USA Ambulatory Surgical Centers Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD5022

December 2024

84

About the Report

USA Ambulatory Surgical Centers (ASC) Market Overview

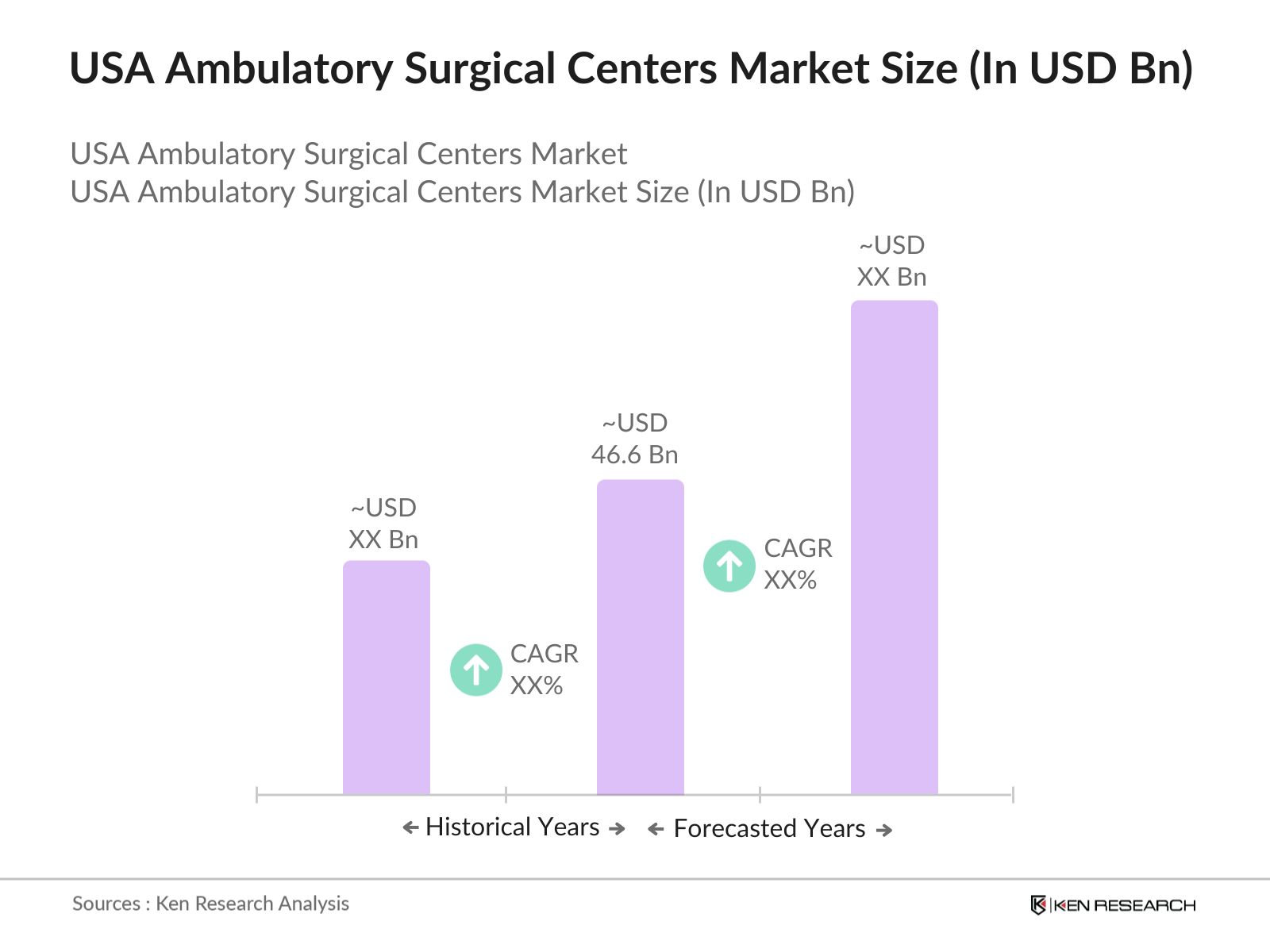

- The USA Ambulatory Surgical Centers market is valued at USD 46.6 billion, based on a five-year historical analysis. The growth of this market is driven by several factors, including the rising number of outpatient surgeries, technological advancements in minimally invasive procedures, and cost-efficiency compared to inpatient surgeries. Increasing demand for convenience, shorter recovery times, and favourable reimbursement policies also play major roles in driving the market forward. The rising preference for outpatient surgeries and the growing number of ASCs are key contributors to the markets expansion.

- The cities and regions dominating the USA ASC market include California, Texas, and Florida. The dominance of these regions is attributed to their large populations, a high number of aging residents requiring surgeries, and advanced healthcare infrastructure. These states also have a dense concentration of ASCs, driven by the increasing prevalence of chronic conditions and a high demand for outpatient procedures. In these areas, partnerships between healthcare providers and ASC operators have further boosted the market presence.

- In 2023, the CMS announced adjustments to Medicare reimbursement rates for ASCs, with an average increase of 2.8% for qualifying procedures. These changes aim to reflect the rising costs of providing care and ensure that ASCs remain financially viable. However, the reimbursement rates for certain procedures, such as total knee replacements, were reduced, prompting concerns among ASC operators. As reimbursement policies continue to evolve, ASCs must stay compliant with CMS regulations to maintain their operational sustainability.

USA Ambulatory Surgical Centers (ASC) Market Segmentation

- By Procedure Type: The USA ASC market is segmented by procedure type into orthopedic surgeries, gastrointestinal procedures, ophthalmology surgeries, ENT surgeries, and pain management procedures. Orthopedic surgeries hold a dominant market share under the procedure type segmentation. The prevalence of musculoskeletal disorders and the aging population's growing need for joint replacements and other orthopedic procedures contribute to the dominance of this segment. Technological advancements in orthopedic surgery, such as robotic-assisted surgeries and minimally invasive techniques, further enhance the capacity of ASCs to deliver high-quality care in this field.

