USA Aircraft Maintenance, Repair, and Overhaul (MRO) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD3664

November 2024

86

About the Report

USA Aircraft Maintenance, Repair, and Overhaul (MRO) Market Overview

- The USA Aircraft Maintenance, Repair, and Overhaul (MRO) market is valued at USD 9.2 billion, based on a five-year historical analysis. The markets growth is driven by several factors, including the increase in air passenger traffic and the aging of aircraft fleets, necessitating more frequent maintenance and repairs. Additionally, technological advancements, such as predictive maintenance and the integration of IoT, have enabled airlines and MRO providers to streamline operations, contributing to the market's growth. Furthermore, the growing regulatory requirements for aircraft safety are propelling demand for MRO services across commercial and military sectors.

- Cities such as Miami, Dallas, and Atlanta dominate the USA Aircraft MRO market due to their strategic locations as key aviation hubs with extensive air traffic. Miami, in particular, is an epicenter for MRO services due to its proximity to Latin America, acting as a major gateway for airlines serving cross-continental routes. Furthermore, Atlantas proximity to major OEMs and a dense network of airline headquarters, such as Delta Airlines, plays a vital role in cementing its importance in the MRO industry.

- Environmental regulations are becoming increasingly important for the MRO market. In 2023, the Environmental Protection Agency (EPA) mandated that all MRO providers in the U.S. must comply with updated environmental standards for the disposal of hazardous materials, such as chemicals used in aircraft cleaning and maintenance. These regulations aim to minimize the environmental impact of MRO operations, requiring facilities to implement waste management systems and reduce their carbon footprint. Compliance with these regulations is crucial for MRO providers to maintain their operating licenses and avoid costly penalties.

