US Healthy Snacks Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11475

December 2024

87

About the Report

US Healthy Snacks Market Overview

- The US Healthy Snacks market is valued at USD 21.46 billion, based on a five-year historical analysis. This growth is driven by rising health awareness among consumers, which has led to a significant shift toward nutritious and convenient snacking options. The increased demand for plant-based and functional snacks has further propelled the market as companies innovate to meet these consumer preferences, particularly in urban centers.

- Major cities like New York, Los Angeles, and Chicago dominate the healthy snacks market due to their higher population densities and increased health consciousness. These cities also have a large presence of specialty stores and natural food markets, which are essential distribution channels for premium healthy snacks, contributing to their market dominance.

- Government policies aimed at reducing the consumption of added sugars and sodium have significantly impacted the healthy snacks market. The U.S. Department of Health and Human Services reports that these policies have led to the reformulation of over 8,000 snack products to meet health guidelines. These measures are part of the broader effort to combat obesity and cardiovascular diseases, which affect nearly 82 million Americans. As of 2023, snack manufacturers are increasingly focused on reducing sugar and sodium content to comply with these health standards.

US Healthy Snacks Market Segmentation

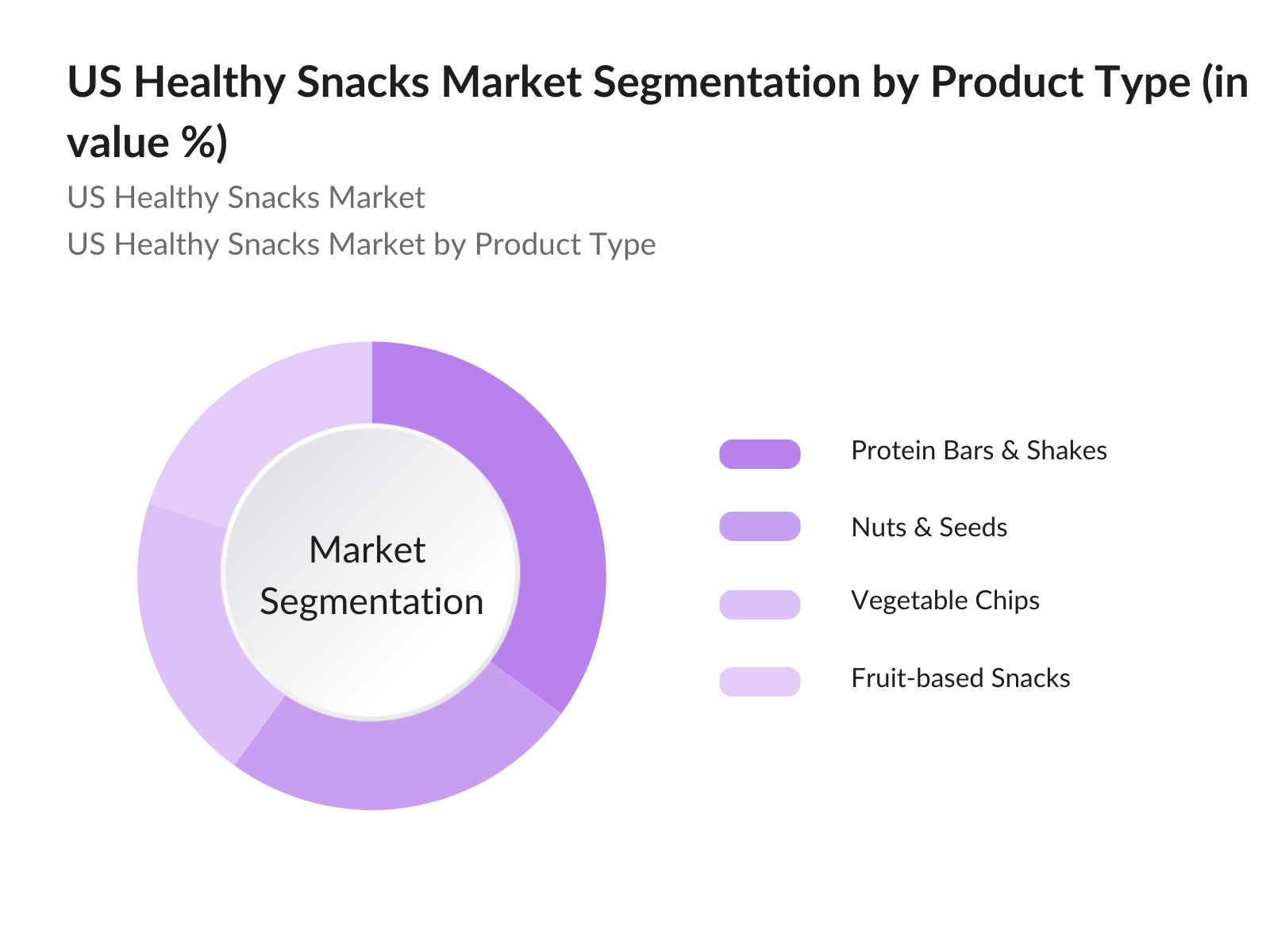

- By Product Type: The US Healthy Snacks market is segmented by product type into Nuts & Seeds, Protein Bars & Shakes, Vegetable Chips, and Fruit-based Snacks. Among these, Protein Bars & Shakes have the largest market share in 2023. Their popularity stems from the growing demand for on-the-go snacks that provide balanced nutrition. Consumers, especially athletes and health-conscious individuals, prefer protein-packed snacks for their convenience and health benefits, which has led to the dominance of this sub-segment.

