U.S. Outdoor Recreation Products Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD9064

December 2024

97

About the Report

U.S. Outdoor Recreation Products Market Overview

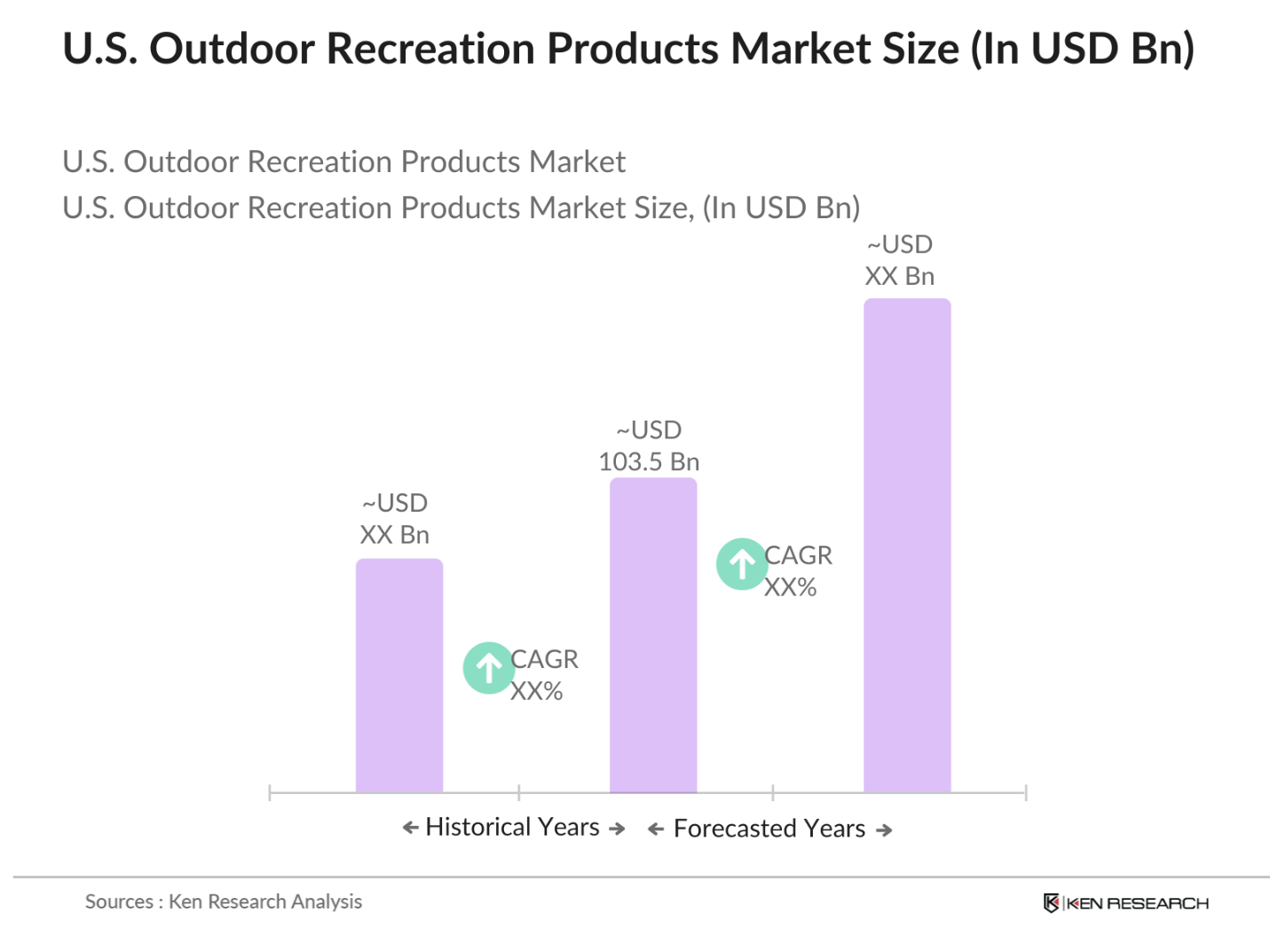

- The U.S. Outdoor Recreation Products market is valued at USD 103.5 billion, based on a five-year historical analysis. This market is driven by an increasing focus on health and wellness, with consumers investing in products that support outdoor activities such as hiking, cycling, and camping. The rise in remote work has also spurred interest in outdoor activities, with many seeking ways to enjoy recreational activities closer to home.

