USA Alcoholic Drinks Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD2392

December 2024

85

About the Report

USA Alcoholic Drinks Market Overview

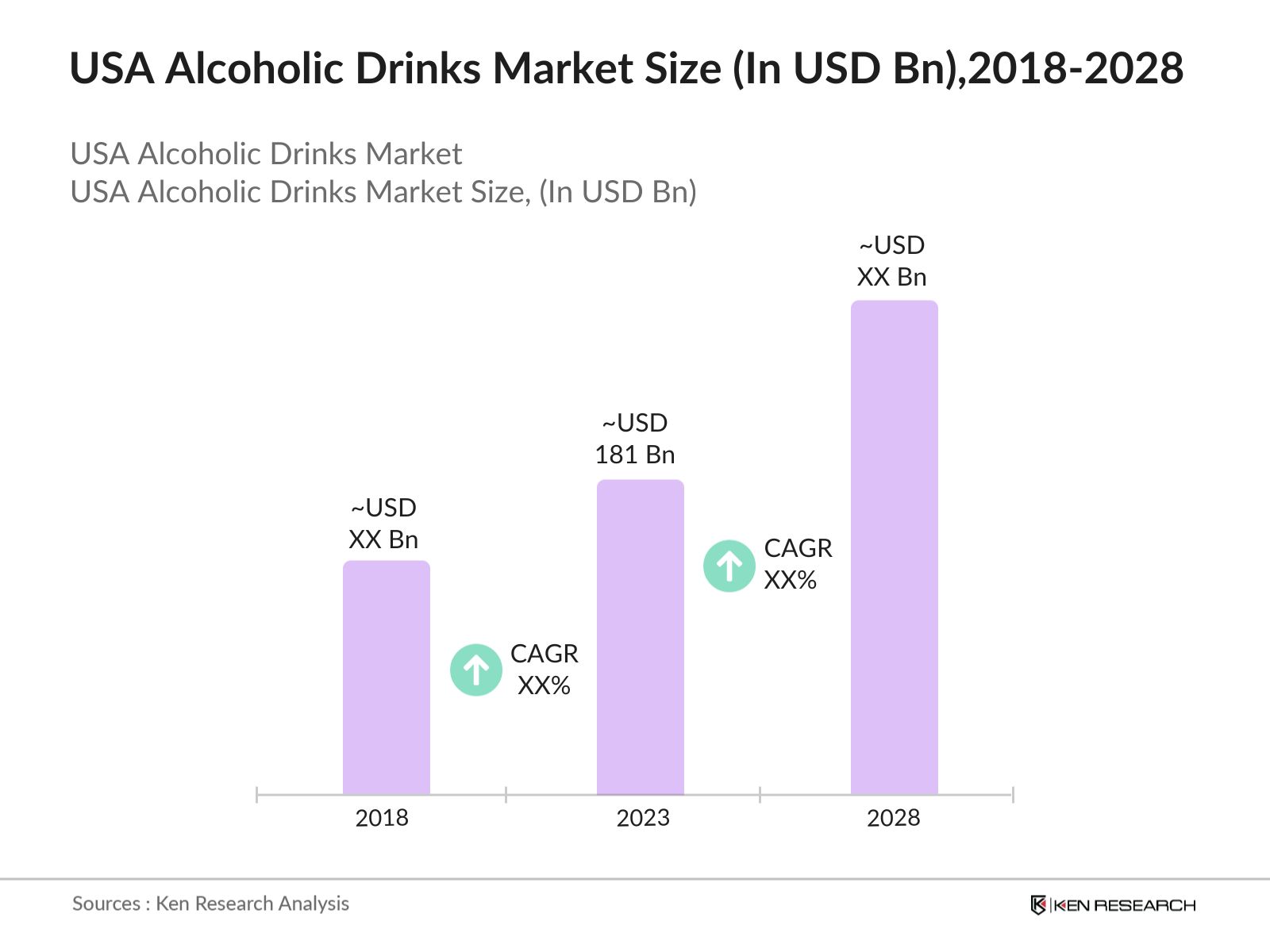

- In 2023, the USA Alcoholic Drinks Market reached a market size of USD 181 billion, driven primarily by the increasing consumer demand for premium and craft alcoholic beverages. Growth was largely fueled by the rising popularity of craft beers and premium spirits, as well as the expanding range of flavored alcoholic beverages catering to evolving consumer tastes.

