U.S. HVAC Systems Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD4320

November 2024

82

About the Report

U.S. HVAC Systems Market Overview

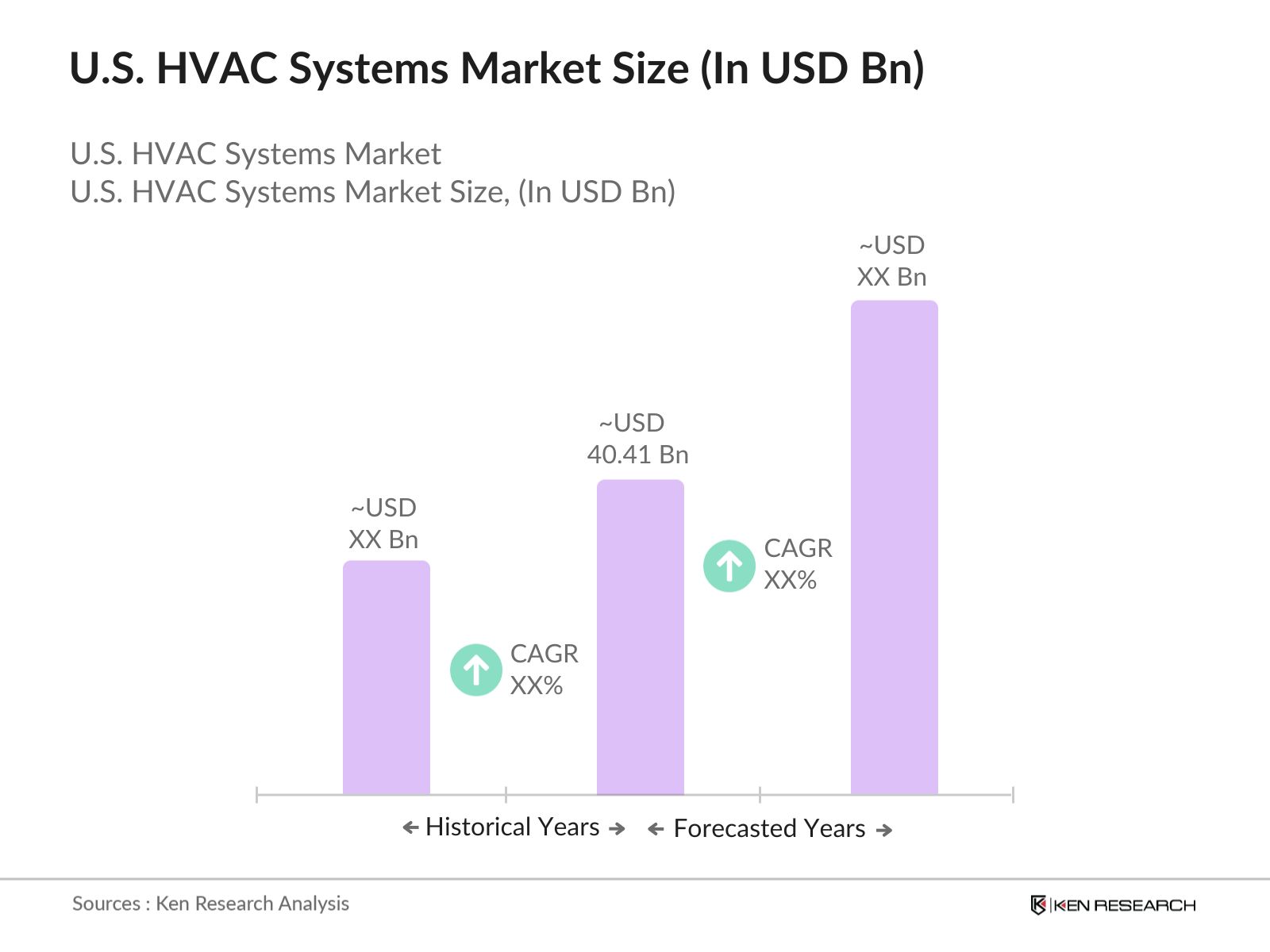

- The U.S. HVAC Systems market, valued at USD 40.41 billion, is driven by several key factors such as rising energy efficiency standards, government incentives, and the growing adoption of smart and connected HVAC technologies. With advancements in energy-efficient solutions and a heightened focus on sustainability, demand is consistently rising across both residential and commercial sectors. Furthermore, regulatory mandates for energy efficiency are pushing businesses and consumers to upgrade their HVAC systems, contributing to market growth in 2023.

