U.S. Residential Washing Machine Market Outlook 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11463

November 2024

81

About the Report

U.S. Residential Washing Machine Market Overview

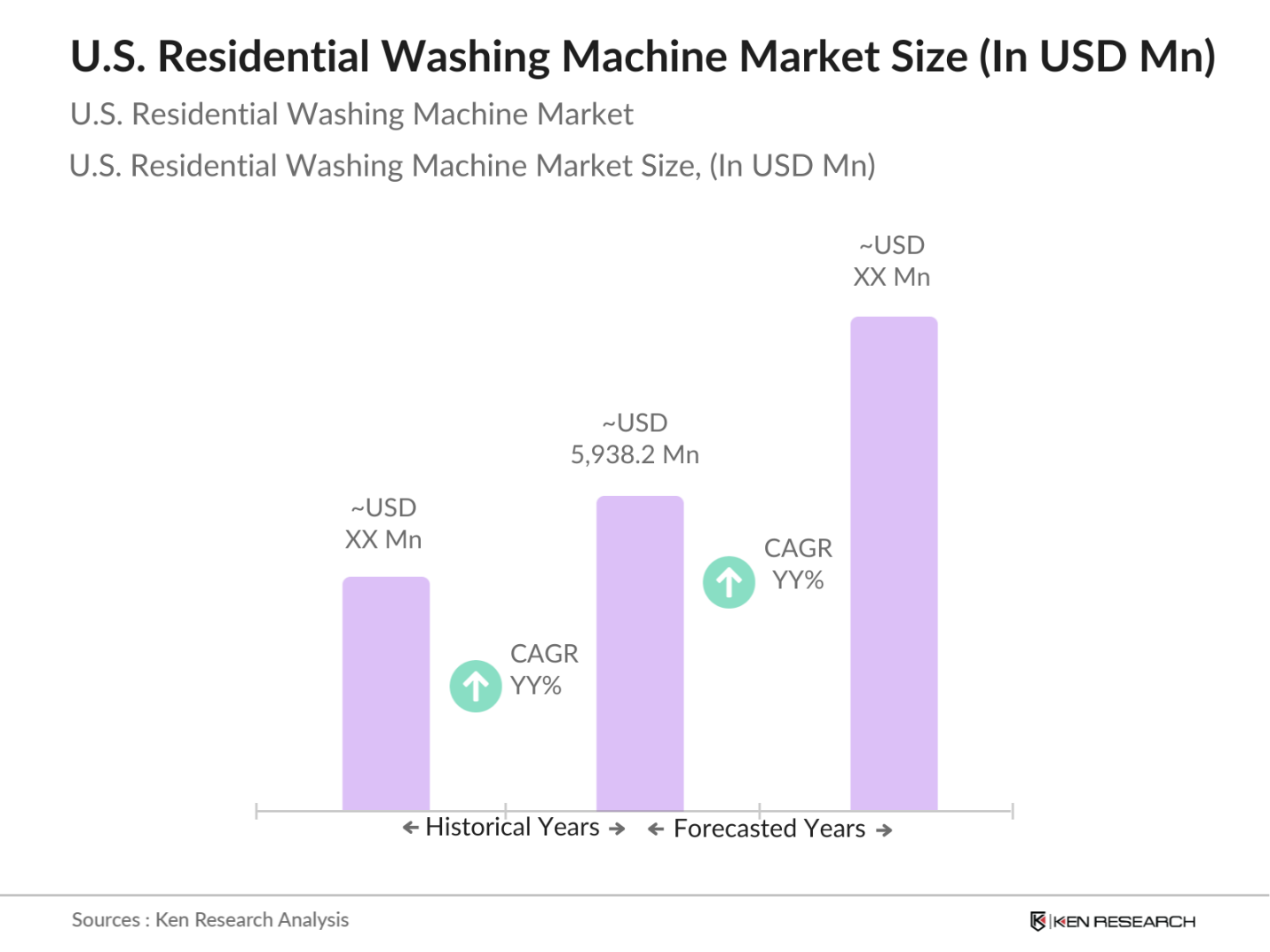

- The U.S. residential washing machine market is valued at USD 5,938.2 million based on recent data, driven by continuous technological advancements and evolving consumer demand for energy-efficient home appliances. The market growth is further accelerated by increased urbanization and the rise in disposable incomes, leading to higher adoption rates of premium washing machines. Additionally, consumer preferences are shifting towards fully automatic and smart washing machines equipped with IoT, AI, and energy-saving features, which further boosts demand.

