U.S. Household Appliances Market Outlook 2030

Region:North America

Author(s):Shivani

Product Code:KROD7021

November 2024

99

About the Report

U.S. Household Appliances Market Overview

- The U.S. household appliances market is valued at approximately USD 58.33 billion, driven by increased demand for smart home appliances, energy-efficient products, and the integration of IoT (Internet of Things). Consumers are more inclined toward high-tech solutions, particularly as working professionals seek appliances that offer both convenience and energy savings. This shift toward smart and eco-friendly solutions is a critical driver, as technological advancements enable appliances to interact with users through smart applications and AI-based assistants.

- In the U.S. household appliances market, California and Texas emerge as dominant regions due to their high population density, urbanization, and consumer demand for premium appliances. Additionally, states like New York and Florida, with higher disposable incomes, drive the demand for luxury appliances, while smart home systems are increasingly popular among tech-savvy residents. The rise in urban apartment living and emphasis on eco-friendly solutions further contribute to the dominance of these regions.

- The U.S. governments Energy Star program, overseen by the Environmental Protection Agency (EPA), continues to drive the adoption of energy-efficient household appliances. As of 2024, the program provides tax credits and rebates for consumers purchasing Energy Star-certified appliances like refrigerators, dishwashers, and washing machines. These incentives encourage energy conservation, with the EPA reporting that Energy Star products helped reduce over 2 billion metric tons of greenhouse gas emissions since the program's inception. This initiative also supports lower utility bills for consumers, saving an average of $575 annually per household.

