U.S. Off-Road Vehicles Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD8385

October 2024

99

About the Report

U.S. Off-Road Vehicles Market Overview

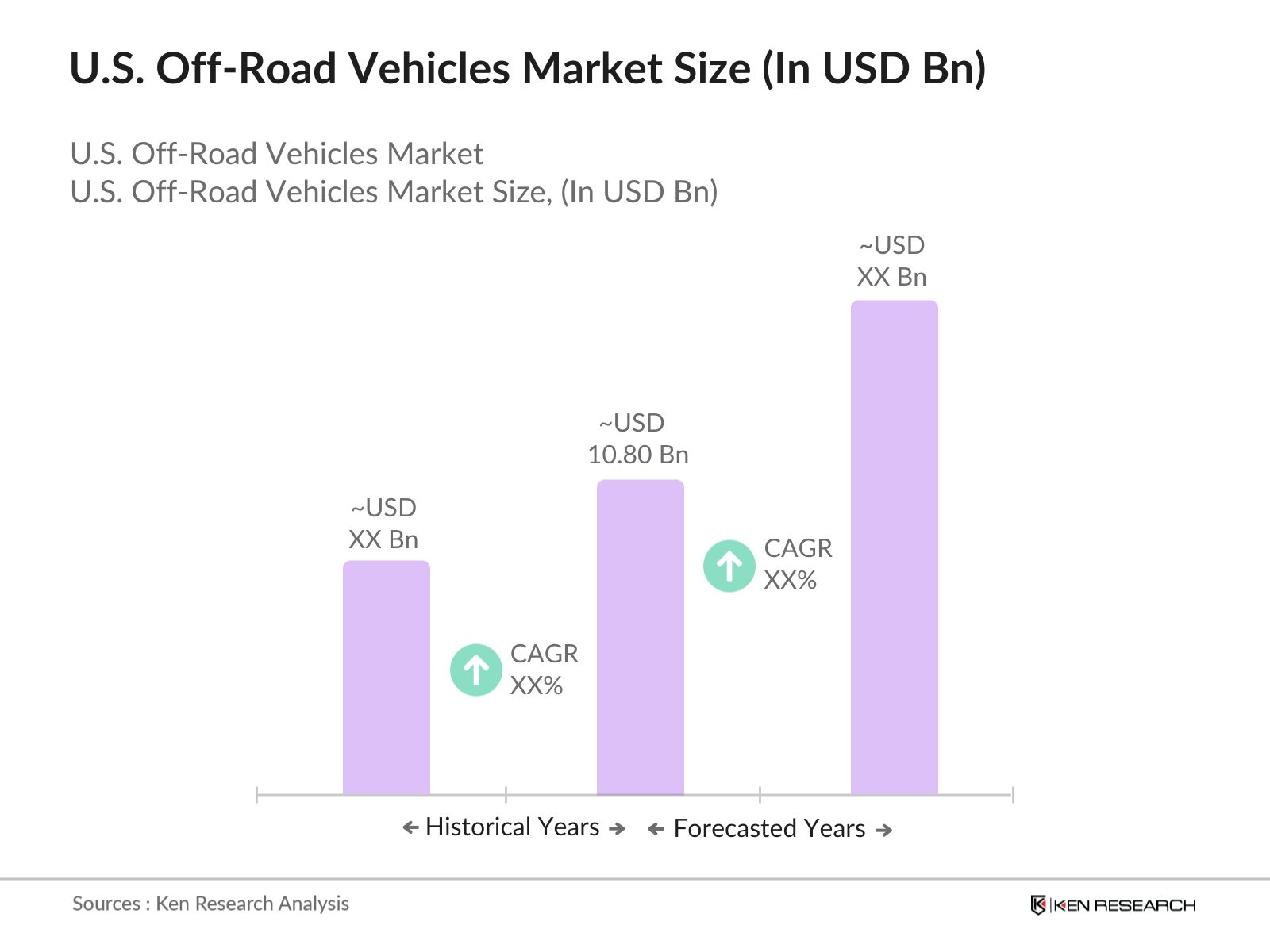

- The U.S. Off-Road Vehicles market is valued at USD 10.80 billion, based on a five-year historical analysis. This market is driven by the increasing demand for recreational activities and utility purposes across diverse terrains, such as agriculture, forestry, and defense sectors. Expanding disposable incomes, coupled with technological advancements like electric and hybrid off-road vehicles, have spurred market growth. The demand for off-road recreational vehicles, such as all-terrain vehicles (ATVs) and side-by-side vehicles (SxS), has increased significantly, supported by favorable government policies and environmental regulations to promote off-road tourism and adventure activities.

- Major U.S. regions such as California, Texas, and Florida dominate the off-road vehicles market, attributed to their extensive off-road parks, trails, and a strong culture of outdoor recreational activities. Additionally, the growing interest in off-road motorsports in these regions fuels the market, further supported by a high concentration of manufacturers, dealerships, and consumer bases. The southern U.S. states, known for their agriculture and forestry activities, also play a crucial role in boosting the utility applications of off-road vehicles.

- The U.S. off-road vehicle market is heavily influenced by environmental regulations under the Clean Air Act (CAA). The Environmental Protection Agency (EPA) enforces stringent emission standards for non-road vehicles, including off-road vehicles. In 2023, the EPA required off-road vehicles to comply with Tier 4 standards, which mandate a significant reduction in nitrogen oxide (NOx) and particulate matter (PM) emissions. This regulation has pushed manufacturers to adopt cleaner engine technologies. Violating these emission limits can result in heavy fines, with penalties exceeding $45,000 per non-compliant vehicle, according to EPA enforcement data.

