U.S. Automotive Service Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11446

November 2024

87

About the Report

U.S. Automotive Service Market Overview

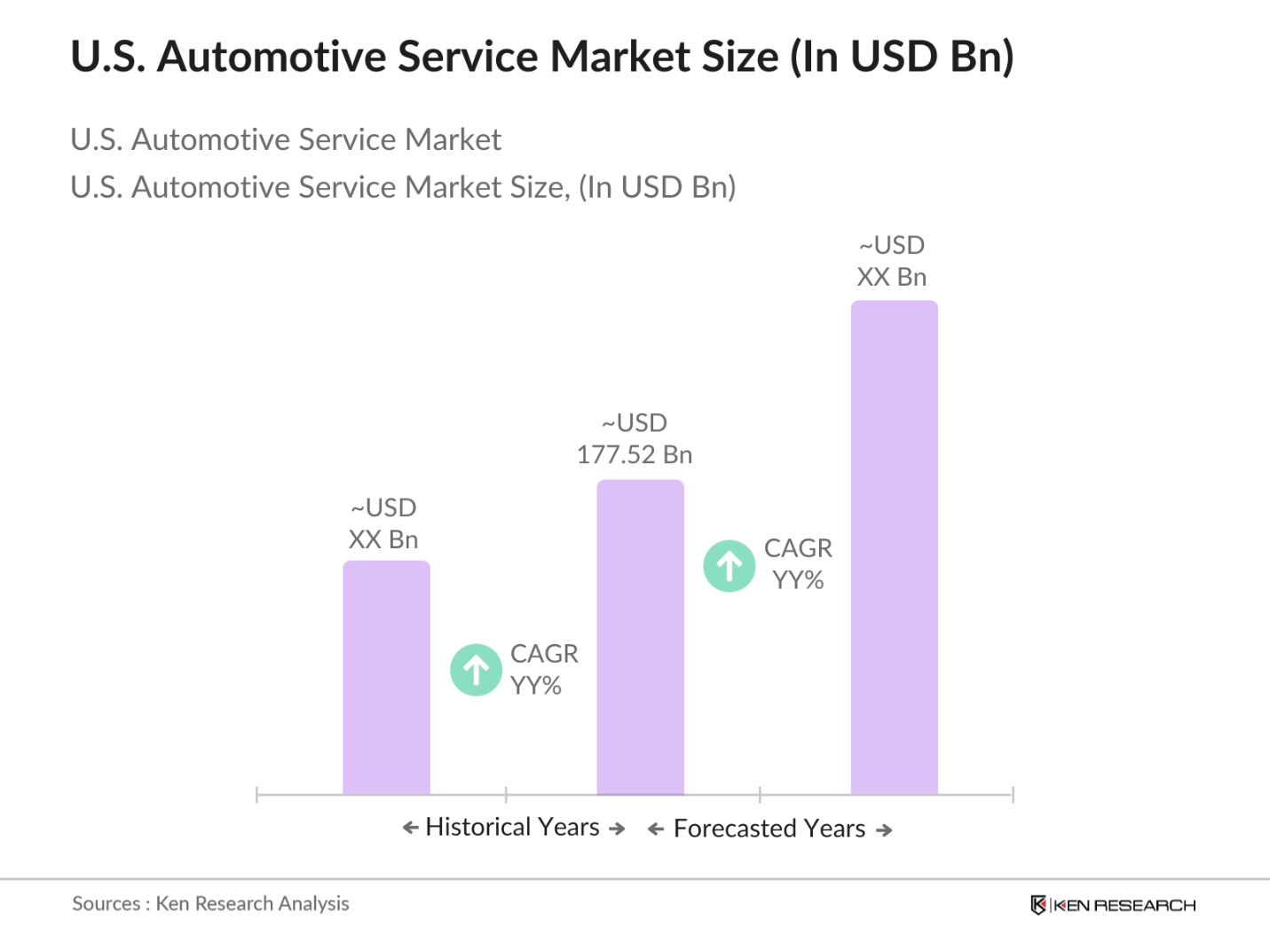

- The U.S. automotive service market is valued at approximately USD 177.52 billion, primarily driven by the increasing vehicle population and the rising average age of vehicles. The market is experiencing significant demand for routine maintenance and repair services as older vehicles require frequent servicing. Moreover, advancements in vehicle technologies, such as telematics, electrification, and digital diagnostics, are further propelling the demand for specialized repair services. These drivers are critical for maintaining vehicle performance and addressing technological complexities in modern vehicles.