- Key regions that dominate the market include urban centers like New York, Los Angeles, and Chicago, where consumers prioritize advanced technology and convenience in household appliances. The high rate of urbanization, combined with an increasing number of smart homes in these areas, drives demand for modern washing machines. These cities also experience a higher concentration of middle- to high-income families who favor energy-efficient and premium washing machine models.

- The European Unions Eco-Design Directive mandates energy efficiency standards for household appliances, including washing machines, requiring manufacturers to meet strict energy consumption and water usage benchmarks. In 2023, the directive further tightened regulations on water and energy use for washing machines, providing incentives for companies to innovate in energy-saving technologies. Additionally, consumers in EU countries can access rebates and subsidies when purchasing energy-efficient appliances, further encouraging the transition to more sustainable options.

U.S. Residential Washing Machine Market Segmentation

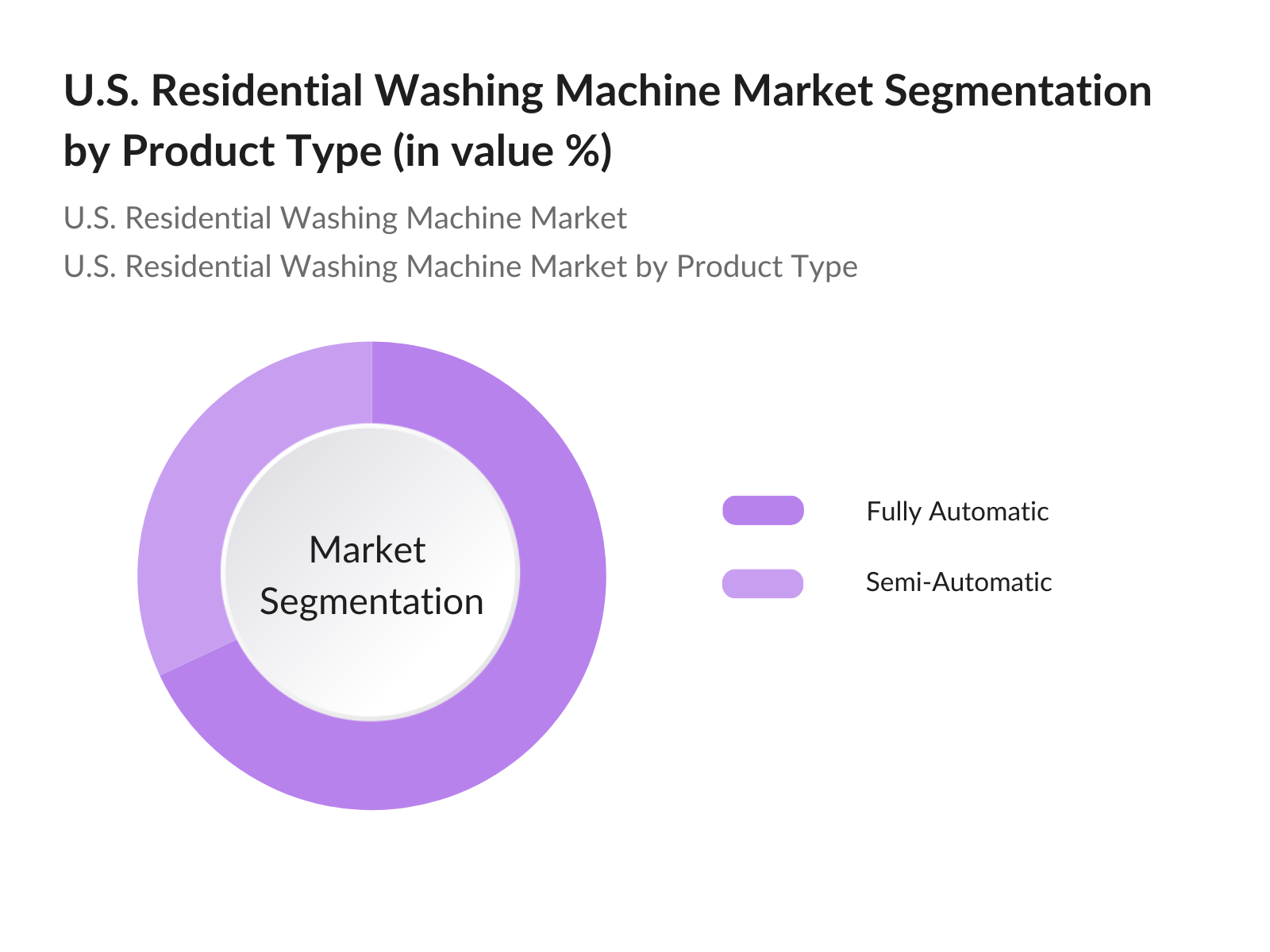

- By Product Type: The U.S. residential washing machine market is segmented by product type into fully automatic and semi-automatic washing machines. Fully automatic machines hold a dominant market share due to their user-friendly features and superior efficiency. They are equipped with smart controls and various automated wash programs that reduce human intervention. This segment has witnessed growth driven by busy lifestyles and the need for convenient laundry solutions.