U.S. Off-Road Vehicles Market Segmentation

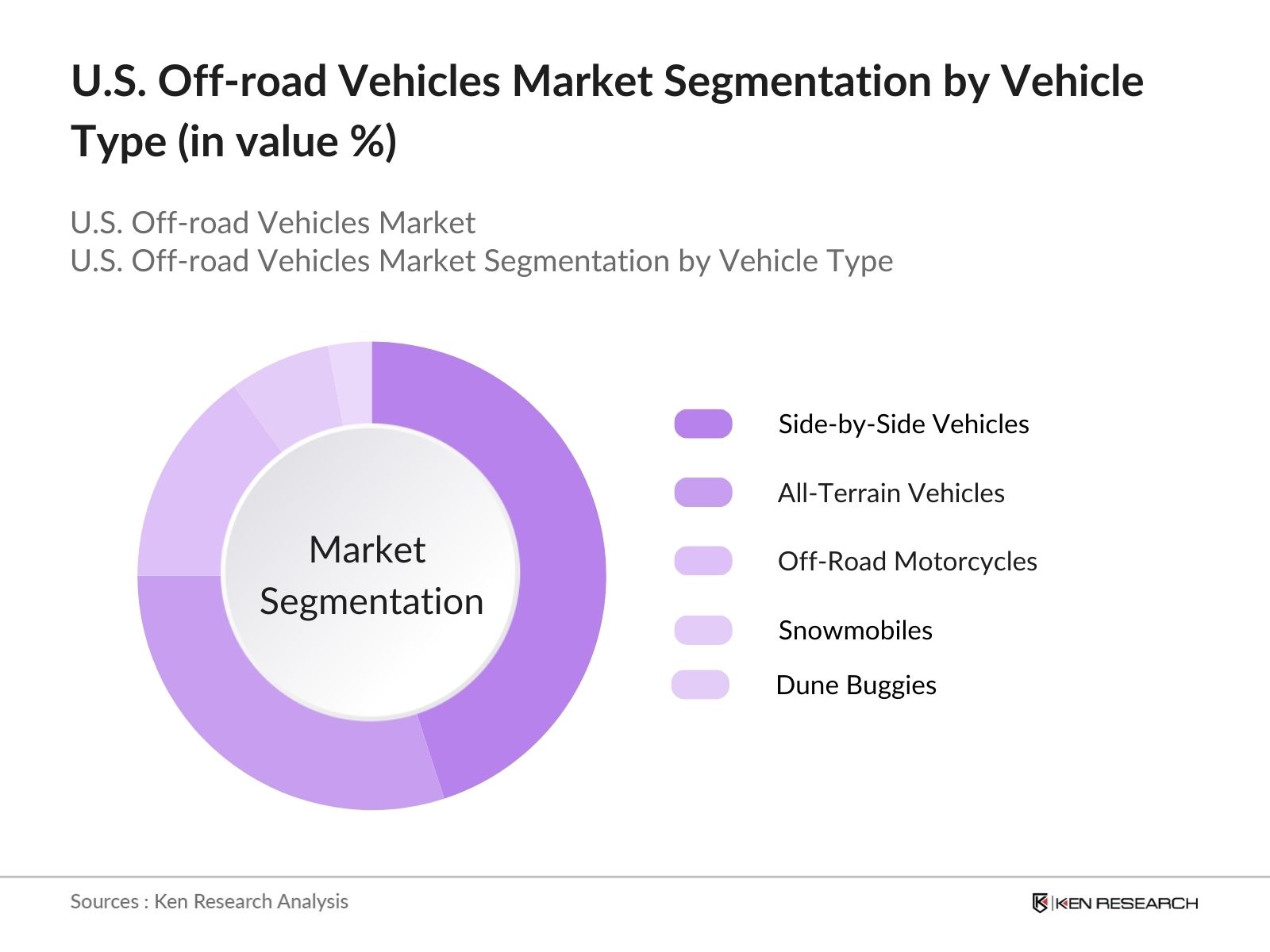

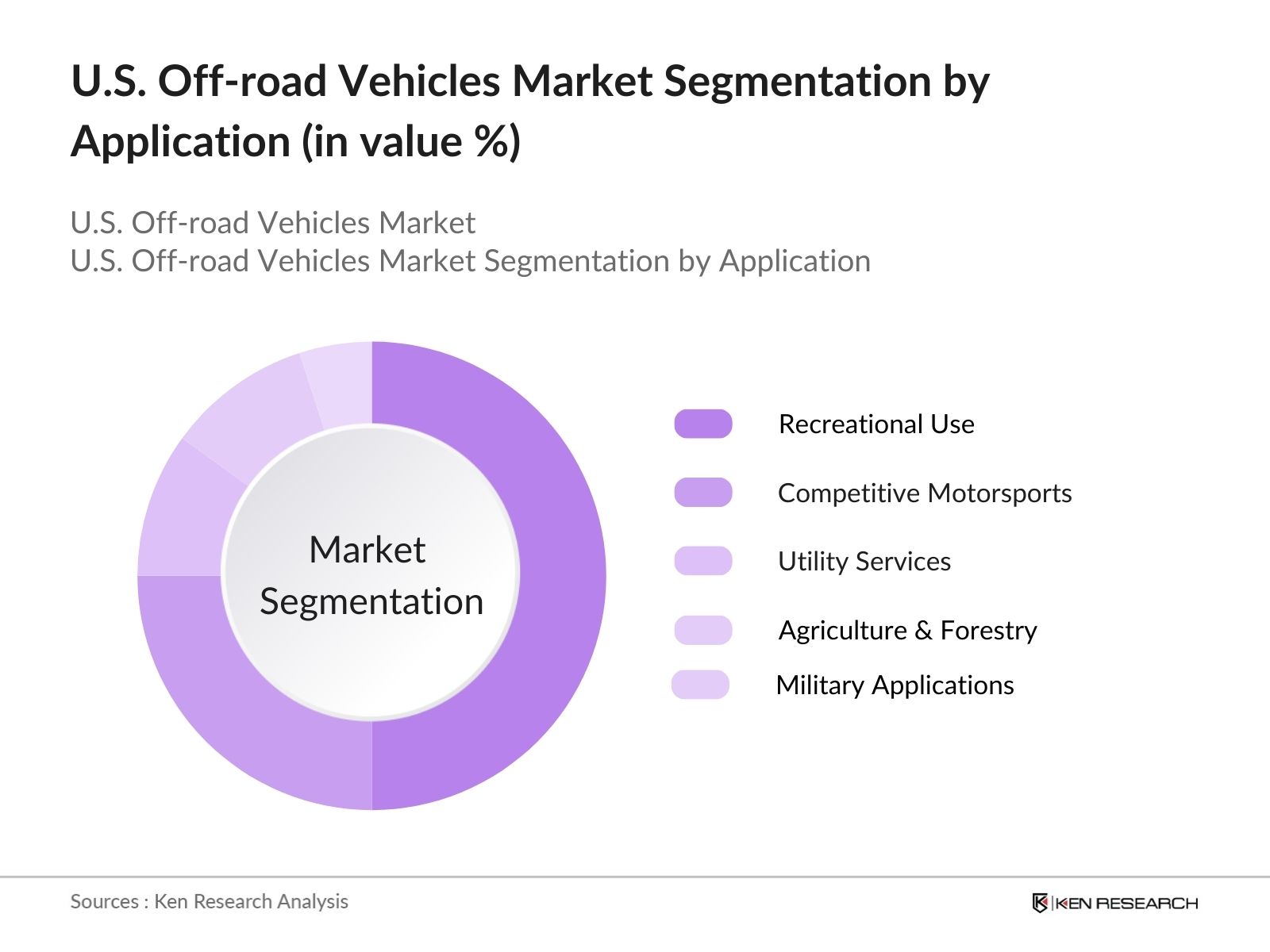

The U.S. Off-Road Vehicles market is segmented by vehicle type and by application.

- By Vehicle Type: The market is segmented by vehicle type into all-terrain vehicles (ATVs), side-by-side vehicles (SxS), off-road motorcycles, snowmobiles, and dune buggies. Side-by-side vehicles have a dominant market share under this segment, driven by their versatility in both recreational and utility use. SxS vehicles are widely favored due to their enhanced safety features, higher load capacity, and comfort for multiple passengers. These vehicles are commonly used for farming, industrial applications, and sports activities, contributing to their extensive adoption across rural and urban areas.

- By Application: The market is also segmented by application into recreational use, competitive motorsports, utility services, agriculture & forestry, and military applications. Recreational use dominates