USA All-Terrain Vehicle (ATV) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD4802

November 2024

93

About the Report

USA All-Terrain Vehicle (ATV) Market Overview

- The USA All-Terrain Vehicle (ATV) market is valued at USD 2.05 billion, based on a five-year historical analysis. This market growth is driven by several factors, including the increasing popularity of off-road recreational activities, the rising use of ATVs in agriculture and forestry, and the introduction of advanced technology such as electric ATVs. The recreational vehicle segment has seen a significant boost from consumers seeking outdoor leisure activities. This rise in demand is further accelerated by government investments in public land development for recreational use.

- The market is dominated by states with abundant outdoor recreational opportunities, including California, Texas, and Florida. These states provide ample off-road environments like deserts, forests, and trails, which attract a large number of ATV enthusiasts. Additionally, Texas, known for its agricultural sector, uses ATVs for farming and ranching activities, driving market growth in the utility segment. The dominance of these regions can be attributed to their favorable geographical conditions and increasing disposable incomes, which further propel the demand for ATVs.

- Regulations governing ATV access to public lands are increasingly affecting the market. In 2023, the U.S. Bureau of Land Management (BLM) imposed stricter guidelines for off-road vehicle use in federally protected areas. These rules are designed to protect sensitive ecosystems from damage caused by off-road vehicles. The BLM has designated specific areas for ATV use while restricting access to certain wilderness areas. This regulation has implications for ATV manufacturers and consumers, limiting where ATVs can be legally operated while also promoting responsible usage of public lands.

