U.S. Beef Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD8626

December 2024

98

About the Report

U.S. Beef Market Overview

- The U.S. beef market is valued at USD 92 billion, based on a five-year historical analysis. This market is primarily driven by strong domestic demand for premium cuts and high-quality beef products, alongside the nation's robust infrastructure supporting beef production, distribution, and processing. The steady growth in consumer spending, a preference for high-protein diets, and export opportunities to countries with limited beef production further fuel the demand, consolidating the market's size in 2023.

- Major cities in the U.S., including Dallas, Omaha, and Chicago, dominate beef production due to their proximity to large cattle farming regions and extensive meat processing facilities. These cities benefit from well-established supply chains, trained labor, and logistical efficiencies that contribute to their central role in the beef industry, making them hubs for production and export activities.

- Trade tariffs continue to impact U.S. beef exports, with tariffs imposed by major trade partners affecting approximately 300,000 metric tons of U.S. beef exports in 2023. Trade restrictions can limit growth opportunities in high-demand regions, emphasizing the need for favorable trade negotiations. Efforts are ongoing to renegotiate tariffs, which would benefit the U.S. beef market by expanding access to international markets.

U.S. Beef Market Segmentation

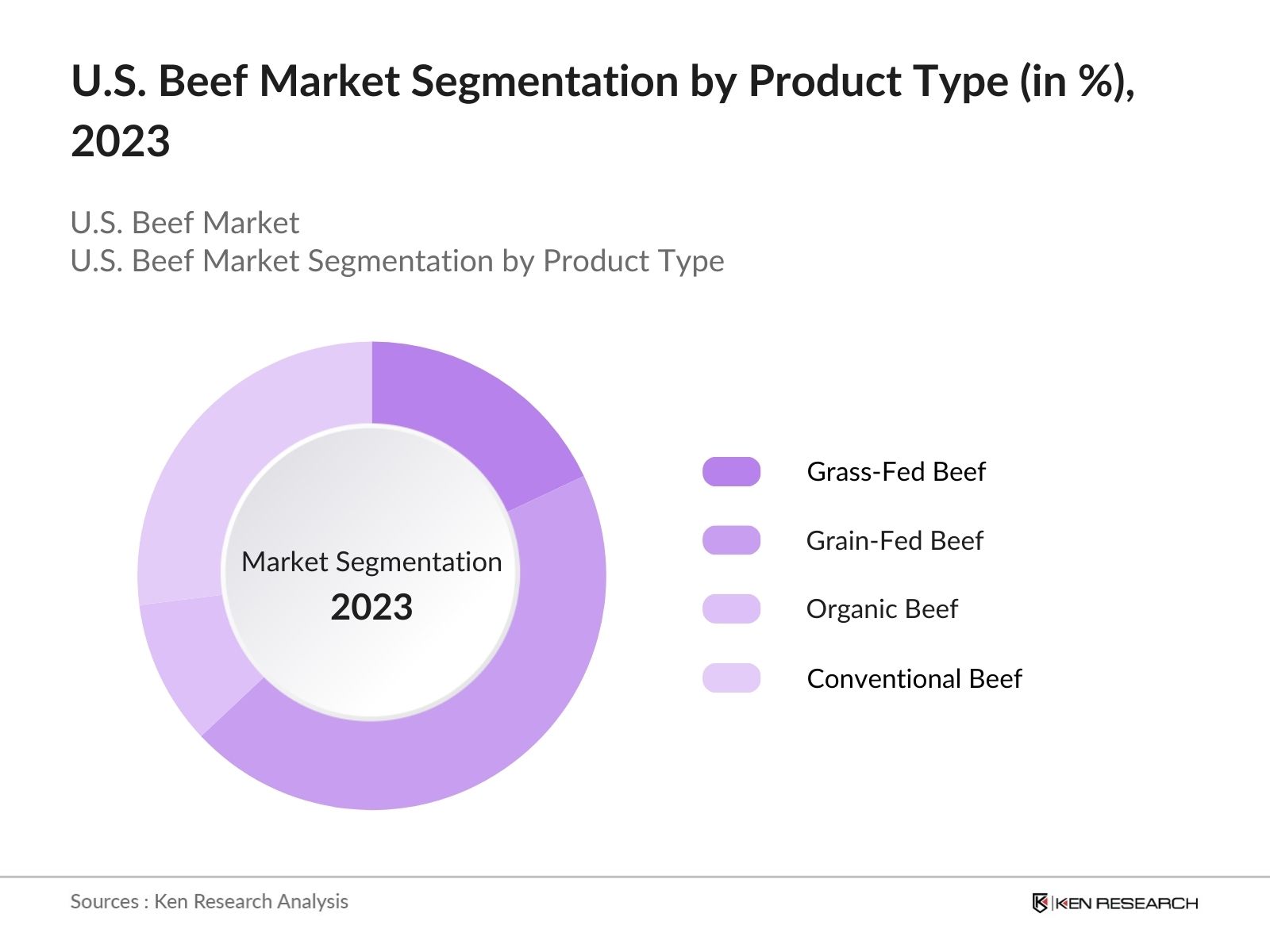

By Product Type: The market is segmented by product type into grass-fed beef, grain-fed beef, organic beef, and conventional beef. Recently, grain-fed beef has held a dominant market share under the product type segmentation. Its popularity stems from consumer preferences for the marbling and tenderness associated with grain-finished beef, commonly used in restaurants and grocery stores. Grain-fed beef also aligns with established cattle farming practices in the Midwest and South, where feedlots are integral to regional economies.

