US Healthcare RCM Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD2050

December 2024

92

About the Report

US Healthcare RCM Market Overview

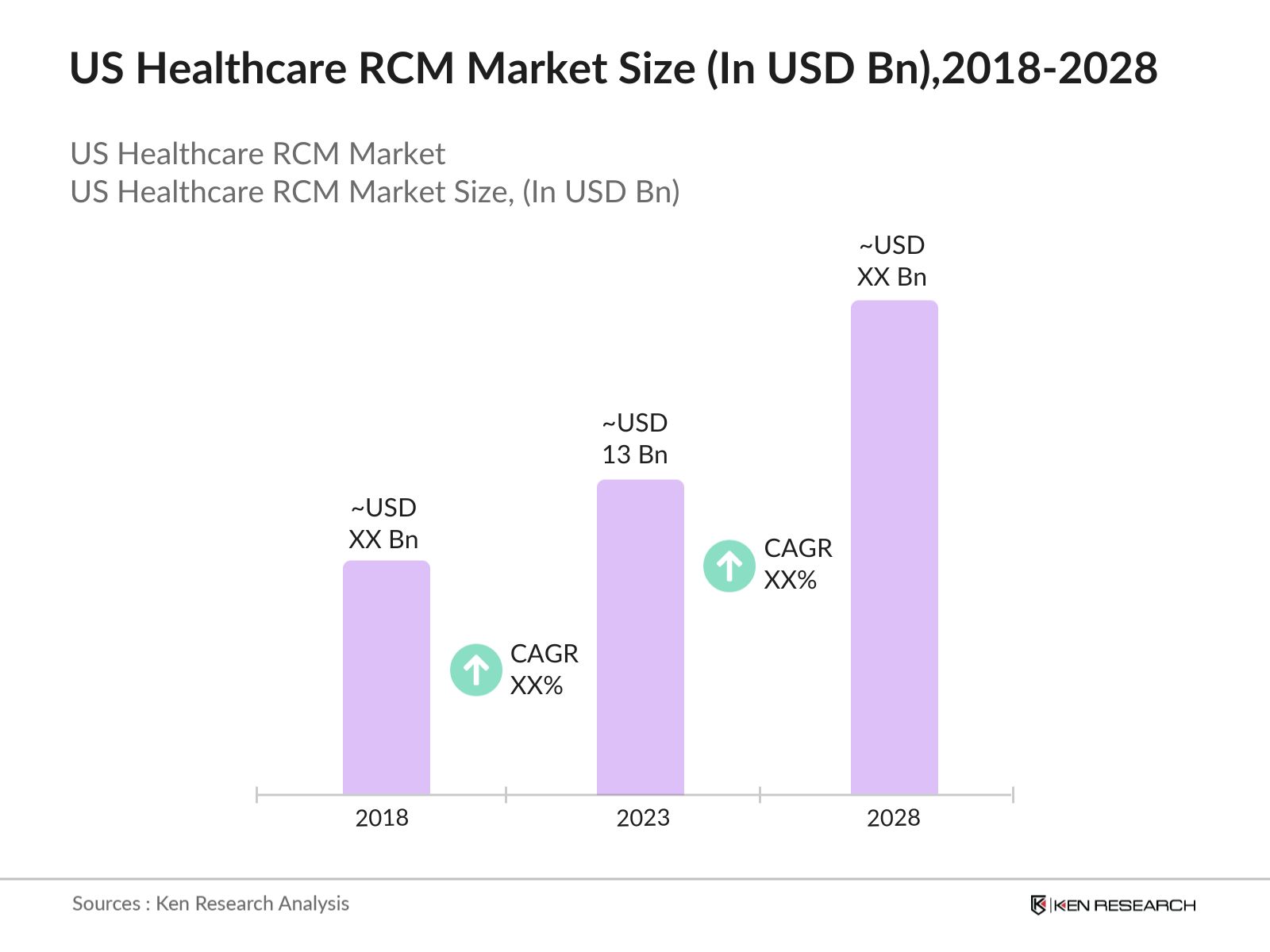

- The US Healthcare Revenue Cycle Management (RCM) Market was valued at USD 13 billion in 2023. The growth of the RCM market is primarily driven by the increasing demand for automation in healthcare billing, coupled with the rising number of healthcare providers adopting cloud-based solutions to manage the complexities of billing and reimbursement processes. Furthermore, regulatory mandates like ICD-11 implementation are pushing for more robust RCM systems to ensure accuracy in coding and claims processing.

