USA Advanced Wound Care Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD885

July 2024

100

About the Report

USA Advanced Wound Care Market Overview

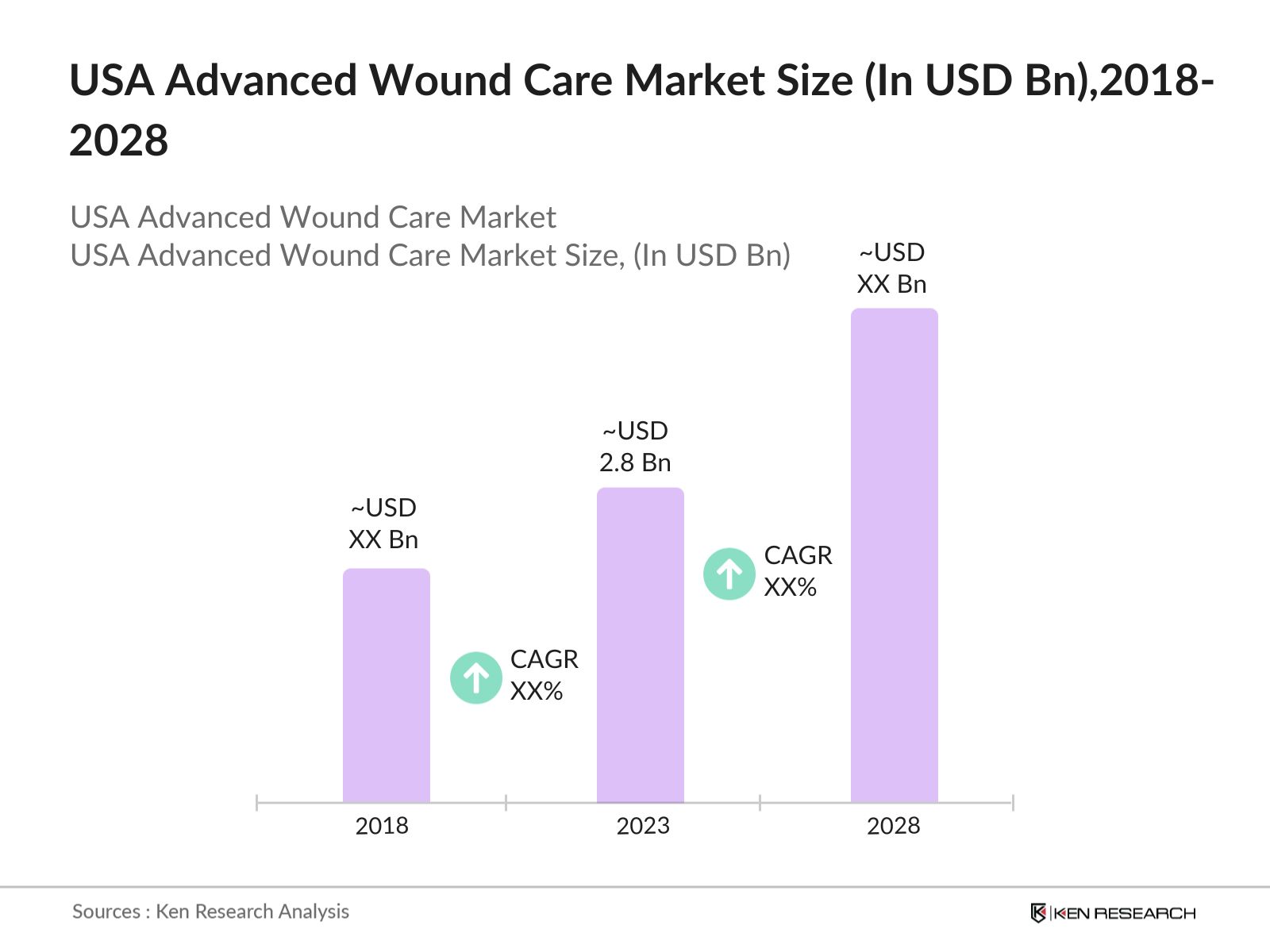

- The USA advanced wound care market was valued at $2.8 billion in 2023. This growth is driven by continued technological advancements, such as smart wound care solutions and regenerative medicine.

