US Battery Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11472

December 2024

95

About the Report

US Battery Market Overview

- The US Battery Market is valued at approximately USD 16.9 billion, based on a five-year historical analysis. This growth is driven by rapid advancements in energy storage technologies and a surge in electric vehicle (EV) adoption. The increased reliance on renewable energy sources has amplified the need for efficient and reliable batteries, further supported by state and federal incentives for cleaner energy solutions. The market's expansion is propelled by heightened demand across automotive, industrial, and consumer sectors, as the US aims to reduce carbon emissions and transition to a low-carbon economy.

- Dominant regions in the US battery market include California, Texas, and New York, with these states taking the lead due to high EV adoption rates, strong government initiatives, and significant investments in renewable energy projects. California, in particular, stands out with aggressive clean energy policies and incentives that fuel demand for batteries in residential, commercial, and utility-scale energy storage solutions. These states also house major infrastructure projects and high-tech industries, contributing to their market dominance.

- The U.S. government provides substantial tax credits for electric vehicle purchases, including a $7,500 incentive aimed at encouraging consumers to transition to EVs. This initiative not only promotes the adoption of electric vehicles but also stimulates demand for the batteries required to power them, fostering growth in the battery market.

US Battery Market Segmentation

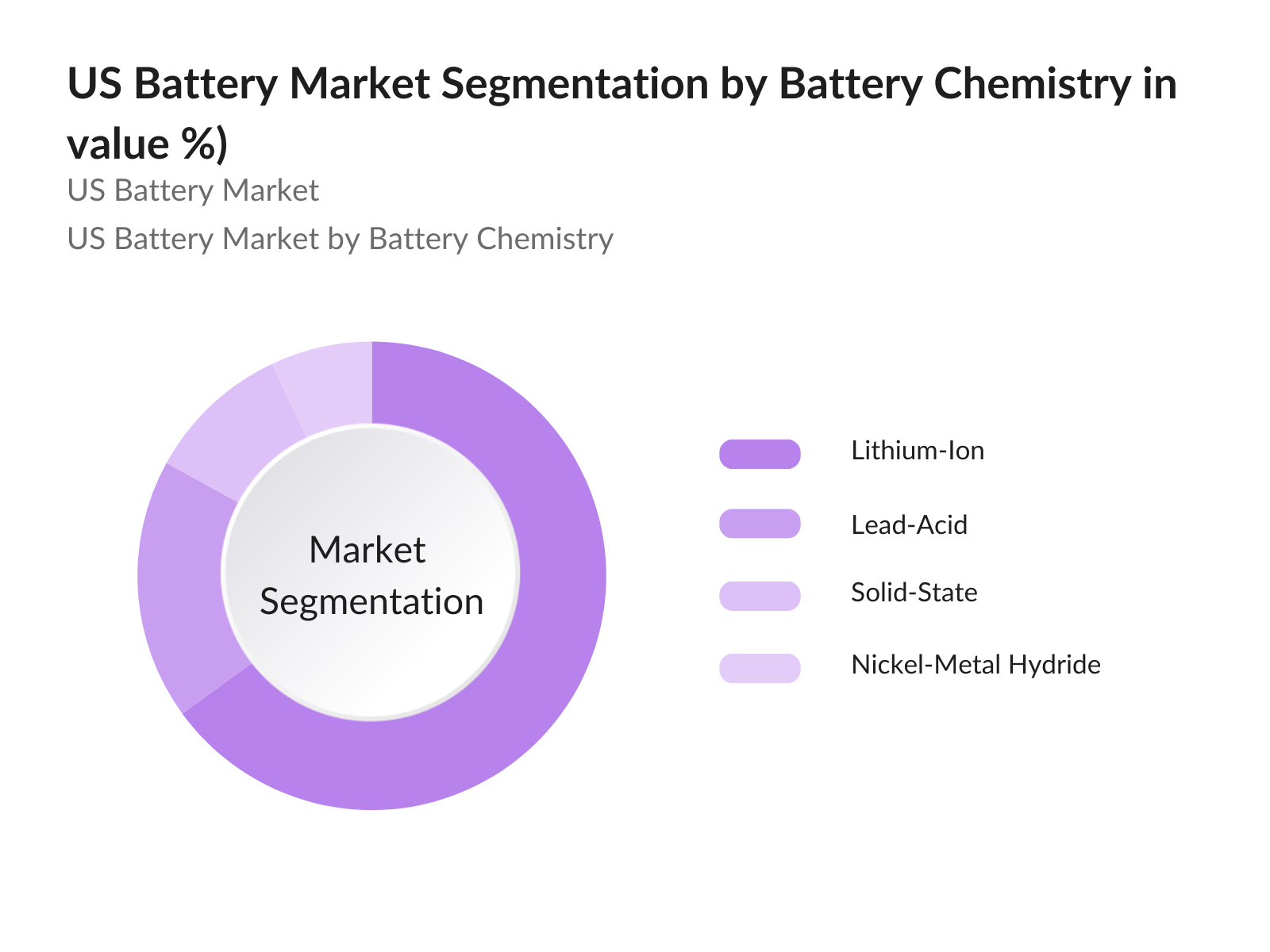

- By Battery Chemistry: The US Battery Market is segmented by battery chemistry into lithium-ion, lead-acid, solid-state, and nickel-metal hydride batteries. Lithium-ion batteries currently hold a dominant market share in the battery chemistry segment due to their high energy density, longer cycle life, and widespread application across electric vehicles, consumer electronics, and grid storage. The scalability of lithium-ion technology for both small devices and large energy storage systems reinforces its market position, making it the most preferred choice among manufacturers and consumers alike.

