US Orphan Drugs Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD9062

December 2024

85

About the Report

US Orphan Drugs Market Overview

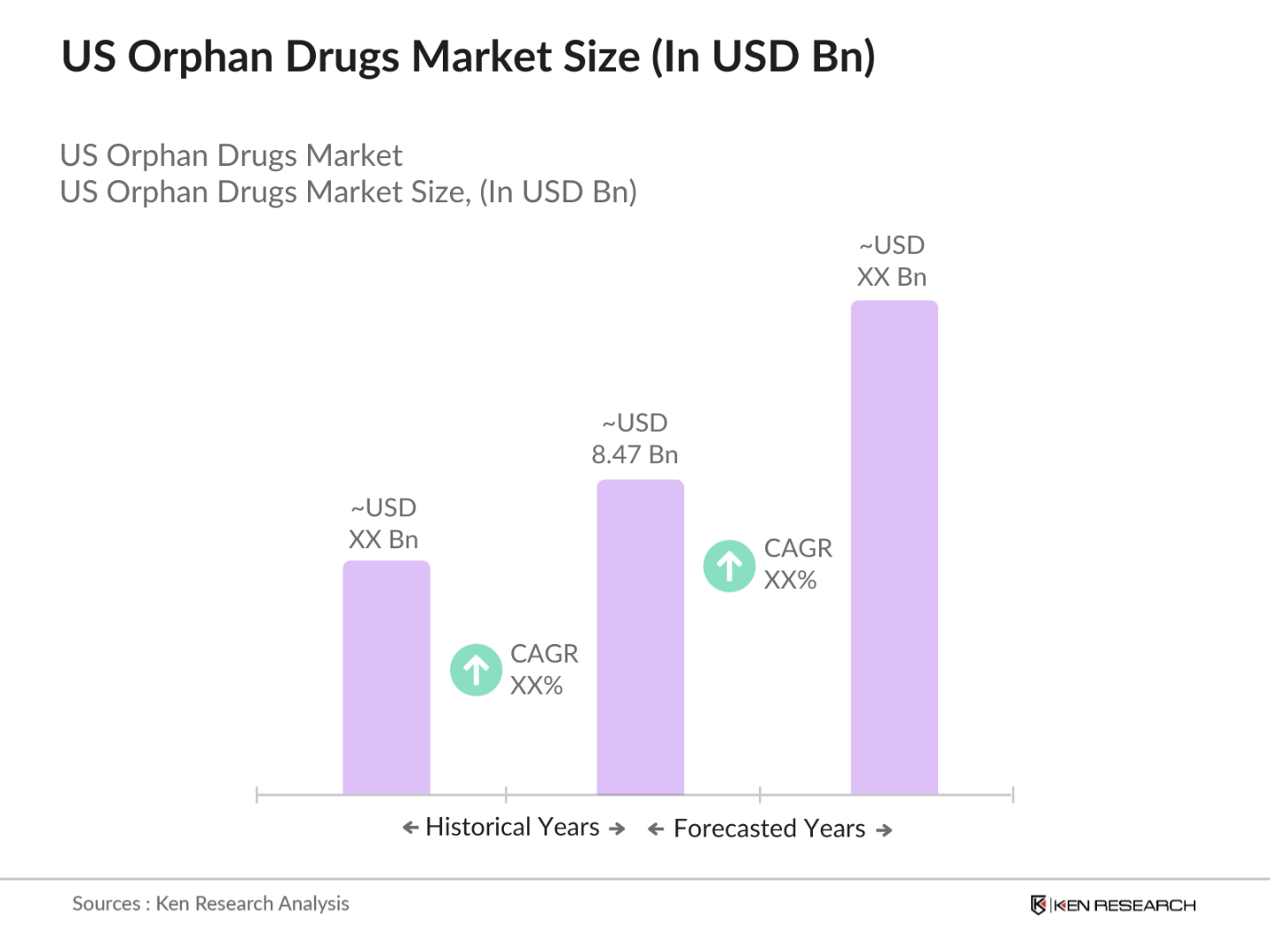

- The US Orphan Drugs market is valued at USD 8.47 billion, based on a five-year historical analysis. This growth is primarily driven by favorable regulatory frameworks such as the Orphan Drug Act, which provides incentives including tax credits, market exclusivity, and FDA support, aimed at fostering innovation in treatments for rare diseases. Additionally, advancements in biotechnology and growing investments in R&D by pharmaceutical companys further fuel market expansion.