- The USA wound care market is dominated by major players such as Smith & Nephew, 3M, ConvaTec Group, Johnson & Johnson, and Medtronic. These companies are pivotal in driving innovation and providing a wide range of products that address the diverse needs of wound care treatments.

- In 2024, ConvaTec has acquired an innovative anti-infective nitric oxide technology platform from 30 Technology Limited. This acquisition aims to enhance their advanced wound care offerings and explore applications in other business categories. ConvaTec plans to launch new products based on this technology by 2025.

USA Advanced Wound Care Current Market Analysis

- Innovation in wound care technologies, particularly in the areas of smart dressings and biologics, is a key growth driver. Advanced dressings now feature capabilities like infection monitoring and moisture maintenance, improving healing processes and patient outcomes.

- The wound care market plays a crucial role in reducing healthcare costs by shortening recovery times and improving the quality of life for patients. Effective wound management prevents complications such as infections, which are costly to treat and can lead to prolonged hospital stays.

- The South and Midwest regions of the USA dominate the wound care market. These areas have a higher prevalence of chronic diseases and a larger elderly population, both of which are key demographics for wound care products. The availability of advanced healthcare facilities also supports market dominance in these regions.

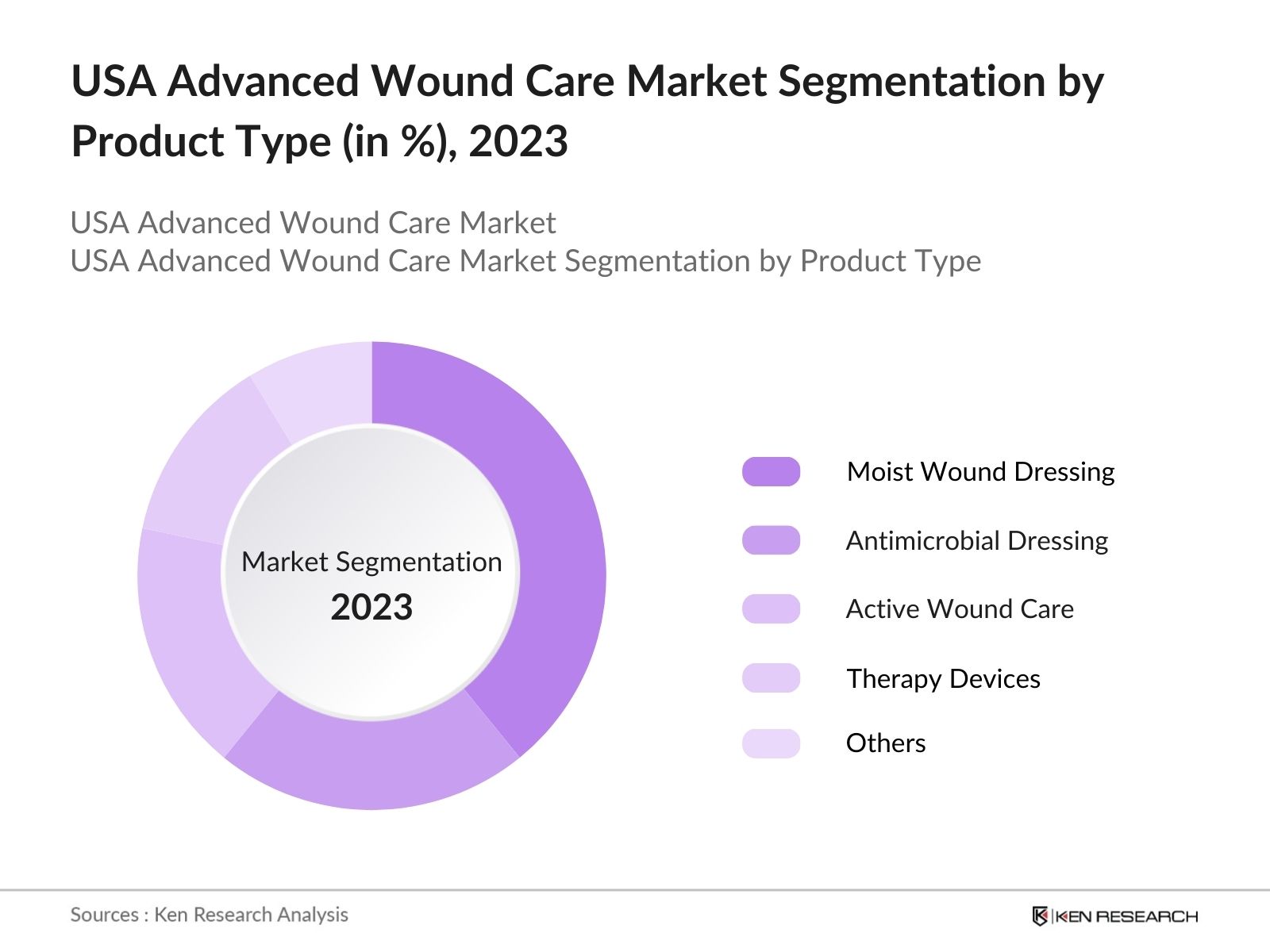

USA Advanced Wound Care Market Segmentation

By Product Type: In 2023, the USA advanced wound care market is segmented by product type into moist wound dressings, antimicrobial dressing, active wound care, therapy devices and others. Moist wound dressings dominate the USA Advanced Wound Care market, holding a significant share in USA Wound Care market. Moist Wounds are known for their versatility, these dressings are crucial for creating and maintaining a moist healing environment.

