US Meat Substitutes Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD3287

October 2024

91

About the Report

US Meat Substitutes Market Overview

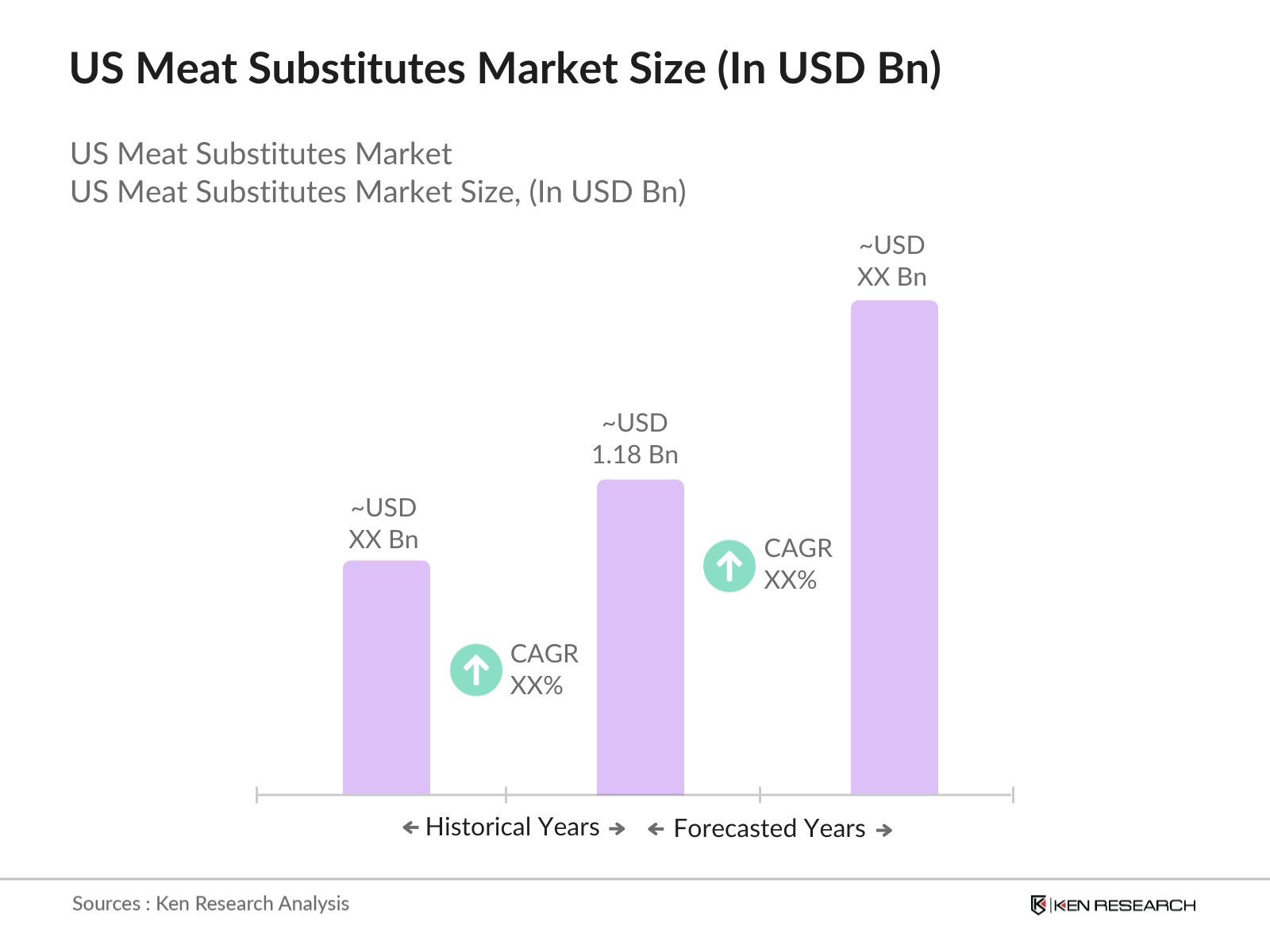

- The US meat substitutes market is valued at USD 1.18 billion, based on a five-year historical analysis. This market is driven by a combination of factors including rising health consciousness, environmental sustainability concerns, and the growing adoption of vegan and flexitarian diets. With an increasing number of consumers seeking plant-based alternatives to animal protein, demand for products like plant-based patties, tofu, and tempeh is surging. This trend is further reinforced by technological advancements in food processing and innovations in alternative proteins, which have improved the taste and texture of meat substitutes.

