U.S. Pen Needles Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD9459

December 2024

94

About the Report

U.S. Pen Needles Market Overview

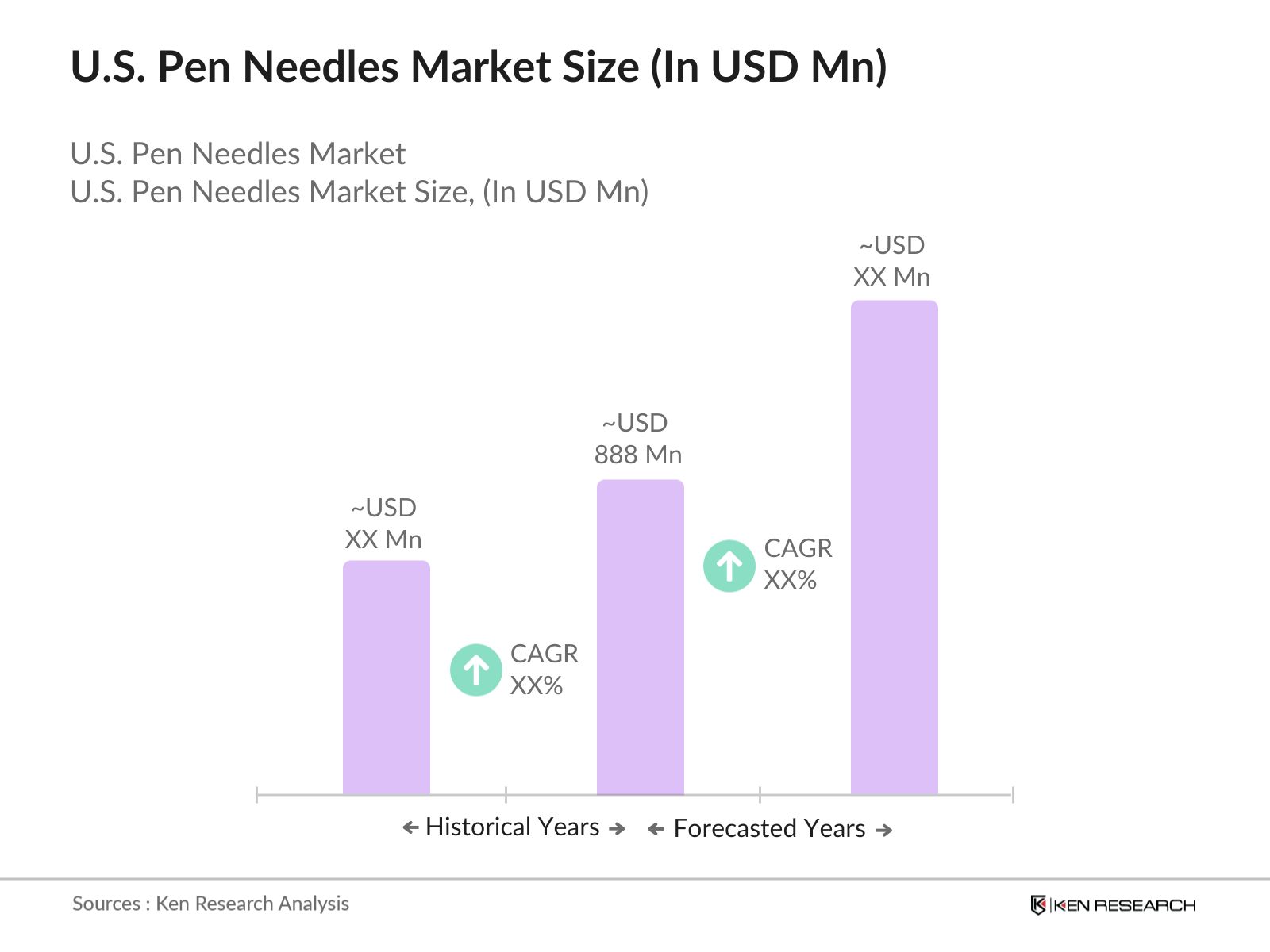

- The U.S. Pen Needles market is valued at USD 888 million, primarily driven by the increasing prevalence of diabetes and the rising demand for insulin delivery systems among the aging population. As more individuals turn to self-administration of insulin, the use of pen needles has surged. Government efforts to promote better diabetes management, coupled with advancements in pen needle technologies, have further fueled this growth.