- The dominance of the US in the orphan drugs market is attributed to its robust healthcare infrastructure, research facilities, and strong support from governmental bodies. Major cities such as Boston, San Francisco, and New York are pivotal in driving the market due to their concentration of leading biotech firms, research institutes, and venture capital investments in orphan drug development.

- The Orphan Drug Act (ODA) of 1983 remains the cornerstone of orphan drug development in the U.S. By 2024, the ODA has facilitated the approval of over 500 orphan drugs, offering critical incentives such as tax credits, grants, and market exclusivity. Amendments to the Act, including the Rare Pediatric Disease Priority Review Voucher Program, further enhance its effectiveness by offering additional financial incentives. These government-backed measures continue to be vital for encouraging pharmaceutical companies to invest in rare disease research.

US Orphan Drugs Market Segmentation

By Drug Type: The market is segmented by drug type into biologics and small molecules. Recently, biologics have held a dominant share in this segment due to their ability to address complex diseases, especially in the fields of oncology and rare genetic disorders. Biologics, which include monoclonal antibodies, gene therapies, and advanced biologic drugs, offer innovative treatments that are more targeted and effective compared to traditional small molecules. The high development cost and longer clinical trial phases are offset by government incentives, making this sub-segment a primary driver of market growth.

By Therapeutic Area: The market is segmented by therapeutic area into oncology, neurology, hematology, endocrinology, and cardiovascular. Oncology remains the largest therapeutic area, driven by the increasing prevalence of rare cancers and significant advancements in cancer research. This segment benefits from extensive R&D funding, with numerous orphan drug approvals specifically targeting rare forms of cancer. Companies focusing on orphan oncology drugs are also supported by patient advocacy groups, which further amplifies market growth in this sub-segment.

US Orphan Drugs Competitive Landscape

The US Orphan Drugs market is dominated by a few major players, including global pharmaceutical giants and specialized biotech firms. These companies maintain a competitive edge through continuous R&D investments, strategic collaborations, and a focus on orphan drug development. The consolidation of the market highlights the influence of these key players, as they hold multiple orphan drug designations and lead in both drug discovery and commercialization.

|

Company Name |

Established Year |

Headquarters |

No. of Orphan Drug Approvals |

Revenue (USD Bn) |

R&D Spending (%) |

Product Pipeline |

FDA Designations |

Number of Clinical Trials |

Strategic Collaborations |

|

Novartis AG |

1996 |

Basel, Switzerland |

|||||||

|

Pfizer Inc. |

1849 |

New York, USA |

|||||||

|

Roche Holding AG |

1896 |

Basel, Switzerland |

|||||||

|

Amgen Inc. |

1980 |

Thousand Oaks, USA |

|||||||

|

Vertex Pharmaceuticals |

1989 |

Boston, USA |

US Orphan Drugs Industry Analysis

Growth Drivers

- Orphan Drug Designation by FDA: The U.S. FDAs Orphan Drug Designation (ODD) program is a key driver in the orphan drugs market. As of 2024, the FDA has granted over 1,050 orphan drug designations since the program's inception. These designations allow for seven years of market exclusivity upon approval, helping pharmaceutical companies recover development costs. By 2023, the FDA reported granting 587 orphan designations, significantly enhancing drug development for rare diseases. This program plays a critical role in expanding treatment options for an estimated 25-30 million Americans suffering from rare diseases.

- Increasing Prevalence of Rare Diseases: Rare diseases affect about 10% of the U.S. population, equating to roughly 30 million individuals. The increasing identification and diagnosis of these conditions contribute significantly to orphan drug market growth. According to the NIH, there are over 7,000 known rare diseases, with more being discovered each year. With advancements in genomic sequencing, rare disease diagnosis has improved, leading to a growing patient base requiring specialized treatments. This rise in the number of diagnosed cases directly fuels demand for orphan drugs and further drives the market.

- Favorable Government Incentives: The Orphan Drug Act (ODA) provides tax credits for 50% of clinical testing costs, aiding companies in developing orphan drugs. In 2022, the IRS reported tax credits worth over $1.2 billion were claimed under this program, supporting drug research and development. Moreover, FDA grants market exclusivity for orphan drugs for seven years, a critical incentive for pharmaceutical companies to invest in high-risk projects. These benefits reduce the financial burden and offer lucrative returns, significantly boosting the development of new therapies for rare diseases.