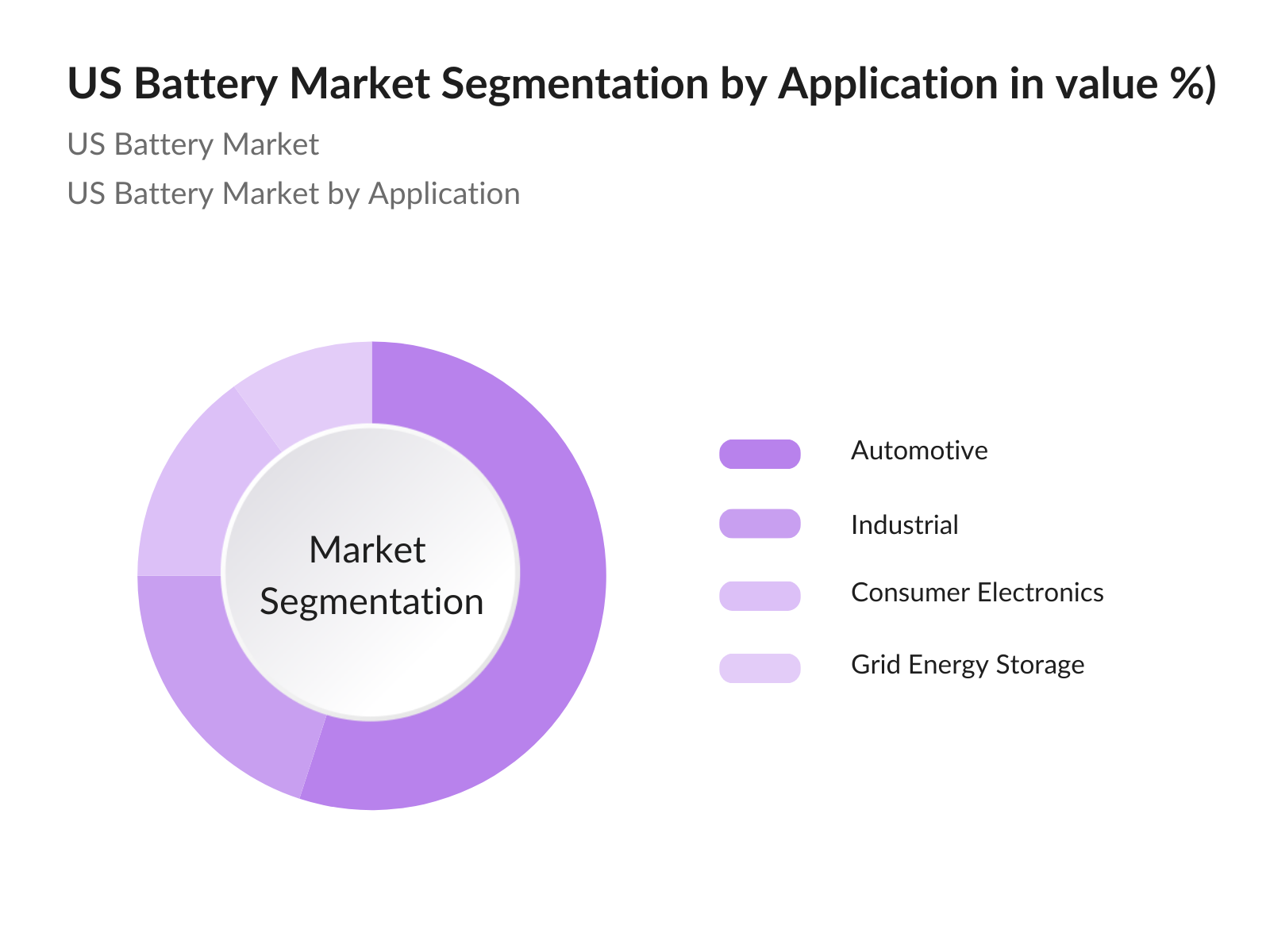

- By Application: The application segmentation of the US Battery Market includes automotive, industrial, consumer electronics, and grid energy storage. The automotive segment has emerged as the largest due to the exponential growth in electric vehicle adoption. Battery demand in the automotive sector is fueled by consumer demand for eco-friendly vehicles, extensive investments by automakers in EV technology, and supportive government policies promoting electric vehicle use. With companies like Tesla and Ford committing to sustainable transportation, the automotive sector remains a critical driver of battery market growth.

US Battery Market Competitive Landscape

The US battery market is dominated by a mix of global and domestic companies, each leveraging its unique capabilities in research, development, and production. These companies collectively shape the competitive landscape through innovation, strategic partnerships, and investment in new battery technologies.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investment |

Battery Recycling Initiatives |

Technological Capabilities |

Market Reach |

Sustainability Initiatives |

|

Panasonic Corporation |

1918 |

Japan |

High |

- |

- |

- |

- |

- |

|

LG Chem |

1947 |

South Korea |

High |

- |

- |

- |

- |

- |

|

Tesla, Inc. |

2003 |

USA |

High |

- |

- |

- |

- |

- |

|

BYD Company Ltd. |

1995 |

China |

High |

- |

- |

- |

- |

- |

|

CATL (Contemporary Amperex) |

2011 |

China |

Very High |

- |

- |

- |

- |

- |

US Battery Market Analysis

Market Growth Drivers

- Adoption of Renewable Energy Sources: The adoption of renewable energy sources is a significant driver for the US battery market. The shift toward clean energy is spurred by policies targeting a fully clean energy grid. The storage capacity provided by batteries is crucial for integrating intermittent renewable sources like wind and solar into the grid. This expansion of renewable energy aligns with global climate initiatives, driving substantial investment in battery technologies. As states and localities ramp up their renewable energy goals, the demand for efficient energy storage solutions will continue to rise, positioning the battery market for further growth in the coming years.

