U.S. Ultralight Aircraft Market Outlook to 2030

Region:North America

Author(s):Shivani Mehra

Product Code:KROD11465

November 2024

81

About the Report

U.S. Ultralight Aircraft Market Overview

- The U.S. ultralight aircraft market is valued at USD 2.58 Billion, driven by increasing interest in recreational aviation and technological innovations in lightweight materials. The demand for affordable personal aviation and accessibility for amateur pilots are key factors bolstering this growth. Advancements in avionics and safety features have made ultralight aircraft more appealing for a range of users, from hobbyists to professional trainers, fueling market expansion.

- The U.S. ultralight aircraft market is predominantly concentrated in regions with large open airspaces and supportive regulatory frameworks, such as California, Florida, and Texas. These areas dominate due to favorable weather conditions year-round, thriving tourism industries, and strong aviation communities, which encourage recreational and sports aviation activities. The presence of numerous flight training schools and aviation clubs further enhances market dominance in these regions.

- The Federal Aviation Administration (FAA) has been actively supporting the certification and development of electric propulsion technologies for various aircraft categories, including ultralights. This support comes as part of a broader commitment to reducing aviations environmental impact and aligning with the U.S. government's sustainable energy goals. By promoting electrification, the FAA is enabling ultralight manufacturers to explore cleaner and more efficient propulsion options, which could reduce operational costs and make ultralight aviation more accessible.