- Key players in this market include Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, and Change Healthcare. These companies dominate the market by offering end-to-end RCM solutions, incorporating advanced technologies like AI-driven analytics and automation to enhance the efficiency of revenue cycle management processes across healthcare institutions.

- In 2023, Change Healthcare announced a collaboration with Google Cloud to enhance its RCM solutions using artificial intelligence (AI) and machine learning. This partnership aims to streamline billing processes, minimize administrative burdens, and reduce claim denials by leveraging AI-driven insights into patient data. The collaboration has garnered attention as Change Healthcare is expected to see a 12% growth in its RCM segment revenue for 2024.

- California is a dominant player in this market in 2023, due to the strong healthcare infrastructure, coupled with the presence of several large healthcare institutions and technology companies, has positioned it as a leader in RCM adoption. With healthcare expenditures in the state exceeding USD 500 billion in 2023, California continues to invest in advanced healthcare IT solutions, including RCM systems, to manage the large volume of patient data and billing requirements.

US Healthcare RCM Market Segmentation

The US Healthcare RCM Market is segmented into different factors like by product type, by application and region.

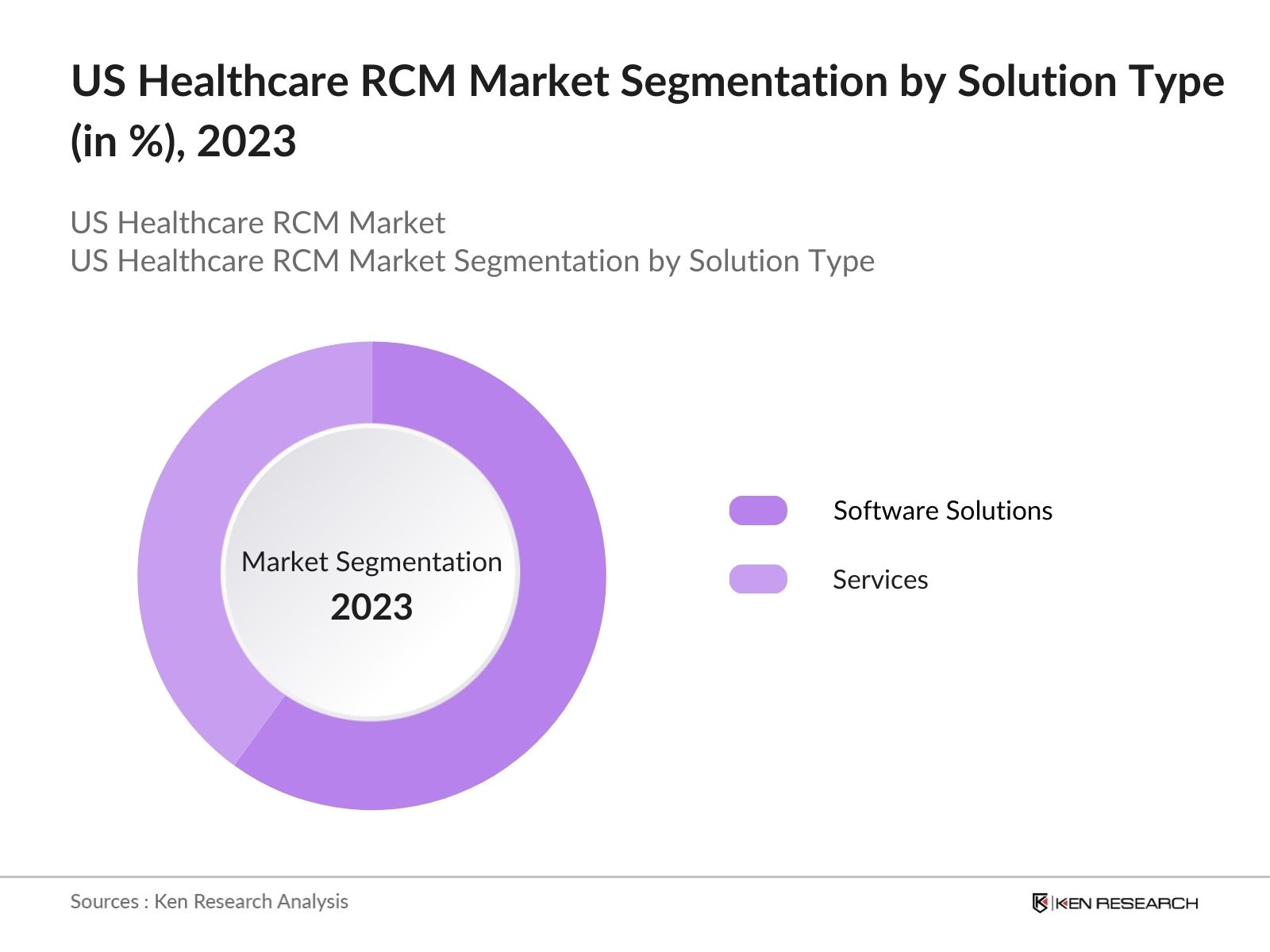

By Solution Type: The market is segmented by solution type into software solutions and services. In 2023, software solutions held the dominant market share, due to the growing demand for cloud-based RCM systems has driven this dominance, as healthcare providers increasingly prioritize scalability and real-time data access. Major software providers like Epic Systems and Allscripts have continued to offer integrated RCM solutions, making them highly sought-after in the healthcare industry.

