US SaaS Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD2023

November 2024

82

About the Report

US SaaS Market Overview

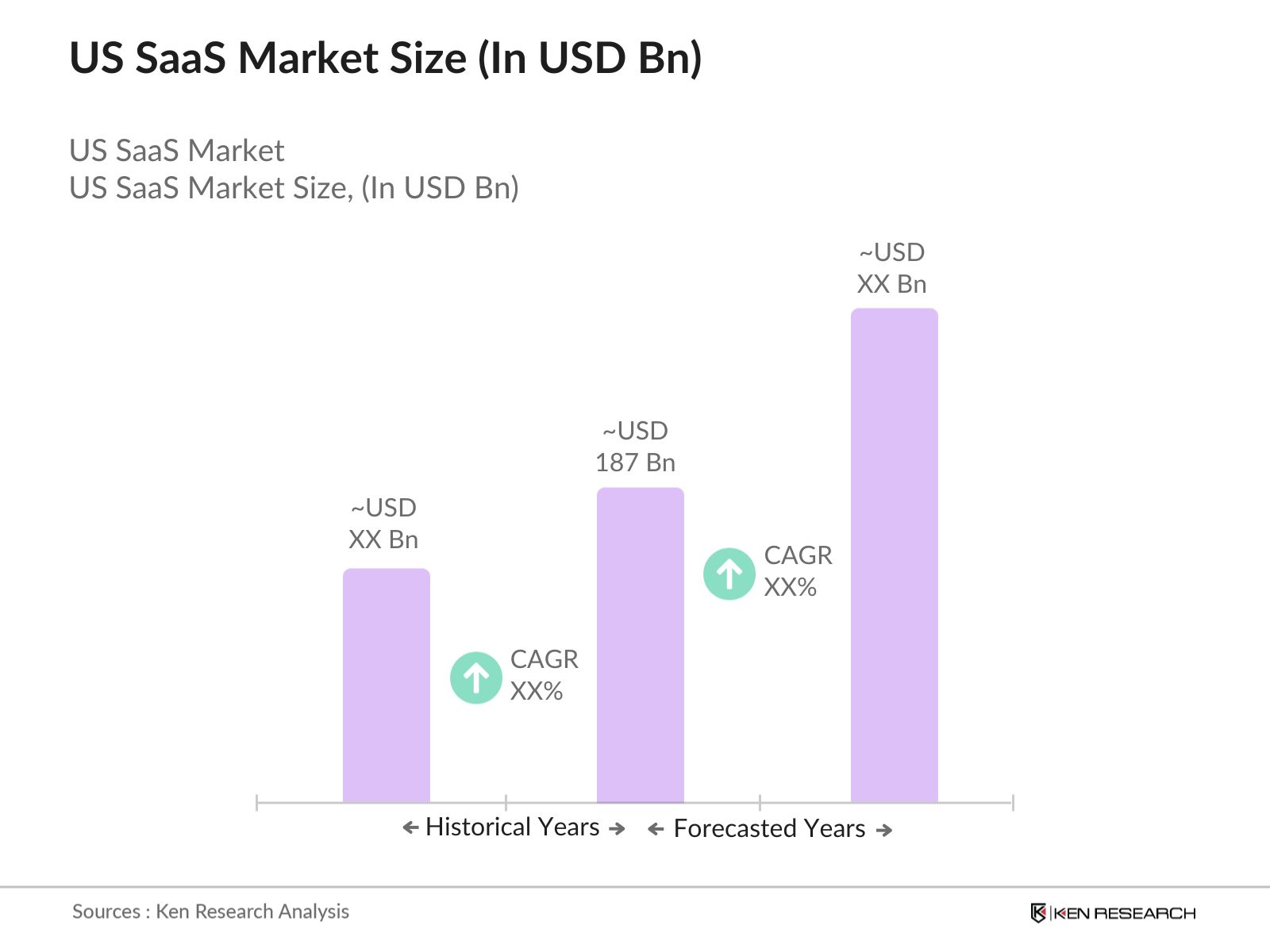

The US SaaS market is valued at USD 187 billion, based on a five-year historical analysis. The growth of this market is primarily driven by increasing demand for cloud-based solutions from both large enterprises and small to medium-sized businesses. The subscription-based pricing model allows organizations to scale their software needs as required, which is attractive for managing operational costs. Additionally, the increased reliance on remote work tools, CRM, and ERP systems has fueled the expansion of SaaS solutions across industries.

