Service Market Government Regulation

3.5 US Automotive Service Market SWOT Analysis

3.6 US Automotive Service Market Stake Ecosystem

3.7 US Automotive Service Market Competition Ecosystem

4. US Automotive Service Market Segmentation, 2023

4.1 US Automotive Service Market Segmentation by Service Type (in value %), 2023

4.2 US Automotive Service Market Segmentation by Vehicle Type (in value %), 2023

4.3 US Automotive Service Market Segmentation by Region (in value %), 2023

5. US Automotive Service Market Competition Benchmarking

5.1 US Automotive Service Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. US Automotive Service Future Market Size (in USD Bn), 2023-2028

7. US Automotive Service Future Market Segmentation, 2028

7.1 US Automotive Service Market Segmentation by Service Type (in value %), 2028

7.2 US Automotive Service Market Segmentation by Vehicle Type (in value %), 2028

7.3 US Automotive Service Market Segmentation by Region (in value %), 2028

8. US Automotive Service Market Analysts’ Recommendations

8.1 US Automotive Service Market TAM/SAM/SOM Analysis

8.2 US Automotive Service Market Customer Cohort Analysis

8.3 US Automotive Service Market Marketing Initiatives

8.4 US Automotive Service Market White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on US Automotive Service Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for US Automotive Service Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output:

Our team will approach multiple automotive service companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from automotive service companies.

Frequently Asked Questions

01 How big is US Automotive Service Market?

The US automotive service market was valued at USD 183 billion in 2023, driven by the increasing number of vehicles on the road, advancements in automotive technology, and the rising average age of vehicles.

02 What are the growth drivers of the US Automotive Service Market?

Growth drivers of US automotive service market include the increasing vehicle population, rising expenditure on vehicle maintenance, expansion of automotive service networks, and the adoption of advanced diagnostic tools. These factors contribute to the growing demand for automotive services.

03 What are the challenges in US Automotive Service Market?

Challenges in US automotive service market include a shortage of skilled technicians, increasing complexity of automotive systems, rising cost of automotive parts, and strict regulatory compliance requirements. These factors pose operational and financial challenges for service providers.

04 Who are the major players in the US Automotive Service Market?

Key players of US automotive service market include AutoNation Inc., Jiffy Lube International, Inc., Midas, Inc., Pep Boys, and Monro Muffler Brake, Inc. These companies dominate the market with their extensive service networks and comprehensive range of automotive services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.