U.S. Medical Devices Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD3411

December 2024

96

About the Report

U.S. Medical Devices Market Overview

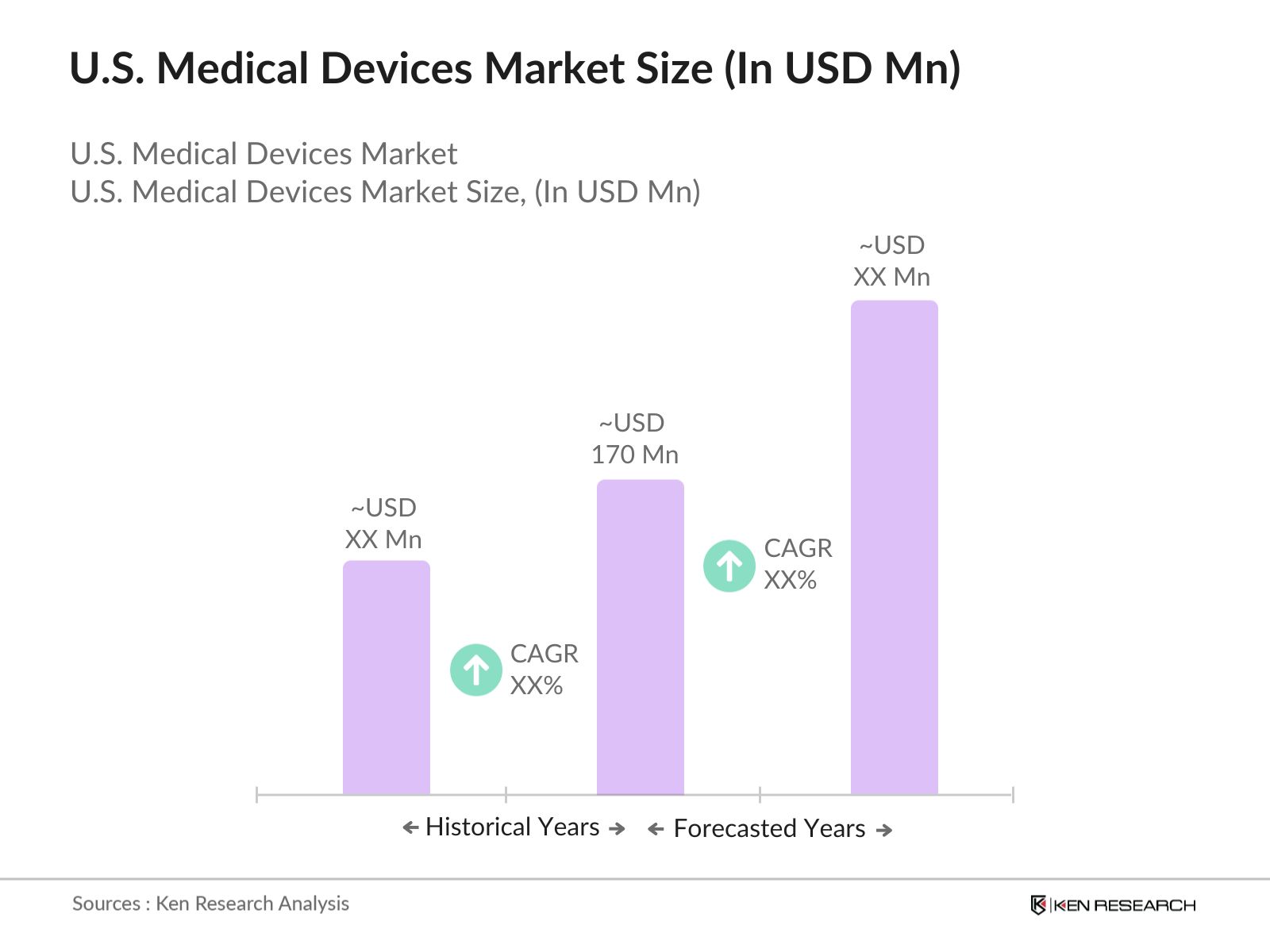

- The U.S. medical devices market, a significant segment of the global healthcare industry, is valued at USD 170 million, driven primarily by advancements in technology and an aging population with increased healthcare demands. The market has experienced substantial growth due to the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders. Additionally, the continuous R&D investment from key players has further fueled market development, ensuring the availability of innovative devices to meet diverse healthcare needs. As healthcare delivery becomes increasingly dependent on technology, this trend is expected to persist.

