U.S. Generator Sales Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD6972

December 2024

83

About the Report

U.S. Generator Sales Market Overview

- The U.S. generator sales market is valued at USD 6.10 billion, driven by rising demand for backup power solutions in response to increasing power outages, industrial expansion, and critical infrastructure support. The growing focus on energy security and technological advancements in generator systems, such as hybrid and fuel-efficient models, have further boosted market demand. Federal investments in power infrastructure and the growing awareness around energy efficiency are also contributing to the markets expansion.

- Key metropolitan areas like New York, Los Angeles, and Houston dominate the generator sales market due to their large industrial bases, frequent power disruptions, and substantial residential demand for backup systems. These cities also house major commercial hubs, which drives higher demand for reliable power sources, making them key revenue contributors in the market. The concentration of large-scale manufacturing and energy sectors in these regions amplifies generator use.

- The U.S. Department of Energy has implemented various policies aimed at improving fuel efficiency and promoting the adoption of backup power systems. In 2024, the DOE introduced new fuel efficiency standards for industrial generators, requiring a 10% increase in fuel efficiency compared to 2022 standards. Additionally, the DOEs backup power grant program, which allocated over $500 million in grants for businesses installing generators in critical infrastructure, has helped drive market growth. These policies have made generators more accessible and efficient, especially for industrial and commercial users.