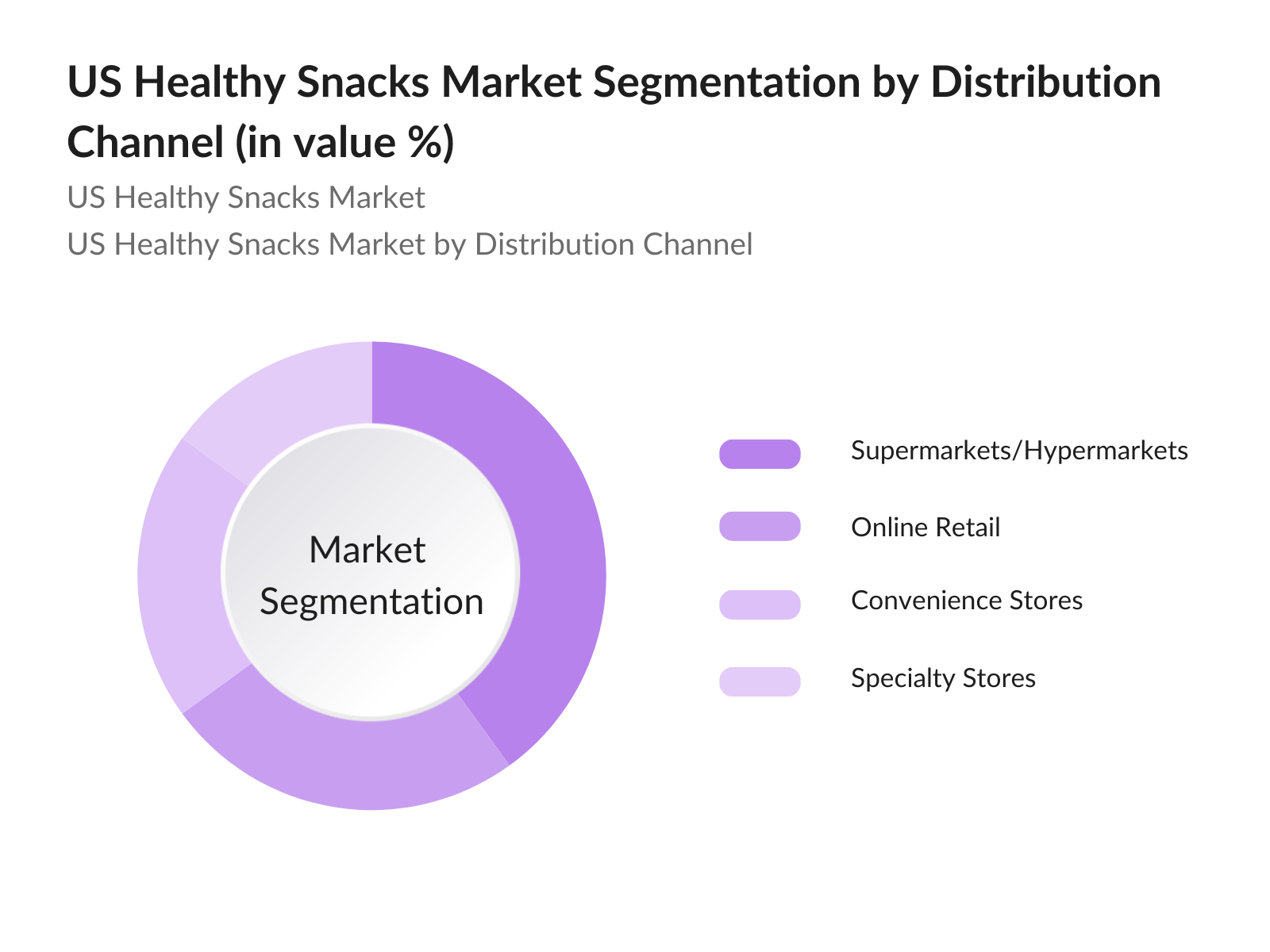

- By Distribution Channel: The US Healthy Snacks market is segmented by distribution channel into Supermarkets/Hypermarkets, Online Retail, Convenience Stores, and Specialty Stores. Among these, Supermarkets/Hypermarkets held the largest market share in 2023. This dominance is driven by their ability to offer a wide variety of healthy snack options under one roof, catering to diverse consumer preferences. Their strategic locations, frequent promotional deals, and the convenience of a one-stop-shop experience make them the most preferred choice for health-conscious consumers seeking easy access to snacks. Additionally, their broad reach across both urban and suburban areas boosts their market position.

US Healthy Snacks Market Competitive Landscape

The US Healthy Snacks market is dominated by several major players, including multinational companies and specialized snack producers. This consolidation demonstrates the significant market power these companies hold, driven by brand recognition, product innovation, and distribution network reach.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD bn) |

No. of Employees |

Key Product Line |

Recent Acquisition |

Sustainability Initiatives |

R&D Focus |

Geographical Reach |

|

PepsiCo (Frito-Lay) |

1965 |

Purchase, New York |

- | - | - | - | - | - | - |

|

General Mills (Nature Valley) |

1928 |

Minneapolis, Minnesota |

- | - | - | - | - | - | - |

|

Mondelez International |

2012 |

Chicago, Illinois |

- | - | - | - | - | - | - |

|

Clif Bar & Company |

1992 |

Emeryville, California |

- | - | - | - | - | - | - |

|

Blue Diamond Growers |

1910 |

Sacramento, California |

- | - | - | - | - | - | - |

