USA Abrasive market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD3654

December 2024

83

About the Report

USA Abrasive Market Overview

- The USA Abrasive Industry is valued at USD 3.6 billion, driven by the growth of key sectors such as metal fabrication, construction, and automotive manufacturing. Demand for abrasives is propelled by the expansion of these industries, which rely heavily on abrasives for grinding, cutting, and polishing applications. Increased industrialization, technological advancements in manufacturing processes, and the rising need for precision tools further contribute to market growth.

- The USA Abrasive Industry is dominated by cities such as Detroit, Los Angeles, and Houston, which are hubs for automotive, aerospace, and metalworking industries. Detroit, being a major automotive manufacturing center, drives demand for abrasives used in car production and maintenance. Los Angeles and Houston, with their strong presence in aerospace and oil industries, also contribute significantly to the demand for specialized abrasives required in precision manufacturing and heavy industrial applications.

- OSHA safety standards for abrasive blasting are critical in maintaining worker safety and environmental compliance. In 2023, OSHA implemented new regulations requiring employers to use engineering controls to limit worker exposure to airborne contaminants, impacting nearly 1,000 facilities nationwide. The compliance costs for implementing these standards can average $150,000 per facility, which affects operational budgets but ultimately enhances workplace safety and reduces liability.

USA Abrasive Market Segmentation

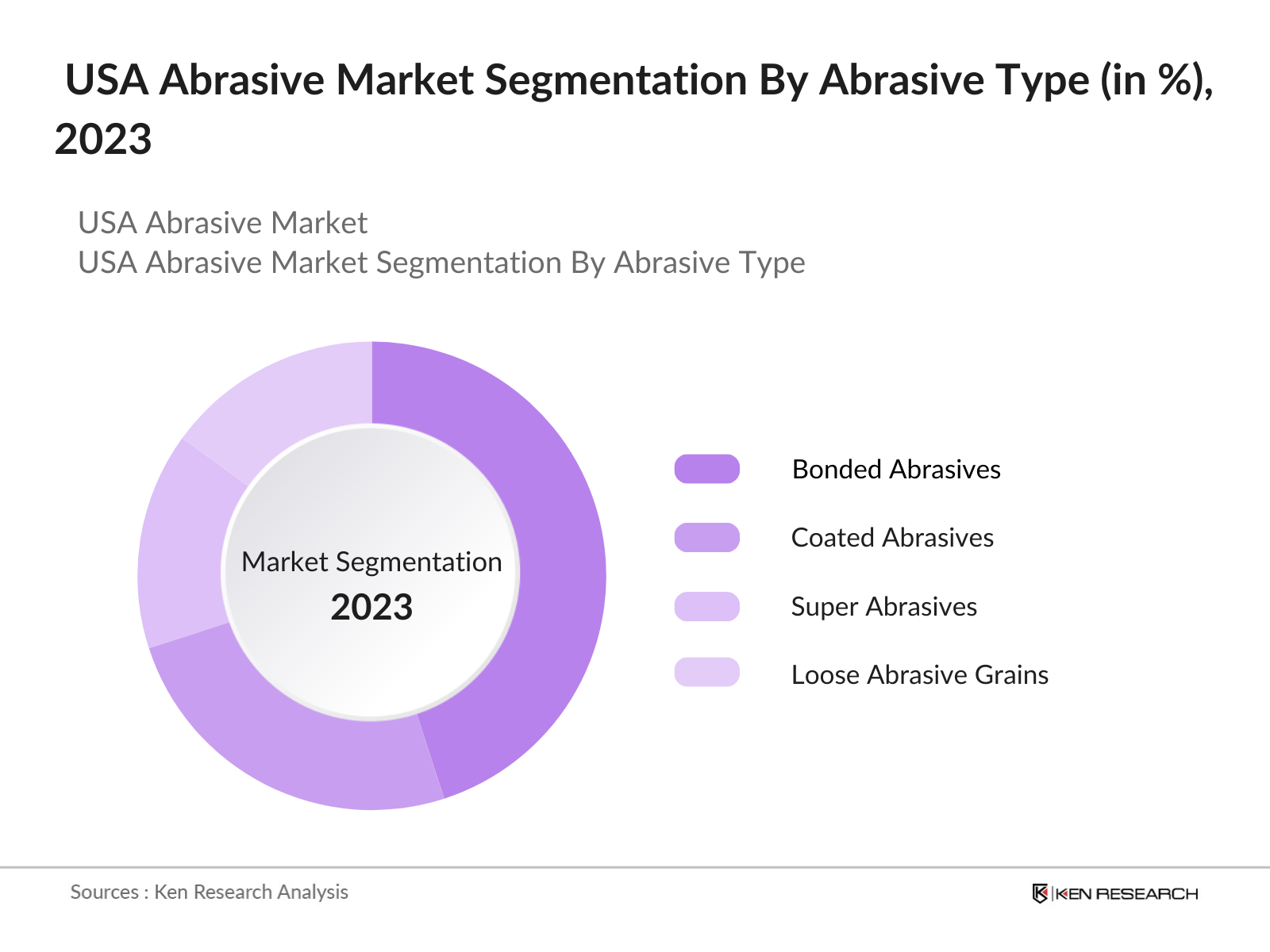

By Abrasive Type: The USA Abrasive Industry is segmented by abrasive type into bonded abrasives, coated abrasives, super abrasives, and loose abrasive grains. Bonded abrasives hold a dominant market share in the industry, primarily due to their extensive use in grinding and cutting applications across metalworking and construction sectors. The strong presence of leading brands in this category, such as Norton and Saint-Gobain, combined with the versatility of bonded abrasives in handling different materials, further solidifies their leading position.