U.S. Generator Sales Market Segmentation

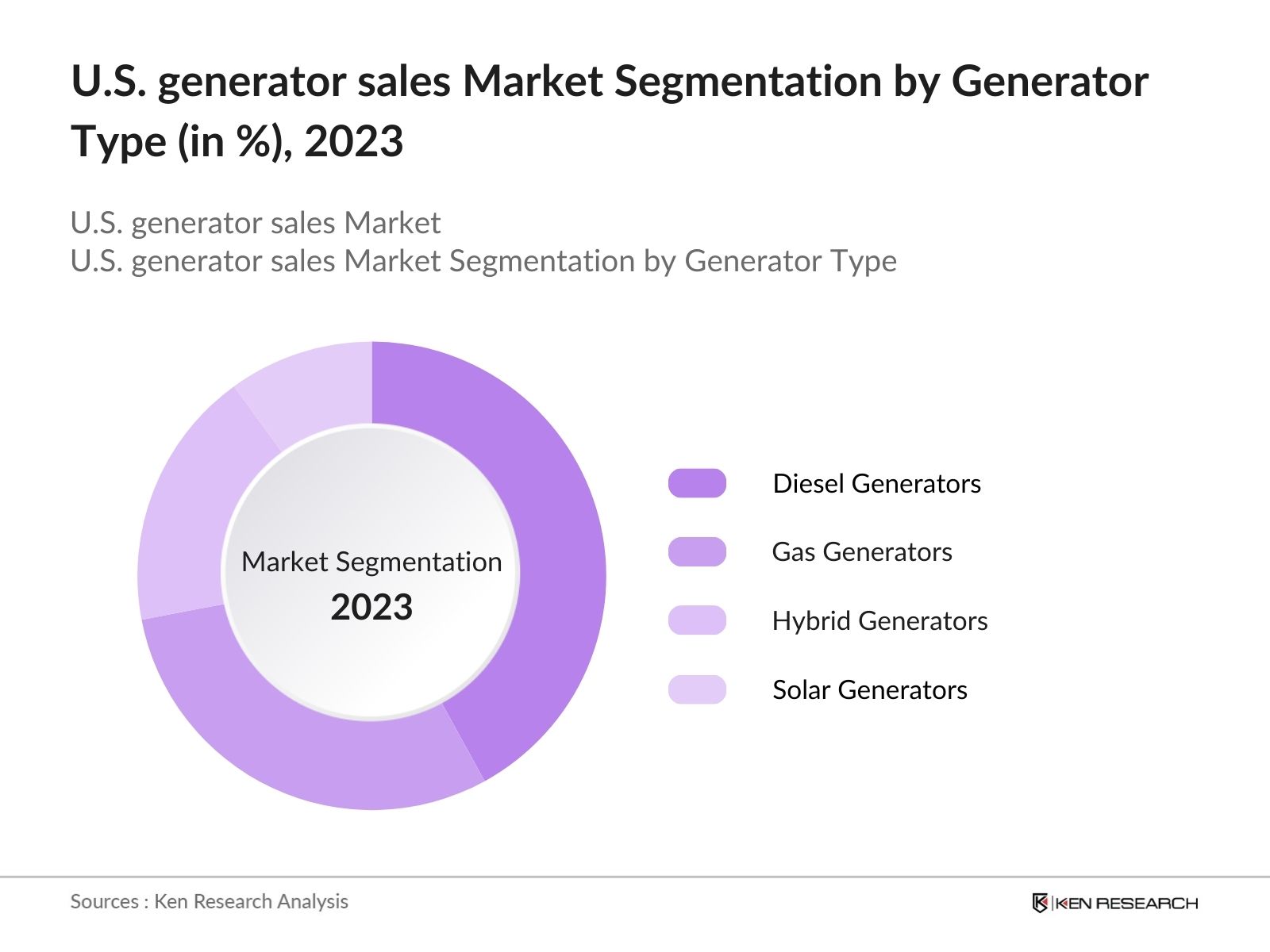

By Generator Type: The market is segmented by generator type into diesel generators, gas generators, hybrid generators, and solar generators. Diesel generators currently dominate this segment due to their reliability, high efficiency, and longer operational life. They are widely used in industrial and commercial sectors where continuous power is critical, such as healthcare and data centers. Despite concerns over emissions, advancements in diesel engine technology have maintained the relevance of diesel generators across industries.