USA Aircraft MRO Market Segmentation

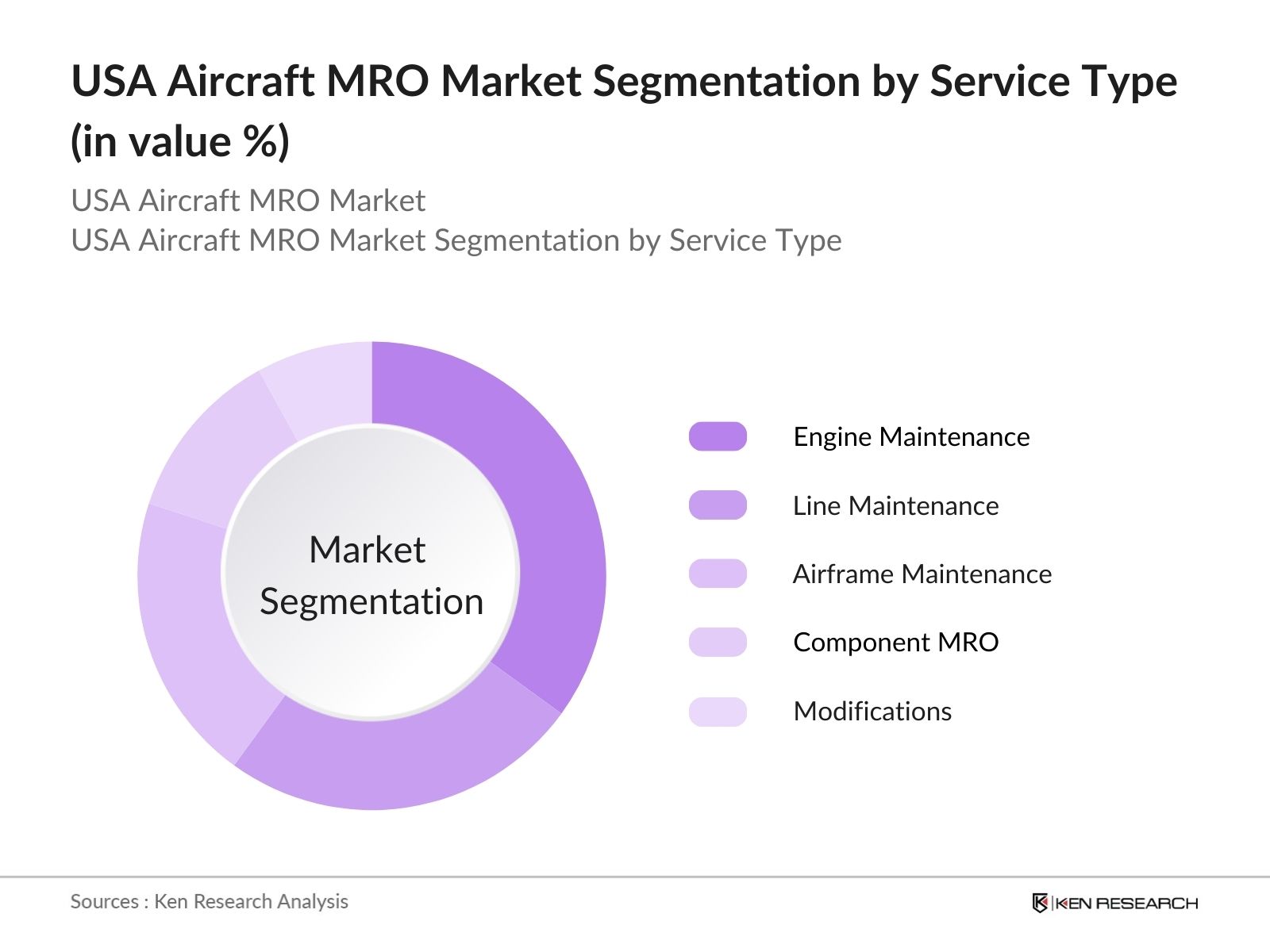

By Service Type: The market is segmented by service type into engine maintenance, line maintenance, airframe maintenance, component MRO, and modifications. Among these, engine maintenance holds the dominant market share due to the critical role engines play in aircraft safety and performance. The engine is subject to regular and extensive inspections, repairs, and overhauls, making this sub-segment highly lucrative. Additionally, advancements in engine technology and fuel efficiency continue to drive demand for specialized MRO services in this category.