- The dominant regions in the US meat substitutes market include California and New York, driven by their large urban populations and progressive food culture. These states have a high concentration of health-conscious consumers and a well-established infrastructure for the foodservice industry. The strong presence of plant-based food startups and the integration of meat substitutes into mainstream restaurants and grocery chains further contribute to their dominance in the market.

- In 2024, the FDA and USDA have strict labeling standards in place for plant-based products, ensuring that consumers are fully informed about the content and nutritional value of meat substitutes. These regulations require that plant-based products meet specific labeling criteria to avoid misleading consumers, particularly when comparing them to traditional meat products. The government has also introduced guidelines for plant-based labeling to ensure consistency in ingredient disclosure and allergen warnings, which have contributed to increased consumer confidence in meat substitutes.

US Meat Substitutes Market Segmentation

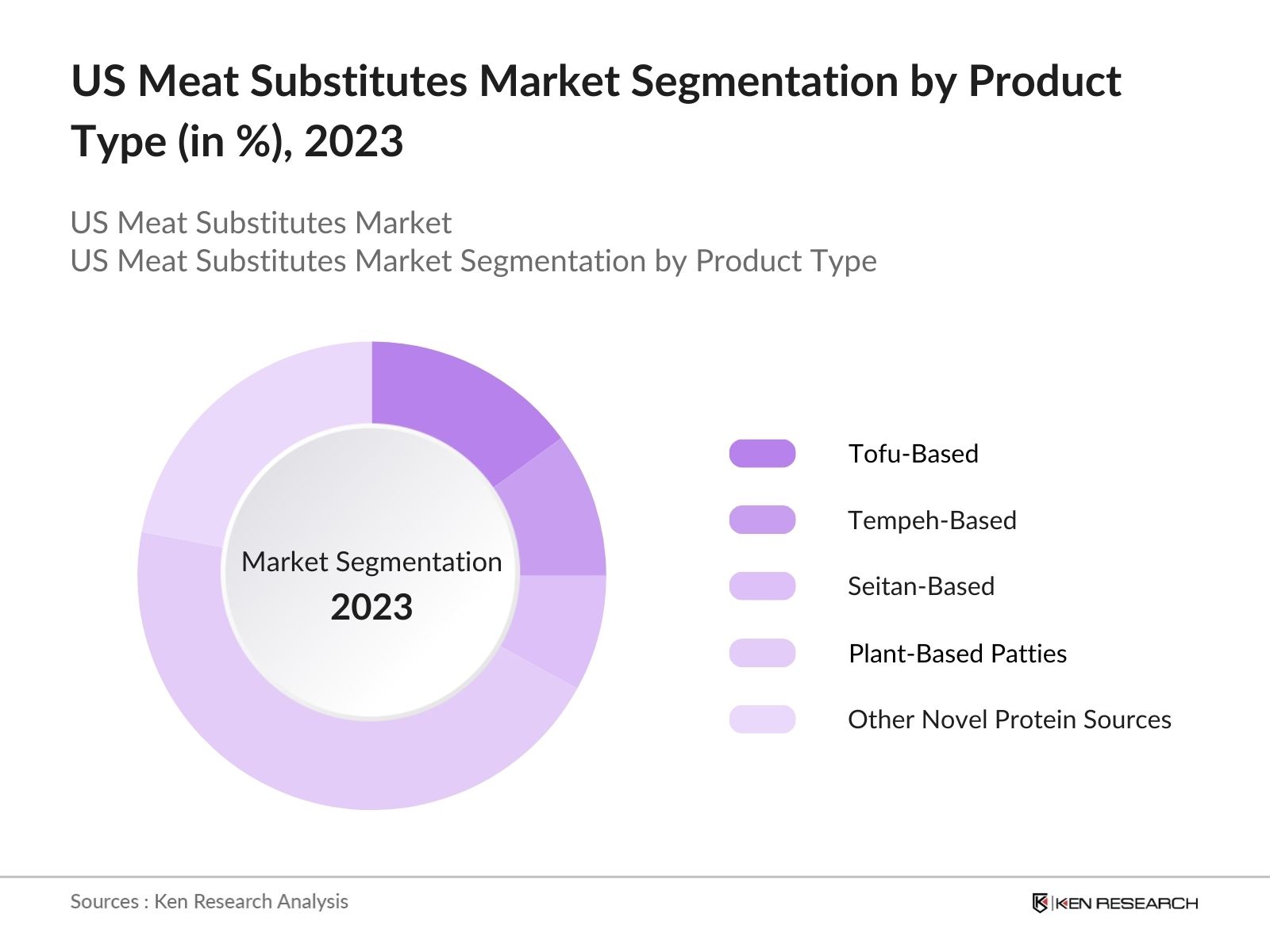

- By Product Type: The market is segmented by product type into tofu-based, tempeh-based, seitan-based, plant-based patties, and other novel protein sources. Recently, plant-based patties have gained a dominant market share in the product type segmentation. This dominance is largely due to the rising popularity of plant-based fast-food options and collaborations between meat substitute brands and fast-food chains. For instance, brands like Beyond Meat and Impossible Foods have established partnerships with global fast-food chains like Burger King and McDonalds, leading to increased consumer exposure and accessibility.