U.S. Household Appliances Market Segmentation

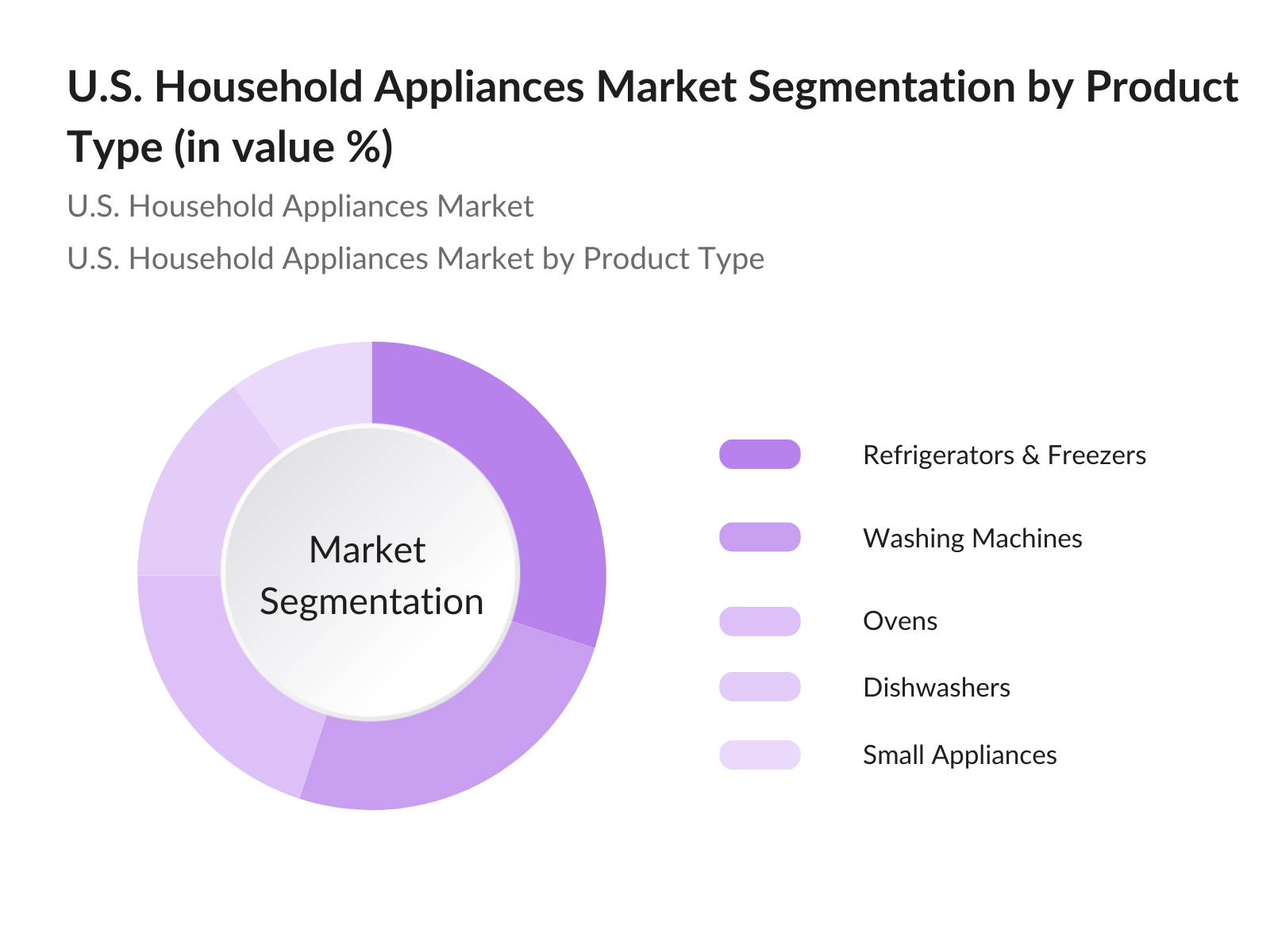

By Product Type: The U.S. household appliances market is segmented into refrigerators and freezers, washing machines, dishwashers, ovens, and small appliances such as vacuum cleaners and coffee makers. Among these, refrigerators and freezers hold the dominant share, driven by technological advancements like multi-door smart refrigerators with enhanced energy efficiency. Smart refrigerators, capable of interacting with other home devices and offering customized user experiences, are gaining significant popularity among tech-conscious consumers.

By Distribution Channel: Distribution channels for household appliances in the U.S. include multi-branded stores, exclusive brand outlets, and e-commerce platforms. E-commerce leads in market share as online shopping continues to grow rapidly, driven by the convenience of home delivery and competitive pricing. Additionally, exclusive brand outlets play a crucial role, offering customized and high-end product ranges that appeal to premium consumers.

U.S. Household Appliances Market Competitive Landscape

The U.S. household appliances market is consolidated, with key players holding a dominant presence through extensive R&D investments, smart technology integration, and product psortfolio expansions. These companies have built strong brand recognition and cater to diverse consumer needs ranging from affordability to high-end luxury appliances.

|

Company |

Established |

Headquarters |

Market-Specific Parameters |

|

Whirlpool |

1911 |

Michigan, USA |

- |

|

LG Electronics |

1958 |

Seoul, South Korea |

- |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

- |

|

Haier Group |

1984 |

Qingdao, China |

- |

|

Bosch |

1886 |

Stuttgart, Germany |

- |

U.S. Household Appliances Market Analysis

Market Growth Drivers

- Consumer Preferences, Innovation, and Sustainability: The shift in consumer preferences toward energy-efficient and smart home appliances is driving the U.S. household appliances market. In 2023, over 76 million households in the U.S. are equipped with at least one smart home device, pushing the demand for more integrated and multi-functional appliances. The rise in consumer awareness regarding sustainable living and the governments emphasis on energy conservation is accelerating the innovation in eco-friendly appliances. The U.S. Department of Energys Energy Star program reports that using energy-efficient appliances has resulted in savings of around 500 terawatt-hours (TWh) annually across U.S. households.

- Rise in Disposable Income: The disposable income of American households has significantly increased, reaching $18.7 trillion in 2023, as per the U.S. Bureau of Economic Analysis. This increase is a primary driver for the demand for household appliances, as consumers are willing to invest in premium, smart, and energy-efficient products. With more purchasing power, households are adopting high-end appliances that enhance comfort and convenience, contributing to the market's growth.

- Increasing Demand for Smart Home Solutions: In 2023, more than 50 million smart appliances are installed across U.S. households, driven by the growing popularity of automation, convenience, and energy efficiency. Appliances integrated with IoT, voice assistants, and remote-control features are increasingly being adopted by consumers. The U.S. Federal Communications Commission (FCC) noted a significant rise in broadband usage between 2022-2023, which has enabled smoother integration of smart appliances into homes, further boosting the demand for these products.

