US Point of Care Diagnostics Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD2848

November 2024

98

About the Report

US Point of Care Diagnostics Market Overview

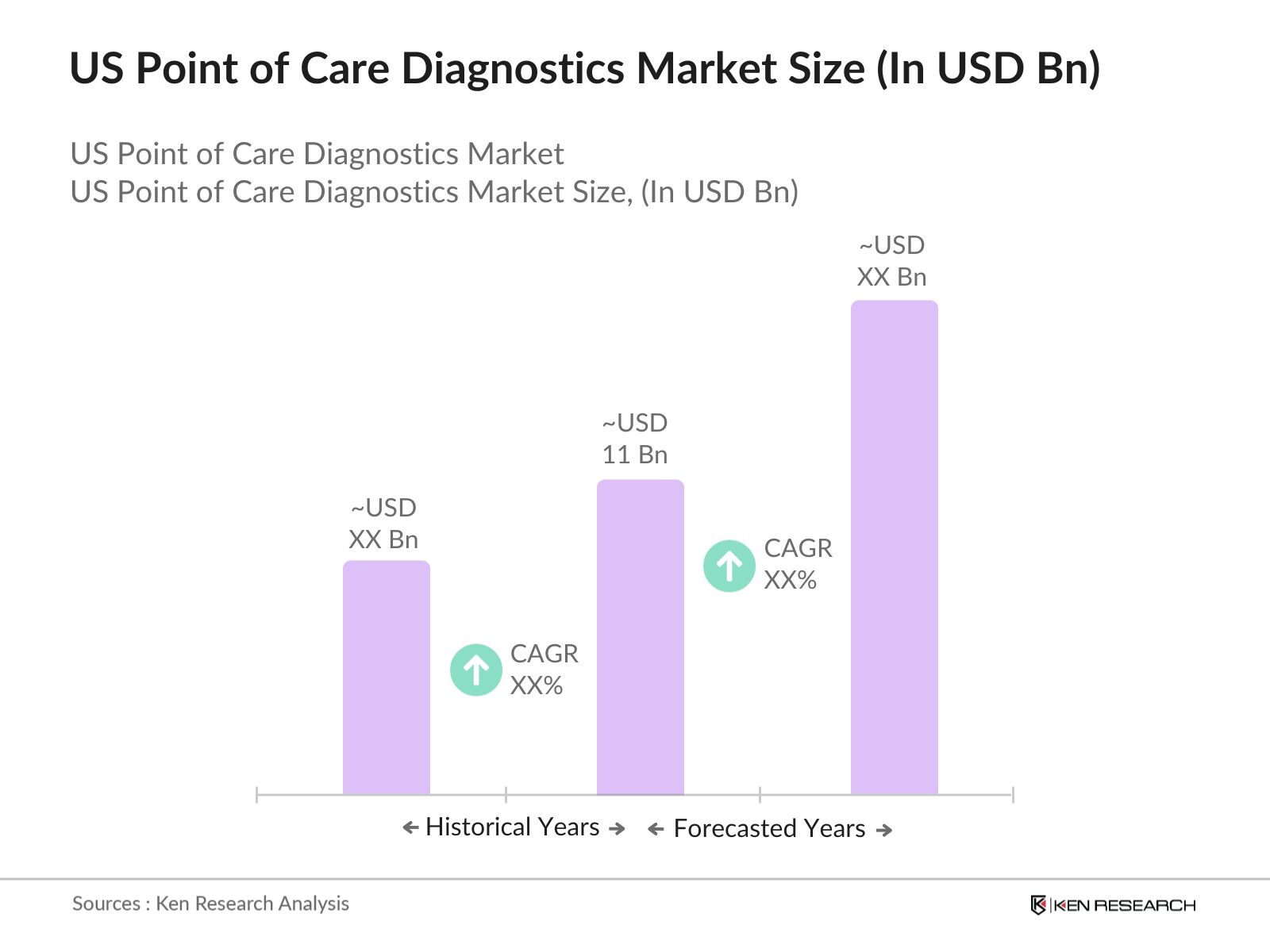

- The US Point of Care Diagnostics (POC) market is valued at USD 11 billion, driven by the growing need for rapid diagnostic results and increasing cases of chronic and infectious diseases such as diabetes and cardiovascular diseases. The market benefits from the healthcare sector's push for decentralized diagnostics, especially in homecare settings and retail clinics, which has led to more investments in POC technologies. The strong focus on patient-centered care and the rise in self-testing due to consumer demand for convenience are further pushing market expansion.