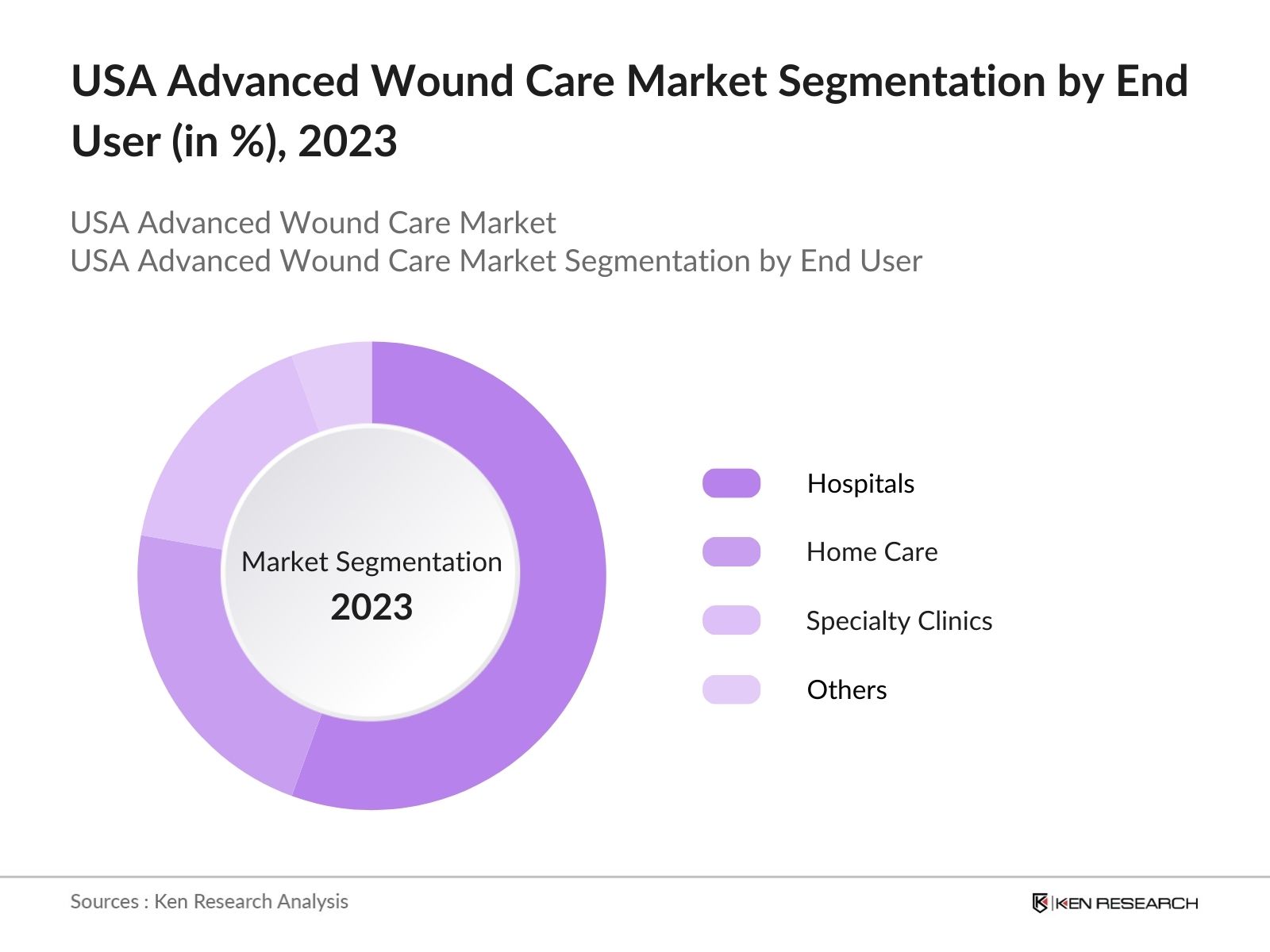

By End-User: In 2023, the USA advanced wound care market is segmented by end user into hospitals, home care, specialty clinics and others. Hospitals dominate the USA Advanced Wound Care market with almost half of the market share, driven by the substantial volume of surgical procedures and the critical demand for advanced wound care solutions in acute care settings.

By Region: In 2023, the USA advanced wound care market is segmented by region into north, south, east and west. Northern region including states like New York and Massachusetts, has a significant concentration of top-tier hospitals and medical research facilities, contributing to a robust market for advanced wound care products. The aging population in this region also contributes to the market share.

USA Advanced Wound Care Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Smith & Nephew |

1856 |

London, UK |

|

3M Healthcare |

1902 |

St. Paul, MN, USA |

|

ConvaTec Group |

1978 |

Reading, UK |

|

Coloplast |

1957 |

Humlebæk, Denmark |

|

Mölnlycke Health |

1849 |

Gothenburg, Sweden |

- Smith & Nephew plc: Smith & Nephew is a leading player in the advanced wound care market, offering a comprehensive range of products including bioactive dressings, negative pressure wound therapy (NPWT), and advanced surgical devices. The company reported revenue of $5.1 billion in 2022, with its wound care segment contributing significantly to its growth.

- 3M Healthcare: The company’s healthcare division generated $8.9 billion in revenue in 2022, reflecting significant demand for its innovative wound care solutions and expanding global footprint. In 2023, 3M Healthcare completed the acquisition of Acelity, a leading provider of advanced wound care and regenerative medicine solutions, for $6.7 billion. This acquisition significantly expanded 3M's wound care product offerings.

- Mölnlycke Health Care AB: Mölnlycke is renowned for its high-quality wound care products, such as the Mepilex series. It invested $132 million in 2023 in R&D to develop next-generation wound care products, focusing on improving patient outcomes and reducing treatment times. The investment aims to bring innovative solutions to the market faster.

