U.S. Protein Supplements Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD3916

October 2024

89

About the Report

U.S. Protein Supplements Market Overview

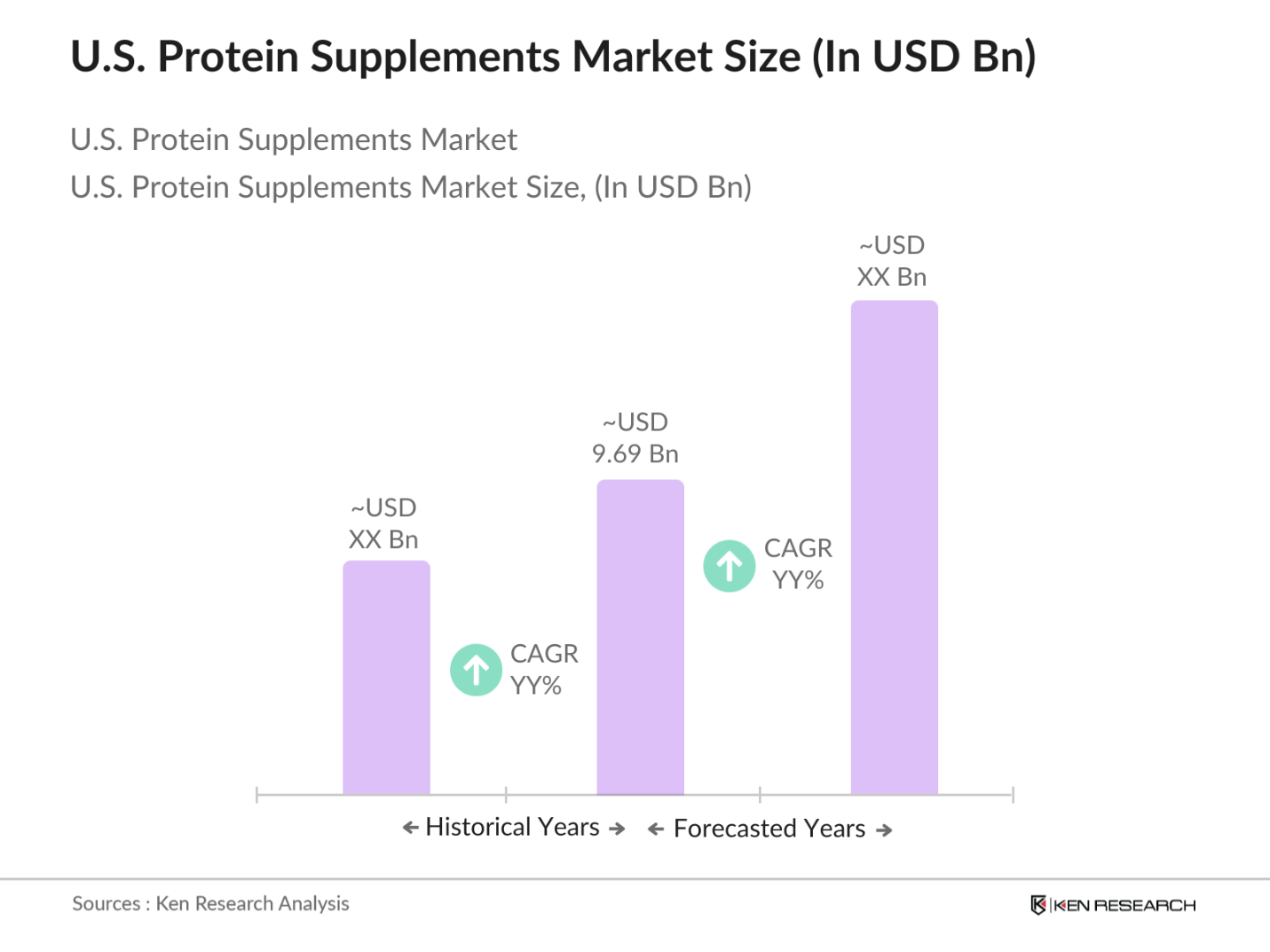

- The U.S. protein supplements market is valued at USD 9.69 billion, reflecting a strong demand driven by the rising awareness of health and fitness among consumers. The growth of the sports nutrition industry, along with the expanding vegan and plant-based diet trends, is fueling the adoption of protein supplements.

