US Smart Speaker Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD5880

December 2024

86

About the Report

US Smart Speaker Market Overview

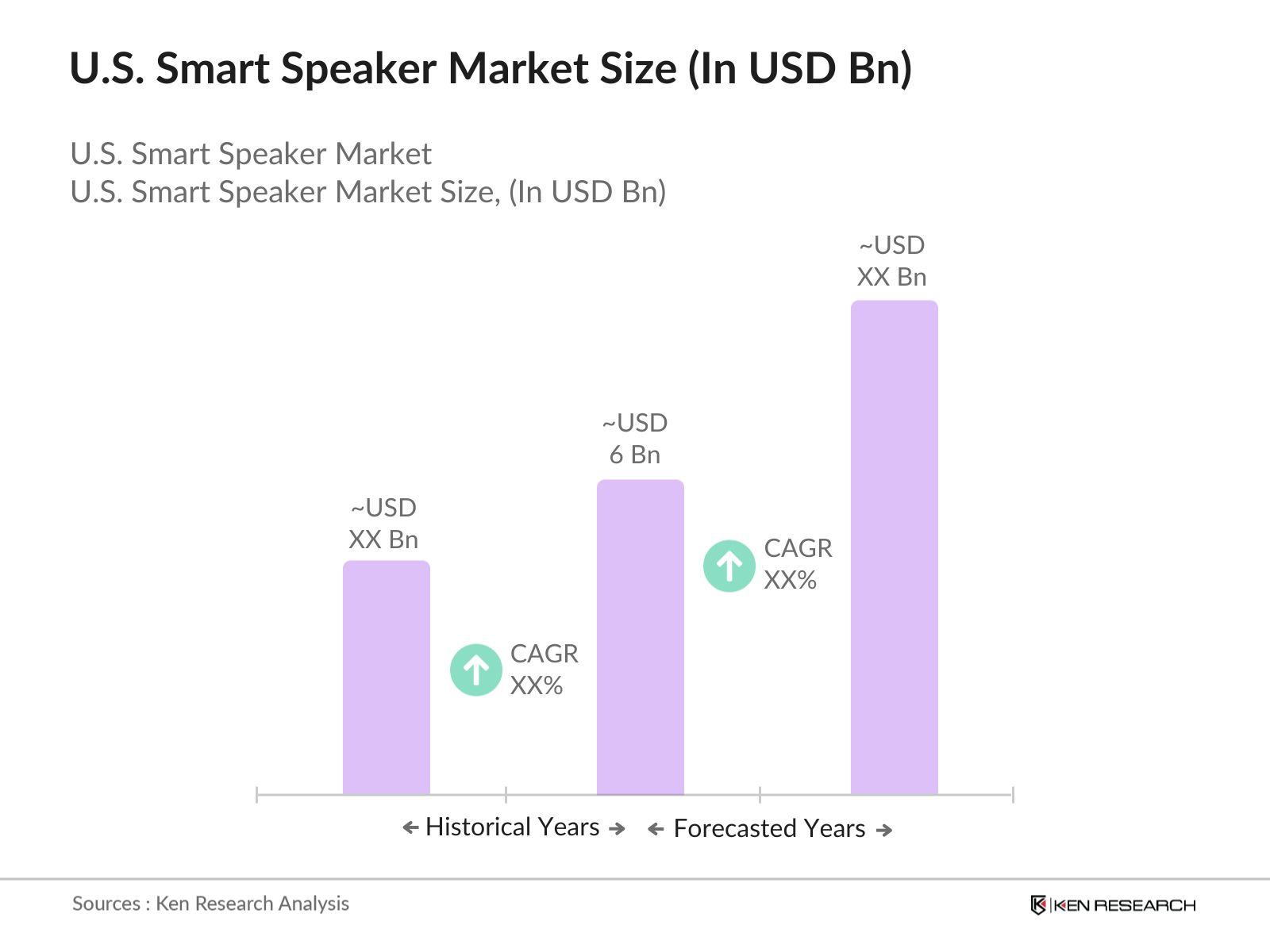

- The U.S. Smart Speaker market is valued at USD 6 billion, driven by robust adoption of IoT technologies and increasing consumer inclination toward smart home ecosystems. The integration of advanced features such as AI-powered voice assistants, seamless connectivity, and multi-device compatibility has fueled market growth. The proliferation of 5G technology has further enhanced the capabilities of these devices, encouraging consumer demand across diverse demographic segments.