U.S. Ultralight Aircraft Market Segmentation

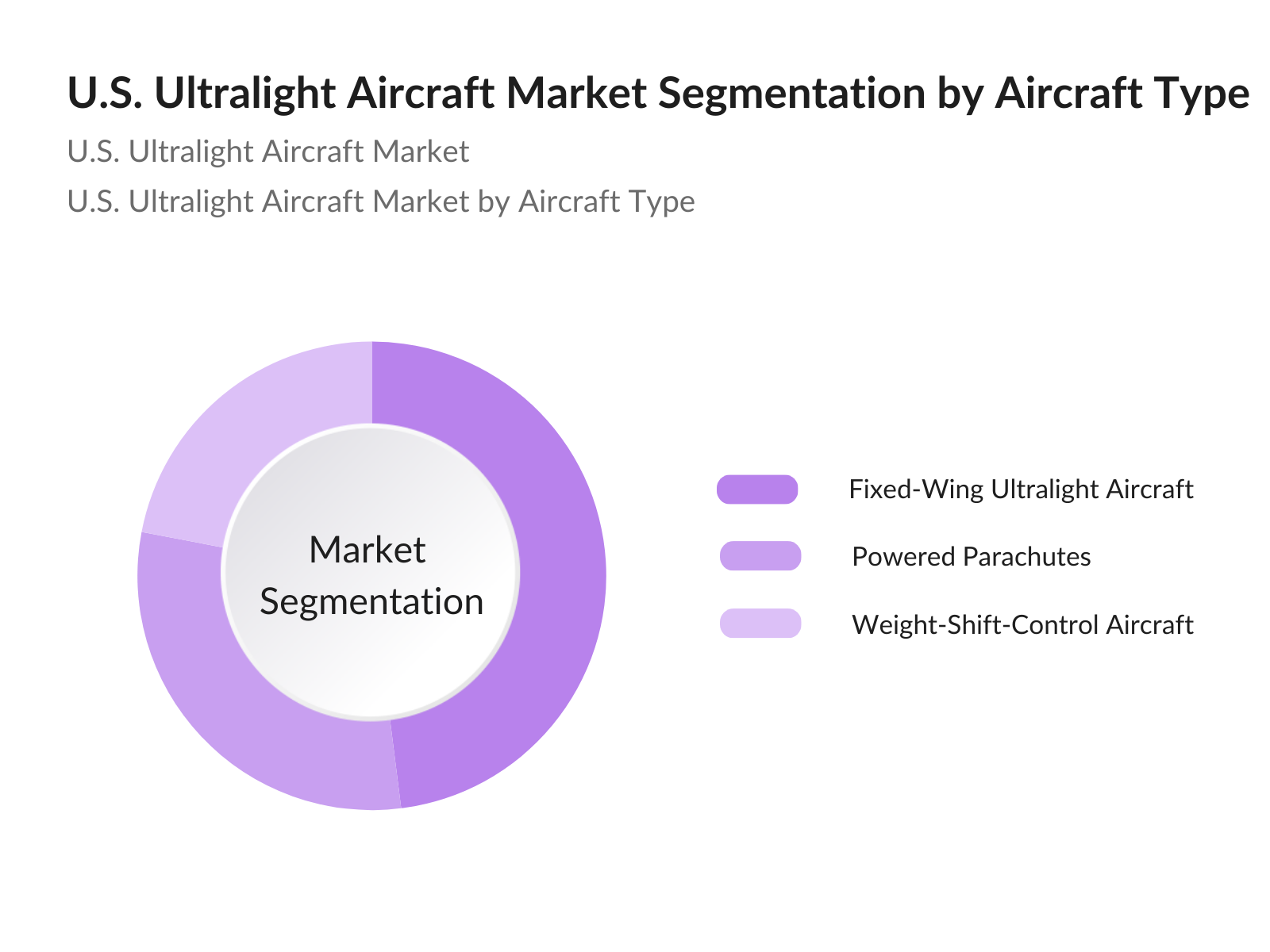

- By Aircraft Type: The U.S. ultralight aircraft market is segmented by aircraft type into fixed-wing ultralight aircraft, powered parachutes, and weight-shift-control aircraft. Fixed-wing ultralight aircraft dominate this segment due to their superior speed, range, and versatility, making them popular among recreational users. The stability and ease of control associated with fixed-wing models attract both beginners and seasoned aviators, contributing to their market leadership.