- Cities like Los Angeles, New York, and Chicago are key drivers of the protein supplements market due to their large population bases of fitness enthusiasts, gyms, and specialized nutrition retailers. These urban areas exhibit high demand for protein supplements as they host numerous health and fitness facilities, leading to a concentration of premium product sales. Furthermore, the growing popularity of e-commerce platforms and healthy lifestyle choices in these regions plays a significant role in sustaining market dominance.

- The U.S. Food and Drug Administration (FDA) has stringent guidelines governing the marketing claims made by protein supplement manufacturers. In 2023, the FDA enforced over 200 warning letters to companies that did not adhere to labeling standards. These guidelines are aimed at ensuring that protein supplement labels accurately reflect the benefits and ingredients of the product, which has increased transparency but also added regulatory compliance costs for manufacturers.

U.S. Protein Supplements Market Segmentation

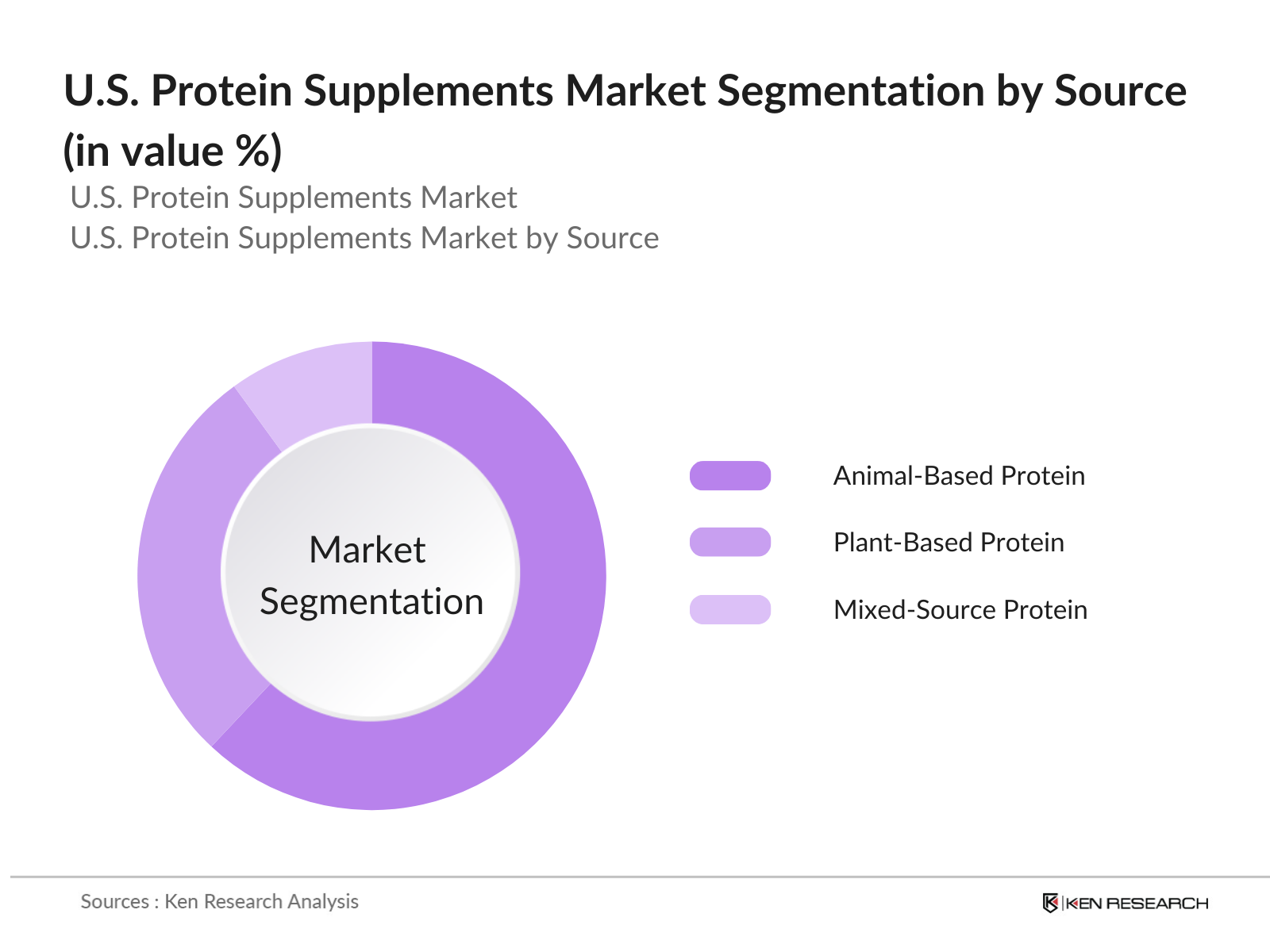

By Source: The U.S. protein supplements market is segmented by source into animal-based protein, plant-based protein, and mixed-source protein. Animal-based protein products, particularly whey and casein, continue to dominate the market due to their superior amino acid profile, easy digestibility, and long-standing popularity among athletes and bodybuilders. In contrast, plant-based proteins, especially pea and soy, are growing rapidly in response to rising veganism and concerns about sustainability.

