USA Alcoholic Beverages Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD4236

November 2024

84

About the Report

USA Alcoholic Beverages Market Overview

- The USA Alcoholic Beverages Market, valued at USD 37 billion, has shown steady growth driven by factors such as increased consumer spending on premium alcoholic products, especially among millennials and Gen Z. This market growth is bolstered by the rising demand for craft and premium beverages as consumers are increasingly drawn to quality and brand identity over quantity. Evolving consumer preferences towards ready-to-drink (RTD) products and low-alcohol beverages also contribute significantly to the market's expansion, as these options offer convenience without compromising on experience.

- Key cities like New York, Los Angeles, and Chicago dominate the alcoholic beverages market due to high urbanization, strong cultural acceptance of alcohol, and the presence of a large, diverse consumer base. These cities also host numerous events and nightlife hubs, further driving demand. Additionally, Texas and California are significant contributors due to their size and the presence of large-scale distribution networks and breweries that cater to both local and export demands, making them major influencers in the industry.

- Excise taxes on alcoholic beverages are a major regulatory burden in the U.S., impacting prices and profit margins. In 2024, the Alcohol and Tobacco Tax and Trade Bureau collected over $10 billion in excise taxes, which directly affects pricing and profitability across the sector. Higher taxes present a significant challenge for smaller producers, who often operate on thinner margins and face difficulties in absorbing additional costs.

USA Alcoholic Beverages Market Segmentation

The USA Alcoholic Beverages market is segmented by product type and by distribution channel.

- By Product Type: The USA Alcoholic Beverages market is segmented by product type into beer, wine, spirits, ready-to-drink (RTD), and others. Recently, beer has maintained a dominant market share in the USA under the segmentation of product type, primarily due to its deep-rooted popularity among all age groups. Major brands like Anheuser-Busch InBev and Molson Coors have solidified consumer loyalty, and the availability of various options from craft to mainstream varieties has fueled its sustained demand. Additionally, marketing strategies that emphasize local craft varieties and sustainable production methods are resonating well with consumers.

- By Distribution Channel: The USA Alcoholic Beverages market is segmented by distribution channel into on-trade, off-trade, and online channels. The off-trade channel, which includes sales from grocery stores, convenience stores, and liquor stores, dominates the market due to its accessibility and cost-effectiveness. Off-trade options offer consumers the ability to purchase alcohol at lower prices compared to bars or restaurants, and the convenience of buying in bulk has driven its popularity. Furthermore, the rise in online retail within the off-trade segment has added to its appeal, particularly among younger consumers.