- Cities such as Los Angeles, Chicago, and New York dominate the U.S. automotive service market due to their dense vehicle populations, high demand for maintenance services, and significant adoption of electric and hybrid vehicles. These cities have a robust network of automotive service centers and benefit from increasing consumer awareness about regular vehicle upkeep and the need for emission compliance in high-traffic areas. Furthermore, these regions are early adopters of advanced automotive technologies, which require specialized services.

- The U.S. government has implemented federal tax credits to encourage the adoption of electric vehicles (EVs), which in turn increases demand for EV-specific maintenance services. Under the Clean Vehicle Credit program, buyers of qualifying electric vehicles can receive up to $7,500 in tax credits, boosting EV sales. As of 2023, the U.S. Department of Energy reported that over 2.5 million EVs were registered, leading to heightened demand for specialized EV maintenance services, such as battery diagnostics and charging infrastructure upkeep. This incentive supports the growth of EV-related automotive services.

U.S. Automotive Service Market Segmentation

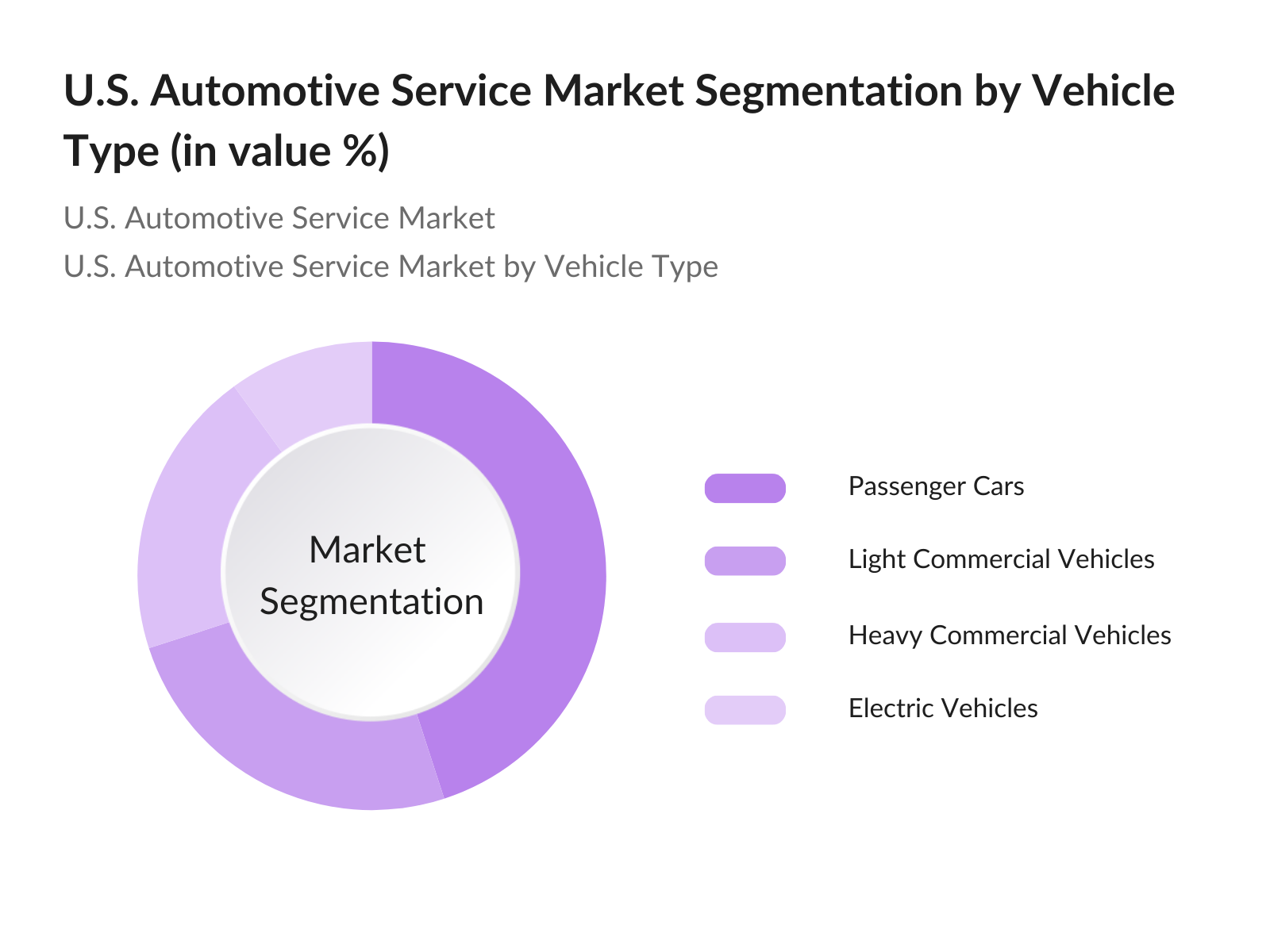

- By Vehicle Type: The U.S. automotive service market is segmented by vehicle type into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles. Passenger cars dominate the market due to the high volume of privately owned vehicles and their regular need for routine maintenance and repair services. The growing trend toward preventive maintenance has led to increased demand for oil changes, tire rotations, and brake services. The rapid technological advancements in vehicle systems and electronics further contribute to the dominance of this segment.

