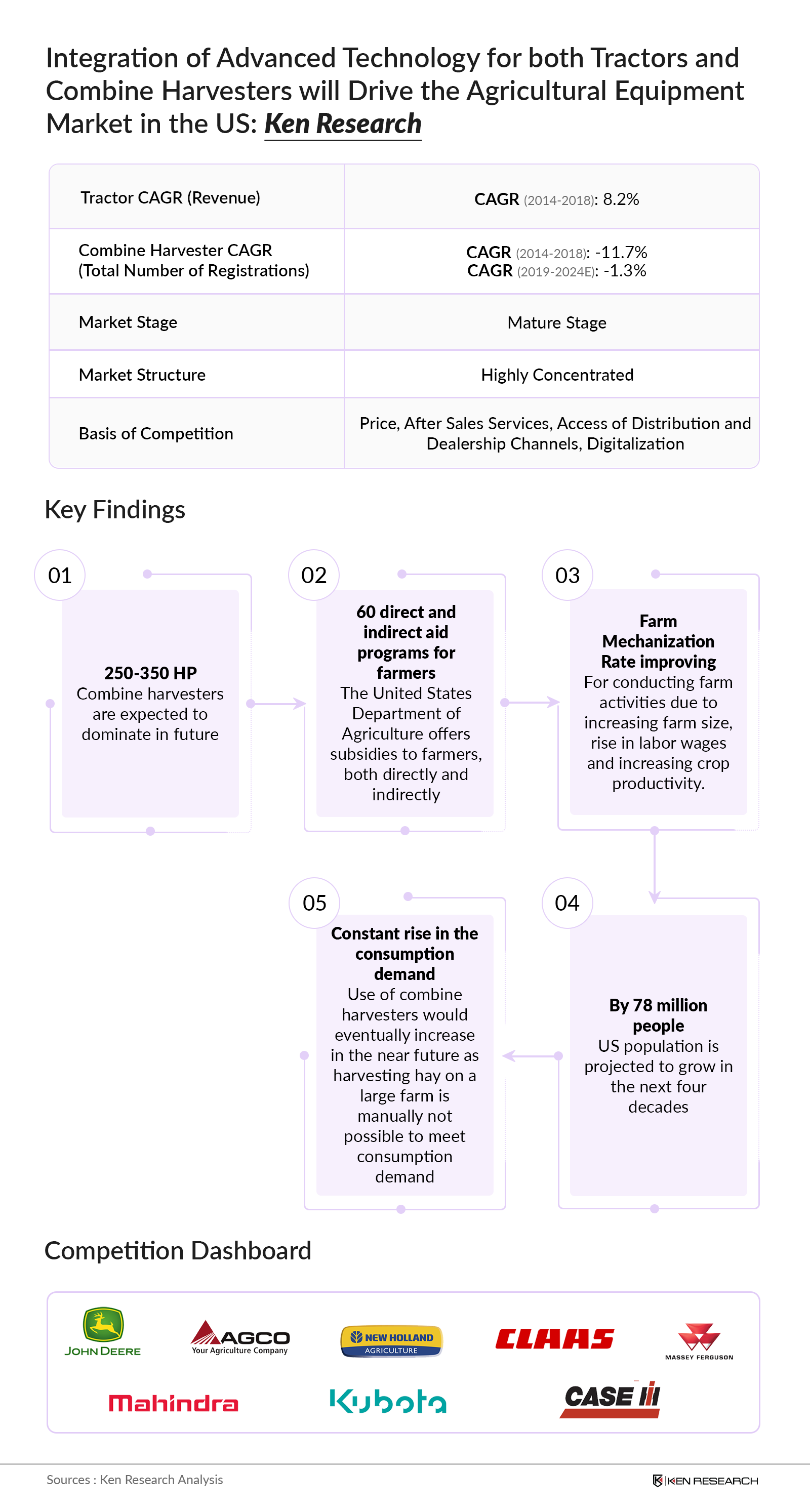

US Tractor and Combine Harvesters Market Outlook to 2024

By Tractor Type (2WD and 4WD), By Tractor HP (<40 HP, 40-100 HP and >100 HP) and By Combine Harvester HP (Upto 250 HP, 250-350 HP and Above 350 HP)

Region:North America

Product Code:KR916

November 2019

109

About the Report

US Agriculture Equipment Market Overview

US Tractor Market Size

US Tractor Market Segmentation

US Combine Harvesters Market Segmentation

Comparative Landscape in US Tractor and Combine Harvester Market

US Tractor and Combine Harvester Market Future Outlook and Projections

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- US Agriculture Equipment Market Value Chain Analysis

