USA 3D Printing Industry Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD4230

October 2024

93

About the Report

USA 3D Printing Market Overview

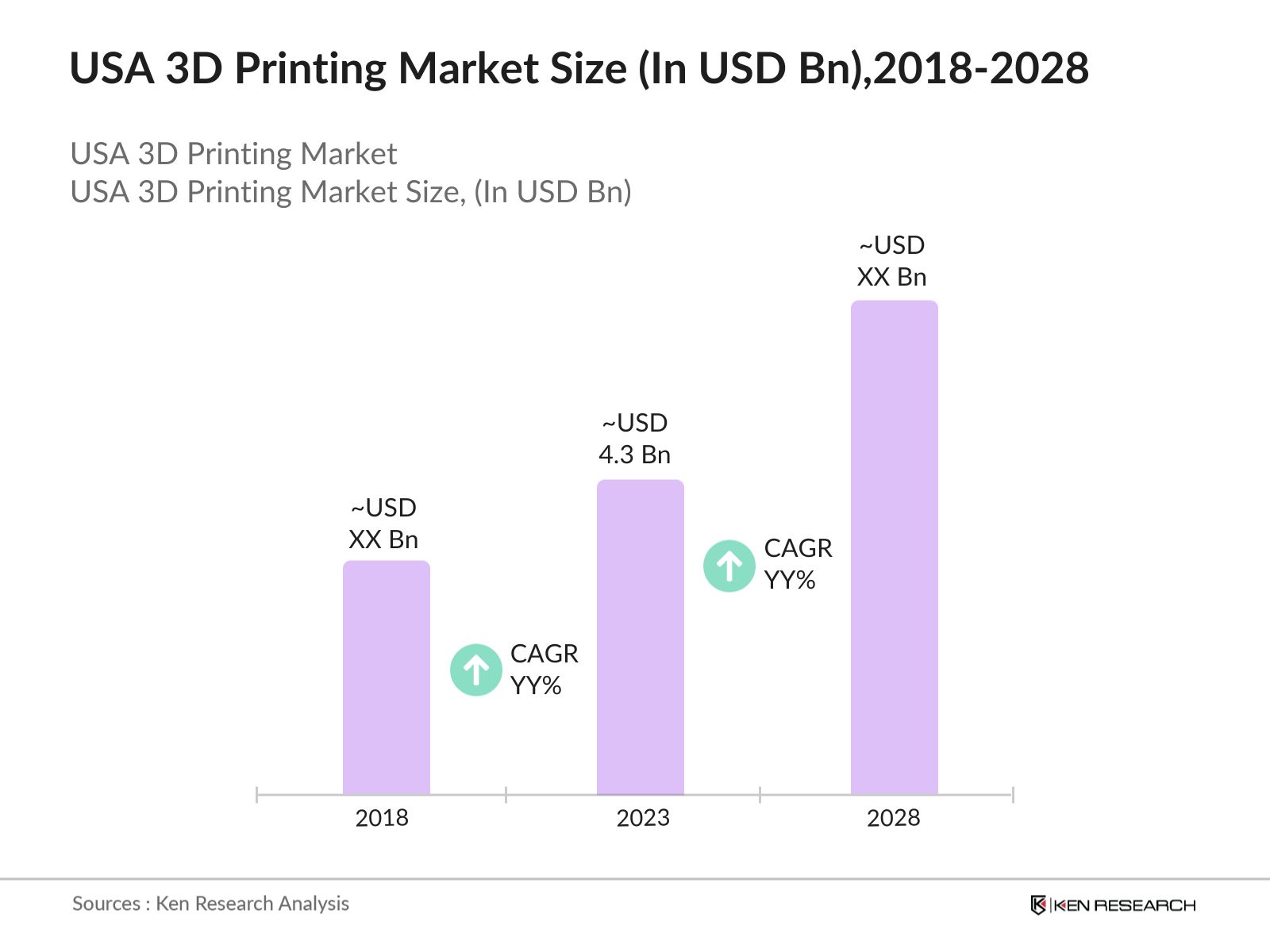

- The USA 3D Printing Market was valued at USD 4.3 billion in 2023. This growth is primarily fueled by the increasing demand for customized products, cost-effective manufacturing processes, and the expanding application of 3D printing in sectors such as healthcare, aerospace, automotive, and consumer goods.