Market Challenges:

- Supply Chain Disruptions and Semiconductor Shortages: The U.S. household appliances market continues to face significant challenges due to global supply chain disruptions, particularly in the semiconductor industry. In 2023, the U.S. Department of Commerce highlighted that semiconductor shortages led to delays in the production of smart appliances, which heavily depend on these chips for functionalities like IoT integration. These disruptions caused extended lead times, increased costs for manufacturers, and reduced availability of products for consumers, hindering market growth. The shortage has also contributed to a backlog of orders and prolonged delivery times across the U.S.

- Regulatory Compliance and Product Safety Standards: Household appliance manufacturers in the U.S. face stringent regulatory compliance requirements, particularly around energy efficiency and product safety standards. The U.S. Consumer Product Safety Commission (CPSC) and the Department of Energy (DOE) set rigorous guidelines for energy consumption, safety, and environmental impact. Ensuring compliance with these standards often increases production costs and requires continuous product modifications. In 2023, manufacturers reported challenges in meeting updated safety protocols and energy efficiency requirements, especially as regulations around emissions and environmental impact tighten.

U.S. Household Appliances Market Future Outlook

Over the next few years, the U.S. household appliances market is expected to witness significant growth, primarily driven by the increasing adoption of smart appliances, environmental sustainability concerns, and ongoing technological advancements. With rising consumer awareness around energy consumption, major players are expected to focus more on creating energy-efficient products that cater to both luxury and affordability segments.

Market Opportunities:

- Integration with AI and IoT: The U.S. household appliances market is increasingly adopting AI and IoT technologies, enhancing the user experience through smart functionality. In 2023, the number of U.S. households equipped with AI-powered appliances such as smart ovens, refrigerators, and vacuum cleaners continues to grow. These appliances can perform tasks autonomously, learn user preferences, and integrate seamlessly with other smart home systems. The rollout of 5G infrastructure, as reported by the Federal Communications Commission (FCC), further enables real-time device control and enhances the functionality of IoT-enabled appliances.

- Rise of Multi-functional Appliances: The growing demand for space-efficient solutions has led to the rise of multi-functional household appliances in the U.S. market. Consumers are increasingly opting for appliances that serve multiple purposes, such as washer-dryer combos or refrigerators with built-in touchscreens. This trend aligns with the need for convenience and efficient use of space in urban environments. As reported by the U.S. Census Bureau, urbanization continues to increase, driving demand for compact, multi-functional appliances that suit smaller living spaces.

Scope of the Report

|

By Product Type |

Refrigerators Freezers Washing Machines Ovens Dishwashers Air Conditioners Small Appliances |

|

By Distribution Channel |

Multi-branded Stores Exclusive Outlets E-Commerce |

|

By Application |

Residential Commercial |

|

By End-User |

Smart Appliances Traditional Appliances Energy-Efficient Appliances |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., ENERGY STAR, U.S. Department of Energy)

Smart Home Technology Providers

Appliance Retail Chains

E-commerce Platforms

Residential Property Developers

Manufacturers of Smart Devices and IoT Solutions

High-end Consumer Electronics Buyers

Companies

Major Players

Whirlpool Corporation

LG Electronics

Samsung Electronics

Haier Group

Bosch

Panasonic Corporation

Electrolux AB

Gorenje Group

GE Appliances

Hitachi Ltd.

Midea Group

Viking Range, LLC

Sub-Zero Group, Inc.