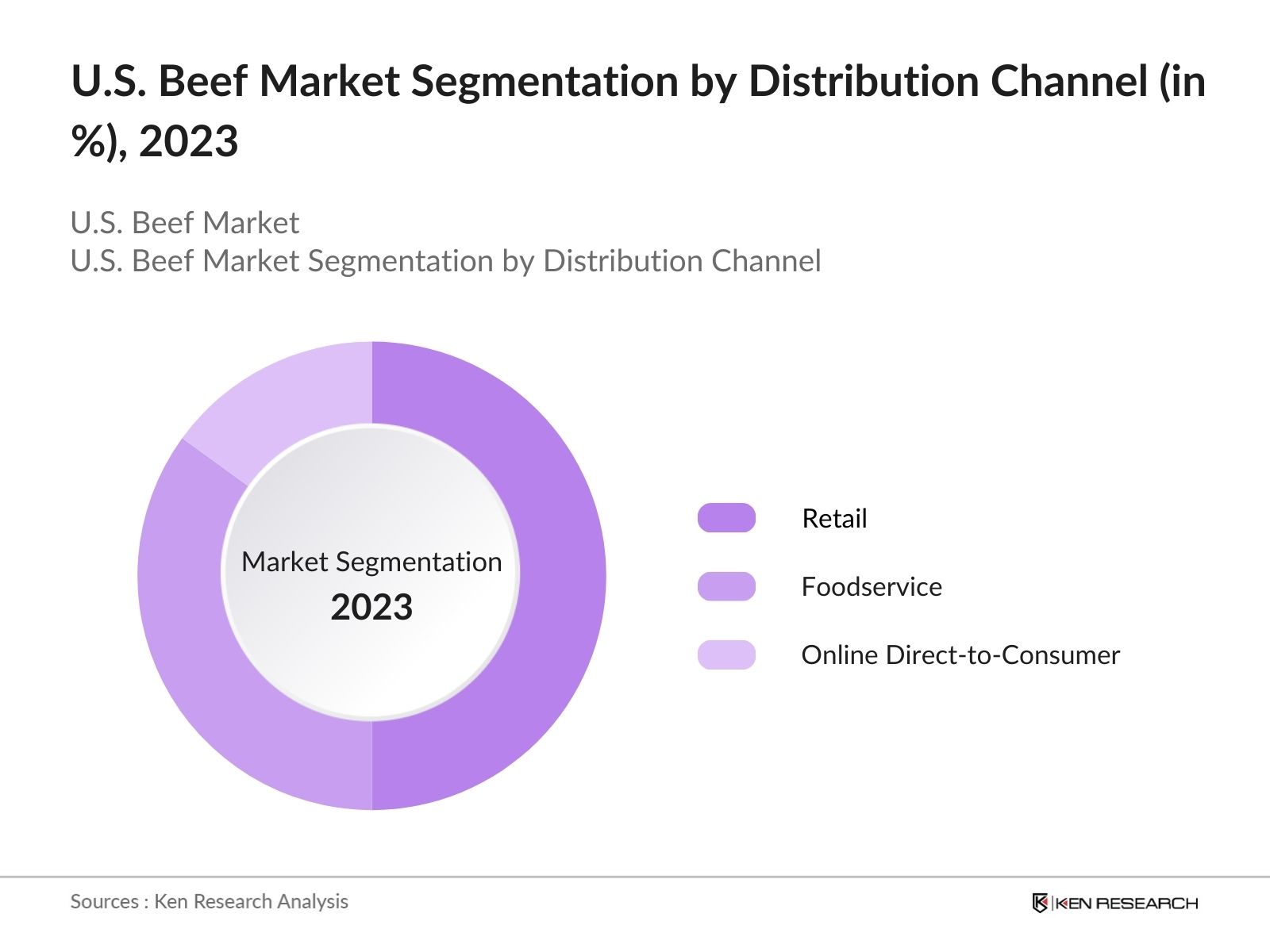

By Distribution Channel: The market is segmented by distribution channel into retail, foodservice, and online direct-to-consumer. The retail segment currently leads the distribution channels due to the substantial presence of supermarkets and specialty stores. Retailers provide accessible options for consumers and stock a wide variety of beef cuts catering to diverse preferences. Additionally, partnerships with local farmers and sustainable sourcing initiatives contribute to the retail channel's dominance.

U.S. Beef Market Competitive Landscape

The U.S. beef market is dominated by a few major players, including domestic leaders like Cargill and Tyson Foods, along with international names such as JBS USA. These companies leverage extensive supply chains, advanced processing technologies, and strong branding to maintain a competitive edge. Their market influence is also reinforced by significant investment in sustainable practices and animal welfare standards.

|

Company |

Establishment Year |

Headquarters |

Cattle Sourcing Strategy |

Processing Capacity |

Sustainability Initiatives |

Export Markets |

Certifications |

Distribution Network |

Technological Advancements |

|

Cargill |

1865 |

Minnesota, USA |

|||||||

|

Tyson Foods |

1935 |

Arkansas, USA |

|||||||

|

JBS USA |

1953 |

Colorado, USA |

|||||||

|

National Beef Packing Co. |

1992 |

Kansas, USA |

|||||||

|

Smithfield Foods |

1936 |

Virginia, USA |

U.S. Beef Industry Analysis

Growth Drivers

- Rising Domestic Demand: The U.S. beef market has seen substantial domestic demand, with beef consumption reaching 60 kilograms per capita in 2023, underscoring the strong consumer base within the country. Factors driving this include increased disposable incomes and changing dietary habits favoring protein-rich foods. USDA data indicates that beef is the primary meat choice for American households, driven by its cultural significance and growing availability across urban and rural areas. This demand has also contributed to a consistent increase in domestic cattle farming operations to meet consumer preferences.

