US Pediatrics Supplements Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1426

November 2024

95

About the Report

US Pediatrics Supplements Market Overview

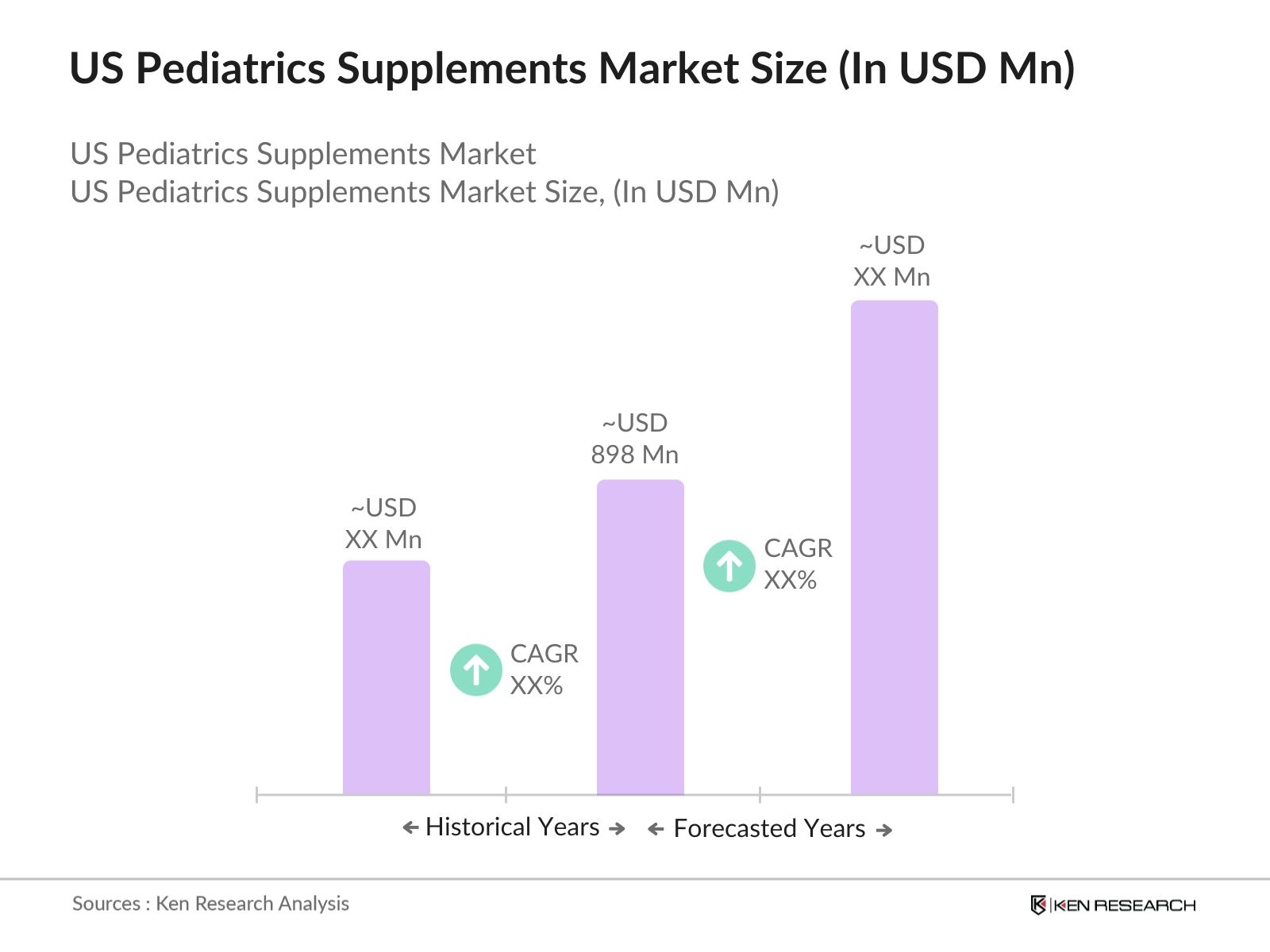

- The U.S. Pediatrics Supplements Market is valued at USD 898 million, based on a comprehensive five-year historical analysis. This valuation is driven by the rising awareness among parents regarding childrens nutritional needs, particularly as dietary habits and lifestyles have shifted. The demand for supplements addressing essential vitamins, minerals, and immune-boosting probiotics has significantly expanded, further propelled by the growing pediatric recommendations by healthcare providers to supplement daily nutritional intake.