- Key regions like New York, California, and Texas dominate the market due to their large healthcare infrastructure and high patient demand for decentralized testing solutions. These states benefit from a dense population, progressive healthcare regulations, and significant investments in health technologies, which accelerate the adoption of POC diagnostics. Cities within these regions act as hubs for healthcare innovation, attracting manufacturers, healthcare providers, and funding, giving them a dominant position in the US market.

- In 2024, the FDA continues to offer fast-track approvals for POC diagnostics that address urgent healthcare needs, particularly for infectious diseases and chronic conditions. This is expected to accelerate the launch of over 50 new diagnostic devices focused on rapid testing for diseases like sepsis and influenza.

US Point of Care Diagnostics Market Segmentation

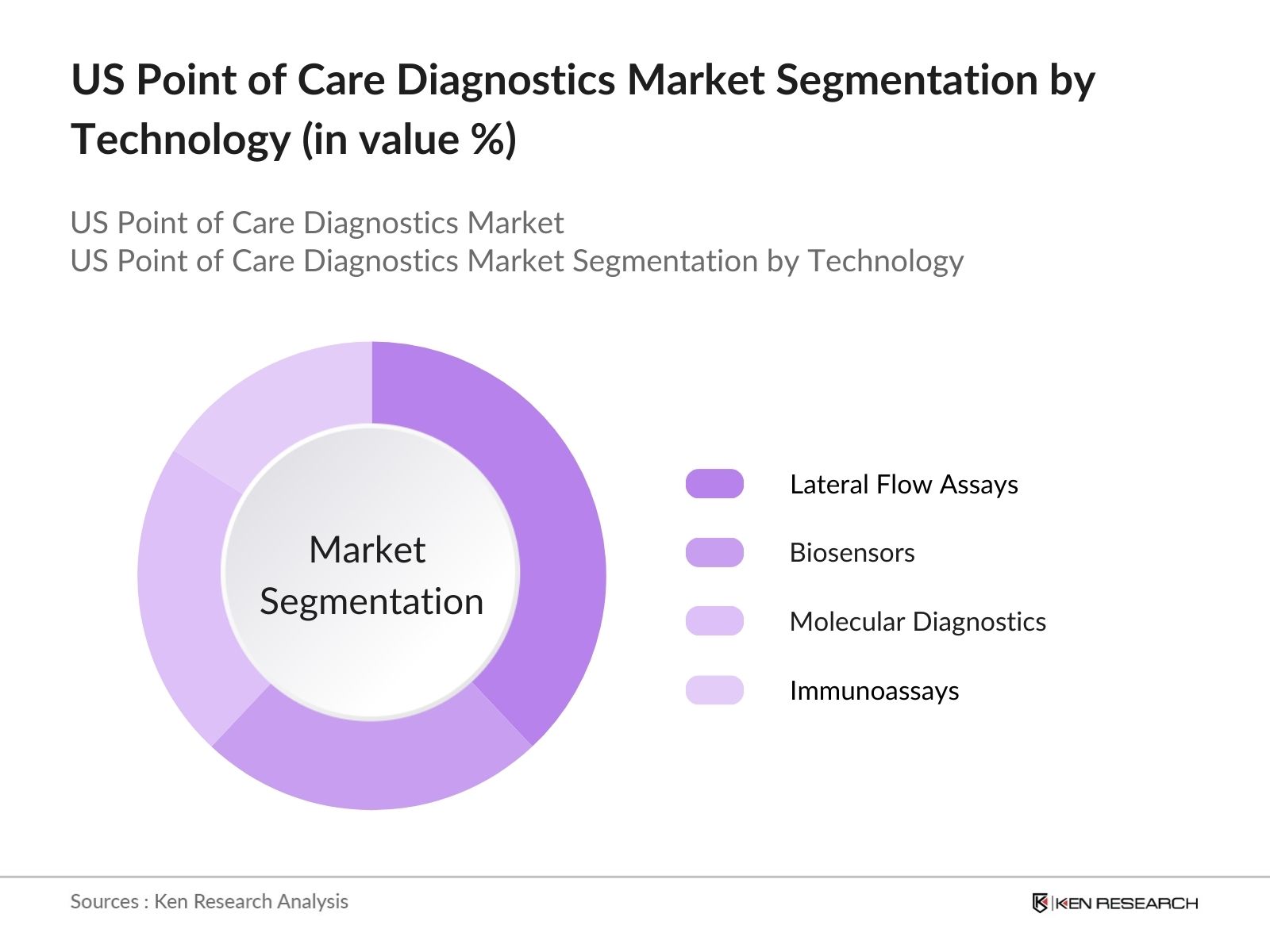

By Technology

The US Point of Care Diagnostics market is segmented by technology into lateral flow assays, biosensors, molecular diagnostics, and immunoassays. Among these, lateral flow assays hold a dominant market share due to their widespread use in rapid diagnostic tests for infectious diseases, including COVID-19, and the ease of use without requiring complex laboratory equipment. The simplicity of these devices, their relatively low cost, and their capability for mass production contribute to their prevalence in both healthcare and homecare settings.

