US Telehealth Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD1336

October 2024

90

About the Report

US Telehealth Market Overview

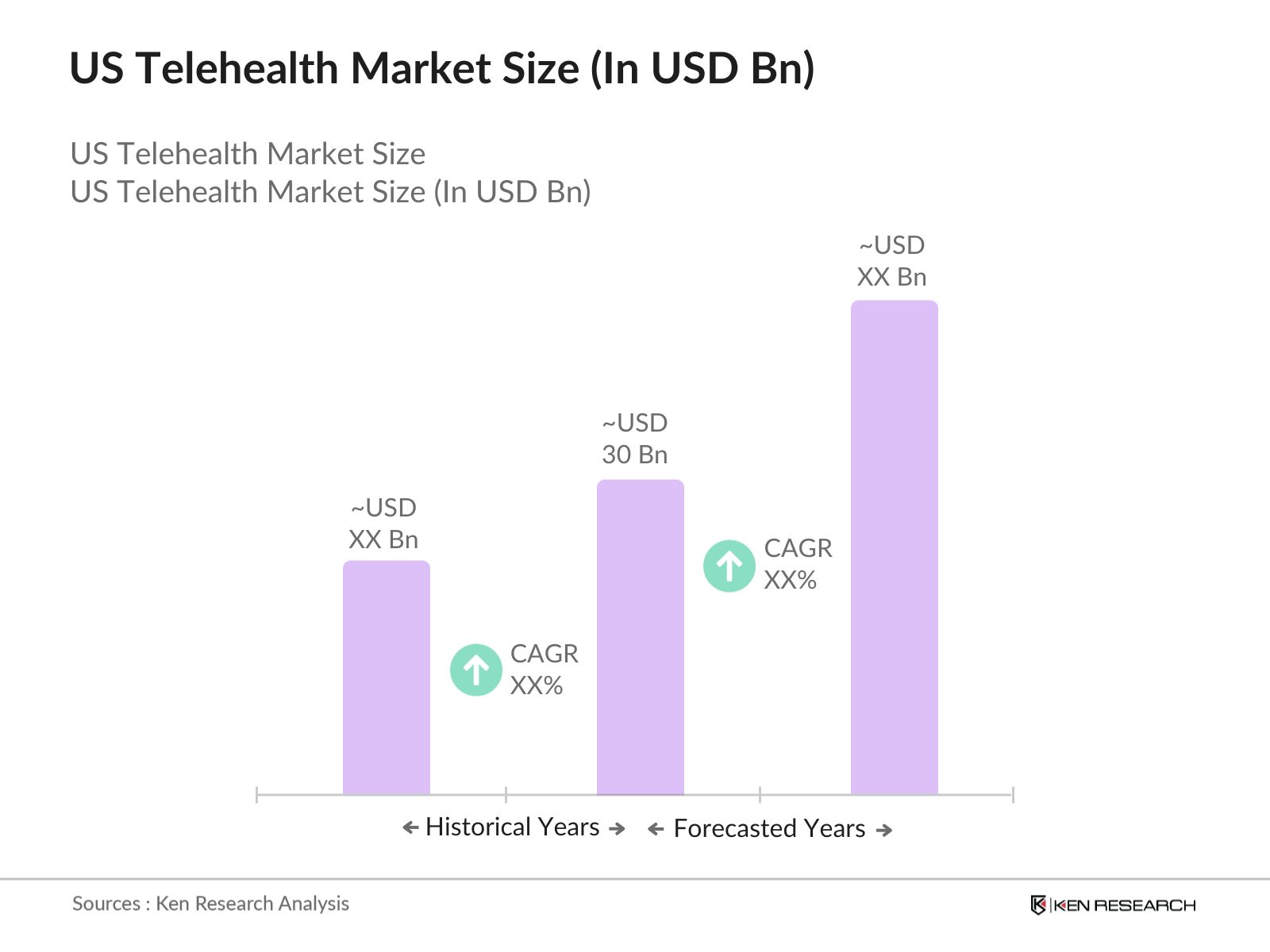

- The US Telehealth Market was valued at USD 30 billion in 2023, driven by increasing healthcare costs, technological advancements, and the need for improved access to healthcare services. The ongoing shift towards value-based care and the convenience offered by telehealth services have boosted market growth. The US government has introduced various initiatives to support telehealth adoption, further driving the market.

- Key players in the US telehealth market include Teladoc Health, Amwell, MDLIVE, Doctor on Demand, and American Well Corporation. These companies lead the market with comprehensive service offerings, advanced technology platforms, and strategic partnerships that enhance patient care and expand service accessibility.

- The market in the US is predominantly concentrated in urban areas, with cities like New York, Los Angeles, and Chicago leading in telehealth adoption due to their advanced healthcare infrastructure and high patient awareness.

