US Optical Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD10993

December 2024

80

About the Report

USA Optical Market Overview

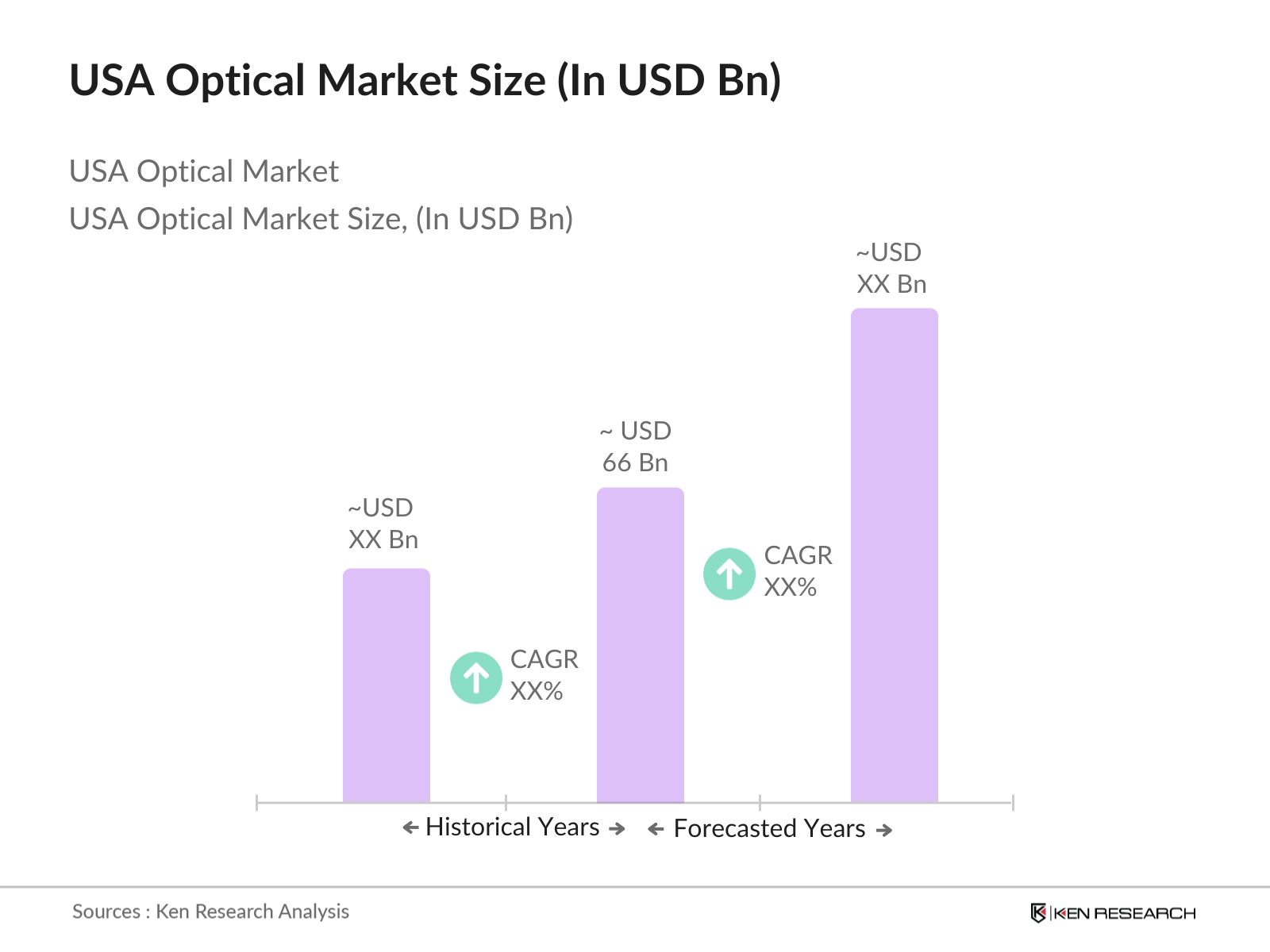

- The USA optical market, valued at USD 66 billion based on recent analyses, is primarily driven by the increasing prevalence of vision impairments, along with a rapidly aging population that necessitates vision correction products such as prescription glasses and contact lenses. The shift in consumer preferences towards premium and customized eyewear, fueled by fashion trends and advancements in lens technology, also contributes to the growth. Additionally, the rising adoption of optical instruments in healthcare facilities and retail chains is augmenting market demand.

