U.S. Insulin Delivery Devices Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3284

December 2024

83

About the Report

U.S. Insulin Delivery Devices Market Overview

- The U.S. insulin delivery devices market is valued at USD 4 billion, based on a five-year historical analysis. This market is driven primarily by the rising prevalence of diabetes, increasing demand for more convenient insulin delivery systems, and the advancement of smart technologies. With over 34 million Americans diagnosed with diabetes, the demand for insulin devices such as insulin pens, pumps, and continuous subcutaneous insulin infusion systems has surged. The market is also boosted by the growing number of geriatric populations in need of diabetes care.

- The cities of New York, Los Angeles, and Houston are dominant in this market due to their high population density, advanced healthcare infrastructure, and significant healthcare spending. These cities also have a higher incidence of diabetes and obesity, leading to greater demand for insulin delivery devices. Their established hospital networks and retail pharmacy chains allow for seamless distribution of these devices, which contributes to their market dominance.

- ACA continues to support diabetes management, ensuring wider access to insulin delivery devices through subsidies and insurance coverage. In 2024, these provisions will further expand coverage for insulin pumps and pens, making them more accessible to low-income patients. The ACA has mandated that all health plans provide coverage for diabetes care as an essential health benefit, which includes insulin delivery devices like pumps and pens. This requirement aims to improve access to necessary treatments for individuals with diabetes, particularly those who are low-income.

