U.S. Hangover Cure Products Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD4470

December 2024

94

About the Report

U.S. Hangover Cure Products Market Overview

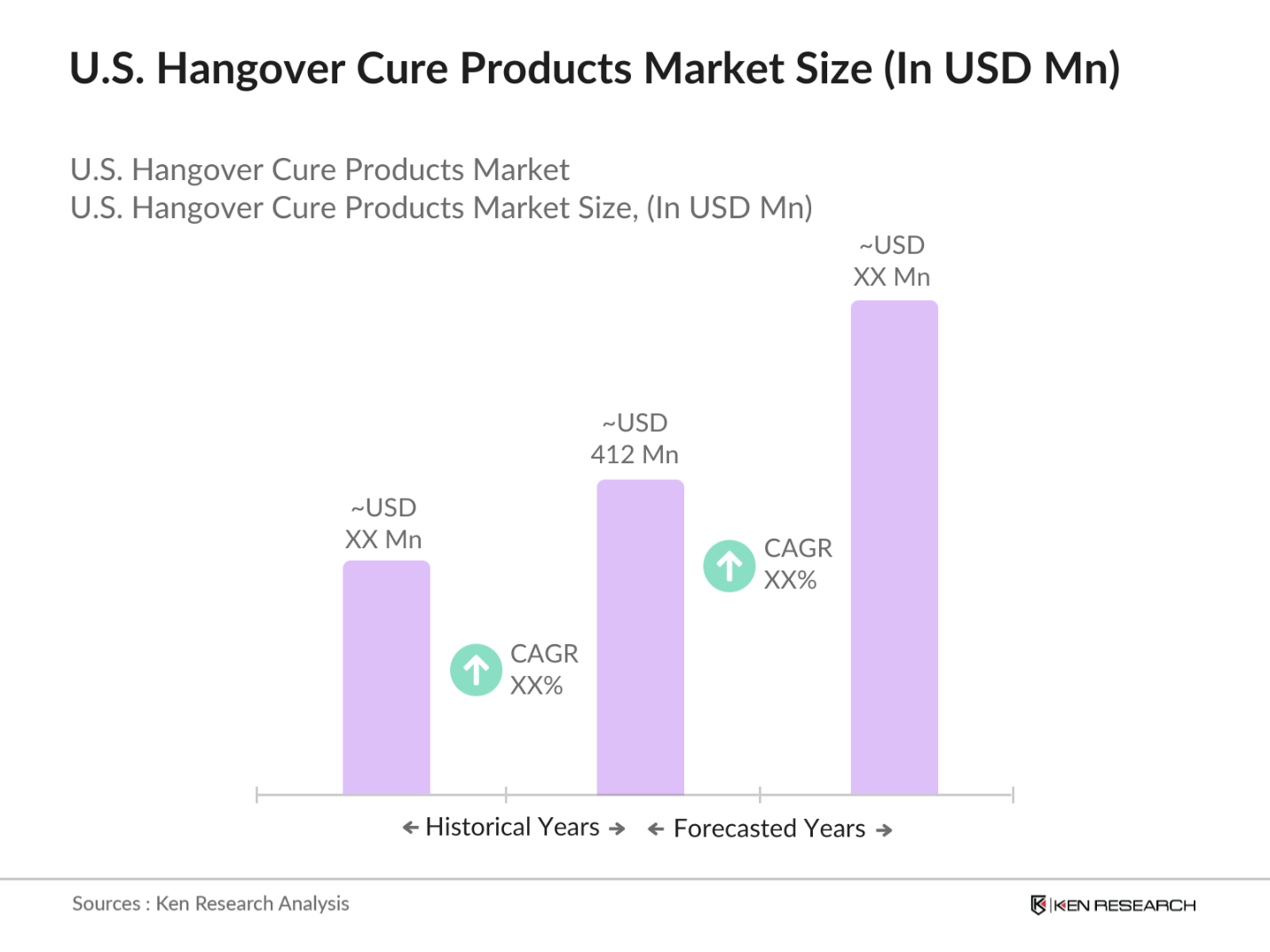

- The U.S. Hangover Cure Products market is valued at USD 412 million, based on a five-year historical analysis. The market's growth is driven by increased alcohol consumption and a growing consumer focus on health and wellness. As consumers become more conscious of the negative effects of hangovers, the demand for products designed to alleviate hangover symptoms has risen. E-commerce platforms have also contributed to the markets expansion by offering consumers easier access to various hangover cure products.