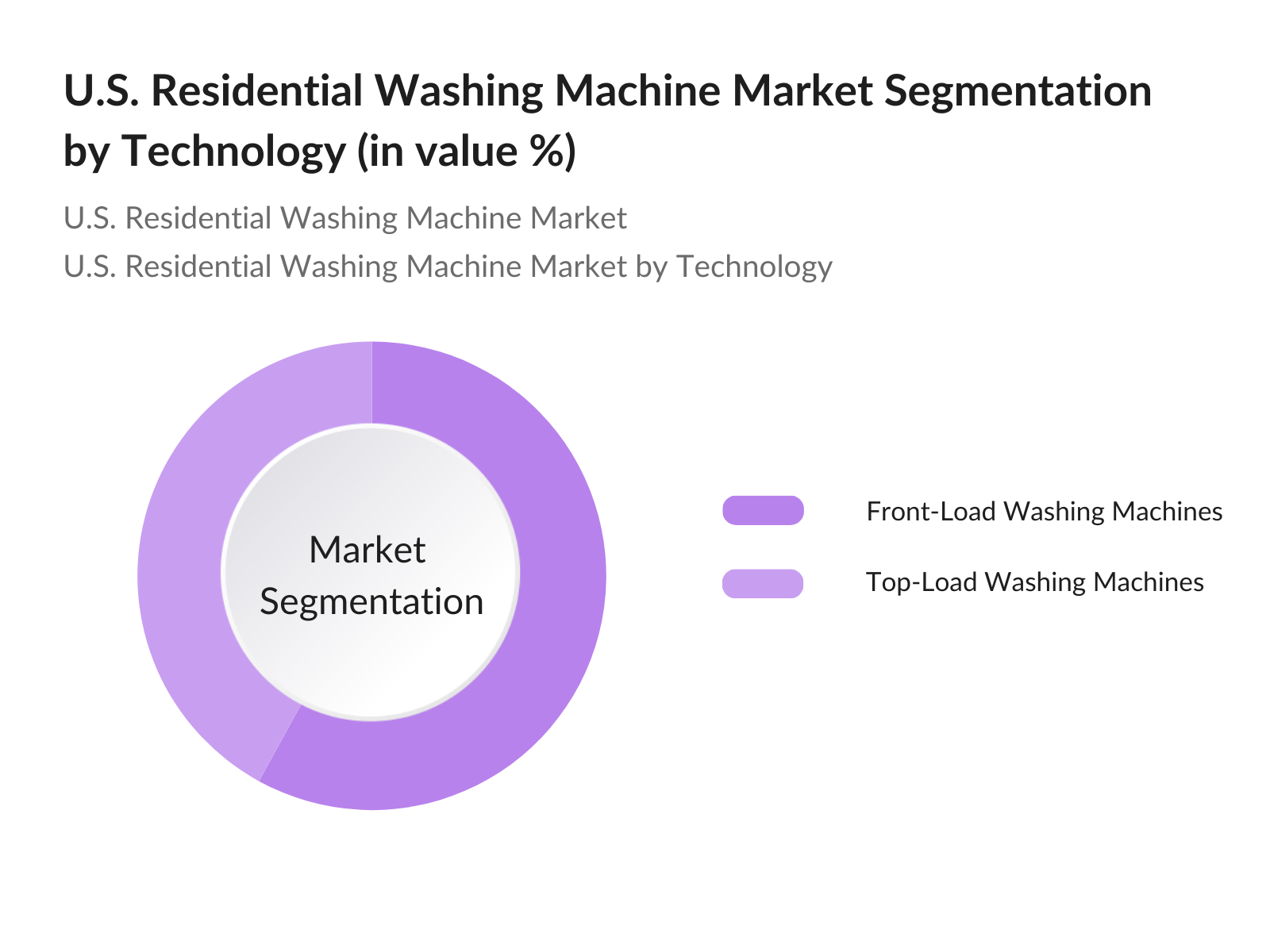

- By Technology: The market is divided into front-load and top-load washing machines. Front-load washing machines dominate the market due to their water and energy efficiency, which aligns with the growing consumer focus on sustainability. These machines also offer better cleaning performance and are preferred by consumers looking for long-term cost savings on utility bills.

U.S. Residential Washing Machine Market Competitive Landscape

The U.S. residential washing machine market is dominated by key players who continuously innovate and improve their product lines to maintain market leadership. The consolidation of these market players is driven by their significant investments in R&D, strategic partnerships, and aggressive marketing tactics. Companies like Whirlpool and Samsung lead the way with innovative products and a robust global presence

|

Company |

Year of Establishment |

Headquarters |

Revenue (2023, USD) |

No. of Employees |

Key Product |

Technology Innovation |

R&D Investments |

Sustainability Initiatives |

|

Whirlpool Corporation |

1911 |

Benton Harbor, MI |

21 billion |

- |

- |

- |

- |

- |

|

Samsung Electronics Co. |

1938 |

Suwon, South Korea |

230 billion |

- |

- |

- |

- |

- |

|

LG Electronics Inc. |

1958 |

Seoul, South Korea |

57 billion |

- |

- |

- |

- |

- |

|

General Electric Co. |

1892 |

Boston, MA |

76 billion |

- |

- |

- |

- |

- |

|

AB Electrolux |

1919 |

Stockholm, Sweden |

14 billion |

- |

- |

- |

- |

- |

U.S. Residential Washing Machine Market Analysis

Market Growth Drivers

- Energy Efficiency (Government initiatives, ENERGY STAR compliance): The global focus on energy efficiency has led to the widespread adoption of initiatives like ENERGY STAR, a U.S. government-backed program that helps consumers identify energy-efficient appliances. As of 2024, over 2 million ENERGY STAR-certified washing machines have been sold, saving approximately 60 billion kilowatt-hours (kWh) annually, according to the U.S. Department of Energy. Government rebates on energy-efficient appliances also promote the demand for high-efficiency models. In the EU, the Ecodesign Directive mandates energy savings for appliances, contributing to a significant reduction in household energy consumption.

- Technological Advancements (AI and IoT-enabled appliances): Technological advancements, particularly the integration of Artificial Intelligence (AI) and the Internet of Things (IoT), have revolutionized the washing machine market. AI-enabled washing machines can make real-time adjustments to washing cycles based on the weight of the load, fabric type, and even the level of dirt, helping to reduce water and energy consumption. IoT features allow for remote control and monitoring of washing machines via smartphones or smart home systems, providing convenience and further enhancing energy efficiency. These innovations are reshaping consumer preferences toward smart and connected appliances.