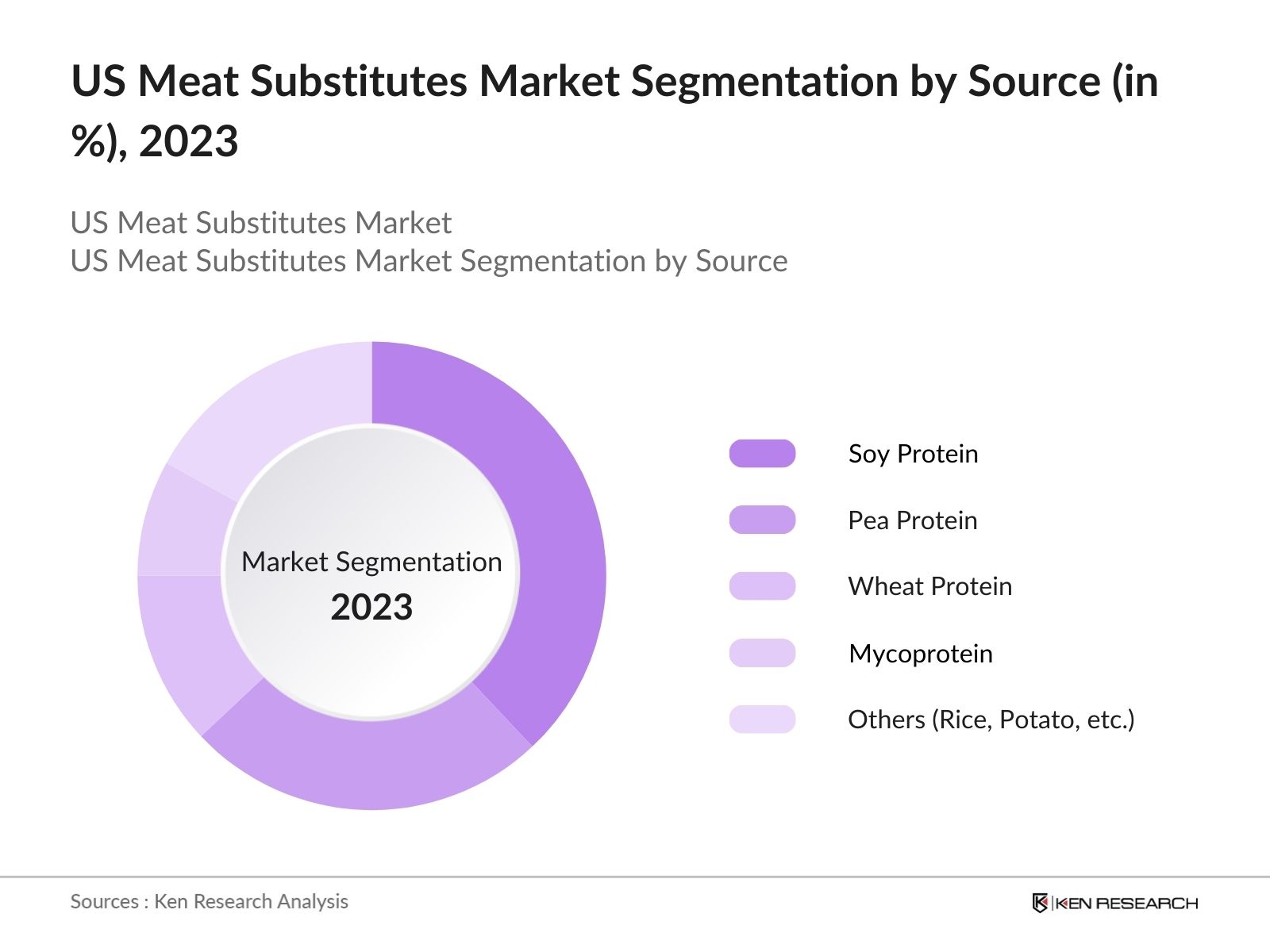

- By Source: The market is also segmented by source into soy protein, pea protein, wheat protein, mycoprotein, and others (such as rice and potato protein). Soy protein continues to hold the largest market share within this segmentation. The reason for its dominance lies in its high protein content, wide availability, and versatile use in a variety of meat substitute products. Additionally, soy-based meat substitutes have long been recognized for their ability to mimic the texture and flavor of meat, making them a popular choice for both consumers and manufacturers.

US Meat Substitutes Market Competitive Landscape

The US meat substitutes market is dominated by a few key players, including Beyond Meat, Impossible Foods, and MorningStar Farms, who continue to innovate in the space. These companies have built strong brand recognition and consumer loyalty, partly due to their focus on taste and nutrition. Additionally, partnerships with restaurant chains and retailers have expanded their distribution networks, solidifying their presence in both retail and foodservice channels.

|

Company |

Year Established |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Product Range |

Sustainability Initiatives |

R&D Expenditure |

Strategic Partnerships |

Geographic Presence |

|---|---|---|---|---|---|---|---|---|---|

|

Beyond Meat |

2009 |

El Segundo, CA |

|||||||

|

Impossible Foods |

2011 |

Redwood City, CA |