- The USA market is dominated by urban centers such as New York, Los Angeles, and Chicago due to their large populations, high disposable incomes, and access to cutting-edge optical care technology. These cities also serve as hubs for major optical brands and distribution centers, which further bolsters their dominance. Moreover, their residents are more inclined to invest in fashion eyewear, contributing to the growth of the premium segment.

- The USA optical market is highly regulated, with the FDA overseeing the safety and effectiveness of contact lenses and optical devices. In 2023, the FDA updated its regulations regarding the materials used in contact lenses to ensure higher safety standards. Additionally, the FTC's Contact Lens Rule mandates that optometrists provide prescriptions to patients, promoting transparency and consumer rights.

USA Optical Market Segmentation

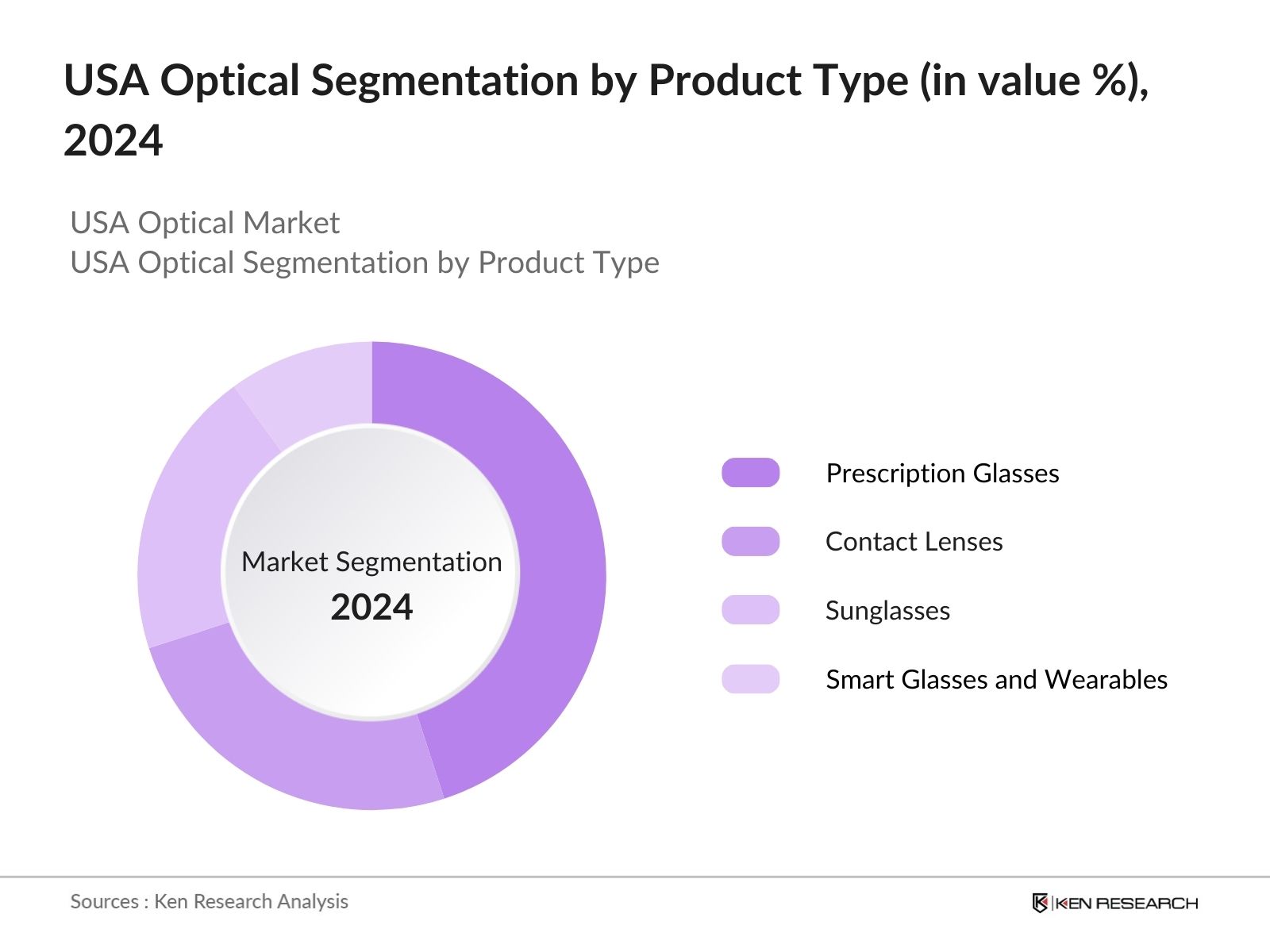

By Product Type: The USA optical market is segmented by product type into prescription glasses, contact lenses, sunglasses, and smart glasses and wearables. Among these, prescription glasses hold the largest share of the market. This is primarily due to the increased incidence of vision impairment and the need for corrective eyewear, especially among the aging population. Brands such as EssilorLuxottica have a strong presence in this segment, offering a range of high-quality lenses with advanced coatings, such as anti-reflective and blue light-blocking technologies, which enhance their appeal to consumers.