- Electrification of Transport Sector: The electrification of the transport sector is accelerating rapidly, with electric vehicle (EV) sales expected to exceed 3 million units by the end of 2023. This shift is fueled by federal incentives, including a $7,500 tax credit for EV purchases. The increasing adoption of EVs necessitates a robust battery supply chain and innovations in battery technology. Additionally, the infrastructure bill allocates $7.5 billion for EV charging stations, enhancing the adoption of electric vehicles and supporting the transition to cleaner transportation options.

- Increased Consumer Electronics Usage: The demand for consumer electronics, which relies heavily on portable battery technologies, is witnessing a surge. In 2022, approximately 350 million smartphones were sold in the U.S., along with a significant increase in the usage of laptops and tablets. The growth of the Internet of Things (IoT) is also driving demand for batteries, with an expected 50 billion connected devices globally by 2025. This increased reliance on batteries in everyday consumer electronics is propelling innovations in battery efficiency and miniaturization, catering to the market's growing needs.

Market Challenges:

- High Manufacturing Costs: High manufacturing costs pose a significant challenge for the US battery market. The average cost to produce lithium-ion batteries was around $137 per kWh in 2022. Factors contributing to these costs include the extraction of raw materials, labor, and production technology. As the demand for EVs and energy storage systems rises, manufacturers are facing pressure to optimize production processes to reduce costs. The potential price volatility of raw materials like lithium, cobalt, and nickel further exacerbates this challenge, necessitating more efficient supply chain management and recycling technologies.