|||||||

|

Gardein |

2003 |

Richmond, BC |

|||||||

|

Tofurky |

1980 |

Hood River, OR |

|||||||

|

MorningStar Farms |

1974 |

Battle Creek, MI |

US Meat Substitutes Industry Analysis

Growth Drivers

- Rising Consumer Health Awareness: In 2024, the US saw a rise in health-conscious consumers, which is a major factor driving the demand for meat substitutes. According to the CDC, over 60% of Americans are seeking healthier dietary alternatives, including reducing their red meat intake in favor of plant-based options. This trend aligns with the US governments push towards healthier diets to combat obesity and cardiovascular diseases, both of which cost the economy billions of dollars annually. The increase in plant-based diets has been supported by the USDA's dietary guidelines promoting more vegetable and protein variety.

- Growing Vegan and Flexitarian Population: The growing vegan and flexitarian population in the US has fueled the demand for meat substitutes. By 2024, 10 million Americans identified as vegan, and a significant portion of the population (22%) is estimated to follow a flexitarian diet. According to the National Institutes of Health, this shift is largely driven by ethical concerns regarding animal welfare and the increasing awareness of health benefits linked to plant-based diets. The plant-based food movement continues to grow, especially in urban areas, where consumers are more likely to adopt sustainable food choices.

