US Personal Mobility Devices Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD9159

December 2024

94

About the Report

USA Personal Mobility Devices Market Overview

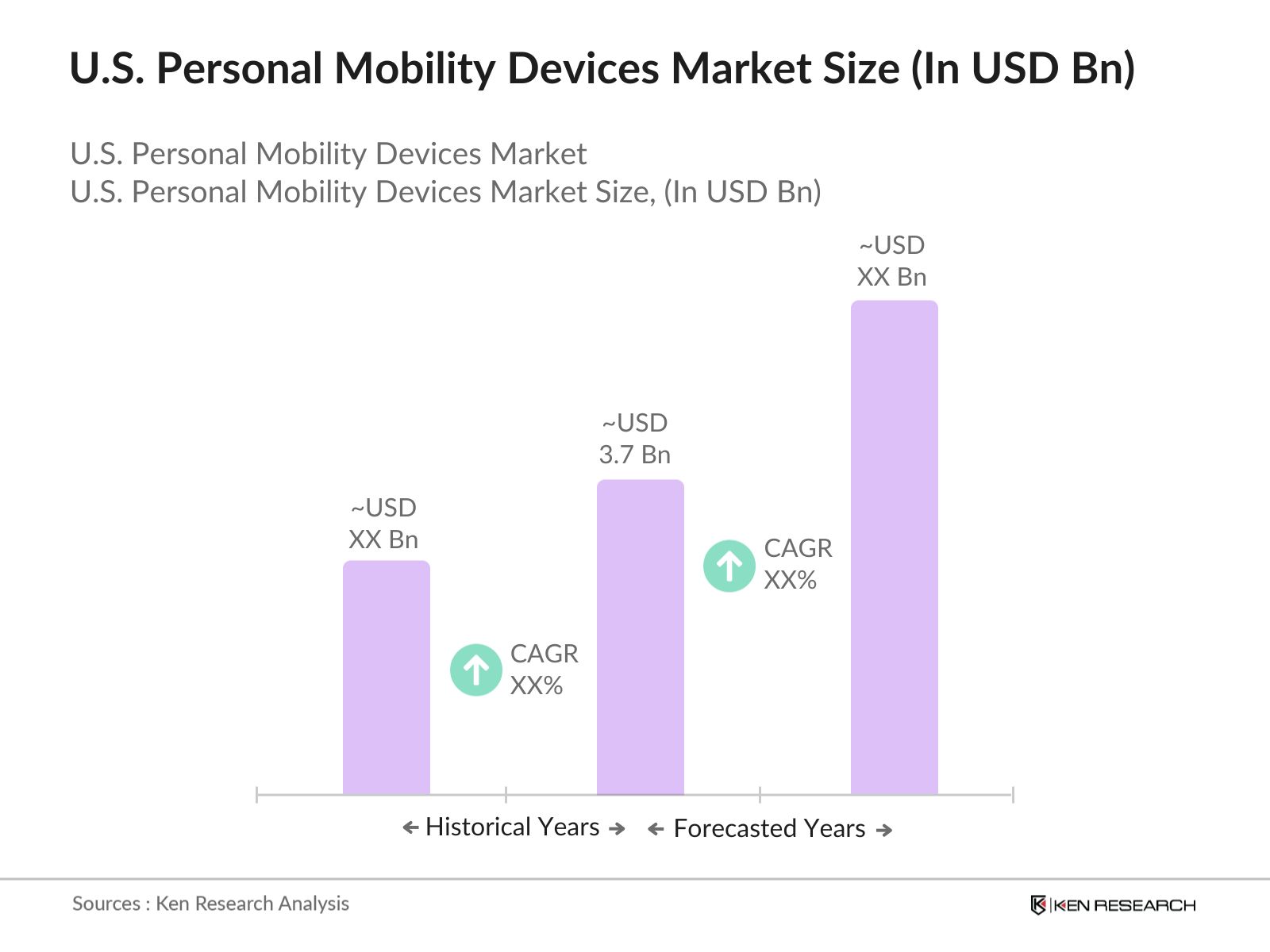

- The U.S. Personal Mobility Devices market is valued at USD 3.7 billion, based on a comprehensive five-year analysis of historical trends. This market growth is fueled by an aging population, rising cases of mobility-related disabilities, and advancements in assistive technology. Increasing awareness and accessibility, alongside government support through Medicare and Medicaid, have further driven market penetration across urban and rural areas.