- In 2023, Teladoc Health partnered with Microsoft to integrate Microsoft Teams with Teladoc's Solo platform, providing clinicians with a streamlined workflow for telehealth consultations. This integration is expected to enhance the efficiency of telehealth services and expand the market reach of Teladoc Health.

US Telehealth Market Segmentation

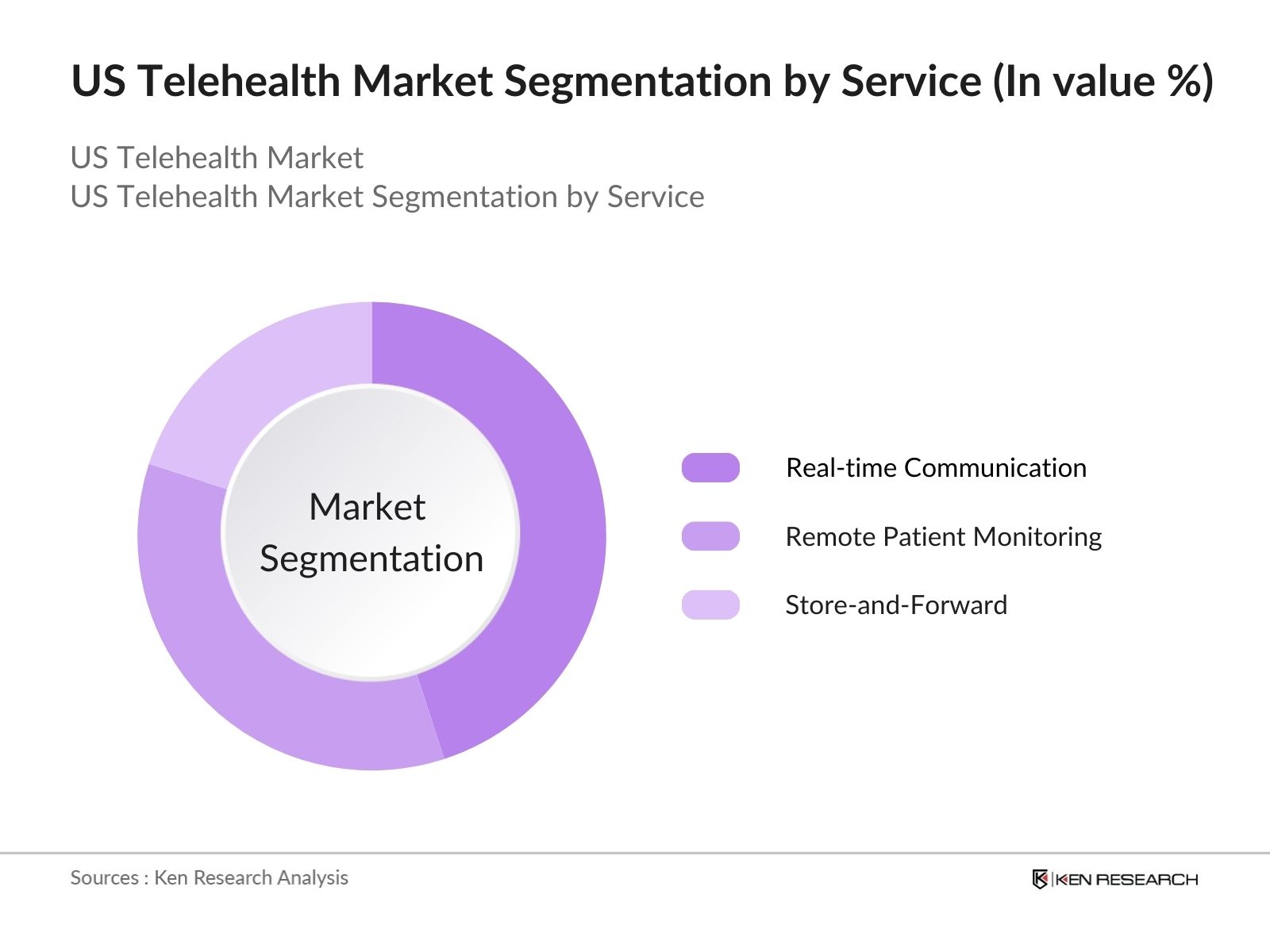

The US Telehealth market is segmented by various factors like service type, application, and region.

By Service Type: The market is segmented by service type into real-time communication, remote patient monitoring, and store-and-forward. In 2023, real-time communication held the dominant market share due to its widespread use in urgent care and primary consultations. Real-time communication services include video conferencing, which is essential for providing timely care, especially in rural areas. Leading providers like Amwell and Doctor on Demand have established a strong presence in this segment, contributing to its dominance.