- Key cities like Denver, Seattle, and San Francisco dominate the outdoor recreation products market in the U.S., largely due to their proximity to national parks, outdoor-friendly weather, and strong local support for environmental and recreational initiatives. The markets concentration in these areas is supported by both consumer preferences for outdoor activities and the presence of major outdoor brands that cater to this demographic.

- The National Outdoor Recreation Act prioritizes funding and development for recreational facilities, impacting demand for related products. In 2023, the U.S. Department of the Interior allocated over $300 million toward infrastructure in state and national parks, enhancing accessibility and recreational opportunities. These improvements not only support consumer participation but also increase demand for quality outdoor products as more areas become accessible.

U.S. Outdoor Recreation Products Market Segmentation

By Product Type: The U.S. Outdoor Recreation Products market is segmented by product type into camping equipment, hiking gear, water sports equipment, cycling gear, and outdoor apparel. Recently, camping equipment has held a dominant share under this segmentation. The dominance is attributed to a surge in outdoor tourism and an increased preference for adventure travel. Consumers are increasingly inclined toward self-contained travel options, with brands like Coleman and REI Co-op leading the way by offering durable, multifunctional camping products suited to varying terrains and climates.

By Distribution Channel: The market is also segmented by distribution channel into online retail, specialty stores, department stores, and hypermarkets/supermarkets. Online retail is currently dominating this segment, fueled by the convenience of e-commerce and an increase in online shopping during the pandemic. With detailed product descriptions and virtual try-ons becoming popular, consumers find it easier to shop online for outdoor recreation gear, especially from brands like Patagonia, YETI, and The North Face, which have strong online presences and attractive e-commerce platforms.

U.S. Outdoor Recreation Products Market Competitive Landscape

The U.S. Outdoor Recreation Products market is dominated by established players such as REI Co-op, Patagonia, and The North Face, who hold significant influence over product quality, innovation, and sustainability standards. This consolidation underscores the importance of brand recognition and eco-friendly practices within the industry, as consumers increasingly favor brands with sustainable, high-quality products and long-standing reputations.

U.S. Outdoor Recreation Products Industry Analysis

Growth Drivers

- Increasing Interest in Outdoor Activities: The U.S. outdoor recreation industry has seen a surge in consumer participation in outdoor activities, with more Americans engaging in pursuits like hiking, camping, and cycling. According to the U.S. Bureau of Economic Analysis, over 145 million people participated in some form of outdoor recreation in 2023, supported by various initiatives to promote outdoor wellness. The National Park Service reported that visitor numbers to national parks rose by nearly 7 million between 2022 and 2023, highlighting a significant increase in public interest. This trend aligns with the broader societal emphasis on mental and physical wellness facilitated by outdoor activities.

- Rising Consumer Spending on Health and Wellness: Spending on health and wellness-related products has escalated across the U.S., contributing positively to the outdoor recreation market. In 2023, the U.S. Department of Commerce noted that Americans spent around $150 billion on health and fitness products, with a sizable portion allocated to outdoor fitness gear. This spending increase is driven by a growing public understanding of health benefits derived from outdoor activity, particularly among younger demographics who value experiences over material goods. Spending data also underscores an increase in the purchase of products such as hiking equipment, bicycles, and outdoor sportswear.