- The U.S. market is dominated by regions with a high concentration of healthcare infrastructure and technological advancement, such as California, Massachusetts, and Minnesota. These states host major medical device manufacturers and benefit from established ecosystems of innovation, skilled workforces, and close collaboration between academic research institutions and industries. In particular, Silicon Valley in California stands out due to its role in the development of cutting-edge medical technology and its access to significant venture capital funding.

- The FDA approval process is critical for medical devices entering the U.S. market. In 2022, the FDA approved 67 novel medical devices through its Premarket Approval (PMA) pathway and over 3,000 through the 510(k) process. The FDA has introduced programs like the Breakthrough Devices Program, which expedites approval for technologies addressing life-threatening conditions. The average time for approval has decreased, but the rigorous process still requires substantial clinical trials and safety data. This ensures that medical devices in the U.S. meet the highest safety and efficacy standards.

U.S. Medical Devices Market Segmentation

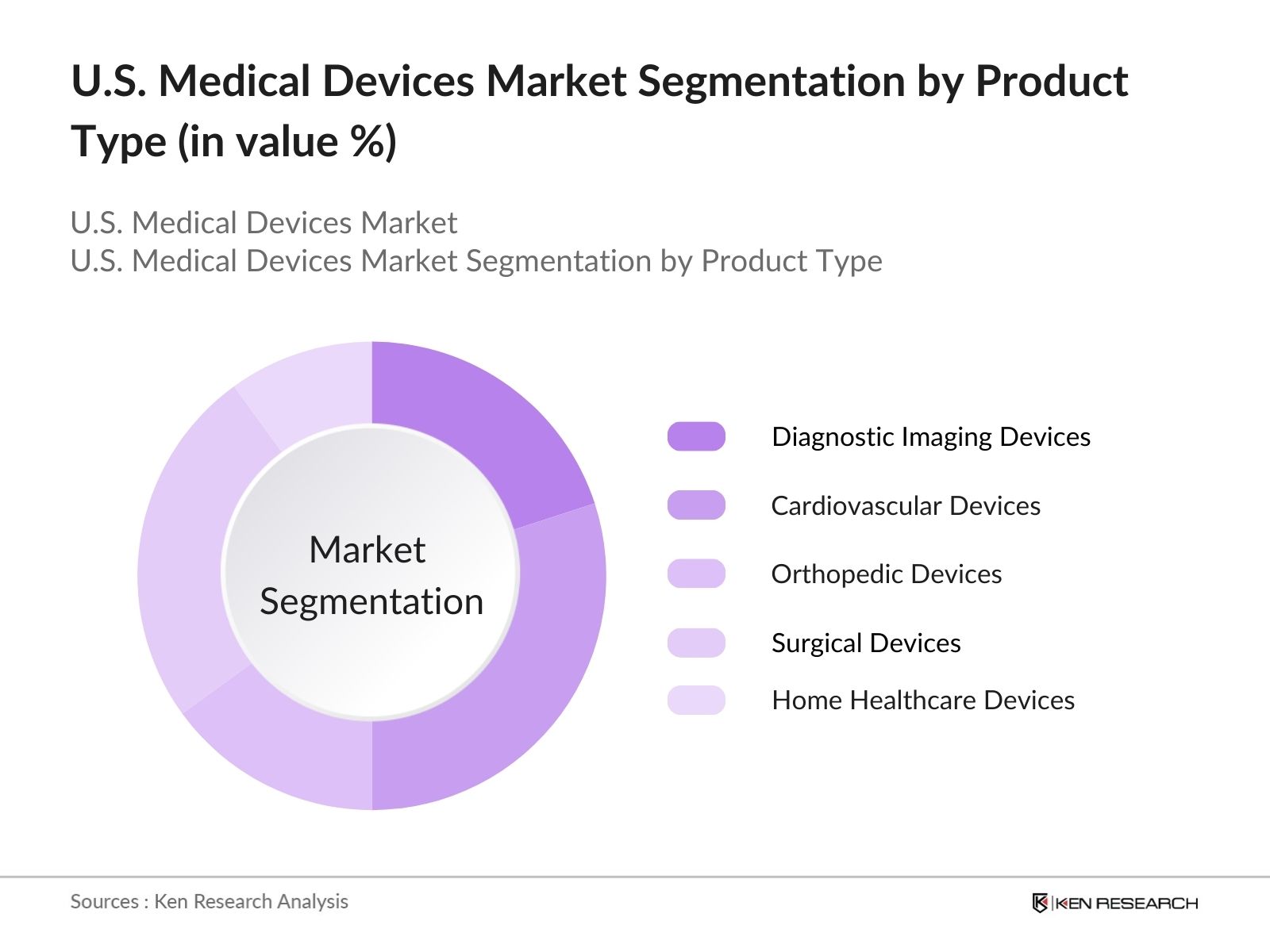

- By Product Type: The U.S. medical devices market is segmented by product type into diagnostic imaging devices, cardiovascular devices, orthopedic devices, surgical devices, and home healthcare devices. Recently, cardiovascular devices have held a dominant market share under this segmentation due to the increasing prevalence of heart-related conditions such as hypertension, heart failure, and coronary artery disease. With a significant portion of the population suffering from cardiovascular ailments, there has been a consistent demand for devices such as pacemakers, stents, and heart monitors, making this segment crucial for healthcare providers.