- By Ownership Type: The ASC market is also segmented by ownership type, which includes physician-owned, hospital-affiliated, and corporate-owned centers. Physician-owned ASCs account for the largest share under this segmentation. These centers dominate due to their ability to maintain operational independence, provide specialized care, and respond quickly to market changes. Additionally, the control physicians have over their clinical and administrative operations, coupled with their ability to tailor procedures to patient needs, makes physician-owned ASCs more competitive.

USA Ambulatory Surgical Centers (ASC) Market Competitive Landscape

The USA ASC market is dominated by key players that shape the competitive landscape. These players focus on expanding their service offerings, acquiring new facilities, and entering strategic partnerships to remain competitive. The industry sees consolidation through mergers and acquisitions, with some companies expanding their reach and capabilities through such strategies.

|

Company Name |

Established Year |

Headquarters |

Number of ASCs |

Specialties Covered |

Revenue (USD) |

Partnerships |

Recent Acquisition |

Technology Investments |

Geographical Presence |

|

United Surgical Partners |

1998 |

Dallas, TX |

- |

- |

- |

- |

- |

- |

- |

|

Surgery Partners Inc. |

2004 |

Brentwood, TN |

- |

- |

- |

- |

- |

- |

- |

|

HCA Healthcare |

1968 |

Nashville, TN |

- |

- |

- |

- |

- |

- |

- |

|

Envision Healthcare |

1992 |

Nashville, TN |

- |

- |

- |

- |

- |

- |

- |

|

SCA Health |

1982 |

Deerfield, IL |

- |

- |

- |

- |

- |

- |

- |

USA Ambulatory Surgical Centers (ASC) Market Analysis

USA Ambulatory Surgical Centers (ASC) Market Growth Drivers

- Increase in Outpatient Surgical Volume: The United States healthcare system has seen a shift towards outpatient care due to advancements in medical procedures and patient preferences. In 2022, the number of outpatient surgeries performed in the US was approximately 15 million, driven by the increased focus on minimally invasive techniques that reduce recovery time and lower hospital stays. This shift is supported by technological advancements in surgical equipment, allowing for complex procedures to be conducted outside of traditional hospital settings. As of 2024, outpatient surgeries are expected to continue to rise, reflecting increased patient demand for quicker, cost-efficient procedures.