- Cities like New York, Los Angeles, and Chicago dominate the personal mobility devices market in the U.S. due to their dense populations, higher aging demographics, and strong healthcare infrastructure. These regions have well-established supply chains, greater adoption of advanced technologies, and a robust presence of manufacturers and distributors catering to a variety of mobility needs.

- Indias Accessible India Campaign and Chinas Disability Development Fund are allocating resources to ensure assistive devices reach rural and underprivileged populations. China alone has set aside RMB 100 billion in 2024 for nationwide distribution programs.

USA Personal Mobility Devices Market Segmentation

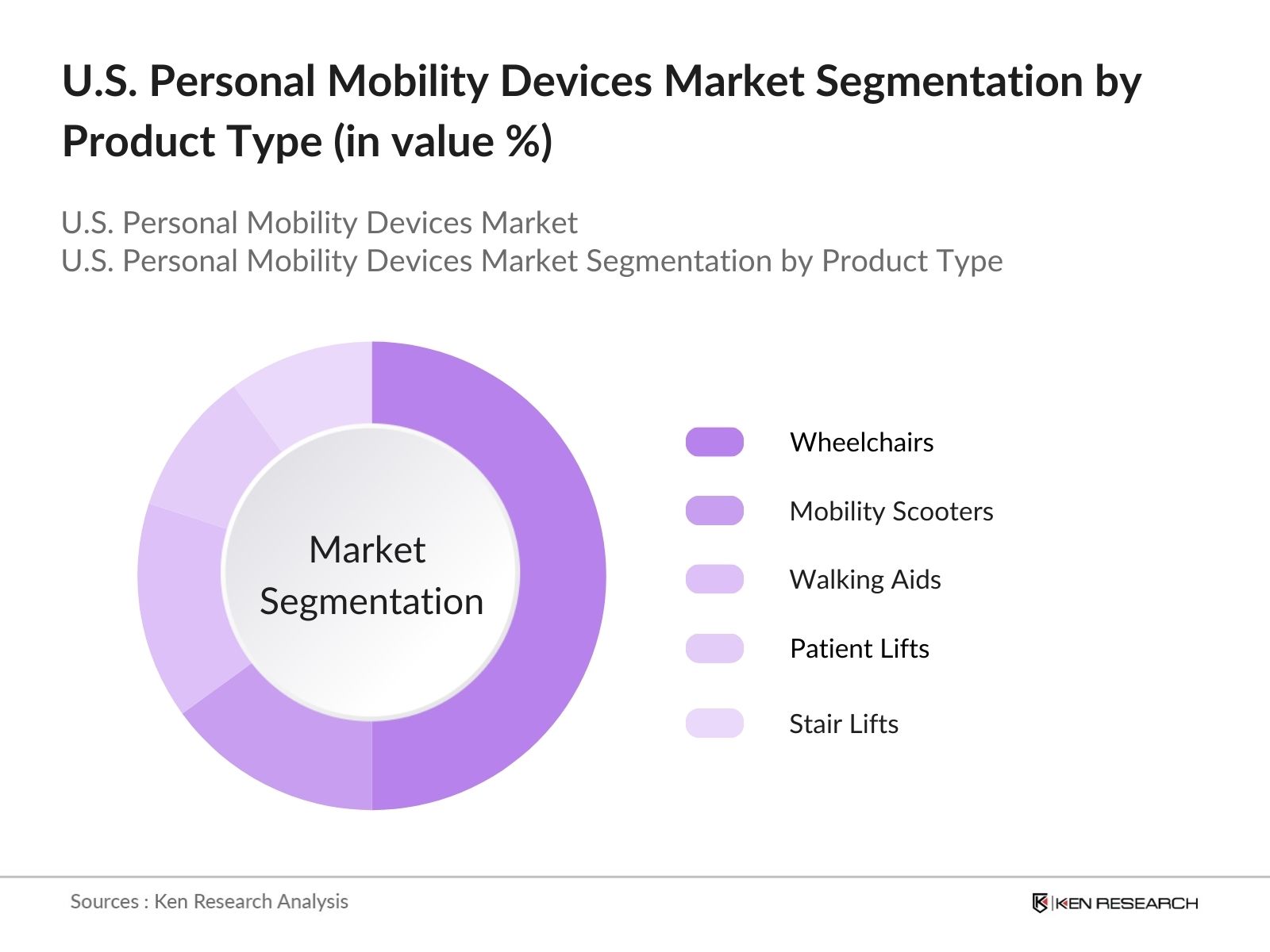

By Product Type: The U.S. Personal Mobility Devices market is segmented by product type into wheelchairs, mobility scooters, walking aids, patient lifts, and stair lifts. Wheelchairs (manual and powered) dominate the segment due to their essential role in enhancing mobility for people with severe disabilities. Powered wheelchairs, in particular, have witnessed increased adoption owing to their advanced features, including customizable controls and longer battery life. This makes them a preferred choice among users seeking higher autonomy.