U.S. Insulin Delivery Devices Market Segmentation

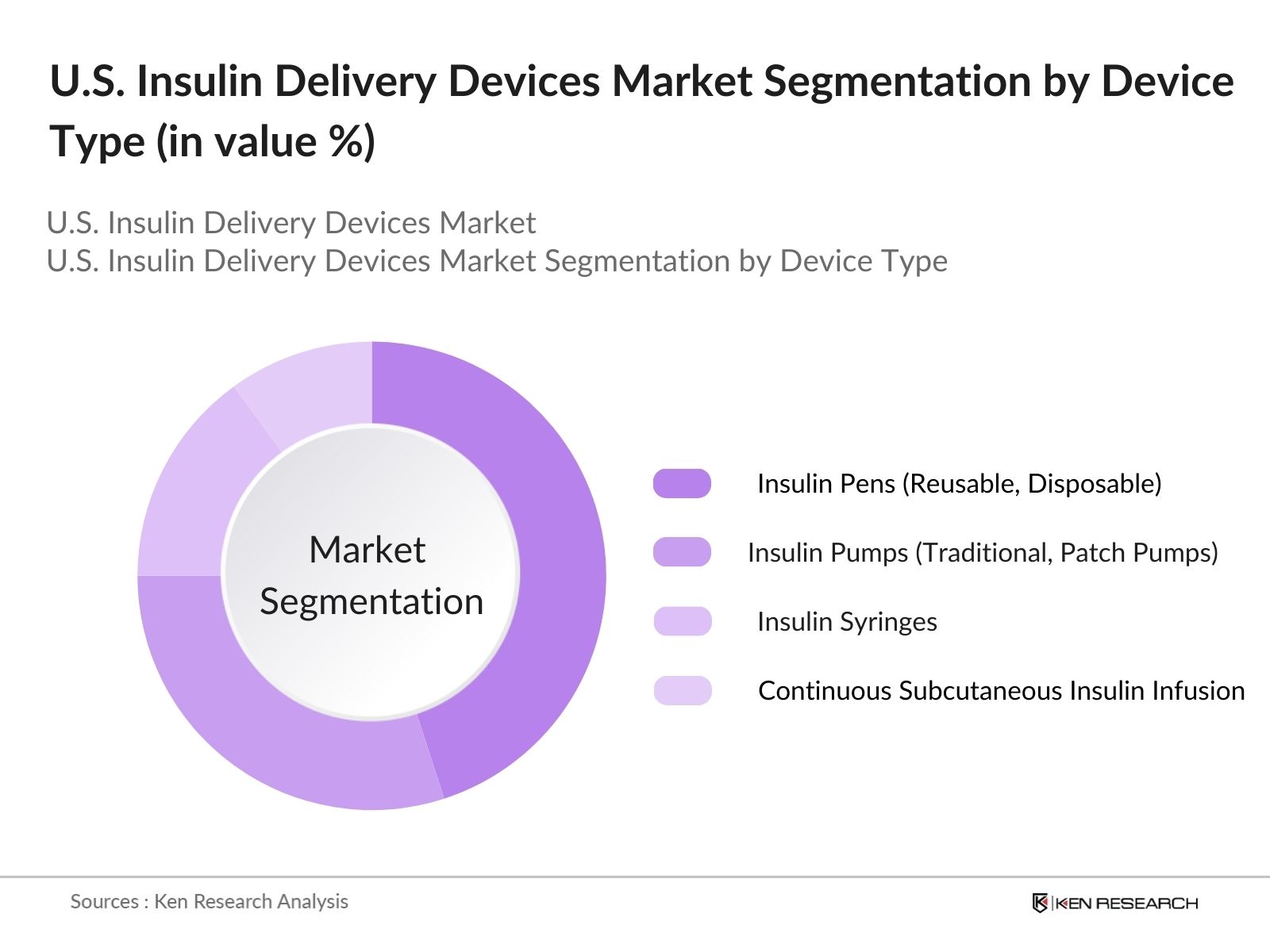

By Device Type: The U.S. insulin delivery devices market is segmented by device type into insulin pens, insulin pumps, insulin syringes, and continuous subcutaneous insulin infusion (CSII) devices. Among these, insulin pens hold the dominant market share. This is due to their user-friendly design, increasing patient preference for convenience, and wide availability across retail pharmacies. Insulin pens offer pre-measured doses, which helps reduce the chances of administering incorrect insulin amounts, making them particularly popular among elderly patients and those with visual impairments.

