U.S. Pharmaceutical Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11457

November 2024

99

About the Report

U.S. Pharmaceutical Market Overview

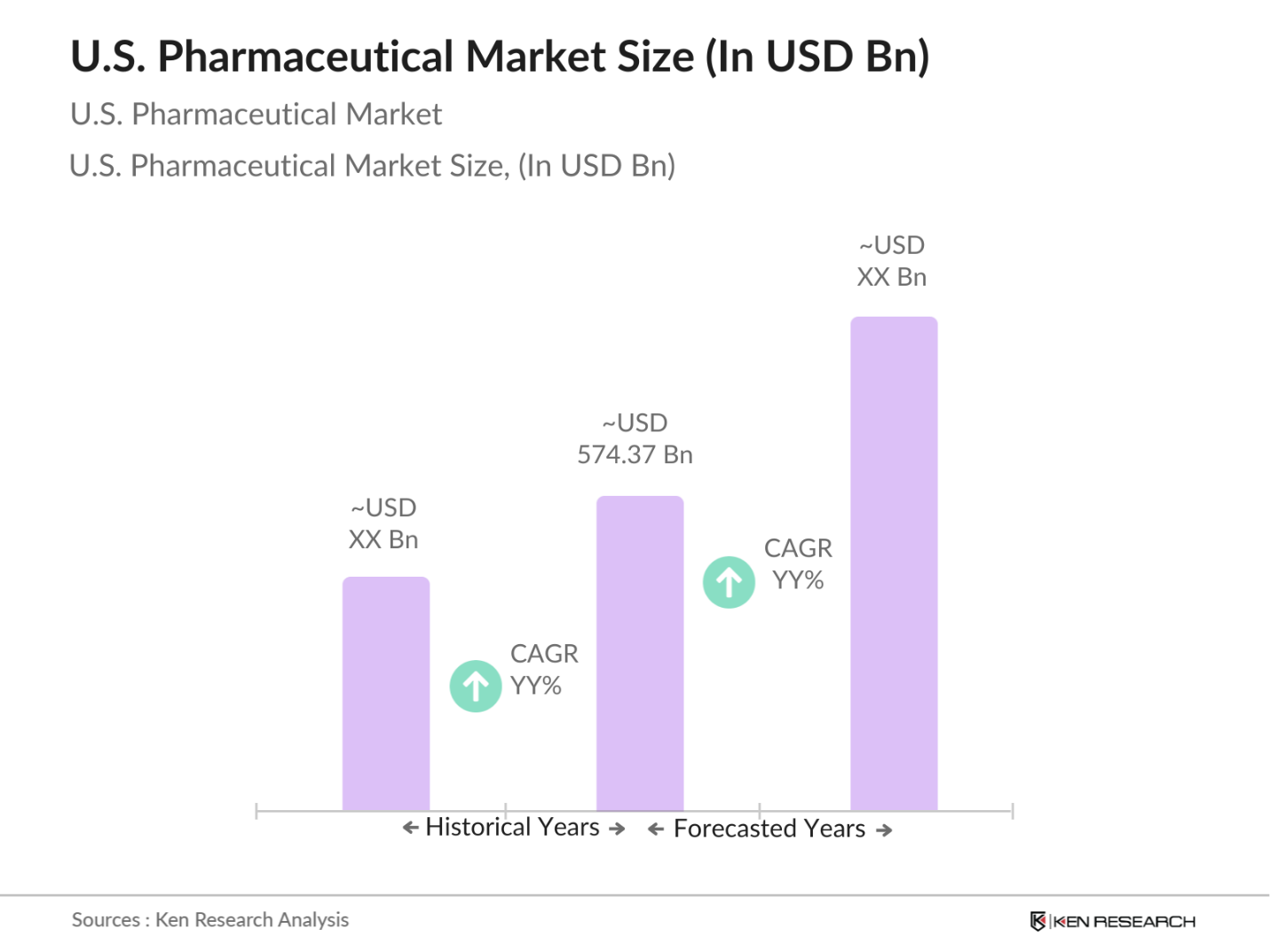

- The U.S. pharmaceutical market is valued at USD 574.37 billion, reflecting robust growth driven by factors such as an aging population and rising prevalence of chronic diseases. The pharmaceutical sector's expansion is further supported by advancements in biotechnology and increased healthcare spending. With ongoing innovations and a strong focus on research and development, the market is expected to witness sustained growth, providing vital medicines and therapies to meet the evolving healthcare needs of the population.