- Environmental Sustainability Concerns: Environmental sustainability is a core driver behind the rising adoption of meat substitutes in the US. Agriculture accounts for nearly 10% of total greenhouse gas emissions in the US, as per the Environmental Protection Agency (EPA). In comparison, producing plant-based meat alternatives, such as pea protein, generates fewer emissions and requires less land and water. The Biden administration has emphasized sustainability initiatives, which support the growth of plant-based industries. As of 2024, initiatives like the USDA's "Climate-Smart Agriculture" are incentivizing the shift towards more sustainable food production systems.

Market Challenges

- High Cost of Production: As of 2024, the cost of producing plant-based proteins is roughly 40% higher than conventional meat due to the advanced technologies and processes involved, according to data from the USDA. Furthermore, the costs associated with sourcing alternative ingredients such as pea protein and soy are subject to agricultural volatility. This issue is particularly pressing for small-to-medium-sized enterprises that struggle with achieving economies of scale.

- Consumer Resistance to Processed Foods: Despite the health benefits of plant-based diets, many consumers remain resistant to the consumption of highly processed meat substitutes. In 2024, the National Institutes of Health reported that 35% of Americans avoid processed food products, including meat alternatives, due to concerns over artificial ingredients, preservatives, and long ingredient lists. The demand for "clean label" alternatives is growing, prompting companies to develop simpler, more transparent ingredient formulations. This resistance continues to slow market penetration for certain highly processed plant-based products.

US Meat Substitutes Market Future Outlook

Over the next five years, the US meat substitutes market is expected to experience growth, driven by continuous product innovations, increasing investments in alternative protein technologies, and rising consumer awareness of health and environmental impacts. Meat substitutes are expected to become more mainstream, with expanded retail availability and a growing presence in foodservice sectors. Furthermore, advancements in food processing technologies will likely improve the taste, texture, and nutritional profile of meat substitutes, further driving adoption.

Future Market Opportunities

- Innovation in Product Variety and Taste: There is a growing opportunity for innovation in product variety and taste to cater to the diverse dietary preferences of US consumers. By 2024, the USDA reported that 14% of US households regularly purchased meat substitutes, with rising demand for products that mimic the texture and flavor of traditional meat. Companies investing in flavor optimization and diverse plant-based offerings (e.g., pea, soy, lentil, and mushroom proteins) are likely to capture a larger market share. Technological advancements like extrusion and fermentation are helping improve taste and texture to appeal to a broader consumer base.

- Expansion into Retail and Foodservice Channels: The US meat substitutes market has a strong opportunity to expand into retail and foodservice channels, particularly with the growing demand for plant-based fast-food options. In 2024, over 10,000 fast-food outlets across the country added plant-based options to their menus, according to the USDA's Economic Research Service. Similarly, plant-based products have seen increased shelf space in grocery stores, with 90% of retailers carrying these products nationwide. This expansion into both retail and foodservice provides opportunities for growth across the supply chain, from production to distribution.

Scope of the Report

|

Segment |

Sub-Segments |

|---|---|

|

Product Type |

Tofu-Based Tempeh-Based Seitan-Based Plant-Based Patties Other Novel Protein Sources |

|

Source |

Soy Protein Pea Protein Wheat Protein Mycoprotein Others (Rice, Potato, etc.) |

|

Distribution Channel |

Retail E-commerce Foodservice |

|

End-User |

Households Restaurants Fast Food Chains |

|

Region |

North US South US East US West US |

Products

Key Target Audience

Food and Beverage Manufacturers

Retail and E-Commerce Platforms

Foodservice Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Health and Wellness Organizations

Alternative Protein Startups

Quick Service Restaurant Chains

Banks and Financial Institutions

Companies

Major Players

Beyond Meat

Impossible Foods

MorningStar Farms

Gardein

Tofurky

Lightlife

Quorn Foods

Field Roast

Dr. Praegers

Amys Kitchen

Sweet Earth Foods

The Vegetarian Butcher

Alpha Foods

No Evil Foods

Boca Foods

Table of Contents

1. US Meat Substitutes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. US Meat Substitutes Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. US Meat Substitutes Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Health Awareness