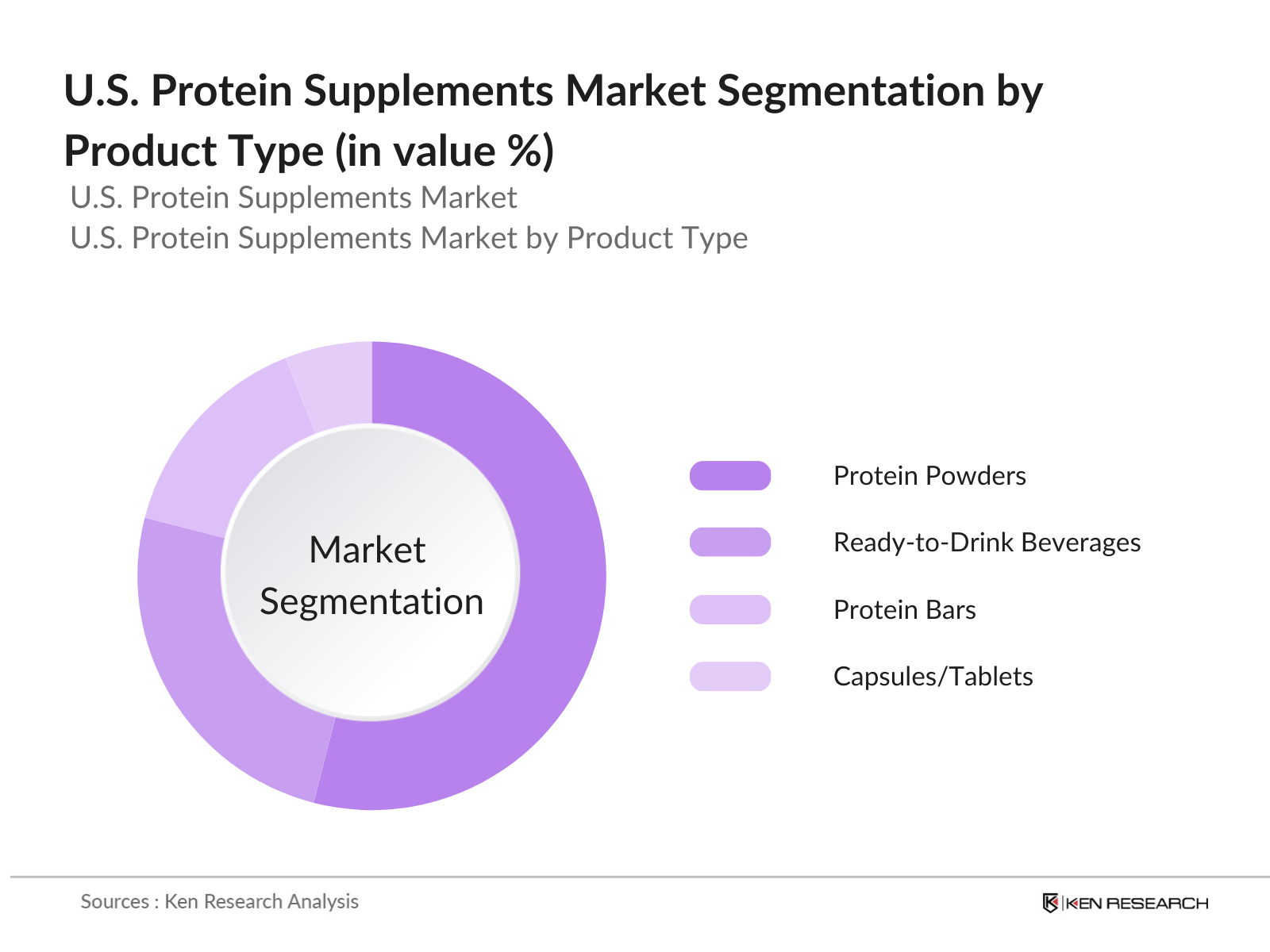

By Product Type: The U.S. protein supplements market is also categorized by product type into protein powders, ready-to-drink (RTD) beverages, protein bars, and capsules/tablets. Protein powders have maintained a dominant market position owing to their versatility, ease of use, and suitability for various dietary regimens. Protein powders appeal to a wide demographic, from professional athletes to casual fitness enthusiasts, because they can be easily customized into shakes or mixed with food.

U.S. Protein Supplements Market Competitive Landscape

The U.S. protein supplements market is highly competitive, with several key players dominating the landscape. Major players include multinational companies and specialized nutrition brands with a strong focus on product innovation and marketing. The competition is intensified by the emergence of new players capitalizing on the growing demand for plant-based and clean-label supplements. These companies invest significantly in research and development to introduce new product varieties and formats, meeting evolving consumer preferences.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Certifications |

Revenue (USD Bn) |

Number of Employees |

Key Innovations |

Market Strategy |

|

Glanbia Nutritionals |

1997 |

Downers Grove, IL |

||||||

|

PepsiCo Inc. |

1965 |

Purchase, NY |

||||||

|

MusclePharm Corp. |

2006 |

Burbank, CA |

||||||

|

Abbott Laboratories |

1888 |

Abbott Park, IL |

||||||

|

Herbalife Nutrition Ltd. |

1980 |

Los Angeles, CA |

U.S. Protein Supplements Market Analysis

Market Growth Drivers

- Ex E-commerce Channels: The rise in e-commerce platforms has significantly contributed to the accessibility of protein supplements in the U.S. Between 2022 and 2023, e-commerce sales in the U.S. grew by $244 billion, as per the U.S. Department of Commerce. Protein supplements are increasingly being sold online, which eliminates middlemen and lowers distribution costs. Online platforms, including Amazon and other specialized fitness retailers, have increased consumer access, further driving the market forward. Macroeconomic factors such as high internet penetration and mobile phone usage have also fueled this trend.