- Key metropolitan areas such as New York, Los Angeles, and Chicago hold prominence in the pediatrics supplements market, primarily due to higher disposable incomes, increased health awareness among parents, and access to specialized pediatric healthcare services. These cities also have a robust network of pharmacies and specialty health stores, ensuring product availability and variety.

- The FDA imposes specific guidelines for pediatric supplements, including ingredient safety checks and dosage regulations. As of 2023, compliance is mandatory under the FDAs Dietary Supplement Health and Education Act, with nearly 500 products subject to FDA audits annually to ensure child safety. These guidelines provide a regulatory framework for safe pediatric product development.

US Pediatrics Supplements Market Segmentation

The U.S. Pediatrics Supplements Market is segmented by product type and by distribution channel.

- By Product Type: The U.S. Pediatrics Supplements Market is segmented by product type into Vitamins, Minerals, Omega-3 and DHA, Probiotics, and Protein Supplements. Recently, Vitamins have shown dominant market share within this segment due to their comprehensive role in supporting child health and immunity. Vitamins, such as Vitamin D and Vitamin C, are commonly recommended for pediatric use to address potential deficiencies, which are more prevalent in children with restricted diets or specific health needs.

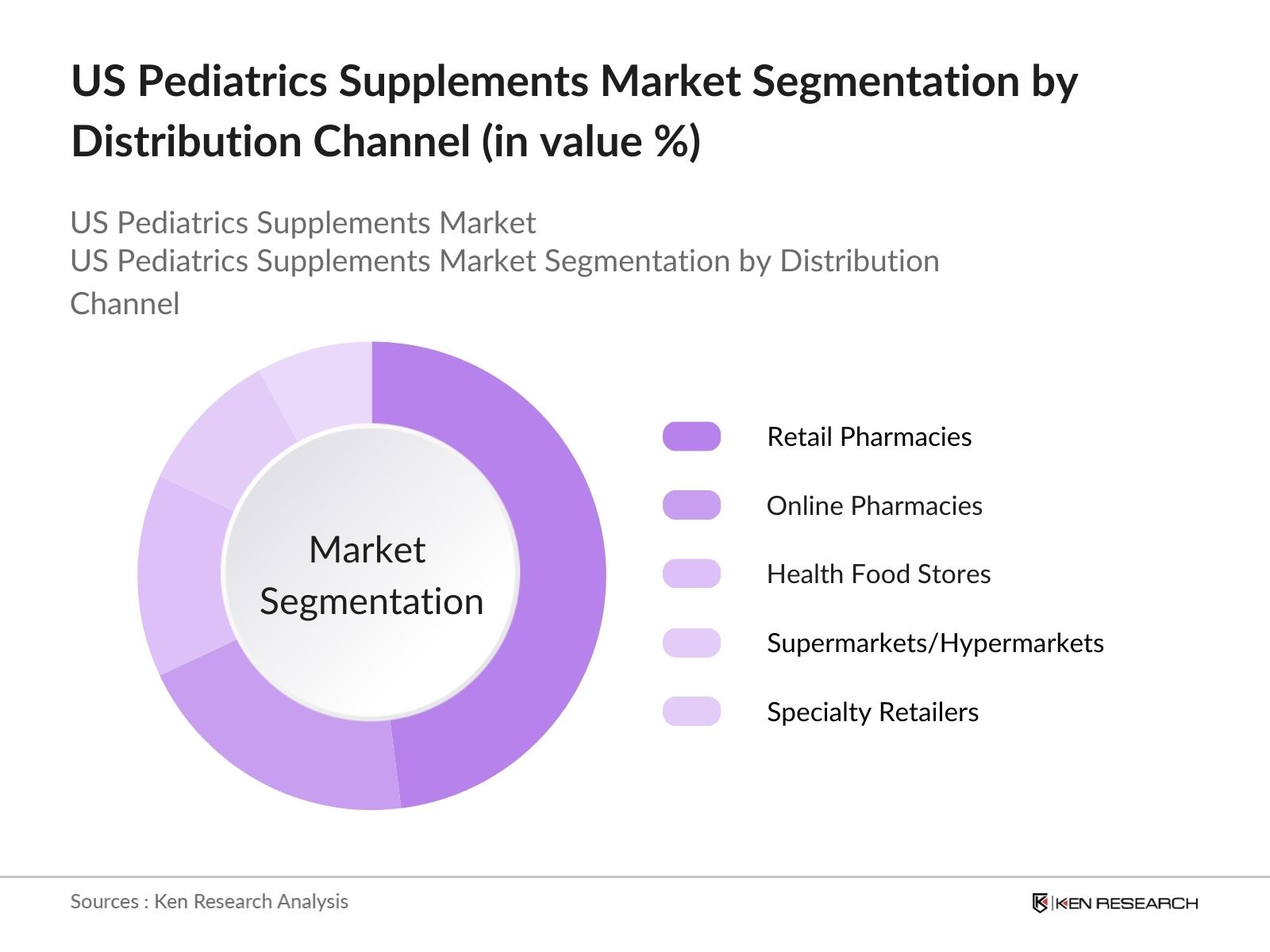

- By Distribution Channel: The market is also segmented by distribution channel into Retail Pharmacies, Online Pharmacies, Health Food Stores, Supermarkets/Hypermarkets, and Specialty Retailers. Retail Pharmacies dominate this segment, with nearly half of all sales occurring in these locations. This dominance is due to the trusted nature of pharmacies and direct interactions with pharmacists who provide product recommendations to parents. Additionally, retail pharmacies are often more accessible and offer a curated selection of pediatric-specific products.

US Pediatrics Supplements Market Competitive Landscape

The U.S. Pediatrics Supplements Market features a range of key players that drive competition through innovative product lines, robust distribution networks, and targeted marketing efforts. Notably, the market includes both large multinational corporations and specialized nutrition brands. The market is marked by high consolidation, where major players maintain significant influence through established product reputations, consistent quality certifications, and strong distribution channels.