US Healthy Snacks Market Analysis

Market Growth

- Increasing Health Consciousness (Consumer Demand): The growing awareness of health and wellness among American consumers is driving demand for healthier snack options. According to data from the U.S. Department of Health and Human Services, approximately 74 million Americans aged 18-34 prioritize nutritious and clean eating in their daily routines. This shift is also influenced by government health campaigns aimed at reducing obesity and promoting better dietary choices.

- Rise in Plant-based and Organic Snacking (Product Innovation): The demand for plant-based and organic snacks in the U.S. has surged as more consumers seek sustainable and ethically sourced foods. Recent data from the USDA reveals that plant-based snack sales grew by over 15% in 2023, supported by an expanding range of products such as organic nut bars and plant-based protein snacks. In addition, the global agricultural shift towards organic farming increased the availability of organic ingredients, which directly impacts snack product innovation.

- Expanding Distribution Channels (E-commerce and Specialty Stores): The rapid expansion of e-commerce and specialty stores is facilitating the availability of healthy snacks in the U.S. The U.S. Census Bureau reports that online grocery sales grew by 20 billion dollars from 2022 to 2024, driven by increasing demand for specialty food products, including healthy snacks. Large retailers such as Walmart and Amazon Fresh have also invested in dedicated sections for health-focused snacks, making them easily accessible to a wider audience. Specialty stores focusing on organic and plant-based products have recorded a 10% increase in sales in 2023.