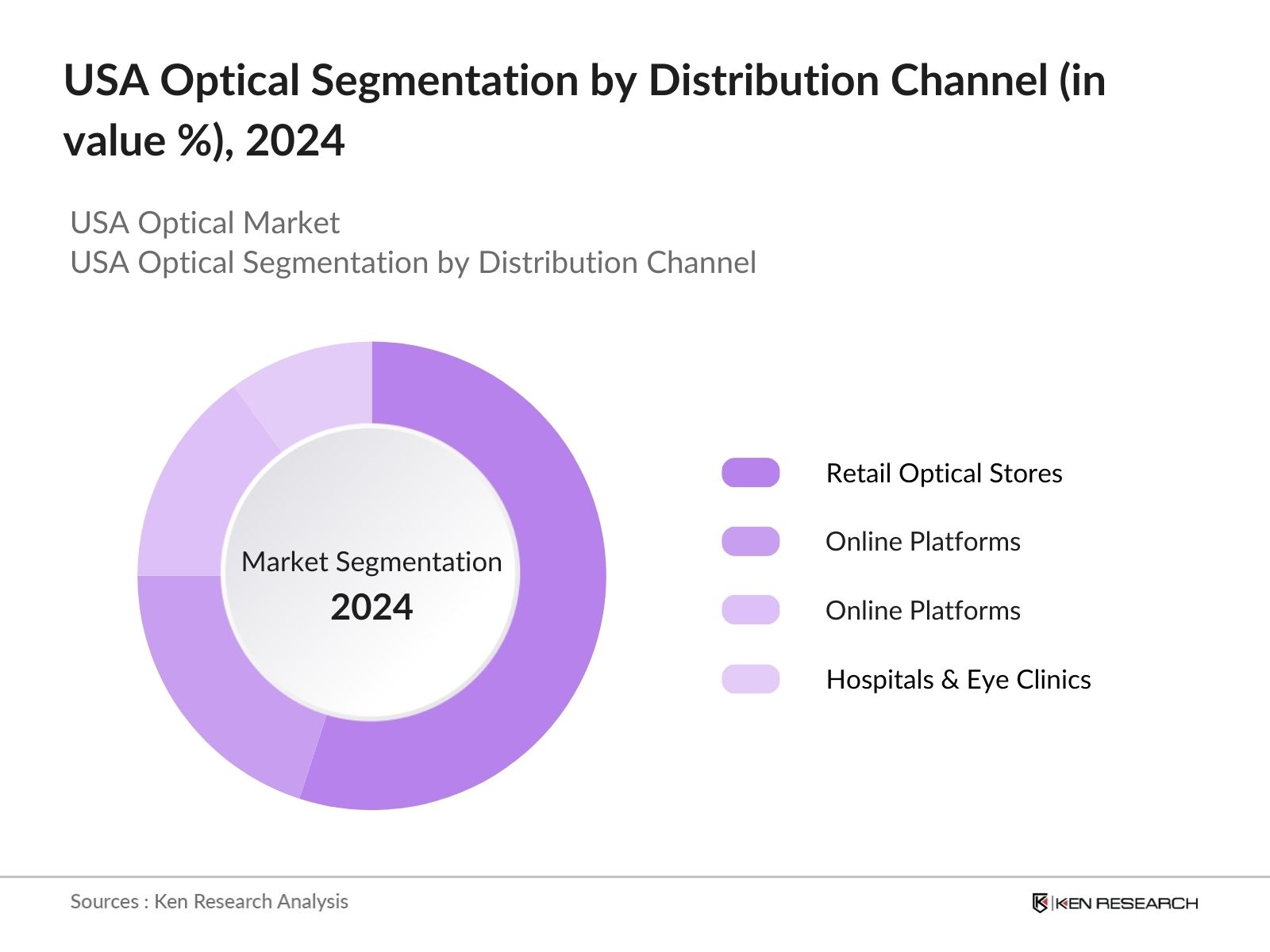

By Distribution Channel: The USA optical market is segmented by distribution channel into retail optical stores, online platforms, independent opticians, and hospitals & eye clinics. Retail optical stores dominate the market share, largely due to the personalized service they offer, which includes fitting, adjustments, and after-sale services. These stores are also increasingly incorporating advanced diagnostic tools, allowing customers to receive comprehensive eye exams in-store, further solidifying their dominance. However, online platforms are rapidly gaining ground due to convenience, competitive pricing, and access to a wide range of products.

USA Optical Market Competitive Landscape

The USA optical market is dominated by a mix of global conglomerates and innovative regional players. Companies such as EssilorLuxottica and Johnson & Johnson Vision dominate due to their extensive product portfolios and strong distribution networks. These key players have capitalized on strategic partnerships, technological advancements, and consumer preferences for premium and smart eyewear.

|

Company |

Year of Establishment |

Headquarters |

No. of Employees |

Revenue (2023) |

Product Portfolio |

R&D Investments |

Key Partnerships |

Sustainability Initiatives |

|

EssilorLuxottica |

2018 |

Charenton-le-Pont, FR |

||||||

|

Johnson & Johnson Vision |

1959 |

Jacksonville, FL, USA |

||||||

|

Alcon |

1945 |

Fort Worth, TX, USA |

||||||

|

Warby Parker |

2010 |

New York, NY, USA |

||||||

|

Zeiss Vision Care |

1846 |

Oberkochen, DE |

USA Optical Market Analysis

Growth Drivers

- Technological Innovations (Lens Technology, Smart Glasses, AR/VR Integration): Technological advancements in the USA optical market have significantly reshaped consumer preferences. The integration of augmented reality (AR) and virtual reality (VR) in eyewear is gaining momentum, with companies like Apple and Google leading the way. In 2023, the U.S. exported optical devices worth over $10.4 billion, driven by innovations in lens technology and wearable devices like smart glasses. The rise of these technologies has increased the demand for AR/VR-integrated eyewear, offering enhanced functionalities beyond vision correction.