- The market is dominated by key players such as Stratasys, 3D Systems Corporation, HP Inc., General Electric (GE), and Desktop Metal. These companies are at the forefront of innovation, continuously developing new materials and technologies to meet the evolving needs of various industries.

- In September 2023, 3D Systems was awarded a $10.7 million contract by the U.S. Air Force to develop a large-format metal 3D printer. This contract, managed by the Air Force Research Laboratory, aims to advance metal 3D printing capabilities for hypersonic applications, with project completion expected by September 2025.

- California is currently the dominant state in the market with the presence of major technology companies, extensive research and development facilities, and a strong industrial base in the state. Silicon Valley, in particular, has emerged as a hub for 3D printing innovation, with numerous startups and established companies focusing on developing cutting-edge technologies and applications.

USA 3D Printing Market Segmentation

The market is segmented into various factors like technology, application, and region.

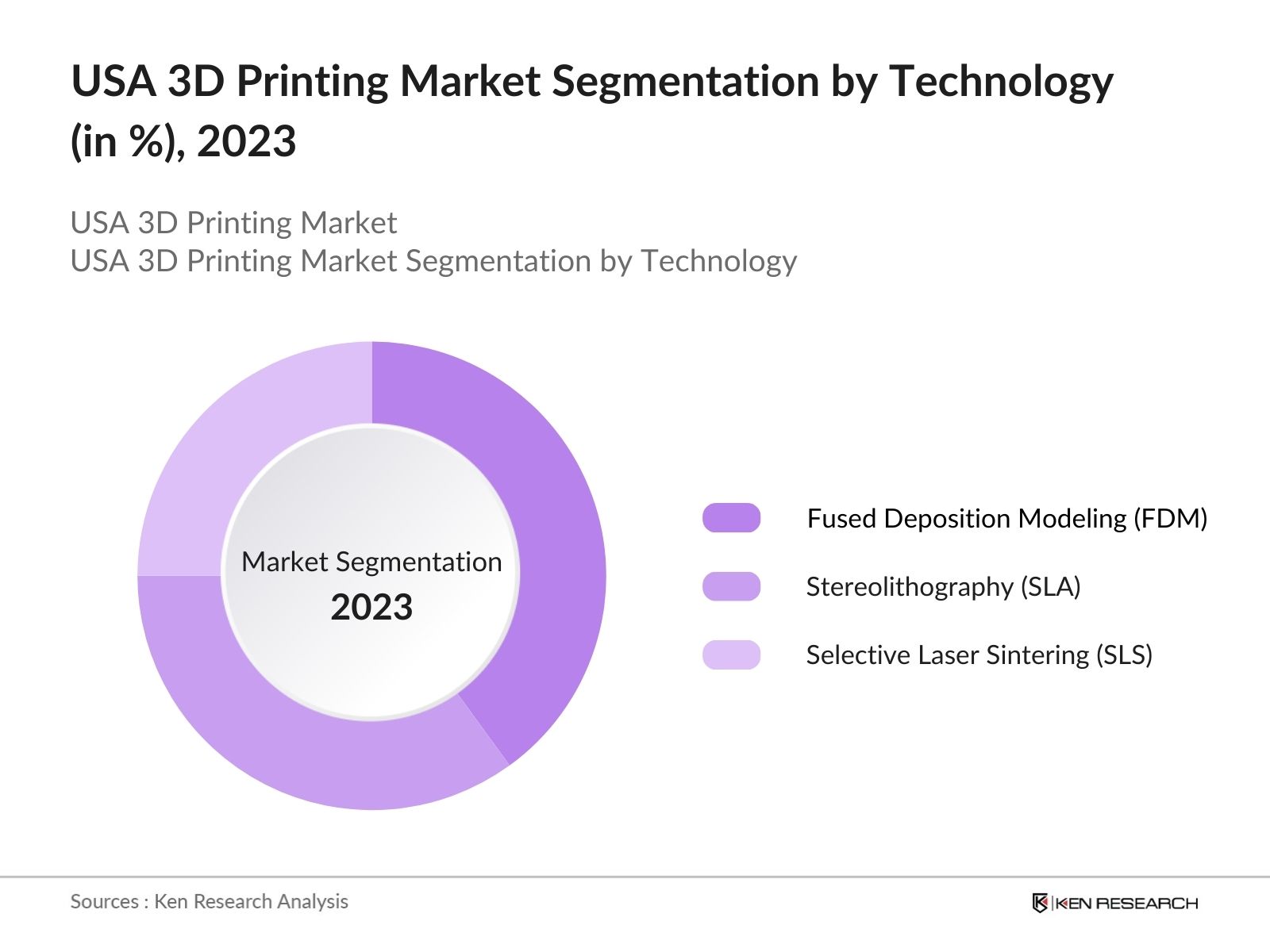

By Technology: The market is segmented by technology into stereolithography (SLA), selective laser sintering (SLS), and fused deposition modeling (FDM). In 2023, FDM technology held the largest market share due to its wide application across various industries, including automotive, aerospace, and consumer goods.

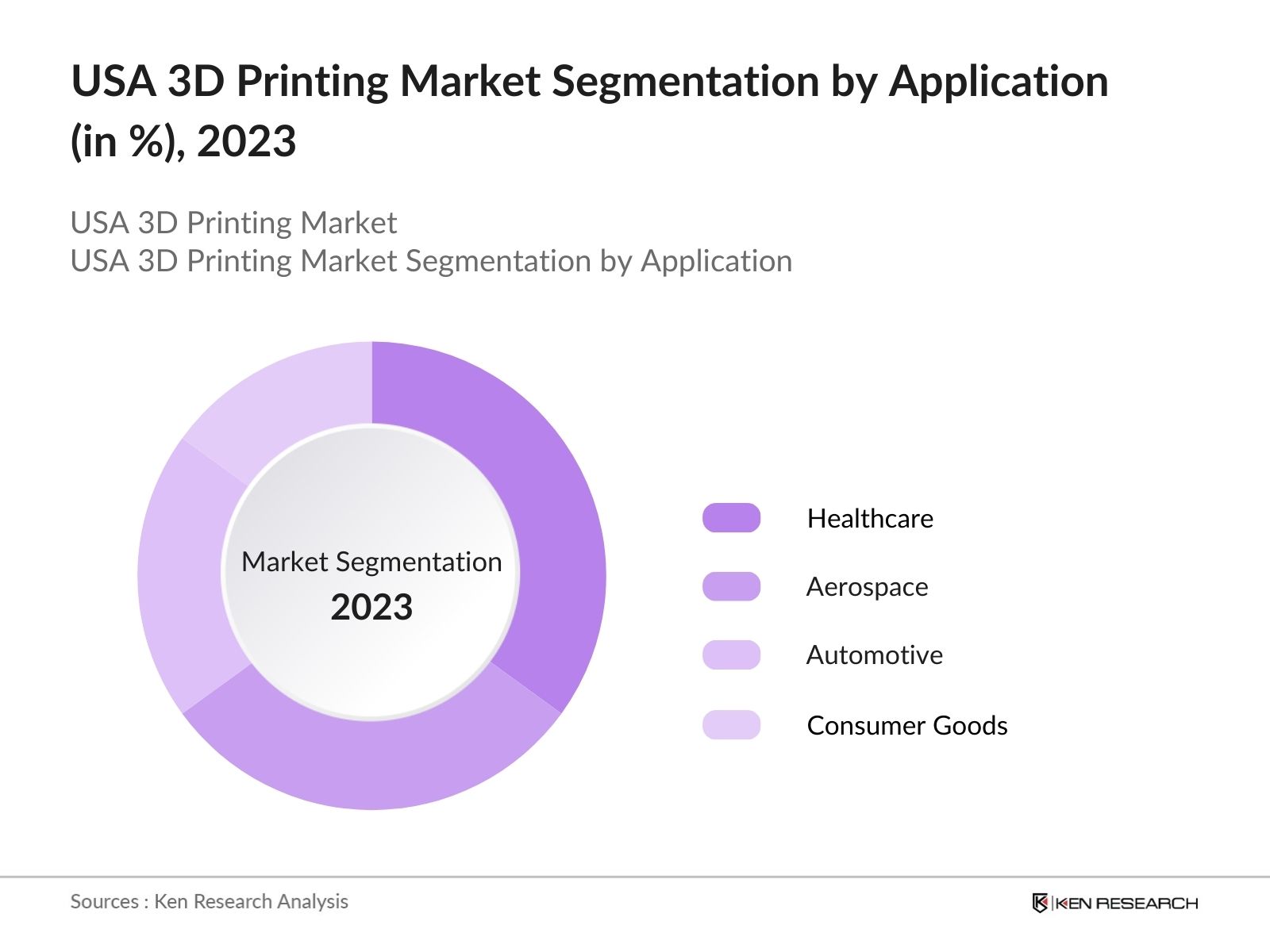

By Application: The market is segmented by application into aerospace, healthcare, automotive, and consumer goods. In 2023, the healthcare segment dominated the market with the growing adoption of 3D printing for the production of customized medical devices, implants, and prosthetics has driven this segment's growth.