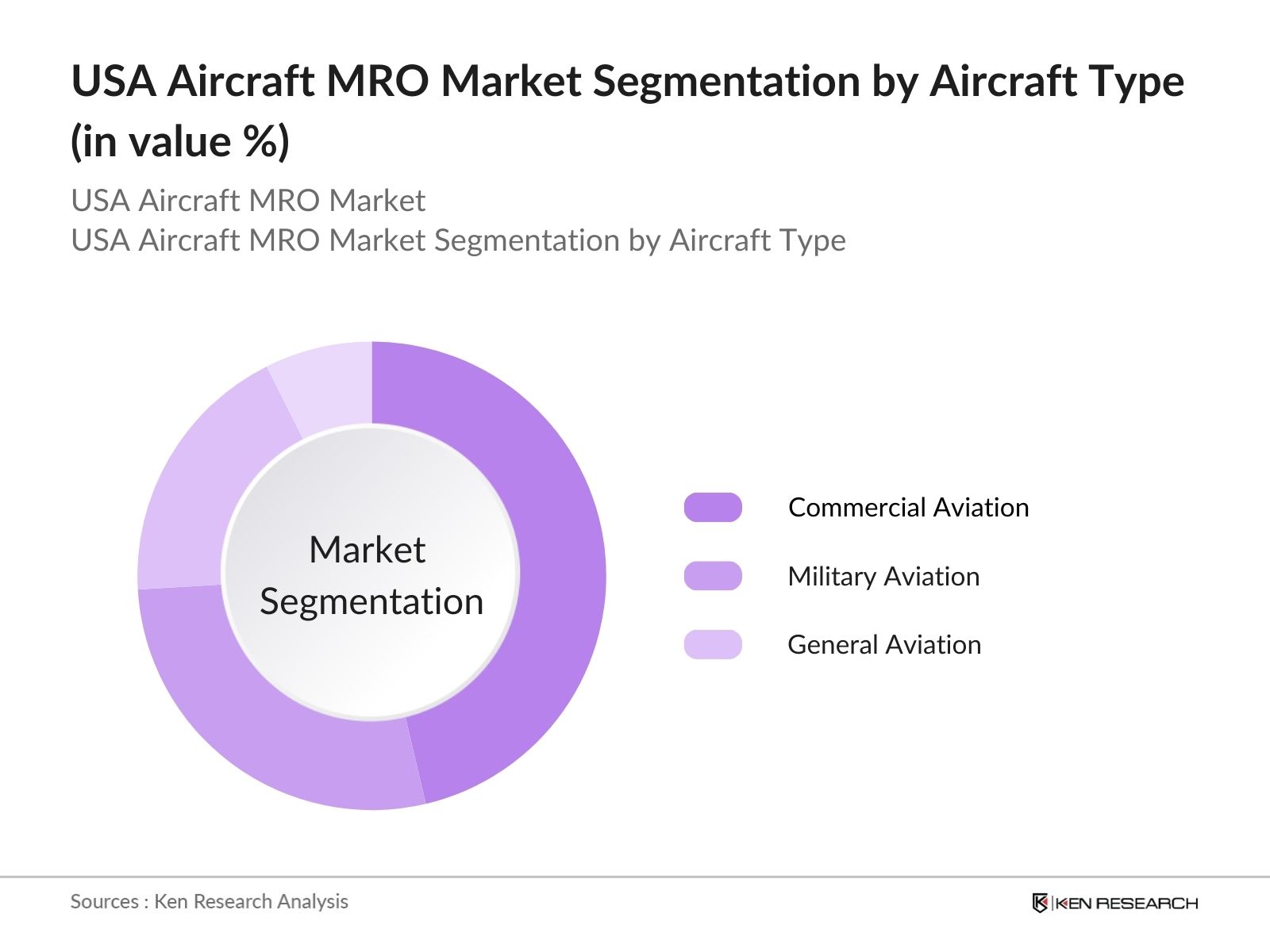

By Aircraft Type: The market is segmented by aircraft type into commercial aviation, military aviation, and general aviation. Commercial aviation holds a significant share in this segment due to the increasing number of commercial aircraft and the high frequency of flights. Airlines operating within this sector rely heavily on MRO services to ensure fleet efficiency, safety, and compliance with regulatory standards. The need for regular maintenance of wide-body and narrow-body aircraft further propels the dominance of this sub-segment.

USA Aircraft MRO Market Competitive Landscape

The USA Aircraft MRO market is dominated by major global players and OEMs who provide a wide range of services. The consolidation of the industry is evident, with companies like AAR Corp., Delta TechOps, and Honeywell Aerospace being key providers of MRO services. OEMs such as Boeing and General Electric Aviation also play a significant role due to their expertise in engine and airframe maintenance.

|

Company Name |

Establishment Year |

Headquarters |

|

AAR Corp. |

1951 |

Illinois, USA |

|

Delta TechOps |

1924 |

Atlanta, USA |

|

Honeywell Aerospace |

1936 |

Arizona, USA |

|

Boeing Global Services |

2017 |

Texas, USA |

|

General Electric Aviation |

1917 |

Ohio, USA |

USA Aircraft MRO Industry Analysis

Growth Drivers

- Increasing Air Passenger Traffic: The USA Aircraft MRO market is experiencing growth, driven by the rise in air passenger traffic. In 2022, over 850 million passengers were carried by U.S. airlines, with the number expected to exceed 900 million in 2024, according to the Federal Aviation Administration (FAA). The growth in passenger traffic translates into increased aircraft usage, leading to higher demand for MRO services as maintenance intervals shorten due to more frequent flights. This upward trend in air travel necessitates regular maintenance and repair to ensure the safety and reliability of aircraft.

- Aging Fleet and Fleet Expansion: The average age of commercial aircraft in the U.S. fleet is 12 years as of 2023, with many older aircraft requiring extensive maintenance. Furthermore, U.S. airlines are expanding their fleets, with over 1,500 new aircraft deliveries expected between 2023 and 2025. This combination of aging planes and fleet expansion drives the need for robust MRO services. The older an aircraft becomes, the more intensive its maintenance requirements are, from structural repairs to engine overhauls, further boosting the MRO market demand.

- Strict Regulatory Compliance and Safety Requirements: The Federal Aviation Administration (FAA) mandates strict regulatory compliance for MRO services. As of 2023, all U.S. aircraft must undergo regular maintenance inspections every 24 months or 1,000 flight hours, whichever comes first. These regulations aim to ensure airworthiness and safety, enforcing rigorous MRO procedures. Additionally, the FAA implemented new safety directives in 2024 concerning maintenance for aging aircraft, emphasizing non-destructive testing (NDT) to detect structural fatigue. These regulations require MRO providers to maintain certification and adhere to high standards, further driving demand for skilled maintenance services.