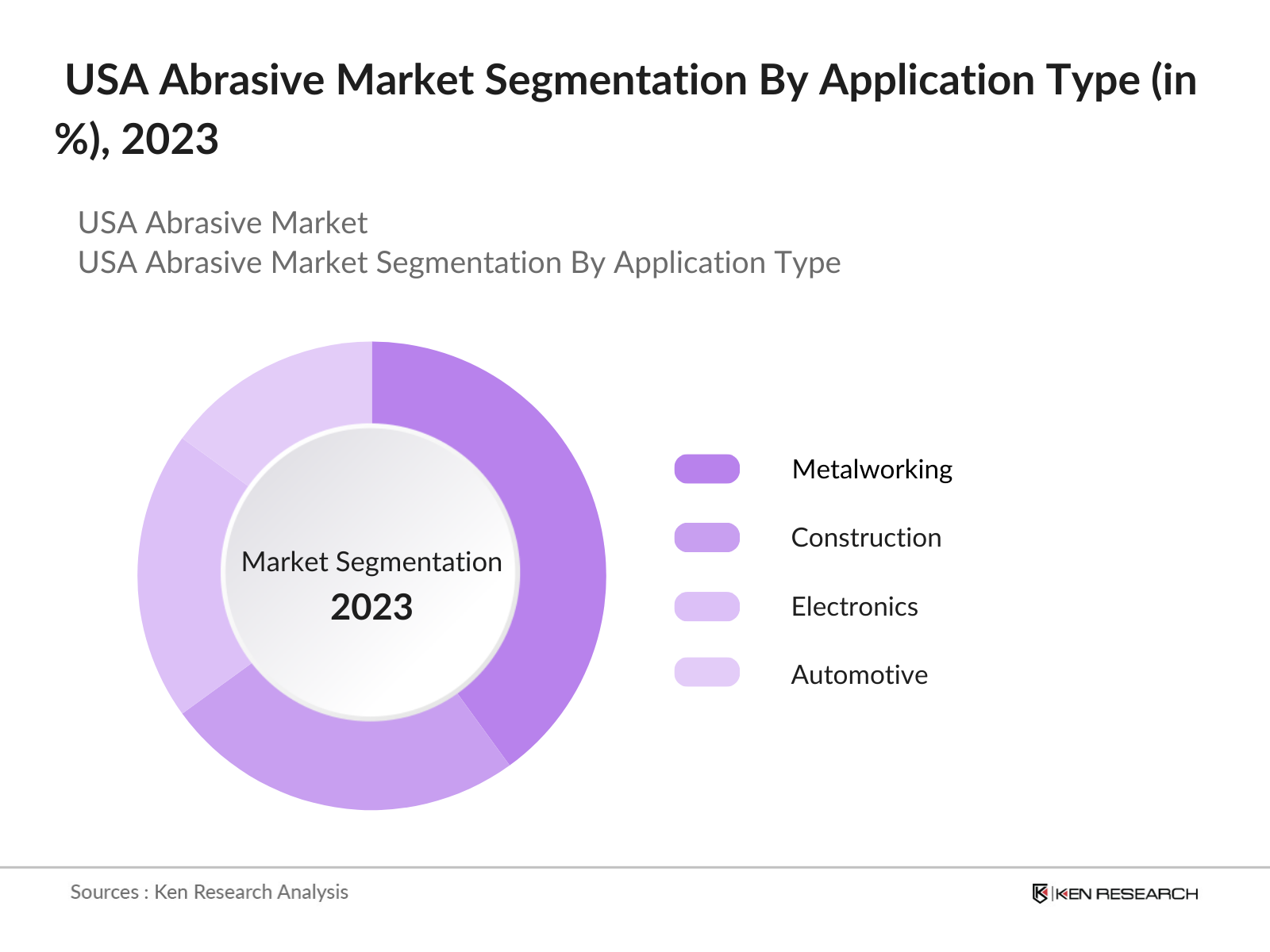

By Application: The USA Abrasive Industry is segmented by application into metalworking, construction, electronics, and automotive. Metalworking dominates the application segment, as abrasives are integral to machining and finishing processes in the production of metal parts. The demand for precision and high-performance abrasives in metal fabrication, especially in automotive and aerospace sectors, drives the growth of this sub-segment.

USA Abrasive Market Competitive Landscape

The USA Abrasive Industry is characterized by a mix of multinational corporations and domestic companies, with key players controlling significant market shares. The competitive landscape highlights strong market consolidation, particularly among companies with a global footprint. Saint-Gobain Abrasives and 3M lead the market due to their wide product range, technological innovations, and strong distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Manufacturing Facilities |

R&D Investment |

Global Presence |

Distribution Network |

Sustainability Initiatives |

|

Saint-Gobain Abrasives |

1665 |

France |

Abrasive Wheels, Belts |

20+ |

High |

Strong |

Extensive |

Strong Focus on Recycling |

|

3M Company |

1902 |

USA |

Coated, Bonded Abrasives |

10+ |

Medium |

Strong |

Extensive |

Green Manufacturing Practices |

|

Norton Abrasives |

1885 |

USA |

Grinding Wheels |

15+ |

High |

Medium |

Strong |

Water Conservation Efforts |

|

Carborundum Universal Ltd. |

1954 |

India |

Industrial Abrasives |

10+ |

Medium |

Medium |

Medium |

Use of Recyclable Materials |

|

Robert Bosch GmbH |

1886 |

Germany |

Power Tools, Abrasives |

12+ |

High |

Strong |

Extensive |

Low-Emission Manufacturing |

USA Abrasive Industry Analysis

Growth Drivers

- Expansion of Manufacturing Sectors: The growth of the metalworking and construction sectors significantly drives the USA abrasive industry. The manufacturing sector's output reached approximately $2.2 trillion, supported by increased investment in infrastructure and industrial activities, which is projected to continue at a steady rate. Notably, the