- Dominant cities in the market include New York, Los Angeles, and Chicago due to high alcohol consumption rates and the presence of a large urban population with a strong focus on health and wellness trends. These metropolitan areas are also hubs for innovation, where companies often launch new products targeting health-conscious consumers. Additionally, the presence of numerous nightlife venues and social events in these cities contributes to higher demand for hangover remedies.

- The U.S. FDA maintains strict guidelines for dietary supplements, which apply to hangover cure products. In 2023, the FDA issued 55 warning letters to companies for non-compliance with these guidelines, highlighting the importance of adhering to labeling and health claims standards. These regulations impact product development and marketing strategies in the hangover cure market. Companies that comply with these guidelines can avoid regulatory pitfalls and market their products with greater confidence.

U.S. Hangover Cure Products Market Segmentation

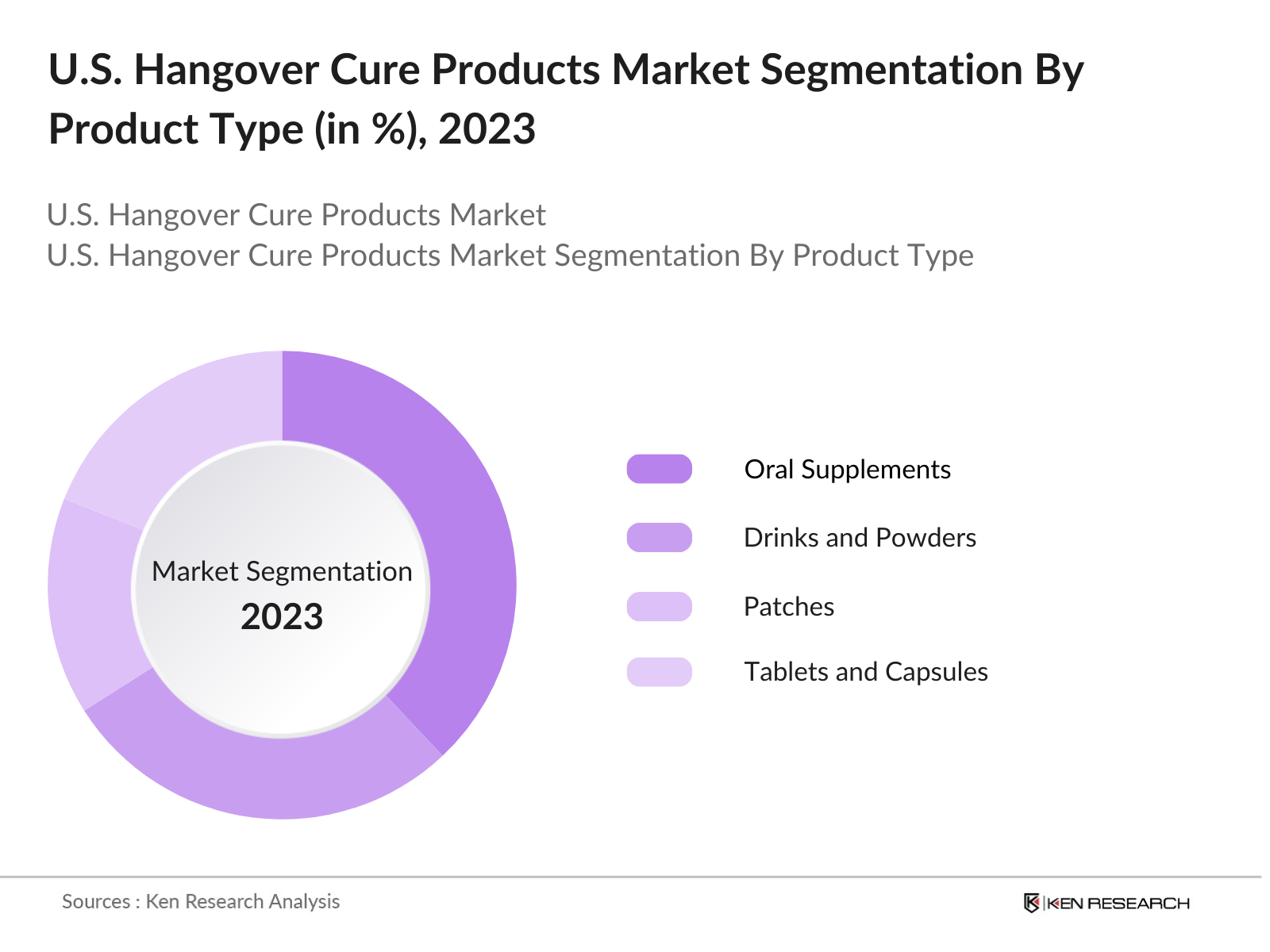

By Product Type: The U.S. Hangover Cure Products market is segmented by product type into oral supplements, drinks and powders, patches, and tablets and capsules. Recently, oral supplements have a dominant market share under this segmentation. The dominance of oral supplements is attributed to their convenience and the variety of natural ingredients such as herbs and vitamins they contain. Products like Blowfish and Flyby offer fast relief, appealing to health-conscious consumers seeking effective solutions. These supplements are also portable and easy to consume, making them popular choices.