- Cost Efficiency and Patient Convenience: Ambulatory Surgical Centers (ASCs) provide cost-effective alternatives to hospital-based surgeries. According to CMS data from 2023, procedures performed in ASCs cost about 45% less than in hospitals, offering substantial savings to the healthcare system. These centers also contribute to patient convenience by providing faster access to surgical care, as the average wait time for elective procedures in ASCs is lower than in traditional hospital settings. In addition, ASCs help reduce hospital readmission rates, thus minimizing overall healthcare costs.

- Favourable Reimbursement Policies: Reimbursement policies in the US have become more favourable towards ASCs. For instance, Medicare added over 260 procedures to its approved outpatient surgery list in 2023, allowing ASCs to handle a broader range of services. The average Medicare reimbursement for an outpatient procedure in 2023 was $1,800, compared to $4,600 for the same procedure in a hospital setting. These policies drive patient inflow towards ASCs, helping lower national healthcare expenditures and increasing access to high-quality surgical care.

USA Ambulatory Surgical Centers (ASC) Market Challenges

- Stringent Medicare Regulations: While reimbursement policies are becoming more favourable, ASCs face challenges from stringent Medicare regulations. For instance, many ASCs are required to comply with detailed reporting on quality measures under the ASC Quality Reporting Program. As of 2023, approximately 3,800 ASCs in the US must report data on surgical outcomes, patient safety, and infection rates to maintain compliance, which increases administrative burdens and operational costs. Failure to comply results in financial penalties, limiting profit margins and placing smaller ASCs at a disadvantage.

- Workforce Shortages and Training Gaps: ASCs are facing increasing challenges in recruiting skilled personnel, including surgeons, anesthesiologists, and nurses. According to the U.S. Bureau of Labor Statistics (BLS), by mid-2023, there was a shortage of approximately 10,000 registered nurses specializing in surgery. The shortage of trained staff in ambulatory settings is expected to grow as more surgeries shift to ASCs, creating gaps in workforce availability and impacting operational efficiency. This shortage is exacerbated by the lack of comprehensive training programs tailored to the specific needs of ASCs.

USA Ambulatory Surgical Centers (ASC) Market Future Outlook

Over the next five years, the USA ASC market is expected to witness substantial growth driven by increased demand for outpatient surgeries, advancements in surgical technologies, and a shift toward value-based care. As more complex surgeries become feasible in an ambulatory setting, ASCs will continue to expand their service offerings. Government support in the form of favourable reimbursement policies and the rising adoption of minimally invasive techniques will further catalyse this market's growth.

USA Ambulatory Surgical Centers (ASC) Market Opportunities

- Aging Population and Demand for Surgical Procedures: As the US population ages, the demand for surgical procedures continues to increase. According to the U.S. Census Bureau, over 54 million Americans were aged 65 or older in 2023, with this number expected to rise substantially. This demographic shift will increase the demand for surgeries such as cataract removal, knee replacements, and cardiac procedures, all of which are commonly performed in ASCs. The rise in chronic conditions, such as diabetes and arthritis, also drives the need for surgical interventions, positioning ASCs as a critical component in addressing this demand.

- Rise of Hybrid Ambulatory Centers: Hybrid ambulatory centers, which combine ASCs with diagnostic and therapeutic services, are emerging as a growth opportunity. These centers offer comprehensive care under one roof, allowing patients to receive diagnostic imaging, outpatient surgery, and rehabilitation in the same facility. As of 2024, the number of hybrid ASCs has grown by 15% across major metropolitan areas in the US. This trend reflects the growing demand for integrated healthcare models that improve patient outcomes and reduce healthcare costs by streamlining services.