Market Challenges

- High Development Costs: The development of orphan drugs is costly, with average R&D spending ranging from $1.5 billion to $2.6 billion per drug. According to the Tufts Center for the Study of Drug Development, these high costs are exacerbated by the complexity of clinical trials and the need for specialized manufacturing processes. Limited patient populations necessitate higher per-patient trial costs, and the extended regulatory approval process further increases financial burdens on drug developers. Despite incentives, these high costs remain a significant barrier for smaller biotech firms.

- Limited Patient Population: Orphan drugs target rare diseases that affect fewer than 200,000 people in the U.S. This limited patient population constrains the potential market for any single drug. For example, cystic fibrosis, one of the more common rare diseases, affects about 30,000 Americans, while many other rare diseases impact fewer than 1,000 individuals. The challenge lies in justifying the high R&D costs against the relatively small market size, making profitability a concern for pharmaceutical companies without robust incentives or government backing.

US Orphan Drugs Market Future Outlook

Over the next five years, the US Orphan Drugs market is expected to see significant expansion driven by continuous government support, advancements in biotechnology, and increasing R&D investments. The rising prevalence of rare diseases and increasing patient awareness are also key factors contributing to this growth. Additionally, the FDA's fast-track approval processes for orphan drugs will further accelerate the introduction of new treatments to the market. As biopharma companies continue to collaborate with research institutions and patient advocacy groups, the future of the orphan drugs market remains promising.

Future Market Opportunities

- Expansion into New Therapeutic Areas: The orphan drugs market is expanding beyond traditional areas like oncology and neurology into new therapeutic categories such as rare infectious diseases and metabolic disorders. In 2023, more than 30 orphan drugs targeting new areas, including rare cardiovascular and endocrine disorders, were under FDA review. The diversification into these emerging therapeutic areas presents significant opportunities for drug developers to address unmet medical needs and tap into new patient populations, thereby driving market growth.

- Collaborations with Academic and Research Institutions: Collaborations between pharmaceutical companies and academic research institutions have become pivotal in advancing orphan drug development. In 2023, the NIH reported funding over 1,200 research collaborations focused on rare diseases, contributing to drug discovery and preclinical development. These partnerships accelerate the translation of scientific discoveries into potential therapies, enhancing the orphan drugs pipeline. Universities and research institutions provide expertise and innovative approaches, helping to overcome some of the scientific challenges associated with rare disease drug development.

Scope of the Report

|

Drug Type |

Biologics Small Molecules |

|

Therapeutic Area |

Oncology Neurology Hematology Endocrinology Cardiovascular |

|

Distribution Channel |

Hospital Pharmacies Specialty Pharmacies Online Pharmacies |

|

Route of Administration |

Oral Injectable Others |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotechnology Firms

Government and Regulatory Bodies (FDA, NIH)

Patient Advocacy Groups

Healthcare Providers

Investor and Venture Capitalist Firms

Research Institutions

Drug Distributors

Companies

Major Players

Novartis AG

Pfizer Inc.

Roche Holding AG

Bristol-Myers Squibb

AbbVie Inc.

Alexion Pharmaceuticals

Amgen Inc.

Sanofi

Vertex Pharmaceuticals

Biogen Inc.

Regeneron Pharmaceuticals

Gilead Sciences

Bayer AG

Takeda Pharmaceutical

Jazz Pharmaceuticals

Table of Contents

US Orphan Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

US Orphan Drugs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

US Orphan Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Orphan Drug Designation by FDA (Key Driver)

