U.S. Clinical Laboratories Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD8708

December 2024

100

About the Report

U.S. Clinical Laboratories Market Overview

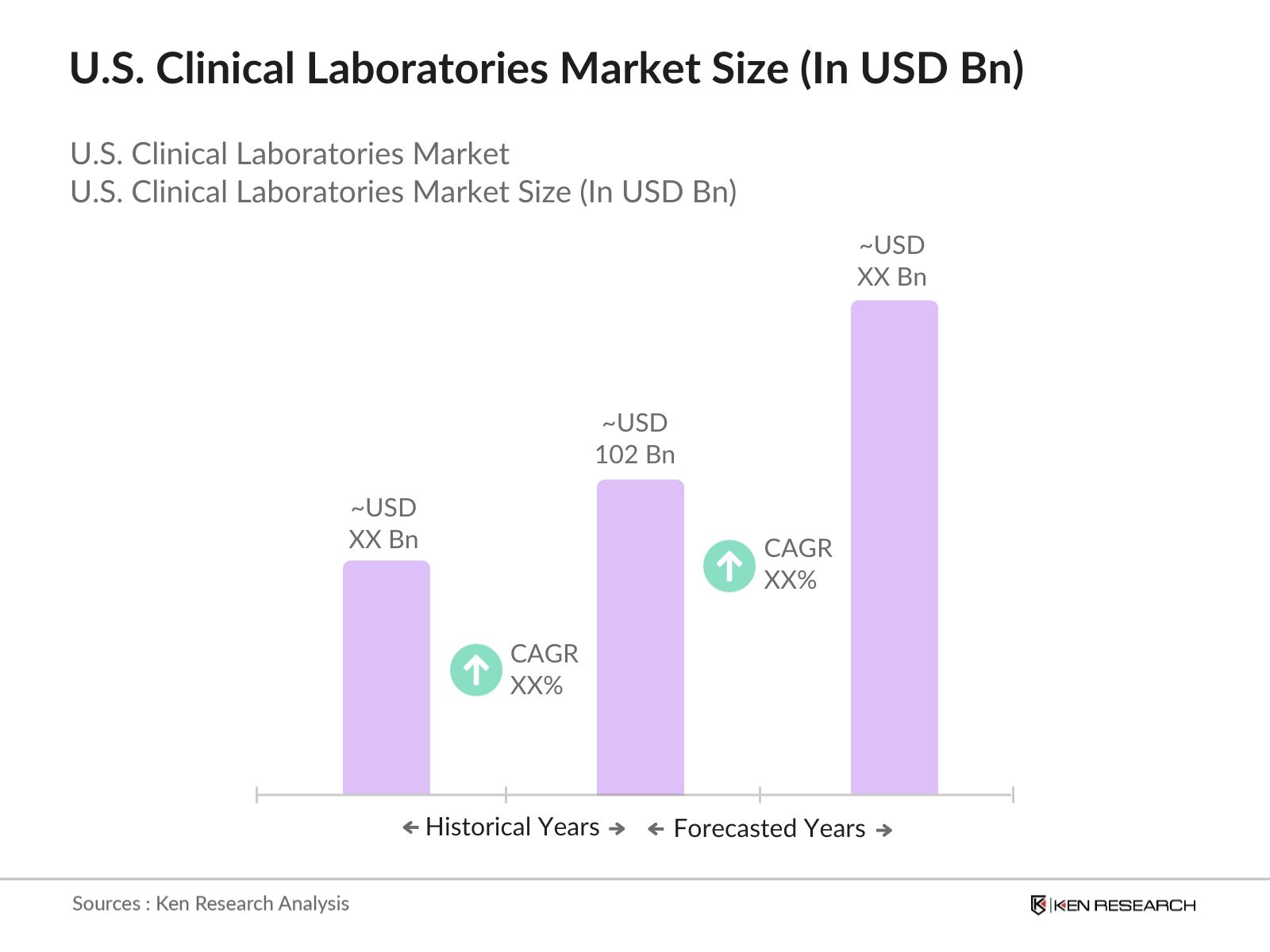

- The U.S. clinical laboratories market is valued at USD 102 billion, primarily driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and an expanding focus on preventive healthcare measures. This market is expected to see steady growth as healthcare providers prioritize accurate and timely diagnostics to enhance patient outcomes. Key factors such as a rising geriatric population, technological innovations in laboratory testing, and heightened awareness of health issues further contribute to the market's robustness and long-term viability.

- Major demand centers for clinical laboratory services in the U.S. include metropolitan areas like New York, Los Angeles, and Chicago. The dominance of these cities can be attributed to their extensive healthcare infrastructure, which includes leading hospitals, research institutions, and a large, diverse patient population. Furthermore, these regions are home to numerous healthcare innovations and investments, which bolster the clinical laboratories market. The presence of key healthcare organizations also drives market growth by fostering advancements in laboratory services.