- Changing Household Structures (Larger families, demand for high-capacity washing machines): The rise in multi-generational living and larger family units, particularly in regions like Asia and Africa, has driven demand for high-capacity washing machines. Larger families require washing machines that can handle more significant loads, typically up to 15kg, to meet their daily laundry needs efficiently. The increasing trend of urbanization and changing household dynamics has led to a shift in consumer preferences toward appliances that offer greater capacity and efficiency, enabling households to save time and resources while managing larger laundry volumes.

Market Challenges:

- Competition from Low-Cost Brands: The global washing machine market is highly competitive, with low-cost brands, particularly from Asia, capturing significant market share. Brands such as Haier and Midea dominate the lower-end segment, with unit prices under $300. In 2023, the import of low-cost appliances from China to Africa increased by 15%, with over 3 million units sold annually. This price competition poses challenges for premium brands that rely on advanced technologies to justify higher price points. Consumers in cost-sensitive markets are more inclined to opt for affordable, albeit less efficient, alternatives.

- E-Waste and Environmental Concerns: E-waste is a growing concern globally, with the International Telecommunication Union reporting that over 53.6 million metric tons of e-waste were generated in 2023, up from 50 million in 2022. Washing machines contribute to this growing environmental problem as they are discarded when they become obsolete or too costly to repair. The European Unions Waste Electrical and Electronic Equipment (WEEE) directive aims to mitigate this by enforcing stricter recycling standards, yet the rising consumption of smart appliances complicates e-waste management, as the components are often harder to recycle.

U.S. Residential Washing Machine Market Future Outlook

Over the next five years, the U.S. residential washing machine market is expected to experience robust growth. This expansion will be driven by the increasing adoption of smart home appliances, consumer demand for energy-efficient products, and innovations in IoT and AI technologies. The shift towards larger-capacity washing machines and the rise of premium models that offer advanced functionality are also set to contribute to market expansion. Moreover, the ongoing focus on water conservation and eco-friendly practices will further fuel the adoption of energy-efficient washing machines.

Market Opportunities:

- Demand for Compact and Portable Washing Machines: As urbanization increases, particularly in densely populated regions, the demand for compact and portable washing machines has risen. Consumers living in smaller apartments or shared housing spaces are opting for space-efficient appliances that can fit into limited living environments. Compact washers, designed to save space without compromising performance, are becoming popular in urban areas where living space is a premium. This trend provides manufacturers with an opportunity to innovate and cater to the growing market for portable, efficient, and space-saving home appliances.

- Growth of Front-Load Segment (Superior water efficiency): The front-load washing machine segment has seen strong growth, largely due to its superior water efficiency compared to top-load models. Front-load washers are designed to use significantly less water per cycle, making them an attractive option for consumers focused on water conservation. As environmental concerns and water usage regulations become more stringent globally, consumers are increasingly choosing front-load machines that offer both efficiency and performance. The segments growth is also fueled by the rising awareness of sustainable living practices and the push toward eco-friendly home appliances.

Scope of the Report

|

By Product Type |

Fully Automatic Semi-Automatic |

|

By Technology |

Top Load Front Load |

|

By Capacity |

Below 6 Kg 6 to 8 Kg Above 8 Kg |

|

By Distribution Channel |

Online Offline |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Major Home Appliance Manufacturers

Retailers and Distributors (e.g., Lowe's, Home Depot)

Government and Regulatory Bodies (U.S. Department of Energy)

Consumer Electronics Chains (e.g., Best Buy)

Investment and Venture Capitalist Firms

Energy Efficiency Consultants

Real Estate Developers (Smart Home Segment)

E-commerce Platforms (Amazon, Walmart)

Companies

Players mentioned in the report

Whirlpool Corporation

Samsung Electronics Co. Ltd.

LG Electronics Inc.

General Electric Co.

AB Electrolux

Kenmore

Maytag

BSH Hausgerte GmbH

IFB Industries Ltd.

Panasonic Corporation

Midea Group Co. Ltd.

Hitachi, Ltd.

Haier Smart Home Co. Ltd.