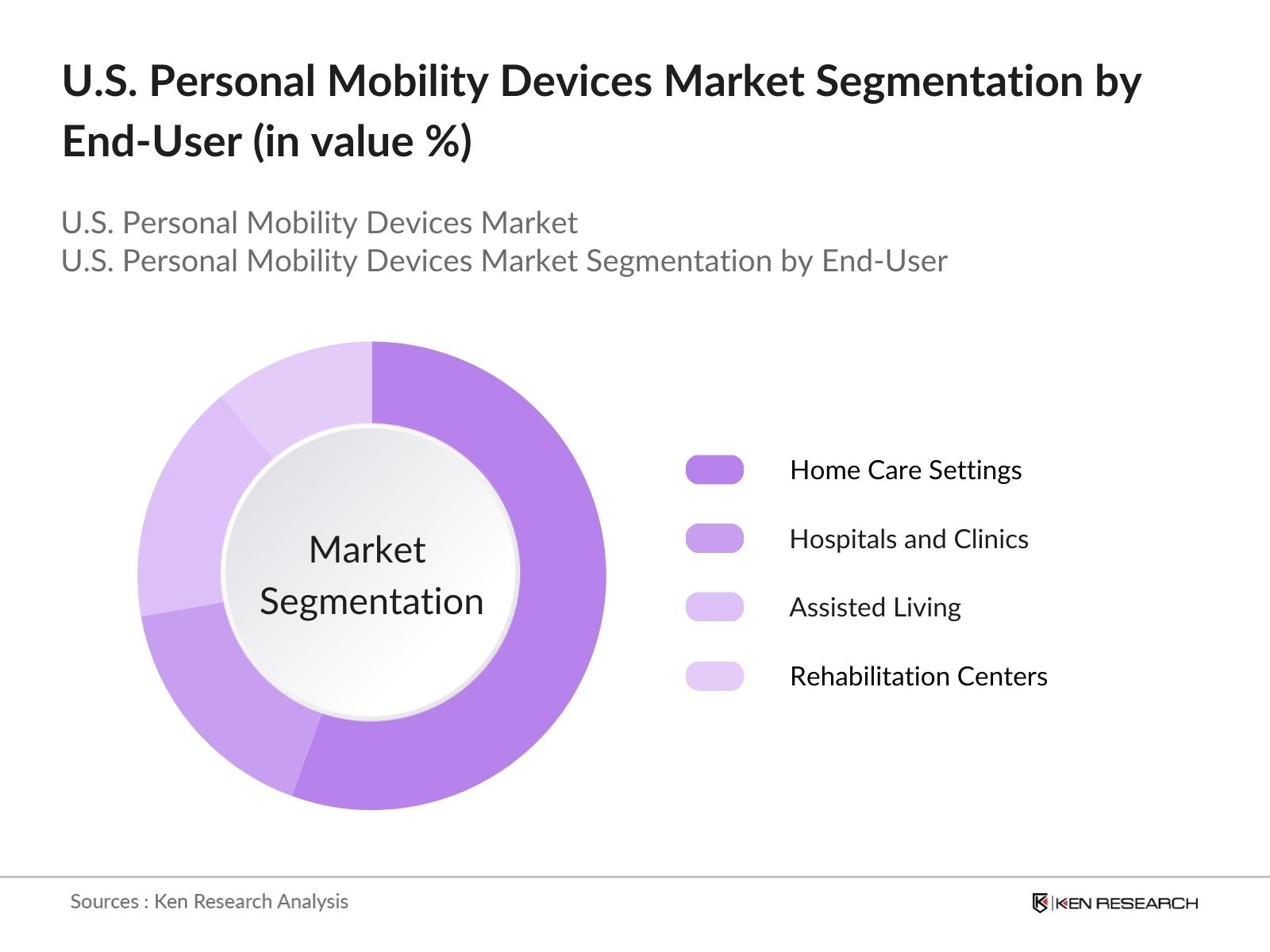

By End-User: The market is further segmented into hospitals and clinics, home care settings, assisted living facilities, and rehabilitation centers. Home care settings hold a dominant position in this segment due to the growing preference for aging-in-place among the elderly. Advancements in portable and easy-to-use devices have made home-based solutions more practical, driving higher demand in this category.