- There is a notable shift towards point-of-care testing (POCT), which allows for rapid diagnostic results at or near the site of patient care. The global POCT market is expanding, driven by the need for timely decision-making in clinical settings. The convenience and speed of POCT are particularly beneficial in emergency and remote settings, leading to its increased adoption.

U.S. Clinical Laboratories Market Segmentation

-

By Test Type: The market is segmented by test type into clinical chemistry, hematology, genetic testing, microbiology & cytology, and toxicology. Clinical chemistry currently holds a dominant market share within this segmentation, driven by its widespread application in routine diagnostics, including metabolic and organ function tests. The increasing incidence of diabetes, cardiovascular diseases, and other chronic conditions necessitates regular biochemical testing, thus solidifying the position of clinical chemistry as a critical component in healthcare diagnostics.

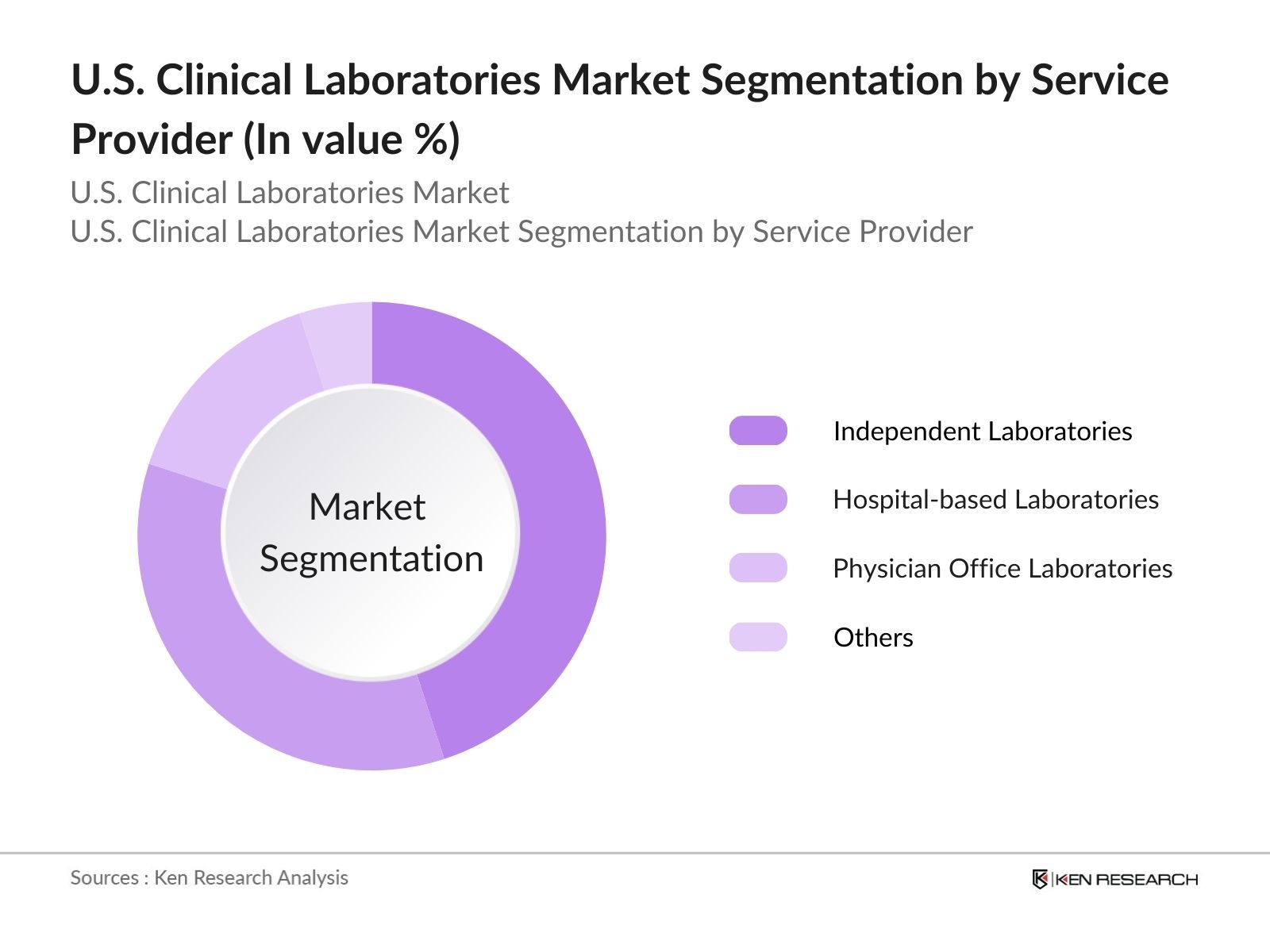

- By Service Provider: The market is segmented by service provider into hospital-based laboratories, independent laboratories, physician office laboratories (POLs), and others. Independent laboratories lead this segment, attributed to their operational efficiency and specialization in specific diagnostic tests. Their ability to offer a wider range of tests and faster turnaround times makes them attractive to healthcare providers seeking reliable laboratory services. Additionally, independent labs often invest in advanced technologies that enhance test accuracy and efficiency, further solidifying their market presence.