USA All-Terrain Vehicle (ATV) Market Segmentation

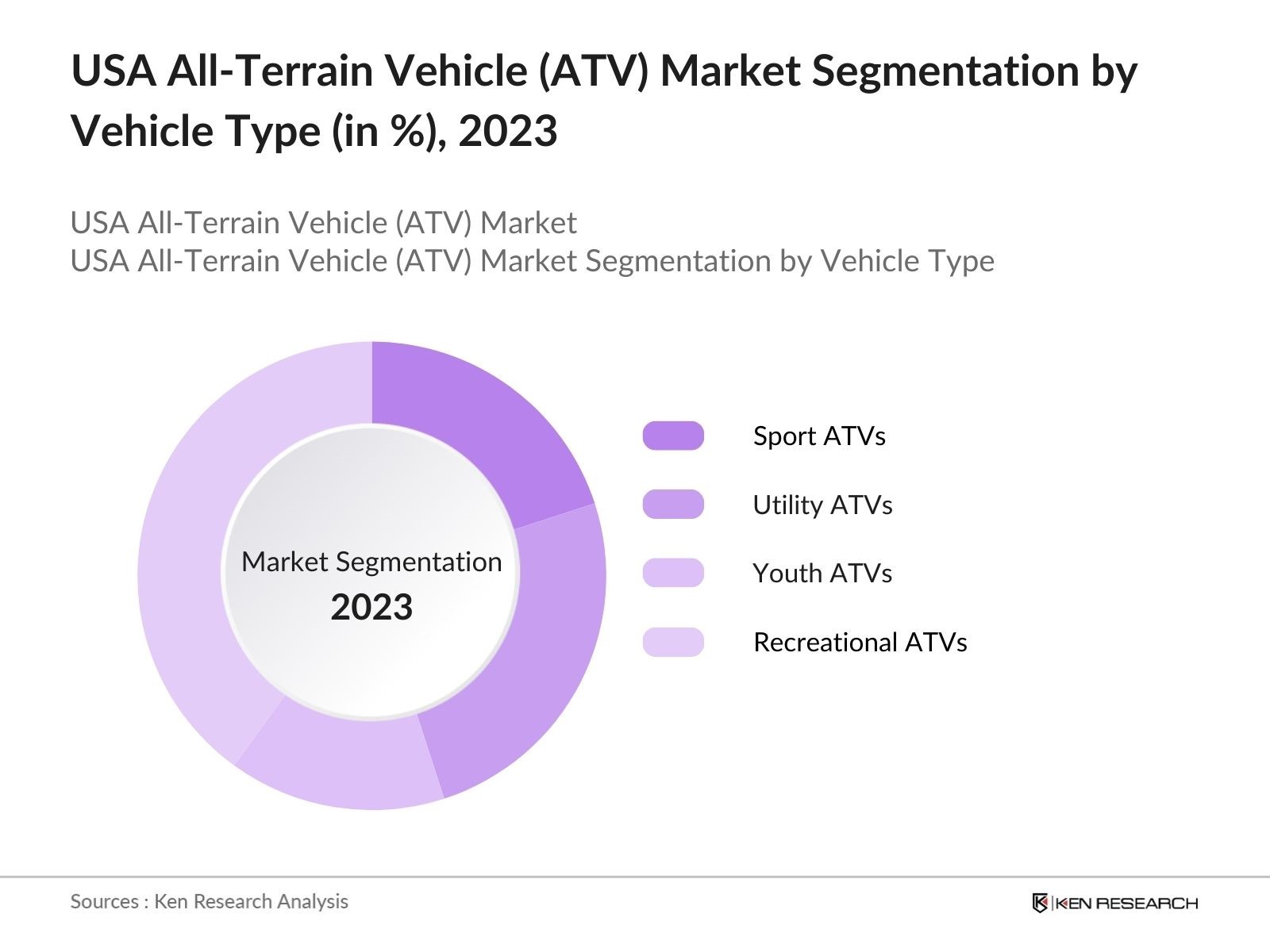

By Vehicle Type: The market is segmented by vehicle type into sport ATVs, utility ATVs, youth ATVs, and recreational ATVs. Recreational ATVs dominate the market under this segmentation due to the growing interest in outdoor sports and adventure activities. Consumers are increasingly drawn to off-roading events and the thrill of maneuvering through rugged terrains. Brands such as Polaris and Can-Am are prominent in this segment, catering to the consumer demand for high-performance vehicles equipped with enhanced safety and smart features.