- Several cities such as New York, Los Angeles, and Chicago dominate the HVAC systems market due to their high population density, commercial building expansions, and stringent environmental regulations. Additionally, warm states like Florida and Texas exhibit significant demand for cooling solutions, driven by climate conditions and urbanization. The large-scale infrastructure development in these cities also boosts the demand for modern HVAC systems, ensuring these locations remain key growth hubs for the industry.

- The U.S. HVAC market is subject to stringent regulations from the Environmental Protection Agency (EPA) regarding refrigerant management under the Clean Air Act. By 2024, the EPA mandates that all HVAC systems must transition away from HFCs due to their environmental impact. Non-compliance can result in significant fines, forcing manufacturers to adopt alternative refrigerants, such as hydrofluoroolefins (HFOs), which have a lower global warming potential. This regulatory environment is reshaping the HVAC market, leading to the development of eco-friendly systems.

U.S. HVAC Systems Market Segmentation

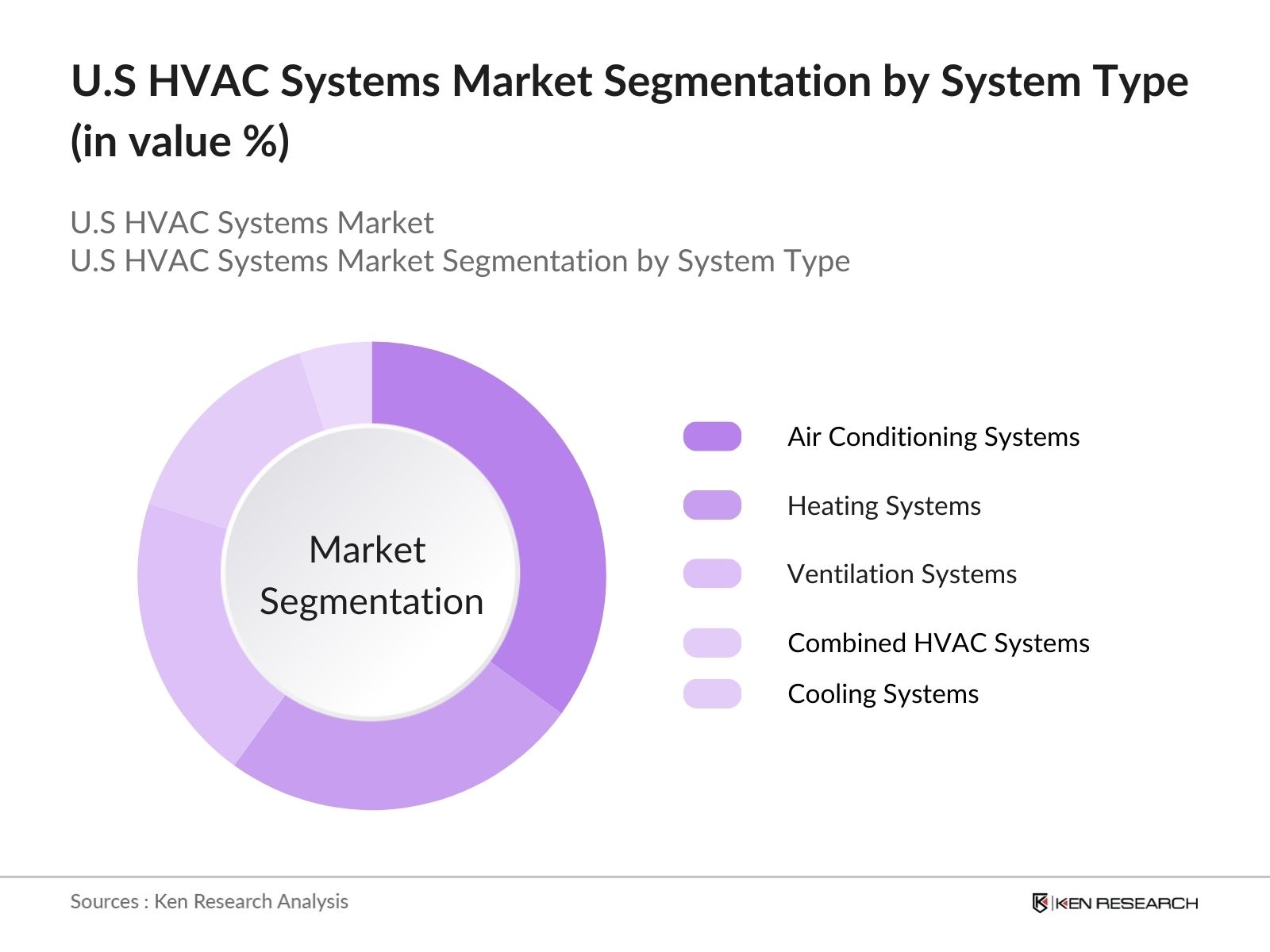

The U.S. HVAC market is segmented by system type and by end-use application.