USA Advanced Wound Care Industry Analysis

USA Advanced Wound Care Market Growth Drivers

- Increasing Prevalence of Chronic Wounds: The prevalence of chronic wounds in the USA is on the rise, significantly driving the demand for advanced wound care products. In 2024, 6.5 million patients were reported in the USA suffering from chronic wounds

- Aging Population: The aging population in the USA is a significant driver for the advanced wound care market. In 2024, the population aged 65 and above reached 58 million. Older adults are more susceptible to chronic wounds and slower healing processes, thus increasing the demand for specialized wound care products that can promote faster and more effective healing.

- Increased Healthcare Expenditure: The USA’s healthcare expenditure in 2024 is estimated to be around $4.3 trillion. A significant portion of this spending is allocated to chronic disease management, including advanced wound care. This increased expenditure reflects a growing recognition of the importance of effective wound care in reducing hospital stays and improving patient outcomes, thereby driving market growth.

USA Advanced Wound Care Market Challenges

- High Costs: Advanced wound care products and treatments are often expensive, limiting accessibility for some patients. For instance, NPWT devices can cost between $25 to $30 per day, making them unaffordable for long-term use without adequate insurance coverage.

- Reimbursement Issues: Variability and complexity in reimbursement policies can hinder the adoption of advanced wound care products. Differences in Medicare and Medicaid reimbursement rates across states add to the complexity and limit uniform access to care.

- Awareness Gaps: Lack of awareness and training among healthcare providers regarding advanced wound care solutions can impede market growth. Many healthcare professionals are still unfamiliar with the latest wound care technologies and best practices.

USA Advanced Wound Care Market Government Initiatives

- FDA Regulatory Framework: The FDA implemented a new regulatory framework in 2023 to expedite the approval of innovative wound care products. This includes provisions for accelerated review of technologies demonstrating significant clinical benefits. The new measures are anticipated to encourage innovation and faster market entry for effective wound care products.

- Public Awareness Campaigns: In 2022, the U.S. Department of Health and Human Services (HHS) launched a nationwide public awareness campaign to educate the public and healthcare professionals about advanced wound care. The campaign includes educational materials, training programs, and outreach initiatives to improve knowledge and adoption of advanced wound care solutions.

USA Advanced Wound Care Market Future Outlook

By 2028, the USA Advanced Wound Care Market is expected grow exponentially, driven by continued advancements in wound care technology and increased awareness of the importance of proper wound management. The adoption of telemedicine and remote patient monitoring for wound care is anticipated to grow, further boosting market expansion.

Future Market Trends

-

Growth in Telemedicine for Wound Care: Over the next five years, the use of telemedicine in wound care is expected to grow significantly. By 2028, it is estimated that 15 million patients in the USA will have access to telemedicine wound care services. This growth is driven by advancements in remote monitoring technologies and the increasing adoption of telehealth platforms, providing better access to wound care for patients in rural and underserved areas.

-

Increased Focus on Preventive Care: By 2028, there will be a greater focus on preventive care in the advanced wound care market. Healthcare providers will emphasize early intervention and proactive management of wound care to prevent complications and reduce the incidence of chronic wounds. This shift towards preventive care is expected to improve patient outcomes and reduce the overall burden on the healthcare system.

Scope of the Report

|

By Product Type |

Moist Wound Dressings Antimicrobial Dressings Active Wound Care Therapy Devices Others |

|

By End User |

Hospitals Home Care Specialty Clinics Others |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Medical Device Manufacturers

Advanced Wound Care Product Manufacturers

Wound Care Product Distributors

Hospitals and Healthcare Facilities

Ambulatory Surgical Centers

Specialty Clinics

Pharmaceutical Companies

Medical Device Companies

Health Insurance Companies

Regulatory Agencies (e.g., FDA)

Medical Supply Retailers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:  Â

Smith & Nephew

Molnlycke Health Care

ConvaTec Group

3M Company

Acelity (part of 3M)

Coloplast

Medline Industries

Integra LifeSciences

Organogenesis Holdings Inc.

