US Veterinarians Market Outlook to 2030

Region:North America

Author(s):Mukul

Product Code:KROD5109

October 2024

95

About the Report

US Veterinarians Market Overview

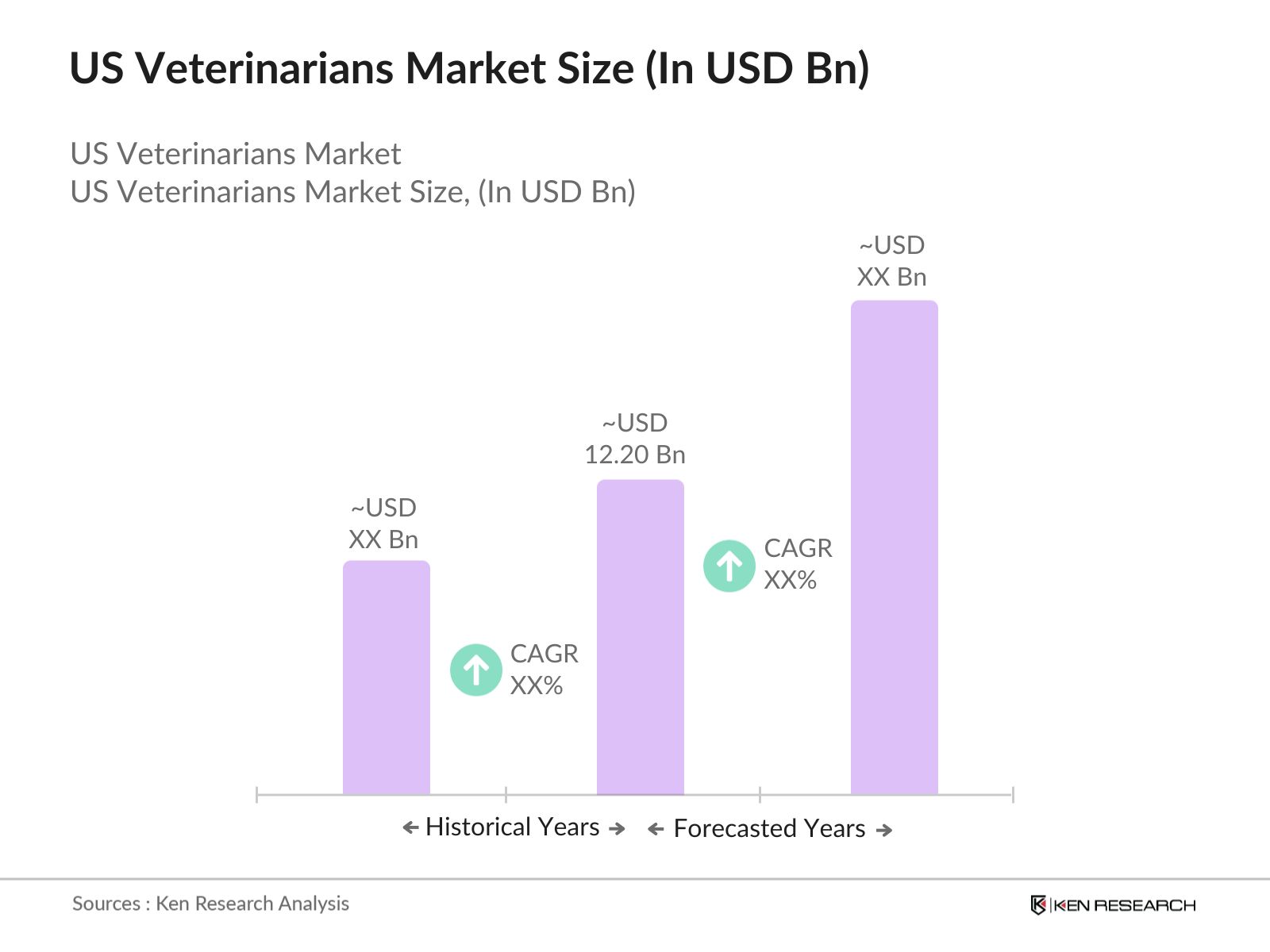

- The US veterinarians market is valued at USD 12.20 billion, based on a five-year historical analysis. The market is driven by increasing pet ownership, the rising importance of preventive care, and the demand for advanced veterinary services. The growing awareness of animal health, coupled with advancements in veterinary diagnostics and treatments, has expanded the market. The increase in disposable income for pet owners and a surge in animal healthcare spending further contribute to the sustained growth of the market.