- Major urban areas like New York City, Los Angeles, and Chicago dominate the U.S. smart speaker market due to higher disposable incomes, widespread smart home adoption, and tech-savvy consumer bases. Additionally, these cities host a large proportion of early adopters and are often the testing grounds for innovative smart home solutions, which amplifies their dominance in the market.

- TheSmart Home Initiative was launched by the U.S. Department of Energy (DOE) in2023. This initiative aims to promote energy efficiency and sustainability through the adoption of smart home technologies, including smart speakers. The initiative emphasizes the integration of smart speakers with energy management systems, allowing homeowners to monitor and control their energy usage more effectively.

US Smart Speaker Market Segmentation

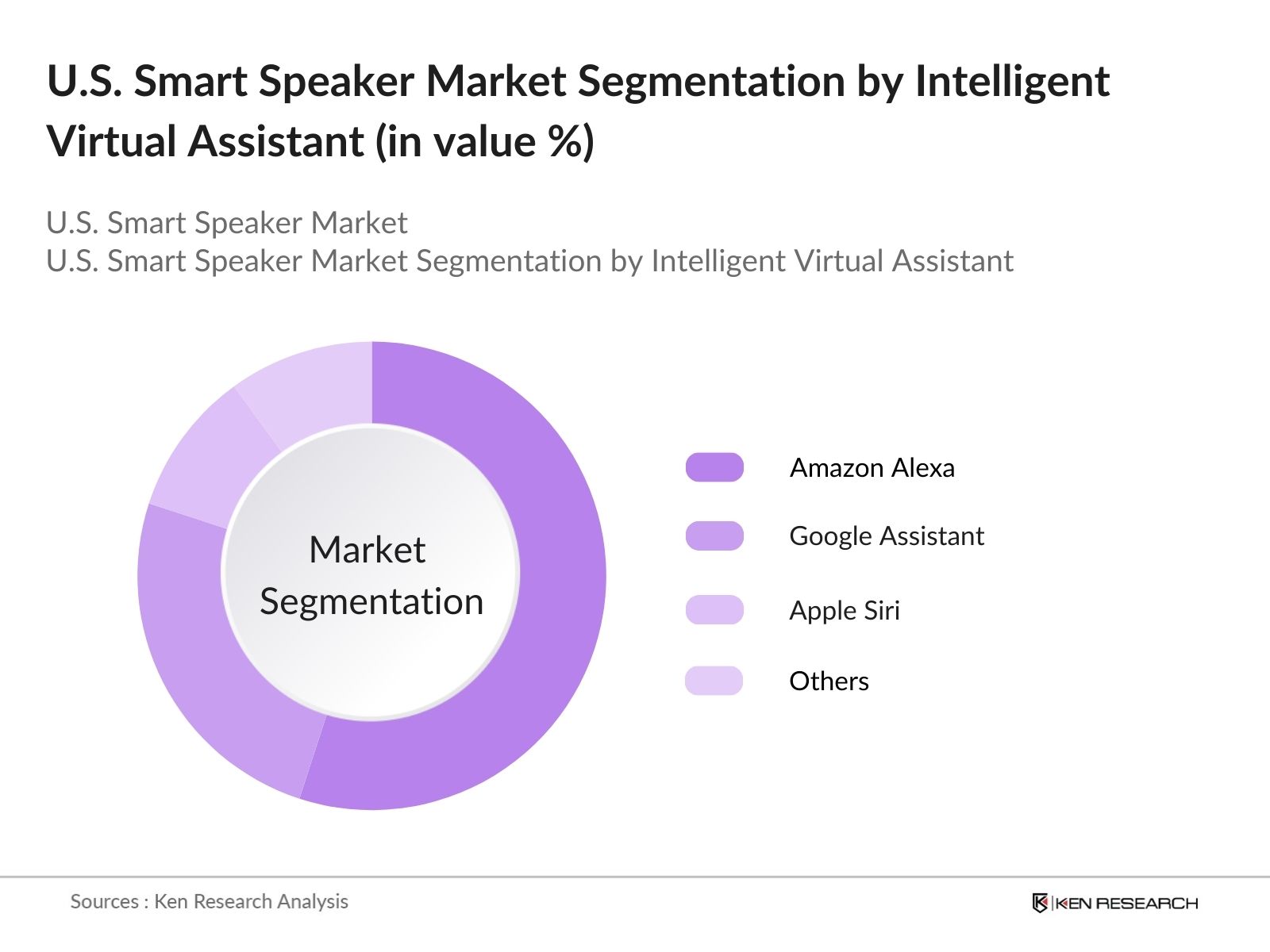

By Intelligent Virtual Assistant: The U.S. Smart Speaker market is segmented by intelligent virtual assistant into Amazon Alexa, Google Assistant, Apple Siri, and others. Recently, Amazon Alexa has dominated this segment due to its extensive third-party integrations, compatibility with smart home devices, and affordability of its Echo product line. The strong ecosystem around Alexa, combined with frequent updates and added functionalities, further solidifies its leadership.