U.S. Clinical Laboratories Market Competitive Landscape

The U.S. clinical laboratories market is dominated by a few major players, including Laboratory Corporation of America, Quest Diagnostics, and Sonic Healthcare USA. These companies leverage strong brand recognition, extensive service offerings, and continuous technological investments to maintain their competitive edge and market leadership.

U.S. Clinical Laboratories Market Analysis

Growth Drivers

- Increase in Chronic Disease Prevalence: The growing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders significantly drives the U.S. clinical laboratories market. According to the Centers for Disease Control and Prevention (CDC), around 60% of U.S. adults have a chronic disease, highlighting the need for regular laboratory testing. This trend leads healthcare providers to increase their reliance on clinical laboratory services for diagnosis, monitoring, and management of these conditions, ultimately fueling market growth.

- Technological Advancements in Diagnostics: Rapid advancements in diagnostic technologies, including molecular testing and point-of-care testing, are transforming the landscape of clinical laboratories. Innovations such as next-generation sequencing (NGS) and digital pathology enhance diagnostic accuracy and efficiency. Furthermore, these technologies enable laboratories to conduct a broader range of tests, thus increasing their value proposition to healthcare providers and patients alike. The integration of automation and artificial intelligence (AI) in laboratory workflows also contributes to improved operational efficiency.

- Increasing Geriatric Population: The global population aged 65 and over is projected to reach 1.5 billion by 2050, up from 727 million in 2020. In the United States, the population aged 65 and older was around 57.8 million in 2022, representing about 17.3% of the total population. This demographic shift is associated with a higher prevalence of age-related diseases, necessitating comprehensive diagnostic services. The ageing population's increased healthcare needs are expected to drive the demand for laboratory diagnostics, as early detection and management of diseases become paramount in this age group.

Challenges

- Regulatory Compliance and Reimbursement Issues: Navigating the complex regulatory landscape remains a significant challenge for laboratory diagnostics providers. Compliance with standards such as the Clinical Laboratory Improvement Amendments (CLIA) and obtaining approvals from bodies like the U.S. Food and Drug Administration (FDA) for laboratory-developed tests (LDTs) can be time-consuming and costly. Additionally, reimbursement policies vary across regions, with some countries lacking comprehensive coverage for diagnostic tests, leading to financial uncertainties for providers.

- High Operational Costs: The operational costs associated with running clinical laboratories, including personnel, equipment maintenance, and technology upgrades, can be substantial. This financial burden is particularly challenging for independent laboratories, which may struggle to compete with larger organizations that benefit from economies of scale. Balancing quality services with cost efficiency remains a critical challenge for many players in the market. These high costs can be a barrier to entry and sustainability, particularly for smaller laboratories.

U.S. Clinical Laboratories Market Future Outlook

The U.S. clinical laboratories market is poised for substantial growth, driven by advancements in diagnostic technology, an increasing focus on personalized medicine, and an aging population. The ongoing development of innovative testing methodologies and the expansion of laboratory services will likely enhance the overall market landscape. As healthcare continues to prioritize preventative measures and early detection, the demand for clinical laboratory services is expected to rise, setting a positive trajectory for future market expansion.

Future Market Opportunities

- Expansion of Telehealth Services: The rise of telehealth services, accelerated by the COVID-19 pandemic, presents new opportunities for clinical laboratories. Telehealth platforms increasingly integrate laboratory services, enabling patients to access diagnostic testing remotely. This trend is expected to grow, offering laboratories a chance to expand their reach and improve patient engagement. Clinical labs that adapt their services to fit the telehealth model can tap into this emerging market segment, enhancing their overall service delivery.

- Increased Investment in Research and Development: There is a growing emphasis on research and development within the clinical laboratories sector, particularly concerning advanced diagnostics and personalized medicine. The increasing availability of funding for innovative laboratory technologies presents an opportunity for companies to enhance their service offerings and improve patient care outcomes. As healthcare providers seek to incorporate advanced diagnostic tools into their practices, clinical laboratories that prioritize R&D will be well-positioned to lead the market.