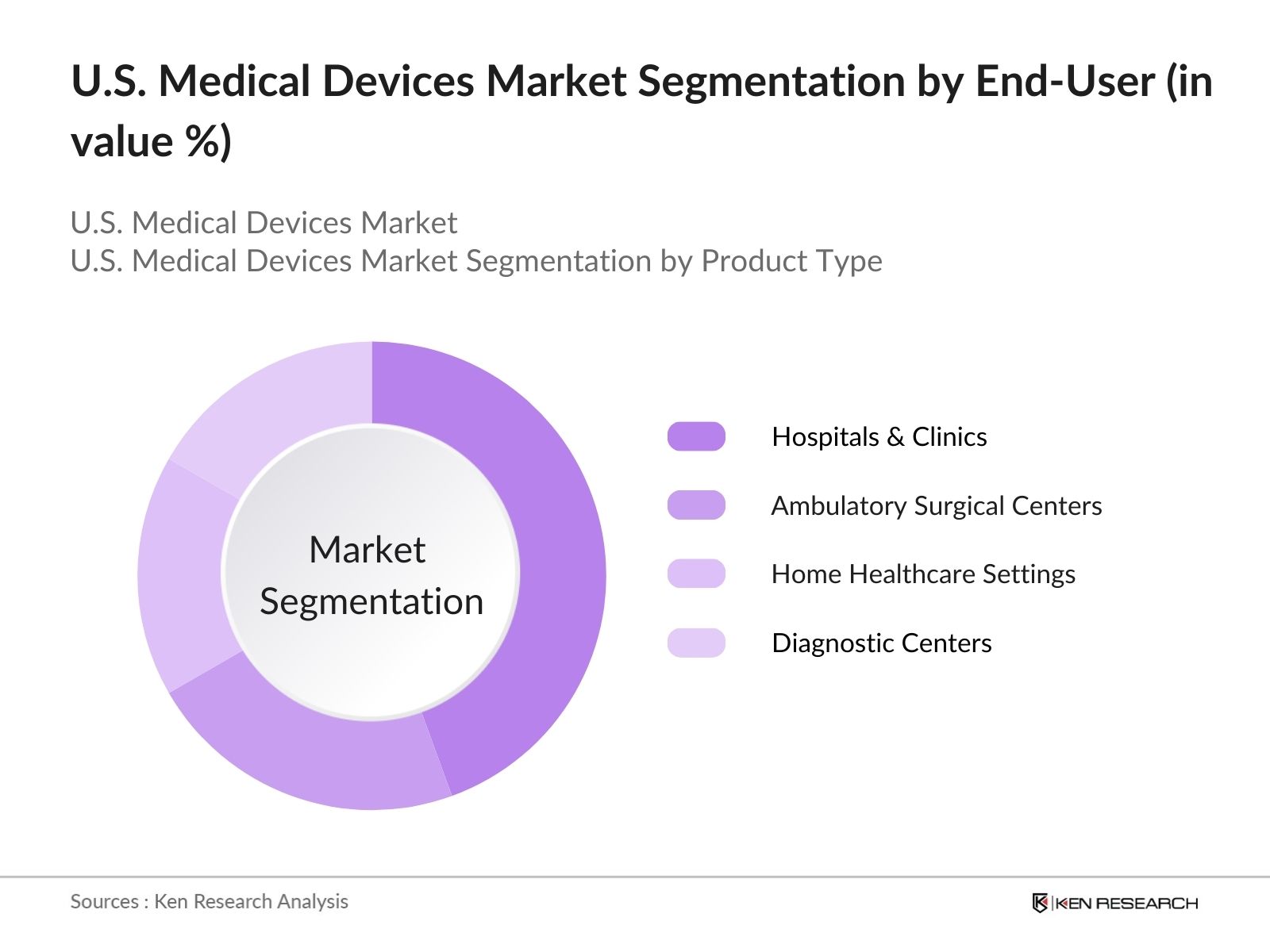

- By End-User: The U.S. medical devices market is also segmented by end-user into hospitals & clinics, ambulatory surgical centers (ASCs), home healthcare settings, diagnostic centers, and long-term care centers. Hospitals and clinics dominate this segment due to their ability to integrate a wide range of medical devices in a comprehensive healthcare environment. These facilities typically handle more complex cases requiring advanced diagnostic tools and surgical equipment, contributing to their substantial market share. Additionally, the integration of high-tech devices in hospitals facilitates better outcomes in critical care, making this the primary end-user category.

U.S. Medical Devices Market Competitive Landscape

The U.S. medical devices market is characterized by a few major players who dominate the landscape through a combination of innovation, regulatory approvals, and strategic acquisitions. Companies like Medtronic, Abbott Laboratories, and Boston Scientific have consistently maintained leadership positions, driven by continuous product development, strong R&D budgets, and a wide portfolio of FDA-approved devices. This market consolidation underscores the high barriers to entry, with only a few firms having the capacity to navigate the complex regulatory environment and invest heavily in technological advancements.

|

Company |

Year Established |

Headquarters |

R&D Investment |

Number of Patents |

Revenue (USD Bn) |

|

Medtronic |

1949 |

Minneapolis, Minnesota |

|||

|

Abbott Laboratories |

1888 |

Abbott Park, Illinois |

|||

|

Boston Scientific |

1979 |

Marlborough, Massachusetts |

|||

|

Stryker Corporation |

1941 |

Kalamazoo, Michigan |

|||

|

GE Healthcare |

1892 |

Chicago, Illinois |

U.S. Medical Devices Industry Analysis

Market Growth Drivers

- Aging Population (Healthcare Demand): The aging U.S. population is a key driver for the medical devices market. In 2023, over 55 million Americans were aged 65 or older, and this number continues to rise due to improved life expectancy and declining birth rates. With an aging population, the demand for medical devices such as orthopedic implants, diagnostic devices, and cardiovascular equipment is increasing. The U.S. Census Bureau projects that by 2030, one in five Americans will be 65 or older, creating sustained demand for healthcare services and products. This growth is expected to amplify the need for medical innovations.