The dominant regions in the US SaaS market include tech hubs such as Silicon Valley, Seattle, and New York. These cities benefit from access to a highly skilled workforce, a strong venture capital ecosystem, and an innovation-driven business culture. Silicon Valley, in particular, houses some of the largest SaaS providers, contributing to its dominance. Additionally, these regions have well-established cloud infrastructure and are at the forefront of digital transformation, making them highly competitive in the SaaS market.

The US SaaS market is under increased scrutiny for potential monopolistic practices. In 2023, the Federal Trade Commission initiated investigations into major SaaS providers to ensure compliance with antitrust laws aimed at promoting fair competition. Antitrust regulations prevent market monopolies and encourage innovation within the SaaS industry. The FTC reports that over 400 investigations were launched to assess the competitive practices of leading SaaS firms, highlighting the government's commitment to maintaining a fair and open market.

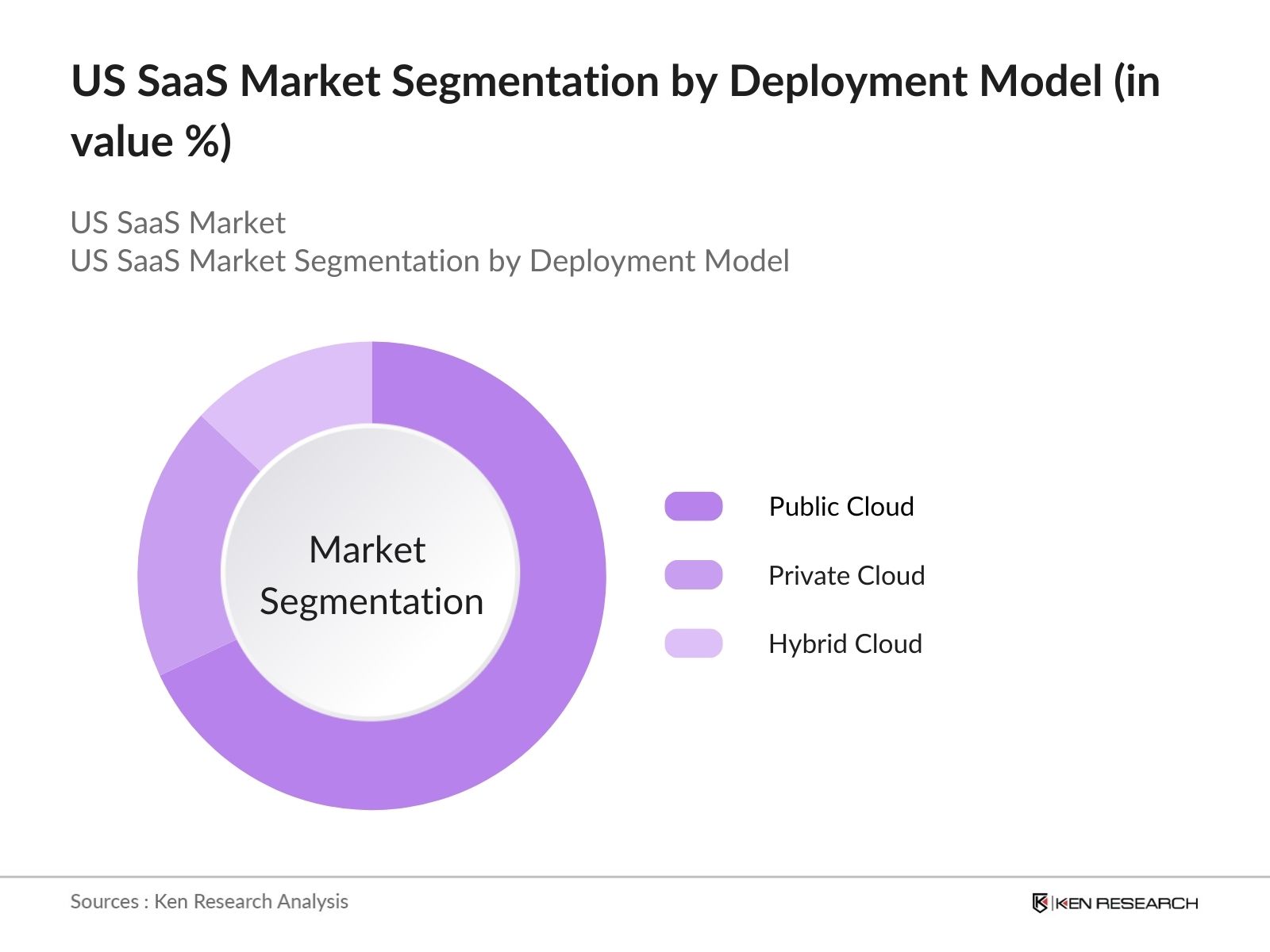

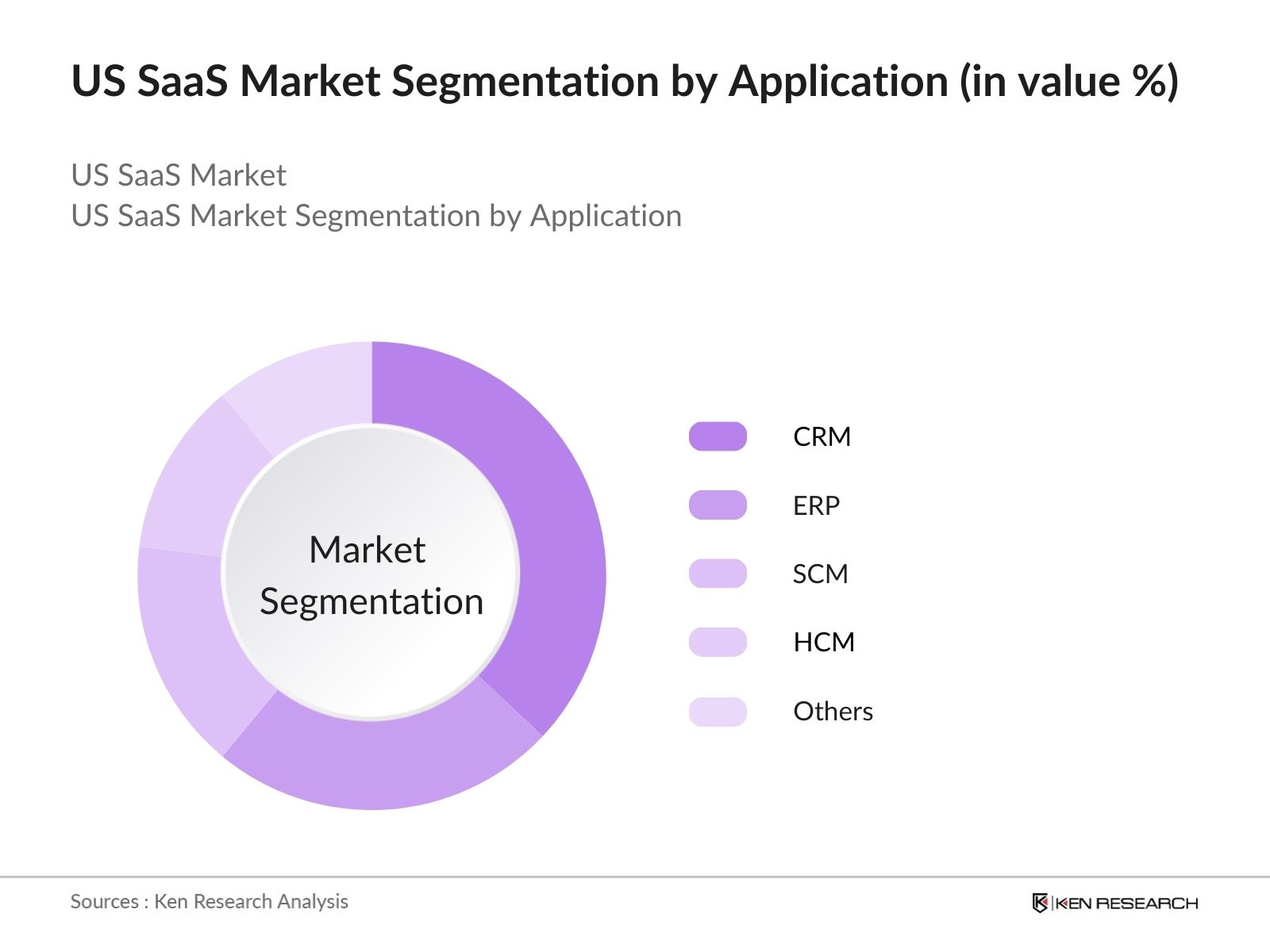

US SaaS Market Segmentation

By Deployment Model: The market is segmented by deployment models into Public Cloud, Private Cloud, and Hybrid Cloud. Recently, Public Cloud solutions have dominated market share under this segmentation, due to their lower initial costs, scalability, and ease of use. This segment is largely driven by demand from small and medium-sized enterprises that lack the resources to manage their own IT infrastructure but require the flexibility and cost-efficiency of a cloud-based solution.

By Application: The market is further segmented by application into CRM, ERP, SCM, HCM, and Others. Customer Relationship Management (CRM) applications hold the largest market share due to their critical role in managing client interactions, sales, and customer service. The dominance of CRM solutions can be attributed to the increasing need for personalized customer experiences, which is essential for businesses aiming to retain clients and drive customer satisfaction.