3.1.2. Increasing Prevalence of Rare Diseases (Key Driver)

3.1.3. Favorable Government Incentives (Tax Credits, Market Exclusivity)

3.1.4. Growing Investments in Biotech and Pharmaceuticals

3.2. Market Challenges

3.2.1. High Development Costs (R&D Spending)

3.2.2. Limited Patient Population (Market Size)

3.2.3. Regulatory Complexities (FDA Approval Process)

3.3. Opportunities

3.3.1. Advancements in Gene Therapy and Precision Medicine

3.3.2. Expansion into New Therapeutic Areas

3.3.3. Collaborations with Academic and Research Institutions

3.4. Trends

3.4.1. Increased Use of Biologics and Advanced Therapies

3.4.2. Surge in Personalized Treatment Approaches (Genomic Medicine)

3.4.3. Adoption of Patient-Centric Models (Patient Registries)

3.5. Government Regulation

3.5.1. Orphan Drug Act and Amendments

3.5.2. FDA Regulatory Pathways (Accelerated Approval, Breakthrough Therapy Designation)

3.5.3. NIH Funding and Research Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Drug Manufacturers

3.7.2. Patient Advocacy Groups

3.7.3. Regulatory Bodies

3.7.4. Research Institutions

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

US Orphan Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Biologics

4.1.2. Small Molecules

4.2. By Therapeutic Area (In Value %)

4.2.1. Oncology

4.2.2. Neurology

4.2.3. Hematology

4.2.4. Endocrinology

4.2.5. Cardiovascular

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Specialty Pharmacies

4.3.3. Online Pharmacies

4.4. By Route of Administration (In Value %)

4.4.1. Oral

4.4.2. Injectable

4.4.3. Others

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

US Orphan Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Novartis AG

5.1.2. Pfizer Inc.

5.1.3. Roche Holding AG

5.1.4. Bristol-Myers Squibb

5.1.5. AbbVie Inc.

5.1.6. Alexion Pharmaceuticals

5.1.7. Amgen Inc.

5.1.8. Sanofi

5.1.9. Vertex Pharmaceuticals

5.1.10. Biogen Inc.

5.1.11. Regeneron Pharmaceuticals

5.1.12. Gilead Sciences

5.1.13. Bayer AG

5.1.14. Takeda Pharmaceutical

5.1.15. Jazz Pharmaceuticals

5.2. Cross Comparison Parameters (R&D Investment, Orphan Drug Designations, Product Pipeline, Clinical Trials)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

US Orphan Drugs Market Regulatory Framework

6.1. Orphan Drug Act

6.2. FDA Approval Process for Orphan Drugs

6.3. Incentives and Financial Support for R&D

US Orphan Drugs Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

US Orphan Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Therapeutic Area (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Route of Administration (In Value %)

8.5. By Region (In Value %)

US Orphan Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves constructing a comprehensive market ecosystem map, identifying major stakeholders including pharmaceutical companies, biotech firms, research institutions, and government bodies within the US Orphan Drugs market. Extensive desk research, including secondary data and proprietary databases, is employed to gather detailed industry information. The primary aim is to identify the key variables influencing market growth and dynamics.

Step 2: Market Analysis and Construction

During this phase, we compile and analyze historical market data for the US Orphan Drugs sector. This involves examining key metrics such as drug approvals, patient population, and market penetration. Furthermore, we evaluate R&D expenditures and government incentives to ensure the reliability of revenue projections and market trends.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we conduct consultations through computer-assisted telephone interviews (CATIs) with industry experts, including executives from leading pharmaceutical firms, healthcare professionals, and regulatory authorities. These consultations provide valuable insights into market dynamics and serve to refine the data collected in previous phases.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data gathered from primary and secondary sources, including direct engagement with drug manufacturers. This ensures a comprehensive and accurate analysis of the US Orphan Drugs market. The final output includes a detailed report that is reviewed and validated by industry experts to ensure its accuracy and relevance.

Frequently Asked Questions

01 How big is the US Orphan Drugs Market?

The US Orphan Drugs market is valued at USD 8.47 billion, driven by strong government support, increasing R&D investments, and a rising number of FDA-approved orphan drugs.

02 What are the challenges in the US Orphan Drugs Market?

Challenges in the US Orphan Drugs market include high development costs, regulatory complexities, and a limited patient population for many orphan drugs, which can restrict revenue potential for pharmaceutical companies.

03 Who are the major players in the US Orphan Drugs Market?

Key players in the US Orphan Drugs market include Novartis AG, Pfizer Inc., Roche Holding AG, Amgen Inc., and Vertex Pharmaceuticals. These companies lead the market due to their extensive R&D investments and multiple orphan drug approvals.

04 What are the growth drivers of the US Orphan Drugs Market?

The US Orphan Drugs market is driven by favorable government incentives, advancements in biotechnology, and the increasing prevalence of rare diseases. Additionally, patient advocacy and FDA support play a crucial role in market expansion.

05 What are the key trends in the US Orphan Drugs Market?

Key trends in the US Orphan Drugs market include the rise of biologics and gene therapies, a focus on personalized medicine, and the increasing role of patient advocacy in driving drug development and approval processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.