- US Agricultural Equipment Market Overview

- US Agriculture Equipment Market Ecosystem

- US Tractor Market

- US Combine Harvester Market

- Regulatory Framework in US Agricultural Equipment Market

- Customer Profiling in US Agriculture Equipment Market

- US Agriculture Equipment Second hand Market

- Comparative Landscape in US Agriculture Equipment Market

Products

Key Target Audience

Existing Agricultural Equipment Companies

New Market Entrants- Domestic OEMs

New Market Entrants- Foreign OEMs

Agricultural Equipment Financing Companies

Government Bodies

Investors & Venture Capital Firms

Agricultural Equipment Manufacturers

Agricultural Equipment Distributors

Agricultural Equipment Associations

Time Period Captured in the Report:

Historical Period: 2014 -2018

Forecast Period: 2019-2024

Companies

Key Segments Covered

By Tractor Type

Two-Wheel Drive (2WD)

Four-Wheel Drive (4 WD)

By Tractor HP (For Two-Wheel Drive Tractors)

40 HP

40-100 HP

Above 100 HP

By Combine Harvesters HP

Up to 250 HP

250-350 HP

Above 350 HP

John Deere

New Holland

AGCO

Mahindra

Kubota

CaseIH

Claas

Gleaner

Massey Ferguson

Other Players (Kioti, Yanmar, Zetor, Ventrac, Farmtrac, Deutz Fahr, Challenger, International Harvester, MacDon and Colombo)

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Sizing and Modeling

2.4. Market Sizing- Agricultural Equipment

2.5. Variables (Dependent and Independent)

2.6. Correlation Matrix

2.7. Regression Matrix

2.8. Limitations & Final Conclusions

2.9Limitations

2.10Final Conclusion

3. US Tractor & Harvester Market Overview, 1900-2018

3.1. Evolution of US Agricultural Equipment Market

Supply Side Evolution

Demand side evolution

3.2. Overview of Agricultural Pattern in US, 2018

3.3. US Farming Overview

3.3.1. Contribution of Agriculture in US GDP

3.3.2. Land Under Cultivation And Distribution Of Major Crops

3.3.3. Change in Cropping Pattern

3.3.4. Farm Holding Structure/ Nature Of Ownership

4. US Tractor & Combine Harvester Market Ecosystem, 2018

5. US Tractors & Combine Harvesters Market Value Chain Analysis, 2018

5.1Value Chain Flow chart for importing brands, 2018

5.2Value chain flow chart for market with domestic oem’s, 2018

5.3Role & Overview Of Various Entities, 2018

6. US Tractors Market, 2014-2024E

6.1. US Tractor Market Size, 2014-2018

6.2. Best Selling Tractor Model, 2018

6.3. US Tractor Market Segmentation (By Wheel Type & HP), 2014-2018

2 Wheel Drive Tractors further Market Segmentation By HP (6.4. US Tractor Market Trade Scenario

(Import and Export Value), 2014-2018

6.5. Us Tractor Market Future Outlook And Projections, 2019-2024

7. US Combine Harvesters Market, 2014-2024

7.1. US Combine Harvesters Market Size, 2014-2018

7.2. US Combine Harvester Market Segmentation By HP (Up to 250 HP, 250-350 HP & Above 350 HP),

2018

7.3. US Combine Harvesters Market, Trade Scenario, 2014-2018

7.4. US Combine Harvester Market Future Outlook and Projections, 2019-2024E

8. Regulatory Framework in US Tractor & Harvester Market

9. Customer Profiling in US Tractor & Combine Harvesters Market, 2018

9.1Decision Making Parameter For Tractors, 2018

9.2Decision Making Parameters For Combine Harvesters, 2018

9.3Pain Points Of Farmers, 2018

10. Market Related Snapshots, 2014-2024

10.1. Snapshot of Agriculture Equipment Second Hand Market, 2014-2024

10.2. US Agriculture Equipment Financing Market, 2014-2024

10.3. US Agriculture Equipment Rental Market, 2014-2024

10.4. US Agriculture Equipment After Market Services, 2014-2024

11. Comparative Landscape in US Tractors & Combine Harvesters Market, 2018

11.1. Competition Scenario in US Tractors & Combine Harvesters Market, 2018

11.2. Market Share of Major Players Operating in US Tractors Market (By Sales Volume), 2014-

2018

11.3. Market Share of Major Players Operating in US Combine Harvesters Market (By Sales

Volume), 2014-2018

11.4. Strengths and Weaknesses Of Major Players, 2018

11.5. Company Profiling Of Major Players Operating in US Tractor & Harvester Market

11.5.1. John Deere

11.5.2. CNH Industrial

11.5.3. AGCO

11.5.4. Kubota

11.5.5. Claas

11.5.6. Mahindra

11.5.7. Other Players (Kioti, Yanmar, Zetor, Ventrac, Farmtrac, Deutz Fahr, Challenger,

International Harvester, MacDon and Colombo), 2018

12. Analyst Recommendations in the US Tractor and Combine Harvesters Market

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.