- By System Type: The market is segmented by system type into heating systems, cooling systems, ventilation systems, air conditioning systems, and combined HVAC systems. Among these, air conditioning systems hold a dominant market share due to the increasing demand for cooling solutions in states with hot climates such as California, Florida, and Texas. Additionally, the growing prevalence of energy-efficient air conditioning units has made this segment the preferred choice for both residential and commercial customers.

- By End-Use Application: The market is also segmented by end-use application into residential, commercial, industrial, institutional, and healthcare. The commercial segment has captured a substantial market share, largely driven by new construction activities, retrofitting of existing infrastructure, and the implementation of energy-efficient standards in office spaces and retail facilities. Commercial real estate in major cities like New York and Los Angeles has also experienced rapid growth, spurring demand for advanced HVAC systems in these urban areas.

U.S. HVAC Systems Market Competitive Landscape

U.S. HVAC Systems Market Competitive Landscape

The U.S. HVAC market is dominated by a mix of local and international players, with major manufacturers like Carrier, Trane, and Daikin leading the industry. These companies have solidified their market presence through continuous innovation, strategic partnerships, and a focus on developing energy-efficient systems. Consolidation within the industry is evident as these key players engage in mergers and acquisitions to expand their technological capabilities and geographical reach.

U.S. HVAC Systems Market Analysis

Growth Drivers

- Rising Energy Efficiency Standards (Energy Consumption, SEER Rating): The U.S. HVAC systems market is experiencing significant growth due to increasingly stringent energy efficiency standards. For instance, the U.S. Department of Energy (DOE) has updated Seasonal Energy Efficiency Ratio (SEER) requirements in 2023, mandating a SEER rating of 15 for central air conditioners in the southern U.S. states and 14 for northern states. This push towards higher energy efficiency is expected to lead to a decrease in energy consumption across residential and commercial sectors. According to the U.S. Energy Information Administration (EIA), HVAC systems accounted for approximately 40% of total energy use in buildings in 2024, driving the need for energy-efficient systems.

- Urbanization and Population Growth (Residential and Commercial HVAC Demand): Rapid urbanization in the U.S. is driving demand for HVAC systems, especially in cities with growing populations. The U.S. Census Bureau reports that urban populations have continued to increase steadily, with cities like Austin and Phoenix growing by over 50,000 residents in the past year alone. This trend has increased both residential and commercial construction projects, creating a direct surge in HVAC demand. In 2023, residential construction permits reached over 1.5 million units, and many of these projects include the installation of modern, efficient HVAC systems to accommodate the growing urban population.

- Government Incentives and Tax Rebates (Tax Credits, Incentive Programs): The U.S. government has launched multiple incentive programs to boost the adoption of energy-efficient HVAC systems. Through the Inflation Reduction Act, homeowners can now receive tax credits up to $2,000 for installing energy-efficient HVAC systems. This initiative aims to reduce energy consumption and greenhouse gas emissions. Additionally, states like California and New York offer rebates for upgrading to high-efficiency HVAC units. In 2023, the federal government allocated $500 million towards such energy efficiency upgrades, contributing to the markets expansion by encouraging both residential and commercial customers to upgrade their systems.

Market Challenges

- High Initial Installation Costs (Cost of Systems, Installation): The high initial costs associated with purchasing and installing HVAC systems pose a significant barrier to market expansion. For instance, installing a central air conditioning system in the U.S. can range from $5,000 to $12,000, depending on the homes size and energy efficiency goals. This cost factor has slowed the adoption of advanced, energy-efficient HVAC systems, especially among middle-income households. According to the U.S. Census Bureau, the median household income in 2023 was $74,580, which means that a significant portion of the population struggles to afford the installation of high-end HVAC systems.

- Skilled Labor Shortages (Technician Availability): A shortage of skilled labor is another critical challenge for the HVAC market. The U.S. Bureau of Labor Statistics (BLS) reported a significant gap in the availability of qualified HVAC technicians in 2024, with over 20,000 unfilled positions in the industry. This shortage impacts installation times and increases labor costs, which further adds to the overall expense for consumers. Training and certification programs are in place to address this issue, but the current pace of technician training is insufficient to meet the growing market demand.