- Increase in Rates in the Population: Protein deficiency is becoming a critical health issue in the U.S., with estimates showing that over 30 million Americans, particularly older adults, are not meeting daily protein intake requirements, according to USDA statistics. Protein supplements are increasingly seen as a solution, particularly in age groups suffering from muscle degradation due to poor diet. Macroeconomic indicators, such as rising healthcare costs related to malnutrition, are pushing consumers toward easy-access supplements.

- Rise in Health and Fitness Enthusiasts: The U.S. has witnessed a significant increase in the number of health-conscious individuals due to greater awareness of the benefits of exercise and nutrition. In 2022, over 55 million Americans held gym memberships, a number supported by the U.S. Census Bureau's data on lifestyle changes toward fitness. The fitness industry has seen increased revenue, with a substantial portion spent on protein supplements, specifically post-workout protein powders and shakes. Macroeconomic indicators, such as rising disposable income in households, have fueled this trend, especially in urban areas.

Market Challenges

- High Production Costs: The cost of producing high-quality protein supplements has increased due to inflationary pressures in the U.S. economy. The Bureau of Labor Statistics reports that raw material prices, particularly for dairy-based protein like whey, increased by nearly $12 per ton between 2022 and 2023. These cost hikes have created challenges for manufacturers, making it harder to maintain competitive pricing without sacrificing quality. Additionally, rising labor costs in protein supplement manufacturing facilities are further inflating overall production expenses.