- Major players in the USA Alcoholic Drinks Market include Anheuser-Busch InBev, Constellation Brands, Diageo, Molson Coors Beverage Company, and Brown-Forman. These companies dominate the market through a mix of well-established brands and innovative new products. They have extensive distribution networks and have heavily invested in marketing strategies to capture a significant share of the market.

- In 2023, Heineken USA introduced Heineken Silver, a premium lower-carb and lower-calorie beer, targeting modern consumers who prefer lighter beverages. This launch is part of Heineken's strategy to appeal to a new generation of beer drinkers in the U.S. market. This move aligns with the growing trend towards healthier drinking options, positioning Heineken to capture a larger share of the evolving beer market.

- Cities such as New York, Los Angeles, and Chicago dominate the alcoholic drinks market in the USA. New York leads due to its high population density, diverse consumer base, and vibrant nightlife, which fosters higher consumption of alcoholic beverages. Los Angeles and Chicago also have strong market presence due to their large urban populations and robust hospitality sectors, which promote sales of alcoholic drinks through bars, restaurants, and nightclubs.

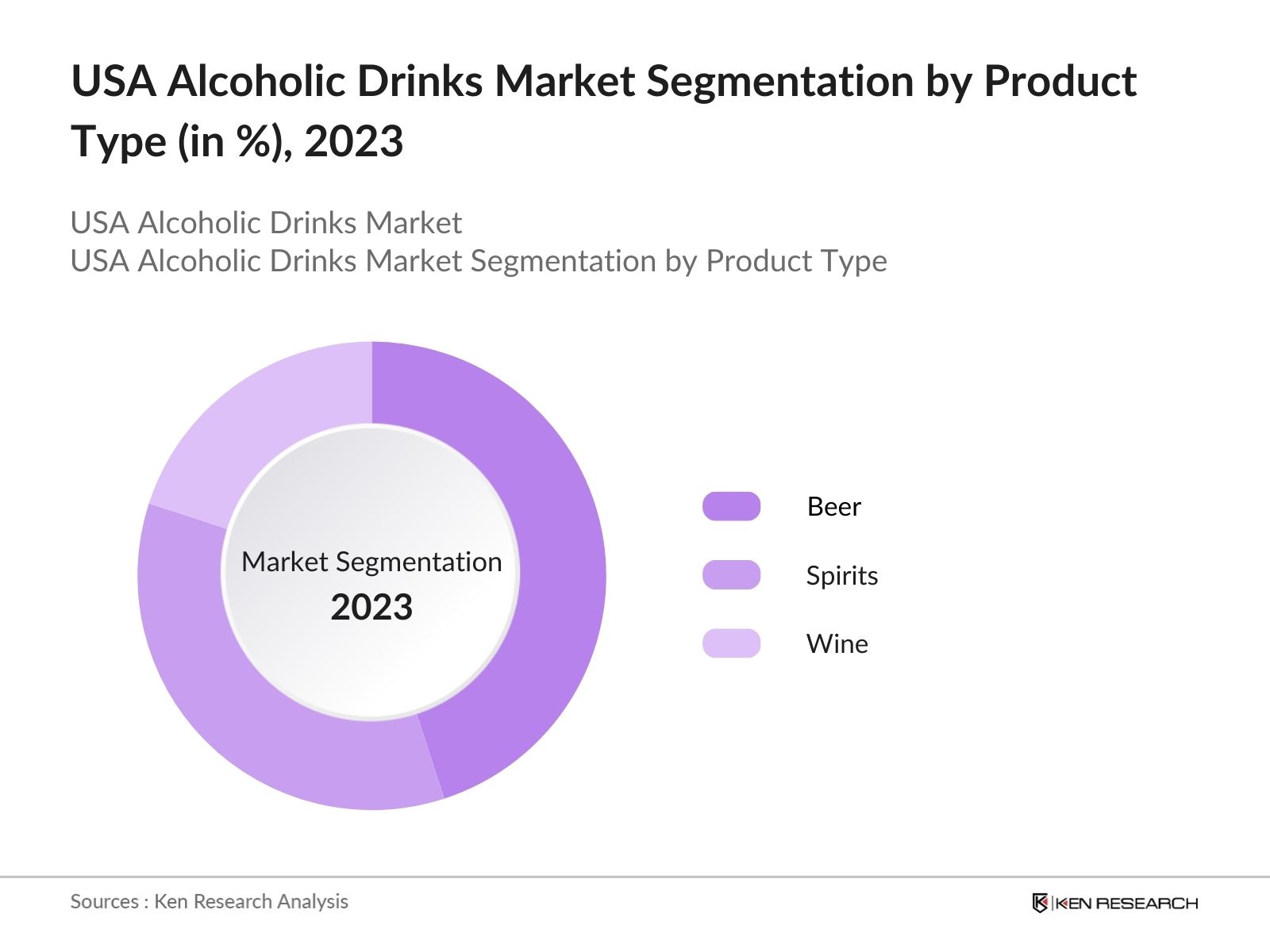

USA Alcoholic Drinks Market Segmentation

By Product Type: The market is segmented by product type into beer, spirits, and wine. In 2023, beer dominated this segment due to its long-standing popularity and cultural significance in the American market. The availability of a wide range of craft and premium beer options, along with the strong presence of major beer festivals, contributes to the dominance of this subsegment.