Scope of the Report

|

Procedure Type |

Orthopedic Surgeries Gastrointestinal Procedures Ophthalmology Surgeries ENT Surgeries Pain Management Procedures |

|

Ownership Type |

Physician-Owned Hospital-Affiliated Corporate-Owned |

|

Payment Model |

Fee-for-Service Bundled Payments Capitated Payments |

|

Specialty |

Single-Specialty ASCs Multi-Specialty ASCs |

|

Region |

Northeast USA Midwest USA Southern USA Western USA |

Products

Key Target Audience

Hospital Systems

Insurance Providers

Ambulatory Surgery Center Operators

Healthcare Investors and Venture Capitalist Firms

Medical Device Manufacturers

Banks and Financial Institutions

Government and Regulatory Bodies (Centers for Medicare & Medicaid Services, FDA)

Physician Networks

Healthcare Real Estate Developers

Companies

Major Players in the Market

United Surgical Partners International

Surgery Partners Inc.

HCA Healthcare

Envision Healthcare

SCA Health

Tenet Healthcare Corporation

NovaMed Inc.

Ambulatory Surgical Centers of America

Regent Surgical Health

NorthStar Anesthesia

Mednax Services Inc.

The Joint Commission

AMSURG

Surgical Care Affiliates

Covenant Surgical Partners

Table of Contents

1. USA Ambulatory Surgical Centers (ASC) Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Growth Rate of the ASC Market

1.4 Market Segmentation Overview

2. USA Ambulatory Surgical Centers Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones in ASCs

3. USA Ambulatory Surgical Centers Market Analysis

3.1 Growth Drivers (Expansion of Outpatient Procedures, Insurance Coverage, Technological Advancements)

3.1.1 Increase in Outpatient Surgical Volume

3.1.2 Cost Efficiency and Patient Convenience

3.1.3 Advancements in Minimally Invasive Surgery

3.1.4 Favorable Reimbursement Policies

3.2 Market Challenges (Regulatory Hurdles, Physician-Owned Restrictions, Competition from Hospitals)

3.2.1 Stringent Medicare Regulations

3.2.2 Workforce Shortages and Training Gaps

3.2.3 Rising Operational Costs

3.3 Opportunities (Shifting Demographics, Telehealth Integration)

3.3.1 Aging Population and Demand for Surgical Procedures

3.3.2 Rise of Hybrid Ambulatory Centers

3.3.3 Increased Demand for Pain Management Services

3.4 Trends (Consolidation of ASCs, Outpatient Shift, Value-Based Care)

3.4.1 Strategic Partnerships with Hospitals and Health Systems

3.4.2 Telemedicine for Post-Surgical Care

3.4.3 Value-Based Care and Bundled Payment Models

3.5 Government Regulations (ASC Quality Reporting Program, Certificate of Need)

3.5.1 Changes in Medicare Reimbursement Rates

3.5.2 ASC Licensing Requirements

3.5.3 Compliance with OSHA and HIPAA Guidelines

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stakeholder Ecosystem (Providers, Patients, Insurers, Government Agencies)

3.8 Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Competition)

3.9 Competition Ecosystem (Industry Players, Market Share)

4. USA Ambulatory Surgical Centers Market Segmentation

4.1 By Procedure Type (In Value %)

4.1.1 Orthopedic Surgeries

4.1.2 Ophthalmic Surgeries

4.1.3 Gastrointestinal Procedures

4.1.4 ENT (Ear, Nose, Throat) Surgeries

4.1.5 Pain Management Procedures

4.2 By Specialty (In Value %)

4.2.1 Single-Specialty ASCs

4.2.2 Multi-Specialty ASCs

4.3 By Ownership Type (In Value %)

4.3.1 Physician-Owned

4.3.2 Hospital-Affiliated

4.3.3 Corporate-Owned

4.4 By Payment Model (In Value %)

4.4.1 Fee-for-Service

4.4.2 Bundled Payments

4.4.3 Capitated Payments

4.5 By Region (In Value %)

4.5.1 Northeast USA

4.5.2 Midwest USA

4.5.3 Southern USA

4.5.4 Western USA

5. USA Ambulatory Surgical Centers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 United Surgical Partners International