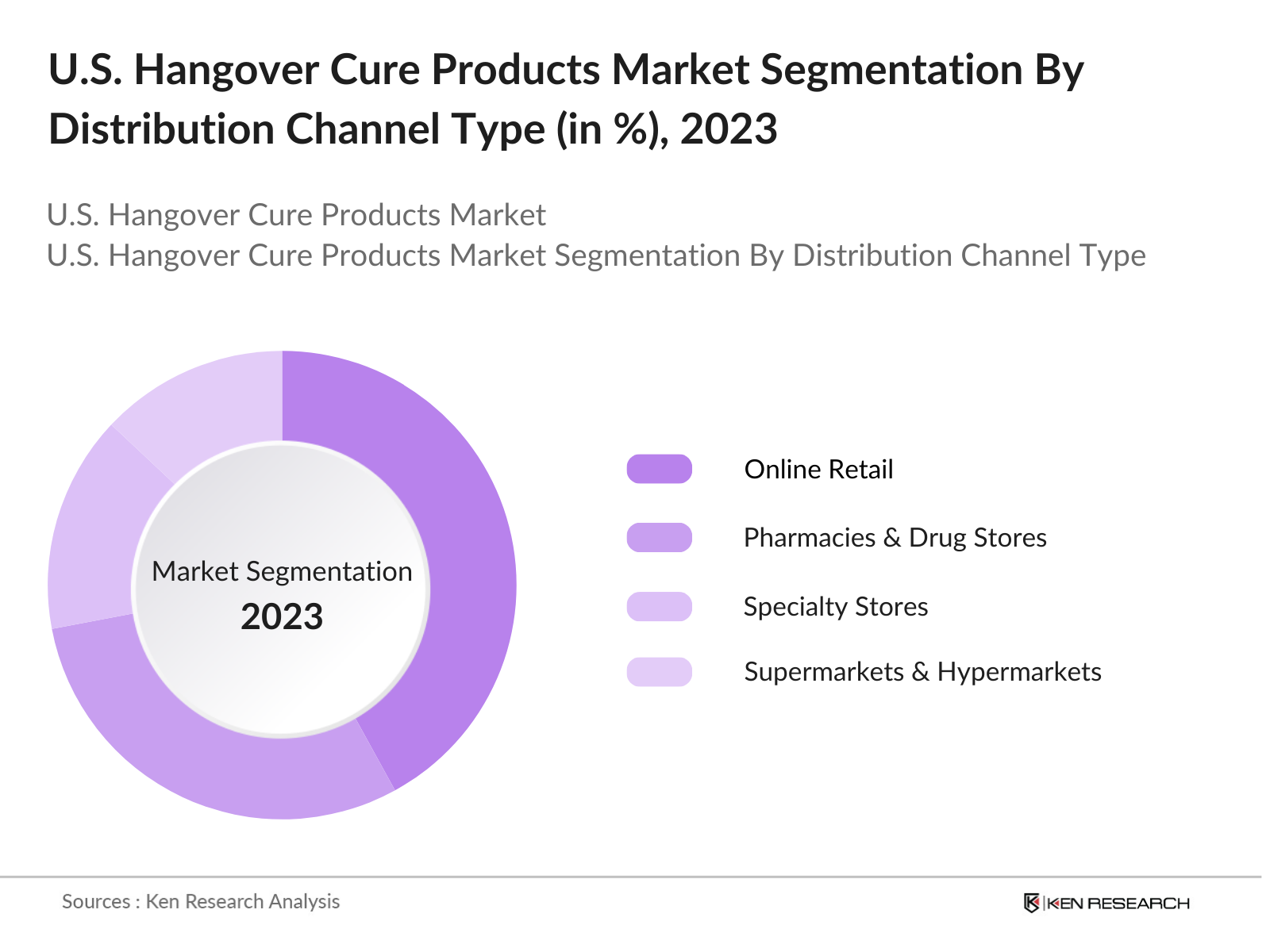

By Distribution Channel: The U.S. Hangover Cure Products market is also segmented by distribution channel into online retail, pharmacies & drug stores, specialty stores, and supermarkets & hypermarkets. Online retail has captured a dominant market share in this segment, primarily due to the convenience it offers consumers. The rise of e-commerce platforms like Amazon and direct-to-consumer websites has simplified the purchasing process, enabling customers to access a wide range of products from the comfort of their homes. Additionally, online retail offers a wider variety of options and consumer reviews, influencing purchasing decisions.

U.S. Hangover Cure Products Market Competitive Landscape

The U.S. Hangover Cure Products market is dominated by a few key players who have established a strong presence through innovative product offerings and strategic marketing. These companies focus on expanding their distribution channels and launching new products tailored to consumer preferences. The competitive landscape is characterized by the growing influence of e-commerce and an increased focus on natural, health-conscious ingredients.

U.S. Hangover Cure Products Industry Analysis

Growth Drivers

- Rising Alcohol Consumption: Alcohol consumption in the U.S. has seen a steady rise, contributing to the demand for hangover cure products. According to the National Institute on Alcohol Abuse and Alcoholism, U.S. per capita alcohol consumption increased to 2.51 gallons in 2023, up from 2.48 gallons in 2022, which boosts the need for aftercare solutions like hangover remedies. The CDC also reports that approximately 25% of adults engage in binge drinking, creating a large market for hangover solutions. The steady demand for these products aligns with increasing alcohol consumption patterns.

- Increased Focus on Health & Wellness: The focus on health and wellness is pushing consumers to seek remedies for the negative aftereffects of alcohol. According to a 2023 report by the U.S. Department of Health, around 61% of adults aged 18-65 are focused on improving their overall well-being, which includes minimizing hangovers after drinking. This trend has led to a rise in demand for products that alleviate hangover symptoms, without compromising on health. A growing preference for products that offer health benefits also drives innovation within the market, encouraging more functional hangover solutions.