- Dominant cities in the U.S. pharmaceutical market include New York, San Francisco, and Boston, which serve as key hubs for pharmaceutical research and development. New York benefits from a vast pool of healthcare professionals and major pharmaceutical companies, while Boston is renowned for its concentration of biotechnology firms and academic institutions. San Francisco, with its strong tech presence, is increasingly attracting investments in biopharmaceutical innovations, making these cities central to the markets dynamics.

- The FDA plays a critical role in regulating the pharmaceutical industry, overseeing the approval processes for new drugs. In 2022, the FDA approved 37 new molecular entities, reflecting ongoing efforts to bring innovative therapies to market. The average time for drug approval can exceed 10 years, necessitating significant investment in clinical trials and regulatory compliance. These lengthy processes can delay access to life-saving medications, underscoring the importance of regulatory reform to streamline approvals without compromising safety.

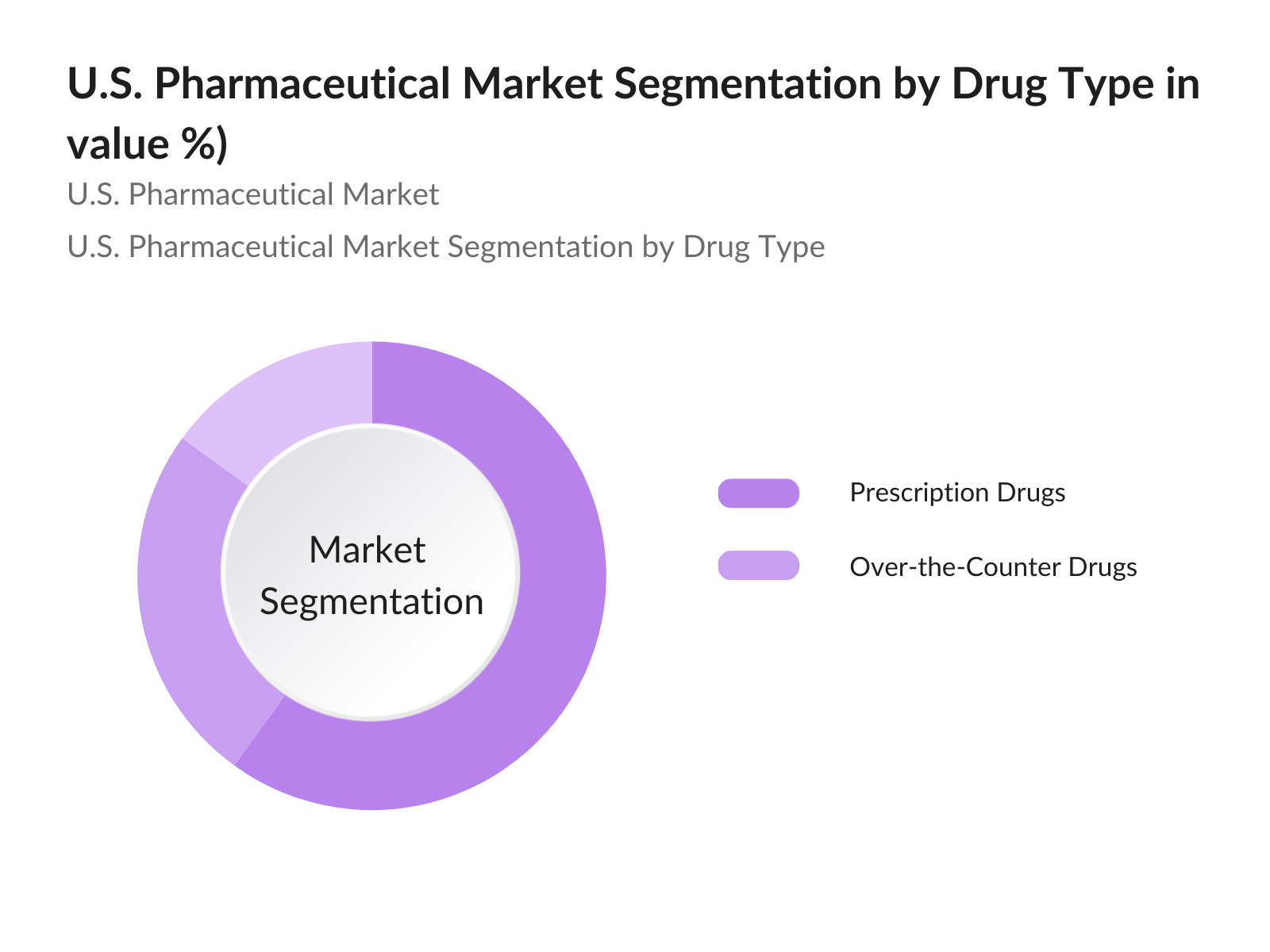

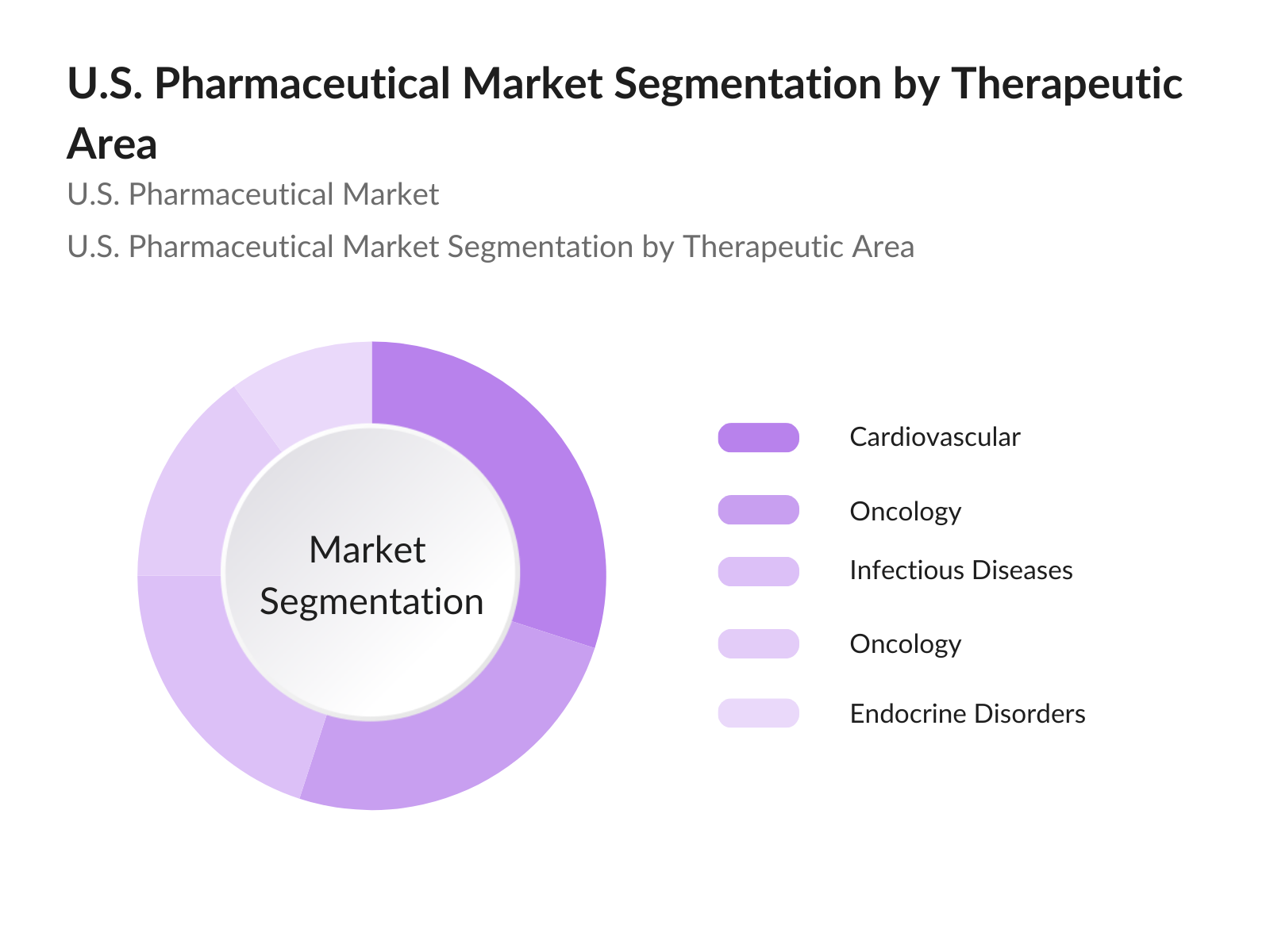

U.S. Pharmaceutical Market Segmentation

- By Drug Type: The U.S. pharmaceutical market is segmented by drug type into prescription drugs and over-the-counter (OTC) drugs. In this segmentation, prescription drugs hold a dominant market share due to the increasing incidence of chronic diseases and the demand for specialized medications. Prescription