By Region: The market is segmented by region into North, South, East, and West. In 2023, the West region held the largest market share due to the region leadership in innovation and technology development has made it the most significant contributor to the USA 3D printing sector.

USA 3D Printing Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Stratasys |

1989 |

Eden Prairie, Minnesota |

|

3D Systems Corporation |

1986 |

Rock Hill, South Carolina |

|

HP Inc. |

1939 |

Palo Alto, California |

|

General Electric (GE) |

1892 |

Boston, Massachusetts |

|

Desktop Metal |

2015 |

Burlington, Massachusetts |

- Stratasys: Stratasys has announced a restructuring plan aiming for a 15% workforce reduction by year-end, targeting $40 million in annual cost savings from Q1 2025. In Q2 2024, Stratasys reported revenues of $138 million, down from $159.8 million in Q2 2023, amid challenging market conditions.

- HP Inc.: HP Inc. has partnered with Indo-MIM to enhance metal 3D parts production in India, anticipating growth in the sector. This collaboration aims to leverage advanced manufacturing technologies, meeting the rising demand for customized metal parts across various industries, including automotive and aerospace.

USA 3D Printing Market Analysis

Market Growth Drivers

- Increasing Adoption in Healthcare: The adoption of 3D printing technology in the healthcare sector is rising, driven by the need for patient-specific implants and prosthetics. In 2024, the number of 3D-printed medical devices has increased, with hospitals across the USA increasing their investments in this technology to improve patient outcomes. The application of 3D printing in bioprinting and tissue engineering is also gaining traction, further driving demand.

- Demand from Aerospace Sector: The aerospace industry continues to be a major driver for the 3D printing sector. In 2024, aerospace companies in the USA produced 3D-printed parts, primarily for lightweight components and complex geometries that traditional manufacturing methods cannot achieve. The U.S. Department of Defense's supported in 3D printing technologies, underscores the critical role this technology plays in the defense sector.

- Shift Towards Mass Customization: The trend of mass customization, particularly in the consumer goods and automotive sectors, is accelerating the adoption of 3D printing. In 2024, the number of customized 3D-printed consumer products has increased. Companies are leveraging 3D printing to offer personalized products at scale, reducing lead times and enhancing customer satisfaction.

Market Challenges

- Material Limitations: The limited availability of 3D printing materials, particularly for high-performance applications, continues to challenge the market. In 2024, there were only about 150 commercially available 3D printing materials, with a portion being limited to plastics. The lack of diverse materials suitable for different industries restricts the adoption of 3D printing technology, especially in sectors like aerospace and healthcare.

- Intellectual Property Concerns: As 3D printing technology advances, concerns about intellectual property (IP) theft are rising. In 2024, the number of IP infringement cases related to 3D printing increased to over 500 in the USA. The ease of copying and reproducing designs using 3D printers has led to a surge in IP disputes, creating legal challenges for companies operating in this space.

Government Initiatives

- U.S. Department of Tax Credit: The U.S. government offers a $20 billion federal R&D tax credit to incentivize companies investing in research and development, including advancements in 3D printing technologies. This initiative, as of 2024, supports innovation by allowing eligible companies to reduce their tax liability, fostering growth in emerging technologies like additive manufacturing.

USA 3D Printing Market Future Outlook

The future trends in USA 3D printing industry are advancements in metal printing, expanded use in construction, increased customization in healthcare, and greater integration of AI and machine learning for enhanced precision and efficiency, driving innovation and adoption across multiple industries by 2028.

Future Market Trends

- Adoption of 3D Printing in Construction: The use of 3D printing in the construction industry is anticipated to rise, with the number of 3D-printed buildings in the USA expected to reach 2,000 by 2028. This trend will be driven by the need for sustainable and cost-effective construction methods, as well as the development of new construction materials suitable for 3D printing.