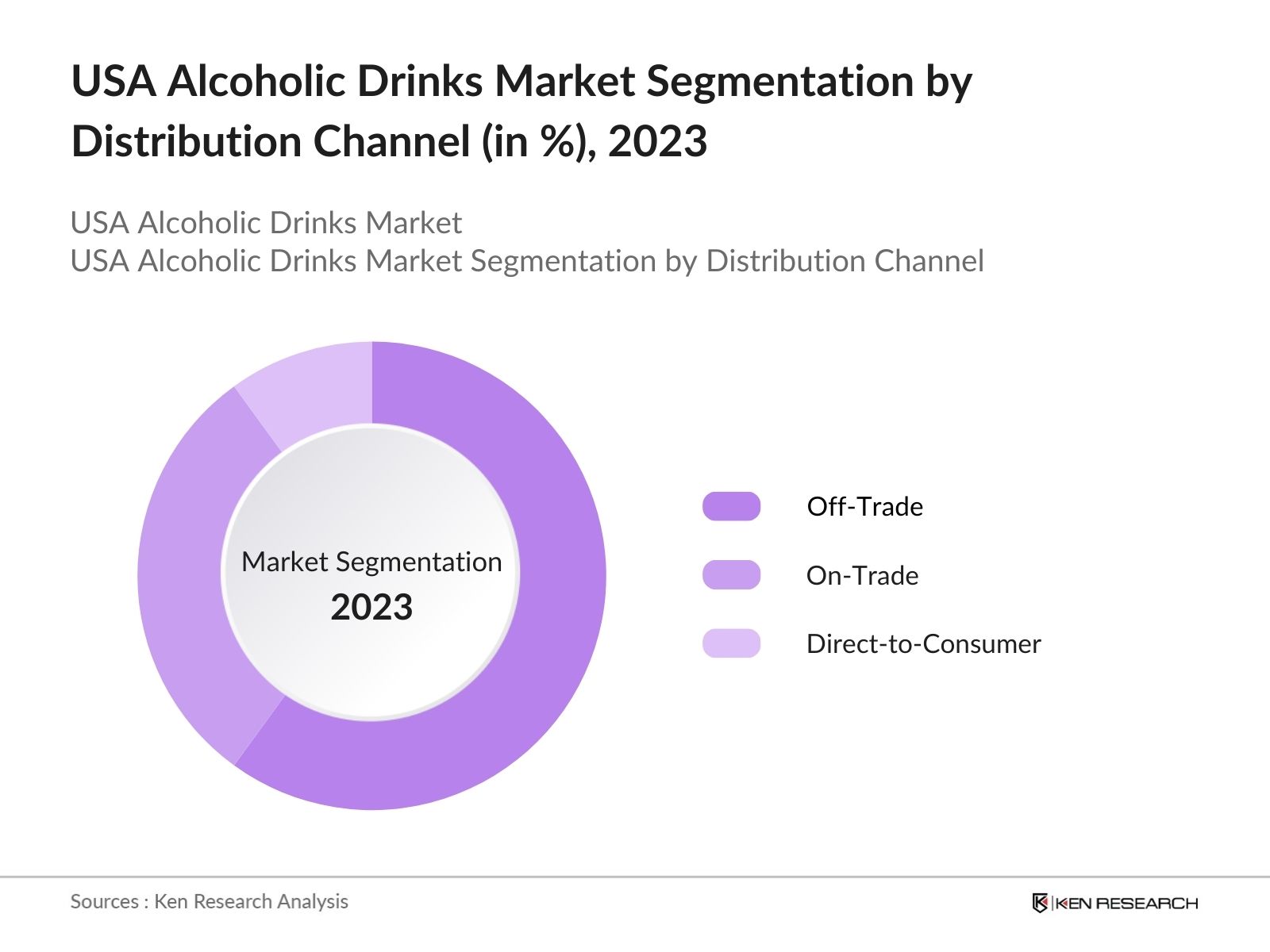

By Distribution Channel: The market is also segmented by distribution channel into on-trade (bars, restaurants, and clubs), off-trade (retail outlets and online stores), and direct-to-consumer sales. In 2023, off-trade channels led this segment, driven by the convenience of purchasing alcoholic drinks from supermarkets, liquor stores, and online platforms. The COVID-19 pandemic accelerated the shift towards off-trade channels, as consumers increasingly favored home consumption.

By Region: The market is segmented into North, South, East, and West regions. In 2023, the North region dominated this segment, owing to a high concentration of urban populations and a strong presence of breweries and distilleries. The region's developed infrastructure and vibrant nightlife scene also support substantial alcohol sales, making it the leading region in the market.

USA Alcoholic Drinks Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Anheuser-Busch InBev |

2008 |

Leuven, Belgium |

|

Constellation Brands |

1945 |

Victor, New York, USA |

|

Diageo |

1997 |

London, United Kingdom |

|

Molson Coors Beverage Company |

2005 |

Chicago, Illinois, USA |

|

Brown-Forman |

1870 |

Louisville, Kentucky, USA |

- Anheuser-Busch InBev: In 2024, Anheuser-Busch is investing $7 million in its Fairfield, California brewery for infrastructure upgrades, including roofing, equipment overhauls, and lighting improvements. This investment aims to enhance the brewery's capabilities to produce high-quality beer while maintaining a 99% recycling rate. The company has invested nearly $2 billion in U.S. facilities over the past five years, reinforcing its commitment to job creation and economic growth in California, where it has operated since 1954.

- Constellation Brands: In 2024, Constellation Brands announced the acquisition of Sea Smoke, a renowned California winery known for its high-quality Pinot Noir. This acquisition aligns with the company's strategy to expand its higher-end wine offerings and cater to the growing consumer preference for premium products. This strategic move is expected to strengthen Constellation Brands' presence in the luxury wine segment and enhance its portfolio of premium brands.

USA Alcoholic Drinks Industry Analysis

Growth Drivers:

- Increasing Consumer Demand for Premium Products: The USA alcoholic drinks market has been experiencing a notable surge in demand for premium and craft alcoholic beverages. Americans now consume an average of 2.51 gallons of alcohol per person, reflecting an increase of over 15% compared to 20 years ago. This trend is driven by an increasing number of consumers willing to spend more on premium experiences, especially in urban areas.