drugs are essential for treating conditions such as diabetes, cancer, and cardiovascular diseases, contributing significantly to patient outcomes. Pharmaceutical companies are continuously investing in research and development to bring innovative therapies to market, further solidifying the position of prescription drugs as a key driver of growth in the industry.

- By Therapeutic Area: The market is also segmented by therapeutic area, including cardiovascular, oncology, central nervous system (CNS), infectious diseases, and endocrine disorders. Oncology leads the market share due to the rising incidence of cancer and the continuous advancement of targeted therapies. With significant investments directed towards research and development in cancer treatments, including immunotherapy and personalized medicine, the oncology segment is positioned for substantial growth. The demand for effective cancer therapies has been bolstered by increased awareness and screening programs, making oncology a critical area in the pharmaceutical market.

U.S. Pharmaceutical Market Competitive Landscape

The U.S. pharmaceutical market is dominated by several key players, including established companies that lead in innovation and market presence. These companies play a crucial role in shaping the industry, leveraging their extensive resources and expertise to develop new therapies and medications. The competitive landscape is characterized by ongoing research and development efforts, strategic partnerships, and mergers and acquisitions, which are essential for maintaining a competitive edge in this rapidly evolving market.

U.S. Pharmaceutical Market Analysis

Market Growth Drivers

- Aging Population: The U.S. population aged 65 and older is projected to increase to 78 million, with a significant portion of this demographic suffering from multiple chronic conditions, according to the Centers for Disease Control and Prevention (CDC). This growing elderly population drives demand for pharmaceuticals, as they typically require more medications to manage their health. The average life expectancy in the U.S. has risen to 79.1 years, further intensifying the need for effective healthcare solutions. The substantial healthcare needs of this aging demographic underscore the critical role of pharmaceuticals in improving quality of life and managing chronic diseases.

- Rise in Chronic Diseases: Chronic diseases such as diabetes, heart disease, and cancer continue to rise in the U.S., impacting millions. The National Center for Chronic Disease Prevention and Health Promotion reported that a substantial number of American adults live with at least one chronic condition, and this figure is projected to increase. In 2023, an estimated 37 million Americans have diabetes, with costs related to the disease surpassing $327 billion annually, encompassing medical care and lost productivity. This alarming trend necessitates ongoing pharmaceutical innovation to develop effective treatment options and management strategies for chronic diseases.