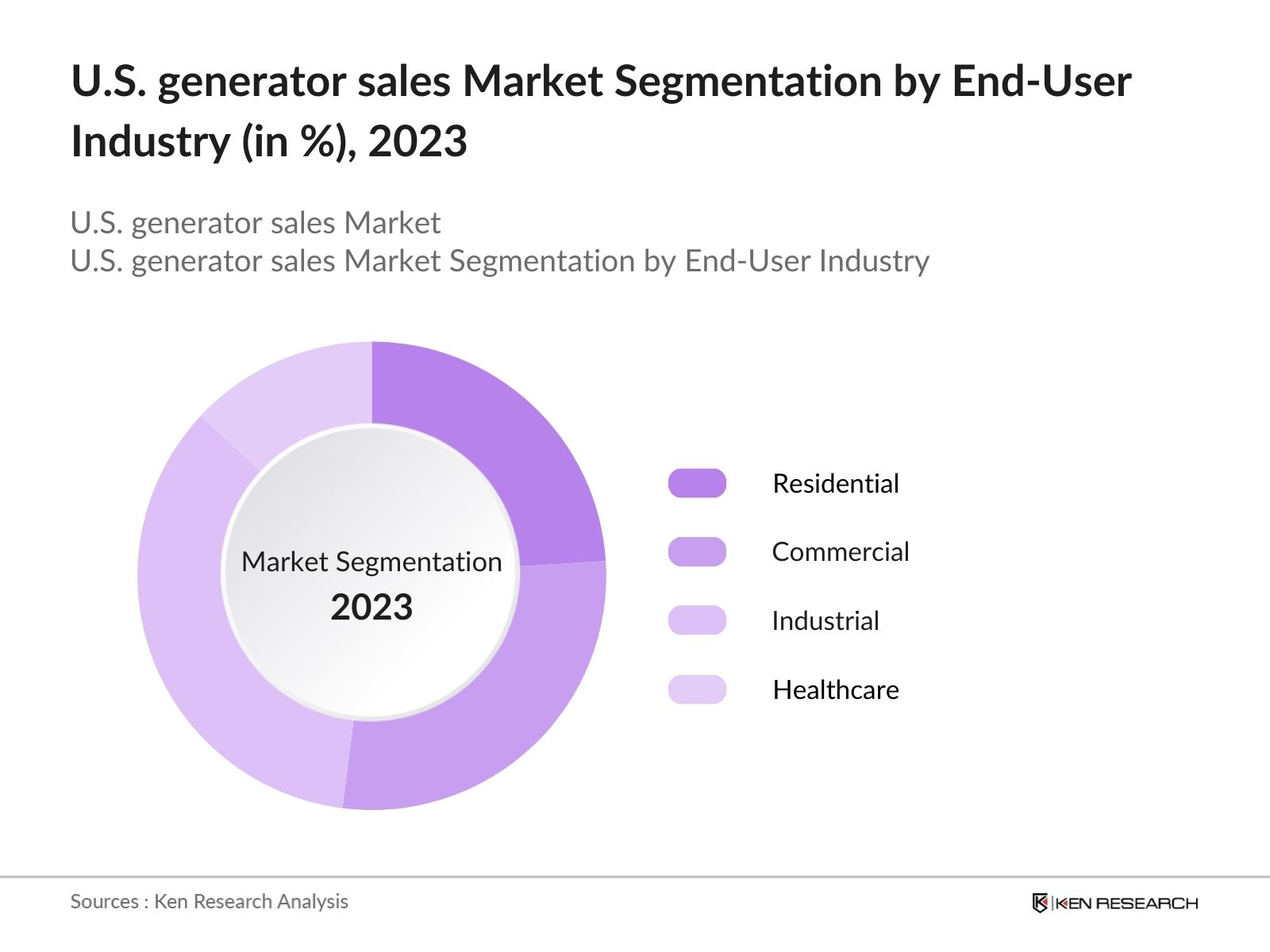

By End-User Industry: The market is also segmented by end-user industries, including residential, commercial, industrial, and healthcare. The industrial segment has been the dominant market player due to its high demand for reliable power sources in manufacturing plants, mining operations, and oil & gas facilities. The increased automation in industries also necessitates constant power supply, making generators indispensable for operations in sectors with high energy consumption.

U.S. Generator Sales Market Competitive Landscape

The U.S. generator sales market is dominated by several key players, with competition centered around technological innovation, reliability, and fuel efficiency. Companies like Caterpillar Inc. and Generac Holdings Inc. hold substantial market share due to their strong product portfolios and established brand loyalty. The market's consolidation reflects the high entry barriers created by extensive capital requirements and stringent regulatory standards on emissions.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD) |

No. of Employees |

R&D Investment |

Key Products |

U.S. Market Share |

Global Reach |

Technology Focus |

|

Caterpillar Inc. |

1925 |

Illinois, USA |

|||||||

|

Cummins Inc. |

1919 |

Indiana, USA |

|||||||

|

Generac Holdings Inc. |

1959 |

Wisconsin, USA |

|||||||

|

Kohler Co. |

1873 |

Wisconsin, USA |

|||||||

|

Atlas Copco AB |

1873 |

Stockholm, Sweden |

U.S. Generator Sales Industry Analysis

Growth Drivers

- Industrial Power Demand (Key Sector: Oil & Gas, Mining, Manufacturing): In 2024, the industrial sector in the U.S., driven by oil & gas, mining, and manufacturing, has seen a surge in power demand, significantly bolstering generator sales. The U.S. Energy Information Administration (EIA) reported that oil and gas production alone consumed nearly 35% of industrial electricity in 2023, contributing to the need for backup power solutions. Additionally, the mining sector, responsible for 11.3% of U.S. industrial energy consumption, heavily relies on generators for operations in remote areas. With the manufacturing sector contributing over $2.5 trillion to the U.S. economy, generator demand remains vital for continuous production.