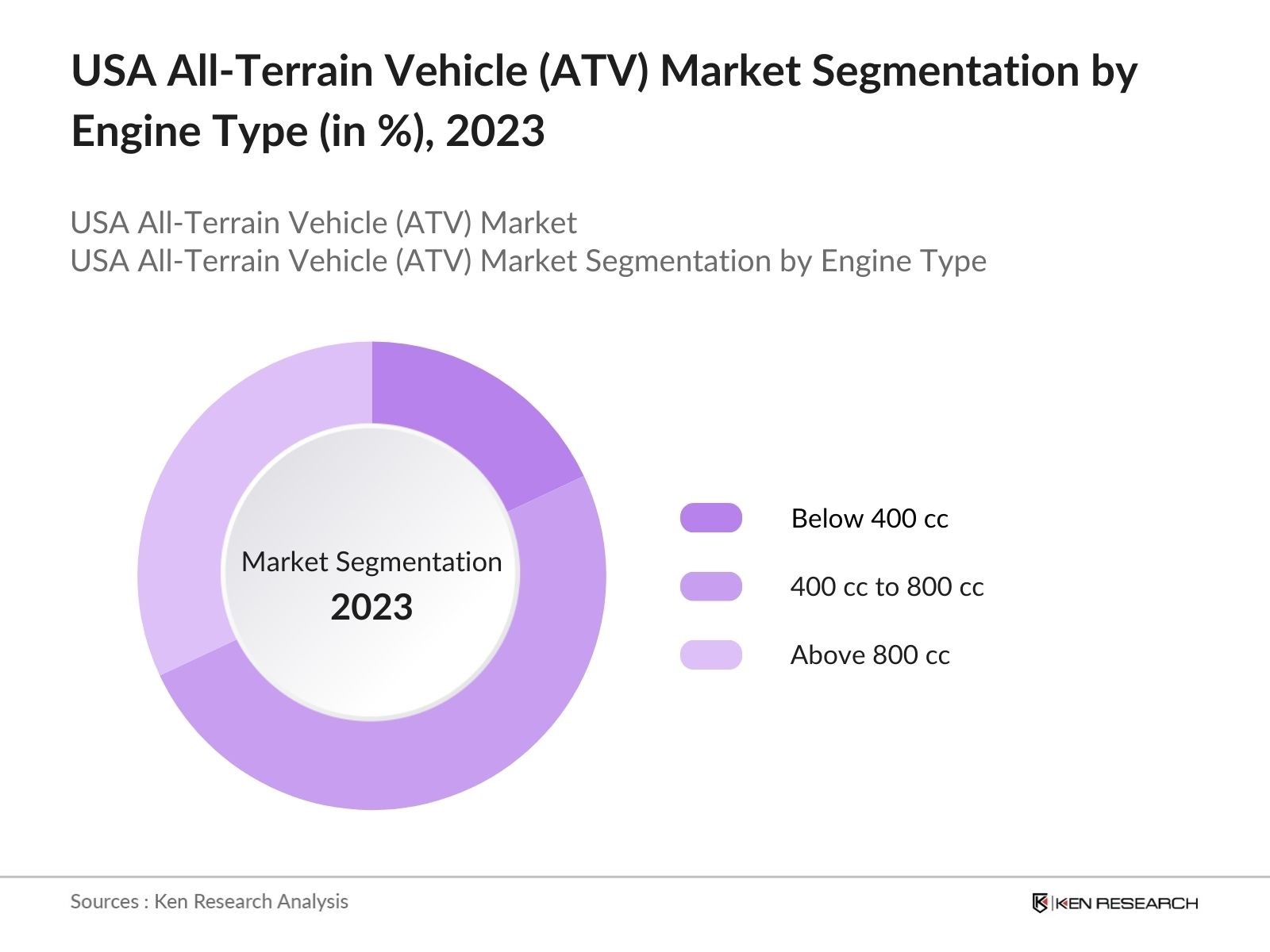

By Engine Type: The market is also segmented by engine type into below 400 cc, 400 cc to 800 cc, and above 800 cc. The 400 cc to 800 cc segment holds the highest market share, as these engine sizes offer a balance between power, performance, and fuel efficiency. This range is preferred by both recreational users and professionals who need a reliable vehicle for agricultural tasks or law enforcement. The demand for vehicles in this engine category is fueled by their versatility in handling both utility and recreational tasks.

USA All-Terrain Vehicle (ATV) Market Competitive Landscape

The USA ATV market is dominated by a few key players, including Polaris Industries, Honda, Yamaha, and Can-Am, with strong market positions due to their diverse product offerings and brand loyalty. These companies lead the market through continuous innovation, offering ATVs with advanced features such as electric powertrains, smart connectivity, and enhanced safety mechanisms. Additionally, their extensive distribution networks allow them to reach various consumer segments across the country, from recreational users to agricultural professionals.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD) |

Product Portfolio |

Market Presence |

R&D Investment |

Electric ATV Offerings |

|

Polaris Industries Inc. |

1954 |

Minnesota, USA |

||||||

|

Honda Motor Co., Ltd. |

1948 |

Tokyo, Japan |

||||||

|

Yamaha Motor Co., Ltd. |

1955 |

Iwata, Japan |

||||||

|

Can-Am (BRP Inc.) |

1942 |

Quebec, Canada |

||||||

|

Kawasaki Heavy Industries |

1896 |

Tokyo, Japan |

USA All-Terrain Vehicle (ATV) Industry Analysis

Growth Drivers

- Increasing Outdoor Recreation Activities: The rise in outdoor recreation activities in the U.S. has driven the demand for All-Terrain Vehicles (ATVs). According to the Outdoor Industry Association, in 2023, over 160 million Americans engaged in outdoor activities such as off-roading and trail riding. This increase in recreational participation is largely attributed to rising disposable income, with the U.S. Bureau of Economic Analysis reporting that the average personal income in the U.S. was approximately $68,700 in 2023. This financial flexibility supports the purchase of high-end ATVs, especially among enthusiasts seeking to explore rugged terrains.