USA Personal Mobility Devices Market Competitive Landscape

The U.S. Personal Mobility Devices market is dominated by a mix of global giants and local players, offering a diverse portfolio of products and innovative solutions. The market's competitive landscape is characterized by advancements in assistive technologies and consolidation through strategic partnerships and acquisitions.

USA Personal Mobility Devices Market Analysis

Growth Drivers

- Aging Population: The global aging population is significantly contributing to the demand for assistive devices, with the United Nations estimating that by 2024, over 1.1 billion people worldwide will be aged 60 or older. In markets like North America and Europe, where aging populations are particularly prevalent, the need for assistive technologies and healthcare solutions to support independent living is growing. For example, the U.S. Census Bureau reported that approximately 77 million Americans will be over the age of 65 by 2024, driving the adoption of devices to address mobility and health challenges.

- Rising Prevalence of Disabilities: The World Health Organization (WHO) estimates that over 1.2 billion people globally live with some form of disability in 2024, with musculoskeletal disorders and vision impairments being among the most common. The demand for assistive devices like wheelchairs, hearing aids, and prosthetics is therefore surging, particularly in high-burden regions such as Asia-Pacific and North America, where over 300 million individuals face moderate to severe disability challenges.

- Favorable Reimbursement Policies: Governments across regions such as North America and Europe are introducing favorable reimbursement policies for assistive devices, with over $70 billion allocated in 2024 in Medicare and Medicaid in the U.S. alone for disability-related services. These policies significantly lower out-of-pocket costs for consumers, thereby boosting device adoption rates. Similarly, Germany and Japan have announced new budget allocations to subsidize advanced assistive technologies.

Market Challenges

- High Cost of Advanced Devices: Advanced assistive devices, particularly those incorporating AI and robotics, remain prohibitively expensive. For instance, exoskeletons for mobility assistance cost between $40,000 and $120,000 as of 2024, limiting adoption among middle-income families and in low-income countries. Lack of government subsidies in emerging markets further exacerbates affordability issues.

- Limited Awareness in Rural Areas: In regions like South Asia and Sub-Saharan Africa, over 60% of the population resides in rural areas where awareness about assistive devices and their benefits is minimal. Poor healthcare infrastructure and lack of trained personnel further hinder the distribution and adoption of these technologies, leaving millions without necessary assistance.

USA Personal Mobility Devices Market Future Outlook

Over the next five years, the U.S. Personal Mobility Devices market is expected to experience significant growth driven by ongoing technological advancements, rising awareness about assistive devices, and increased government and private sector investments. The integration of smart technologies, such as IoT-enabled mobility devices, is likely to revolutionize user experience and expand market reach across demographics.

Market Opportunities

- Expansion into Emerging Markets: Over 2.3 billion people in emerging economies such as India, Brazil, and South Africa have limited or no access to assistive technologies as of 2024. Companies are increasingly entering these markets, where government partnerships for subsidized programs are opening up new revenue streams. The Indian government, for example, has allocated INR 20,000 crore to fund assistive technology development for rural and underserved areas.

- Development of Affordable Devices: Manufacturers are focusing on low-cost alternatives that maintain quality. For example, modular prosthetics that cost $1,000$3,000 are being developed for widespread adoption in low- and middle-income countries, where the majority of unmet demand lies.

Scope of the Report

|

By Product Type |

Wheelchairs |

|

By End User |

Hospitals and Clinics |

|

By Distribution Channel |

Online Retailers |

|

By Technology |

Manual Devices |

|

By Region |

Northeast |

Products

Key Target Audience

Medical Device Distributors

Healthcare Providers

Hospitals and Rehabilitation Centers

Government and Regulatory Bodies (e.g., FDA, Medicare, Medicaid)

Home Care Service Providers

Product Manufacturers and Suppliers

Investors and Venture Capitalist Firms

Technology and IoT Solution Providers

Companies

Players Mentioned in the Report:

Invacare Corporation

Pride Mobility Products

Sunrise Medical

Drive DeVilbiss Healthcare

Permobil AB

Ottobock

GF Health Products

Kaye Products

Carex Health Brands

Magic Mobility

Table of Contents

1. USA Personal Mobility Devices Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. USA Personal Mobility Devices Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. USA Personal Mobility Devices Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population