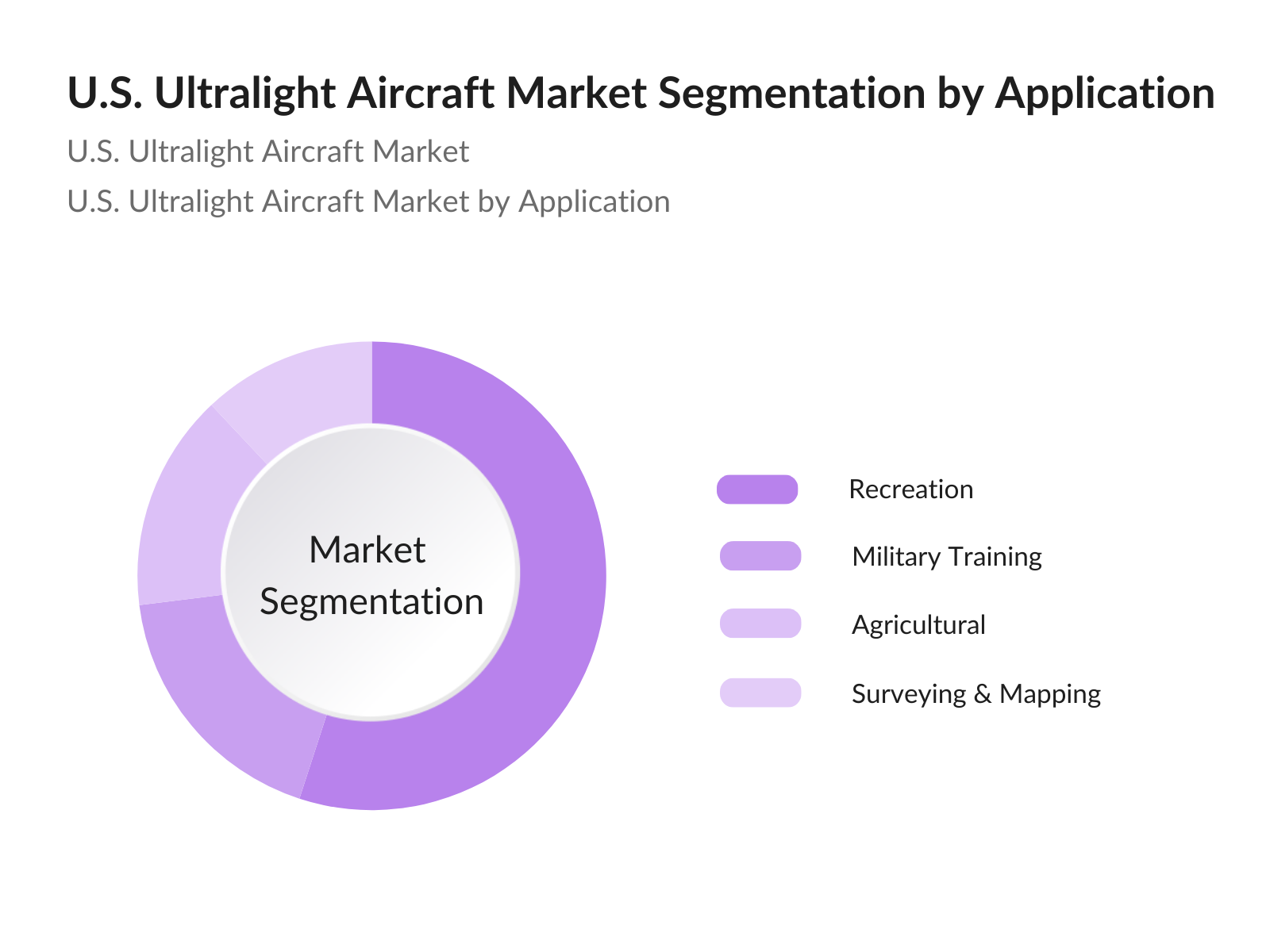

- By Application: The U.S. ultralight aircraft market is segmented by application into recreation, military training, agriculture, and surveying & mapping. Recreational use dominates due to growing interest in personal aviation and adventure sports. This segment attracts a diverse user base, including aviation enthusiasts and individuals seeking new forms of leisure, supported by an increase in ultralight flight schools and a well-developed tourism infrastructure

U.S. Ultralight Aircraft Market Competitive Landscape

The U.S. ultralight aircraft market is led by key players specializing in various ultralight and recreational aircraft models. Established brands like Quicksilver Manufacturing and Kolb Aircraft hold significant influence due to their longstanding market presence and reputation for reliable aircraft. Innovation in materials and navigation technology is central to competition within the market.

|

Company |

Year Established |

Headquarters |

Key Parameters |

|

Quicksilver Manufacturing |

1972 |

California |

- |

|

Kolb Aircraft |

1980 |

Pennsylvania |

- |

|

AirBorne Australia |

1983 |

New South Wales |

- |

|

CGS Aviation |

1977 |

Ohio |

- |

|

Lockwood Aircraft Corp. |

1992 |

Florida |

- |

U.S. Ultralight Aircraft Market Analysis

Market Growth Drivers

- Technological Innovations: The U.S. ultralight aircraft market is experiencing significant advancements in materials and propulsion systems. The integration of lightweight composite materials has enhanced aircraft performance and fuel efficiency. Additionally, the development of electric propulsion systems is reducing operational costs and environmental impact. For instance, the Federal Aviation Administration (FAA) has been actively supporting the certification of electric vertical takeoff and landing (eVTOL) aircraft, indicating a shift towards more sustainable aviation technologies.

- Demand for Affordable Personal Aviation: The rising cost of traditional aviation has led to increased interest in ultralight aircraft as a cost-effective alternative. According to the Bureau of Economic Analysis, the average disposable personal income in the U.S. was $55,671 in 2023, allowing more individuals to invest in recreational aviation. Ultralight aircraft offer a more accessible entry point into aviation, with lower purchase and maintenance costs compared to general aviation aircraft.

- Expansion of Adventure Tourism: The U.S. Travel Association reported that adventure tourism contributed $683 billion to the U.S. economy in 2023. Ultralight aviation is becoming a popular component of this sector, offering unique aerial experiences. Tour operators are increasingly incorporating ultralight flights into their packages, catering to the growing consumer interest in adventure activities.

Market Challenges:

- Regulatory Restrictions: The FAAs Part 103 regulations impose strict operational limitations on ultralight aircraft, which include a maximum empty weight of 254 pounds and a fuel capacity limit of 5 gallons. These restrictions hinder design flexibility, impacting performance and operational capabilities. Due to these limits, manufacturers struggle to incorporate advanced technology or achieve higher performance standards that might compete with other categories. For example, the FAA's limitation on maximum speed and altitude affects the versatility of ultralight aircraft for broader applications. These restrictions create a barrier to innovation within the sector.