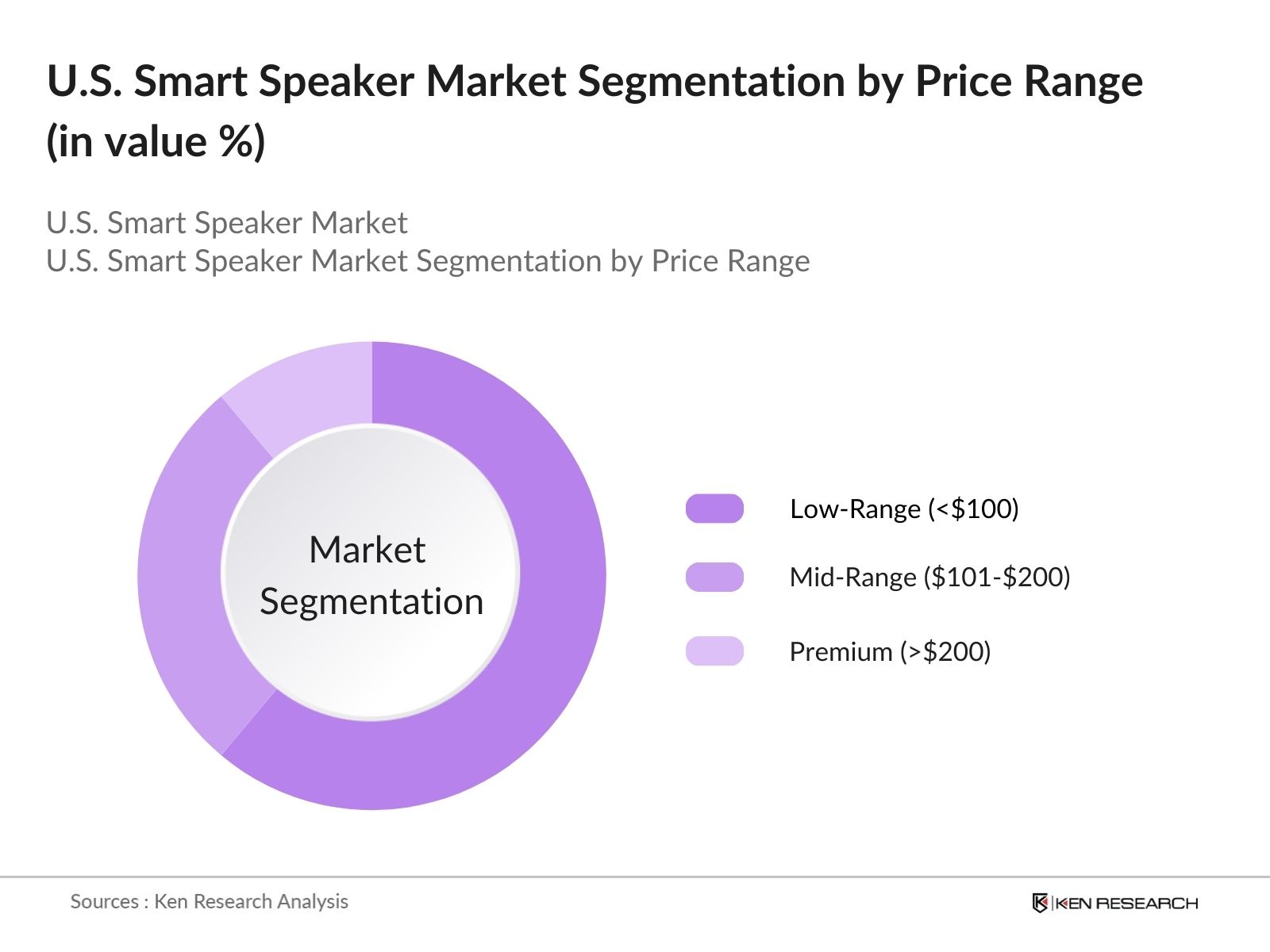

By Price Range: The U.S. Smart Speaker market is categorized by price range into low-range (less than $100), mid-range ($101 to $200), and premium (above $200). Low-range devices dominate this segment due to their affordability, making them accessible to a broader audience. Entry-level devices like the Amazon Echo Dot and Google Nest Mini have seen widespread adoption among first-time users exploring smart home technology.

US Smart Speaker Market Competitive Landscape

The U.S. Smart Speaker market is dominated by a few key players, including Amazon, Google, and Apple. These companies leverage strong R&D capabilities and strategic partnerships to enhance product offerings. Emerging players such as Sonos and Bose cater to premium audio quality, carving niches in the market. The competitive landscape reflects the balance between innovation and consumer affordability.

US Smart Speaker Market Analysis

Growth Drivers

- Rising Adoption of Smart Home Devices: The global smart home market is experiencing significant growth, with revenue projected to reach $154.4 billion in 2024. This surge is driven by increasing consumer demand for home automation solutions that enhance convenience, security, and energy efficiency.

- Integration of Voice Assistants: The incorporation of voice-controlled virtual assistants, such as Amazon Alexa and Google Assistant, into smart home devices has revolutionized user interaction. This integration simplifies device control and has been a key factor in the widespread adoption of smart home technologies.

- Expansion of IoT Ecosystem: The proliferation of Internet of Things (IoT) devices has created a more interconnected home environment. This expansion allows for seamless communication between various smart devices, enhancing the overall user experience and driving market growth.

Market Challenges

- Data Privacy and Security Concerns: The increasing connectivity of smart home devices has raised concerns about data privacy and security. Consumers are wary of potential breaches and unauthorized access to personal information, which can hinder market growth.