- Technological Advancements in ATV Manufacturing: Recent advancements in ATV technology, particularly the development of electric ATVs and enhanced safety features, have significantly improved performance and safety. Electric ATVs are becoming popular as they align with environmental concerns. The U.S. Environmental Protection Agency (EPA) has been pushing for cleaner technology adoption, making electric vehicles (EVs) a growing trend in 2024. Additionally, manufacturers are focusing on integrating advanced safety systems such as electronic stability control, making ATVs safer and more reliable for consumers. This technological shift is expected to support the growth of the market by catering to a more eco-conscious audience.

- Expanding Use of ATVs in Agriculture, Military, and Law Enforcement: ATVs are increasingly being used in sectors such as agriculture, military, and law enforcement. In agriculture, the U.S. Department of Agriculture (USDA) reports that rural farms have adopted ATVs for tasks such as monitoring livestock and crop inspection. The U.S. military and law enforcement also utilize ATVs for operations in rough terrains where conventional vehicles fail. The Defense Logistics Agency spent over $80 million on ATVs and related equipment for defense purposes in 2023. This expanding application of ATVs in diverse sectors is contributing to market growth.

Market Challenges

- Safety Concerns and High Accident Rates: ATV-related accidents remain a concern in the U.S. According to the Consumer Product Safety Commission (CPSC), ATV accidents caused nearly 100,000 injuries and over 400 fatalities in 2023. Safety concerns, such as rollovers and lack of protective gear, have led to stricter safety regulations and increased consumer awareness about the dangers of ATV usage. These safety concerns often deter potential buyers, especially parents looking for family recreational activities, thus affecting market demand. This issue is compounded by the high costs associated with insurance and medical expenses related to ATV accidents.

- High Maintenance Costs: The high cost of maintaining ATVs is another challenge affecting the market. Due to their intensive use in rough terrains, ATVs require frequent servicing and part replacements. The average cost of annual maintenance for an ATV in the U.S. ranges from $500 to $1,200, depending on the usage and model, according to the American Motorcyclist Association. Additionally, the rising cost of spare parts and labor exacerbates the financial burden on ATV owners. This often discourages price-sensitive consumers from purchasing ATVs, especially those considering it for occasional recreational use.

USA All-Terrain Vehicle (ATV) Market Future Outlook

Over the next five years, the USA All-Terrain Vehicle market is expected to see robust growth, driven by rising consumer interest in outdoor activities, advancements in electric ATV technology, and increased government support for developing off-road recreational spaces. The introduction of electric ATVs will cater to environmentally conscious consumers, while the utility segment will see continued adoption across agriculture, forestry, and law enforcement sectors. Furthermore, the increase in shared mobility services, such as ATV rentals, is likely to open up new market opportunities.

Future Market Opportunities

- Growing Interest in Electric and Hybrid ATVs: The growing interest in electric and hybrid ATVs presents significant opportunities for manufacturers. With the U.S. government pushing for cleaner energy solutions, electric vehicles are gaining popularity, including in the ATV market. The U.S. Department of Energy has announced over $2 billion in subsidies for electric vehicle manufacturers in 2023, encouraging the development of electric ATVs. These ATVs are appealing to environmentally conscious consumers and those looking to reduce fuel costs. The absence of engine noise and lower maintenance requirements further make electric ATVs attractive for recreational and professional use.