- Technological Advancements (R&D Investment): The U.S. medical device industry heavily invests in research and development (R&D). In 2022, U.S. medical device companies invested over $30 billion in R&D, resulting in innovations such as 3D printing, AI-assisted diagnostic tools, and wearable devices. These technologies enhance the efficacy of medical treatments and improve patient outcomes. The U.S. ranks first globally in medical device patents, with more than 40% of the world's medical device patents originating in the country, highlighting its leadership in innovation. The development of robotic surgery and minimally invasive devices reflects this R&D focus.

- Healthcare Reforms (Policy and Regulatory Landscape): Healthcare reforms continue to shape the U.S. medical device market. The Affordable Care Act (ACA) increased access to healthcare services for millions of Americans, expanding the market for medical devices. Furthermore, in 2022, U.S. government healthcare spending exceeded $1.4 trillion, ensuring sustained demand for devices required in hospitals and outpatient care. Regulatory initiatives such as the FDA's Breakthrough Devices Program have expedited the approval of novel devices, allowing faster access to innovative treatments. These policy shifts support both the development and commercialization of medical technologies.

Market Challenges

- Regulatory Compliance (FDA, ISO Certifications): Strict regulatory requirements in the U.S. present a challenge for medical device manufacturers. The FDAs 510(k) approval process for medical devices requires rigorous testing and documentation, which can delay time-to-market. In 2023, it was reported that the average time for FDA clearance of new devices exceeded 177 days. Additionally, companies must adhere to international ISO certifications for product safety and quality assurance. Non-compliance can result in costly delays or product recalls, making regulatory adherence a significant hurdle in the medical device industry.