- Residential Power Demand (Increased Urbanization, Power Outage Frequency): The growing urban population in the U.S., which reached over 275 million in 2023, along with frequent power outages due to natural disasters, has increased residential generator sales. According to the U.S. Census Bureau, urbanization has driven the demand for backup power, especially in regions prone to storms like Texas, which saw over 72 hours of outages in 2022 alone. This increase in demand is further supported by FEMA, which reported that over 60% of U.S. households experienced power interruptions in 2023, leading to a surge in sales of residential backup generators.

- Technological Advancements in Generators (Fuel Efficiency, Hybrid Generators, Automation): The U.S. generator market has seen significant technological advancements between 2022 and 2024, particularly in fuel-efficient and hybrid generator models. Modern generators now offer up to 25% more fuel efficiency compared to older models, as per the U.S. Department of Energy. Additionally, hybrid generators, which combine renewable energy sources with conventional fuel, have gained popularity. The introduction of automated systems, such as IoT-enabled remote monitoring, has improved operational efficiency, reducing downtime by up to 30% in industrial applications, according to the National Renewable Energy Laboratory (NREL).

Market Challenges

- High Initial Purchase Cost: The high upfront cost of purchasing generators remains a significant barrier in the U.S. market. Industrial-grade generators, particularly diesel-powered models, can cost upwards of $50,000, depending on capacity, as per the U.S. Department of Energy. While these units are essential for uninterrupted operations in sectors like healthcare and manufacturing, the initial financial outlay limits adoption, particularly among small- and medium-sized enterprises (SMEs). Moreover, while larger corporations can absorb these costs, smaller firms are often forced to rely on leasing options or government-backed incentives to procure these backup systems.

- Fluctuating Fuel Prices (Diesel, Natural Gas): The volatility in fuel prices, particularly for diesel and natural gas, has posed challenges to generator operations. In 2024, the U.S. saw diesel prices hovering around $4 per gallon, impacting operational costs for industrial users. Natural gas, although more stable, saw regional price fluctuations, especially during peak demand periods in the winter months, which pushed prices above $7 per MMBtu in certain regions. These fluctuations add unpredictability to the cost of running generators, especially for sectors like mining and oil & gas that require continuous operations.

U.S. Generator Sales Market Future Outlook

The U.S. generator sales market is set to experience sustained growth due to a combination of rising energy demands, climate-related power disruptions, and ongoing industrial expansion. Governmental support for renewable energy integration, coupled with advancements in hybrid and green energy generators, is expected to drive market evolution. The growing adoption of IoT-enabled generators that support predictive maintenance and remote monitoring will further push the boundaries of innovation in the sector.

Market Opportunities

- Growing Demand for Green Energy Generators (Solar Hybrid Generators, Biofuel Generators): The U.S. generator market is witnessing growing demand for green energy alternatives, such as solar hybrid generators and biofuel-powered units. In 2024, the U.S. Department of Energy reported that solar-powered generators accounted for nearly 12% of new generator installations. Biofuel generators, which can reduce greenhouse gas emissions by up to 85%, are also gaining traction in states like California, where strict emission regulations are in place. These generators are especially attractive to businesses seeking to reduce their carbon footprint and comply with environmental regulations while ensuring energy security.

- Expansion into Remote & Off-Grid Applications (Construction, Mining Sites)

Remote and off-grid locations, particularly in sectors like construction and mining, present significant growth opportunities for the U.S. generator market. According to the U.S. Department of Labor, over 800,000 people were employed in construction-related roles in off-grid or semi-urban areas as of 2023. Mining sites, which often operate in remote locations without access to grid power, also rely heavily on generators. This has driven demand for portable, high-capacity generators that can operate in harsh environmental conditions, ensuring uninterrupted power supply for critical operations.