- In terms of geographical dominance, cities like New York, Los Angeles, and Houston lead the market. These cities have a high prevalence of diabetes cases, and their well-developed healthcare infrastructure ensures easier access to advanced insulin administration tools. Additionally, the higher disposable income levels in these regions contribute to the increased adoption of safety and smart pen needles, which are more expensive but offer greater convenience and reduced risk.

- The U.S. Food and Drug Administration (FDA) regulates the safety and efficacy of pen needles. In 2024, the FDA approved several new pen needle models featuring advanced safety and comfort designs, including ultra-thin needles and smart technologies. These approvals ensure that pen needles meet rigorous safety standards, enhancing patient trust in these products. The FDAs continuous monitoring and regulation play a vital role in ensuring the availability of high-quality pen needles in the U.S. market.

U.S. Pen Needles Market Segmentation

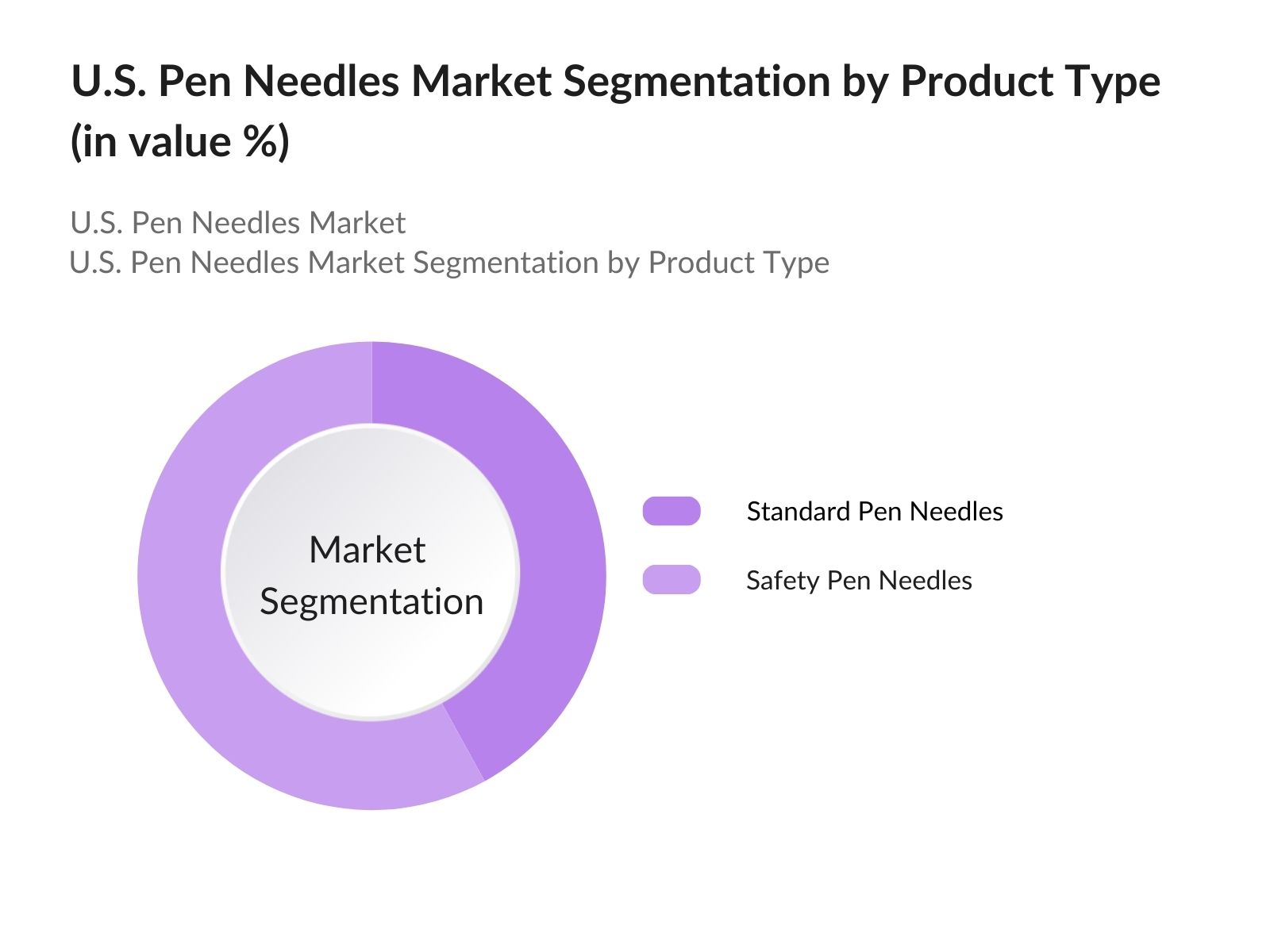

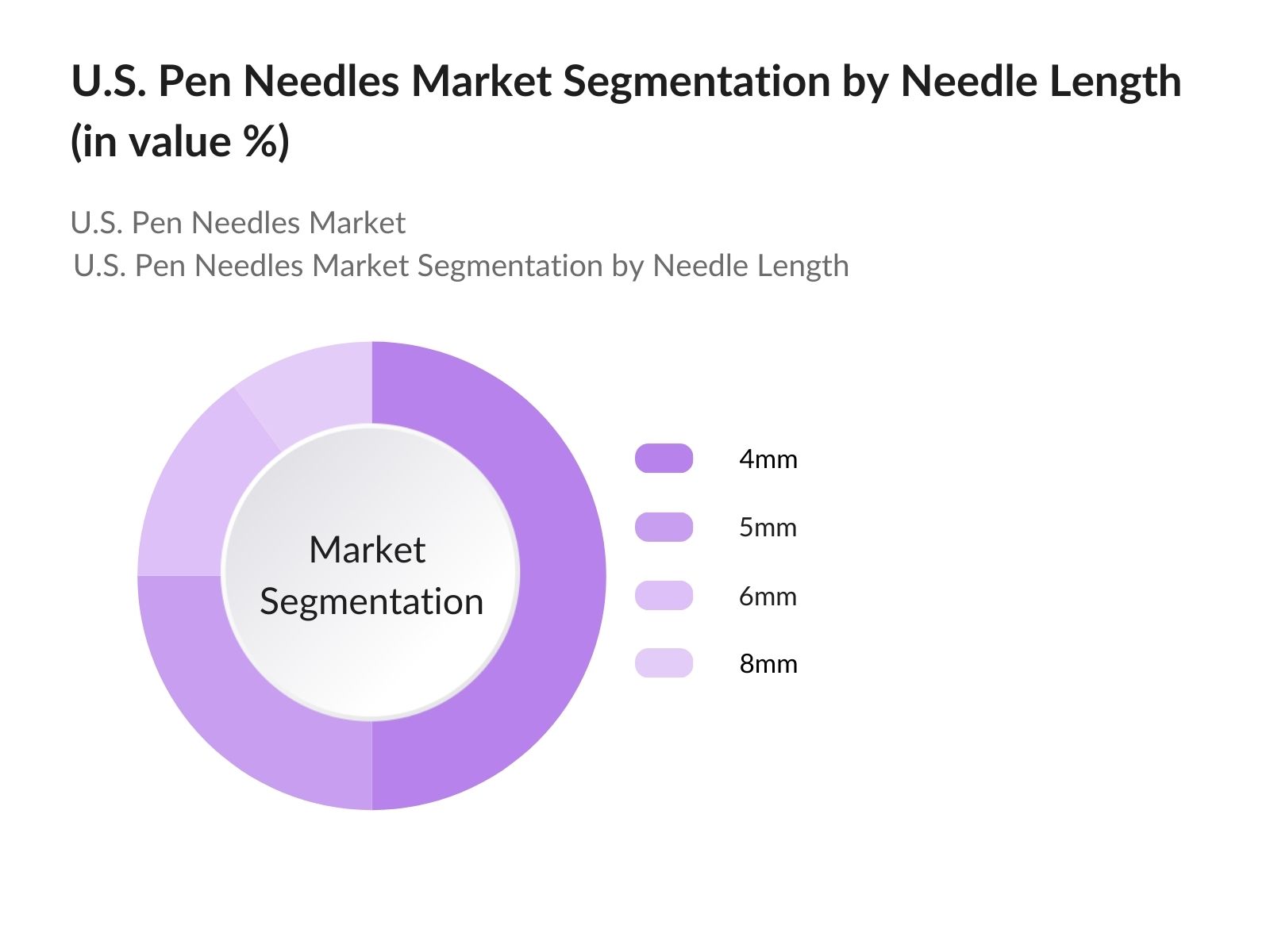

The U.S. Pen Needles market is segmented by product type and by needle length.

- By Product Type: The U.S. Pen Needles market is segmented by product type into standard pen needles and safety pen needles. Recently, safety pen needles have dominated the market share due to increasing awareness about the risks associated with needle-stick injuries and the need for safer insulin delivery methods. These