- Rising Vision Impairment and Aging Population: The USAs aging population is a significant driver of the optical market. In 2024, approximately 54 million Americans were over the age of 65, and these demographic experiences a higher prevalence of vision impairment and age-related conditions like cataracts and macular degeneration. According to the CDC, over 12 million Americans aged 40 and older have vision impairment, further increasing the demand for corrective eyewear, contact lenses, and surgery-related products. The market growth is further supported by increased healthcare expenditure in optometry services, which exceeded $2.6 billion in 2023.

- Increased Awareness for Eye Care and Protection (Blue Light Blocking, UV Protection): Consumer awareness of eye protection has surged, particularly due to the effects of prolonged screen exposure. The CDC reported that over 83% of adults spend more than four hours daily on screens, intensifying demand for blue light-blocking lenses. Furthermore, increased outdoor activities have raised the need for UV protection eyewear. In 2023, approximately 78 million pairs of UV-protected eyewear were sold in the U.S., with consumers becoming more aware of the link between UV exposure and long-term eye damage, further driving demand for protective optical solutions.

Market Challenges

- High Cost of Advanced Optical Products: Despite the growing demand for advanced optical products, the high cost of premium solutions remains a challenge. For example, smart glasses, such as Google Glass or Metas AR glasses, retail at upwards of $500 per pair, pricing out a significant portion of consumers. In 2023, the average price for advanced optical lenses, including progressive and blue light-blocking lenses, was approximately $180 per pair, which is considerably higher than basic corrective lenses. This pricing has limited access, especially among lower-income groups, thereby constraining wider market penetration.