- Eco-Friendly and Sustainable Product Demand: Demand for sustainable outdoor recreation products has risen as consumers become more environmentally conscious. The U.S. Environmental Protection Agency (EPA) recorded a marked increase in consumer preference for eco-friendly products, especially in the outdoor apparel sector, where biodegradable and recycled materials are now commonly used. A report from 2023 highlighted that around 30% of outdoor brands now emphasize sustainability in product design. This shift reflects consumer desire for products that minimize environmental impact while promoting sustainable recreation practices.

Market Challenges

- Seasonal Demand Fluctuations: The outdoor recreation market is subject to significant seasonal fluctuations, impacting product demand and sales. For instance, the U.S. Department of Commerce reported a decrease in outdoor gear sales during the winter months, while summer sees a peak in demand for camping and hiking equipment. Such seasonal trends make it challenging for retailers and manufacturers to maintain steady revenue throughout the year, leading some companies to diversify product lines to stabilize sales.

- Regulatory and Environmental Restrictions: Strict regulations on environmental protection limit certain activities within outdoor recreation. The EPA enforces regulations on emissions and environmental impact, directly affecting the production of motorized recreation products such as ATVs. In 2023, new standards were implemented to reduce carbon emissions from recreational vehicles, posing a compliance cost for manufacturers. These regulations, while aimed at environmental protection, present a challenge for product manufacturers seeking to innovate while remaining compliant with U.S. environmental laws.

U.S. Outdoor Recreation Products Market Future Outlook

Over the next five years, the U.S. Outdoor Recreation Products market is expected to grow significantly, propelled by an increase in consumer interest in outdoor activities, technological advancements in outdoor gear, and expanding e-commerce accessibility. Increased consumer awareness about sustainable and eco-friendly options will also play a crucial role, driving demand for brands that prioritize environmental responsibility and product longevity.

Opportunities

- Expansion of E-commerce in Outdoor Products: E-commerce has opened significant avenues for the U.S. outdoor recreation products market, with online sales of outdoor gear rising considerably. The U.S. Census Bureau reported that in 2023, e-commerce accounted for nearly 23% of all outdoor product sales, a jump driven by consumer preference for convenience and a wider product variety. This digital shift allows smaller brands to reach a national audience and capitalize on the growing online retail trend, presenting a prime opportunity for further market expansion.

- Technological Innovations in Gear and Equipment: Advancements in technology have led to the development of more efficient, lightweight, and durable outdoor products. For example, innovations in materials science have produced waterproof yet breathable fabrics now widely used in outdoor apparel. In 2023, the Department of Defenses Research & Engineering reported developments in compact, high-efficiency batteries for portable outdoor devices. Such innovations allow consumers to experience enhanced outdoor products, with further R&D likely to fuel market growth.

Scope of the Report

|

Product Type |

Camping Equipment Hiking Gear Water Sports Equipment Cycling Gear Outdoor Apparel |

|

Distribution Channel |

Online Retail Specialty Stores Department Stores Hypermarkets/Supermarkets |

|

Consumer Age Group |

Youth Adults Seniors |

|

Seasonality |

Summer Products Winter Products Year-Round Essentials |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Outdoor Retail Chains and Specialty Companies

E-commerce Platform Companies

Outdoor Sports and Adventure Clubs

National Parks and Recreation Services (U.S. National Park Service)

Eco-Friendly Outdoor Product Manufacturing Industries

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency)

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report

REI Co-op

Patagonia

The North Face

YETI Holdings

Columbia Sportswear

Marmot

Arc'teryx

L.L. Bean

Coleman (Newell Brands)

Big Agnes

Table of Contents

1. U.S. Outdoor Recreation Products Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. U.S. Outdoor Recreation Products Market Size (in USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. U.S. Outdoor Recreation Products Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Interest in Outdoor Activities

