US Sensors and Actuators Market Outlook to 2030

By product type –Sensor (Pressure Sensors, Temperature Sensors and others) and Actuators (Hydraulic Actuators Pneumatic Actuators, Electrical Actuators and others), By End user (Automotive, Healthcare, Oil, & Gas, Consumer Electronics and others) and By Regional Split (North/East/West/South)

Region:North America

Author(s):Shambhavi Awasthi

Product Code:KROD242

September 2023

85

About the Report

Market Overview:

US sensors and actuators market across the world is growing owing to the demand for factory automation applications. The United States has been a significant player in the sensors and actuators market, which encompasses a wide range of industries including automotive, healthcare, consumer electronics, industrial automation, aerospace, and more. Sensors are devices that detect changes in their environment and convert them into electrical signals, while actuators are devices that respond to these signals by producing physical actions or movements. The COVID-19 pandemic has significantly accelerated the longstanding trend toward factory automation, thus fueling the US sensors and actuators market.

The is expected to grow with a CAGR of ~6.5% between 2017-2022 driven by the increasing demand for sensors and actuators of smaller size and increased performance in industrial automation, consumer electronics, Internet of Things (IoT), and implantable electronic applications. The growing demand for MEMS sensors used in advanced driver assistance systems (ADAS) which support increasing road safety will further drive this segment.

The domestic and international players are Texas instruments which cater US sensors and actuators TE Connectivity, Texas Instruments Inc., Honeywell International IncBosch Sensortec , GmbH, Renesas Electronics Corporation, Emerson Electric Co., SMC Corporation, Flowserve Corporation, Schlumberger Limited, Parker-Hannifin Corporation are the top players offering sensors and actuators services.

US sensors and actuators Market Analysis

The sensors and actuators market in the United States has been a critical component of various industries, including automotive, healthcare, consumer electronics, industrial automation, aerospace, and more. Sensors are devices that detect and measure physical properties such as temperature, pressure, light, and motion, while actuators are devices that control or manipulate mechanical systems based on sensor inputs.

- The US sensors and actuators market is anticipated to grow at the CAGR rate of ~8% between 2022-2028.

- The rise in automation of production systems in both discrete and process industries has increased the demand for components capable of providing critical data related to the production process. These sensors facilitate process control in factories by detecting the presence and position of metal objects.

- The proliferation of IoT has driven the demand for sensors and actuators, as these devices are crucial for collecting data from the physical world and enabling communication between devices and systems.

- There has been a trend toward miniaturization and integration of sensors and actuators, allowing for their incorporation into smaller and more sophisticated devices. This has been particularly relevant in sectors like wearable technology and medical devices.

Key Trends by Market Segment:

By Product Type: The sensors and actuators market is segmented by type into sensors and actuators. Among sensors there are following segments Pressure Sensors, Temperature Sensors, Position Sensors and others, among Actuators there are following segments Pneumatic Actuators, Electrical Actuators, Magnetic Actuators and others.

Among the given segments the dominating segment, Pressure Sensors which are used in a wide range of applications, including automotive, industrial, and consumer electronics, to measure pressure levels in liquids and gases dominates the market in 2022.

Followed by temperature Sensors that are widely used in industrial processes, automotive systems, and consumer electronics to monitor and control temperature variations.

In addition, among the actuators segment the Electric actuators, which are commonly used in various applications due to their precision, controllability, and efficiency dominates the market in 2022.

They find extensive use in industrial automation, robotics, aerospace, and automotive systems and followed by Pneumatic actuators use compressed air to create motion and are frequently employed in industrial processes, manufacturing, and automation systems.