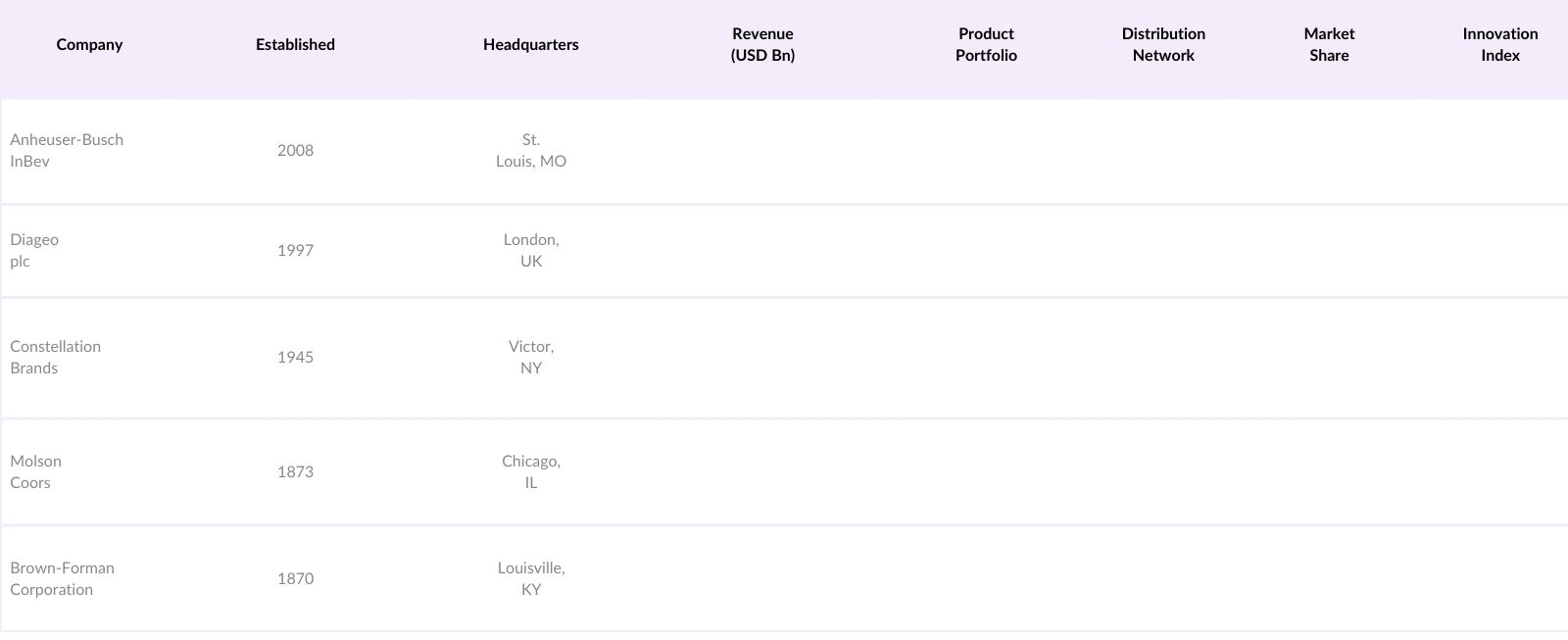

USA Alcoholic Beverages Market Competitive Landscape

The USA Alcoholic Beverages market is characterized by a consolidation of large global brands and regional players. Major companies such as Anheuser-Busch InBev, Diageo, and Constellation Brands dominate, creating high entry barriers for new entrants. Their market influence is rooted in widespread distribution networks, diverse portfolios, and significant advertising budgets, enabling them to maintain a competitive edge.

USA Alcoholic Beverages Industry Analysis

Growth Drivers

- Changing Consumer Preferences: Consumer preferences in the USA alcoholic beverage market have shifted significantly towards premium and unique offerings. For instance, the demand for craft beer and spirits has surged, with 2024 figures showing that over 30% of millennial consumers prefer craft options over traditional ones, according to U.S. Bureau of Economic Analysis data on consumption trends. This shift aligns with an increased interest in quality and authenticity in alcoholic beverages. Additionally, nearly 45 million U.S. consumers aged 2134 prioritize unique experiences, pushing brands to diversify offerings and innovate.

- Increase in Disposable Income: Higher disposable income among U.S. households has boosted demand for alcoholic beverages, with median income in 2024 exceeding $74,000 annually, a rise that supports the affordability of premium alcoholic options (U.S. Census Bureau). This increase, particularly notable among younger professionals, has led to a 10% rise in spending on premium and craft alcoholic beverages. Consumers in metropolitan areas with higher-than-average disposable incomes are purchasing more frequently, further driving market growth.

- Rise of Premium and Craft Segment: Premium and craft alcoholic products are experiencing notable growth as consumer demand for high-quality, unique beverages continues to expand. In 2024, premium spirits make up nearly 40% of the U.S. spirits market, according to Alcohol and Tobacco Tax and Trade Bureau (TTB) insights, reflecting a shift toward higher-quality preferences. Growth in this segment is also supported by an estimated 11,000 operational craft breweries and distilleries nationwide, each tapping into consumer demand for local and artisanal products.

Market Challenges

- Regulatory Constraints: Stringent regulations in the U.S., including the three-tier distribution system and federal excise taxes, impose constraints on alcohol production, distribution, and sales. The Alcohol and Tobacco Tax and Trade Bureau (TTB) collects billions annually in excise taxes from the alcoholic beverage sector, creating financial and operational challenges for brands, especially smaller players. Strict state laws further complicate market entry, with state-level restrictions on distribution affecting both manufacturers and consumers.