3.1.2 Rising Consumer Spending on Health and Wellness

3.1.3 Eco-Friendly and Sustainable Product Demand

3.1.4 Government Initiatives Supporting Outdoor Recreation

3.2 Market Challenges

3.2.1 Seasonal Demand Fluctuations

3.2.2 Regulatory and Environmental Restrictions

3.2.3 High Competition from Low-Cost Imports

3.3 Opportunities

3.3.1 Expansion of E-commerce in Outdoor Products

3.3.2 Technological Innovations in Gear and Equipment

3.3.3 Partnerships with National Parks and Recreation Agencies

3.4 Trends

3.4.1 Increase in Multi-Purpose Gear Demand

3.4.2 Focus on Lightweight and Compact Products

3.4.3 Growth in Outdoor Digital Platforms and Services

3.5 Government Regulations

3.5.1 National Outdoor Recreation Act

3.5.2 Sustainability and Environmental Compliance

3.5.3 Safety Standards for Outdoor Equipment

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. U.S. Outdoor Recreation Products Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Camping Equipment

4.1.2 Hiking Gear

4.1.3 Water Sports Equipment

4.1.4 Cycling Gear

4.1.5 Outdoor Apparel

4.2 By Distribution Channel (in Value %)

4.2.1 Online Retail

4.2.2 Specialty Stores

4.2.3 Department Stores

4.2.4 Hypermarkets/Supermarkets

4.3 By Consumer Age Group (in Value %)

4.3.1 Youth

4.3.2 Adults

4.3.3 Seniors

4.4 By Seasonality (in Value %)

4.4.1 Summer Products

4.4.2 Winter Products

4.4.3 Year-Round Essentials

4.5 By Region (in Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. U.S. Outdoor Recreation Products Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 REI Co-op

5.1.2 Patagonia

5.1.3 The North Face

5.1.4 Columbia Sportswear

5.1.5 Marmot

5.1.6 Black Diamond Equipment

5.1.7 Arc'teryx

5.1.8 L.L. Bean

5.1.9 YETI Holdings

5.1.10 Coleman (Newell Brands)

5.1.11 La Sportiva

5.1.12 Big Agnes

5.1.13 Mountain Hardwear

5.1.14 Fjllrven

5.1.15 Hydro Flask

5.2 Cross Comparison Parameters (Revenue, Market Position, Brand Recognition, Product Range, Innovation, Sustainability Initiatives, Online Presence, Consumer Ratings)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. U.S. Outdoor Recreation Products Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. U.S. Outdoor Recreation Products Future Market Size (in USD)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. U.S. Outdoor Recreation Products Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Distribution Channel (in Value %)

8.3 By Consumer Age Group (in Value %)

8.4 By Seasonality (in Value %)

8.5 By Region (in Value %)

9.U.S. Outdoor Recreation Products Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the U.S. Outdoor Recreation Products market. This step was underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the U.S. Outdoor Recreation Products market was compiled and analyzed. This included assessing market penetration, product demand, and revenue generation metrics, alongside quality statistics to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry experts representing various companies. These consultations provided valuable insights into operational and financial dynamics within the sector, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple outdoor product manufacturers to acquire insights into product trends, sales performance, consumer preferences, and other pertinent factors. This process verified and complemented statistics derived from the bottom-up approach, ensuring a comprehensive analysis of the U.S. Outdoor Recreation Products market.

Frequently Asked Questions

01. How big is the U.S. Outdoor Recreation Products market?

The U.S. Outdoor Recreation Products market is valued at USD 103.5 billion, driven by increasing interest in outdoor activities and sustainable product demand.

02. What are the key challenges in the U.S. Outdoor Recreation Products market?

Challenges include high seasonal demand fluctuations, regulatory restrictions, and competition from low-cost imports, all impacting the profitability and operational consistency of the market.

03. Who are the major players in the U.S. Outdoor Recreation Products market?

Key players include REI Co-op, Patagonia, The North Face, YETI Holdings, and Columbia Sportswear, noted for their brand recognition, quality, and sustainability practices.

04. What are the growth drivers of the U.S. Outdoor Recreation Products market?

Growth is driven by increased consumer focus on health and wellness, technological advancements in outdoor gear, and the growth of eco-friendly, sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.