needles are designed with retractable mechanisms, reducing the chances of accidental injuries, which makes them popular in hospitals, clinics, and home care settings. Furthermore, safety regulations in the U.S. have encouraged healthcare providers to adopt these safer alternatives.

- By Needle Length: The U.S. Pen Needles market is also segmented by needle length into 4mm, 5mm, 6mm, and 8mm. Among these, 4mm needles have the largest market share. The dominance of this sub-segment is driven by the fact that shorter needles provide more comfort and are clinically proven to deliver insulin effectively, regardless of a patients body mass index (BMI). This shorter length also minimizes the risk of injecting insulin into the muscle, which can lead to hypoglycemia. These attributes have made 4mm needles the preferred choice among both healthcare professionals and patients.

U.S. Pen Needles Competitive Landscape

The U.S. Pen Needles market is dominated by a few major players, including BD (Becton, Dickinson and Company), which is the leading provider of both standard and safety pen needles, and other global manufacturers such as Novo Nordisk and Ypsomed. This consolidation is due to the high R&D investments required for developing safer and more advanced pen needles, as well as the need for adherence to stringent regulatory standards in the U.S. market.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Market Share |

|

BD (Becton, Dickinson) |

1897 |

Franklin Lakes, NJ |

|||

|

Novo Nordisk |

1923 |

Bagsvrd, Denmark |

|||

|

Ypsomed |

1984 |

Burgdorf, Switzerland |

|||

|

Owen Mumford |

1952 |

Oxfordshire, UK |

|||

|

Terumo Corporation |

1921 |

Tokyo, Japan |

U.S. Pen Needles Industry Analysis

Market Growth Drivers

- Increase in Diabetic Population: The rising diabetic population is a significant driver for pen needles in the U.S. As of 2024, approximately 37.3 million Americans have diabetes, according to the Centers for Disease Control and Prevention (CDC). With a growing portion of these individuals using insulin injections, pen needles have become a primary tool for insulin administration. The International Diabetes Federation confirms that diabetes management through injections remains a dominant method, especially in older populations who account for over 90% of insulin-dependent cases. This rise in diabetes prevalence significantly pushes the demand for pen needles.

- Technological Advancements in Pen Needles: Technological advancements are revolutionizing the pen needles market. Innovations like ultra-fine needle tips (down to 4mm in length and 32G in thickness) reduce pain and improve ease of use, making them popular among diabetic patients. In 2024, about 60% of patients reported favoring newer needle designs that enhance comfort and accuracy during self-administration. Additionally, improvements in needle lubrication have made insertion smoother, further boosting adoption among both older adults and younger patients with Type 1 diabetes.