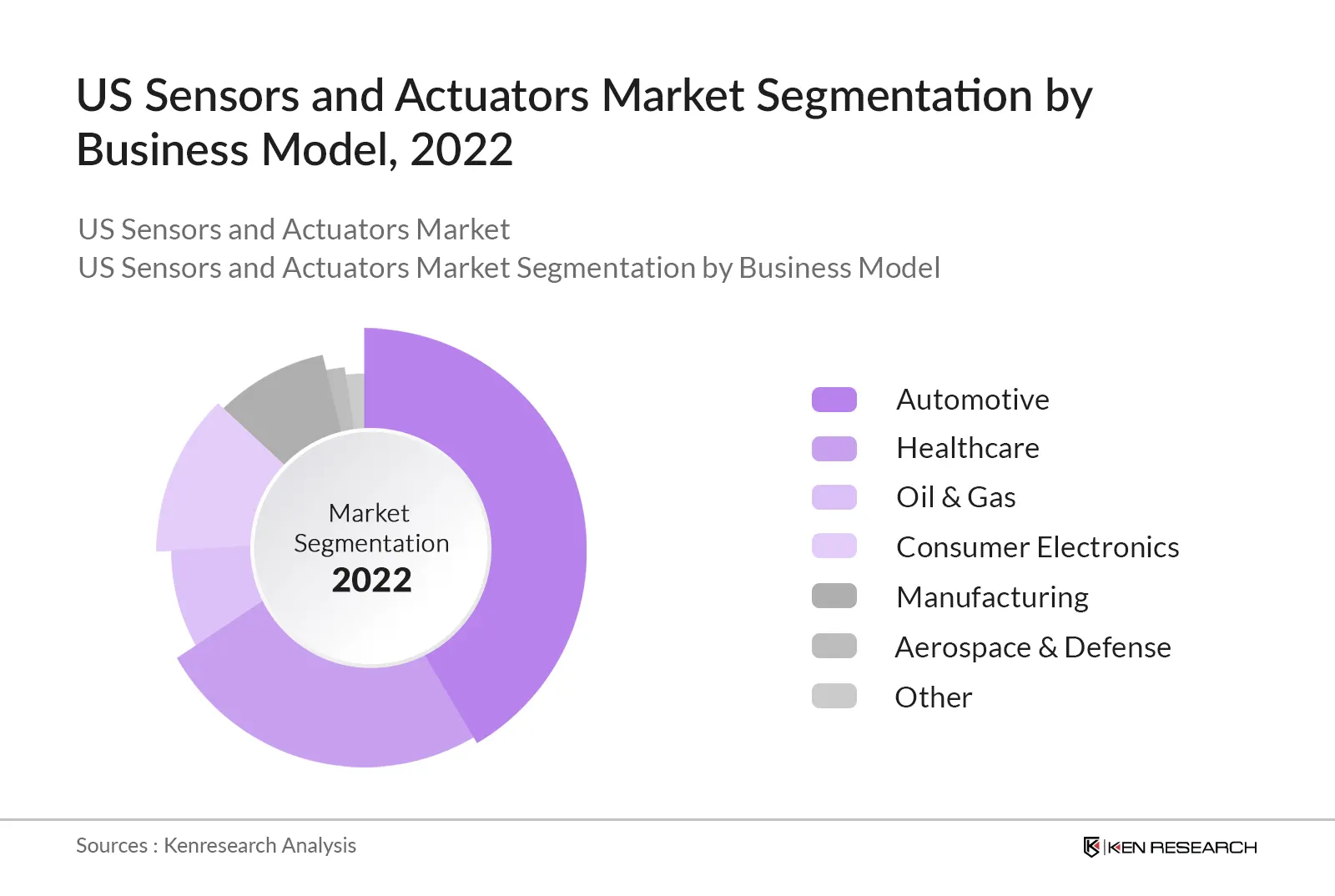

By End user applications: By the segmentation of end user the major market share areas in US sensors and actuators market are Automotive, Healthcare, Oil, & Gas, Consumer Electronics, Manufacturing, Aerospace & Defense and Other

The dominant segment is the automotive industry in 2022.The automotive sector relies on sensors and actuators for applications like engine control, anti-lock braking systems, airbag deployment, parking assistance, adaptive cruise control, and more.

By Geography: In 2022, the regional segmentation of the US sensors and actuators market is divided into east, west, north and south region of United States.

The dominant region is the west region of United States due to the major dominance of California over the over areas of United States. Silicon Valley is renowned as a global hub for technology and innovation. Its home to numerous technology companies, startups, research institutions, and venture capitalists. Many advancements in sensors, actuators, and related technologies have originated from this region.

In addition; San diego in California has a significant presence of technology companies and research institutions, particularly in areas like biotechnology, electronics, and aerospace. These sectors often involve the use of sensors and actuators in various applications.

Competitive Landscape:

There are about ~1300 US sensors and actuators service provider companies in US with majority of them offering their services in the country. US sensors and actuators market is moderately fragmented with top 5-6 players contribute more than 50% of service capacity and players like actuators TE Connectivity, Texas Instruments Inc., Honeywell International IncBosch Sensortec , GmbH, Renesas Electronics Corporation, Emerson Electric Co., SMC Corporation, Flowserve Corporation, Schlumberger Limited, Parker-Hannifin Corporation. They are players, which are majorly providing their services in sensors and actuators market.

Recent Developments:

- TE Connectivity, a leading company in connectivity and sensors, acquired ERNI Group AG (ERNI), a leading player in electronic connectivity for factory automation and automotive. The acquisition of ERNI complements TE Connectivity's wide connectivity product portfolio, specifically in high-speed and fine-pitch connectors for automotive, factory automation, and other industrial applications.

- In August 2021, Parker Hannifin Corporation, a leading market player in motion and control technologies, announced the acquisition of Meggitt PLC, a company operating in aerospace and defense motion and control technologies. In Coventry, United Kingdom, Meggitt PLC had approximately USD 2.3 billion in annual revenue in annual revenue in 2020.

- Curtiss-Wright announced the launch of its newest actuators with integral controls, the Exlar SA-R080 rotary, and SA-L080 linear actuator. The SA-080 is a frame size (80 mm) in the harsh environment control and sense series of industrial electro-mechanical actuators.

- October 2021 - Ewellix developed a smart electro-mechanical actuator with extended functionality for application in demanding applications such as construction and agricultural machinery. This smart actuator, CAHB-2xS, provides four new or enhanced features: accurate position sensors, control, built-in monitoring or diagnostics, and communication.