- Export Market Growth: The U.S. beef export market has grown significantly, with exports reaching 1.4 million metric tons in 2023. Major export destinations like Japan and South Korea accounted for over 40% of total exports, fueled by trade agreements and consumer preference for American beef quality. According to the USDA, rising demand in Asia for high-quality beef cuts has pushed the U.S. to strengthen its export capacity. Trade agreements, such as the U.S.-Japan Trade Agreement, have contributed to reducing tariffs, supporting the competitive positioning of U.S. beef in these high-demand regions.

- Government Subsidies in Cattle Farming: Government subsidies have been instrumental in supporting U.S. cattle farmers, with subsidies reaching $3 billion in 2023 to aid livestock production costs. The USDA supports cattle farming through direct payment schemes and disaster assistance programs, which help offset risks like droughts affecting feed availability. Subsidies also assist in sustaining operations during market downturns, ensuring a steady beef supply for both domestic and export needs. This financial support encourages ranchers to maintain high standards, indirectly benefiting consumer and export markets.

Market Challenges

- Environmental Concerns and Regulations: The U.S. beef industry faces increased environmental scrutiny, with cattle farming linked to over 160 million metric tons of CO2 emissions in 2023. In response, the U.S. government has implemented stricter regulations targeting emissions and land-use practices. EPA guidelines now require cattle farms to adopt sustainable practices, such as methane capture and efficient water use. The growing need for compliance adds cost pressures, impacting smaller farms more significantly due to limited capital.