- Expansion in Rural and Emerging Markets: The expansion of ATVs into rural and emerging markets, particularly in the agriculture sector, presents growth opportunities. According to the U.S. Department of Agriculture, the demand for ATVs in rural areas has been increasing due to their utility in farming, such as in transporting materials and monitoring crops. In 2023, over 1.5 million farms in the U.S. were reported to use ATVs for various agricultural purposes. These vehicles are also gaining traction in emerging markets, including areas with difficult terrains, further boosting the market's reach.

Scope of the Report

|

By Vehicle Type |

Sport ATVs Utility ATVs Youth ATVs Recreational ATVs |

|

By Engine Type |

Below 400 cc 400 cc to 800 cc Above 800 cc |

|

By Application |

Sports and Recreation Military and Defense Agriculture and Forestry Law Enforcement Tourism and Adventure Sports |

|

By Fuel Type |

Gasoline-powered Electric-powered |

|

By Region |

North-East South-East Mid-West Western |

Products

Key Target Audience

ATV Manufacturers

Off-Road Recreational Companies

Government and Regulatory Bodies (U.S. Environmental Protection Agency, U.S. Department of Agriculture)

Agricultural Sector Operators

Military and Law Enforcement Agencies

Tourism and Adventure Sports Companies

Investor and Venture Capitalist Firms

Public Land Management Agencies

Companies

Major Players

Polaris Industries Inc.

Honda Motor Co., Ltd.

Yamaha Motor Co., Ltd.

Can-Am (BRP Inc.)

Kawasaki Heavy Industries

Arctic Cat Inc.

Suzuki Motor Corporation

Textron Inc.

Kymco

CFMoto

Hisun Motors Corp.

KTM AG

Mahindra & Mahindra Ltd.

John Deere

Linhai Powersports

Table of Contents

1. USA All-Terrain Vehicle (ATV) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Growth drivers for off-road vehicles, rugged terrain demand, and recreational activities)

1.4. Market Segmentation Overview

2. USA All-Terrain Vehicle (ATV) Market Size (In USD Bn)

2.1. Historical Market Size (ATV sales growth rate, total units sold by manufacturers, consumer preferences)

2.2. Year-On-Year Growth Analysis (Annual growth metrics, ATV sales performance)

2.3. Key Market Developments and Milestones (OEM developments, product innovation, regulation impacts)

3. USA All-Terrain Vehicle (ATV) Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Outdoor Recreation Activities

3.1.2. Technological Advancements in ATV Manufacturing (Electric ATVs, enhanced safety features)

3.1.3. Expanding Use of ATVs in Agriculture, Military, and Law Enforcement

3.1.4. Rising Disposable Income and Off-Road Enthusiasts

3.2. Market Challenges

3.2.1. Stringent Environmental Regulations

3.2.2. Safety Concerns and High Accident Rates

3.2.3. High Maintenance Costs

3.3. Opportunities

3.3.1. Growing Interest in Electric and Hybrid ATVs

3.3.2. Expansion in Rural and Emerging Markets

3.3.3. Development of Rental and Shared ATV Services

3.4. Trends

3.4.1. Popularity of Off-Roading Events and Competitions

3.4.2. Growth in Electric ATVs (Sustainability and emissions)

3.4.3. ATV Integration with GPS and Smart Connectivity

3.5. Government Regulation

3.5.1. Emission Standards for ATVs (EPA regulations)

3.5.2. Safety Standards and Vehicle Certification (Consumer Protection Safety Act)

3.5.3. Off-Road Vehicle Access and Public Lands Usage (Federal and state land regulations)

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, distributors, service providers)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Competitive landscape of leading manufacturers)