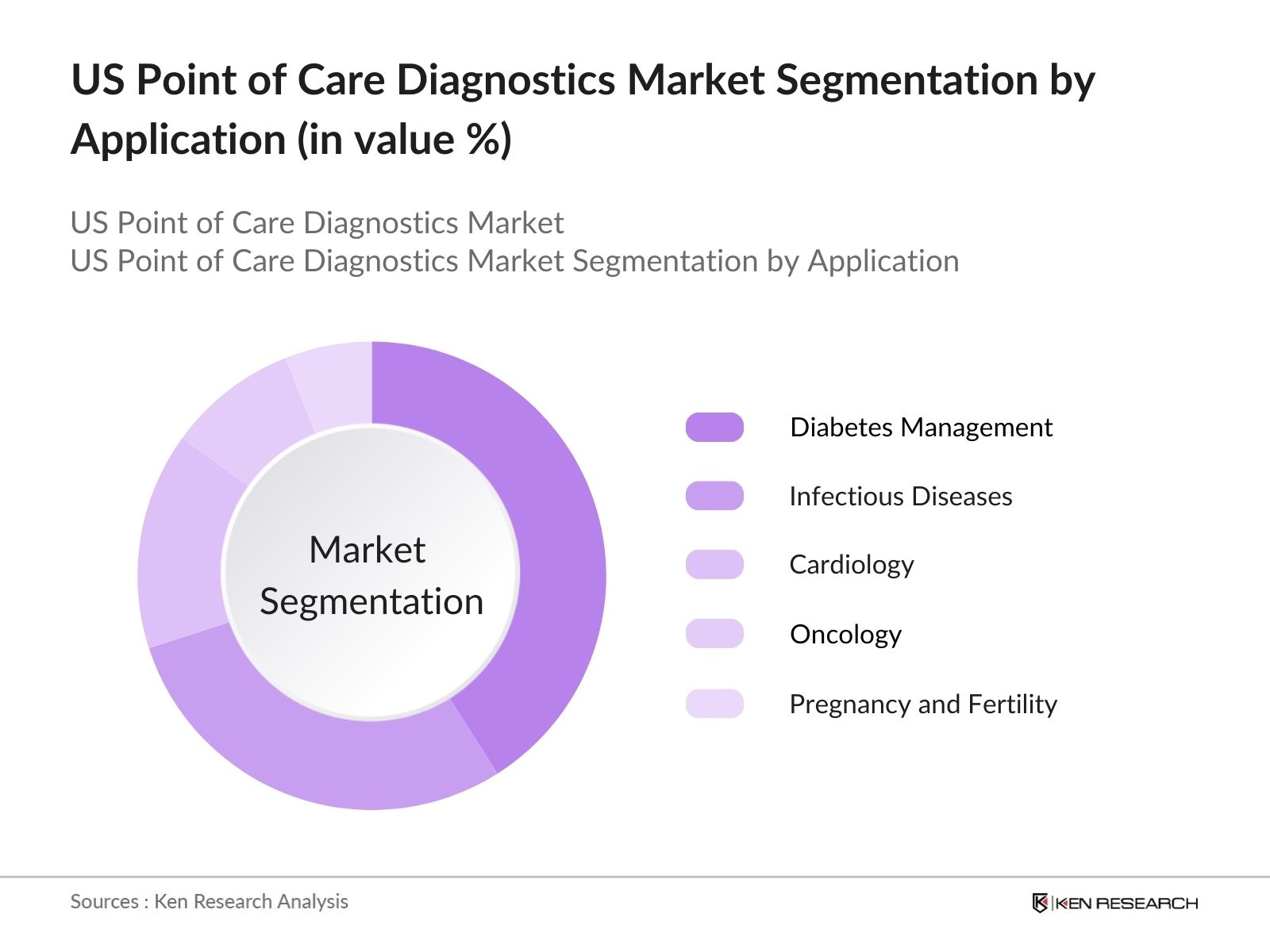

By Application

The market is also segmented by application into cardiology, oncology, infectious diseases, diabetes management, and pregnancy and fertility testing. Diabetes management is the leading segment in terms of market share, largely due to the high prevalence of diabetes in the US and the increasing demand for continuous glucose monitoring (CGM) devices. These devices enable real-time monitoring, allowing for better disease management and improved patient outcomes, which is crucial in managing chronic conditions like diabetes.