- Supply Chain Disruptions (Raw Material Availability, Global Shipping): The USA optical market, like other sectors, has faced ongoing supply chain disruptions due to global shipping challenges and raw material shortages. In 2023, delays in the supply of optical-grade plastics and metals used in frames and lenses led to a backlog of 12% in order fulfillment. Additionally, increased shipping costs have put pressure on manufacturers, with international freight rates nearly doubling compared to pre-pandemic levels. This supply instability has disrupted the availability of new products, pushing manufacturers to seek alternative local suppliers to mitigate these delays.

USA Optical Market Future Outlook

Over the next five years, the USA optical market is expected to show significant growth, driven by rising demand for premium eyewear, advancements in lens technology, and increased adoption of smart and wearable devices. As the aging population grows, the need for vision correction products will intensify, fueling further expansion. Moreover, the ongoing shift toward eco-friendly and sustainable materials is expected to shape consumer preferences, creating opportunities for companies to innovate and diversify their product offerings.

Market Opportunities

- Digital Health Integration (Tele-optometry, Online Vision Testing): Tele-optometry has emerged as a promising opportunity within the USA optical market. In 2023, over 24 million Americans used digital health platforms for optometry consultations and vision testing, significantly expanding access to eye care services, particularly in rural and underserved areas. This trend has also reduced the overall cost of care, as virtual services typically offer lower consultation fees than in-person visits. The growing use of telehealth platforms is transforming optometry, with providers increasingly adopting digital solutions to streamline services and broaden their consumer base.

- Expansion into Emerging Markets: While the U.S. optical market remains robust, opportunities for growth exist in expanding to global markets. U.S. exports of optical products to emerging markets such as India, Brazil, and Southeast Asia totaled $3.5 billion in 2023. These regions have seen a surge in demand for high-quality eyewear, driven by rising middle-class incomes and increased awareness of vision care. American optical companies are strategically positioning themselves in these markets by offering affordable yet advanced optical solutions, paving the way for future expansion.

Products

Key Target Audience

Eyewear Manufacturers

Optical Retail Chains

Hospitals & Eye Care Clinics

Online Optical Retailers

Lens and Frame Component Suppliers

Eye Health Insurance Providers

Government and Regulatory Bodies (FDA, FTC)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

EssilorLuxottica

Johnson & Johnson Vision

Alcon

Warby Parker

Zeiss Vision Care

Bausch + Lomb

CooperVision

Hoya Corporation

Safilo Group

National Vision Inc.

Fielmann AG

Marcolin Group

Charmant Group

De Rigo

Maui Jim

Table of Contents

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on creating a comprehensive map of the USA optical markets ecosystem, including all key stakeholders. Through a combination of desk research and proprietary data, we identify the main drivers of market growth and key challenges.

Step 2: Market Analysis and Construction

Here, we analyze historical data, including market penetration rates and the ratio of optical service providers to consumers. Additionally, we assess the quality-of-service statistics, providing a detailed revenue estimate based on the current competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

In this step, we conduct interviews with industry experts using computer-assisted telephone interviews (CATIs). This step validates our market hypotheses and provides detailed financial and operational insights.

Step 4: Research Synthesis and Final Output

This final phase includes discussions with optical manufacturers and distributors to gain insights into product segmentation, customer preferences, and sales performance. This data, combined with our research, results in a comprehensive and validated market analysis.

Frequently Asked Questions

01. How big is the USA Optical Market?

The USA optical market is valued at approximately USD 66 billion in 2023, driven by the rising aging population, technological innovations in eyewear, and increasing consumer interest in fashion-oriented and functional eyewear.

02. What are the challenges in the USA Optical Market?

The USA optical market faces challenges such as supply chain disruptions, particularly in sourcing raw materials for optical products, and competition from online retailers offering lower prices. High consumer expectations for customization and premium products also pressure companies to innovate constantly.

03. Who are the major players in the USA Optical Market?

Key players in USA optical market include EssilorLuxottica, Johnson & Johnson Vision, Alcon, Warby Parker, and Zeiss Vision Care, which dominate due to their extensive distribution networks, product innovations, and strong brand presence.

04. What are the growth drivers of the USA Optical Market?

The USA optical market is propelled by an aging population that requires vision correction, technological advancements in lens coatings and materials, and the increasing popularity of smart and wearable optical devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.