- The US veterinarians market is predominantly concentrated in urban areas such as New York, Los Angeles, and Chicago, where there is a high density of pet ownership and sophisticated veterinary infrastructure. These cities dominate the market due to a combination of high pet ownership rates, advanced veterinary services, and the availability of specialized care. Additionally, regions with strong agricultural activities, such as Texas and California, lead in the livestock veterinary sector, driven by the need to maintain the health of large herds.

- Veterinary service chains are rapidly expanding across the US, with major players increasing their market presence through acquisitions and new clinic openings. By 2023, corporate-owned veterinary practices accounted for approximately 25% of all clinics in the US. This trend is driven by the operational efficiencies and economies of scale that larger chains offer, enabling them to provide more affordable care and a broader range of services. The market for corporate veterinary services was valued at $20 billion in 2023.

US Veterinarians Market Segmentation

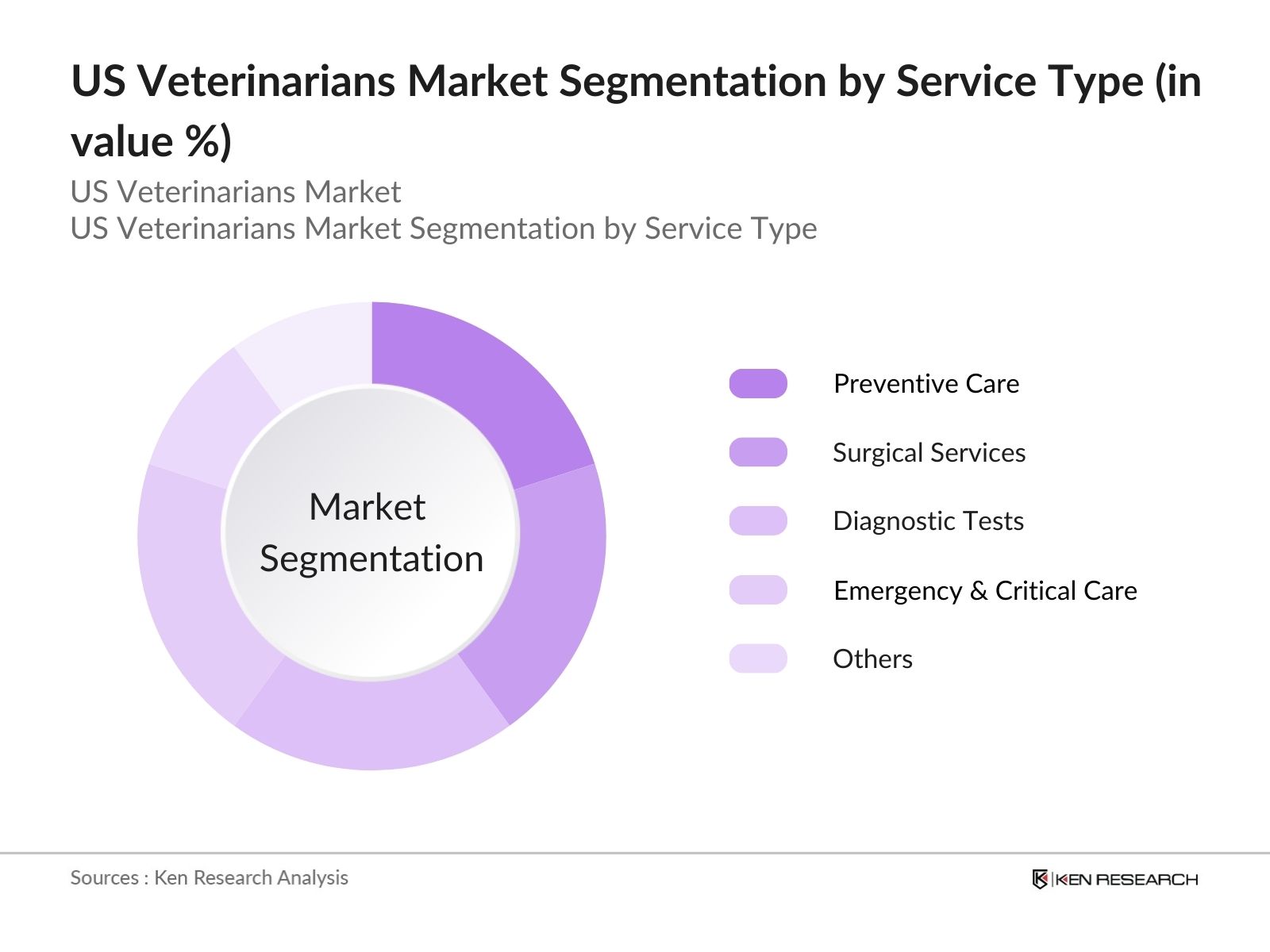

- By Service Type: The US veterinarians market is segmented by service type into preventive care, surgical services, diagnostic tests, emergency & critical care, and others. Preventive care has a dominated the market due to the increasing emphasis on early detection of diseases and the growing trend of wellness programs for pets. Preventive measures, such as vaccinations and routine health check-ups, have gained significant traction as pet owners prioritize long-term health management for their animals.