Competitive Landscape

The US Point of Care Diagnostics market is dominated by major players that have established a strong presence through product innovation and strategic partnerships. These companies focus on expanding their technological capabilities to maintain competitiveness in the growing market.

|

Company Name |

Established |

Headquarters |

Product Portfolio |

R&D Investment |

Revenue Growth |

Testing Platforms |

Market Presence |

Partnerships |

Competitive Edge |

|---|---|---|---|---|---|---|---|---|---|

|

Abbott Laboratories |

1888 |

Abbott Park, Illinois |

|||||||

|

Roche Diagnostics |

1896 |

Basel, Switzerland |

|||||||

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

|||||||

|

Thermo Fisher Scientific |

1956 |

Waltham, Massachusetts |

|||||||

|

Quidel Corporation |

1979 |

San Diego, California |

US Point of Care Diagnostics Market Analysis

3.1. Growth Drivers

- Regulatory Incentives: The U.S. government has introduced several incentives to encourage the adoption of point-of-care diagnostics (POC), including expedited FDA approvals and tax benefits for manufacturers developing rapid diagnostic devices. In 2024, over 200 new POC diagnostic devices are expected to gain fast-track approvals, fueling market expansion. This is driven by the increasing demand for real-time diagnostic tools that reduce the need for centralized labs.

- Shift to Home-based Diagnostics: By 2024, home-based diagnostics are seeing significant adoption, particularly driven by the need for self-monitoring tools for chronic diseases such as diabetes. The demand for glucose monitoring kits alone is projected to increase by 15 million units annually, with home diagnostics becoming a standard for managing chronic conditions.

- Chronic Disease Prevalence: The rising incidence of chronic diseases, including cardiovascular diseases and diabetes, has created a surge in demand for POC diagnostics in the U.S. By the end of 2024, over 37 million Americans are managing diabetes, and the need for real-time glucose monitoring devices is projected to result in a market demand increase of 4.5 million units.

Market Challenges

- Reimbursement Complexities: Navigating reimbursement models for POC diagnostics remains a significant hurdle. As of 2024, nearly 35% of healthcare providers have reported delays or complications in receiving reimbursements for POC tests, resulting in slower adoption among smaller healthcare facilities.

- Data Security Concerns: As POC diagnostics become more integrated with digital health platforms, ensuring the security of patient data is increasingly challenging. By 2024, it is estimated that over 2 million POC devices will be connected to cloud platforms, making cybersecurity a critical concern for healthcare providers and patients alike.

Future Outlook

Over the next five years, the US Point of Care Diagnostics market is expected to experience robust growth driven by the increasing demand for rapid diagnostic solutions, technological advancements in molecular and biosensor-based diagnostics, and the expansion of telemedicine services. As healthcare shifts toward personalized care and early diagnosis, point-of-care testing will play a critical role in improving patient outcomes and reducing the burden on traditional healthcare facilities.

Opportunities

Emerging Technologies: Emerging technologies like nanotechnology and AI-based diagnostics are expected to open new opportunities for POC applications. By 2024, around 5,000 new AI-driven diagnostic devices will enter the U.S. market, offering enhanced diagnostic speed and accuracy for multiple diseases.

Personalized Medicine: The growing focus on personalized medicine is creating opportunities for customized POC diagnostics. As of 2024, the demand for personalized diagnostic tools is set to rise, with over 10 million POC devices tailored to individual genetic profiles expected to be utilized in personalized care strategies.

Scope of the Report

|

By Technology |

Lateral Flow Assays Biosensors Molecular Diagnostics Immunoassays |

|

By Application |

Cardiology Oncology Infectious Diseases Diabetes Management Pregnancy and Fertility Testing |

|

By Mode of Testing |

Prescription-based Point of Care Over-the-Counter Testing |

|

By End-User |

Hospitals and Clinics Homecare Settings Diagnostic Laboratories Retail Clinics |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Hospitals and Healthcare Providers

Homecare Providers

Retail Clinics

Diagnostic Laboratories

Government and Regulatory Bodies (FDA, CMS)

Investors and Venture Capitalist Firms

Medical Device Manufacturers

Telemedicine Companies

Companies

Players Mentioned in the report:

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

BD (Becton, Dickinson and Company)