Future Outlook:

The US Sensors and Actuators market is anticipated to grow at a CAGR of 8% between 2022-2028 owning to increase in automation, influx of new investment and rising digitization.

- Industrial robots have been increasingly utilized in industrial automation. Sensors and actuators are one of the key components of these robots. China, the United States, and Japan are at the forefront of industrial robots adoption. In response to the growing demand, market players also introduce robot-specific products.

- The Internet of Things (IoT) is expected to continue driving demand for sensors and actuators. As more devices become connected and data-driven, the need for sensors to collect information and actuators to act upon it will grow.

- Industries like manufacturing, automotive, and robotics will increasingly rely on sensors and actuators for automation and control. This includes applications in autonomous vehicles, smart factories, and industrial robots.

- In the healthcare sector, sensors and actuators will play a crucial role in the development of wearable health tech, remote patient monitoring, and robotic-assisted surgery. The aging population and the need for better healthcare solutions will drive this growth.

- The push for energy-efficient buildings and processes will drive demand for sensors and actuators in areas like smart HVAC systems, lighting control, and industrial automation, contributing to energy savings and sustainability.

- Furthermore, As more devices become connected, the importance of sensor and actuator data security and privacy will increase. This will lead to the development of more robust security measures and regulations.

Scope of the Report

|

US sensors and actuators Market Segmentation |

|

|

US sensors and Actuators segmentation by product type |

|

|

By type of Sensors |

Pressure Sensors, Temperature Sensors, Position Sensors, Others |

|

By type of Actuators |

Pneumatic Actuators Electrical Actuators Magnetic Actuators Others |

|

By end user application |

Automotive Healthcare Oil, & Gas Consumer Electronics Manufacturing Aerospace Defense Other |

|

By regional areas |

East West North South |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce Companies

Third-Party sensors and actuators Providers

Potential Market Entrants

US sensors and actuators Companies

Automotive parts manufacturers Companies

Industry Associations

Consulting Agencies

Government Regulating Authorities

Investors

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2028

Companies

Major Players Mentioned in the Report:

TE Connectivity,

Texas Instruments Inc.,

Honeywell International

IncBosch Sensortec , GmbH,

Renesas Electronics Corporation,

Emerson Electric Co.,

SMC Corporation,

Flowserve Corporation,

Schlumberger Limited,

Parker-Hannifin Corporation

Table of Contents

1. Executive Summary

2. US sensors and actuators market Overview

2.1 Taxonomy of the Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for the Market

2.5 Growth Drivers of the US sensors and actuators market

2.6 Issues and Challenges of the US sensors and actuators market

2.7 Impact of COVID-19 on the US sensors and actuators market

2.8 SWOT Analysis

3. US sensors and actuators market Size, 2017 – 2022

4. US sensors and actuators market Segmentation

4.1 By product Type, 2017 - 2022

4.2 By End User Application, 2017 - 2022

4.3 By Regional Split, 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles

5.3.1 TE Connectivity,

5.3.2 Texas Instruments Inc.,

5.3.3 Honeywell International

5.3.4 IncBosch Sensortec , GmbH,

5.3.5 Renesas Electronics Corporation,

5.3.6 Emerson Electric Co.

5.3.7 SMC Corporation,

5.3.8 Flowserve Corporation,

5.3.9 Schlumberger Limited

5.3.10 Parker-Hannifin Corporation

6. US sensors and actuators Future Market Size, 2022 – 2028

7. US sensors and actuators Future Market Segmentation

7.1 By Type, 2022 - 2028

7.2 By End User Application, 2022 - 2028

7.3 By Regional Split, 2022 - 2028

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on sensors and actuators over the years, penetration of marketplaces and service provider’s ratio to compute revenue generated for logistics services. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team has approached multiple sensors and actuators services providing channels and understand nature of product segments and sales, consumer preference and other parameters, which supported US validate statistics derived through bottom to top approach from US sensors and actuators providers.

Frequently Asked Questions

01 How big is the US Sensors and Actuators Market?

Revenue in the Sensors & Actuators market is projected to reach US$1.60 Bn in 2023

02 What are the 4 main types of sensors?

There are many different types of sensors, the main categories are-

Position Sensors.

Pressure Sensors.

Temperature Sensors.

Force Sensors.

03 What are different types of sensors and actuators in IoT?

The most widely used types IoT sensors are flow sensors, force sensors, humidity sensors, pressure sensors, photoelectric sensors, water level sensors, and ultrasonic sensors.

04 What is the Future Growth Rate of the US sensors and actuators Market?

The US sensors and actuators Market is expected to witness a CAGR of ~8% over the 2022-2028

05 What are the Key Factors Driving the US sensors and actuators Market?

Advancements in Technology and the proliferation of the Internet of Things (IoT) and the industry 4.0 movement are likely to fuel the growth in the US sensors and actuators Market.

06 Which is the largest user application Segment within the US sensors and actuators Market?

The automotive type segment held the largest share of the US sensors and actuators Market in 2022.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.