Derma Sciences (Integra LifeSciences)

Hollister Incorporated

Paul Hartmann AG

Cardinal Health

B. Braun Melsungen AG

Advanced Medical Solutions Group plc

BSN Medical (Essity)

MiMedx Group, Inc.

KCI Licensing, Inc. (Acelity)

DeRoyal Industries, Inc.

Alliqua BioMedical, Inc.

Table of Contents

1. USA Advanced Wound Care Market Overview

1.1 USA Advanced Wound Care Market Taxonomy Â

2. USA Advanced Wound Care Market Size (in USD Bn), 2018-2023

3. USA Advanced Wound Care Market Analysis

3.1 USA Advanced Wound Care Market Growth Drivers Â

3.2 USA Advanced Wound Care Market Challenges and Issues Â

3.3 USA Advanced Wound Care Market Trends and Development Â

3.4 USA Advanced Wound Care Market Government Regulation Â

3.5 USA Advanced Wound Care Market SWOT Analysis Â

3.6 USA Advanced Wound Care Market Stake Ecosystem Â

3.7 USA Advanced Wound Care Market Competition Ecosystem Â

4. USA Advanced Wound Care Market Segmentation, 2023

4.1 USA Advanced Wound Care Market Segmentation by Product Type (in value %), 2023 Â

4.2 USA Advanced Wound Care Market Segmentation by End User (in value %), 2023 Â

4.3 USA Advanced Wound Care Market Segmentation by Region (in value %), 2023 Â

5. USA Advanced Wound Care Market Competition Benchmarking

5.1 USA Advanced Wound Care Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics) Â

6. USA Wound Care Future Market Size (in USD Bn), 2023-2028

7. USA Wound Care Future Market Segmentation, 2028

7.1 USA Advanced Wound Care Market Segmentation by Product Type (in value %), 2028 Â

7.2 USA Advanced Wound Care Market Segmentation by End User (in value %), 2028 Â

7.3 USA Advanced Wound Care Market Segmentation by Region (in value %), 2028 Â

8. USA Advanced Wound Care Market Analysts’ Recommendations

8.1 USA Advanced Wound Care Market TAM/SAM/SOM Analysis Â

8.2 USA Advanced Wound Care Market Customer Cohort Analysis Â

8.3 USA Advanced Wound Care Market Marketing Initiatives Â

8.4 USA Advanced Wound Care Market White Space Opportunity Analysis Â

Disclaimer Â

Contact UsÂ

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.  Â

Step 2 Market Building:

Collating statistics on USA advanced wound care market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA advanced wound care market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.  Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.  Â

Step 4 Research Output:

Our team will approach multiple hospitals and clinics in the country to understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach multiple hospitals and clinics in the country.

Frequently Asked Questions

01 How big is the USA advanced wound care market?

The USA advanced wound care market was valued at $2.8 billion in 2023. This growth is driven by continued technological advancements, such as smart wound care solutions and regenerative medicine.

02 Who are the major players in the USA advanced wound care market?

Major players in the USA advanced wound care market include Smith & Nephew, Molnlycke Health Care, ConvaTec Group and 3M Company. The prevalence of chronic wounds in the USA is on the rise, significantly driving the demand for advanced wound care products.

03 What factors drive the USA advanced wound care market?

Major growth drivers of the USA advanced wound care market include the rising prevalence of chronic diseases, technological advancements, increased healthcare spending, and an aging population. The aging population in the USA is a significant driver for the advanced wound care market.

04 What are the challenges in USA advanced wound care market?

Major challenges in the USA advanced wound care market include high costs, reimbursement issues, lack of awareness, regulatory hurdles, and economic constraints. Variability and complexity in reimbursement policies can hinder the adoption of advanced wound care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.