construction sector alone is expected to create an additional 100,000 jobs, bolstering the demand for abrasives used in various applications, including cutting and grinding. The Metalworking Manufacturing Industry also accounted for over $1 trillion in 2022, indicating robust activity that supports abrasive consumption.

- Increasing Demand for Precision Tools: The demand for precision tools, essential in sectors like aerospace and automotive manufacturing, has surged. The precision machining industry was valued at approximately $47 billion, reflecting a 5% increase from the previous year. This growth is largely driven by advancements in technology, requiring higher precision in machining processes, which, in turn, enhances the need for high-performance abrasives. The automotive sector, specifically, is expected to produce over 12 million vehicles in 2023, each requiring multiple abrasive processes during manufacturing.

- Advancements in Abrasive Technologies: Recent advancements in abrasive technologies are pivotal for industry growth. In 2022, investments in R&D for abrasive materials exceeded $500 million, resulting in innovations like super abrasives, which improve efficiency and reduce processing times. Moreover, the introduction of advanced ceramic and diamond abrasives has seen demand rise, particularly in the automotive and aerospace sectors, which together accounted for 25% of total abrasive usage in 2023. These innovations not only enhance performance but also expand the application range of abrasives across various industries.

Market Challenges

- High Raw Material Costs: High raw material costs pose a significant challenge for the abrasive industry. In 2023, the price of aluminum oxide increased by approximately $0.50 per pound, reaching $2.20, while silicon carbide prices rose to $3.00 per pound. These increases are primarily due to supply chain disruptions and inflationary pressures, leading to higher production costs for manufacturers. Additionally, the cost of energy, a critical factor in the production process, has surged, with energy prices averaging $0.11 per kWh in 2023, further straining profit margins.