this segment due to the increasing popularity of off-road adventures and motorsports in the U.S. The availability of dedicated off-road parks and trails, coupled with growing participation in adventure tourism, has led to a substantial demand for vehicles designed specifically for recreation. The rise in organized events, such as off-road racing competitions, further promotes the growth of this sub-segment.

U.S. Off-Road Vehicles Market Competitive Landscape

The U.S. Off-Road Vehicles market is dominated by key players like Polaris Industries and Yamaha Motor Co., which lead the market with their wide-ranging portfolios and strong distribution networks. Other global and domestic brands are also highly competitive, focusing on technological innovations such as electric and autonomous off-road vehicles.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

Vehicle Range (Electric/Gas) |

Dealership Network |

R&D Investments (USD Mn) |

Market Penetration (Countries) |

Partnerships |

Production Capacity (Units) |

|

Polaris Industries |

1954 |

Minnesota, USA |

7.0 |

||||||

|

Yamaha Motor Co. |

1955 |

Iwata, Japan |

15.0 |

||||||

|

Honda Motor Co. |

1946 |

Tokyo, Japan |

12.5 |

||||||

|

Can-Am (BRP) |

1942 |

Quebec, Canada |

6.0 |

||||||

|

Kawasaki Heavy Industries |

1896 |

Tokyo, Japan |

14.5 |

U.S. Off-Road Vehicles Market Analysis

Growth Drivers

- Increased Demand for Recreational Activities: Off-road recreational activities have surged in the U.S., driven by rising consumer interest in outdoor adventures. In 2023, the U.S. Department of Commerce recorded a 20% increase in registrations for off-road vehicle (ORV) recreational events, particularly in states such as California, Utah, and Texas, where the demand for ATVs and UTVs spiked. This growth aligns with the 2024 increase in domestic travel spending on recreational outdoor activities, estimated at $887 billion by the U.S. Bureau of Economic Analysis (BEA), reflecting heightened consumer interest in off-road pursuits.