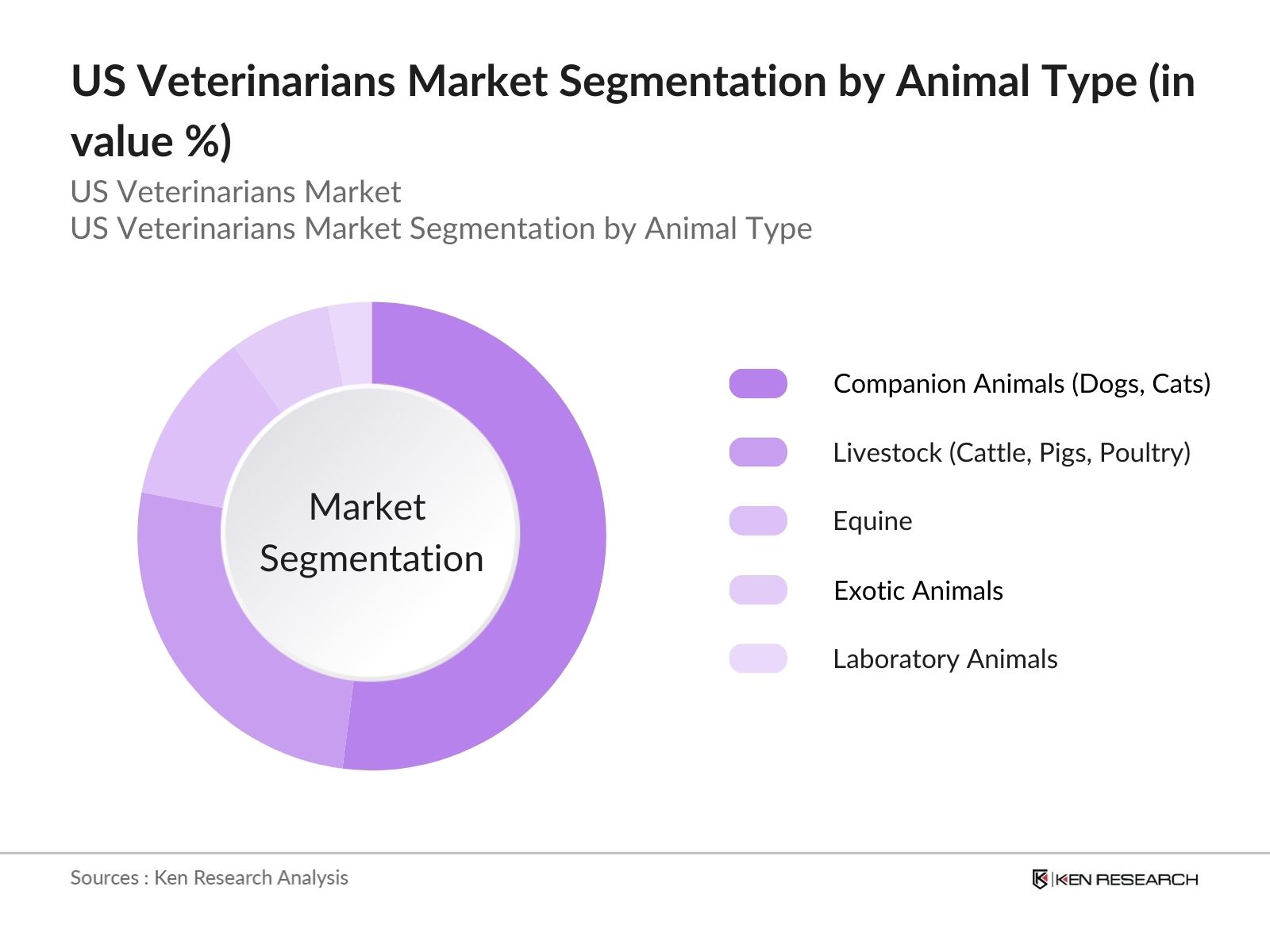

- By Animal Type: The market is further segmented by animal type into companion animals (dogs, cats), livestock (cattle, pigs, poultry), equine, exotic animals, and laboratory animals. Companion animals, particularly dogs, dominated the market due to the high level of pet ownership in the US. The growing demand for specialized treatments for chronic conditions, such as arthritis and cancer in dogs and cats, contributes to this segments dominance.

US Veterinarians Market Competitive Landscape

The US veterinarians market is dominated by a few key players such as Banfield Pet Hospital and VCA Animal Hospitals. These companies have established a strong network of veterinary clinics across the country, leveraging their broad service portfolios, strong brand loyalty, and cutting-edge technology integration to maintain market leadership. Their ability to provide both preventive and specialized care, along with advanced diagnostic capabilities, has positioned them ahead of local and regional competitors.

|

Company Name |

Establishment Year |

Headquarters |

Number of Clinics |

Annual Revenue (USD) |

Service Range |

Technology Adoption |

Strategic Initiatives |

|

Banfield Pet Hospital |

1955 |

Vancouver, WA |

1,000+ |

2.5 Billion |

Full Service |

Advanced Diagnostics |

Expansion & M&A |

|

VCA Animal Hospitals |

1986 |

Los Angeles, CA |

900+ |

2 Billion |

Specialty Care |

Telemedicine |

Strategic Partnerships |

|

National Veterinary Assoc |

1996 |

Agoura Hills, CA |

700+ |

1.6 Billion |

General Practice |

AI Diagnostics |

Acquisitions |

|

BluePearl Vet Hospital |

1996 |

Tampa, FL |

90+ |

1.2 Billion |

Emergency Services |

Remote Consultations |

Technology Investments |

|

IDEXX Laboratories |

1983 |

Westbrook, ME |

N/A |

2.4 Billion |

Diagnostics |

AI-Based Tools |

R&D Investments |

US Veterinarians Industry Analysis

US Veterinarians Market Growth Drivers