- Labor Shortages in Meat Processing: Labor shortages in the meat processing sector continue to challenge the U.S. beef market, with processing plants reporting a workforce gap of over 10,000 positions in 2023. According to the U.S. Bureau of Labor Statistics, factors such as the physically demanding nature of the work and health risks deter workers. This shortage has led to operational inefficiencies, increasing the time required for processing and raising costs, ultimately affecting supply and retail pricing.

U.S. Beef Market Future Outlook

The U.S. beef market is expected to maintain a steady growth trajectory over the next few years, supported by increasing consumer demand for high-quality protein sources and sustained export opportunities. Strategic investments in supply chain transparency, sustainable farming practices, and animal welfare are likely to strengthen consumer trust and further drive market expansion. The ongoing development of direct-to-consumer sales channels also offers growth potential, addressing evolving consumer preferences for convenience and product traceability.

Future Market Opportunities

- Expanding Export Opportunities in Asia: The U.S. beef industry is witnessing expanding export opportunities in Asia, where beef imports increased by over 200,000 metric tons in 2023. Japan and China, in particular, show strong demand due to rising incomes and a preference for U.S. beef quality. Trade negotiations have also facilitated reduced tariffs, making U.S. beef more competitive. This growth is crucial for sustaining profitability within the sector and counterbalancing domestic market challenges.

- Innovations in Traceability and Food Safety: Innovative traceability solutions are enhancing food safety and transparency, critical in meeting consumer expectations. The USDA has implemented new guidelines, pushing for end-to-end traceability across the beef supply chain. In 2023, more than 60% of major beef producers adopted blockchain technology for traceability, ensuring product quality from farm to table. This transparency aligns with consumer priorities, making traceable beef products more competitive domestically and internationally.

Scope of the Report

|

By Product Type |

Grass-Fed Beef Grain-Fed Beef Organic Beef Conventional Beef |

|

By Distribution Channel |

Retail (Supermarkets, Butchers) Foodservice (Restaurants, Hotels) Online Direct-to-Consumer |

|

By Cut Type |

Ground Beef Steaks Roasts Other Cuts |

|

By End User |

Households Foodservice Industry Industrial Processing |

|

By Region |

Midwest South West Northeast |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, EPA)

Major Retail Chains

Meat Processing Equipment Manufacturers

Organic Food Retailers

Restaurant Chains

Export Market Buyers

Banks and Financial Institutes

Large-Scale Distributors

Companies

Major Players

Tyson Foods

JBS USA

National Beef Packing Company

Smithfield Foods

Perdue Farms

Meyer Natural Foods

American Foods Group

Creekstone Farms

Greater Omaha Packing Co.

Hormel Foods

Wayne Farms

Keystone Foods

Sysco Corporation

Agri Beef Co.

Table of Contents

1. U.S. Beef Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Current Consumption, Export and Import Data)

1.4 Market Segmentation Overview

2. U.S. Beef Market Size (In USD Million)

2.1 Historical Market Size (Retail Sales, Wholesale Volume)

2.2 Year-On-Year Growth Analysis (Cattle Production, Consumption Trends)

2.3 Key Market Developments and Milestones (Policy Changes, Trade Agreements)

3. U.S. Beef Market Analysis

3.1 Growth Drivers

3.1.1 Rising Domestic Demand

3.1.2 Export Market Growth

3.1.3 Consumer Preference for Premium Cuts

3.1.4 Government Subsidies in Cattle Farming

3.2 Market Challenges

3.2.1 Fluctuating Feed Prices

3.2.2 Environmental Concerns and Regulations

3.2.3 Labor Shortages in Meat Processing

3.2.4 Health-Related Consumer Concerns

3.3 Opportunities

3.3.1 Expanding Export Opportunities in Asia

3.3.2 Premiumization and Organic Meat Demand

3.3.3 Innovations in Traceability and Food Safety

3.4 Trends

3.4.1 Increasing Automation in Processing

3.4.2 Shift towards Grass-Fed Beef

3.4.3 Rise of Direct-to-Consumer Channels

3.4.4 Demand for Plant-based Alternatives

3.5 Government Regulation

3.5.1 USDA Grading and Standards

3.5.2 Environmental Compliance and Emission Targets

3.5.3 Animal Welfare Standards

3.5.4 Trade Tariffs and Export Restrictions

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Ranchers, Processors, Distributors)