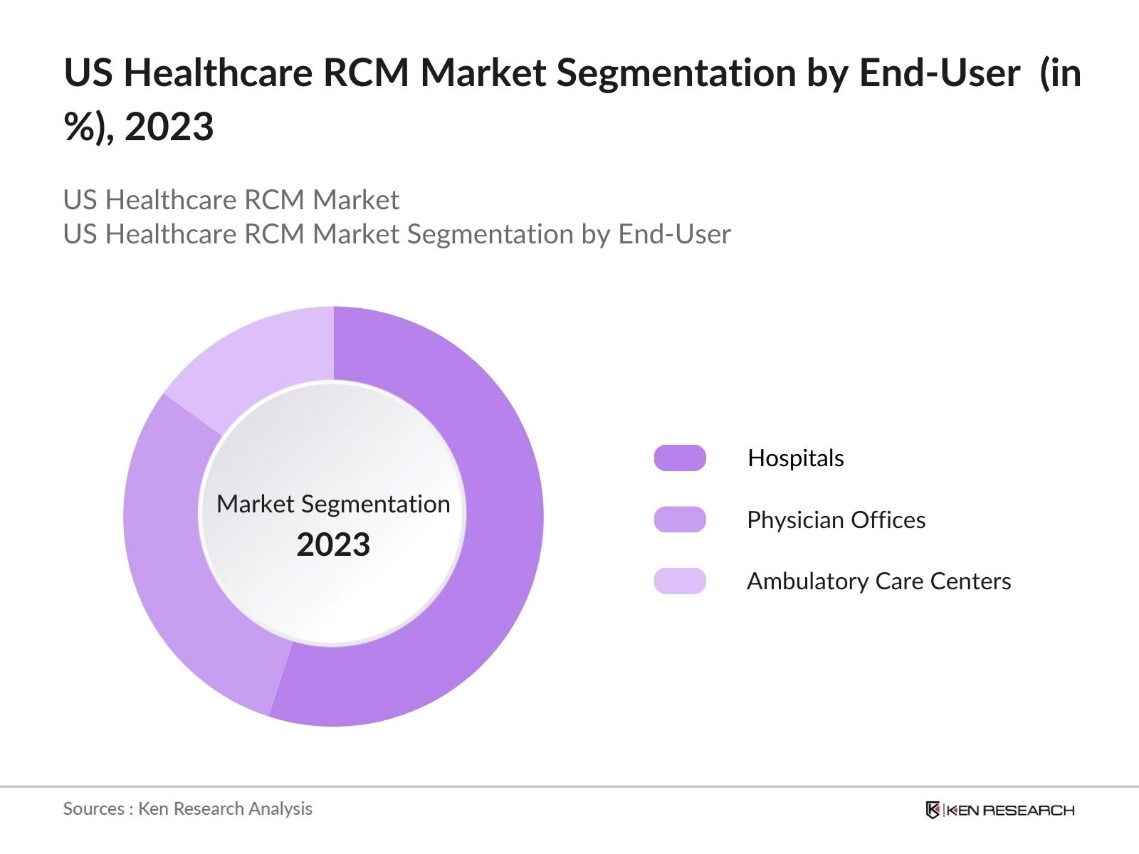

By End-User: The market is segmented by end-user into hospitals, physician offices, and ambulatory care centers. Hospitals dominated this segment in 2023, driven by the growing need for comprehensive RCM systems to manage the large volume of patient claims and billing operations. The complexity of hospital operations, combined with the need for precise coding and billing across multiple departments, has led hospitals to invest heavily in RCM solutions.

By Region: The market is segmented by region into north, south, east, and west. The Western region dominated the market in 2023, primarily due to the highly developed healthcare infrastructure and significant investments in healthcare IT. The presence of major tech hubs, such as Silicon Valley, facilitates the rapid adoption of advanced RCM solutions, enabling efficient management of the complex healthcare billing systems in the region.

US Healthcare RCM Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Cerner Corporation |

1979 |

Kansas City, MO |

|

McKesson Corporation |

1833 |

Irving, TX |

|

Allscripts Healthcare |

1986 |

Chicago, IL |

|

Epic Systems Corporation |

1979 |

Verona, WI |

|

Change Healthcare |

2007 |

Nashville, TN |

