USA Antiparasitic Drugs Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6623

December 2024

90

About the Report

USA Antiparasitic Drugs Market Overview

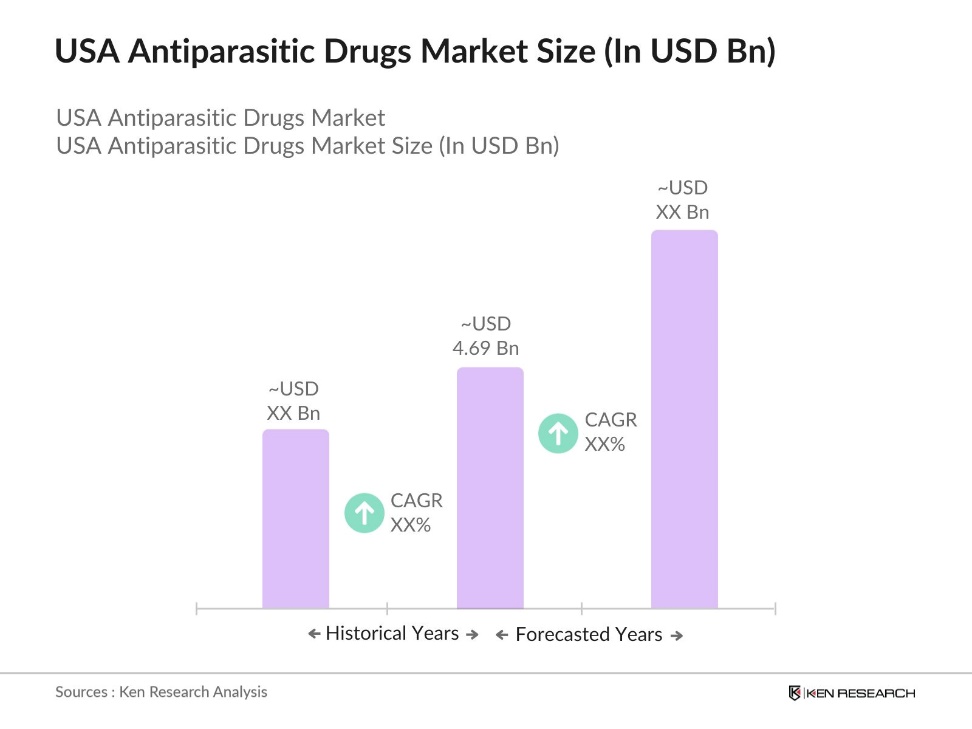

- The USA antiparasitic drugs market is valued at USD 4.69 billion, based on a five-year historical analysis. This market has been driven by an increase in parasitic infections affecting humans and animals, advancements in antiparasitic medications, and the expansion of veterinary applications. Moreover, heightened awareness of zoonotic diseases and an increase in pet ownership have reinforced the need for antiparasitic drugs in both human and veterinary healthcare sectors.

- In the USA, cities like New York, Los Angeles, and Houston dominate the market due to their large urban populations and well-established healthcare infrastructures, which facilitate efficient disease diagnosis and treatment availability. Furthermore, regions with significant pet populations contribute heavily to the demand for veterinary antiparasitic treatments, reflecting regional preferences and lifestyle factors.

- Manufacturers of antiparasitic drugs must meet Good Manufacturing Practice (GMP) standards to ensure product quality and safety. According to the FDA's FY 2023 Annual Report, the agency conducted a total of 2,953 inspections across various drug manufacturing establishments. Facilities found non-compliant with these standards face penalties or operational halts, stressing the need for stringent manufacturing practices.

USA Antiparasitic Drugs Market Segmentation

By Drug Class: The market is segmented by drug class into antimalarials, anthelmintics, antiprotozoals, and ectoparasiticides. Recently, anthelmintics have shown dominance within this segment due to their widespread use in treating intestinal worms and other helminth infections in both humans and animals. The rising incidence of zoonotic helminth infections and the growing prevalence of livestock farming also contribute to the strength of this segment. Leading pharmaceutical companies offer a broad range of anthelmintic products, supporting its prominent position in the market.