Health and Wellness Trends: The increasing focus on health and wellness among U.S. consumers has led to a decline in alcohol consumption, particularly among younger generations. Recent CDC reports indicate that over 60% of adults are limiting alcohol intake for health reasons, citing preferences for healthier alternatives. With the rise of sober-curious and wellness-driven lifestyles, demand for traditional alcoholic beverages faces new obstacles, forcing brands to adapt with low- and no-alcohol options to maintain market relevance.

USA Alcoholic Beverages Market Future Outlook

Over the next five years, the USA Alcoholic Beverages market is poised for substantial growth due to several key factors. Consumer demand for premium and craft beverages is expected to increase, driven by a rising preference for quality and unique experiences. Furthermore, innovation within the low-alcohol and no-alcohol segments is likely to attract new consumer demographics. Digital platforms will continue to redefine retail and distribution, making the online segment a significant growth channel.

Market Opportunities

- Growth in Low and No-Alcohol Segment: The low and no-alcohol segment is witnessing a strong uptick, driven by consumer demand for healthier lifestyle choices. Data from the U.S. TTB highlights that non-alcoholic beverage sales have increased by 35% over the past two years, with millennial and Gen Z consumers as primary drivers. This segment offers opportunities for alcohol brands to diversify portfolios and capture market share within health-conscious demographics, particularly as younger consumers embrace low-ABV options. [Link to data source]

- Innovation in Flavors and Packaging: Innovative flavor profiles and packaging have become critical success factors for U.S. alcohol brands. Nearly 50% of consumers in a recent USDA survey prefer beverages with unique flavors, such as fruit-infused or spiced spirits, showing a significant shift from traditional options. Eco-friendly packaging options, including recycled and biodegradable materials, are also growing, as 68% of consumers report a preference for sustainable packaging. These trends enable brands to attract eco-conscious consumers and tap into evolving taste preferences.

Scope of the Report

Products

Key Target Audience

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Alcohol and Tobacco Tax and Trade Bureau, U.S. Food and Drug Administration)

Alcoholic Beverage Manufacturers

Retail and Wholesale Distributors

Hospitality Industry (Bars, Restaurants, Hotels)

E-commerce Platforms

Packaging and Labeling Firms

Technology and Innovation Companies

Companies

Players mention in the Report:

Anheuser-Busch InBev

Diageo plc

Constellation Brands

Molson Coors Beverage Company

Brown-Forman Corporation

Heineken NV

E. & J. Gallo Winery

Bacardi Limited

The Boston Beer Company

Campari Group

Sazerac Company

Craft Brew Alliance

Mark Anthony Brands

New Belgium Brewing Company

Pernod Ricard

Table of Contents

1. USA Alcoholic Beverages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Alcoholic Beverages Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Alcoholic Beverages Market Analysis

3.1. Growth Drivers

3.1.1. Changing Consumer Preferences

3.1.2. Increase in Disposable Income

3.1.3. Rise of Premium and Craft Segment

3.1.4. Expansion in E-commerce

3.2. Market Challenges

3.2.1. Regulatory Constraints

3.2.2. Health and Wellness Trends

3.2.3. High Production and Operational Costs

3.3. Opportunities

3.3.1. Growth in Low and No-Alcohol Segment

3.3.2. Innovation in Flavors and Packaging

3.3.3. Increase in Social Media and Influencer Marketing

3.4. Trends

3.4.1. Rise of Ready-to-Drink (RTD) Beverages

3.4.2. Increasing Demand for Premiumization

3.4.3. Rise of Environmentally Friendly Practices

3.5. Regulatory Impact

3.5.1. Excise Taxes

3.5.2. Advertising and Marketing Regulations

3.5.3. State-level Distribution Laws

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. USA Alcoholic Beverages Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Beer