3.8 Porters Five Forces Analysis (Supply Chain, Import-Export Impact)

3.9 Competition Ecosystem (Processing Facilities, Distribution Networks)

4. U.S. Beef Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Grass-Fed Beef

4.1.2 Grain-Fed Beef

4.1.3 Organic Beef

4.1.4 Conventional Beef

4.2 By Distribution Channel (In Value %)

4.2.1 Retail (Supermarkets, Butchers)

4.2.2 Foodservice (Restaurants, Hotels)

4.2.3 Online Direct-to-Consumer

4.3 By Cut Type (In Value %)

4.3.1 Ground Beef

4.3.2 Steaks

4.3.3 Roasts

4.3.4 Other Cuts

4.4 By End User (In Value %)

4.4.1 Households

4.4.2 Foodservice Industry

4.4.3 Industrial Processing

4.5 By Region (In Value %)

4.5.1 Midwest

4.5.2 South

4.5.3 West

4.5.4 Northeast

5. U.S. Beef Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cargill

5.1.2 Tyson Foods

5.1.3 JBS USA

5.1.4 National Beef Packing Company

5.1.5 Smithfield Foods

5.1.6 Perdue Farms

5.1.7 Meyer Natural Foods

5.1.8 American Foods Group

5.1.9 Creekstone Farms

5.1.10 Greater Omaha Packing Co.

5.1.11 Hormel Foods

5.1.12 Wayne Farms

5.1.13 Keystone Foods

5.1.14 Sysco Corporation

5.1.15 Agri Beef Co.

5.2 Cross Comparison Parameters (Production Volume, Sustainability Initiatives, Export Markets, Certifications, Processing Capacity, Market Share, Distribution Networks, Technological Advancements)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint Ventures, Strategic Investments)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. U.S. Beef Market Regulatory Framework

6.1 USDA Grading Standards

6.2 Food Safety Inspection Service (FSIS) Compliance

6.3 Environmental Protection Agency (EPA) Regulations

6.4 Organic Certification Requirements

7. U.S. Beef Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. U.S. Beef Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Cut Type (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. U.S. Beef Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we established a comprehensive overview of the U.S. beef market by identifying all primary stakeholders, including producers, distributors, and regulatory bodies. Extensive desk research was conducted using government databases and industry reports to define the market's key variables.

Step 2: Market Analysis and Data Compilation

This phase involved collecting and analyzing historical data on market size, distribution channels, and production volumes. Information was cross-referenced to provide reliable insights into current and past performance metrics, ensuring data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated based on gathered data and then validated through consultations with industry experts from top companies. These discussions provided invaluable insights into market dynamics, trends, and challenges, reinforcing the data findings.

Step 4: Research Synthesis and Final Output

The final report synthesis involved integrating data from primary and secondary research to present a holistic view of the U.S. beef market. This phase ensured that the report accurately reflects market specifics, providing business professionals with a detailed, validated analysis.

Frequently Asked Questions

01. How big is the U.S. Beef Market?

The U.S. beef market is valued at USD 92 billion, driven by robust domestic demand, premium product offerings, and strong infrastructure support for production and distribution.

02. What are the key challenges in the U.S. Beef Market?

The primary challenges in the U.S. beef market include fluctuating feed costs, labor shortages, and increasing environmental regulations. Additionally, evolving consumer preferences towards plant-based alternatives present competitive challenges.

03. Who are the major players in the U.S. Beef Market?

Key players in the U.S. beef market include Cargill, Tyson Foods, JBS USA, National Beef Packing Company, and Smithfield Foods, recognized for their extensive supply chains, brand loyalty, and market influence.

04. What are the growth drivers of the U.S. Beef Market?

Growth drivers in the U.S. beef market include high domestic demand for quality beef products, increased protein consumption, and the U.S.s established position as a global beef exporter.

05. Which product types dominate the U.S. Beef Market?

Grain-fed beef is highly popular due to its texture and flavor, appealing to consumers seeking premium dining experiences, and aligns with established U.S. cattle farming practices in the U.S. beef market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.