- Increased Pet Ownership: The US pet population is continuously growing, with over 90 million dogs and 94 million cats as of 2023. This rise is supported by changing household dynamics, where 70% of households now have at least one pet, according to data from the American Pet Products Association (APPA). The economic value of the pet industry reached $123.6 billion in 2022, showing an increase in spending on veterinary services, pet healthcare, and related industries. Macroeconomic indicators reflect a stable income per capita growth in the US in 2023, averaging $68,700, further facilitating the rise in pet ownership and care expenditures. Source

- Rise in Pet Insurance: The number of insured pets in the US reached approximately 4.4 million by 2023, a significant increase from the previous year. This upward trend is driving demand for regular and emergency veterinary services, as insured pet owners tend to visit veterinarians more frequently. In 2023, the average annual premium for pet insurance was $640 for dogs and $387 for cats, with veterinary care expenditures rising in tandem. The broader macroeconomic environment reflects increased disposable income among pet owners, fueling demand for comprehensive pet healthcare. Source

- Veterinary Telemedicine: The adoption of veterinary telemedicine surged in 2022, with over 25% of veterinary practices now offering telehealth consultations. This shift is partially due to the COVID-19 pandemic, which accelerated remote healthcare services. The American Veterinary Medical Association (AVMA) reports that telemedicine has been particularly effective in rural and underserved areas, where access to in-person veterinary care is limited. Furthermore, the broadband internet penetration rate in the US exceeded 91% in 2023, facilitating the growth of telemedicine services in the veterinary field

US Veterinarians Market Restraints

- Shortage of Veterinary Professionals: The US faces a critical shortage of veterinary professionals, with the Bureau of Labor Statistics (BLS) reporting around 89,000 veterinarians in the workforce in 2023, insufficient to meet rising demand. This shortfall is projected to continue through 2025, driven by increasing pet ownership and an aging workforce. Furthermore, veterinary job openings rose by 4,800 positions in 2023, exacerbating the gap between demand and available professionals. The shortage is most acute in rural areas, where the number of veterinarians is disproportionately low.