- McKesson Corporation: In its fiscal 2024 report, McKesson Corporation announced consolidated revenues of USD 309 billion for the full year, a 12% increase from the previous year, driven primarily by growth in the U.S. pharmaceutical segment. McKesson's U.S. Pharmaceutical division saw a 16% revenue increase, fueled by higher prescription volumes and specialty products. The company also generated USD 4.3 billion in cash flow from operations and continued its strategic focus on oncology and biopharma services platforms.

- Allscripts Healthcare: In March 2022, Allscripts announced the sale of its hospital and large physician practice business segment to Harris Computer Corporation, a subsidiary of Constellation Software, for up to $700 million. This segment included key products such as Sunrise, Paragon, and Touchworks, which accounted for approximately 60% of Allscripts' total revenue. The sale was part of a strategy to streamline operations and focus on Veradigm, its data analytics and healthcare solutions business, which is expected to grow organically by 6-7% annually

US Healthcare RCM Market Analysis

Growth Drivers

- Increasing Healthcare Expenditure: In 2024, US healthcare expenditure is expected to surpass USD 4.8 trillion, driven by the growing population, increasing demand for advanced medical treatments, and rising costs of healthcare services. This rise in healthcare spending is compelling hospitals and healthcare providers to adopt more efficient RCM systems to manage billing and reimbursement processes. Additionally, the shift towards value-based care is pushing providers to streamline their financial operations, further driving the demand for RCM solutions.