Market Challenges

- High Costs Associated with Pen Needles: The cost of pen needles remains a barrier for many patients, even with insurance. On average, the cost of pen needles ranges between $25 and $50 for a pack of 100, depending on the brand and needle specifications. In 2024, approximately 20% of diabetic patients in the U.S. reported difficulties in affording their insulin injection supplies, according to the Kaiser Family Foundation. High out-of-pocket costs can limit access, especially among low-income groups and those without comprehensive health insurance coverage.

- Alternatives to Pen Needles (Inhalable Insulin, Insulin Pumps): Alternatives to pen needles, such as inhalable insulin and insulin pumps, present a challenge to the pen needle market. Inhalable insulin, introduced in the U.S. market in recent years, offers a needle-free solution, attracting patients with needle phobia. Insulin pump adoption is also on the rise, with 10% of insulin-dependent patients in 2023 using pumps instead of pen needles. These alternatives are more expensive initially but are seen as more convenient and less invasive in the long term, impacting pen needle sales.

U.S. Pen Needles Market Future Outlook

Over the next few years, the U.S. Pen Needles market is expected to experience continued growth due to advancements in pen needle technology, increasing government support for diabetes management, and an aging population that is more reliant on insulin administration. As technology evolves, smart pen needles that offer real-time data tracking and better control over dosage are expected to see increased adoption. Furthermore, environmental concerns may drive the development of more eco-friendly and biodegradable pen needles, adding to market growth.

Market Opportunities

- Growing Aging Population: The aging population in the U.S. is one of the primary drivers of demand for pen needles. In 2024, over 56 million Americans are aged 65 and older, according to the U.S. Census Bureau, with nearly 30% of them managing diabetes. This demographic heavily relies on insulin injections, increasing the need for accessible and comfortable pen needles. As the U.S. population continues to age, the demand for diabetic management solutions such as pen needles is expected to rise.

- Increasing Demand in Emerging Markets: U.S. manufacturers of pen needles are seeing growing demand in emerging markets, particularly in Asia and Latin America. In 2024, the U.S. exported over $1.2 billion worth of medical devices, including pen needles, to these regions, driven by a growing middle class and an increasing prevalence of diabetes in countries like India and Brazil. U.S. companies are capitalizing on this demand by expanding distribution networks and forming partnerships with local healthcare providers.

Scope of the Report

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics)

Home Care Settings

Long-Term Care Facilities

Diabetes Care Centers

Insulin Manufacturers

Investors and Venture Capital Firms

Government and Regulatory Bodies (U.S. FDA, CDC)

Distributors and Wholesalers

Companies

U.S. Pen Needles Major Players

BD (Becton, Dickinson and Company)

Novo Nordisk

Ypsomed

Owen Mumford

Terumo Corporation

HTL-STREFA S.A.

Ultimed, Inc.

Allison Medical

Artsana S.p.A.

Hindustan Syringes & Medical Devices

Twobiens Co. Ltd.

Shanghai Kindly Enterprise Development Group

Sugama Needle Co., Ltd.

VOGT Medical

Promisemed Medical Supplies

Table of Contents

1. U.S. Pen Needles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Pen Needles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Pen Needles Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Diabetic Population

3.1.2. Technological Advancements in Pen Needles

3.1.3. Rising Preference for Self-Administration of Medication

3.1.4. Government Initiatives Supporting Diabetes Management

3.2. Market Challenges

3.2.1. High Costs Associated with Pen Needles

3.2.2. Alternatives to Pen Needles (Inhalable Insulin, Insulin Pumps)

3.2.3. Issues with Needle Phobia

3.3. Opportunities

3.3.1. Growing Aging Population

3.3.2. Increasing Demand in Emerging Markets

3.3.3. Development of Eco-friendly Pen Needles

3.4. Trends

3.4.1. Smart Pen Needles Integration

3.4.2. Needle Retraction Technology

3.4.3. Collaboration with Insulin Pen Manufacturers

3.5. Government Regulation

3.5.1. U.S. FDA Approvals for Pen Needles

3.5.2. Reimbursement Policies

3.5.3. Safety Guidelines for Needle Use

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. Pen Needles Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Standard Pen Needles