- Regulatory Compliance: Veterinary practices in the US must adhere to a complex web of federal, state, and local regulations, which can be challenging to navigate. Compliance with the Controlled Substances Act (CSA), Food and Drug Administration (FDA) regulations, and state veterinary board rules imposes financial and operational burdens on veterinary clinics. In 2023, compliance costs for small veterinary practices averaged $15,000 annually, according to industry estimates. The burden of staying compliant with evolving regulations has become a key operational challenge for many veterinary professionals.

US Veterinarians Market Future Outlook

Over the next five years, the US veterinarians market is expected to witness significant growth, driven by increasing pet adoption rates, advancements in veterinary care, and rising demand for specialized services. The growing importance of pet wellness and preventive healthcare, coupled with the rising influence of telemedicine in veterinary services, will fuel market expansion. Innovations in diagnostic tools and therapeutic treatments are expected to further enhance the quality and range of services offered by veterinary professionals.

Market Opportunities

- Technological Innovations in Veterinary Diagnostics: The rise of technological innovations in diagnostics, such as AI-powered imaging, point-of-care testing, and wearable pet health devices, is creating new opportunities for veterinary professionals. In 2023, the use of diagnostic imaging in veterinary practices grew by 14%, supported by advancements in AI that reduce diagnostic errors. The global sale of veterinary diagnostic tools reached $2 billion in 2022. The US Department of Agriculture (USDA) is also supporting the development of these technologies through grants and research initiatives. Source

- Rising Demand for Specialized Veterinary Services: There has been an increasing demand for specialized veterinary services, such as oncology, cardiology, and neurology, particularly for companion animals. In 2023, nearly 15% of veterinary clinics offered specialized services, up from 10% in 2022. This growth is driven by the willingness of pet owners to invest in advanced treatments for their pets. Macroeconomic data shows that the average annual income for veterinarians specializing in niche fields reached $120,000 in 2023, reflecting the high demand and profitability of these services.

Scope of the Report

|

By Service Type |

Preventive Care Surgical Services Diagnostic Tests Emergency & Critical Care Others |

|

By Specialty |

Small Animal Veterinarians Large Animal Veterinarians Exotic Animal Veterinarians Veterinary Surgeons Veterinary Dermatologists |

|

By Practice Type |

Private Clinical Practice Corporate Veterinary Chains Veterinary Hospitals Public Health Veterinary Practices Research & Academia |

|

By Animal Type |

Companion Animals (Dogs, Cats) Livestock (Cattle, Pigs, Poultry) Equine Exotic Animals Laboratory Animals |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Veterinary Clinics & Hospitals

Veterinary Product Manufacturers

Animal Welfare Organizations

Pet Insurance Companies

Government and Regulatory Bodies (FDA, USDA)

Pet Retailers

Pharmaceutical Companies

Investment and Venture Capital Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Banfield Pet Hospital

VCA Animal Hospitals

National Veterinary Associates

BluePearl Specialty and Emergency Pet Hospital

IDEXX Laboratories, Inc.

Mars Veterinary Health

PetVet Care Centers

Pathway Vet Alliance

Compassion-First Pet Hospitals

MedVet

Heartland Veterinary Partners

Mission Veterinary Partners

VetCor

Zoetis

Elanco Animal Health

Table of Contents

1. US Veterinarians Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview (Service Type, Specialty, Practice Type, Region, Animal Type)

2. US Veterinarians Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Growth Rate %)

2.3. Key Market Developments and Milestones (Regulatory, Technological Advancements, Market Entry of Key Players)

3. US Veterinarians Market Analysis

3.1. Growth Drivers (Increased Pet Ownership, Rise in Pet Insurance, Veterinary Telemedicine, Expanding Pet Services)

3.2. Market Challenges (High Cost of Veterinary Education, Shortage of Veterinary Professionals, Regulatory Compliance, Inflation in Veterinary Services Pricing)

3.3. Opportunities (Technological Innovations in Veterinary Diagnostics, Rising Demand for Specialized Veterinary Services, Growth in Livestock Sector, M&A Activities in the Market)