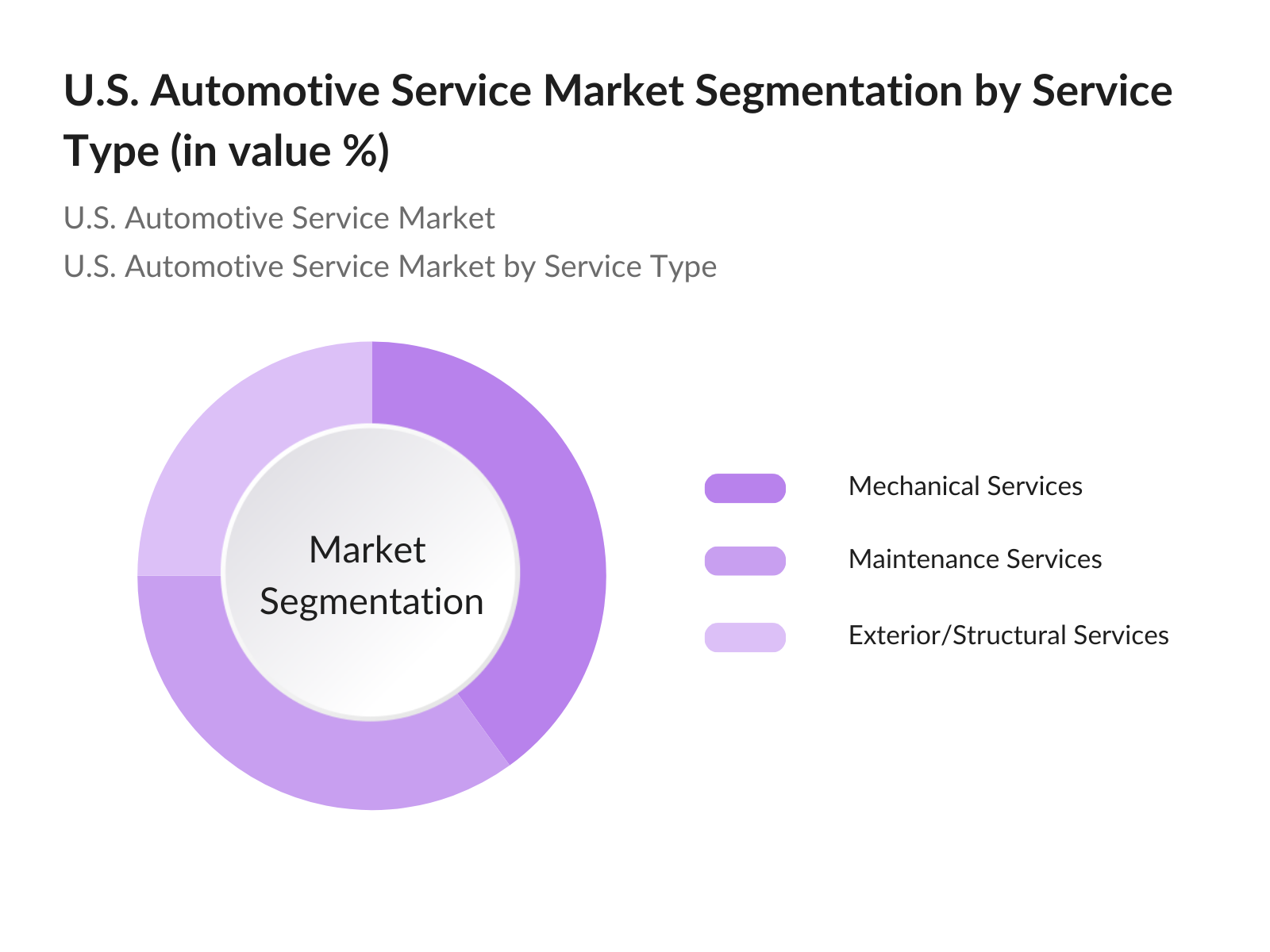

- By Service Type: The market is segmented by service type into mechanical services, maintenance services, and exterior/structural services. Mechanical services, including repairs for engines, transmissions, and braking systems, hold the largest market share due to the increasing complexity of modern vehicles. With the rise of electric vehicles and hybrid models, specialized mechanical services are becoming necessary to manage evolving technologies within these vehicle systems. Additionally, mechanical services are essential for older vehicles, which frequently require part replacements due to wear and tear.

U.S. Automotive Service Market Competitive Landscape

The U.S. automotive service market is highly fragmented, with several major players leading the market through technological innovation and service network expansion. Companies such as Monro, Firestone Complete Auto Care, and Jiffy Lube dominate the landscape, leveraging their extensive service networks and ability to service a wide range of vehicles. The market is becoming increasingly competitive as companies invest in new service technologies like AI-driven diagnostics and telematics.

|

Company |

Establishment Year |

Headquarters |

Service Footprint |

Technological Integration |

Customer Base |

Revenue Generation (USD Bn) |

Strategic Initiatives |

Electric Vehicle Focus |

|

Monro Inc. |

1957 |

New York |

Nationwide |

- |

- |

- |

- |

- |

|

Firestone Complete Auto Care |

1926 |

Tennessee |

Nationwide |

- |

- |

- |

- |

- |

|

Jiffy Lube International |

1979 |

Houston |

Nationwide |

- |

- |

- |

- |

- |

|

Meineke Car Care Centers |

1972 |

North Carolina |

Nationwide |

- |

- |

- |

- |

- |

|

AutoNation Inc. |

1996 |

Florida |

Nationwide |

- |

- |

- |

- |

- |

U.S. Automotive Service Market Analysis

Market Growth Drivers