High Manufacturing Costs (Raw Materials, Supply Chain Disruptions): Medical device manufacturing involves high costs due to expensive raw materials such as titanium and advanced plastics, coupled with labor-intensive processes. In 2023, the global supply chain crisis exacerbated costs, with shipping delays increasing average material costs by over 15%. U.S. manufacturers faced challenges in securing raw materials, leading to production slowdowns and increased costs. As labor shortages continue and raw material prices fluctuate, maintaining profitability in the medical device sector remains difficult.

U.S. Medical Devices Market Future Outlook

The U.S. medical devices market is set to experience continued growth over the next five years, driven by an increasing focus on healthcare digitization, expanding demand for home healthcare solutions, and advancements in artificial intelligence (AI) and robotics in medical procedures. The surge in chronic diseases, combined with the aging population, will further boost the need for innovative and efficient medical devices. Additionally, governmental support for medical technology innovation and favorable reimbursement policies will play a pivotal role in shaping the future market landscape.

Market Opportunities

- Telemedicine & Remote Patient Monitoring (Adoption of Digital Health): The rise of telemedicine and remote patient monitoring offers a significant opportunity for medical device companies. In 2023, over 100 million Americans used telehealth services, driven by the convenience and efficiency of remote care. Devices such as wearable health trackers and remote diagnostic tools are increasingly adopted to monitor chronic conditions like diabetes and hypertension. The U.S. governments investment in expanding broadband access to rural areas, amounting to over $65 billion, supports the growth of telemedicine and remote monitoring, positioning digital health as a critical future market.

- Expansion of AI in Healthcare (AI-powered Diagnostic Devices): Artificial intelligence (AI) is revolutionizing healthcare, particularly in diagnostics. By 2023, over 200 AI-powered devices had received FDA approval, including tools for detecting early-stage cancers and analyzing medical imaging data. The growing use of AI in healthcare is expected to reduce diagnostic errors and enhance patient outcomes. Additionally, AIs ability to process vast amounts of data efficiently is being leveraged to personalize treatments, making healthcare more effective. The U.S. governments investment of over $6 billion in AI research emphasizes its growing role in the medical device market.

Scope of the Report

|

Diagnostic Imaging Devices Cardiovascular Devices Orthopedic Devices Surgical Devices Home Healthcare Devices |

|

|

By End-User |

Hospitals & Clinics Ambulatory Surgical Centers Home Healthcare Settings Diagnostic Centers Long-term Care Centers |

|

By Technology |

Wearable Technologies Artificial Intelligence (AI) Integration Robotics 3D Printing Internet of Medical Things (IoMT) |

|

By Application |

Cardiology Orthopedics Neurology Oncology Gynecology |

|

By Region |

North East West South |

Products

Key Target Audience

Hospitals and Healthcare Providers

Ambulatory Surgical Centers (ASCs)

Diagnostic Centers

Long-term Care Centers

Medical Device Manufacturers

Government and Regulatory Bodies (FDA, CMS)

Venture Capital and Investment Firms

Health Insurance Providers

Companies

Players Mention in the Report:

Medtronic

Abbott Laboratories

Boston Scientific

Stryker Corporation

GE Healthcare

Johnson & Johnson

Siemens Healthineers

Philips Healthcare

Zimmer Biomet

3M Health Care

Becton Dickinson (BD)

Thermo Fisher Scientific

Intuitive Surgical

Hologic Inc.

Edwards Lifesciences

Table of Contents

1. U.S. Medical Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Medical Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Medical Devices Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population (Healthcare Demand)