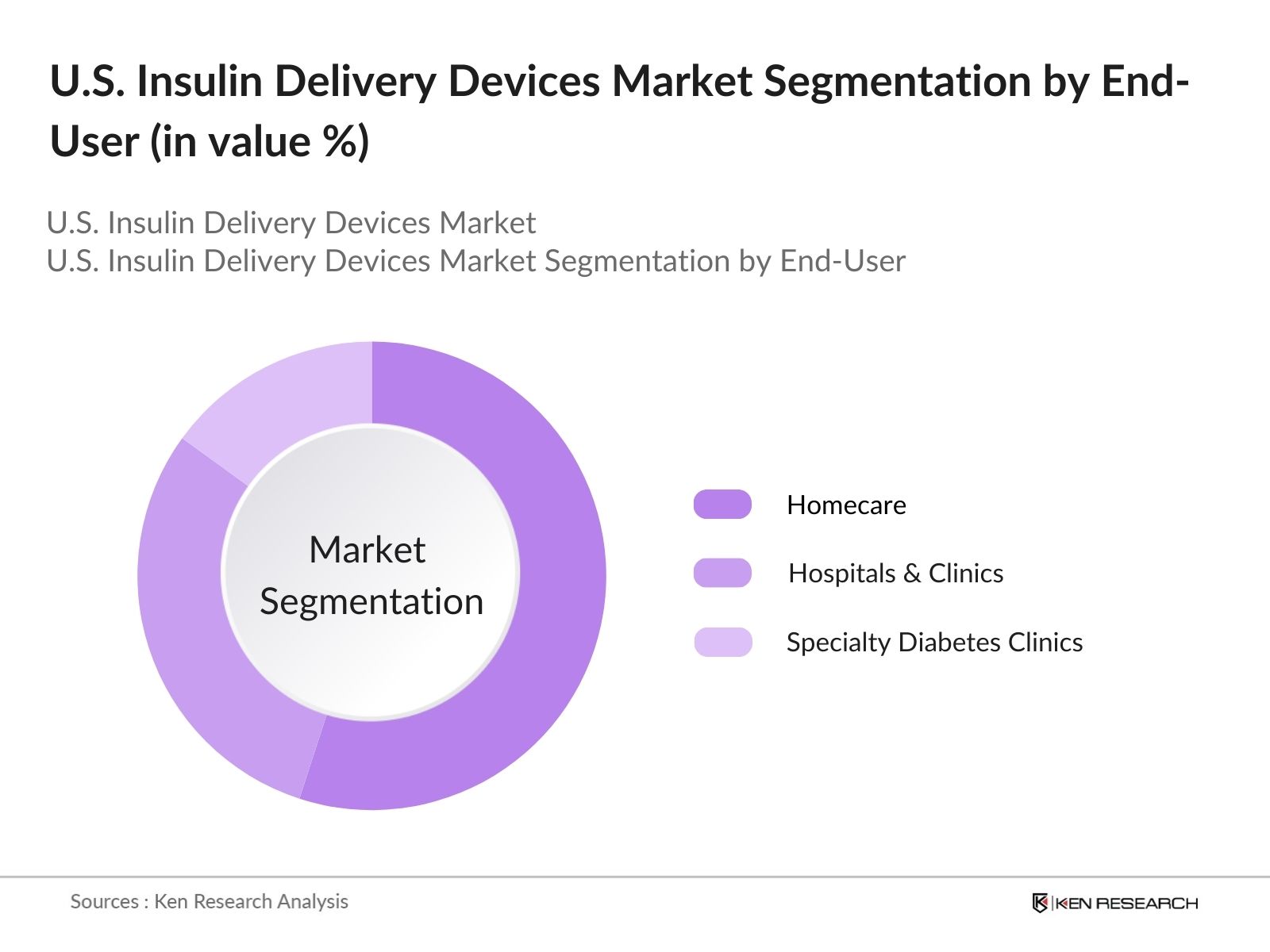

By End-User: The market is also segmented by end-user into homecare, hospitals & clinics, and specialty diabetes clinics. The homecare segment dominates the market as patients increasingly prefer self-administration of insulin using pens and pumps. The rise in telemedicine and remote monitoring services, along with increasing patient education on diabetes management, has significantly driven the demand for home-use devices.

U.S. Insulin Delivery Devices Market Competitive Landscape

The U.S. insulin delivery devices market is dominated by major players who lead through technological innovation, strategic partnerships, and extensive distribution networks. Companies such as Medtronic and Novo Nordisk hold significant influence in the market due to their advanced product lines and strong R&D capabilities.The U.S. insulin delivery devices market is dominated by several global and domestic manufacturers, such as Medtronic, Novo Nordisk, and Eli Lilly. These companies leverage their strong R&D focus and established distribution channels to maintain their market position.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

No. of Employees |

Key Product |

Patent Portfolio |

Recent Developments |

Strategic Partnerships |

|

Medtronic |

1949 |

Minneapolis, Minnesota |

||||||

|

Novo Nordisk |

1923 |

Bagsvrd, Denmark |

||||||

|

Eli Lilly and Company |

1876 |

Indianapolis, Indiana |

||||||

|

Insulet Corporation |

2000 |

Acton, Massachusetts |

||||||

|

Tandem Diabetes Care |

2006 |

San Diego, California |

U.S. Insulin Delivery Devices Market Analysis

Growth Drivers

- Prevalence of Diabetes: The U.S. faces a significant rise in diabetes diagnoses, with the CDC reporting over 37 million Americans diagnosed with diabetes by 2023. This substantial patient base directly boosts demand for insulin delivery devices, especially insulin pens and pumps. Given the projected healthcare burden, public health initiatives continue to address diabetes care needs, increasing the demand for advanced insulin delivery technologies.

- Increasing Geriatric Population: The U.S. Census Bureau indicates that by 2024, over 56 million individuals in the U.S. will be 65 or older, a demographic heavily impacted by diabetes. As diabetes prevalence correlates with age, this population surge drives demand for user-friendly insulin delivery devices, particularly for self-administration systems tailored to elderly needs.

- Rising Awareness of Diabetes Management: Ongoing diabetes management programs such as those led by the American Diabetes Association (ADA) are pushing for better public understanding of diabetes care. Campaigns in 2023 focused on improving access to self-monitoring tools and education for insulin use, further driving the need for effective insulin delivery solutions to prevent complications.