US SaaS Market Competitive Landscape

The US SaaS market is dominated by a few major players, including tech giants like Microsoft, Salesforce, and Adobe, who have entrenched themselves as industry leaders through extensive SaaS portfolios. These companies lead the market due to their innovation-driven product strategies, robust cloud infrastructure, and strategic partnerships. The competitive landscape highlights the significant influence of these key players as they continuously invest in research and development to maintain their leadership.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

SaaS Portfolio |

Global Reach |

Employee Count |

Cloud Capabilities |

Customer Base |

Strategic Initiatives |

|

Microsoft Corporation |

1975 |

Redmond, WA |

|||||||

|

Salesforce.com, Inc. |

1999 |

San Francisco, CA |

|||||||

|

Adobe Inc. |

1982 |

San Jose, CA |

|||||||

|

SAP SE |

1972 |

Walldorf, Germany |

|||||||

|

Oracle Corporation |

1977 |

Austin, TX |

US SaaS Industry Analysis

Growth Drivers

Digital Transformation: Digital transformation continues to drive the US SaaS market, with businesses rapidly adopting cloud technologies. According to the IMF, cloud adoption in the US surged in 2022-2023, aligning with an estimated $8.3 trillion worth of digital economic output. As of 2024, over 90% of US companies have adopted some form of cloud computing, with SaaS being a key enabler. Industry 4.0 technologies, such as IoT, are creating new SaaS applications for automation and analytics. This trend is boosting demand for SaaS platforms that integrate AI, machine learning, and advanced data processing.