3.1.2. Technological Advancements (R&D Investment)

3.1.3. Healthcare Reforms (Policy and Regulatory Landscape)

3.1.4. Increased Chronic Diseases (Diabetes, Cardiovascular, etc.)

3.2. Market Challenges

3.2.1. Regulatory Compliance (FDA, ISO Certifications)

3.2.2. High Manufacturing Costs (Raw Materials, Supply Chain Disruptions)

3.2.3. Data Security & Privacy Concerns (HIPAA Compliance)

3.2.4. Short Product Life Cycles (Technology Obsolescence)

3.3. Opportunities

3.3.1. Telemedicine & Remote Patient Monitoring (Adoption of Digital Health)

3.3.2. Expansion of AI in Healthcare (AI-powered Diagnostic Devices)

3.3.3. Increasing Surgical Robotics Adoption (Minimally Invasive Procedures)

3.3.4. Emerging Markets Expansion (Rural Health Initiatives)

3.4. Trends

3.4.1. Wearable Medical Devices (Consumer Health Integration)

3.4.2. Personalization of Medical Devices (Patient-specific Solutions)

3.4.3. Growth of Home Healthcare Devices (Shift Towards Patient-centric Care)

3.4.4. Regulatory Shifts in MDR/IVDR (Medical Device Regulation Updates)

3.5. Government Regulation

3.5.1. FDA Approvals (Clearance Process)

3.5.2. Compliance with Device Safety Standards (Classifications I, II, III)

3.5.3. Reimbursement Policies (CMS Reimbursement Procedures)

3.5.4. Import/Export Restrictions (Tariffs and Trade Agreements)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. U.S. Medical Devices Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Diagnostic Imaging Devices

4.1.2. Cardiovascular Devices

4.1.3. Orthopedic Devices

4.1.4. Surgical Devices

4.1.5. Home Healthcare Devices

4.2. By End-User (In Value %)

4.2.1. Hospitals & Clinics

4.2.2. Ambulatory Surgical Centers (ASCs)

4.2.3. Home Healthcare Settings

4.2.4. Diagnostic Centers

4.2.5. Long-term Care Centers

4.3. By Technology (In Value %)

4.3.1. Wearable Technologies

4.3.2. Artificial Intelligence (AI) Integration

4.3.3. Robotics

4.3.4. 3D Printing

4.3.5. Internet of Medical Things (IoMT)

4.4. By Application (In Value %)

4.4.1. Cardiology

4.4.2. Orthopedics

4.4.3. Neurology

4.4.4. Oncology

4.4.5. Gynecology

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. U.S. Medical Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Johnson & Johnson

5.1.3. Abbott Laboratories

5.1.4. Boston Scientific

5.1.5. GE Healthcare

5.1.6. Stryker Corporation

5.1.7. Zimmer Biomet

5.1.8. Philips Healthcare

5.1.9. Becton Dickinson (BD)

5.1.10. Thermo Fisher Scientific

5.1.11. 3M Health Care

5.1.12. Hologic Inc.

5.1.13. Siemens Healthineers

5.1.14. Intuitive Surgical

5.1.15. Edwards Lifesciences

5.2. Cross Comparison Parameters (Revenue, R&D Investment, Number of Patents, Market Share, Headquarters, FDA Approvals, Product Launches, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts

5.8. Venture Capital Funding

5.9. Private Equity Investments

6. U.S. Medical Devices Market Regulatory Framework

6.1. FDA Regulations (Class I, II, III)

6.2. Medical Device Reporting (MDR) Requirements

6.3. ISO 13485 Certifications

6.4. CE Marking for International Trade

7. U.S. Medical Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Medical Devices Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. U.S. Medical Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the U.S. medical devices market. This step was underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective was to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the U.S. medical devices market was compiled and analyzed. This included assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics was conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple medical device manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction served to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. medical devices market.

Frequently Asked Questions

01. How big is the U.S. Medical Devices Market?

The U.S. medical devices market is valued at USD 170 million, driven by a growing demand for advanced healthcare solutions, including diagnostic imaging, surgical devices, and home healthcare technologies.

02. What are the challenges in the U.S. Medical Devices Market?

Challenges in the U.S. medical devices market include strict regulatory compliance, high manufacturing costs, and the need for continuous innovation to keep up with technological advancements. Additionally, the evolving regulatory landscape with FDA approvals can slow down product rollouts.

03. Who are the major players in the U.S. Medical Devices Market?

Key players in the U.S. medical devices market include Medtronic, Abbott Laboratories, Boston Scientific, Stryker Corporation, and GE Healthcare, all of which dominate through strong product portfolios, extensive R&D investments, and a global presence.

04. What are the growth drivers of the U.S. Medical Devices Market?

The U.S. medical devices market is propelled by advancements in AI and robotics, a rise in chronic diseases, and an increasing elderly population. Additionally, the push toward home healthcare and wearable medical devices is significantly contributing to market growth.

05. What are the trends in the U.S. Medical Devices Market?

Notable trends in U.S. medical devices market include the adoption of wearable devices, the integration of AI in diagnostic tools, and the growing use of 3D printing for custom medical devices. The market is also seeing a shift toward minimally invasive surgical technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.