- Supply Chain Vulnerabilities (Raw Materials): Supply chain vulnerabilities, particularly concerning raw materials, are a pressing issue for the US battery industry. The U.S. currently imports over 80% of its lithium, primarily from Australia and South America. This reliance makes the supply chain susceptible to geopolitical tensions and trade restrictions. In 2022, prices for lithium carbonate increased to nearly $70,000 per ton due to supply shortages. The U.S. government has initiated measures to bolster domestic production, aiming to reduce reliance on foreign sources and stabilize the supply chain for critical minerals needed for battery production.

US Battery Market Future Outlook

Over the next five years, the US Battery Market is expected to experience robust growth, driven by advancements in battery technology, increased EV adoption, and rising demand for renewable energy storage solutions. Government incentives, coupled with heightened consumer awareness about sustainable alternatives, are likely to further propel market growth. Continuous R&D investment and strategic collaborations among battery manufacturers will play a pivotal role in meeting evolving energy storage needs.

Market Opportunities:

- Expansion in Energy Storage Solutions: The expansion of energy storage solutions is a key opportunity for the battery market, driven by the increasing integration of renewable energy. As of 2022, the U.S. had installed about 3.3 GW of grid-scale energy storage capacity, with projections to reach 30 GW by 2025. This surge is largely influenced by the need for reliable backup power systems and the management of renewable energy fluctuations. The development of advanced energy storage technologies, such as flow batteries and grid-scale lithium-ion systems, presents significant growth potential for manufacturers and innovators in the sector.

- Growth in Grid-Connected Batteries: The growth in grid-connected batteries offers promising prospects for the battery market, particularly in stabilizing energy distribution. The U.S. government has allocated $1.5 billion for the expansion of battery storage systems, supporting projects that enhance grid resilience and reliability. By 2025, the anticipated increase in grid-connected battery installations is projected to exceed 20 GW, facilitating more effective management of renewable energy sources and peak demand periods. This growth will not only create opportunities for battery manufacturers but also contribute to the overall sustainability of the energy grid.

Scope of the Report

|

By Battery Chemistry |

Lithium-Ion Nickel-Metal Hydride Lead-Acid Solid-State Others |

|

By Application |

Automotive |

|

By End-User |

Residential Commercial Utility |

|

By Battery Type |

Primary Batteries |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive Manufacturers

Energy Storage Solution Providers

Renewable Energy Project Developers

Electric Vehicle Manufacturers

Battery Technology Research Institutes

Government and Regulatory Bodies (Environmental Protection Agency, Department of Energy)

Investments and Venture Capitalist Firms

Consumer Electronics Manufacturers

Companies

Players Mentioned in the report

Panasonic Corporation

LG Chem

Tesla, Inc.

BYD Company Ltd.

CATL (Contemporary Amperex Technology Co. Ltd.)

Samsung SDI Co., Ltd.

Duracell Inc.

Energizer Holdings, Inc.

East Penn Manufacturing Co.

GS Yuasa Corporation

Saft Groupe S.A.

Johnson Controls International

Amperex Technology Limited

Envision AESC

Exide Technologies

Table of Contents

1. US Battery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Structure (By Battery Chemistry, Application, End-User, Battery Type, Distribution Channel)

1.4 Market Segmentation Overview

2. US Battery Market Size (In USD Million)

2.1 Historical Market Size Analysis

2.2 Year-On-Year Growth Patterns

2.3 Key Milestones and Developments

2.4 Demand Analysis (Battery Chemistry)

3. US Battery Market Analysis

3.1 Growth Drivers

3.1.1 Adoption of Renewable Energy Sources

3.1.2 Electrification of Transport Sector

3.1.3 Technological Advancements in Battery Design

3.1.4 Increased Consumer Electronics Usage

3.2 Market Challenges

3.2.1 High Manufacturing Costs

3.2.2 Supply Chain Vulnerabilities (Raw Materials)

3.2.3 Regulatory Barriers

3.2.4 Environmental Disposal Concerns

3.3 Opportunities

3.3.1 Expansion in Energy Storage Solutions

3.3.2 Growth in Grid-Connected Batteries

3.3.3 Innovations in Battery Recycling

3.4 Trends

3.4.1 Rise in Lithium-Ion Battery Adoption

3.4.2 Demand for Electric Vehicle Batteries

3.4.3 Integration with Smart Energy Solutions

3.4.4 Shift Towards Solid-State Batteries

3.5 Government Regulations

3.5.1 Emission Standards

3.5.2 Incentives for EV Adoption

3.5.3 Tax Benefits for Renewable Energy Storage Solutions

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. US Battery Market Segmentation