- Expansion of E-commerce and Online Sales Channels: The expansion of e-commerce and online sales channels has significantly boosted the alcoholic drinks market in the USA. In 2021, 24% of U.S. consumers spent $50 or more on a bottle of alcohol, which increased to 33% in 2022. This growth is attributed to the convenience and accessibility of online shopping, which allows consumers to explore a wider range of products and have them delivered directly to their homes.

- Growing Popularity of Hard Seltzers and Low-Alcohol Beverages: The rising popularity of hard seltzers and low-alcohol beverages has emerged as a significant growth driver. The total volume of alcoholic beverages sold in the U.S. was 31.27 billion liters in 2022. This surge in demand is largely driven by health-conscious consumers seeking low-calorie and low-sugar options. Additionally, younger consumers, particularly millennials and Gen Z, are increasingly opting for these lighter alternatives, which are perceived as healthier and more refreshing than traditional alcoholic drinks.

Market Challenges:

- Regulatory Restrictions and Compliance Issues: The USA alcoholic drinks market faces stringent regulatory restrictions and compliance issues, which can pose significant challenges for manufacturers and distributors. These regulations aim to promote transparency and consumer safety but also increase compliance costs for companies. Moreover, the complex patchwork of state and local laws governing alcohol sales, distribution, and advertising further complicates operations, particularly for companies looking to expand into new markets.

- Rising Production Costs and Supply Chain Disruptions: Rising production costs and supply chain disruptions have emerged as major challenges for the USA alcoholic drinks market. Additionally, the ongoing shortage of glass bottles and aluminum cans has forced many producers to seek alternative packaging solutions, further escalating costs. These supply chain disruptions have also led to delays in production and distribution, impacting the availability of products on the market and reducing profit margins for manufacturers.

Government Initiatives:

- Increased Enforcement of Competition Laws: The U.S. Department of the Treasury released a report in 2022 that found significant concentration in certain alcohol markets. The report recommended strengthened review of horizontal consolidation, enforcement of trade practice rules against exclusionary conduct, and reform of post-Prohibition era regulations that hinder small firms and new entrants. Increased antitrust enforcement could impact market concentration and competition.

- TTBs Streamlined Permit Process: The TTB's Streamlined Permit Process initiative was initiated in 2018 as part of the agency's strategic plan for fiscal years 2018-2022. The TTB set a priority goal to reduce average approval times for alcohol and tobacco business permits by at least 20% (from 96 days to 75 days) and achieve the 75-day standard for 85% of applicants. Key strategies included streamlining permit processes, modernizing permit applications, and enhancing the Permits Online system.

USA Alcoholic Drinks Future Market Outlook

USA Alcoholic Drinks Market is projected to experience significant growth over the next five years, driven by evolving consumer preferences, innovative product offerings, and favorable regulatory changes.

Future Trends

- Expansion of Low-Alcohol and Non-Alcoholic Beverages: As health and wellness trends continue to influence consumer behavior, companies will likely increase their focus on developing innovative, low-calorie alternatives that cater to health-conscious individuals. This trend is anticipated to reshape the market landscape, with more brands launching new products to meet the growing demand for healthier drinking options.

- Increased Adoption of Sustainable and Eco-Friendly Practices: The focus on sustainability is expected to become more pronounced in the USA alcoholic drinks market, with companies adopting eco-friendly practices and sustainable packaging solutions. This shift is likely to drive companies to invest in green technologies and reduce their carbon footprint, promoting a more sustainable industry overall.

Scope of the Report

|

By Product Type |

Wine Beer Spirits |

|

By Distribution Channel |

Off-Trade On-Trade Direct-to-Consumer |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Alcoholic Beverage Manufacturers

Health and Wellness Companies

Packaging and Labeling Companies

Event Management Companies

Hospitality Industry

Travel and Tourism

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Alcohol and Tobacco Tax and Trade Bureau)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Anheuser-Busch InBev