4.1.2. Wine

4.1.3. Spirits

4.1.4. Ready-to-Drink (RTD)

4.1.5. Others

4.2. By Distribution Channel (In Value %)

4.2.1. On-trade

4.2.2. Off-trade

4.2.3. Online Channels

4.3. By Alcohol Content (In Value %)

4.3.1. High Alcohol Content

4.3.2. Medium Alcohol Content

4.3.3. Low Alcohol Content

4.3.4. Non-Alcoholic

4.4. By Age Group (In Value %)

4.4.1. 18-24

4.4.2. 25-34

4.4.3. 35-44

4.4.4. 45-54

4.4.5. 55 and above

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Alcoholic Beverages Market Competitive Analysis

5.1. Profiles of Major Companies

5.1. Major Players

5.1.1. Anheuser-Busch InBev

5.1.2. Diageo plc

5.1.3. Constellation Brands Inc.

5.1.4. Heineken NV

5.1.5. Molson Coors Beverage Company

5.1.6. Pernod Ricard

5.1.7. Brown-Forman Corporation

5.1.8. E. & J. Gallo Winery

5.1.9. Bacardi Limited

5.1.10. The Boston Beer Company, Inc.

5.1.11. Campari Group

5.1.12. Sazerac Company, Inc.

5.1.13. Craft Brew Alliance, Inc.

5.1.14. Mark Anthony Brands International

5.1.15. New Belgium Brewing Company

5.2. Cross Comparison Parameters

Headquarters Location

Market Presence

Revenue

Product Portfolio

Marketing Channels

Sustainability Initiatives

Innovation Index

Consumer Rating

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Grants and Incentives

6. USA Alcoholic Beverages Market Regulatory Framework

6.1. Federal Alcohol Regulations

6.2. State-Level Distribution and Sales Laws

6.3. Labeling Requirements

6.4. Advertising Restrictions

6.5. Import and Export Regulations

7. USA Alcoholic Beverages Future Market Size (In USD Bn)

7.1. Market Size Projections

7.2. Key Growth Factors

8. USA Alcoholic Beverages Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Alcohol Content (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. USA Alcoholic Beverages Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Demographics and Preferences

9.3. Brand Positioning Strategies

9.4. Emerging Trends and Innovation

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map is constructed to encompass major stakeholders within the USA Alcoholic Beverages Market. This includes secondary research utilizing proprietary and open databases to define variables influencing market dynamics.

Step 2: Market Analysis and Data Collection

Data on market size, penetration rates, and product performance is gathered through analysis of historical data. This includes evaluation of sales figures, market share, and distribution channels to produce accurate revenue estimates.

Step 3: Hypothesis Validation and Industry Consultation

Key market assumptions are verified through consultation with industry experts using computer-assisted interviews (CATIs), allowing for comprehensive operational insights and reliable data validation.

Step 4: Synthesis and Final Output

The final phase integrates findings from primary research and expert feedback to provide a verified analysis of the USA Alcoholic Beverages Market, covering product segments, revenue trends, and emerging market trends.

Frequently Asked Questions

01. How big is the USA Alcoholic Beverages Market?

The USA Alcoholic Beverages Market was valued at USD 37 billion, with growth fueled by premium and craft products, driven by evolving consumer preferences.

02. What are the main challenges in the USA Alcoholic Beverages Market?

Key challenges in USA Alcoholic Beverages Market include stringent government regulations, rising competition from non-alcoholic beverages, and fluctuating raw material prices affecting profitability.

03. Who are the major players in the USA Alcoholic Beverages Market?

Prominent companies in USA Alcoholic Beverages Market include Anheuser-Busch InBev, Diageo, Constellation Brands, Molson Coors, and Brown-Forman, known for extensive distribution networks and strong brand presence.

04. What drives the growth of the USA Alcoholic Beverages Market?

USA Alcoholic Beverages Market growth is driven by increased consumer spending on premium products, the popularity of craft beverages, and a shift towards convenient ready-to-drink options.

05. Which segment is dominating in the USA Alcoholic Beverages Market?

Beer remains a dominant segment due to high consumer loyalty and the popularity of craft varieties, supported by strong marketing and distribution efforts from major brands.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.