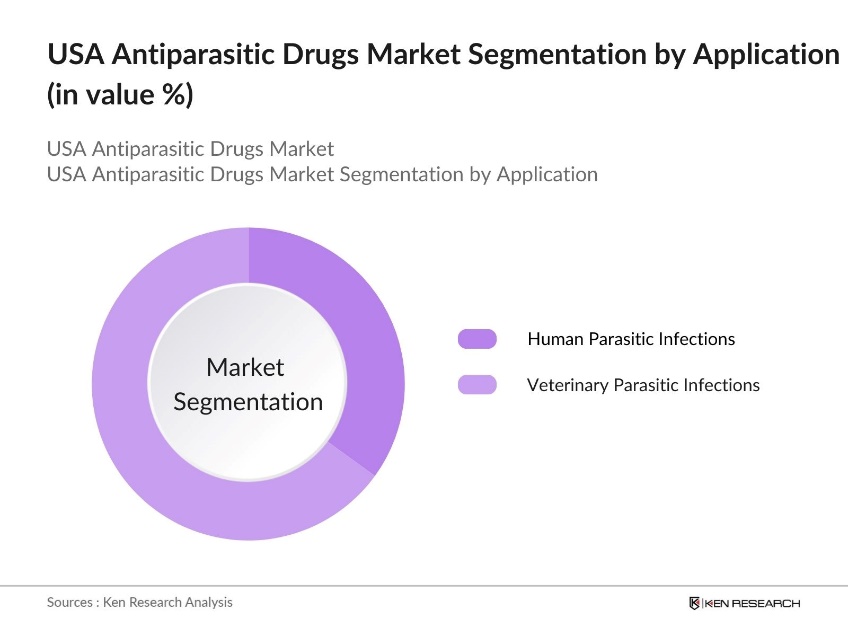

By Application: The market is segmented by application into human parasitic infections and veterinary parasitic infections. Veterinary applications currently hold a dominant position, driven by an increase in pet ownership, awareness of zoonotic diseases, and the importance of antiparasitic treatments in the livestock industry. Additionally, various government programs support the use of veterinary antiparasitic drugs to prevent outbreaks and maintain animal health, particularly within the livestock sector.

USA Antiparasitic Drugs Market Competitive Landscape

The USA antiparasitic drugs market is dominated by a select group of key players. Companies like Pfizer Inc. and Bayer AG lead in product innovation and have established partnerships with both healthcare providers and veterinary organizations. These companies leverage robust distribution networks, extensive R&D investments, and significant market presence to maintain their competitive edge.

USA Antiparasitic Drugs Industry Analysis

Growth Drivers

- Increasing Prevalence of Parasitic Infections: The USA has observed a steady increase in parasitic infections, particularly in states with warmer climates, which are more prone to vector-borne diseases. Data from the Centers for Disease Control and Prevention (CDC) in 2023 highlights that over 300,000 people in the U.S. have chronic Chagas disease, an infection commonly transmitted by triatomine bugs. Additionally, toxoplasmosis cases have shown a notable increase, impacting around 10% of the population. These rising numbers reflect a greater need for antiparasitic drugs to manage and control the spread of these diseases.

- Rising Awareness and Screening Initiatives: The U.S. healthcare system has placed a renewed emphasis on parasitic disease awareness through state-level screening initiatives and public health campaigns. The NIH's overall funding for various health initiatives has increasedreporting a program level of approximately $49.183 billion for FY 2023. Such efforts have increased the detection rates of infections like giardiasis and cryptosporidiosis, thereby creating a pressing demand for effective antiparasitic medications.

- Advancements in Antiparasitic Drug Development: Recent advancements have accelerated antiparasitic drug development, focusing on innovative formulations that better target resistant parasites. FDA approvals of new drugs showcase these developments, with research initiatives supporting advanced therapies like nanoformulations to enhance efficacy. This progress underscores a commitment to creating more effective, targeted treatments, benefiting both patients and the broader healthcare field.

Market Challenges

- High Development Costs: Developing antiparasitic drugs involves substantial financial investment, with significant costs associated with research, development, and clinical trials. Pharmaceutical companies face high capital demands due to complex processes and stringent safety standards. These financial challenges make it difficult for new treatments to enter the market, impacting the overall development pipeline for antiparasitic drugs.

- Stringent Regulatory Approvals: Antiparasitic drugs must undergo an intensive review process by the FDA to meet strict safety and efficacy standards. This regulatory scrutiny often leads to extended approval timelines, which can delay the market entry of new drugs. These rigorous requirements, while essential for patient safety, pose challenges for manufacturers aiming to introduce innovative treatments.

USA Antiparasitic Drugs Market Future Outlook

Over the next five years, the USA antiparasitic drugs market is expected to witness notable growth, driven by increased R&D in drug development, advancements in biologic therapies, and greater demand for veterinary antiparasitic products. Key trends such as the rising awareness of zoonotic diseases, growth in pet ownership, and government initiatives aimed at livestock health are expected to boost the market further.

Market Opportunities

- Growth in Veterinary Applications: The demand for antiparasitic drugs within the veterinary market is rising alongside increased pet ownership in the U.S. As more pet owners seek effective treatments to protect animals from parasitic infections, pharmaceutical companies and veterinary services are finding growing opportunities in this segment. This expansion highlights the strong potential for antiparasitic products tailored specifically for animals.

- Novel Drug Delivery Systems: Innovative drug delivery systems, such as controlled-release tablets and transdermal patches, are creating new possibilities in antiparasitic treatments. These advancements not only improve the effectiveness of drugs but also enhance patient adherence. This trend presents a promising opportunity for pharmaceutical companies to develop more efficient, user-friendly antiparasitic therapies that benefit both patients and providers.

Scope of the Report

|

Drug Class |

Antimalarials Anthelmintics Antiprotozoals Ectoparasiticides |

|

Application |

Human Parasitic Infections Veterinary Parasitic Infections |

|

Route of Administration |

Oral Topical Parenteral |

|

End-User |

Hospitals and Clinics Retail Pharmacies Online Pharmacies |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Pharmaceutical Manufacturers

Online Pharmacies

Livestock Industry Players

Animal Health Organizations

Government and Regulatory Bodies (FDA and USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Pfizer Inc.