Constellation Brands

Diageo

Molson Coors Beverage Company

Brown-Forman

Heineken USA

Boston Beer Company

Pernod Ricard USA

Bacardi USA

E. & J. Gallo Winery

Beam Suntory

Mark Anthony Brands

Campari America

Sazerac Company

Remy Cointreau USA

Table of Contents

1. USA Alcoholic Drinks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. USA Alcoholic Drinks Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Alcoholic Drinks Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Premium Products

3.1.2. Growing Popularity of Hard Seltzers and Low-Alcohol Beverages

3.1.3 Expansion of E-commerce and Online Sales Channels

3.1.4 Innovation in Product Flavors and Varieties

3.2. Challenges

3.2.1. Regulatory Restrictions and Compliance Issues

3.2.2 Rising Production Costs and Supply Chain Disruptions

3.2.3 Market Saturation in Established Categories

3.3. Opportunities

3.3.1. Expansion of E-commerce and Online Sales Channels

3.3.2 Increased Adoption of Sustainable and Eco-Friendly Practices

3.3.3 Rise of Digital Marketing and Direct-to-Consumer Strategies

3.4. Trends

3.4.1. Expansion of Low-Alcohol and Non-Alcoholic Beverages

3.4.2. Increased Adoption of Sustainable and Eco-Friendly Practices

3.4.3. Rise of Digital Marketing and Direct-to-Consumer Strategies

3.5. Government Regulation

3.5.1. TTBs Streamlined Permit Process

3.5.2 Increased Enforcement of Competition Laws

3.5.3. Support for Sustainable Practices

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. USA Alcoholic Drinks Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Beer

4.1.2. Spirits

4.1.3. Wine

4.2. By Distribution Channel (in Value %)

4.2.1. On-Trade

4.2.2. Off-Trade

4.2.3. Direct-to-Consumer Sales

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

4.4. By Age Group (in Value %)

4.4.1. 18-25

4.4.2. 26-35

4.4.3. 36-50

4.4.4. 51 and above

4.5. By Packaging Type (in Value %)

4.5.1. Bottles

4.5.2. Cans

4.5.3. Others

5. USA Alcoholic Drinks Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Anheuser-Busch InBev

5.1.2. Constellation Brands

5.1.3. Diageo

5.1.4. Molson Coors Beverage Company

5.1.5. Brown-Forman

5.1.6. Heineken USA

5.1.7. Boston Beer Company

5.1.8. Pernod Ricard USA

5.1.9. Bacardi USA

5.1.10. E. & J. Gallo Winery

5.1.11. Beam Suntory

5.1.12. Mark Anthony Brands

5.1.13. Campari America

5.1.14. Sazerac Company

5.1.15. Remy Cointreau USA

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. USA Alcoholic Drinks Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. USA Alcoholic Drinks Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. USA Alcoholic Drinks Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. USA Alcoholic Drinks Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By Region (in Value %)

9.4. By Age Group (in Value %)

9.5. By Packaging Type (in Value %)

10. USA Alcoholic Drinks Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on USA Alcoholic Drinks Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Alcoholic Drinks Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple alcoholic drinks companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from alcoholic drinks companies.

Frequently Asked Questions

01 How big is USA Alcoholic Drinks Market?

In 2023, the USA Alcoholic Drinks Market reached a market size of USD 181 billion, driven primarily by the increasing consumer demand for premium and craft alcoholic beverages.

02. What are the growth drivers of the USA Alcoholic Drinks Market?

Growth drivers of the USA Alcoholic Drinks Market include the increasing demand for premium and craft beverages, the expansion of e-commerce and online sales channels, and the growing popularity of hard seltzers and low-alcohol drinks. These factors are contributing to market expansion.

03 What are the challenges in USA Alcoholic Drinks Market?

Challenges in the USA alcoholic drinks market include stringent regulatory restrictions, rising production costs, and a shift in consumer preferences toward health and wellness. These factors are forcing companies to innovate and adapt to changing market conditions.

04 Who are the major players in the USA Alcoholic Drinks Market?

Key players in the USA alcoholic drinks market include Anheuser-Busch InBev, Constellation Brands, Diageo, Molson Coors Beverage Company, and Brown-Forman. These companies lead the market due to their extensive product portfolios and strong distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.