US Pediatrics Supplements Market Analysis

Growth Drivers

- Increasing Focus on Pediatric Health: Rising investments in child healthcare underscore the expanding focus on pediatric health in the U.S. The federal government allocated $13 billion in 2023 toward initiatives supporting childrens health, including those addressing nutritional gaps through supplements. Additionally, U.S. pediatric healthcare expenditure has grown, with significant resources directed toward preventive care and addressing nutrition gaps. Pediatric health organizations, including the American Academy of Pediatrics, emphasize the importance of nutritional supplements for specific pediatric age groups, reflecting a proactive stance on healthcare.

- Rise in Parental Awareness of Pediatric Nutrition: Parental awareness surrounding pediatric nutrition has increased, with data indicating that 84% of U.S. parents expressed concerns over their childs nutrient intake in 2023. Educational campaigns by health agencies and pediatric societies emphasize the benefits of early nutritional supplementation. This increase in awareness aligns with findings that parents spend over $200 per year on supplements per child for essential vitamins and minerals, especially in families following specific diets like veganism.

- Growing Prevalence of Nutritional Deficiencies: A CDC survey highlights that nearly 31% of U.S. children aged 2-11 years experience at least one form of nutritional deficiency. Deficiencies in vitamins D, B12, and iron are notably prevalent among children, affecting cognitive and physical development, and leading to higher demand for pediatric supplements. With pediatric anemia cases reported in nearly 5 million children, parental demand for corrective supplements has been substantial, indicating a targeted growth driver for this market.

Market Challenges

Stringent Regulatory Approvals: Pediatric supplements face rigorous FDA scrutiny, with products requiring compliance with safety and efficacy standards under the Dietary Supplement Health and Education Act. The approval process includes evaluations for ingredient safety, with nearly 40% of pediatric supplements delayed due to compliance issues, extending launch timelines. This rigorous process impacts manufacturers, as FDA-reported delays in 2023 reached an average of 120 days, underscoring regulatory hurdles for market players.