- Advances in Biotechnology: Biotechnology is a driving force in the pharmaceutical industry, significantly shaping the development of new treatments. The U.S. biotech sector saw investments exceeding $29 billion in 2022, reflecting robust growth and innovation. The FDA approved 19 novel biologics in 2023 alone, emphasizing the rapid development of biologic therapies. These advancements enable the creation of targeted therapies and personalized medicine, transforming treatment protocols and improving patient outcomes across various diseases, particularly in oncology and autoimmune disorders. The ongoing evolution in biotechnology underscores its critical role in advancing healthcare solutions and addressing complex medical challenges.

Market Challenges:

- Regulatory Hurdles: Navigating the complex regulatory landscape remains a significant challenge for the pharmaceutical industry. The FDA's approval process can take an average of 10 years, with a notable number of new drug applications being rejected or delayed due to regulatory issues. These delays can impede market entry for innovative drugs, resulting in substantial financial losses for companies, with the average cost per new drug developed estimated at $1.3 billion. The stringent regulatory environment necessitates ongoing investment in compliance and strategic planning to mitigate potential setbacks and ensure successful drug development and market access.

- Pricing Pressure: Pharmaceutical pricing continues to face intense scrutiny and pressure, primarily due to rising healthcare costs and public outcry over drug affordability. The U.S. government spent approximately $1,400 per capita on prescription drugs in 2022, reflecting a growing concern over drug pricing strategies. In response, lawmakers are pushing for price negotiations and transparency regulations, which could significantly impact pharmaceutical revenues. The evolving landscape requires companies to adapt their pricing strategies to maintain market access and profitability while addressing stakeholder concerns about affordability.

U.S. Pharmaceutical Market Future Outlook

Over the next five years, the U.S. pharmaceutical market is expected to experience significant growth driven by continuous government support, advancements in drug development technologies, and increasing consumer demand for innovative therapies. As the population ages and healthcare needs evolve, the emphasis on personalized medicine and biotechnology will likely enhance treatment options. Additionally, regulatory advancements and strategic collaborations among pharmaceutical companies will contribute to a more dynamic market environment.

Market Opportunities:

- Emerging Markets: Emerging markets present a significant growth opportunity for the U.S. pharmaceutical industry. In 2022, the pharmaceutical market in emerging economies was valued at $362 billion, with an expected increase in demand due to rising incomes and improved access to healthcare. For instance, countries like India and Brazil are witnessing rapid urbanization and healthcare investments, which are projected to boost pharmaceutical sales. This trend emphasizes the importance of developing strategies to penetrate these markets effectively, leveraging local partnerships and tailored product offerings.

- Digital Health Innovations: The integration of digital health technologies into pharmaceutical practices offers substantial opportunities for growth. The digital health market, which includes telehealth and wearable technologies, was valued at $152 billion in 2022 and continues to expand as patients increasingly demand remote healthcare solutions. A significant number of U.S. adults reported using digital health tools to manage their health in 2023, highlighting the shift toward technology-driven care. Pharmaceutical companies that embrace digital health innovations can enhance patient engagement, improve adherence to treatment, and ultimately drive sales, positioning themselves effectively in a rapidly evolving healthcare landscape.

Scope of the Report

|

By Drug Type |

Prescription Drugs Over-the-Counter (OTC) Drugs |

|

By Therapeutic Area |

Cardiovascular Oncology Central Nervous System Infectious Diseases Endocrine Disorders |

|

By Distribution Channel |

Retail Pharmacies Hospitals Online Pharmacies |

|

By Formulation Type |

Tablets Capsules Injectable Drugs Topical Formulations Oral Solutions |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotechnology Companies

Healthcare Providers

Insurance Companies

Hospitals and Clinics

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, CMS)

Pharmacy Benefit Managers

Companies

Players Mentioned in the report

Pfizer

Johnson & Johnson

Merck & Co., Inc.

Amgen

Gilead Sciences, Inc.