Market Challenges

- High Maintenance Costs: High maintenance costs continue to be a significant challenge for the MRO market. According to the Bureau of Transportation Statistics, the total maintenance expenses for U.S. airlines exceeded $25 billion in 2023, accounting for a substantial portion of operating costs. Labor, materials, and spare parts are the primary cost drivers. As aircraft become more technologically advanced, the complexity of maintenance procedures increases, pushing up labor costs. The introduction of newer aircraft models often requires specialized tools and parts, further escalating expenses in MRO operations.

- Shortage of Skilled Workforce: The shortage of skilled labor is a major hurdle for the U.S. MRO market. By 2024, it is estimated that the industry will need an additional 10,000 certified aviation mechanics to meet the growing demand for maintenance services, according to the FAA. This shortfall is exacerbated by an aging workforce, with over 30% of current aviation technicians expected to retire within the next five years. The lack of new entrants into the field, coupled with increasing demand for MRO services, is leading to delays in maintenance operations and increased labor costs.

USA Aircraft MRO Market Future Outlook

Over the next five years, the USA Aircraft MRO market is expected to witness steady growth driven by rising air traffic, technological advancements, and the increasing complexity of modern aircraft. The demand for predictive maintenance solutions, digital MRO platforms, and drone-based inspections is expected to drive growth further. Additionally, the expanding low-cost carrier (LCC) market and military fleet modernization are likely to create additional opportunities for MRO service providers.

Future Market Opportunities

- Growth of Low-Cost Carriers: The rise of low-cost carriers (LCCs) in the U.S. presents significant growth opportunities for the MRO market. In 2023, LCCs accounted for 40% of domestic air travel, according to the U.S. Department of Transportation. As these carriers expand their fleets to capture a larger market share, the demand for cost-effective MRO services will increase. LCCs tend to operate older aircraft, which require more frequent maintenance. This creates a growing market for independent MRO providers to offer affordable maintenance solutions tailored to the cost-sensitive nature of LCCs.

- Digitalization of MRO Operations: Digitalization is transforming MRO operations, offering significant efficiency gains and cost reductions. By 2024, it is expected that 60% of U.S. MRO providers will have adopted digital platforms to manage maintenance schedules, inventory, and labor, according to the FAA. These platforms enable real-time tracking of aircraft maintenance history, streamlining the scheduling of repairs and minimizing downtime. The adoption of digital tools such as augmented reality (AR) and virtual inspections is also improving the accuracy of maintenance tasks, reducing the time spent on inspections and repairs by 20%.

Scope of the Report

|

Service Type |

Engine Maintenance Line Maintenance Airframe Maintenance Component MRO Modifications |

|

Aircraft Type |

Commercial Aviation Military Aviation General Aviation |

|

Component Type |

Engine Avionics Landing Gear Airframe |

|

End User |

Airlines MRO Providers OEMs |

|

Region |

North-East Midwest Western Southern |

Products

Key Target Audience

Airlines and Commercial Fleet Operators

Military Aircraft Operators

OEMs (Original Equipment Manufacturers)

Independent MRO Providers

Banks and Financial Institutes

Airport Authorities

Government and Regulatory Bodies (Federal Aviation Administration)

Investors and Venture Capitalist Firms

Suppliers of Aircraft Parts and Components

Companies

Major Players in the USA Aircraft MRO Market

AAR Corp.

Delta TechOps

United Airlines MRO Services

General Electric Aviation

Honeywell Aerospace

Boeing Global Services

ST Aerospace

Lufthansa Technik

StandardAero

Pratt & Whitney

Collins Aerospace

AFI KLM E&M

Rolls-Royce Holdings

HAECO Group

Safran Group

Table of Contents

1. USA Aircraft MRO Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Growth of Commercial, Military, and General Aviation MRO)

1.4 Market Segmentation Overview (By Service Type, Aircraft Type, Component Type, Region)

2. USA Aircraft MRO Market Size (In USD Mn)

2.1 Historical Market Size (Commercial, Military, General Aviation MRO)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Key Technology Integrations, M&A Activity, Regulatory Changes)