Expansion of Remote Workforce: The shift towards a remote workforce remains a major growth driver in the US SaaS market. The Bureau of Labor Statistics reported that in 2024, approximately 22 million Americans work remotely, a significant increase from pre-pandemic levels. This trend is driving demand for SaaS-based communication and collaboration tools, including Zoom, Microsoft Teams, and Slack. Additionally, remote work software investments by enterprises grew by over $5 billion in 2023, further propelling the SaaS market expansion, according to US government economic reports.

IT Spending in Enterprises: US enterprises continue to increase IT spending, with a notable focus on SaaS. According to World Bank data, total IT expenditure in the US reached $1.30 trillion in 2023, with a significant portion allocated to cloud-based solutions, especially SaaS. Over 60% of this IT spend is directed toward scalable solutions that enhance operational efficiency, including SaaS platforms that support critical enterprise functions such as HR, finance, and customer relationship management.

Market Challenges

High Competition: The US SaaS market is highly competitive, with thousands of providers battling for market share. Intense competition is leading to price wars, where companies lower their pricing strategies to attract customers. Data from the US Department of Commerce in 2023 shows that the total number of SaaS providers increased by 17,000 since 2020, further intensifying competition. This saturated market has created differentiation challenges, as businesses struggle to distinguish their offerings from competitors.

Customer Churn: Customer churn is a recurring issue for SaaS businesses due to heightened competition and price sensitivity. A 2024 report from the US Small Business Administration shows that SMBs are particularly sensitive to pricing changes, with a churn rate of 7% annually. Enterprises are shifting between platforms for better pricing, flexibility, and service quality. This churn threatens long-term profitability and highlights the need for SaaS providers to deliver continuous value through product enhancements and customer success strategies.