- Innovative Product Launches: With the rise in alcohol consumption, companies are investing in innovative product launches to cater to this market. In 2023, over 50 new hangover cure products hit the U.S. market, many featuring natural ingredients like turmeric, milk thistle, and electrolytes. According to the U.S. Patent and Trademark Office, patent filings for hangover remedies increased by 14% between 2022 and 2023, demonstrating a growing focus on innovation in this sector. This surge in new product developments continues to push market growth.

Market Challenges

- Limited Scientific Backing for Certain Products: A major challenge in the U.S. hangover cure market is the lack of comprehensive scientific backing for many products. According to the FDA, over 60% of dietary supplements, which include hangover remedies, lack sufficient scientific evidence to support their efficacy claims. In 2023, the FDA issued 15 warning letters to companies selling hangover cures with unverified health benefits. This skepticism among consumers and regulatory scrutiny creates hurdles for growth in this segment.

- Regulatory Hurdles: Regulatory hurdles are another challenge for the hangover cure market in the U.S. As per FDA guidelines, products marketed as dietary supplements must meet specific labeling and safety standards. In 2023, 18% of new hangover remedies faced delays due to compliance issues with FDA regulations. Additionally, state-specific laws on alcohol-related products can complicate the market entry for companies. These regulatory barriers slow down the introduction of new products into the market, stifling growth.

U.S. Hangover Cure Products Market Future Outlook

The U.S. Hangover Cure Products market is expected to experience robust growth in the coming years, driven by continued consumer demand for health-conscious products and increasing interest in natural ingredients. Over the next five years, technological innovations, expanding e-commerce channels, and strategic partnerships with alcohol brands are expected to significantly influence market dynamics. Additionally, ongoing product development aimed at improving efficacy and convenience is likely to propel market growth further.

Opportunities

Growing Demand for Natural Ingredients: Consumers are increasingly leaning toward natural and organic ingredients, driving the demand for hangover remedies that offer such benefits. In 2023, the U.S. organic product market was valued at over $60 billion, with a growing subset in natural dietary supplements. According to the USDA, 45% of U.S. consumers prefer supplements with natural ingredients over synthetic ones, creating an opportunity for brands to cater to this segment by developing plant-based and chemical-free hangover remedies.

Expansion into International Markets: U.S. companies have an opportunity to expand into international markets where alcohol consumption is rising, and hangover products are less available. For instance, U.S. exports of dietary supplements increased by 8% in 2023, according to the U.S. International Trade Commission. Key markets for growth include Asia and Europe, where awareness of such products is growing. International expansion presents a strategic opportunity for U.S. companies to increase their reach and revenue.

Scope of the Report

|

Product Type |

Oral Supplements Drinks and Powders Patches Tablets and Capsules |

|

Distribution Channel |

Online Retail Pharmacies & Drug Stores Specialty Stores Supermarkets & Hypermarkets |

|

Ingredient Type |

Herbal and Natural Ingredients Electrolytes Amino Acids Vitamins and Antioxidants |

|

Formulation Type |

Liquid Formulations Solid Formulations Dissolvable Formulations |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, U.S. Department of Health & Human Services)

Health and Wellness Product Industries

Online Retail Platforms Companies

Alcohol Brands and Beverage Companies

Pharmaceutical Companies

Dietary Supplement Distributors Industries

Private Label Product Companies

Companies

Major Players

Blowfish for Hangovers

DrinkAde

Flyby

PartySmart

Cheers Health

The Plug Drink

Morning Recovery

Zaca Recovery

Liquid IV

Purple Tree Labs

Resqwater

No Days Wasted (DHM Detox)

H-Proof

Hangover Hero

AfterDrink

Table of Contents

1. U.S. Hangover Cure Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Hangover Cure Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Hangover Cure Products Market Analysis