Scope of the Report

|

By Test Type |

Clinical Chemistry |

|

By Service Provider |

Hospital-based Laboratories |

|

By Test Complexity |

Routine Tests |

|

By Application |

Routine Medical Testing |

|

By Region |

Northeast |

Products

Key Target Audience

Healthcare Providers

Diagnostic Equipment Manufacturers

Pharmaceutical Companies

Health Insurance Companies

Government and Regulatory Bodies (e.g., Centers for Medicare & Medicaid Services)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Research and Academic Institutions

Companies

Players Mentioned in the Report

Laboratory Corporation of America

Quest Diagnostics

Sonic Healthcare USA

Mayo Clinic Laboratories

Bio-Reference Laboratories, Inc.

ARUP Laboratories

DaVita Inc.

Fresenius Medical Care

Genomic Health, Inc.

NeoGenomics Laboratories

Enzo Clinical Labs

Spectra Laboratories

ACM Global Laboratories

PPD, Inc.

BioReference Health, LLC

Table of Contents

Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases

3.1.2. Technological Advancements in Diagnostics

3.1.3. Increasing Geriatric Population

3.1.4. Expansion of Health Insurance Coverage

3.2. Market Challenges

3.2.1. Regulatory Compliance and Reimbursement Issues

3.2.2. High Operational Costs

3.2.3. Shortage of Skilled Laboratory Professionals

3.3. Opportunities

3.3.1. Growth in Personalized Medicine

3.3.2. Integration of Artificial Intelligence in Diagnostics

3.3.3. Expansion into Rural and Underserved Areas

3.4. Trends

3.4.1. Shift Towards Point-of-Care Testing

3.4.2. Adoption of Laboratory Information Management Systems (LIMS)

3.4.3. Increase in Direct-to-Consumer Testing Services

3.5. Government Regulations

3.5.1. Clinical Laboratory Improvement Amendments (CLIA) Standards

3.5.2. FDA Oversight on Laboratory-Developed Tests (LDTs)

3.5.3. Medicare Reimbursement Policies

3.5.4. Data Privacy and Security Regulations (HIPAA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

Market Segmentation

4.1. By Test Type (Value %)

4.1.1. Clinical Chemistry

4.1.2. Hematology

4.1.3. Genetic Testing

4.1.4. Microbiology & Cytology

4.1.5. Toxicology

4.2. By Service Provider (Value %)

4.2.1. Hospital-based Laboratories

4.2.2. Independent Laboratories

4.2.3. Physician Office Laboratories (POLs)

4.2.4. Others

4.3. By Test Complexity (Value %)

4.3.1. Routine Tests

4.3.2. Specialty Tests

4.4. By Application (Value %)

4.4.1. Routine Medical Testing

4.4.2. Early Disease Detection

4.4.3. Diagnostic and Monitoring

4.4.4. Others

4.5. By Region (Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Laboratory Corporation of America Holdings (LabCorp)

5.1.2. Quest Diagnostics Incorporated

5.1.3. Sonic Healthcare Limited

5.1.4. Mayo Clinic Laboratories

5.1.5. Bio-Reference Laboratories, Inc.

5.1.6. ARUP Laboratories

5.1.7. DaVita Inc.

5.1.8. Fresenius Medical Care

5.1.9. Genomic Health, Inc.

5.1.10. NeoGenomics Laboratories

5.1.11. Enzo Clinical Labs

5.1.12. Spectra Laboratories

5.1.13. ACM Global Laboratories

5.1.14. PPD, Inc.

5.1.15. BioReference Health, LLC

5.2. Cross Comparison Parameters (Number of Employees, Headquarters Location, Year of Establishment, Annual Revenue, Service Portfolio, Geographic Presence, Market Share, Recent Developments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

Regulatory Framework

6.1. Accreditation and Certification Processes

6.2. Compliance Requirements

6.3. Quality Assurance Programs

Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Future Market Segmentation

8.1. By Test Type (Value %)

8.2. By Service Provider (Value %)

8.3. By Test Complexity (Value %)

8.4. By Application (Value %)

8.5. By Region (Value %)

Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. clinical laboratories market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the U.S. clinical laboratories market. This includes assessing market penetration, the ratio of service providers to healthcare facilities, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple clinical laboratory manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. clinical laboratories market.

Frequently Asked Questions

How big is the U.S. Clinical Laboratories Market?

The U.S. clinical laboratories market is valued at USD 102 billion, primarily driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and an expanding focus on preventive healthcare measures.

What are the growth drivers of the U.S. Clinical Laboratories Market?

Key growth drivers for the U.S. clinical laboratories market include the rising prevalence of chronic diseases, technological advancements in diagnostics, and an increased emphasis on preventive healthcare measures.

Who are the major players in the U.S. Clinical Laboratories Market?

Major players in the U.S. clinical laboratories market include Laboratory Corporation of America, Quest Diagnostics, Sonic Healthcare USA, and Mayo Clinic Laboratories, among others.

What are the challenges faced by the U.S. Clinical Laboratories Market?

Challenges in the U.S. clinical laboratories market include stringent regulatory compliance issues and high operational costs, which can hinder the growth of smaller laboratories.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.