Market Challenges

- High Competition (Market Saturation): The U.S. healthy snacks market faces intense competition, with over 1,200 brands competing for consumer attention. According to the U.S. Census Bureau, small-scale, regional players continue to enter the market, contributing to market saturation. In 2023, large multinational snack companies are also increasingly diversifying into healthy snack lines, which has led to fierce competition, price wars, and the introduction of new products at an accelerated rate. New brands are finding it difficult to gain market share as they compete with established players who control major distribution channels.

- Pricing Pressures (Premium Ingredients): The use of premium ingredients such as organic nuts, seeds, and alternative sweeteners makes healthy snacks more expensive compared to conventional options. According to the U.S. Bureau of Economic Analysis, the cost of organic farming inputs increased by 8% in 2023 due to inflation and supply chain constraints, contributing to higher production costs for organic snacks. This price sensitivity is a significant challenge, particularly for consumers in lower-income brackets who are less likely to pay a premium for health-oriented products.

US Healthy Snacks Market Future Outlook

Over the next five years, the US Healthy Snacks market is expected to witness strong growth, driven by consumer preferences for healthier, on-the-go food options. The increasing adoption of plant-based diets, functional foods, and personalized nutrition trends are likely to create new growth avenues. Additionally, innovations in clean label ingredients and sustainable packaging will shape the future of the industry as companies align with changing consumer expectations and environmental concerns.

Market Opportunities:

- Increase in Personalized Nutrition Offerings (Consumer Preferences): Personalized nutrition is becoming a significant trend, with snack manufacturers leveraging data analytics to offer customized products tailored to individual dietary preferences. The U.S. Department of Health and Human Services reports that the personalized nutrition market is growing as more consumers demand snacks suited to their specific health goals, such as weight management or gut health. Approximately 9 million Americans now use personalized nutrition plans, and this trend has been instrumental in driving innovation in snack product development.

- Emergence of Snacks for Mental and Gut Health (Functional Foods): Snacks designed to support mental wellness and digestive health are gaining traction in the U.S. market. Snack manufacturers are incorporating ingredients like adaptogens and probiotics to meet this demand. This aligns with the increasing consumer focus on holistic health solutions, as more individuals seek snacks that offer functional benefits beyond basic nutrition.

Scope of the Report

|

By Product Type |

Nuts & Seeds Fruit-based Snacks Protein Bars & Shakes Vegetable Chips Yogurt-based Snacks |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Consumer Group |

Adults Children Elderly |

|

By Ingredient Type |

Plant-based Ingredients Dairy-based Ingredients Grain-based Ingredients |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Healthy Snack Manufacturers

Retailers & Distributors (e.g., Walmart, Whole Foods)

E-commerce Platforms (Amazon, Thrive Market)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Foodservice Companies

Ingredient Suppliers

Packaging Suppliers

Companies

Players Mentioned in the report

PepsiCo (Frito-Lay)

General Mills (Nature Valley)

Kellogg's (RXBAR)

Mondelez International

Kind LLC

Danone North America

Hain Celestial Group

Hormel Foods Corporation (Justin's)

Campbell Soup Company (Pepperidge Farm)

B&G Foods (Back to Nature)

Amplify Snack Brands (SkinnyPop)

Clif Bar & Company

The Hershey Company

Blue Diamond Growers

Nestle USA

Table of Contents

1. US Healthy Snacks Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. US Healthy Snacks Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. US Healthy Snacks Market Analysis 3.1 Growth Drivers