US SaaS Market Future Outlook

Over the next five years, the US SaaS market is expected to show growth driven by the increasing digital transformation across industries, especially in healthcare, finance, and retail sectors. The rising adoption of AI and machine learning in SaaS applications will also fuel market demand, allowing companies to offer more personalized and automated services to their customers. Additionally, the continued growth of remote and hybrid work models will boost demand for collaboration and productivity tools.

Future Market Opportunities

Integration with AI & Machine Learning: AI integration presents a transformative opportunity for SaaS providers. By 2024, AI technologies are forecast to contribute $5 trillion to the global economy, with SaaS platforms playing a critical role. SaaS providers leveraging AI are helping organizations automate routine processes, enhance customer experiences, and extract insights from vast data sets. For instance, AI-powered SaaS platforms in the US healthcare sector have improved diagnostic accuracy by 20% over the past year. AI and machine learning adoption in SaaS is poised to expand further across industries.

Expansion into Niche Verticals: SaaS providers are increasingly targeting niche verticals such as healthcare, education, and financial services. In 2023, the US Department of Health and Human Services reported an increase in SaaS adoption within the healthcare industry, driven by telehealth solutions, patient management systems, and compliance with HIPAA regulations. Similarly, the education sector saw a rise in cloud-based learning platforms. Niche SaaS solutions present an opportunity for providers to cater to specific industry requirements, offering tailored applications that improve efficiency and regulatory compliance.

Scope of the Report

|

Deployment Model |

Public Cloud Private Cloud Hybrid Cloud |

|

Enterprise Size |

Small & Medium Enterprises (SMEs) Large Enterprises |

|

Application |

CRM ERP SCM HCM Others |

|

End-User Industry |

BFSI Healthcare Education Retail IT & Telecom |

|

Region |

North South East West |

Products

Key Target Audience

Large Enterprises

Small and Medium-Sized Enterprises (SMEs)

Cloud Infrastructure Providers

SaaS Platform Developers

Government and Regulatory Bodies (FCC, FTC)

Investment and Venture Capitalist Firms

Banks and Financial Institutes

Financial Institutions

IT and Cybersecurity Firms

Companies

Major Players in the US SaaS Market

Microsoft Corporation

Salesforce.com, Inc.

Adobe Inc.

SAP SE

Oracle Corporation

Google LLC

Amazon Web Services, Inc.

ServiceNow, Inc.

Zoom Video Communications, Inc.

Slack Technologies, Inc.

Dropbox, Inc.

Shopify Inc.

Atlassian Corporation Plc

Twilio Inc.

HubSpot, Inc.

Table of Contents

1. US SaaS Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. US SaaS Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. US SaaS Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation (Cloud Adoption, Industry 4.0)

3.1.2 Expansion of Remote Workforce (Remote Work Tools, Communication Software)

3.1.3 IT Spending in Enterprises (Software-as-a-Service Adoption)

3.1.4 Demand for Scalability & Flexibility (Subscription-Based Models, Freemium Models)

3.2 Market Challenges

3.2.1 High Competition (Price Wars, Differentiation Difficulties)

3.2.2 Data Privacy Concerns (Compliance, Data Security Regulations)

3.2.3 Customer Churn (High Competition, Price Sensitivity)

3.3 Opportunities

3.3.1 Integration with AI & Machine Learning (AI-Driven SaaS Solutions)

3.3.2 Expansion into SMBs (Small & Medium Enterprises Adoption)

3.3.3 Expansion into Niche Verticals (Healthcare, Education, Financial Services)

3.4 Trends

3.4.1 SaaS Verticalization (Industry-Specific SaaS Solutions)

3.4.2 Focus on API-First Solutions (Interoperability & Customization)

3.4.3 Usage-Based Pricing Models (Customer-Centric Pricing, Flexibility)

3.5 Government Regulation

3.5.1 Data Privacy Regulations (GDPR, CCPA, HIPAA)

3.5.2 Cloud Infrastructure Compliance (FedRAMP, SOC 2, ISO 27001)

3.5.3 Antitrust Regulations (Fair Competition, Market Monopolies)

3.6 SWOT Analysis

3.7 SaaS Ecosystem (SaaS Vendors, Cloud Providers, Service Integrators)

3.8 Porters Five Forces (Competitive Rivalry, Bargaining Power of Customers, Bargaining Power of Suppliers, Threat of New Entrants, Threat of Substitutes)