3.1.2 Rising Prevalence of Disabilities

3.1.3 Technological Advancements

3.1.4 Favorable Reimbursement Policies

3.2 Market Challenges

3.2.1 High Cost of Advanced Devices

3.2.2 Limited Awareness in Rural Areas

3.2.3 Regulatory Hurdles

3.3 Opportunities

3.3.1 Expansion into Emerging Markets

3.3.2 Development of Affordable Devices

3.3.3 Integration with Smart Technologies

3.4 Trends

3.4.1 Adoption of IoT in Mobility Devices

3.4.2 Customization and Personalization

3.4.3 Eco-friendly and Sustainable Designs

3.5 Government Regulations

3.5.1 FDA Guidelines

3.5.2 Medicare and Medicaid Policies

3.5.3 Accessibility Standards (ADA Compliance)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. USA Personal Mobility Devices Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Wheelchairs

4.1.2 Manual Wheelchairs

4.1.3 Powered Wheelchairs

4.1.4 Mobility Scooters

4.1.5 Walking Aids

4.1.6 Canes

4.1.7 Crutches

4.1.8 Walkers

4.1.9Rollators

4.1.10 Patient Lifts

4.1.11 Stair Lifts

4.2 By End User (Value %)

4.2.1 Hospitals and Clinics

4.2.2 Home Care Settings

4.2.3 Assisted Living Facilities

4.2.4 Rehabilitation Centers

4.3 By Distribution Channel (Value %)

4.3.1 Online Retailers

4.3.2 Specialty Stores

4.3.3 Hospital Pharmacies

4.3.4 Retail Pharmacies

4.4 By Technology (Value %)

4.4.1 Manual Devices

4.4.2 Powered Devices

4.4.3 Hybrid Devices

4.5 By Region (Value %)

4.5.1 Northeast

4.5.2 Midwest

4.5.3 South

4.5.4 West

5. USA Personal Mobility Devices Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Invacare Corporation

5.1.2 Pride Mobility Products Corp.

5.1.3 Sunrise Medical

5.1.4 Drive DeVilbiss Healthcare

5.1.5 Medline Industries, Inc.

5.1.6 GF Health Products, Inc.

6.1.7 Kaye Products, Inc.

5.1.8 Carex Health Brands, Inc.

5.1.9 NOVA Medical Products

5.1.10 Performance Health

5.1.11 Rollz International

5.1.12 Permobil

5.1.13 Ottobock

5.1.14 Hoveround Corporation

5.1.15 Merits Health Products

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. USA Personal Mobility Devices Market Regulatory Framework

6.1 FDA Approval Processes

6.2 Compliance Requirements

6.3 Certification Processes

7. USA Personal Mobility Devices Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Personal Mobility Devices Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By End User (Value %)

8.3 By Distribution Channel (Value %)

8.4 By Technology (Value %)

8.5 By Region (Value %)

9. USA Personal Mobility Devices Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves a systematic mapping of stakeholders within the U.S. Personal Mobility Devices market. Extensive desk research utilizing secondary and proprietary databases is undertaken to define critical variables influencing market trends.

Step 2: Market Analysis and Construction

This phase includes compiling historical data, analyzing product adoption trends, and evaluating revenue generation. Special focus is placed on the ratio of mobility device usage across various end-users and settings.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated via in-depth interviews with industry professionals, including manufacturers, distributors, and healthcare providers. This ensures that data on pricing, distribution, and technology adoption aligns with market realities.

Step 4: Research Synthesis and Final Output

The final phase consolidates quantitative and qualitative findings to produce a comprehensive report. Market statistics are corroborated using a bottom-up approach, supported by industry-level interviews and validated secondary data.

Frequently Asked Questions

1. How big is the U.S. Personal Mobility Devices market?

The U.S. Personal Mobility Devices market is valued at USD 3.7 billion, driven by an aging population, technological advancements, and increased accessibility to mobility aids.

2. What are the challenges in the U.S. Personal Mobility Devices market?

Key challenges in the U.S. Personal Mobility Devices include high costs of advanced mobility devices, limited reimbursement policies, and regulatory complexities.

3. Who are the major players in the U.S. Personal Mobility Devices market?

Major players in the U.S. Personal Mobility Devices include Invacare Corporation, Pride Mobility Products, Sunrise Medical, Drive DeVilbiss Healthcare, and Permobil AB.

4. What are the growth drivers of the U.S. Personal Mobility Devices market?

Growth drivers in the U.S. Personal Mobility Devices include increasing prevalence of mobility-related disabilities, government support through Medicare and Medicaid, and technological innovations in assistive devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.