- By Application: The market is segmented by application into teleconsultation, telemedicine, telemonitoring, and telesurgery. Teleconsultation dominated the market in 2023, driven by increasing demand for convenient and immediate access to healthcare services. The rise in chronic diseases and the need for continuous care have fueled the demand for teleconsultation services. This segment's growth is supported by the integration of advanced technologies like AI and machine learning, which enhance diagnostic accuracy and patient outcomes.

- By Region: The market is segmented regionally into North, South, East, and West US. In 2023, the West US dominated the market share primarily due to the presence of tech hubs and higher acceptance of digital health solutions. The region benefits from strong infrastructure, high internet penetration, and supportive government policies. The North US follows, with substantial adoption driven by a large aging population and robust healthcare systems.

US Telehealth Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Teladoc Health |

2002 |

Purchase, New York |

|

Amwell |

2006 |

Boston, Massachusetts |

|

MDLIVE |

2009 |

Miramar, Florida |

|

Doctor on Demand |

2012 |

San Francisco, California |

|

American Well Corporation |

2006 |

Boston, Massachusetts |

- Teladoc Health: In 2023, Teladoc Health expanded its service offerings by launching a mental health program tailored for teens and young adults. This initiative is part of Teladocs broader strategy to address mental health issues, which are increasingly recognized as critical to overall health and wellness.

- Amwell: In 2023, Amwell is indeed involved in providing a virtual primary care service through a partnership with CVS Health, which was announced. This service includes access to primary care, on-demand care, chronic condition management, and mental health services.

US Telehealth Market Analysis

Growth Drivers

-

Increasing Healthcare Costs: The rising cost of healthcare in the US has led to the adoption of telehealth as a cost-effective alternative. Telehealth services reduce the need for in-person visits, cutting down on travel costs and time for patients. The shift towards value-based care, which focuses on outcomes rather than services, further supports the growth of telehealth. Telehealth has been associated with average cost savings of USD 147 to USD 186 per visit for patients, as found in a study analyzing nearly 25,500 telehealth visits for cancer patients by national cancer institute.

- Rising Prevalence of Chronic Diseases: Chronic diseases such as diabetes, heart disease, and respiratory disorders are becoming increasingly prevalent in the US, with over 60% of adults managing at least one chronic condition by 2024, according to the Centers for Disease Control and Prevention (CDC). This rise in chronic illnesses is driving the adoption of telehealth solutions that allow continuous monitoring and timely interventions, which are critical for managing these long-term health issues.

- Improved Access to Healthcare: Telehealth addresses the issue of access to healthcare, particularly in rural and underserved areas. Over 61 million people live in rural areas of the U.S., which often face healthcare access challenges. A survey bydigital healthcare advocacy group RockHealth indicated that 73% of rural inhabitants utilized telemedicine in 2022, up from 60% previously, demonstrating a growing reliance on telehealth services to overcome geographic barriers. The convenience of virtual visits, coupled with the ability to connect with specialists across the country, has made healthcare more accessible.

Challenges

-

Regulatory and Reimbursement Issues: One of the important challenges facing the US telehealth market is the regulatory landscape, which varies by state. Differences in licensure requirements, reimbursement policies, and privacy laws create complexities for telehealth providers. In 2023, changes in reimbursement policies by Medicare led to uncertainties in payment structures, impacting provider participation in telehealth programs. Addressing these regulatory hurdles is essential for sustaining market growth.

- Technological Barriers: While technological advancements drive telehealth, they also pose challenges, particularly in terms of infrastructure. In 2023, a substantial portion of rural areas in the US still lacked adequate broadband internet access, which is crucial for the effective delivery of telehealth services. This digital divide limits the reach of telehealth, particularly among underserved populations. Improving digital infrastructure remains a critical challenge for the market.

Government Initiatives

-

The CARES Act 2023: The CARES Act, passed in March 2020, initially provided USD 200 million in funding for telehealth expansion, particularly aimed at improving access in rural areas. This funding was directed through the Federal Communications Commission (FCC) to support healthcare providers in delivering connected care services during the COVID-19 pandemic. The Act also included provisions to enhance broadband access, which is essential for telehealth services

- Telehealth Services Enhancement Act 2024: The Telehealth Services Enhancement Act, proposed in 2024, aims to increase telehealth services for Medicare and Medicaid beneficiaries, particularly in remote and rural areas. It includes provisions for reimbursement parity with in-person visits, which is expected to encourage more healthcare providers to offer telehealth services. This is critical for maintaining access to care for vulnerable populations.

US Telehealth Future Market Outlook

The US telehealth market is poised for substantial growth, driven by advancements in telemedicine technology, expanding access to healthcare services, and favorable government policies.

Future Market Trends

-

Expansion of AI in Telehealth: By 2028, AI and machine learning are expected to play an important role in the telehealth market, particularly in predictive analytics, diagnostics, and personalized medicine. The integration of AI will enable more accurate diagnoses and better patient outcomes, driving substantial investments in telehealth technology.