3.9 Competitive Ecosystem

4. US SaaS Market Segmentation

4.1 By Deployment Model (in Value %)

4.1.1 Public Cloud

4.1.2 Private Cloud

4.1.3 Hybrid Cloud

4.2 By Enterprise Size (in Value %)

4.2.1 Small & Medium Enterprises (SMEs)

4.2.2 Large Enterprises

4.3 By Application (in Value %)

4.3.1 Customer Relationship Management (CRM)

4.3.2 Enterprise Resource Planning (ERP)

4.3.3 Supply Chain Management (SCM)

4.3.4 Human Capital Management (HCM)

4.3.5 Others

4.4 By End-User Industry (in Value %)

4.4.1 BFSI (Banking, Financial Services, and Insurance)

4.4.2 Healthcare

4.4.3 Education

4.4.4 Retail

4.4.5 IT & Telecom

4.5 By Region (in Value %)

4.5.1 North

4.5.2 South

4.5.3 West

4.5.4 East

5. US SaaS Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Microsoft Corporation

5.1.2 Salesforce.com, Inc.

5.1.3 Adobe Inc.

5.1.4 SAP SE

5.1.5 Oracle Corporation

5.1.6 Google LLC

5.1.7 Amazon Web Services, Inc.

5.1.8 ServiceNow, Inc.

5.1.9 Zoom Video Communications, Inc.

5.1.10 Slack Technologies, Inc.

5.1.11 Dropbox, Inc.

5.1.12 Shopify Inc.

5.1.13 Atlassian Corporation Plc

5.1.14 Twilio Inc.

5.1.15 HubSpot, Inc.

5.2 Cross Comparison Parameters

(Revenue, Employee Count, Global Reach, SaaS Portfolio Diversity, Cloud Infrastructure Capabilities, Customer Base, Subscription Models, Industry Specialization)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations, Market Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. US SaaS Market Regulatory Framework

6.1 SaaS-Specific Compliance Standards (SOC 2, ISO 27001, FedRAMP)

6.2 Certification Processes (Cloud Infrastructure Certifications, Compliance Audits)

7. US SaaS Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. US SaaS Future Market Segmentation

8.1 By Deployment Model (in Value %)

8.2 By Enterprise Size (in Value %)

8.3 By Application (in Value %)

8.4 By End-User Industry (in Value %)

8.5 By Region (in Value %)

9. US SaaS Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the US SaaS Market. This step is underpinned by extensive desk research, utilizing secondary databases to gather comprehensive industry-level information. The objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the US SaaS market is compiled and analyzed. This includes assessing market penetration and revenue generation by service providers. An evaluation of service quality will also be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts from a diverse array of companies. These consultations provide valuable financial and operational insights directly from industry practitioners.

Step 4: Research Synthesis and Final Output

The final phase involves engagement with multiple SaaS providers to gain insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the bottom-up analysis, ensuring a comprehensive and accurate analysis of the US SaaS market.

Frequently Asked Questions

01 How big is the US SaaS Market?

The US SaaS market, valued at USD 187 billion, is driven by the widespread adoption of cloud-based software solutions across industries, particularly in CRM, ERP, and collaboration tools.

02 What are the key growth drivers in the US SaaS Market?

The key growth drivers include increased cloud adoption, demand for scalability, remote work tools, and AI-powered SaaS solutions, all of which are transforming how businesses operate and manage their software infrastructure.

03 Who are the major players in the US SaaS Market?

Major players in the market include Microsoft Corporation, Salesforce.com, Inc., Adobe Inc., SAP SE, and Oracle Corporation. These companies dominate the market due to their diverse portfolios, extensive global reach, and continuous innovation in the SaaS space.

04 What challenges does the US SaaS Market face?

The market faces challenges such as high competition, data privacy concerns, and customer churn. Additionally, price wars among SaaS providers create challenges for profitability and differentiation.

05 Which deployment model is dominant in the US SaaS Market?

The public cloud deployment model dominates the US SaaS market, owing to its cost-effectiveness, scalability, and ease of implementation, making it attractive for small and medium-sized enterprises.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.