Quidel Corporation

bioMrieux

Cepheid

Hologic

Sysmex Corporation

Table of Contents

1. US Point of Care Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. US Point of Care Diagnostics Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. US Point of Care Diagnostics Market Analysis

3.1. Growth Drivers

3.1.1 Regulatory Incentives

3.1.2 Shift to Home-based Diagnostics

3.1.3 Technological Advancements

3.1.4 Chronic Disease Prevalence

3.2. Market Challenges

3.2.1 Reimbursement Complexities

3.2.2 Data Security Concerns

3.2.3 Integration Issues

3.2.4 High Device Costs

3.3. Opportunities

3.3.1 Emerging Technologies

3.3.2 Personalized Medicine

3.3.3 Growing Telemedicine Adoption

3.3.4 Rural and Underserved Areas

3.4. Trends

3.4.1 AI Integration

3.4.2 Wearable Diagnostics

3.4.3 Miniaturization of Devices

3.4.5 Expansion of CLIA Waiver Testing

3.5. Government Regulation

3.5.1 FDA Approval Process

3.5.2 CLIA Regulations

3.5.3 HIPAA Compliance

3.5.4 Medicare Reimbursement Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. US Point of Care Diagnostics Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Lateral Flow Assays

4.1.2. Biosensors

4.1.3. Molecular Diagnostics

4.1.4. Immunoassays

4.2. By Application (In Value %)

4.2.1. Cardiology

4.2.2. Oncology

4.2.3. Infectious Diseases

4.2.4. Diabetes Management

4.2.5. Pregnancy and Fertility Testing

4.3. By Mode of Testing (In Value %)

4.3.1. Prescription-based Point of Care

4.3.2. Over-the-Counter Testing

4.4. By End-User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Homecare Settings

4.4.3. Diagnostic Laboratories

4.4.4. Retail Clinics

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. US Point of Care Diagnostics Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Abbott Laboratories

5.1.2. Roche Diagnostics

5.1.3. Siemens Healthineers

5.1.4. Danaher Corporation

5.1.5. Thermo Fisher Scientific

5.1.6. BD (Becton, Dickinson and Company)

5.1.7. Quidel Corporation

5.1.8. bioMrieux

5.1.9. Cepheid

5.1.10. Hologic

5.1.11. Sekisui Diagnostics

5.1.12. OraSure Technologies

5.1.13. Sysmex Corporation

5.1.14. EKF Diagnostics

5.1.15. Bio-Rad Laboratories

5.2 Cross Comparison Parameters (Product Portfolio, R&D Investment, Revenue Growth, Market Presence, Testing Platforms, Partnerships, Manufacturing Capacity, Patent Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. US Point of Care Diagnostics Market Regulatory Framework

6.1. FDA Regulatory Process for Point of Care Devices

6.2. CLIA Waiver and Compliance Requirements

6.3. Data Privacy and HIPAA Compliance

6.4. Reimbursement Policies and Medicare Guidelines

7. US Point of Care Diagnostics Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. US Point of Care Diagnostics Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Mode of Testing (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. US Point of Care Diagnostics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping the key stakeholders and technologies within the US Point of Care Diagnostics Market. It incorporates detailed desk research, leveraging industry-specific databases to identify the core elements influencing market trends and growth.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to assess the market penetration of point-of-care devices. This step includes analyzing sales data, service adoption rates, and device performance to generate reliable revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are developed and validated through expert interviews with professionals from leading diagnostic companies. These insights are used to refine the market model and adjust key growth drivers.

Step 4: Research Synthesis and Final Output

Finally, the data gathered from manufacturers and healthcare providers is synthesized to provide a comprehensive market analysis. This phase ensures the validation of data through both top-down and bottom-up approaches.

Frequently Asked Questions

1. How big is the US Point of Care Diagnostics Market?

The US Point of Care Diagnostics Market is valued at USD 11 billion, driven by rising demand for rapid testing solutions and advancements in diagnostic technologies, particularly in the homecare sector.

2. What are the challenges in the US Point of Care Diagnostics Market?

Challenges in the US Point of Care Diagnostics market include reimbursement complexities, data privacy issues under HIPAA, and the high initial costs of advanced diagnostic devices, which can limit market penetration.

3. Who are the major players in the US Point of Care Diagnostics Market?

Key players in the US Point of Care Diagnostics market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, and Quidel Corporation, all leading the market due to their broad diagnostic portfolios and established healthcare partnerships.

4. What are the growth drivers of the US Point of Care Diagnostics Market?

Growth of US Point of Care Diagnostics market is fueled by the increasing prevalence of chronic diseases, rising consumer demand for at-home diagnostics, and government incentives for decentralized healthcare solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.