- Limited Range and Payload Capacity: Ultralight aircraft are limited in both range and payload due to the FAAs stringent weight and fuel regulations. Typically, ultralights can only cover distances of around 100 miles, with payload capacities restricted to about 500 pounds, limiting their use for activities requiring higher endurance or carrying capacity. This restricts their applications to recreational use and short-distance flights, creating a competitive disadvantage against light sport aircraft, which often offer better range and flexibility for personal and commercial use. Such limitations reduce the markets attractiveness for broader use cases.

U.S. Ultralight Aircraft Market Future Outlook

The U.S. ultralight aircraft market is expected to witness notable growth in the coming years, driven by advances in aircraft technologies and a rising trend towards personal aviation for leisure and sport. Demand for fuel-efficient, low-maintenance models is anticipated to grow as environmental considerations gain prominence. The ongoing development of electric propulsion and hybrid systems in ultralight aircraft will likely attract eco-conscious consumers, adding momentum to market expansion.

Market Opportunities:

- Lightweight Composite Materials: The adoption of advanced composite materials, such as carbon fiber and fiberglass, is driving significant advancements in ultralight aircraft design. These materials are not only lightweight but also provide superior strength and durability, allowing manufacturers to enhance aircraft performance without exceeding regulatory weight limits. The National Institute of Standards and Technology (NIST) reported a 15% increase in the use of composites in aviation from 2022 to 2024, reflecting a broader industry trend towards materials that enhance fuel efficiency and maneuverability. This trend is especially advantageous for ultralight aircraft, where weight reduction is crucial.

- Autonomy in Navigation Systems: Ultralight aircraft are beginning to integrate autonomous navigation and control systems, a trend influenced by advancements in artificial intelligence and machine learning. These systems provide enhanced safety features, such as autopilot capabilities and collision avoidance, making ultralight aircraft more accessible for hobbyists and beginners. The FAA's NextGen program has been exploring the integration of AI-based technologies across various aircraft categories, with plans for broader applications in low-altitude airspace. This trend aligns with a rising demand for simplified piloting experiences, supporting the sector's growth by appealing to a wider audience.

Scope of the Report

|

By Type |

Fixed-Wing Ultralight Aircraft |

|

By Application |

Recreation |

|

By End-User |

Individual Aviation Schools Tourism Agencies |

|

By Propulsion Type |

Electric |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Aviation Training Schools and Institutes

Adventure and Eco-Tourism Operators

Government and Regulatory Bodies (Federal Aviation Administration - FAA)

Environmental Organizations

Investments and Venture Capitalist Firms

Recreational and Sports Aviation Associations

Aircraft Manufacturing Companies

Research & Development Agencies in Aeronautics

Companies

Players mentioned in the report

Quicksilver Manufacturing

Kolb Aircraft

AirBorne Australia

CGS Aviation

Lockwood Aircraft Corp.

AutoGyro GmbH

Powrachute LLC

Belite Aircraft

Ekolot

Aeroprakt

Skyranger Aircraft

Pipistrel

Aeropro CZ

Just Aircraft

P&M Aviation

Table of Contents

1. U.S. Ultralight Aircraft Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. U.S. Ultralight Aircraft Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. U.S. Ultralight Aircraft Market Analysis