4.1 By Battery Chemistry (In Value %)

4.1.1 Lithium-Ion

4.1.2 Nickel-Metal Hydride

4.1.3 Lead-Acid

4.1.4 Solid-State

4.1.5 Others

4.2 By Application (In Value %)

4.2.1 Automotive

4.2.2 Industrial

4.2.3 Consumer Electronics

4.2.4 Grid Energy Storage

4.3 By End-User (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.3.3 Utility

4.4 By Battery Type (In Value %)

4.4.1 Primary Batteries

4.4.2 Secondary Batteries

4.5 By Distribution Channel (In Value %)

4.5.1 OEM

4.5.2 Aftermarket

5. US Battery Market Competitive Analysis

5.1 Detailed Company Profiles

5.1.1 Panasonic Corporation

5.1.2 LG Chem

5.1.3 Samsung SDI Co., Ltd.

5.1.4 BYD Company Ltd.

5.1.5 Tesla, Inc.

5.1.6 CATL (Contemporary Amperex Technology Co. Ltd.)

5.1.7 Duracell Inc.

5.1.8 Energizer Holdings, Inc.

5.1.9 East Penn Manufacturing Co.

5.1.10 GS Yuasa Corporation

5.1.11 Saft Groupe S.A.

5.1.12 Johnson Controls International

5.1.13 Amperex Technology Limited

5.1.14 Envision AESC

5.1.15 Exide Technologies

5.2 Cross Comparison Parameters (Battery Production Capacity, Geographic Presence, R&D Investments, Sustainability Initiatives, Battery Recycling Capabilities, Strategic Alliances, Market Share by Revenue, Technological Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Trends

5.7 Venture Capital Involvement

5.8 Government Subsidies and Grants

5.9 Private Equity Investment

6. US Battery Market Regulatory Framework

6.1 Environmental Standards (Battery Disposal and Recycling)

6.2 Compliance Requirements (Product Quality and Safety)

6.3 Certification Processes (Energy Efficiency Standards)

7. US Battery Future Market Size (In USD Million)

7.1 Market Size Projections

7.2 Key Factors for Future Market Growth

8. US Battery Market Future Segmentation

8.1 By Battery Chemistry (Projected Growth by Type)

8.2 By Application (Expected Demand Segmentation)

8.3 By End-User (Future Market Analysis)

8.4 By Battery Type (Adoption Trends)

8.5 By Distribution Channel (Channel-Specific Trends)

9. US Battery Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Emerging Market Opportunities

9.3 White Space Analysis

9.4 Strategic Growth Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves identifying crucial factors within the US Battery Market, focusing on drivers like technological innovations and EV adoption. Extensive desk research is conducted using secondary and proprietary databases to pinpoint the key variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the US Battery Market is compiled, analyzing adoption rates across segments like automotive and grid storage. This process includes market penetration analysis and revenue estimation, ensuring accurate and reliable insights.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through interviews with industry experts, which provide operational and financial insights. These expert consultations refine the research findings, contributing to an accurate market outlook.

Step 4: Research Synthesis and Final Output

The final phase involves collaboration with battery manufacturers to gather detailed insights on production, sales trends, and consumer demand. This step ensures a well-rounded and validated report on the US Battery Market, supported by both top-down and bottom-up research approaches.

Frequently Asked Questions

01. How big is the US Battery Market?

The US Battery Market is valued at approximately USD 16.9 billion, supported by increasing demand for EVs and energy storage solutions across residential and industrial applications.

02. What are the challenges in the US Battery Market?

Challenges include high production costs, raw material supply constraints, and environmental concerns regarding battery disposal and recycling, which impact the market's growth potential.

03. Who are the major players in the US Battery Market?

Key players include Panasonic, Tesla, LG Chem, BYD, and CATL. These companies dominate the market through their advanced technology, production capabilities, and commitment to sustainability.

04. What drives growth in the US Battery Market?

Market growth is driven by the rising adoption of electric vehicles, the demand for renewable energy storage, and technological innovations in battery efficiency and performance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.