- Complex Supply Chain for Plant-Based Ingredients: Sourcing plant-based protein ingredients like peas and soybeans has become increasingly complex due to supply chain disruptions. According to the USDA, transportation delays caused by logistical bottlenecks resulted in shortages of key ingredients in 2022. The need to import plant-based proteins or source them from distant locations within the U.S. also led to increased transportation costs, further complicating the supply chain. Macroeconomic disruptions in global supply chains due to geopolitical tensions have compounded these challenges.

U.S. Protein Supplements Market Future Outlook

Over the next few years, the U.S. protein supplements market is expected to witness continued growth driven by the increasing popularity of fitness regimens, ongoing product innovations, and rising consumer demand for convenient and sustainable nutrition solutions. With advancements in plant-based protein formulations and the introduction of new product formats, the market is set to attract a broader range of consumers, including those focused on environmental sustainability. Additionally, e-commerce growth and direct-to-consumer models will continue to play a pivotal role in expanding market reach.

Market Opportunities:

- Demand for Organic and Natural Protein Supplements: The U.S. market is witnessing a rising demand for organic and natural protein supplements as consumers become more health-conscious. According to the USDA, the sales of organic food, including protein products, surpassed $60 billion in 2022. Consumers are shifting toward clean-label supplements, free from artificial additives or preservatives. This trend aligns with broader dietary preferences for minimally processed, organic products. Additionally, organic certifications for these products are becoming a key differentiator in the market.

- Increasing Consumer Focus on Sustainability in Packaging: Sustainability is becoming a key concern for U.S. consumers, and this is extending to protein supplements. In 2023, the U.S. Environmental Protection Agency (EPA) noted that over 12 million tons of plastic waste were generated from food and supplement packaging alone. Companies are increasingly focusing on eco-friendly packaging solutions, such as recyclable or biodegradable containers. This shift aligns with growing consumer awareness and preference for products that contribute to environmental sustainability.

Scope of the Report

|

By Source |

Animal-Based Protein Plant-Based Protein Mixed Source Protein |

|

By Product Type |

Protein Powder Ready-to-Drink (RTD) Protein Beverages Protein Bars Protein Capsules/Tablets |

|

By Distribution Channel |

Supermarkets & Hypermarkets Online Stores Specialty Stores Fitness Centers & Pharmacies |

|

By Application |

Sports Nutrition Functional Foods Weight Management |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Health and Fitness Retail Chains

E-Commerce Platforms (e.g., Amazon, Walmart)

Protein Supplement Manufacturers

Nutrition and Wellness Service Providers

Pharmaceutical Companies

Gyms and Fitness Centers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration)

Companies

Players in Mention Report

Glanbia Nutritionals

PepsiCo Inc.

MusclePharm Corp.

Abbott Laboratories

Herbalife Nutrition Ltd.

Amway

GNC Holdings Inc.

NOW Foods

Iovate Health Sciences

Quest Nutrition

Orgain

Dymatize Nutrition

Optimum Nutrition (ON)

Garden of Life

Premier Protein

Table of Contents

U.S. Protein Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

U.S. Protein Supplements Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

U.S. Protein Supplements Market Analysis

3.1. Growth Drivers (Nutritional Awareness, Fitness Trends, Protein Deficiency Solutions)

3.1.1. Rise in Health and Fitness Enthusiasts

3.1.2. Growing Demand for Plant-Based Protein Sources

3.1.3. Expansion in E-commerce Channels

3.1.4. Increase in Protein Deficiency Rates in the Population

3.2. Market Challenges (Ingredient Sourcing, Pricing Fluctuations, Consumer Misinformation)

3.2.1. High Production Costs

3.2.2. Complex Supply Chain for Plant-Based Ingredients

3.2.3. Regulatory Challenges Regarding Supplement Claims

3.3. Opportunities (Product Innovation, Expanding Target Demographics)

3.3.1. Introduction of New Protein Formats (RTD, Protein Bars)

3.3.2. Emerging Markets for Sports Nutrition

3.3.3. Expanding into Female-Centric Products

3.4. Trends (Sustainability, Clean Label Products, Personalized Nutrition)

3.4.1. Demand for Organic and Natural Protein Supplements

3.4.2. Increasing Consumer Focus on Sustainability in Packaging

3.4.3. Rise of Personalized Protein Solutions Based on DNA/Genetics

3.5. Government Regulations (FDA Approvals, Labeling Requirements, Import Tariffs)

3.5.1. FDA Guidelines on Protein Supplement Claims

3.5.2. Tariff Regulations on Imported Ingredients

3.5.3. Labeling Requirements for Dietary Supplements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, E-Commerce Platforms)