- Expanding Off-Road Parks and Trails: The expansion of off-road parks and trail networks has created new avenues for ORV use in the U.S. The National Park Service (NPS) reported a 15% increase in off-road trail miles, now totaling over 60,000 miles nationwide as of 2023. States like Colorado and Nevada have invested in trail development to support local tourism and recreational industries. Federal initiatives under the Outdoor Recreation Jobs and Economic Impact Act of 2022 further boosted the creation of off-road vehicle parks, with over $1.5 billion allocated toward infrastructure.

- Growing Popularity of Adventure Tourism: Adventure tourism continues to grow, with off-road vehicle usage at the forefront. Data from the U.S. Travel Association shows a 12% year-on-year increase in bookings for off-road tours as part of adventure travel packages. In 2023, ORV rental companies saw heightened demand in adventure hubs like Moab, Utah, contributing $9 billion to local economies. This growing trend indicates strong market potential for off-road vehicles within the adventure tourism segment, reinforcing the sector's appeal to tourists seeking rugged outdoor experiences.

Market Challenges

- Stringent Government Regulations on Emissions: The off-road vehicle market faces strict regulations from the EPA under the Clean Air Act, aimed at reducing emissions. In 2023, the EPA imposed emission standards that required a 25% reduction in carbon monoxide output for all off-road vehicles. These rules present challenges for manufacturers, who must comply with emission-reduction technologies, thereby increasing production costs and impacting market entry for smaller players. Compliance with the Clean Air Act remains a significant hurdle for off-road vehicle manufacturers.

- Environmental Concerns over Land Degradation: ORV use has been criticized for its environmental impact, particularly regarding soil erosion and land degradation. In 2023, the U.S. Department of Agriculture (USDA) identified over 12,000 acres of protected land damaged due to unauthorized ORV use. This degradation has prompted local governments to impose stricter access controls on certain public lands, limiting the areas where off-road vehicles can be used. The growing environmental movement also puts pressure on the ORV market to adopt sustainable practices.

U.S. Off-Road Vehicles Market Future Outlook

Over the next five years, the U.S. Off-Road Vehicles market is expected to experience significant growth, driven by technological advancements such as electric off-road vehicles, autonomous capabilities, and increasing demand for multi-utility recreational vehicles. This growth is likely to be supported by government initiatives to expand off-road recreational zones, incentivizing manufacturers to produce environment-friendly and fuel-efficient off-road vehicles. The rising trend of adventure tourism, combined with increasing disposable incomes, is also expected to fuel market expansion. In addition, the expansion of utility applications in agriculture, military, and industrial sectors will further propel the market forward.

Market Opportunities

- Expansion of Electrification in Off-Road Vehicles: Electrification is emerging as a key growth opportunity within the U.S. off-road vehicle market. As of 2023, the DOE noted that over 5,000 electric ORVs were registered nationwide, a notable increase from prior years. Government incentives, including tax credits of up to $7,500 for electric ORV purchases, are further driving demand. This shift is supported by the increasing availability of lithium-ion battery technology, which has extended the range and durability of electric models, making them more viable for recreational and commercial use.

- Rising Demand for Autonomous Off-Road Solutions: The push towards autonomous off-road solutions presents significant opportunities. In 2024, the U.S. Department of Transportation reported that autonomous systems are now being tested in both military and commercial applications, particularly in mining and agriculture sectors where ORVs are widely used. This development could reduce labor costs and enhance operational efficiency in rugged terrains. Companies developing autonomous driving technologies are poised to capitalize on this growing interest, supported by government funding for research and development in autonomous systems.