3.1. Growth Drivers

3.1.1. Rising Alcohol Consumption

3.1.2. Increased Focus on Health & Wellness

3.1.3. Innovative Product Launches

3.1.4. Expanding E-commerce Channels

3.2. Market Challenges

3.2.1. Limited Scientific Backing for Certain Products

3.2.2. Regulatory Hurdles

3.2.3. Consumer Skepticism and Awareness

3.3. Opportunities

3.3.1. Growing Demand for Natural Ingredients

3.3.2. Expansion into International Markets

3.3.3. Partnerships with Alcohol Brands

3.4. Trends

3.4.1. Rise in On-Demand Hangover Services

3.4.2. Personalized Hangover Solutions

3.4.3. Increased Investments in Clinical Research

3.5. Government Regulations

3.5.1. FDA Guidelines for Dietary Supplements

3.5.2. Labeling and Claims Regulations

3.5.3. Import/Export Regulatory Frameworks

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. Hangover Cure Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Oral Supplements

4.1.2. Drinks and Powders

4.1.3. Patches

4.1.4. Tablets and Capsules

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Pharmacies & Drug Stores

4.2.3. Specialty Stores

4.2.4. Supermarkets & Hypermarkets

4.3. By Ingredient Type (In Value %)

4.3.1. Herbal and Natural Ingredients

4.3.2. Electrolytes

4.3.3. Amino Acids

4.3.4. Vitamins and Antioxidants

4.4. By Formulation Type (In Value %)

4.4.1. Liquid Formulations

4.4.2. Solid Formulations

4.4.3. Dissolvable Formulations

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Hangover Cure Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Blowfish for Hangovers

5.1.2. DrinkAde

5.1.3. Flyby

5.1.4. PartySmart

5.1.5. The Plug Drink

5.1.6. AfterDrink

5.1.7. Liquid IV

5.1.8. Purple Tree Labs

5.1.9. No Days Wasted (DHM Detox)

5.1.10. Cheers Health

5.1.11. Zaca Recovery

5.1.12. Resqwater

5.1.13. Hangover Hero

5.1.14. Morning Recovery

5.1.15. H-Proof

5.2. Cross Comparison Parameters (Inception Year, Headquarters, Product Range, Ingredients Used, Consumer Base, Distribution Reach, R&D Investments, Patent Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Hangover Cure Products Market Regulatory Framework

6.1. FDA Guidelines for Dietary Supplements

6.2. Compliance Requirements

6.3. Labeling Standards and Claims

6.4. Certification and Safety Standards

7. U.S. Hangover Cure Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Hangover Cure Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Formulation Type (In Value %)

8.5. By Region (In Value %)

9. U.S. Hangover Cure Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved constructing a detailed ecosystem map covering all stakeholders in the U.S. Hangover Cure Products Market. Extensive desk research was conducted using secondary sources like proprietary databases to gather industry-level data, allowing us to identify the critical factors driving market dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyzed historical market data, including product penetration and distribution channel success rates, to evaluate revenue generation. We also examined industry trends and consumer preferences to ensure that the data reflected real-time market behavior.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses were validated through computer-assisted telephone interviews (CATI) with industry experts, including key stakeholders from the top companies. This helped refine our understanding of operational and financial aspects directly from market participants.

Step 4: Research Synthesis and Final Output

The final stage involved direct engagement with hangover cure product manufacturers, gathering in-depth insights into sales trends, customer preferences, and product development efforts. This allowed us to validate the bottom-up approach, ensuring accuracy in our final analysis.

Frequently Asked Questions

01. How big is the U.S. Hangover Cure Products Market?

The U.S. Hangover Cure Products market was valued at USD 412 million, driven by consumer awareness of health and wellness, along with the rise of alcohol consumption.

02. What are the challenges in the U.S. Hangover Cure Products Market?

Key challenges include regulatory hurdles regarding product labeling, consumer skepticism about product efficacy, and increasing competition from new entrants.

03. Who are the major players in the U.S. Hangover Cure Products Market?

Leading players include Blowfish for Hangovers, Flyby, Cheers Health, DrinkAde, and Morning Recovery, all of which focus on innovative product development and distribution.

04. What are the growth drivers of the U.S. Hangover Cure Products Market?

Growth is driven by increasing alcohol consumption, rising consumer demand for health-conscious remedies, and expanding online sales platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.