U.S. HVAC Systems Market Future Outlook

Over the next five years, the U.S. HVAC market is expected to show significant growth driven by the increasing demand for energy-efficient systems, the adoption of smart HVAC technology, and federal government regulations aimed at reducing energy consumption. Rising consumer awareness around energy conservation and environmental sustainability will further enhance the market's growth trajectory. Furthermore, advancements in IoT and AI-driven HVAC systems will provide new opportunities for innovation and expansion.

Market Opportunities

- Growing Demand for Green Buildings (Energy-efficient HVAC Systems, LEED Certification): There is a growing demand for energy-efficient HVAC systems as part of the green building movement in the U.S. Buildings that achieve LEED (Leadership in Energy and Environmental Design) certification are required to use HVAC systems that meet high energy efficiency standards. In 2024, the U.S. Green Building Council (USGBC) reported that over 69,000 LEED-certified commercial buildings were in operation, driving the demand for HVAC systems that minimize energy consumption. The governments focus on sustainability further supports the growth of green building practices, presenting a significant opportunity for HVAC manufacturers.

- Integration of AI and Machine Learning in HVAC (Predictive Maintenance, Smart Thermostats): The integration of artificial intelligence (AI) and machine learning (ML) into HVAC systems is opening up new opportunities. Predictive maintenance powered by AI can significantly reduce the need for costly repairs and unexpected downtime. Smart thermostats equipped with AI can learn user preferences and automatically adjust settings for optimal energy efficiency. The U.S. Department of Energy has noted that such advancements can reduce HVAC energy consumption by up to 30%, offering a substantial advantage for commercial and residential buildings.

Scope of the Report

|

Heating Systems Cooling Systems Ventilation Systems Air Conditioning Systems Combined HVAC Systems |

|

|

By End-Use Application |

Residential Commercial Healthcare |

|

By Technology |

Ducted Systems Ductless Systems Geothermal Systems Smart HVAC Systems VRF Systems |

|

By Installation Type |

New Installation Retrofitting and Replacement |

|

By Region |

North East West South |

Products

Key Target Audience

HVAC System Manufacturers

Energy Efficiency Consultants

Commercial Real Estate Developers

Residential Construction Companies

Institutional Facility Managers

Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

Banks and Financial Institutes

Investors and Venture Capitalist Firms

HVAC Contractors and Installers

Companies

Players Mention in the Report:

Carrier Corporation

Daikin North America LLC

Trane Technologies

Johnson Controls International plc

Lennox International Inc.

Honeywell International Inc.

Mitsubishi Electric Trane HVAC US

Rheem Manufacturing Company

Goodman Manufacturing Company L.P.

Bosch Thermotechnology Corp.

Nortek Global HVAC

LG Electronics USA, Inc.

York International Corporation

Emerson Electric Co.

Fujitsu General America, Inc.

Table of Contents

1. U.S. HVAC Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. HVAC Systems Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. HVAC Systems Market Analysis

3.1. Growth Drivers

3.1.1. Rising Energy Efficiency Standards (Energy Consumption, SEER Rating)

3.1.2. Urbanization and Population Growth (Residential and Commercial HVAC Demand)

3.1.3. Government Incentives and Tax Rebates (Tax Credits, Incentive Programs)

3.1.4. Technological Advancements (Smart HVAC Systems, IoT Integration)

3.2. Market Challenges

3.2.1. High Initial Installation Costs (Cost of Systems, Installation)

3.2.2. Skilled Labor Shortages (Technician Availability)

3.2.3. Compliance with Environmental Regulations (Refrigerant Phase-out, Energy Efficiency Standards)

3.3. Opportunities

3.3.1. Growing Demand for Green Buildings (Energy-efficient HVAC Systems, LEED Certification)

3.3.2. Integration of AI and Machine Learning in HVAC (Predictive Maintenance, Smart Thermostats)

3.3.3. Expansion of Retrofitting and Upgrading of Existing Systems (System Upgrades, Energy Efficiency Improvement)

3.4. Trends

3.4.1. Adoption of Smart and Connected HVAC Systems (Remote Monitoring, Control)

3.4.2. Increasing Popularity of VRF Systems (Variable Refrigerant Flow, Zonal Cooling/Heating)

3.4.3. Renewable Energy HVAC Integration (Geothermal HVAC, Solar-Powered Systems)

3.5. Government Regulation

3.5.1. U.S. EPA Regulations (Refrigerant Management, Clean Air Act Compliance)

3.5.2. Department of Energy (DOE) HVAC Efficiency Standards

3.5.3. Federal and State-Level Building Codes (ASHRAE Standards, State Energy Codes)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, Installers)