- Increasing Vehicle Age (average vehicle lifespan, component wear): The U.S. automotive service market is experiencing growth due to the increasing average vehicle lifespan, which rose to over 12.5 years by 2023, according to the Bureau of Transportation Statistics (BTS). This trend highlights a growing need for maintenance services, as older vehicles require more frequent repairs and part replacements such as brake pads, filters, and belts. The wear and tear on vehicles older than 10 years contribute to higher service demands. Moreover, with over 290 million vehicles registered in the U.S., the service market sees consistent demand for vehicle upkeep.

- Technological Advancements (diagnostic tools, telematics, EV integration): Technological advancements are reshaping the U.S. automotive service sector, with diagnostic tools and telematics integration leading the way. The adoption of advanced diagnostic systems increased by 18 million vehicles in 2023, as reported by the U.S. Department of Transportation. These tools allow for quicker identification of issues and more precise repairs. Additionally, telematics data enables proactive maintenance alerts, contributing to the demand for preventive services. The increasing presence of electric vehicles (EVs), with over 2.5 million on U.S. roads as of 2023, drives the need for specialized EV maintenance services and advanced diagnostic solutions.

- Demand for Preventive Maintenance (proactive vehicle care, fluid replacements): Preventive maintenance services have seen significant growth, driven by increased consumer awareness of vehicle longevity. In 2023, more than 90 million oil changes were performed in the U.S., according to the Federal Highway Administration (FHWA). The rise in proactive vehicle care services, such as fluid replacements and scheduled inspections, helps prevent larger, costlier repairs. Vehicle owners increasingly prioritize fluid checks, brake inspections, and tire rotations, resulting in consistent demand for routine maintenance services. This trend aligns with the growing number of high-mileage vehicles on U.S. roads, which require more frequent servicing.