- Environmental Regulations: Environmental regulations from organizations like OSHA and the EPA create challenges for abrasive manufacturers. In 2023, the EPA introduced stricter emissions standards, requiring manufacturers to reduce particulate emissions by 30%. Compliance costs can exceed $200,000 per facility, impacting profitability and operational efficiency. Furthermore, OSHA regulations necessitate the adoption of safety measures, which can also increase operational costs and complicate manufacturing processes, leading to potential delays in production.

USA Abrasive Industry Future Outlook

Over the next five years, the USA Abrasive Industry is expected to witness significant growth, driven by advancements in abrasive technologies, increased demand in sectors such as aerospace and automotive, and the rising adoption of industrial automation. The ongoing trend toward sustainable manufacturing and the use of eco-friendly materials in abrasives is also expected to shape the future market landscape. With growing environmental concerns, manufacturers are focusing on developing abrasives that reduce waste and improve efficiency in industrial applications.

Market Opportunities

- Shift Toward Sustainable Abrasives: The shift towards sustainable abrasives presents substantial growth opportunities. The global market for water jet cutting technology, which is eco-friendly, was valued at $3 billion in 2023, showing an increasing preference for less abrasive materials and processes. This transition is supported by a 20% increase in demand for environmentally friendly products across manufacturing sectors. Companies adopting sustainable practices not only reduce environmental impact but also position themselves competitively in a growing market.

- Growth in Aerospace and Defense Manufacturing: The aerospace and defense sectors are expanding rapidly, creating significant demand for high-quality abrasives. In 2023, U.S. defense spending was projected at $877 billion, a 4% increase from the previous year, driving up the need for advanced manufacturing processes, including precision grinding and polishing. This growth is coupled with a projected increase in commercial aircraft deliveries, expected to reach 900 units in 2023, further amplifying the demand for abrasives used in component manufacturing.

Scope of the Report

|

Abrasive Type |

Bonded Abrasives Coated Abrasives Super Abrasives Loose Abrasive Grains |

|

Material |

Natural Abrasives Synthetic Abrasives Metallic Abrasives |

|

Application |

Metalworking Construction Electronics, Automotive |

|

End-User Industry |

Aerospace & Defense Automotive Metal Fabrication Construction Electronics |

|

Region |

Northeast Midwest West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Abrasive Manufacturing Companies

Metalworking Companies

Automotive OEMs and Aftermarket Companies

Aerospace & Defense Companies

Construction Companies

Electronics Manufacturing Companies

Government and Regulatory Bodies (EPA, OSHA)

Investment and Venture Capital Firms

Companies

Players Mentioned in the Report:

Saint-Gobain Abrasives

3M Company

Norton Abrasives

Carborundum Universal Ltd.

Robert Bosch GmbH

Fujimi Incorporated

Tyrolit Group

Deerfos Co. Ltd.

Weiler Corporation

Abrasive Technology, Inc.

Table of Contents

1. USA Abrasive market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Abrasive market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Abrasive market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Manufacturing Sectors (Metalworking, Construction)

3.1.2. Increasing Demand for Precision Tools

3.1.3. Advancements in Abrasive Technologies

3.2. Market Challenges

3.2.1. High Raw Material Costs (Aluminum Oxide, Silicon Carbide)

3.2.2. Environmental Regulations (OSHA, EPA)

3.2.3. Volatile Supply Chains

3.3. Opportunities

3.3.1. Shift Toward Sustainable Abrasives (Water Jet, Air Blasting)

3.3.2. Growth in Aerospace and Defense Manufacturing

3.3.3. Increased Adoption of Industrial Automation

3.4. Trends

3.4.1. Emergence of Super Abrasives (Cubic Boron Nitride, Diamond)

3.4.2. Integration with Robotics in Production Lines

3.4.3. Adoption of 3D Abrasive Printing for Customization

3.5. Government Regulations

3.5.1. OSHA Safety Standards for Abrasive Blasting

3.5.2. EPA Environmental Compliance for Abrasive Manufacturers

3.5.3. Import Tariffs on Raw Abrasive Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Market Entry Barriers, Supplier Power, Buyer Power)