Arelik AS

BSH Hausgerte

Table of Contents

1. U.S. Household Appliances Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Overview of Key Segments

2. U.S. Household Appliances Market Size (In USD Million)

2.1 Historical Market Size

2.2 Current Market Size Analysis

2.3 Key Developments Impacting Market Size

3. U.S. Household Appliances Market Dynamics

3.1 Market Drivers (Consumer Preferences, Innovation, Sustainability)

3.1.1 Rise in Disposable Income

3.1.2 Increasing Demand for Smart Home Solutions

3.1.3 Energy Efficiency and Sustainability Trends

3.2 Market Restraints (Supply Chain, Regulatory Compliance)

3.2.1 Supply Chain Disruptions (Semiconductor Shortages)

3.2.2 High Cost of Product Maintenance

3.3 Opportunities (Technology, Partnerships)

3.3.1 Growth of E-Commerce Platforms

3.3.2 Advancements in Smart Technologies and IoT

3.4 Trends (Smart Homes, Multi-functional Appliances)

3.4.1 Integration with AI and IoT

3.4.2 Consumer Shift to Sustainable Appliances

4. U.S. Household Appliances Market Segmentation (In Value %)

4.1 By Product Type

4.1.1 Refrigerators and Freezers

4.1.2 Dishwashers

4.1.3 Washing Machines

4.1.4 Air Conditioners

4.1.5 Ovens and Cooktops

4.1.6 Small Appliances (Coffee Makers, Vacuum Cleaners)

4.2 By Distribution Channel

4.2.1 Multi-branded Stores

4.2.2 Exclusive Brand Outlets

4.2.3 E-Commerce Platforms

5. U.S. Household Appliances Competitive Landscape

5.1 Major Companies (Profile, Product Offerings, Competitive Strategies)

Whirlpool Corporation

Haier Group Corporation

LG Electronics

Samsung Electronics

Bosch

Panasonic Corporation

Midea Group

Electrolux AB

GE Appliances

Hitachi Ltd.

Gorenje Group

Arelik AS

BSH Hausgerte

Viking Range, LLC

Sub-Zero Group, Inc.

5.2 Cross-Comparison Parameters (Product Portfolio, Market Share, Innovation Index, R&D Investments, Pricing Strategy, Geographic Reach, Revenue Growth, ESG Initiatives)

5.3 Market Share Analysis

5.4 Recent Strategic Initiatives (Mergers, Partnerships, Technological Advancements)

6. U.S. Household Appliances Market Regulatory Framework

6.1 Energy Efficiency Standards (ENERGY STAR, CEE)

6.2 Compliance Requirements

6.3 Certification Processes (UL, ETL, FCC)

7. Future Market Size Projections (In USD Million)

7.1 Market Forecast Analysis

7.2 Growth Potential of Key Segments (Smart Appliances, Energy-efficient Appliances)

8. Future Segmentation of U.S. Household Appliances Market (In Value %)

8.1 By Product Type

8.2 By Distribution Channel

8.3 By Application (Residential, Commercial)

9. Market Analyst's Recommendations

9.1 TAM/SAM/SOM Analysis (Total Available Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Customer Cohort Analysis

9.3 White Space Opportunities

9.4 Marketing and Sales Strategy Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying key variables within the U.S. household appliances market, focusing on energy efficiency, smart technologies, and consumer preferences. These insights are gathered through extensive desk research using secondary databases and proprietary resources.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and market penetration for major product categories, estimating growth through a detailed bottom-up approach. The assessment includes examining the impact of smart home integration and energy efficiency trends on the market.

Step 3: Hypothesis Validation and Expert Consultation

We validate our research through consultations with industry experts and key stakeholders, using computer-assisted interviews to gain insights into product innovations and industry trends. This allows us to refine our market data and ensure a reliable forecast.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data with insights from market players, leading to an accurate and comprehensive outlook on the U.S. household appliances market.

Frequently Asked Questions

01. How big is the U.S. Household Appliances Market?

The U.S. household appliances market is valued at USD 58.33 billion, driven by increased demand for smart, energy-efficient products, especially in urban centers with tech-savvy consumers.

02. What are the key challenges in the U.S. Household Appliances Market?

Supply chain disruptions, particularly in sourcing semiconductors for smart appliances, and high costs of production and maintenance pose significant challenges for manufacturers.

03. Who are the major players in the U.S. Household Appliances Market?

Key players include Whirlpool, LG Electronics, Samsung Electronics, Haier Group, and Bosch, who dominate through innovations in smart technology, energy efficiency, and extensive distribution networks.

04. What are the growth drivers of the U.S. Household Appliances Market?

Technological advancements in smart appliances, rising disposable income, and increased consumer awareness of energy-efficient solutions are driving market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.