3.1.1 Increasing Health Consciousness (Consumer Demand)

3.1.2 Rise in Plant-based and Organic Snacking (Product Innovation)

3.1.3 Expanding Distribution Channels (E-commerce and Specialty Stores)

3.1.4 Government Initiatives Promoting Healthy Eating (Policy Impact)

3.2 Market Challenges

3.2.1 High Competition (Market Saturation)

3.2.2 Pricing Pressures (Premium Ingredients)

3.2.3 Regulatory Constraints (FDA Labeling)

3.3 Opportunities

3.3.1 Growth in Functional and Nutrient-dense Snacks (Health Benefits)

3.3.2 Expansion of Snacks for Specific Diets (Keto, Paleo, Vegan)

3.3.3 Rise in Subscription Snack Boxes (Direct-to-Consumer Models)

3.4 Trends

3.4.1 Growing Popularity of Clean Label Products (Natural Ingredients)

3.4.2 Increase in Personalized Nutrition Offerings (Consumer Preferences)

3.4.3 Emergence of Snacks for Mental and Gut Health (Functional Foods)

3.5 Government Regulations

3.5.1 Nutritional Labeling Standards (FDA)

3.5.2 Policies on Added Sugar and Sodium Limits (Health Guidelines)

3.5.3 Public Health Campaigns for Healthy Snacking (Behavioral Change)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. US Healthy Snacks Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Nuts & Seeds

4.1.2 Fruit-based Snacks

4.1.3 Protein Bars & Shakes

4.1.4 Vegetable Chips

4.1.5 Yogurt-based Snacks

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Specialty Stores

4.3 By Consumer Group (In Value %)

4.3.1 Adults

4.3.2 Children

4.3.3 Elderly

4.4 By Ingredient Type (In Value %)

4.4.1 Plant-based Ingredients

4.4.2 Dairy-based Ingredients

4.4.3 Grain-based Ingredients

4.5 By Region (In Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. US Healthy Snacks Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PepsiCo (Frito-Lay)

5.1.2 General Mills (Nature Valley)

5.1.3 Kellogg's (RXBAR)

5.1.4 Mondelez International

5.1.5 Kind LLC

5.1.6 Danone North America

5.1.7 Hain Celestial Group

5.1.8 Hormel Foods Corporation (Justin's)

5.1.9 Campbell Soup Company (Pepperidge Farm)

5.1.10 B&G Foods (Back to Nature)

5.1.11 Amplify Snack Brands (SkinnyPop)

5.1.12 Clif Bar & Company

5.1.13 The Hershey Company

5.1.14 Blue Diamond Growers

5.1.15 Nestle USA

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Sustainability Practices, Innovation in Ingredients, Product Launches, Distribution Strength, Market Position)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. US Healthy Snacks Market Regulatory Framework

6.1 Food Safety Standards

6.2 Labeling and Compliance

6.3 Import/Export Regulations

6.4 Sustainability Regulations (Eco-friendly Packaging)

7. US Healthy Snacks Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. US Healthy Snacks Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Group (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. US Healthy Snacks Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out key stakeholders in the US Healthy Snacks market. This step includes extensive desk research using secondary databases, including market reports and government publications, to identify the critical variables that shape the market, such as consumer behavior, product preferences, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this stage, we analyze historical data on the US Healthy Snacks market, focusing on factors like product penetration and consumer trends. This includes data on the share of various distribution channels and product segments, which is then cross-referenced with company sales data to validate revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews and consultations with industry professionals, including manufacturers and distributors, we validate the hypotheses about market trends. These insights help refine our understanding of market dynamics, particularly in relation to consumer demand and product innovation.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from manufacturers and market surveys to provide a holistic view of the US Healthy Snacks market. The integration of these insights ensures the final output is accurate, covering product segments, market growth, and emerging trends.

Frequently Asked Questions

01. How big is the US Healthy Snacks Market?

The US Healthy Snacks market was valued at USD 21.46 billion, driven by a growing consumer preference for nutritious and convenient snacking options.

02. What are the challenges in the US Healthy Snacks Market?

Challenges in the market include intense competition, high raw material costs, and regulatory hurdles, particularly around labeling and ingredient transparency.

03. Who are the major players in the US Healthy Snacks Market?

Key players in the market include PepsiCo (Frito-Lay), General Mills, Mondelez International, and Clif Bar & Company, dominating through their wide product offerings and established distribution networks.

04. What are the growth drivers of the US Healthy Snacks Market?

Growth drivers include increased consumer awareness around health, the demand for plant-based and functional foods, and innovations in clean-label and sustainable snack options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.