Scope of the Report

|

By Generator Type |

Diesel Generators Gas Generators Solar Generators Hybrid Generators |

|

By Power Output |

Less than 100 kW 100-500 kW 500-1000 kW More than 1000 kW |

|

By End-User Industry |

Residential Commercial Industrial Healthcare |

|

By Application |

Standby Power Peak Shaving Continuous Power Supply Backup and Emergency Power |

|

By Region |

North East West South |

Products

Key Target Audience

Power Generation Companies

Industrial Manufacturing Facilities

Data Centers & IT Infrastructure Firms

Government and Regulatory Bodies (EPA, U.S. Department of Energy)

Healthcare Facilities

Construction & Mining Companies

Investments and Venture Capitalist Firms

Oil & Gas Companies

Banks and Financial Institutes

Companies

Major Players in the U.S. Generator Sales Market

Caterpillar Inc.

Cummins Inc.

Generac Holdings Inc.

Kohler Co.

Atlas Copco AB

Siemens AG

MTU Onsite Energy

Honda Motor Co., Ltd.

Wartsila Corporation

Mitsubishi Heavy Industries, Ltd.

Aksa Power Generation

Doosan Portable Power

Himoinsa S.L.

Briggs & Stratton Corporation

GE Power

Table of Contents

1. U.S. Generator Sales Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Power Consumption, Industrial Expansion, Climate Trends)

1.4. Market Segmentation Overview

2. U.S. Generator Sales Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (in % Value Growth)

2.3. Key Market Developments and Milestones (Supply Chain Investments, Energy Security Initiatives)

3. U.S. Generator Sales Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Power Demand (Key Sector: Oil & Gas, Mining, Manufacturing)

3.1.2. Residential Power Demand (Increased Urbanization, Power Outage Frequency)

3.1.3. Technological Advancements in Generators (Fuel Efficiency, Hybrid Generators, Automation)

3.1.4. Government Investments in Energy Backup Infrastructure (Federal Energy Policies, FEMA Investments)

3.2. Market Challenges

3.2.1. High Initial Purchase Cost

3.2.2. Fluctuating Fuel Prices (Diesel, Natural Gas)

3.2.3. Increasing Regulations on Emission Standards (EPA Compliance)

3.3. Opportunities

3.3.1. Growing Demand for Green Energy Generators (Solar Hybrid Generators, Biofuel Generators)

3.3.2. Expansion into Remote & Off-Grid Applications (Construction, Mining Sites)

3.3.3. International Export Opportunities (NAFTA, Global Trade Policies)

3.4. Trends

3.4.1. Integration of IoT and Smart Technologies (Predictive Maintenance, Remote Monitoring)

3.4.2. Increasing Demand for Portable Generators (Residential Use, Recreational Activities)

3.4.3. Rising Adoption of Renewable-Based Generators (Battery Storage Integration, Solar Generators)

3.5. Government Regulation

3.5.1. U.S. Department of Energy Policies (Fuel Efficiency Standards, Backup Power Grants)

3.5.2. Environmental Protection Agency (EPA) Emission Standards (Tier 4 Emission Compliance)

3.5.3. Federal Emergency Management Agency (FEMA) Guidelines for Power Outage Preparedness

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Suppliers, Distributors, End-Users, Regulatory Bodies)

3.8. Porters Five Forces Analysis (Power of Suppliers, Buyers, Threat of Substitution, Competition)

3.9. Competition Ecosystem (Market Share Dynamics, Competitive Positioning, Brand Perception)

4. U.S. Generator Sales Market Segmentation

4.1. By Generator Type (In Value %)

4.1.1. Diesel Generators

4.1.2. Gas Generators

4.1.3. Solar Generators

4.1.4. Hybrid Generators

4.2. By Power Output (In Value %)

4.2.1. Less than 100 kW

4.2.2. 100-500 kW

4.2.3. 500-1000 kW

4.2.4. More than 1000 kW

4.3. By End-User Industry (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Healthcare

4.4. By Application (In Value %)

4.4.1. Standby Power

4.4.2. Peak Shaving

4.4.3. Continuous Power Supply

4.4.4. Backup and Emergency Power

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. U.S. Generator Sales Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Caterpillar Inc.