- High Competition Leading to Price Wars: The smart home market is highly competitive, with numerous players offering similar products. This competition has led to price wars, affecting profit margins and potentially impacting the quality of products and services offered.

US Smart Speaker Market Future Outlook

Over the next five years, the U.S. Smart Speaker market is expected to see significant advancements driven by AI integration, enhanced multi-room capabilities, and voice recognition improvements. The expansion of smart home ecosystems and strategic partnerships between manufacturers and service providers are set to drive growth further.

Market Opportunities

- Technological Advancements in AI and NLP: Advancements in Artificial Intelligence (AI) and Natural Language Processing (NLP) are enhancing the capabilities of smart home devices. These technologies enable more intuitive and responsive interactions, presenting opportunities for innovation and improved user experiences.

- Expansion into Commercial Applications: Beyond residential use, smart home technologies are finding applications in commercial settings, such as hotels and offices. This expansion opens new revenue streams and broadens the market scope.

Scope of the Report

|

By Intelligent Virtual Assistant |

Amazon Alexa Google Assistant Apple Siri Others |

|

By Component |

Hardware Software |

|

By Connectivity |

Wi-Fi Bluetooth Others |

|

By Price Range |

Low-Range (Less than $100) Mid-Range ($101 to $200) Premium (Above $200) |

|

By Distribution Channel |

Online Offline |

|

By End User |

Residential Commercial |

Products

Key Target Audience

Smart Home Device Manufacturers

Voice Assistant Developers

E-commerce Platforms

Telecommunications Companies

IoT Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC)

Audio Equipment Retailers

Companies

Players Mentioned in the Report:

Amazon.com, Inc.

Alphabet Inc. (Google)

Apple Inc.

Sonos, Inc.

Bose Corporation

Samsung Electronics Co., Ltd.

Alibaba Group

Xiaomi Corporation

Baidu, Inc.