Market Challenges:

- Labor Shortages (skilled technician availability): Labor shortages remain a significant challenge for the U.S. automotive service industry. According to the Bureau of Labor Statistics (BLS), there were over 60,000 unfilled positions for automotive technicians in 2023. The shortage of skilled workers has led to increased repair times and reduced service availability in many areas. Training programs have struggled to keep pace with technological advancements, particularly in EVs and complex diagnostic tools, further exacerbating the shortage of qualified personnel. The labor gap also drives wage inflation, impacting the profitability of service providers.

- Supply Chain Disruptions (spare parts and automotive chips): Supply chain disruptions continue to challenge the automotive service industry, particularly in sourcing spare parts and automotive chips. In 2023, the U.S. Department of Commerce reported significant delays in automotive semiconductor shipments, with lead times exceeding 24 weeks for critical components. This has led to longer repair times and increased costs, as service providers struggle to obtain necessary parts. The shortage of essential electronic components has also impacted repairs related to vehicle infotainment systems, advanced driver assistance systems (ADAS), and engine control modules.

U.S. Automotive Service Market Future Outlook

Over the next five years, the U.S. automotive service market is expected to witness significant growth, driven by the increasing adoption of electric vehicles, advanced automotive technologies, and a rising vehicle population. The market will also benefit from the growing focus on preventive maintenance as consumers look to extend the lifespan of their vehicles. Companies that can adapt to technological advancements, such as AI-based diagnostics and EV-focused services, will have a competitive edge in capturing market share.

Market Opportunities:

- Rise of Electric Vehicles (EV service demand): The growing number of electric vehicles (EVs) presents a significant opportunity for the U.S. automotive service market. By 2023, the number of EVs on American roads exceeded 2.5 million, according to the Department of Energy (DOE). These vehicles require specialized maintenance, including battery diagnostics, software updates, and charging system checks, creating new service demand. EV service centers and technicians skilled in EV-specific repairs are in high demand, and this segment is expected to continue growing as more consumers adopt electric mobility options.

- AI-Based Maintenance (predictive diagnostics): Artificial intelligence (AI)-based predictive maintenance is an emerging opportunity in the automotive service market. AI tools use telematics data and vehicle sensors to predict component failures before they occur. In 2023, over 14 million vehicles in the U.S. were equipped with AI-driven maintenance systems, according to the National Institute of Standards and Technology (NIST). These systems alert owners to potential issues, allowing for timely repairs and reducing the likelihood of costly breakdowns. This technology is set to enhance service efficiency and improve vehicle longevity, providing a significant growth opportunity for service providers.

Scope of the Report

|

By Vehicle Type |

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles Hybrid Vehicles |

|

By Service Type |

Mechanical Services Maintenance Services Exterior and Structural Services |

|

By Propulsion Type |

Internal Combustion Engine Battery Electric Vehicles Hybrid Electric Vehicles |

|

By End-User |

Private Vehicles Fleet Vehicles |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive Service Providers

Vehicle Manufacturers

Electric Vehicle Manufacturers

Vehicle Fleet Owners

Automotive Parts Suppliers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Transportation)

Insurance Companies

Companies

Players mentioned in the report

Monro Inc.

Firestone Complete Auto Care

Jiffy Lube International, Inc.

Meineke Car Care Centers, LLC

Midas International, LLC

Safelite Group

AutoNation Inc.

Valvoline Inc.

Pep Boys

Goodyear Auto Service

FullSpeed Automotive

Tesla Service Centers

Bridgestone Americas

SpeeDee Oil Change & Auto Service

Sears Auto Centers

Table of Contents

1. U.S. Automotive Service Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. U.S. Automotive Service Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. U.S. Automotive Service Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Vehicle Age (average vehicle lifespan, component wear)