5.1.2. Cummins Inc.

5.1.3. Kohler Co.

5.1.4. Generac Holdings Inc.

5.1.5. MTU Onsite Energy

5.1.6. Briggs & Stratton Corporation

5.1.7. Atlas Copco AB

5.1.8. Siemens AG

5.1.9. GE Power

5.1.10. Honda Motor Co., Ltd.

5.1.11. Wartsila Corporation

5.1.12. Mitsubishi Heavy Industries, Ltd.

5.1.13. Aksa Power Generation

5.1.14. Doosan Portable Power

5.1.15. Himoinsa S.L.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Power Output Range, Regional Presence, Product Portfolio, Emission Standards, Customer Base)

5.3. Market Share Analysis (By Region, By End-User, By Generator Type)

5.4. Strategic Initiatives (Joint Ventures, Partnerships, Strategic Alliances)

5.5. Mergers and Acquisitions (Impact on Market Structure, Key Financials)

5.6. Investment Analysis (R&D Investment, Technology Upgrades)

5.7. Venture Capital Funding (Startups, Emerging Technologies)

5.8. Government Grants (Subsidies, Tax Credits, Renewable Energy Funding)

5.9. Private Equity Investments (Capital Influx, Market Expansion Impact)

6. U.S. Generator Sales Market Regulatory Framework

6.1. National Environmental Standards

6.2. Compliance Requirements (Emission Norms, Noise Regulations)

6.3. Certification Processes (Energy Star, UL Certifications)

7. U.S. Generator Sales Future Market Size (In USD Billion)

7.1. Key Factors Driving Future Market Growth

7.2. Technological Evolution in Generators

8. U.S. Generator Sales Future Market Segmentation

8.1. By Generator Type

8.2. By Power Output

8.3. By End-User Industry

8.4. By Application

8.5. By Region

9. U.S. Generator Sales Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Key Marketing Initiatives

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Identification

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying key factors influencing the U.S. generator sales market. This was achieved through comprehensive desk research, utilizing proprietary databases and government reports, focusing on key players, fuel types, and technological advancements in the industry.

Step 2: Market Analysis and Construction

In this phase, historical data from key industry sources was analyzed. This included understanding the adoption of generators across different sectors, the penetration of fuel types, and evaluating how the demand for emergency power solutions has evolved in the past five years.

Step 3: Hypothesis Validation and Expert Consultation

We conducted interviews with industry experts and generator manufacturers to validate market assumptions. Feedback regarding operational efficiency, costs, and regulatory standards helped shape a reliable and accurate picture of the market.

Step 4: Research Synthesis and Final Output

After gathering insights from both primary and secondary sources, the final synthesis involved cross-verifying statistical data with industry players, leading to the creation of a comprehensive market report. This bottom-up approach ensured a holistic analysis of the U.S. generator sales market.

Frequently Asked Questions

01. How big is the U.S. generator sales market?

The U.S. generator sales market is valued at USD 6.10 billion, driven by rising demand for reliable backup power solutions and industrial expansion.

02. What are the challenges in the U.S. generator sales market?

U.S. generator sales market Key challenges include fluctuating fuel prices, high upfront costs for advanced generator systems, and compliance with stringent environmental regulations such as EPAs emission standards.

03. Who are the major players in the U.S. generator sales market?

Major players in the U.S. generator sales market include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., and Atlas Copco AB.

04. What are the growth drivers of the U.S. generator sales market?

The U.S. generator sales market is primarily driven by increasing industrialization, frequent power outages due to climate-related events, and technological advancements in fuel-efficient and renewable-based generators.

05. What role does technology play in the U.S. generator sales market?

Technological advancements in U.S. generator sales market such as IoT integration, hybrid generators, and renewable energy-based systems are pivotal in increasing operational efficiency and reducing environmental impacts.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.