- Integration of AI and Machine Learning: The integration of AI and machine learning in 3D printing processes is expected to become more prevalent by 2028, leading to greater precision and efficiency. AI-driven design optimization and real-time monitoring will enhance the quality and speed of 3D printing, enabling mass production at lower costs.

Scope of the Report

|

By Technology |

Fused Deposition Modeling (FDM) Stereolithography (SLA) Selective Laser Sintering (SLS) |

|

By Application |

Healthcare Aerospace Automotive Consumer Goods |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Aerospace and Defense Manufacturers

Automotive Manufacturers

Medical Device Manufacturers

Consumer Electronics Companies

Industrial Equipment Manufacturers

Government Regulatory Bodies (e.g., U.S. Department of Defense)

Custom Manufacturing Firms

Banks and Financial Institutions

Venture Capital Firms

Construction Companies

Robotics Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Stratasys

3D Systems Corporation

HP Inc.

General Electric (GE)

Desktop Metal

Markforged

Carbon, Inc.

ExOne

Proto Labs, Inc.

Formlabs

Renishaw plc

SLM Solutions

EOS GmbH

Materialise NV

Ultimaker

Table of Contents

1. USA 3D Printing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA 3D Printing Market Size (in USD), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA 3D Printing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Customization

3.1.2. Expansion in Healthcare Applications

3.1.3. R&D Investments

3.1.4. Adoption in Aerospace Sector

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Material Limitations

3.2.3. Regulatory Challenges

3.2.4. Intellectual Property Concerns

3.3. Opportunities

3.3.1. Growth in Metal 3D Printing

3.3.2. Adoption in Construction Industry

3.3.3. Integration with AI and Machine Learning

3.3.4. Expansion into New Applications

3.4. Trends

3.4.1. AI Integration in 3D Printing

3.4.2. Use in Bioprinting

3.4.3. Advances in Sustainable Materials

3.4.4. Increased Demand for On-Demand Manufacturing

3.5. Government Regulation

3.5.1. R&D Tax Incentives

3.5.2. Defense Department Investments

3.5.3. Support for Advanced Manufacturing

3.5.4. Environmental Standards for 3D Printed Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. USA 3D Printing Market Segmentation, 2023

4.1. By Technology (in Value)

4.1.1. Fused Deposition Modeling (FDM)

4.1.2. Stereolithography (SLA)

4.1.3. Selective Laser Sintering (SLS)

4.2. By Application (in Value)

4.2.1. Healthcare

4.2.2. Aerospace

4.2.3. Automotive

4.2.4. Consumer Goods

4.3. By Region (in Value)

4.3.1. West

4.3.2. North

4.3.3. East

4.3.4. South

5. USA 3D Printing Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Stratasys

5.1.2. 3D Systems Corporation

5.1.3. HP Inc.

5.1.4. General Electric (GE)

5.1.5. Desktop Metal

6. USA 3D Printing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA 3D Printing Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA 3D Printing Market Future Size (in USD), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA 3D Printing Market Future Segmentation, 2028

9.1. By Technology (in Value)

9.2. By Application (in Value)

9.3. By Region (in Value)

10. USA 3D Printing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on USA 3D Printing industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA 3D Printing Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple 3D printing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such 3D printing companies.

Frequently Asked Questions

01 How big is the USA 3D Printing market?

The USA 3D Printing Market was valued at USD 4.3 billion in 2023. This growth is primarily fueled by the increasing demand for customized products, cost-effective manufacturing processes, and the expanding application of 3D printing in sectors such as healthcare, aerospace, automotive, and consumer goods.

02 What are the challenges in USA 3D Printing market?

The major challenges in the USA 3D Printing market include high initial costs, limited material availability, complex regulatory requirements, and intellectual property concerns. These factors can hinder the broader adoption of 3D printing technology in the market.

03 Who are the major players in the USA 3D Printing market?

Key players in the USA 3D Printing market include Stratasys, 3D Systems Corporation, HP Inc., General Electric (GE), and Desktop Metal. These companies lead the market through continuous innovation, strategic partnerships, and significant investments in research and development.

04 What are the main growth drivers of the USA 3D Printing market?

The growth of the USA 3D Printing market includes increasing demand for customized products, significant R&D investments, rising adoption in healthcare and aerospace, and government support for advanced manufacturing technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.