3.1. Growth Drivers (Evolving Regulatory Landscape, Demand for Recreational Aviation)

3.1.1. Technological Innovations

3.1.2. Demand for Affordable Personal Aviation

3.1.3. Increasing Number of Flight Training Schools

3.1.4. Expansion of Adventure Tourism

3.2. Market Challenges (Safety Concerns, Operational Regulations)

3.2.1. Regulatory Restrictions

3.2.2. Limited Range and Payload Capacity

3.2.3. High Maintenance Requirements

3.2.4. Competition with General Aviation

3.3. Opportunities (Expansion in Eco-Tourism, Battery-Powered Aircraft)

3.3.1. Electrification of Aircraft

3.3.2. Rising Use in Agricultural Applications

3.3.3. Potential for Urban Air Mobility (UAM) Integration

3.4. Trends (Advanced Manufacturing Techniques, Integration of AI-Based Control Systems)

3.4.1. Lightweight Composite Materials

3.4.2. Autonomy in Navigation Systems

3.4.3. IoT-Enabled Monitoring Systems

3.4.4. Hybrid Powertrains

4. U.S. Ultralight Aircraft Market Regulatory Framework

4.1. Federal Aviation Administration (FAA) Regulations

4.2. Compliance Requirements for Manufacturing

4.3. Safety Standards and Certification Processes

4.4. Environmental Impact and Emission Regulations

5. U.S. Ultralight Aircraft Market Segmentation

5.1. By Type (In Value %)

5.1.1. Fixed-Wing Ultralight Aircraft

5.1.2. Powered Parachutes

5.1.3. Weight-Shift-Control

5.2. By Application (In Value %)

5.2.1. Recreation

5.2.2. Military Training

5.2.3. Agricultural

5.2.4. Surveying & Mapping

5.3. By End-User (In Value %)

5.3.1. Individual

5.3.2. Aviation Schools

5.3.3. Tourism Agencies

5.4. By Propulsion Type (In Value %)

5.4.1. Electric

5.4.2. Gasoline-Powered

5.4.3. Hybrid

5.5. By Distribution Channel (In Value %)

5.5.1. Direct Sales

5.5.2. Online Retailers

5.5.3. Authorized Dealers

6. U.S. Ultralight Aircraft Market Competitive Analysis

6.1 Detailed Profiles of Major Companies

6.1.1. Quicksilver Manufacturing

6.1.2. CGS Aviation

6.1.3. AirBorne Australia

6.1.4. Kolb Aircraft

6.1.5. Lockwood Aircraft Corp.

6.1.6. P&M Aviation

6.1.7. AutoGyro GmbH

6.1.8. Powrachute LLC

6.1.9. Belite Aircraft

6.1.10. Ekolot

6.1.11. Aeroprakt

6.1.12. Skyranger Aircraft

6.1.13. Pipistrel

6.1.14. Aeropro CZ

6.1.15. Just Aircraft

6.2 Cross Comparison Parameters (Number of Patents, Fleet Size, Production Capacity, Revenue, Distribution Reach, Certifications, Product Line, Customer Reviews)

6.3. Market Share Analysis

6.4. Strategic Initiatives (Product Launches, Collaborations)

6.5. Mergers and Acquisitions

6.6. Investment Analysis

6.7. Private Equity Investments

7. U.S. Ultralight Aircraft Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Innovations, Regulations)

8. U.S. Ultralight Aircraft Market Analyst Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Behavior Analysis

8.3. Marketing and Branding Initiatives

8.4. White Space and Niche Opportunities

8.5. Technological Roadmap Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the primary stakeholders within the U.S. ultralight aircraft market, including manufacturers, training schools, and regulatory bodies. This stage employs extensive desk research, utilizing proprietary and public databases to capture a detailed view of market dynamics, especially focusing on manufacturing trends, regulatory requirements, and consumer demand.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data and trends, focusing on market segmentation such as aircraft types and application areas. We assess metrics like product adoption rate, user demographics, and revenue generation, ensuring that data from primary and secondary sources is aligned for accurate projections.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are formulated and validated through in-depth consultations with industry experts and manufacturers via interviews and surveys. These discussions yield invaluable insights into market challenges, product innovations, and emerging trends, providing a grounded understanding of the industry.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data and insights to present a comprehensive report, incorporating both quantitative and qualitative analyses. Market estimates are validated through consultations with manufacturers, ensuring a robust and well-rounded perspective on the U.S. ultralight aircraft markets current state and future outlook.

Frequently Asked Questions

01. How big is the U.S. Ultralight Aircraft Market?

The U.S. ultralight aircraft market is valued at USD 2.58 Billion, driven by increased interest in recreational aviation and advances in ultralight aircraft technologies.

02. What are the key growth drivers for the U.S. Ultralight Aircraft Market?

Major drivers include the rise in personal aviation for recreation, advancements in lightweight materials, and the availability of flight training schools catering to amateur aviators and enthusiasts.

03. Which companies lead the U.S. Ultralight Aircraft Market?

Leading companies in the market include Quicksilver Manufacturing, Kolb Aircraft, AirBorne Australia, CGS Aviation, and Lockwood Aircraft Corp., which dominate due to their established market presence and innovative product offerings.

04. What are the main challenges in the U.S. Ultralight Aircraft Market?

The market faces challenges such as regulatory restrictions, safety concerns, and the limited payload capacity of ultralight aircraft, which affect their versatility and adoption for varied applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.