Bayer AG

Merck & Co., Inc.

Zoetis Inc.

Sanofi S.A.

GlaxoSmithKline plc

Boehringer Ingelheim

Johnson & Johnson

Elanco Animal Health

F. Hoffmann-La Roche AG

Table of Contents

1. USA Antiparasitic Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Antiparasitic Drugs Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Antiparasitic Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Parasitic Infections

3.1.2. Rising Awareness and Screening Initiatives

3.1.3. Advancements in Antiparasitic Drug Development

3.1.4. Government and Non-Profit Health Programs

3.2. Market Challenges

3.2.1. High Development Costs

3.2.2. Stringent Regulatory Approvals

3.2.3. Limited Awareness in Rural Areas

3.3. Opportunities

3.3.1. Growth in Veterinary Applications

3.3.2. Novel Drug Delivery Systems

3.3.3. Strategic Collaborations with Academic Institutions

3.4. Trends

3.4.1. Increased R&D in Antiparasitic Combinations

3.4.2. Adoption of Biologics in Parasitic Treatment

3.4.3. Expansion of E-commerce in Antiparasitic Drugs Distribution

3.5. Regulatory Environment

3.5.1. FDA Antiparasitic Drug Regulations

3.5.2. Compliance Requirements for Veterinary Use

3.5.3. Certification Standards for Manufacturing

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Analysis

4. USA Antiparasitic Drugs Market Segmentation

4.1. By Drug Class (In Value %)

4.1.1. Antimalarials

4.1.2. Anthelmintics

4.1.3. Antiprotozoals

4.1.4. Ectoparasiticides

4.2. By Application (In Value %)

4.2.1. Human Parasitic Infections

4.2.2. Veterinary Parasitic Infections

4.3. By Route of Administration (In Value %)

4.3.1. Oral

4.3.2. Topical

4.3.3. Parenteral

4.4. By End-User (In Value %)

4.4.1. Hospitals and Clinics

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Antiparasitic Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. GlaxoSmithKline plc

5.1.2. Merck & Co., Inc.

5.1.3. Pfizer Inc.

5.1.4. Sanofi S.A.

5.1.5. Novartis AG

5.1.6. Bayer AG

5.1.7. Boehringer Ingelheim

5.1.8. Elanco Animal Health

5.1.9. Zoetis Inc.

5.1.10. Johnson & Johnson

5.1.11. F. Hoffmann-La Roche AG

5.1.12. Mylan N.V.

5.1.13. Cipla Inc.

5.1.14. Dr. Reddys Laboratories Ltd.

5.1.15. Sun Pharmaceutical Industries Ltd.

5.2. Cross Comparison Parameters (R&D Investment, Market Presence, Revenue Contribution, Geographic Reach, Product Portfolio, Therapeutic Focus, Brand Reputation, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Private Equity and Venture Capital Funding

6. USA Antiparasitic Drugs Market Regulatory Framework

6.1. FDA Guidelines and Approval Process

6.2. Quality Control and Compliance Standards

6.3. Certification and Labeling Requirements

7. USA Antiparasitic Drugs Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors for Projected Market Growth

8. USA Antiparasitic Drugs Future Market Segmentation

8.1. By Drug Class

8.2. By Application

8.3. By Route of Administration

8.4. By End-User

8.5. By Region

9. USA Antiparasitic Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Marketing Initiatives

9.3. Potential White Space Opportunities

9.4. Market Penetration and Diversification Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping the ecosystem of the USA antiparasitic drugs market, identifying all major stakeholders and factors influencing the market. Extensive desk research from verified secondary databases helps define critical variables.

Step 2: Market Analysis and Construction

Historical data compilation and analysis in this stage help establish a foundation for understanding market dynamics. Data on market penetration and revenue generation, validated through comparisons, form the backbone of the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert interviews with stakeholders from both pharmaceutical and veterinary sectors. This step provides insights into operational practices and financial trends.

Step 4: Research Synthesis and Final Output

Data from interviews, industry sources, and validated statistics are combined, allowing for a detailed and accurate report on the USA antiparasitic drugs market, covering both human and veterinary applications.

Frequently Asked Questions

01 How big is the USA Antiparasitic Drugs Market?

The USA antiparasitic drugs market is valued at USD 4.69 billion, driven by increasing cases of parasitic infections and rising awareness in both human and veterinary sectors.

02 What challenges exist in the USA Antiparasitic Drugs Market?

Challenges in USA antiparasitic drugs market include high R&D costs, stringent regulatory approval processes, and limited awareness in rural regions, impacting drug accessibility.

03 Who are the major players in the USA Antiparasitic Drugs Market?

Key players in USA antiparasitic drugs market include Pfizer Inc., Bayer AG, Merck & Co., Inc., Zoetis Inc., and Sanofi S.A., dominating due to their extensive R&D and distribution networks.

04 What drives the growth of the USA Antiparasitic Drugs Market?

The USA antiparasitic drugs market growth is fueled by the rise in zoonotic diseases, increased pet ownership, and government initiatives supporting veterinary health.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.