Lenovo Group Limited

Table of Contents

1. US Smart Speaker Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. US Smart Speaker Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. US Smart Speaker Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of Smart Home Devices

3.1.2. Integration of Voice Assistants

3.1.3. Expansion of IoT Ecosystem

3.1.4. Increasing Consumer Disposable Income

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Competition Leading to Price Wars

3.2.3. Limited Consumer Awareness in Certain Demographics

3.3. Opportunities

3.3.1. Technological Advancements in AI and NLP

3.3.2. Expansion into Commercial Applications

3.3.3. Partnerships with Smart Home Device Manufacturers

3.4. Trends

3.4.1. Emergence of Display-Integrated Smart Speakers

3.4.2. Enhanced Sound Quality and Features

3.4.3. Growth in Multi-Room Audio Systems

3.5. Government Regulations

3.5.1. Data Protection and Privacy Laws

3.5.2. Compliance with Wireless Communication Standards

3.5.3. Environmental and Energy Efficiency Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. US Smart Speaker Market Segmentation

4.1. By Intelligent Virtual Assistant (Market Share %)

4.1.1. Amazon Alexa

4.1.2. Google Assistant

4.1.3. Apple Siri

4.1.4. Others

4.2. By Component (Market Share %)

4.2.1. Hardware

4.2.2. Software

4.3. By Connectivity (Market Share %)

4.3.1. Wi-Fi

4.3.2. Bluetooth

4.3.3. Others

4.4. By Price Range (Market Share %)

4.4.1. Low-Range (Less than $100)

4.4.2. Mid-Range ($101 to $200)

4.4.3. Premium (Above $200)

4.5. By Distribution Channel (Market Share %)

4.5.1. Online

4.5.2. Offline

4.6. By End User (Market Share %)

4.6.1. Residential

4.6.2. Commercial

5. US Smart Speaker Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon.com, Inc.

5.1.2. Alphabet Inc. (Google LLC)

5.1.3. Apple Inc.

5.1.4. Sonos, Inc.

5.1.5. Bose Corporation

5.1.6. Samsung Electronics Co., Ltd.

5.1.7. Alibaba Group Holding Limited

5.1.8. Xiaomi Corporation

5.1.9. Baidu, Inc.

5.1.10. Lenovo Group Limited

5.1.11. Harman International Industries, Inc.

5.1.12. LG Electronics Inc.

5.1.13. Sony Corporation

5.1.14. Panasonic Corporation

5.1.15. Facebook, Inc.

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. Product Portfolio

5.2.4. R&D Investment

5.2.5. Geographical Presence

5.2.6. Strategic Initiatives

5.2.7. Number of Employees

5.2.8. Headquarters Location

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. US Smart Speaker Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. Wireless Communication Standards

6.3. Environmental Compliance

7. US Smart Speaker Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. US Smart Speaker Future Market Segmentation

8.1. By Intelligent Virtual Assistant (Market Share %)

8.2. By Component (Market Share %)

8.3. By Connectivity (Market Share %)

8.4. By Price Range (Market Share %)

8.5. By Distribution Channel (Market Share %)

8.6. By End User (Market Share %)

9. US Smart Speaker Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing and Distribution Strategies

9.4. Identification of Market Gaps and Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the U.S. Smart Speaker market ecosystem. Key variables influencing market dynamics are identified through extensive secondary research, including analysis of government databases and proprietary industry reports.

Step 2: Market Analysis and Construction

This step focuses on compiling historical market data, analyzing adoption trends, and evaluating consumer preferences. Key metrics such as device penetration and revenue generation are assessed to establish the market structure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through consultations with industry stakeholders, including smart home integrators and technology providers, providing critical insights for data accuracy.

Step 4: Research Synthesis and Final Output

The final stage synthesizes inputs from primary and secondary sources to deliver a comprehensive market analysis. A bottom-up approach is applied to validate findings, ensuring high data reliability.

Frequently Asked Questions

01. How big is the U.S. Smart Speaker market?

The U.S. Smart Speaker market is valued at USD 6 billion, driven by increasing adoption of smart home technologies and voice assistants.

02. What are the challenges in the U.S. Smart Speaker market?

Challenges in the U.S. Smart Speaker market include data privacy concerns, high competition, and consumer skepticism about advanced AI capabilities in voice assistants.

03. Who are the major players in the U.S. Smart Speaker market?

Key players in the U.S. Smart Speaker market include Amazon, Google, Apple, Sonos, and Bose, known for their innovation and extensive market reach.

04. What are the growth drivers for the U.S. Smart Speaker market?

Growth of U.S. Smart Speaker market is propelled by advancements in AI, seamless smart home integration, and increasing demand for personalized consumer experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.