Concerns Over Product Efficacy and Safety: Parental concern over supplement safety has increased, with 25% of surveyed parents expressing skepticism regarding product efficacy, according to a 2023 CDC report. Reports have also highlighted instances of undeclared allergens or contaminants, adding to efficacy concerns. Regulatory agencies identified over 300 supplement recalls in 2023 due to contamination issues, emphasizing the ongoing challenge of meeting safety expectations and ensuring product efficacy

US Pediatrics Supplements Market Future Outlook

Over the next five years, the U.S. Pediatrics Supplements Market is expected to see robust growth, driven by factors such as increased awareness around pediatric health and wellness, innovation in supplement formulations, and rising parental demand for organic and natural product options. Expanding e-commerce avenues and partnerships with pediatricians are anticipated to play a key role in shaping market dynamics, with product diversification aligning with new health trends.

Market Opportunities

- Demand for Organic and Natural Supplements: Consumer preference for organic supplements has grown, with an estimated 10 million households in the U.S. actively purchasing organic health products for children. Organic-certified pediatric supplements saw a 23% increase in demand in 2023, especially for products containing natural vitamins and minerals derived from organic sources. This trend highlights a substantial market opportunity as parents increasingly seek non-GMO, additive-free options for their children.

- Expansion into Functional Beverages and Gummies: Functional beverages and gummy supplements targeting children have experienced a 19% sales increase, with gummies being particularly popular due to their palatability. The preference for convenient supplement forms has driven investments in pediatric gummy and beverage lines, representing 15% of all new supplement products launched in 2023. This shift is expected to diversify pediatric supplement options, catering to varied preferences.

Scope of the Report

|

||||

|

By Form |

Gummies Chewables Liquid Drops Powders Capsules |

|||

|

By Distribution Channel |

Retail Pharmacies Online Pharmacies Health Food Stores Supermarkets/Hypermarkets Specialty Retailers |

|||

|

By Age Group |

Infants Toddlers Children Adolescents |

|||

|

By Region |

North East West South |

Products

Key Target Audience

Pediatrics Nutrition Companies

Pediatrics Healthcare Providers

Government and Regulatory Bodies (FDA, CDC)

Online Pharmacies and E-commerce Platforms

Pharmaceutical Distributors

Health Food Retail Chains

Parents and Guardians Organizations

Banks and Financial Institutes

Investors and Venture Capitalist Firms

Companies

Players Mention in the Report:

Abbott Laboratories

Amway Corporation

Church & Dwight Co., Inc.

Nestl Health Science

Bayer AG

The Honest Company, Inc.

SmartyPants Vitamins

ChildLife Essentials

Rainbow Light Nutritional Systems

GNC Holdings, LLC

Nordic Naturals

Garden of Life (Nestl)

Hero Nutritionals

Nature's Way

Zarbees Naturals

Table of Contents

1. U.S. Pediatrics Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Pediatrics Supplements Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Pediatrics Supplements Market Dynamics

3.1. Growth Drivers (Health Trends, Parental Awareness, Nutritional Deficiencies)

3.1.1. Increasing Focus on Pediatric Health

3.1.2. Rise in Parental Awareness of Pediatric Nutrition

3.1.3. Growing Prevalence of Nutritional Deficiencies

3.1.4. Influence of Pediatricians on Supplement Prescriptions

3.2. Market Challenges (Regulatory Hurdles, Product Efficacy, Distribution Channels)

3.2.1. Stringent Regulatory Approvals

3.2.2. Concerns Over Product Efficacy and Safety

3.2.3. Complex Distribution Networks

3.2.4. Limited Pediatric-Specific Ingredients

3.3. Opportunities (Product Innovation, Organic Supplements, Digital Marketing)

3.3.1. Demand for Organic and Natural Supplements

3.3.2. Expansion into Functional Beverages and Gummies

3.3.3. Growth in E-commerce Channels

3.3.4. Partnership with Pediatric Organizations

3.4. Trends (Preference for Clean Label, Customized Formulations, Probiotics)

3.4.1. Clean Label and Transparent Ingredient Sourcing

3.4.2. Rising Interest in Probiotic Supplements

3.4.3. Customized Formulations by Age Group

3.4.4. Focus on Allergen-Free Formulations

3.5. Regulatory Landscape

3.5.1. U.S. FDA Guidelines on Pediatric Supplements

3.5.2. Labeling and Allergen Disclosure Requirements

3.5.3. Compliance with cGMP Standards

3.5.4. Pediatric Endorsements and Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Pediatric Supplements Value Chain

4. U.S. Pediatrics Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins

4.1.2. Minerals

4.1.3. Omega-3 & DHA

4.1.4. Probiotics

4.1.5. Protein Supplements

4.2. By Form (In Value %)

4.2.1. Gummies

4.2.2. Chewables

4.2.3. Liquid Drops

4.2.4. Powders

4.2.5. Capsules

4.3. By Distribution Channel (In Value %)

4.3.1. Retail Pharmacies

4.3.2. Online Pharmacies

4.3.3. Health Food Stores

4.3.4. Supermarkets/Hypermarkets

4.3.5. Specialty Retailers

4.4. By Age Group (In Value %)

4.4.1. Infants

4.4.2. Toddlers

4.4.3. Children

4.4.4. Adolescents

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. U.S. Pediatrics Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Amway Corporation