Market Challenges

- High Cost of Devices: Insulin pumps can cost between $4,500 to $6,500, while continuous glucose monitors can reach over $3,000 annually in maintenance costs, which poses a significant financial burden on patients. These high upfront costs limit the adoption of advanced insulin delivery solutions among uninsured or underinsured patients in the U.S., despite reimbursement options.

- Limited Access in Rural Areas: While urban centers have abundant access to diabetes management resources, rural areas still face major access issues. According to the USDA, over 46 million Americans live in rural areas with limited healthcare infrastructure, and only about 15% have convenient access to insulin delivery devices, causing further health disparities.

U.S. Insulin Delivery Devices Market Future Outlook

Over the next five years, the U.S. insulin delivery devices market is expected to grow significantly, driven by technological advancements in diabetes management devices, rising healthcare spending, and the increasing prevalence of diabetes. With the rise of smart insulin delivery systems that integrate AI and IoT, the market is poised for expansion. The growth of homecare solutions and telemedicine, alongside favorable government policies and increased focus on patient education, will further bolster the market.

Future Market Opportunities

- Technological Innovations: Smart insulin pens, which offer digital integration with mobile apps to track dosage and timing, are witnessing increased demand. With over 12 million diabetics requiring insulin in 2023, advancements in smart insulin delivery systems, such as insulin pumps with integrated continuous glucose monitoring, offer promising opportunities in the market.

- Expanding Home Healthcare: As of 2023, home-based care is growing rapidly, driven by the rise of telehealth services and patient preference for home care. The U.S. home healthcare industry, valued at approximately $150 billion, is increasingly integrating insulin delivery devices, especially as more individuals manage diabetes outside of hospitals.

Scope of the Report

|

Device Type |

Insulin Pens (Reusable, Disposable) Insulin Pumps (Traditional, Patch Pumps) Insulin Syringes Continuous Subcutaneous Insulin Infusion (CSII) Devices |

|

End-User |

Homecare Hospitals & Clinics Specialty Diabetes Clinics |

|

Technology Type |

Smart Insulin Delivery Systems Traditional Devices |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Channels |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Insulin Delivery Device Manufacturers

Healthcare Providers (Hospitals, Clinics, Diabetes Centers)

Homecare Solution Providers

Health Insurance Providers

Retail Pharmacy Chains

Telemedicine Providers

Government and Regulatory Bodies (U.S. FDA, Centers for Medicare & Medicaid Services)

Investors and Venture Capitalist Firms

Companies

Major Players

Medtronic

Novo Nordisk

Eli Lilly and Company

Insulet Corporation

Tandem Diabetes Care

Roche Diabetes Care

Abbott Laboratories

Dexcom, Inc.

Bigfoot Biomedical

Companion Medical

Table of Contents

1. U.S. Insulin Delivery Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Insulin Delivery Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Insulin Delivery Devices Market Analysis