3. USA Aircraft MRO Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Air Passenger Traffic

3.1.2 Aging Fleet and Fleet Expansion

3.1.3 Strict Regulatory Compliance and Safety Requirements

3.1.4 Technological Advancements (Predictive Maintenance, IoT)

3.2 Market Challenges

3.2.1 High Maintenance Costs

3.2.2 Shortage of Skilled Workforce

3.2.3 Fluctuations in Air Traffic Demand

3.3 Opportunities

3.3.1 Growth of Low-Cost Carriers (LCCs)

3.3.2 Digitalization of MRO Operations

3.3.3 Expansion of Aftermarket Services

3.4 Trends

3.4.1 Adoption of Big Data and AI in Predictive Maintenance

3.4.2 Increased Use of Drone-based Inspections

3.4.3 OEM Dominance in MRO Services

3.5 Government Regulation

3.5.1 FAA Regulations for MRO Operations

3.5.2 Compliance with Environmental Standards

3.5.3 Certification Requirements for MRO Facilities

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (OEMs, Airlines, Independent MROs, Regulatory Bodies)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. USA Aircraft MRO Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Engine Maintenance

4.1.2 Line Maintenance

4.1.3 Airframe Maintenance

4.1.4 Component MRO

4.1.5 Modifications

4.2 By Aircraft Type (In Value %)

4.2.1 Commercial Aviation

4.2.2 Military Aviation

4.2.3 General Aviation

4.3 By Component Type (In Value %)

4.3.1 Engine

4.3.2 Avionics

4.3.3 Landing Gear

4.3.4 Airframe

4.4 By End User (In Value %)

4.4.1 Airlines

4.4.2 MRO Providers

4.4.3 OEMs

4.5 By Region (In Value %)

4.5.1 North-East

4.5.2 Midwest

4.5.3 Western

4.5.4 Southern

5. USA Aircraft MRO Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AAR Corp.

5.1.2 Delta TechOps

5.1.3 United Airlines MRO Services

5.1.4 General Electric Aviation

5.1.5 Honeywell Aerospace

5.1.6 Boeing Global Services

5.1.7 ST Aerospace

5.1.8 Lufthansa Technik

5.1.9 StandardAero

5.1.10 Pratt & Whitney

5.1.11 Collins Aerospace

5.1.12 AFI KLM E&M

5.1.13 Rolls-Royce Holdings

5.1.14 HAECO Group

5.1.15 Safran Group

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Service Specialization, Key Contracts, Global Footprint, Certifications, Fleet Coverage)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. USA Aircraft MRO Market Regulatory Framework

6.1 FAA Regulations for MRO

6.2 Environmental Compliance Requirements

6.3 Certification and Licensing for MRO Providers

6.4 Technological Standards and Guidelines

7. USA Aircraft MRO Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Aircraft MRO Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Aircraft Type (In Value %)

8.3 By Component Type (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. USA Aircraft MRO Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves constructing an ecosystem map of all stakeholders in the USA Aircraft MRO Market. This is carried out through extensive desk research, utilizing secondary and proprietary databases to gather comprehensive information at the industry level. The goal is to identify key variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the USA Aircraft MRO Market is compiled and analyzed. This includes evaluating market penetration, service provider growth, and revenue generation trends. Moreover, an assessment of service quality statistics is conducted to verify revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses and validate them through interviews with industry experts representing a diverse set of companies. These interviews offer operational and financial insights that help to fine-tune the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple MRO providers to gather detailed insights into service offerings, sales performance, and customer demand. This interaction serves to confirm the statistical analysis, ensuring a comprehensive, validated market overview.

Frequently Asked Questions

01 How big is the USA Aircraft MRO Market?

The USA Aircraft MRO Market was valued at USD 9.2 billion, driven by the aging aircraft fleet, increasing air passenger traffic, and the demand for more efficient maintenance solutions.

02 What are the challenges in the USA Aircraft MRO Market?

Challenges in the USA Aircraft MRO Market include high maintenance costs, a shortage of skilled labor, and increasing regulatory requirements for aircraft safety and environmental compliance.

03 Who are the major players in the USA Aircraft MRO Market?

Key players in the USA Aircraft MRO Market include AAR Corp., Delta TechOps, General Electric Aviation, Honeywell Aerospace, and Boeing Global Services, dominating due to their comprehensive service offerings and extensive industry experience.

04 What are the growth drivers of the USA Aircraft MRO Market?

Growth in the USA Aircraft MRO Market is propelled by factors such as rising air traffic, fleet modernization, technological advancements in predictive maintenance, and regulatory pressure for safety standards.

05 Which segment dominates the USA Aircraft MRO Market?

Engine maintenance dominates the USA Aircraft MRO Market, as engines require extensive and frequent repairs and overhauls, driven by the need for operational efficiency and safety compliance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.