5.1.2 Surgery Partners Inc.

5.1.3 HCA Healthcare

5.1.4 Envision Healthcare

5.1.5 SCA Health

5.1.6 The Joint Commission

5.1.7 Mednax Services Inc.

5.1.8 Regent Surgical Health

5.1.9 Tenet Healthcare Corporation

5.1.10 Surgical Care Affiliates

5.1.11 NovaMed Inc.

5.1.12 Ambulatory Surgical Centers of America

5.1.13 Covenant Surgical Partners

5.1.14 NorthStar Anesthesia

5.1.15 AMSURG

5.2 Cross Comparison Parameters (Number of Operating Rooms, Revenue, Specialties Covered, Accreditation, Ownership Structure, Payer Mix, Geographical Reach, Number of Physicians)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint Ventures, Partnerships)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Incentives

5.9 Private Equity Investments

6. USA Ambulatory Surgical Centers Market Regulatory Framework

6.1 Compliance with Medicare and Medicaid Guidelines

6.2 Accreditation Standards (AAAHC, The Joint Commission)

6.3 ASC Quality Reporting (ASCQR) Program

6.4 Licensure and Operating Requirements

7. USA Ambulatory Surgical Centers Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. USA Ambulatory Surgical Centers Future Market Segmentation

8.1 By Procedure Type (In Value %)

8.2 By Specialty (In Value %)

8.3 By Ownership Type (In Value %)

8.4 By Payment Model (In Value %)

8.5 By Region (In Value %)

9. USA Ambulatory Surgical Centers Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the primary stakeholders within the USA ASC market ecosystem. Desk research, supported by access to proprietary databases, was conducted to analyze data points such as procedure volumes, reimbursement rates, and operational metrics. This phase helps define the variables influencing market dynamics.

Step 2: Market Analysis and Construction

Data from secondary and primary sources was compiled and analyzed to evaluate market penetration and service provider concentration. This phase assessed the financial performance of ASCs, including profitability metrics, operational efficiency, and reimbursement structures.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts were undertaken through CATI to validate market assumptions. These interviews provided real-world insights into operational challenges, market growth, and competitive strategies, allowing for hypothesis refinement.

Step 4: Research Synthesis and Final Output

In this final stage, the synthesized data was verified through collaboration with ASC operators and healthcare providers. Market forecasts, revenue estimates, and future outlooks were confirmed using both top-down and bottom-up approaches, ensuring data accuracy and relevance.

Frequently Asked Questions

01. How big is the USA Ambulatory Surgical Centers Market?

The USA ASC market is valued at USD 46.6 billion, driven by rising outpatient surgery volumes, technological advancements in minimally invasive procedures, and cost-efficiency benefits over hospital-based surgeries.

02. What are the challenges in the USA Ambulatory Surgical Centers Market?

Key challenges include stringent regulatory requirements, workforce shortages, and competition from hospital outpatient departments. Rising operational costs and compliance with Medicare policies also posses challenges for ASC operators.

03. Who are the major players in the USA Ambulatory Surgical Centers Market?

Major players include United Surgical Partners International, Surgery Partners Inc., HCA Healthcare, Envision Healthcare, and SCA Health. These companies dominate due to their extensive ASC networks, strategic partnerships, and advanced surgical technologies.

04. What are the growth drivers of the USA Ambulatory Surgical Centers Market?

The growth is propelled by increased demand for outpatient surgeries, advancements in surgical technologies, favourable reimbursement models, and a growing preference for minimally invasive procedures among aging populations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.