3.1. Growth Drivers

3.1.1. Prevalence of Diabetes (Diabetes Prevalence Rate, Public Health Data)

3.1.2. Increasing Geriatric Population (Age Demographics, Elderly Population Stats)

3.1.3. Rising Awareness of Diabetes Management (Public Health Campaigns, Awareness Programs)

3.1.4. Favorable Reimbursement Policies (Insurance Coverage, Government Aid Programs)

3.2. Market Challenges

3.2.1. High Cost of Devices (Average Device Pricing, Affordability Issues)

3.2.2. Limited Access in Rural Areas (Healthcare Accessibility, Infrastructure Challenges)

3.2.3. Patient Adherence Issues (Non-Compliance Rates, Usage Statistics)

3.3. Opportunities

3.3.1. Technological Innovations (Advances in Smart Insulin Pens, Continuous Glucose Monitoring Integration)

3.3.2. Expanding Home Healthcare (Growth in Home-Based Treatment, Market Demand for Self-Administered Devices)

3.3.3. New Entrants in Digital Health Space (Emerging Digital Platforms, AI-Driven Insulin Devices)

3.4. Trends

3.4.1. Integration of Wearable Technology (Adoption Rate of Smart Devices, IoT-Connected Insulin Pumps)

3.4.2. Shift Toward Prefilled Insulin Pens (Market Share of Disposable Devices)

3.4.3. Increasing Usage of Automated Insulin Delivery (Growth of Closed-Loop Systems)

3.5. Government Regulation

3.5.1. U.S. FDA Approval Pathways (Pre-Market Approval Processes, Regulatory Timelines)

3.5.2. Medicare Coverage and Policies (Medicare Reimbursement, Coverage for Insulin Pumps and CGMs)

3.5.3. Affordable Care Act Impact on Insulin Delivery (Healthcare Reform Influence, Impact on Insurance Coverage)

3.5.4. Public-Private Partnerships (Collaborations Between Healthcare Providers, Device Manufacturers, and Government)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Healthcare Providers, Distributors, Manufacturers, Insurers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. Insulin Delivery Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Insulin Pens (Reusable, Disposable)

4.1.2. Insulin Pumps (Traditional, Patch Pumps)

4.1.3. Insulin Syringes

4.1.4. Continuous Subcutaneous Insulin Infusion (CSII) Devices

4.2. By Distribution Channel (In Value %)

4.2.1. Hospital Pharmacies

4.2.2. Retail Pharmacies

4.2.3. Online Channels

4.3. By End-User (In Value %)

4.3.1. Homecare

4.3.2. Hospitals & Clinics

4.3.3. Specialty Diabetes Clinics

4.4. By Technology Type (In Value %)

4.4.1. Smart Insulin Delivery Systems

4.4.2. Traditional Devices

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Insulin Delivery Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Novo Nordisk

5.1.3. Eli Lilly and Company

5.1.4. Sanofi

5.1.5. Tandem Diabetes Care

5.1.6. Insulet Corporation

5.1.7. Becton, Dickinson and Company

5.1.8. Ypsomed Holding AG

5.1.9. Roche Diabetes Care

5.1.10. Abbott Laboratories

5.1.11. Dexcom, Inc.

5.1.12. Bigfoot Biomedical

5.1.13. Companion Medical

5.1.14. Senseonics

5.1.15. Biocon

5.2. Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Product Portfolio, Market Share, Key Patents, Strategic Partnerships, Research and Development Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

6. U.S. Insulin Delivery Devices Market Regulatory Framework

6.1. U.S. FDA Device Classifications and Approvals

6.2. Regulatory Compliance Standards

6.3. Insurance Reimbursement Policies

6.4. Certification Processes

7. U.S. Insulin Delivery Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Insulin Delivery Devices Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology Type (In Value %)

8.5. By Region (In Value %)

9. U.S. Insulin Delivery Devices Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Pricing Strategy Recommendations

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables that impact the U.S. insulin delivery devices market. Extensive desk research, incorporating secondary sources such as company filings, government data, and healthcare reports, helps construct an ecosystem map of major stakeholders.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on device adoption rates, reimbursement policies, and market growth drivers. This step includes compiling data from proprietary databases and validated reports to provide insights into market penetration and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated through expert consultations, including interviews with industry insiders, healthcare professionals, and device manufacturers. These insights help refine data accuracy and validate market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data collected into actionable insights. Engagements with insulin device manufacturers further validate the findings, ensuring a robust and accurate market analysis.

Frequently Asked Questions

01. How big is the U.S. Insulin Delivery Devices Market?

The U.S. insulin delivery devices market was valued at USD 4 billion in 2023, driven by increasing diabetes prevalence and demand for advanced insulin delivery systems.

02. What are the challenges in the U.S. Insulin Delivery Devices Market?

Challenges in the U.S. insulin delivery devices market include the high cost of advanced devices, limited access to diabetes care in rural areas, and patient adherence issues.

03. Who are the major players in the U.S. Insulin Delivery Devices Market?

Key players in the U.S. insulin delivery devices market include Medtronic, Novo Nordisk, Eli Lilly and Company, Tandem Diabetes Care, and Insulet Corporation. These companies dominate due to their strong R&D focus and established distribution networks.

04. What are the growth drivers of the U.S. Insulin Delivery Devices Market?

The U.S. insulin delivery devices market is driven by the rising prevalence of diabetes, increasing awareness of diabetes management, technological advancements in insulin delivery systems, and favorable reimbursement policies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.