5.1.3. Church & Dwight Co., Inc.

5.1.4. Nestl Health Science

5.1.5. Bayer AG

5.1.6. The Honest Company, Inc.

5.1.7. SmartyPants Vitamins

5.1.8. ChildLife Essentials

5.1.9. Rainbow Light Nutritional Systems

5.1.10. GNC Holdings, LLC

5.1.11. Nordic Naturals

5.1.12. Garden of Life (Nestl)

5.1.13. Hero Nutritionals

5.1.14. Nature's Way

5.1.15. Zarbees Naturals

5.2. Cross Comparison Parameters (Revenue, Headquarters, Establishment Year, Number of Products, Distribution Reach, Marketing Channels, R&D Investments, Product Certification)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Innovations, Brand Partnerships, Pediatric Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

5.8. Pediatric Health Initiatives

6. U.S. Pediatrics Supplements Market Regulatory Framework

6.1. Compliance with Pediatric Health and Safety Standards

6.2. Mandatory Certifications (e.g., NSF, USDA Organic)

6.3. Ingredient Quality and Testing Requirements

6.4. Advertising Standards for Pediatric Supplements

7. U.S. Pediatrics Supplements Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. U.S. Pediatrics Supplements Future Market Segmentation

8.1. By Product Type

8.2. By Form

8.3. By Distribution Channel

8.4. By Age Group

8.5. By Region

9. U.S. Pediatrics Supplements Market Analysts Recommendations

9.1. Total Addressable Market Analysis

9.2. Customer Demographic Insights

9.3. Marketing and Brand Positioning Strategies

9.4. White Space Opportunities in Pediatric Supplements

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the market ecosystem of pediatric supplements in the U.S., focusing on major stakeholders and key variables that impact market trends. The objective is to delineate the primary drivers, barriers, and opportunities within the ecosystem.

Step 2: Market Analysis and Construction

We compile and examine historical data, focusing on distribution channels, age-specific supplement demand, and consumer health trends. This phase is critical in calculating the market penetration and revenue share by segment.

Step 3: Hypothesis Validation and Expert Consultation

Through targeted consultations with industry experts, including pediatric nutritionists and pharmacists, we validate market hypotheses to confirm critical insights. These discussions provide operational insights that inform revenue estimations and market dynamics.

Step 4: Research Synthesis and Final Output

This step involves integrating data gathered through direct consultations and secondary research, ensuring a well-rounded analysis. The final output reflects accurate, validated statistics and offers actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the U.S. Pediatrics Supplements Market?

The U.S. Pediatrics Supplements Market is valued at USD 898 million, driven by the increasing demand for pediatric nutritional solutions, along with rising parental awareness of childrens health.

02. What are the challenges in the U.S. Pediatrics Supplements Market?

Challenges in U.S. Pediatrics Supplements Market include regulatory compliance, product efficacy concerns, and the need for high safety standards. Moreover, the competitive landscape creates a pressure to innovate constantly.

03. Who are the major players in the U.S. Pediatrics Supplements Market?

Major players in U.S. Pediatrics Supplements Market include Abbott Laboratories, Bayer AG, SmartyPants Vitamins, and The Honest Company. These companies are key due to their focus on quality certifications and distribution channels.

04. What are the growth drivers of the U.S. Pediatrics Supplements Market?

Growth drivers in U.S. Pediatrics Supplements Market include increasing awareness of pediatric health needs, product innovations such as clean-label supplements, and expanding online retail options.

05. How does distribution impact the U.S. Pediatrics Supplements Market?

Retail pharmacies are the dominant channel due to their accessibility and the trusted advice provided by pharmacists, driving consumer confidence in product recommendations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.