3.1.2. Growing Vegan and Flexitarian Population

3.1.3. Environmental Sustainability Concerns

3.1.4. Technological Advancements in Alternative Proteins

3.2. Market Challenges

3.2.1. High Cost of Production

3.2.2. Consumer Resistance to Processed Foods

3.2.3. Supply Chain Constraints

3.3. Opportunities

3.3.1. Innovation in Product Variety and Taste

3.3.2. Expansion into Retail and Foodservice Channels

3.3.3. Increasing Investments and Mergers

3.4. Trends

3.4.1. Clean Label and Non-GMO Alternatives

3.4.2. Integration of Plant-Based Protein in Traditional Meat Products

3.4.3. Rising Popularity of Plant-Based Fast Food Options

3.5. Government Regulation

3.5.1. FDA & USDA Standards for Plant-Based Labeling

3.5.2. Sustainable Agricultural Practices for Plant Protein Crops

3.5.3. Regulatory Framework for Novel Ingredients (e.g., Pea Protein)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Manufacturers, Retailers, Foodservice Providers, Consumers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. US Meat Substitutes Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tofu-Based

4.1.2. Tempeh-Based

4.1.3. Seitan-Based

4.1.4. Plant-Based Patties

4.1.5. Other Novel Protein Sources

4.2. By Source (In Value %)

4.2.1. Soy Protein

4.2.2. Pea Protein

4.2.3. Wheat Protein

4.2.4. Mycoprotein

4.2.5. Others (Rice, Potato, etc.)

4.3. By Distribution Channel (In Value %)

4.3.1. Retail

4.3.2. E-commerce

4.3.3. Foodservice

4.4. By End-User (In Value %)

4.4.1. Households

4.4.2. Restaurants

4.4.3. Fast Food Chains

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. US Meat Substitutes Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Beyond Meat

5.1.2. Impossible Foods

5.1.3. Gardein

5.1.4. Tofurky

5.1.5. MorningStar Farms

5.1.6. Lightlife

5.1.7. Quorn Foods

5.1.8. Field Roast

5.1.9. Dr. Praegers

5.1.10. Amys Kitchen

5.1.11. Sweet Earth Foods

5.1.12. The Vegetarian Butcher

5.1.13. Alpha Foods

5.1.14. No Evil Foods

5.1.15. Boca Foods

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investments, Sustainability Initiatives, Number of Employees, Geographic Presence, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. US Meat Substitutes Market Regulatory Framework

6.1. Labeling Standards (FDA, USDA)

6.2. Compliance Requirements for Novel Proteins

6.3. Certification Processes (Non-GMO, Organic, Vegan)

7. US Meat Substitutes Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. US Meat Substitutes Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Source (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. US Meat Substitutes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the US meat substitutes market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as consumer demand, supply chain factors, and product innovation.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the US meat substitutes market. This includes assessing market penetration, product categories, and revenue generation. Furthermore, an evaluation of product quality and taste improvements will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with meat substitute manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the US meat substitutes market.

Frequently Asked Questions

01. How big is the US Meat Substitutes Market?

The US meat substitutes market is valued at USD 1.18 billion, driven by consumer demand for plant-based alternatives, rising health awareness, and innovations in food processing technologies.

02. What are the challenges in the US Meat Substitutes Market?

Challenges in the US meat substitutes market include high production costs, supply chain constraints, and consumer skepticism towards highly processed plant-based foods. These issues are compounded by competition from traditional meat products.

03. Who are the major players in the US Meat Substitutes Market?

Key players in the US meat substitutes market include Beyond Meat, Impossible Foods, MorningStar Farms, Gardein, and Tofurky. These companies dominate due to their established brand presence, wide distribution networks, and continuous innovation.

04. What are the growth drivers of the US Meat Substitutes Market?

The US meat substitutes market is propelled by factors such as rising health awareness, growing environmental concerns, and the increasing popularity of vegan and flexitarian diets. Additionally, strategic partnerships with fast food chains have boosted market penetration.

05. How is the US Meat Substitutes Market segmented?

The US meat substitutes market is segmented by product type into tofu-based, tempeh-based, seitan-based, plant-based patties, and others. It is also segmented by source into soy protein, pea protein, wheat protein, and mycoprotein.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.