4. USA All-Terrain Vehicle (ATV) Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Sport ATVs

4.1.2. Utility ATVs

4.1.3. Youth ATVs

4.1.4. Recreational ATVs

4.2. By Engine Type (In Value %)

4.2.1. Below 400 cc

4.2.2. 400 cc to 800 cc

4.2.3. Above 800 cc

4.3. By Application (In Value %)

4.3.1. Sports and Recreation

4.3.2. Military and Defense

4.3.3. Agriculture and Forestry

4.3.4. Law Enforcement

4.3.5. Tourism and Adventure Sports

4.4. By Fuel Type (In Value %)

4.4.1. Gasoline-powered

4.4.2. Electric-powered

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. South-East

4.5.3. Mid-West

4.5.4. Western

5. USA All-Terrain Vehicle (ATV) Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Polaris Industries Inc.

5.1.2. Honda Motor Co., Ltd.

5.1.3. Yamaha Motor Co., Ltd.

5.1.4. Kawasaki Heavy Industries, Ltd.

5.1.5. Arctic Cat Inc.

5.1.6. BRP Inc. (Can-Am)

5.1.7. Suzuki Motor Corporation

5.1.8. KTM AG

5.1.9. CFMoto

5.1.10. Hisun Motors Corp.

5.1.11. Textron Inc.

5.1.12. Kymco

5.1.13. Mahindra & Mahindra Ltd.

5.1.14. Linhai Powersports

5.1.15. John Deere

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Product Portfolio, Global Presence, Manufacturing Capabilities, Electric ATV Offerings, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New product launches, joint ventures, partnerships)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private and Public investment)

5.7 Venture Capital Funding (Key venture capital initiatives)

5.8. Government Grants

5.9. Private Equity Investments

6. USA All-Terrain Vehicle (ATV) Market Regulatory Framework

6.1. Emission Standards

6.2. Compliance Requirements (Manufacturing, emissions, and safety)

6.3. Certification Processes (Federal certifications for ATV usage and sales)

7. USA All-Terrain Vehicle (ATV) Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Analysis of ATV market potential)

7.2. Key Factors Driving Future Market Growth (Electric ATVs, recreational demand, military adoption)

8. USA All-Terrain Vehicle (ATV) Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Engine Type (In Value %)

8.3. By Application (In Value %)

8.4. By Fuel Type (In Value %)

8.5. By Region (In Value %)

9. USA All-Terrain Vehicle (ATV) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Consumer segmentation, buying behavior)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables influencing the USA All-Terrain Vehicle market. Desk research was conducted using proprietary databases, government publications, and industry reports to gather essential information on market size, market segmentation, and growth drivers.

Step 2: Market Analysis and Construction

Historical data related to market size, growth trends, and competitive analysis were compiled and analyzed. This step also included evaluating industry performance, production capabilities, and distribution channels to provide accurate revenue and market share estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key industry players were consulted through computer-assisted telephone interviews (CATIs) to validate market hypotheses. Their insights provided operational and strategic perspectives that refined the market forecasts and segmented analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from interviews and secondary research into a comprehensive market analysis report. The validation of figures through a bottom-up approach ensured that the data presented was accurate and aligned with industry standards.

Frequently Asked Questions

01. How big is the USA All-Terrain Vehicle (ATV) Market?

The USA All-Terrain Vehicle market is valued at USD 2.05 billion, driven by increased demand for recreational activities and advancements in ATV technology.

02. What are the challenges in the USA All-Terrain Vehicle Market?

Challenges in the USA All-Terrain Vehicle market include stringent environmental regulations, safety concerns, and high maintenance costs associated with ATVs.

03. Who are the major players in the USA All-Terrain Vehicle Market?

Key players in the USA All-Terrain Vehicle market include Polaris Industries, Honda Motor Co., Yamaha Motor Co., Can-Am, and Kawasaki Heavy Industries, dominating due to their extensive product portfolios and market reach.

04. What are the growth drivers of the USA All-Terrain Vehicle Market?

The USA All-Terrain Vehicle market is propelled by factors such as the increasing popularity of off-road recreational activities, the rise of electric ATVs, and government initiatives supporting outdoor sports.

05. What is the future outlook for the USA All-Terrain Vehicle Market?

The USA All-Terrain Vehicle market is expected to see steady growth driven by advancements in electric ATV technology and expanding applications in sectors like agriculture, forestry, and law enforcement.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.