- Expansion of Telehealth Services: The US telehealth sector witnessed rapid growth in 2023, with over 100 million telehealth visits recorded nationwide. As more healthcare providers incorporate telehealth into their services, there is a rising need for efficient RCM systems to manage billing complexities associated with virtual consultations and remote patient monitoring. This surge in telehealth services is anticipated to contribute to the expansion of the RCM market, particularly in managing claims processing for virtual care.

- Shift to Cloud-Based RCM Solutions: Hospitals and healthcare providers are increasingly adopting cloud-based Revenue Cycle Management (RCM) platforms to optimize costs and improve access to critical data. These platforms provide scalability and flexibility, allowing healthcare organizations to efficiently manage the complexities of billing and claims processing. By integrating cloud solutions, healthcare facilities can streamline data flow across departments, enhance operational efficiency, and improve overall financial management. The shift to cloud-based systems is driven by the need for seamless data management and the ability to handle large volumes of patient information.

Challenges

- Regulatory Complexity: The US healthcare sector operates in a dynamic regulatory environment with frequent changes to healthcare laws and insurance policies. Compliance with evolving regulations like ICD-11 presents challenges, especially for smaller healthcare providers with limited resources for system upgrades. RCM providers must continuously update their systems to align with these regulatory changes, creating added operational burdens and delays in claims processing.

- High Implementation Costs: High implementation costs remain a barrier to adopting advanced RCM systems, especially for smaller healthcare providers. The financial burden includes expenses related to system setup, training, and ongoing maintenance. These challenges slow down market penetration as mid-sized healthcare facilities struggle to justify the investment, limiting access to the efficiency and scalability benefits of cloud-based RCM platforms. This financial strain impacts the overall modernization of healthcare revenue management systems.

Government Initiatives

- Medicaid Expansion Efforts in 2024: In 2024, the US government has continued encouraging states to adopt Medicaid expansion under the Affordable Care Act (ACA). This initiative aims to provide coverage to nearly 3 million uninsured adults, particularly in states that have not expanded Medicaid. The federal government offers enhanced financial support to states that adopt the expansion, including a temporary 5% increase in federal funding to cover Medicaid costs for two years, motivating more states to consider expansion efforts to close the coverage gap.

US Healthcare RCM Market Future Outlook

The US Healthcare RCM Market is projected to grow exponentially by 2028, driven by the increasing adoption of advanced RCM software solutions. The introduction of value-based care models and stricter reimbursement regulations are anticipated to foster significant demand for automated and integrated RCM platforms. Additionally, AI and machine learning are expected to revolutionize billing processes, ensuring improved accuracy and faster claims processing in the coming years.

Future Market Trends

- Growing Adoption of AI in Revenue Cycle Management: The growing adoption of AI in revenue cycle management (RCM) is transforming healthcare billing processes. AI and machine learning technologies streamline claims processing, resulting in faster approvals and fewer billing errors. Healthcare providers are increasingly relying on AI to handle complex billing tasks, improving operational efficiency and financial outcomes. This trend is expected to drive significant advancements in RCM systems, enabling better management of large-scale billing operations in the healthcare industry.

- Growth in Cloud-Based RCM Solutions: The adoption of cloud-based RCM solutions is expected to accelerate as healthcare providers increasingly rely on cloud infrastructure to scale operations and improve interoperability. This shift will enable providers to streamline billing processes and reduce the costs associated with maintaining on-premises systems. By 2028, cloud-based RCM systems are projected to handle a significant volume of healthcare claims, becoming a critical component in modernizing revenue cycle management across the industry.

Scope of the Report

|

By Solution Type |

Software Solutions Services |

|

By End-User |

Hospitals Physician Offices Ambulatory Care Centers |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

RCM service providers

Health insurance companies

Healthcare consultants

Medical billing companies

Technology providers (cloud and AI solutions)

Government healthcare agencies (e.g., CMS)

Investors and VC Firms

Banks and Financial institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Cerner Corporation

McKesson Corporation

Allscripts Healthcare Solutions

Epic Systems Corporation

Change Healthcare

Optum360

Athenahealth

GE Healthcare

Greenway Health

eClinicalWorks

Conifer Health Solutions

R1 RCM Inc.