3.9. Competition Ecosystem

4. USA Abrasive market Segmentation

4.1. By Abrasive Type (In Value %)

4.1.1. Bonded Abrasives (Grinding Wheels, Polishing Stones)

4.1.2. Coated Abrasives (Sandpapers, Belts)

4.1.3. Super Abrasives (Diamond, Cubic Boron Nitride)

4.1.4. Loose Abrasive Grains (Silicon Carbide, Aluminum Oxide)

4.2. By Material (In Value %)

4.2.1. Natural Abrasives (Emery, Diamond)

4.2.2. Synthetic Abrasives (Silicon Carbide, Aluminum Oxide)

4.2.3. Metallic Abrasives (Steel Grit, Stainless Steel Shot)

4.3. By Application (In Value %)

4.3.1. Metalworking (Machining, Finishing)

4.3.2. Construction (Cutting, Grinding)

4.3.3. Electronics (Precision Components, Semiconductor Manufacturing)

4.3.4. Automotive (Polishing, Surface Prep)

4.4. By End-User Industry (In Value %)

4.4.1. Aerospace & Defense

4.4.2. Automotive

4.4.3. Metal Fabrication

4.4.4. Construction

4.4.5. Electronics

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. West

4.5.4. South

5. USA Abrasive market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Saint-Gobain Abrasives

5.1.2. 3M Company

5.1.3. Norton Abrasives

5.1.4. Carborundum Universal Ltd.

5.1.5. Robert Bosch GmbH

5.1.6. Fujimi Incorporated

5.1.7. Tyrolit Group

5.1.8. Deerfos Co. Ltd.

5.1.9. Weiler Corporation

5.1.10. Abrasive Technology, Inc.

5.1.11. Sia Abrasives Industries AG

5.1.12. Pferd Inc.

5.1.13. Klingspor AG

5.1.14. Allied High Tech Products

5.1.15. Hermes Schleifmittel GmbH

5.2. Cross Comparison Parameters (Revenue, Market Share, Abrasive Production Capacity, Product Portfolio, Technological Innovation, Regional Presence, Number of Manufacturing Facilities, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, R&D Investments, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Subsidies

5.9. Private Equity Investments

6. USA Abrasive market Regulatory Framework

6.1. Safety Standards (OSHA Regulations for Abrasive Blasting, Workplace Safety)

6.2. Environmental Standards (EPA Guidelines, Air and Water Quality Controls)

6.3. Compliance Requirements for Abrasive Manufacturing

7. USA Abrasive Industry Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Advancements in Abrasive Materials, Increased Demand in Aerospace & Defense)

8. USA Abrasive Industry Future Market Segmentation

8.1. By Abrasive Type (In Value %)

8.2. By Material (In Value %)

8.3. By Application (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. USA Abrasive market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involved identifying and defining the key variables that influence the USA Abrasive Industry. Extensive desk research was conducted, leveraging secondary sources and proprietary databases to map out the ecosystem of abrasive manufacturers, suppliers, and end-users.

Step 2: Market Analysis and Construction

Historical data related to the USA Abrasive Industry was compiled, focusing on market penetration, sales figures, and market share distribution among product categories. Data from multiple sources was cross-referenced to ensure accuracy in estimating market size and future projections.

Step 3: Hypothesis Validation and Expert Consultation

We engaged industry experts from leading abrasive manufacturers and metalworking firms via computer-assisted telephone interviews (CATIs). Their insights were used to validate hypotheses and refine data accuracy concerning the industry's operational and financial outlook.

Step 4: Research Synthesis and Final Output

In the final phase, insights from abrasive manufacturers were synthesized with the bottom-up market estimates. This process ensured a comprehensive and validated analysis of the USA Abrasive Industry, with a focus on current trends and future growth prospects.

Frequently Asked Questions

01. How big is the USA Abrasive market?

The USA Abrasive market is valued at USD 3.6 billion, driven by demand from key sectors such as metalworking, construction, and automotive manufacturing.

02. What are the challenges in the USA Abrasive market?

Challenges in the market include high raw material costs, stringent environmental regulations, and volatile supply chains, which affect the profitability and operational efficiency of abrasive manufacturers.

03. Who are the major players in the USA Abrasive market?

Key players in the USA Abrasive Industry include Saint-Gobain Abrasives, 3M Company, Norton Abrasives, Carborundum Universal Ltd., and Robert Bosch GmbH, all of whom dominate through their product range and innovation.

04. What are the growth drivers of the USA Abrasive market?

The market is driven by industrialization, increasing demand for precision tools, advancements in abrasive technologies, and the growing need for high-performance abrasives in sectors such as aerospace and automotive.

05. What trends are shaping the USA Abrasive market?

Key trends include the rise of super abrasives, integration with automation and robotics in production lines, and the adoption of environmentally sustainable abrasive products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.