Frigidaire

Danby

Table of Contents

1. U.S. Residential Washing Machine Market Overview

1.1. Definition and Scope

1.2. Market Valuation

1.3. Key Market Developments and Trends

1.4. Market Growth Rate

2. U.S. Residential Washing Machine Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Regional Market Size Analysis

3. U.S. Residential Washing Machine Market Analysis

3.1. Growth Drivers

3.1.1. Energy Efficiency Initiatives

3.1.2. Technological Advancements

3.1.3. Changing Household Structures

3.2. Market Challenges

3.2.1. Competition from Low-Cost Brands

3.2.2. E-Waste and Environmental Concerns

3.3. Opportunities

3.3.1. Demand for Compact Washing Machines

3.3.2. Growth of Front-Load Segment

3.4. Trends

3.4.1. Rise in Smart Appliances

3.4.2. Increased Focus on Sustainability

3.5. Government Regulation

3.5.1. Energy Efficiency Standards

3.5.2. Recycling Initiatives

4. U.S. Residential Washing Machine Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fully Automatic

4.1.2. Semi-Automatic

4.2. By Technology (In Value %)

4.2.1. Top Load

4.2.2. Front Load

4.3. By Capacity (In Value %)

4.3.1. Below 6 Kg

4.3.2. 6 to 8 Kg

4.3.3. Above 8 Kg

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. West Coast

4.5.4. Southern States

5. U.S. Residential Washing Machine Market Competitive Analysis

5.1. Major Players

5.1.1. Whirlpool Corporation

5.1.2. Samsung Electronics Co. Ltd.

5.1.3. LG Electronics Inc.

5.1.4. General Electric Co.

5.1.5. AB Electrolux

5.1.6. Kenmore

5.1.7. Maytag

5.1.8. BSH Hausgerte GmbH

5.1.9. IFB Industries Ltd.

5.1.10. Panasonic Corporation

5.1.11. Midea Group Co. Ltd.

5.1.12. Hitachi, Ltd.

5.1.13. Haier Smart Home Co. Ltd.

5.1.14. Frigidaire

5.1.15. Danby

5.2. Market Share Analysis

5.3. Strategic Initiatives and Collaborations

5.4. R&D Investments and Innovations

6. U.S. Residential Washing Machine Market Regulatory Framework

6.1. Environmental Regulations

6.2. Compliance with Local Standards

6.3. Government Incentives

7. Future Outlook for U.S. Residential Washing Machine Market

7.1. Future Market Size Projections (In USD Million)

7.2. Key Trends Influencing Future Growth

7.3. Market Opportunities and Risks

Analysts Recommendations

8.1. Strategic Insights for Stakeholders

8.2. Market Entry Strategies

8.3. Investment Recommendations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of stakeholders in the U.S. residential washing machine market. Through desk research and proprietary databases, key variables such as product innovation, consumer preferences, and market drivers are identified and analyzed.

Step 2: Market Analysis and Construction

Historical data on the residential washing machine market is compiled and analyzed. This phase assesses product adoption, revenue trends, and the influence of external factors like urbanization and water scarcity on market performance.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed based on the collected data and validated through direct interviews with key industry stakeholders, including manufacturers, distributors, and technology experts. This ensures accuracy and depth in the market analysis.

Step 4: Research Synthesis and Final Output

The final step synthesizes the collected data and insights through a bottom-up approach. Consultations with product managers from leading washing machine brands help validate the data, ensuring the final report offers an accurate and actionable analysis.

Frequently Asked Questions

01. How big is the U.S. residential washing machine market?

The U.S. residential washing machine market is valued at USD 5,938.2 million, driven by continuous innovation in energy-efficient and smart appliances, coupled with increasing urbanization

02. What are the challenges in the U.S. residential washing machine market?

Key challenges include high competition among major players, price sensitivity among consumers, and the environmental impact of discarded appliances. Additionally, navigating U.S. regulatory standards on energy efficiency poses a challenge for manufacturers

03. Who are the major players in the U.S. residential washing machine market?

Leading players include Whirlpool Corporation, Samsung Electronics Co. Ltd., LG Electronics Inc., General Electric Co., and AB Electrolux. These companies dominate through innovation and strategic marketing efforts

04. What drives the growth of the U.S. residential washing machine market?

Growth is propelled by rising consumer demand for smart and energy-efficient appliances, urbanization trends, and an increase in multi-member households requiring higher capacity machines

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.