- Growth in Virtual Primary Care: The expansion of virtual primary care services is expected to be a key trend leading up to 2028. Virtual primary care allows patients to maintain continuous care relationships with their providers through telehealth platforms, which is expected to enhance patient engagement and satisfaction. This growth is driven by the convenience and efficiency of virtual visits, as well as the increasing adoption of telehealth by healthcare providers.

Scope of the Report

|

By Service |

Real-Time Communication Remote Patient Monitoring Store-and-Forward |

|

By Application |

Teleconsultation Telemedicine Telemonitoring Telesurgery |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutes

Hospitals and Healthcare Providers

Insurance Companies

Government Agencies and Regulatory Bodies (CMS, FDA)

Telehealth Technology Providers

HealthTech Startups

Venture Capitalists and Investors

Telemedicine Platform Developers

Patient Advocacy Groups

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Teladoc Health

Amwell

MDLIVE

Doctor on Demand

American Well Corporation

PlushCare

HealthTap

Virtuwell

Babylon Health

VSee

Medtronic

Philips Healthcare

Cisco Systems

IBM Watson Health

Siemens Healthineers

Table of Contents

1. US Telehealth Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Valuation and Historical Performance

1.4 Key Market Trends and Developments

1.5 Market Segmentation Overview

2. US Telehealth Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. US Telehealth Market Analysis

3.1 Growth Drivers

3.1.1 Increased Utilization of Telehealth Services Due to Aging Population

3.1.2 Rising Prevalence of Chronic Diseases

3.1.3 Government Policies Supporting Telehealth Expansion

3.2 Challenges

3.2.1 Regulatory Variability Across States

3.2.2 Digital Divide Impacting Telehealth Access

3.2.3 Healthcare Provider Resistance to Telehealth Adoption

3.3 Opportunities

3.3.1 Expansion of Telehealth in Behavioral Health Services

3.3.2 Growth of Telehealth in Rural Areas

3.3.3 Increasing Integration with Wearable Health Devices

3.4 Trends

3.4.1 Increased Adoption of Remote Patient Monitoring (RPM)

3.4.2 Telehealth Integration with Electronic Health Records (EHR)

3.4.3 Expansion of Telehealth in Behavioral Health Services

3.5 Government Initiatives

3.5.1 Telehealth Extension and Evaluation Act of 2023

3.5.2 FCCs Rural Digital Opportunity Fund (RDOF)

3.5.3 Medicare Telehealth Expansion Initiative

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. US Telehealth Market Segmentation, 2023

4.1 By Service Type (in Value %)

4.1.1 Real-Time Communication

4.1.2 Remote Patient Monitoring

4.1.3 Store-and-Forward

4.2 By Application (in Value %)

4.2.1 Teleconsultation

4.2.2 Telemedicine

4.2.3 Telemonitoring

4.2.4 Telesurgery

4.3 By Region (in Value %)

4.3.1 North US

4.3.2 South US

4.3.3 East US

4.3.4 West US

5. US Telehealth Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 Teladoc Health

5.1.2 Amwell

5.1.3 MDLIVE

5.1.4 Doctor on Demand

5.1.5 American Well Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. US Telehealth Market Competitive Landscape Analysis

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

6.4.1 Venture Capital Funding

6.4.2 Government Grants

6.4.3 Private Equity Investments

7. US Telehealth Market Regulatory Framework

7.1 Telehealth Extension and Evaluation Act of 2023

7.2 Medicare Telehealth Expansion Initiative

7.3 Compliance Requirements and Certification Processes

8. US Telehealth Market Future Outlook (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

8.3 Future Market Segmentation

8.3.1 By Service Type (in Value %)

8.3.2 By Application (in Value %)

8.3.3 By Region (in Value %)

9. US Telehealth Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on USA telehealth market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA telehealth market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple essential telehealth companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from telehealth companies.

Frequently Asked Questions

01 How big is the US Telehealth Market?

The US Telehealth Market was valued at USD 30 billion in 2023, driven by increasing healthcare costs, technological advancements, and the need for improved access to healthcare services. The ongoing shift towards value-based care and the convenience offered by telehealth services have significantly boosted market growth.

02 What are the challenges in the US Telehealth Market?

Challenges in the US Telehealth Market include regulatory variability across states, digital divide issues affecting access, and resistance among healthcare providers to fully adopt telehealth technologies.

03 Who are the major players in the US Telehealth Market?

Key players in the US Telehealth Market include Teladoc Health, Amwell, MDLIVE, Doctor on Demand, and American Well Corporation. These companies lead the market with their comprehensive service offerings and strong technological infrastructure.

04 What are the growth drivers of the US Telehealth Market?

The growth of the US Telehealth Market is driven by the increasing prevalence of chronic diseases, the aging population, and government policies that support the expansion of telehealth services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.