SSI Group

NextGen Healthcare

Waystar

Table of Contents

1. US Healthcare RCM Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. US Healthcare RCM Market Size (in USD), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. US Healthcare RCM Market Analysis

3.1 Growth Drivers

3.1.1. Increasing Healthcare Expenditure

3.1.2. Expansion of Telehealth Services

3.1.3. Shift to Cloud-Based RCM Solutions

3.2 Restraints

3.2.1 Regulatory Complexity

3.2.2 High Implementation Costs

3.2.3. Limited Skilled Workforce

3.3 Opportunities

3.3.1. AI and Automation Integration

3.3.2. Expanding Medicaid Coverage

3.3.3. Public-Private Partnerships

3.4 Trends

3.4.1. Increased AI Adoption

3.4.2. Growth in Cloud-Based RCM Solutions

3. Blockchain Integration for Secure Transactions

3.5 Government Initiatives

3.5.1. Medicaid Expansion (2024)

3.5.2. CMS Simplification for Medicare Billing

3.5.3. EHR Modernization for Better RCM Integration

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. US Healthcare RCM Market Segmentation, 2023

4.1 By Solution Type

4.1.1. Software Solutions

4.1.2. Services

4.2 By End-User

4.2.1. Hospitals

4.2.2. Physician Offices

4.2.3. Ambulatory Care Centers

4.3 By Region

4.3.1. West

4.3.2. East

4.3.3. South

4.3.4. North

4.4 By Technology

4.4. Cloud-Based RCM

4.4 On-Premise RCM

4.5 By Healthcare Facility Size

4.5.1. Large Hospitals

4.5.2. Mid-Sized Facilities

4.5.3. Small Healthcare Providers

5. US Healthcare RCM Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.2. Cerner Corporation

5.1.3. McKesson Corporation

5.1.4. Allscripts Healthcare

5.1.5. Epic Systems Corporation

5.1.6. Change Healthcare

5.2 Cross Comparison Parameters (Employees, Headquarters, Revenue)

6. US Healthcare RCM Market Competitive Landscape

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

7. US Healthcare RCM Market Regulatory Framework

7.1 Compliance with HIPAA

7.2 Certification and Billing Standards

7.3 Federal Reimbursement Regulations

8. US Healthcare RCM Market Future Size (in USD), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. US Healthcare RCM Market Future Segmentation, 2028

9.1 By Solution Type

9.2 By End-User

9.3 By Technology

9.4 By Region

9.5 By Healthcare Facility Size

10. US Healthcare RCM Market Analysts Recommendations

10.1 TAM/SAM/SOM Analysis

10.2 Customer Cohort Analysis

10.3 Marketing Initiatives

10.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on US Healthcare RCM Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for US Healthcare RCM Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple healthcare RCM companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from healthcare RCM companies.

Frequently Asked Questions

01 How big is the US Healthcare RCM Market?

The US Healthcare Revenue Cycle Management (RCM) Market was valued at USD 13 billion in 2023, driven by the increasing demand for automated billing systems and cloud-based solutions.

02 What are the challenges in the US Healthcare RCM Market?

Challenges in US Healthcare RCM Market include regulatory complexity, high implementation costs, data security concerns, and a shortage of skilled professionals for managing advanced RCM systems.

03 Who are the major players in the US Healthcare RCM Market?

Key players in US Healthcare RCM Market include Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, and Change Healthcare.

04 What are the growth drivers of the US Healthcare RCM Market?

Key growth drivers in US Healthcare RCM Market include rising healthcare expenditure, expansion of telehealth services, increasing adoption of cloud-based RCM solutions, and the need for efficient billing management in a value-based care model.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.