3.4. Trends (Increasing Use of Veterinary Management Software, Growth in Companion Animal Segment, Expansion of Veterinary Service Chains, Remote Healthcare & Telemedicine Adoption)

3.5. Government Regulations (Licensing and Accreditation Standards, Animal Welfare Legislation, FDA Guidelines for Veterinary Products, Drug Use Regulations in Veterinary Practice)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Veterinarians, Pet Owners, Suppliers, Pharmaceuticals, Diagnostic Services, Technology Providers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. US Veterinarians Market Segmentation

4.1. By Service Type (In Value %)

Preventive Care

Surgical Services

Diagnostic Tests

Emergency & Critical Care

Others

4.2. By Specialty (In Value %)

Small Animal Veterinarians

Large Animal Veterinarians

Exotic Animal Veterinarians

Veterinary Surgeons

Veterinary Dermatologists

4.3. By Practice Type (In Value %)

Private Clinical Practice

Corporate Veterinary Chains

Veterinary Hospitals

Public Health Veterinary Practices

Research & Academia

4.4. By Animal Type (In Value %)

Companion Animals (Dogs, Cats)

Livestock (Cattle, Pigs, Poultry)

Equine

Exotic Animals

Laboratory Animals

4.5. By Region (In Value %)

Northeast

Midwest

South

West

5. US Veterinarians Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Banfield Pet Hospital

5.1.2. VCA Animal Hospitals

5.1.3. National Veterinary Associates

5.1.4. BluePearl Specialty and Emergency Pet Hospital

5.1.5. IDEXX Laboratories, Inc.

5.1.6. Mars Veterinary Health

5.1.7. PetVet Care Centers

5.1.8. Pathway Vet Alliance

5.1.9. Compassion-First Pet Hospitals

5.1.10. MedVet

5.1.11. Heartland Veterinary Partners

5.1.12. Mission Veterinary Partners

5.1.13. VetCor

5.1.14. Zoetis

5.1.15. Elanco Animal Health

5.2. Cross Comparison Parameters (Revenue, Number of Clinics, Employees, Headquarters, Specialties Offered, Expansion Strategy, M&A Activities, Technology Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Service Offerings, Mergers and Acquisitions, Technology Investments)

5.5. Venture Capital and Private Equity Investments

5.6. Investment and Funding Analysis

5.7. Key Partnership and Collaboration Strategies

6. US Veterinarians Market Regulatory Framework

6.1. State and Federal Licensing

6.2. Veterinary Medical Board Guidelines

6.3. Drug Usage Regulations

6.4. Compliance Requirements for Clinics and Hospitals

7. US Veterinarians Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Telemedicine Adoption, Demand for Specialized Veterinary Services, Livestock Industry Expansion)

8. US Veterinarians Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Specialty (In Value %)

8.3. By Practice Type (In Value %)

8.4. By Animal Type (In Value %)

8.5. By Region (In Value %)

9. US Veterinarians Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Competitive Positioning Strategies

9.4. Marketing and Customer Retention Initiatives

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the US veterinarians market ecosystem, considering key stakeholders such as veterinary clinics, hospitals, and pharmaceutical companies. Comprehensive desk research is conducted to identify critical market variables influencing growth.

Step 2: Market Analysis and Construction

In this phase, historical data related to the US veterinarians market is compiled and analyzed. This includes market growth patterns, technological advancements, and shifts in consumer behavior regarding animal healthcare.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry professionals. These experts provide insights into operational challenges, revenue models, and emerging trends, which refine the accuracy of market data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from key veterinary service providers. This helps verify market statistics using a bottom-up approach, ensuring that the report reflects a reliable analysis of the US veterinarians market.

Frequently Asked Questions

1. How big is the US Veterinarians Market?

The US veterinarians market is valued at USD 12.20 billion, driven by increasing pet ownership and a growing focus on advanced animal healthcare services.

2. What are the challenges in the US Veterinarians Market?

Challenges include a shortage of veterinary professionals, high educational costs, and stringent regulatory compliance, which create barriers to entry for new veterinarians.

3. Who are the major players in the US Veterinarians Market?

Key players include Banfield Pet Hospital, VCA Animal Hospitals, IDEXX Laboratories, and National Veterinary Associates, each contributing to the market's competitive landscape.

4. What are the growth drivers of the US Veterinarians Market?

The market is driven by increasing pet adoption rates, advancements in veterinary diagnostics, and the growing importance of preventive healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.