Scope of the Report

|

||||

|

By Application |

Recreational Use Competitive Motorsports Utility Services Agriculture & Forestry Military Applications |

|||

|

By Fuel Type |

Gasoline Diesel Electric Hybrid |

|||

|

By Distribution Channel |

OEMs Authorized Dealerships Online Retailers Aftermarket Suppliers |

|||

|

By Region |

North East West South |

Products

Key Target Audience

OEM Manufacturers

Off-Road Vehicle Dealers and Distributors

Aftermarket Suppliers

Agricultural & Forestry Equipment Companies

Motorsport Organizations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Transportation, Environmental Protection Agency)

Military and Defense Departments

Companies

Players Mention in the Report:

-

Polaris Industries

Yamaha Motor Co.

Honda Motor Co.

Can-Am (BRP)

Kawasaki Heavy Industries

Arctic Cat Inc.

Suzuki Motor Corporation

CF Moto

Segway Powersports

Textron Inc.

John Deere (Deere & Company)

KTM AG

Zero Motorcycles

Mahindra Automotive North America

Bombardier Recreational Products (BRP)

Table of Contents

1. U.S. Off-Road Vehicles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Off-Road Vehicles Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Off-Road Vehicles Market Analysis

3.1. Growth Drivers

3.2. Market Challenges

3.3. Opportunities

3.4. Trends

3.5. Government Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. Off-Road Vehicles Market Segmentation

4.1. By Vehicle Type (In Value %)

4.2. By Application (In Value %)

4.3. By Fuel Type (In Value %)

4.4. By Distribution Channel (In Value %)

4.5. By Region (In Value %)

5. U.S. Off-Road Vehicles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Polaris Industries

5.1.2. BRP Inc. (Bombardier Recreational Products)

5.1.3. Yamaha Motor Co., Ltd.

5.1.4. Honda Motor Co., Ltd.

5.1.5. Kawasaki Heavy Industries, Ltd.

5.1.6. Arctic Cat Inc.

5.1.7. Suzuki Motor Corporation

5.1.8. Textron Inc.

5.1.9. Can-Am (BRP)

5.1.10. CF Moto

5.1.11. Segway Powersports

5.1.12. Mahindra Automotive North America

5.1.13. John Deere (Deere & Company)

5.1.14. KTM AG

5.1.15. Zero Motorcycles

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Off-Road Vehicles Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. U.S. Off-Road Vehicles Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Off-Road Vehicles Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Application (In Value %)

8.3. By Fuel Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. U.S. Off-Road Vehicles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the U.S. Off-Road Vehicles Market. This step was underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective was to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the U.S. Off-Road Vehicles Market. This included assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of production capacity and dealership network statistics was conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple off-road vehicle manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction served to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. Off-Road Vehicles market.

Frequently Asked Questions

01. How big is the U.S. Off-Road Vehicles market?

The U.S. Off-Road Vehicles market is valued at USD 10.80 billion, driven by growing demand in recreational activities and utility services such as agriculture, forestry, and military applications.

02. What are the key growth drivers in the U.S. Off-Road Vehicles market?

Key growth drivers in U.S. Off-Road Vehicles market include the rising demand for recreational vehicles, advancements in vehicle electrification, increasing disposable incomes, and government incentives to promote off-road tourism and motorsports activities.

03. Who are the major players in the U.S. Off-Road Vehicles market?

Major players in U.S. Off-Road Vehicles market include Polaris Industries, Yamaha Motor Co., Honda Motor Co., Can-Am (BRP), and Kawasaki Heavy Industries, known for their diverse product portfolios and strong distribution networks.

04. What are the challenges in the U.S. Off-Road Vehicles market?

Challenges in U.S. Off-Road Vehicles market include stringent government regulations regarding emissions, high vehicle ownership costs, environmental concerns over land degradation, and limited charging infrastructure for electric off-road vehicles.

05. What is the future outlook of the U.S. Off-Road Vehicles market?

The future outlook of U.S. Off-Road Vehicles market is positive, with expected growth driven by advancements in vehicle electrification, increasing recreational activities, and government support for expanding off-road trail networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.