4.1.2. Safety Pen Needles

4.2. By Needle Length (In Value %)

4.2.1. 4mm

4.2.2. 5mm

4.2.3. 6mm

4.2.4. 8mm

4.3. By Gauge (In Value %)

4.3.1. 31G

4.3.2. 32G

4.3.3. 33G

4.4. By Application (In Value %)

4.4.1. Diabetes Management

4.4.2. Growth Hormone Therapy

4.4.3. Fertility Treatments

4.5. By End User (In Value %)

4.5.1. Hospitals

4.5.2. Clinics

4.5.3. Home Care Settings

4.5.4. Long-term Care Facilities

5. U.S. Pen Needles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BD (Becton, Dickinson and Company)

5.1.2. Novo Nordisk

5.1.3. Owen Mumford Ltd.

5.1.4. Ypsomed

5.1.5. Terumo Corporation

5.1.6. HTL-STREFA S.A.

5.1.7. Allison Medical

5.1.8. Artsana S.p.A.

5.1.9. Ultimed, Inc.

5.1.10. Hindustan Syringes & Medical Devices

5.1.11. Twobiens Co. Ltd.

5.1.12. Shanghai Kindly Enterprise Development Group

5.1.13. Sugama Needle Co., Ltd.

5.1.14. VOGT Medical

5.1.15. Promisemed Medical Supplies

5.2. Cross Comparison Parameters

No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Production Capacity, Market Share

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Pen Needles Market Regulatory Framework

6.1. U.S. FDA Regulatory Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. U.S. Pen Needles Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Pen Needles Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Needle Length (In Value %)

8.3. By Gauge (In Value %)

8.4. By Application (In Value %)

8.5. By End User (In Value %)

9. U.S. Pen Needles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified key variables influencing the U.S. Pen Needles market by constructing an ecosystem map of major stakeholders, including manufacturers, distributors, and healthcare providers. Extensive desk research using proprietary databases was conducted to define market dynamics and key drivers.

Step 2: Market Analysis and Construction

During this step, we compiled historical data related to the market, focusing on key performance metrics such as market penetration rates, sales data, and market share of pen needles. Analysis was carried out to validate the accuracy and reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We consulted with industry experts via telephone interviews to validate market hypotheses, providing valuable insights into operational efficiencies, sales channels, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from various manufacturers to validate the insights collected and ensure the accuracy of the bottom-up analysis. This data was cross-checked with expert insights and additional secondary research sources.

Frequently Asked Questions

01. How big is the U.S. Pen Needles Market?

The U.S. Pen Needles market is valued at approximately USD 888 million, driven by the increasing prevalence of diabetes and the rise of self-administered insulin therapy.

02. What are the challenges in the U.S. Pen Needles Market?

Challenges in the U.S. Pen Needles market include the high cost of safety needles, alternatives such as insulin pumps, and consumer reluctance due to needle phobia.

03. Who are the major players in the U.S. Pen Needles Market?

Major players in U.S. Pen Needles market include BD (Becton, Dickinson), Novo Nordisk, Ypsomed, Owen Mumford, and Terumo Corporation, all of which have established themselves through R&D investments and strategic partnerships.

04. What are the growth drivers of the U.S. Pen Needles Market?

Growth is propelled in U.S. Pen Needles market by factors such as the increasing prevalence of diabetes, advancements in pen needle technology, and government initiatives to promote better diabetes care.

05. Which product type dominates the U.S. Pen Needles Market?

Safety pen needles dominate the U.S. Pen Needles market due to growing awareness about the risks of needle-stick injuries and stringent healthcare safety regulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.