3.1.2 Technological Advancements (diagnostic tools, telematics, EV integration)

3.1.3 Demand for Preventive Maintenance (proactive vehicle care, fluid replacements)

3.1.4 Government Emission Standards (impact on service demand)

3.2 Market Challenges

3.2.1 Labor Shortages (skilled technician availability)

3.2.2 Economic Fluctuations (inflation, repair costs)

3.2.3 Supply Chain Disruptions (spare parts and automotive chips)

3.3 Opportunities

3.3.1 Rise of Electric Vehicles (EV service demand)

3.3.2 AI-Based Maintenance (predictive diagnostics)

3.3.3 Expansion of Aftermarket Services (accessories, maintenance)

3.4 Trends

3.4.1 Growing Use of Digital Tools (software-driven maintenance)

3.4.2 Subscription-Based Services (monthly maintenance packages)

3.4.3 Shared Mobility (increased maintenance frequency for fleets)

3.5 Regulatory Framework

3.5.1 Automotive Repair Laws (state-specific regulations)

3.5.2 Emission Reduction Policies (vehicle inspections)

3.5.3 Certifications and Compliance Requirements

4. U.S. Automotive Service Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Passenger Cars

4.1.2 Light Commercial Vehicles

4.1.3 Heavy Commercial Vehicles

4.1.4 Electric Vehicles

4.1.5 Hybrid Vehicles

4.2 By Service Type (In Value %)

4.2.1 Mechanical Services (repairs, engine work)

4.2.2 Maintenance Services (oil changes, tire rotations)

4.2.3 Exterior and Structural Services (collision repair)

4.3 By Propulsion Type (In Value %)

4.3.1 Internal Combustion Engine (ICE)

4.3.2 Battery Electric Vehicles (BEVs)

4.3.3 Hybrid Electric Vehicles (HEVs)

4.4 By Ownership (In Value %)

4.4.1 Private Vehicles

4.4.2 Fleet Vehicles (rental, commercial fleets)

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. U.S. Automotive Service Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Monro Inc.

5.1.2 Firestone Complete Auto Care

5.1.3 Jiffy Lube International, Inc.

5.1.4 Midas International, LLC

5.1.5 Meineke Car Care Centers, LLC

5.1.6 Safelite Group

5.1.7 AutoNation Inc.

5.1.8 Valvoline Inc.

5.1.9 Pep Boys

5.1.10 Goodyear Auto Service

5.1.11 FullSpeed Automotive (Grease Monkey)

5.1.12 Tesla Service Centers

5.1.13 Bridgestone Americas

5.1.14 SpeeDee Oil Change & Auto Service

5.1.15 Sears Auto Centers

5.2 Cross Comparison Parameters (Revenue, Service Footprint, Digital Integration, Sustainability Initiatives, Customer Base, Market Share, Technological Expertise, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. U.S. Automotive Service Market Regulatory Framework

6.1 Vehicle Safety Regulations

6.2 Emission Testing Standards

6.3 Licensing and Certification for Service Centers

7. U.S. Automotive Service Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. U.S. Automotive Service Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By Propulsion Type (In Value %)

8.4 By Ownership (In Value %)

8.5 By Region (In Value %)

9. U.S. Automotive Service Market Analysts' Recommendations

9.1 Customer Cohort Analysis

9.2 Marketing Initiatives

9.3 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping the U.S. automotive service ecosystem, identifying key stakeholders, including service centers, manufacturers, and suppliers. Data is sourced from secondary databases and proprietary industry reports.

Step 2: Market Analysis and Construction

This phase focuses on historical data analysis for market segments such as vehicle type and service type. Detailed assessments of market penetration and service center networks are also conducted.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through consultations with industry experts via phone interviews. These discussions provide insights into operational challenges and opportunities in the U.S. automotive service market.

Step 4: Research Synthesis and Final Output

Final validation is achieved through engagement with automotive service providers and manufacturers, verifying data on service trends, technological integration, and consumer behavior. This ensures the accuracy of the market insights.

Frequently Asked Questions

01. How big is the U.S. Automotive Service Market?

The U.S. automotive service market is valued at USD 177.52 billion, driven by an increasing number of vehicles on the road and technological advancements in vehicle maintenance.

02. What are the key challenges in the U.S. Automotive Service Market?

Labor shortages and economic fluctuations are significant challenges. The shortage of skilled technicians affects service quality and efficiency, while economic factors influence consumer spending on repairs.

03. Who are the major players in the U.S. Automotive Service Market?

Key players include Monro Inc., Firestone Complete Auto Care, Jiffy Lube International, Meineke Car Care Centers, and AutoNation Inc., dominating the market through technological innovations and extensive service networks.

04. What are the growth drivers for the U.S. Automotive Service Market?

Growth is driven by an aging vehicle population, increasing demand for electric vehicles, and technological advancements in vehicle diagnostics and maintenance tools.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.