3.8. Porters Five Forces (Bargaining Power, Competition, Threat of Substitutes)

3.9. Competition Ecosystem

4. U.S. HVAC Systems Market Segmentation

4.1. By System Type (In Value %)

4.1.1. Heating Systems

4.1.2. Cooling Systems

4.1.3. Ventilation Systems

4.1.4. Air Conditioning Systems

4.1.5. Combined HVAC Systems

4.2. By End-Use Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Institutional

4.2.5. Healthcare

4.3. By Technology (In Value %)

4.3.1. Ducted Systems

4.3.2. Ductless Systems

4.3.3. Geothermal Systems

4.3.4. Smart HVAC Systems

4.3.5. VRF Systems

4.4. By Installation Type (In Value %)

4.4.1. New Installation

4.4.2. Retrofitting and Replacement

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. U.S. HVAC Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Carrier Corporation

5.1.2. Daikin North America LLC

5.1.3. Trane Technologies

5.1.4. Johnson Controls International plc

5.1.5. Lennox International Inc.

5.1.6. Honeywell International Inc.

5.1.7. Mitsubishi Electric Trane HVAC US

5.1.8. Rheem Manufacturing Company

5.1.9. Goodman Manufacturing Company L.P.

5.1.10. Bosch Thermotechnology Corp.

5.1.11. Nortek Global HVAC

5.1.12. LG Electronics USA, Inc.

5.1.13. York International Corporation

5.1.14. Emerson Electric Co.

5.1.15. Fujitsu General America, Inc.

5.2 Cross Comparison Parameters (Energy Efficiency Rating, System Types, Revenue, Number of Employees, Geographical Presence, Technology Portfolio, Market Share, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. HVAC Systems Market Regulatory Framework

6.1. HVAC Energy Efficiency Standards

6.2. Compliance with Federal and State-Level Energy Regulations

6.3. Refrigerant Management and Regulations (Phasing Out HCFCs, HFCs)

6.4. Certification and Licensing for HVAC Contractors (EPA 608, NATE Certification)

7. U.S. HVAC Systems Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. HVAC Systems Future Market Segmentation

8.1. By System Type (In Value %)

8.2. By End-Use Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Installation Type (In Value %)

8.5. By Region (In Value %)

9. U.S. HVAC Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping all key stakeholders within the U.S. HVAC market, including manufacturers, suppliers, and end users. Desk research was conducted using proprietary databases and secondary sources to gather comprehensive data on market dynamics and variables such as energy efficiency standards, technological innovations, and demand drivers.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data to assess market penetration, with a focus on residential and commercial sectors. The study included evaluating HVAC system upgrades, the integration of IoT technology, and the overall impact on energy consumption to validate revenue estimates for the current market.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts were conducted via phone interviews and online surveys to validate market hypotheses. These experts, ranging from HVAC system manufacturers to energy efficiency consultants, provided insights into market trends and operational challenges.

Step 4: Research Synthesis and Final Output

The final phase focused on compiling insights from various market players, including data on product performance, consumer preferences, and industry best practices. This information was used to cross-validate the market figures and ensure that the analysis provides a comprehensive and accurate view of the U.S. HVAC market.

Frequently Asked Questions

01. How big is the U.S. HVAC market?

The U.S. HVAC market is valued at USD 40.41 billion, driven by increasing demand for energy-efficient systems and the adoption of smart HVAC technology across residential and commercial sectors.

02. What are the challenges in the U.S. HVAC market?

Challenges in the U.S. HVAC market include high installation costs, a shortage of skilled labor, and the need to comply with stringent environmental regulations, particularly regarding energy efficiency standards and refrigerant management.

03. Who are the major players in the U.S. HVAC market?

Key players in the U.S. HVAC market include Carrier Corporation, Daikin North America LLC, Trane Technologies, Johnson Controls International plc, and Lennox International Inc. These companies dominate the market due to their extensive product portfolios and strong focus on energy efficiency.

04. What are the growth drivers of the U.S. HVAC market?

The U.S. HVAC market is driven by increasing consumer awareness of energy conservation, government incentives for upgrading HVAC systems, and technological advancements such as smart thermostats and AI-powered HVAC solutions.

05. Which segment dominates the U.S. HVAC market?

The air conditioning systems segment dominates the U.S. HVAC market due to high demand in warm regions like Florida, Texas, and California. The popularity of energy-efficient air conditioners also contributes to this segments leadership.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.