3.8. Porters Five Forces

3.9. Competition Ecosystem

U.S. Protein Supplements Market Segmentation

4.1. By Source (In Value %)

4.1.1. Animal-Based Protein (Whey, Casein, Collagen)

4.1.2. Plant-Based Protein (Soy, Pea, Hemp, Rice)

4.1.3. Mixed Source Protein

4.2. By Product Type (In Value %)

4.2.1. Protein Powder

4.2.2. Ready-to-Drink (RTD) Protein Beverages

4.2.3. Protein Bars

4.2.4. Protein Capsules/Tablets

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Online Stores

4.3.3. Specialty Stores

4.3.4. Fitness Centers & Pharmacies

4.4. By Application (In Value %)

4.4.1. Sports Nutrition

4.4.2. Functional Foods

4.4.3. Weight Management

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

U.S. Protein Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Glanbia Nutritionals

5.1.2. PepsiCo Inc.

5.1.3. The Hut Group

5.1.4. MusclePharm Corp.

5.1.5. Abbott Laboratories

5.1.6. Herbalife Nutrition Ltd.

5.1.7. Amway

5.1.8. GNC Holdings Inc.

5.1.9. NOW Foods

5.1.10. Iovate Health Sciences

5.1.11. Quest Nutrition

5.1.12. Orgain

5.1.13. Dymatize Nutrition

5.1.14. Optimum Nutrition (ON)

5.1.15. Garden of Life

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Key Innovations, Certifications, Geographical Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Partnerships, Mergers & Acquisitions)

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

U.S. Protein Supplements Market Regulatory Framework

6.1. FDA Regulations for Dietary Supplements

6.2. Compliance Requirements for Protein Labeling

6.3. Certification Processes for Organic Protein Sources

U.S. Protein Supplements Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

U.S. Protein Supplements Future Market Segmentation

8.1. By Source (In Value %)

8.2. By Product Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

U.S. Protein Supplements Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved developing an industry map to identify the critical factors affecting the U.S. protein supplements market. This phase relied on secondary research using government reports, company filings, and other proprietary databases to define key market variables.

Step 2: Market Analysis and Construction

In this phase, we collected and analyzed historical data on the U.S. protein supplements market, focusing on product types, distribution channels, and regional preferences. The market penetration analysis helped in calculating the market's revenue generation and the prominence of different product segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested through interviews with key stakeholders in the protein supplement supply chain, including manufacturers, retailers, and distributors. Their insights helped refine the market data and provided operational perspectives on current trends.

Step 4: Research Synthesis and Final Output

In the final phase, primary data collected from interviews and proprietary databases were synthesized with secondary sources to provide a well-rounded analysis. This validated the market data and produced a comprehensive report covering all aspects of the U.S. protein supplements market.

Frequently Asked Questions

01. How big is the U.S. Protein Supplements Market?

The U.S. protein supplements market is valued at USD 9.69 billion, driven by the growing demand for fitness and wellness products and increasing consumer awareness regarding the benefits of protein supplements.

02. What are the challenges in the U.S. Protein Supplements Market?

Challenges include ingredient sourcing complexities, high production costs, and stringent regulatory requirements imposed by the FDA, especially concerning product claims and labeling.

03. Who are the major players in the U.S. Protein Supplements Market?

Key players in the U.S. market include Glanbia Nutritionals, PepsiCo Inc., Abbott Laboratories, Herbalife Nutrition Ltd., and MusclePharm Corp., each leveraging innovative products and strong distribution networks.

04. What are the growth drivers of the U.S. Protein Supplements Market?

The market's growth is propelled by rising health consciousness, the popularity of fitness trends, and the increasing consumer preference for plant-based protein options. The expansion of e-commerce platforms further supports market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.