Bristol-Myers Squibb

AbbVie

Sanofi

GlaxoSmithKline

Novartis

Roche

Eli Lilly and Company

AstraZeneca

Bayer

Teva Pharmaceutical Industries

Table of Contents

1. U.S. Pharmaceutical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Pharmaceutical Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Pharmaceutical Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population

3.1.2. Rise in Chronic Diseases

3.1.3. Advances in Biotechnology

3.1.4. Increased Healthcare Expenditure

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. Pricing Pressure

3.2.3. Patent Expiry Issues

3.3. Opportunities

3.3.1. Emerging Markets

3.3.2. Personalized Medicine

3.3.3. Digital Health Innovations

3.4. Trends

3.4.1. Shift to Value-Based Care

3.4.2. Growth of Biosimilars

3.4.3. Increased Focus on R&D

3.5. Government Regulation

3.5.1. FDA Drug Approval Processes

3.5.2. Drug Pricing Policies

3.5.3. Healthcare Reform Impact

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. U.S. Pharmaceutical Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Prescription Drugs

4.1.2. Over-the-Counter (OTC) Drugs

4.2. By Therapeutic Area (In Value %)

4.2.1. Cardiovascular

4.2.2. Oncology

4.2.3. Central Nervous System

4.2.4. Infectious Diseases

4.2.5. Endocrine Disorders

4.3. By Distribution Channel (In Value %)

4.3.1. Retail Pharmacies

4.3.2. Hospitals

4.3.3. Online Pharmacies

4.4. By Region (In Value %)

4.4.1. Northeast

4.4.2. Midwest

4.4.3. South

4.4.4. West

5. U.S. Pharmaceutical Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pfizer Inc.

5.1.2. Johnson & Johnson

5.1.3. Merck & Co., Inc.

5.1.4. Abbott Laboratories

5.1.5. Gilead Sciences, Inc.

5.1.6. Bristol-Myers Squibb

5.1.7. Amgen Inc.

5.1.8. GlaxoSmithKline PLC

5.1.9. Sanofi S.A.

5.1.10. Novartis AG

5.1.11. Roche Holding AG

5.1.12. Eli Lilly and Company

5.1.13. Bayer AG

5.1.14. AstraZeneca PLC

5.1.15. Teva Pharmaceutical Industries Ltd.

5.2. Cross Comparison Parameters (Market Capitalization, R&D Expenditure, Number of FDA Approvals, Product Pipeline, Geographic Presence, Revenue Growth Rate, Market Share, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. U.S. Pharmaceutical Market Regulatory Framework

6.1. Drug Approval Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. U.S. Pharmaceutical Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. U.S. Pharmaceutical Market Future Segmentation

8.1. By Drug Type (In Value %)

8.2. By Therapeutic Area (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

9. U.S. Pharmaceutical Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the U.S. pharmaceutical market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the U.S. pharmaceutical market. This includes assessing market penetration, the ratio of pharmaceuticals to healthcare providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pharmaceutical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the U.S. pharmaceutical market.

Frequently Asked Questions

01. How big is the U.S. pharmaceutical market?

The U.S. pharmaceutical market is valued at USD 574.37 billion, driven by the aging population, rising chronic diseases, and significant advancements in biotechnology.

02. What are the challenges in the U.S. pharmaceutical market?

Challenges include stringent regulatory requirements, pricing pressures, and the impact of patent expirations on revenue streams. Additionally, competition from generic drugs poses a risk to market profitability.

03. Who are the major players in the U.S. pharmaceutical market?

Key players in the market include Pfizer, Johnson & Johnson, Merck & Co., Inc., Amgen, and Gilead Sciences. These companies dominate due to their strong R&D capabilities, extensive product portfolios, and established market presence.

04. What are the growth drivers of the U.S. pharmaceutical market?

The market is propelled by factors such as an aging population, increased prevalence of chronic diseases, ongoing advancements in drug development, and a rising focus on personalized medicine and biotechnology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.