USA Architectural Services Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3594

October 2024

92

About the Report

USA Architectural Services Market Overview

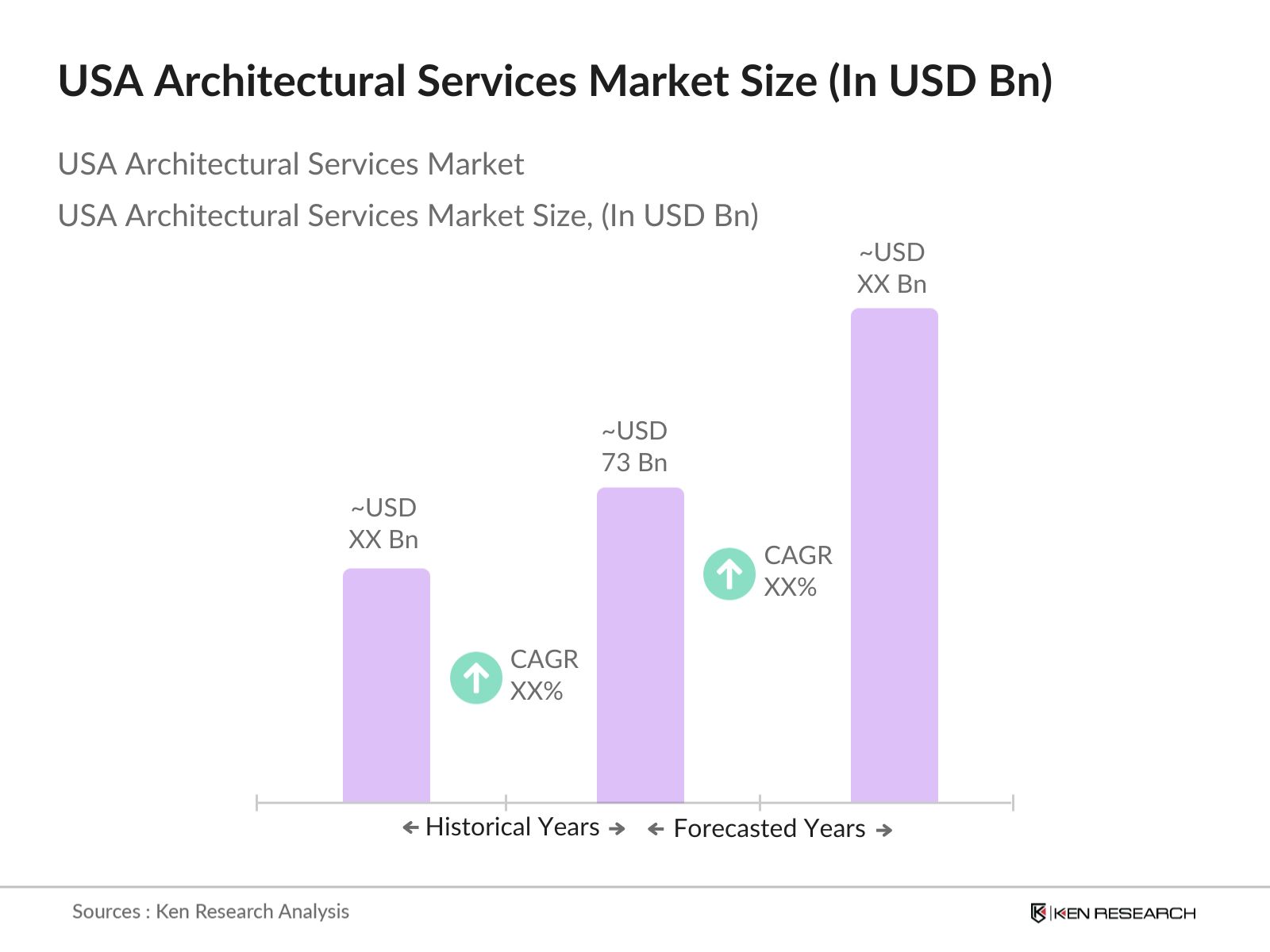

- The USA Architectural Services Market is valued at USD 73 billion, according to a recent report, and this value is influenced by the increased demand for green building practices and sustainable architectural designs. The growing emphasis on energy-efficient and environmentally friendly buildings has led to a rise in projects utilizing architectural services, particularly in sectors like healthcare and education. Additionally, the demand for construction and project management services remains robust, further boosting the market's size.

- The major cities driving growth in the architectural services market include New York, Los Angeles, and Chicago. These cities are characterized by a high concentration of commercial real estate developments, headquarters of leading architectural firms, and a favorable regulatory environment promoting modern, sustainable construction. The dominance of these cities is also due to their role as hubs for major industrial and residential construction projects, making them central to architectural activities in the USA.

- Compliance with green building standards such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) is mandatory for many new projects in the US. These standards focus on sustainable building practices, energy efficiency, and reduced environmental impact. The World Banks reports indicate that sustainable building standards are becoming the norm across developed nations, including the US, as part of broader efforts to curb climate change.

USA Architectural Services Market Segmentation

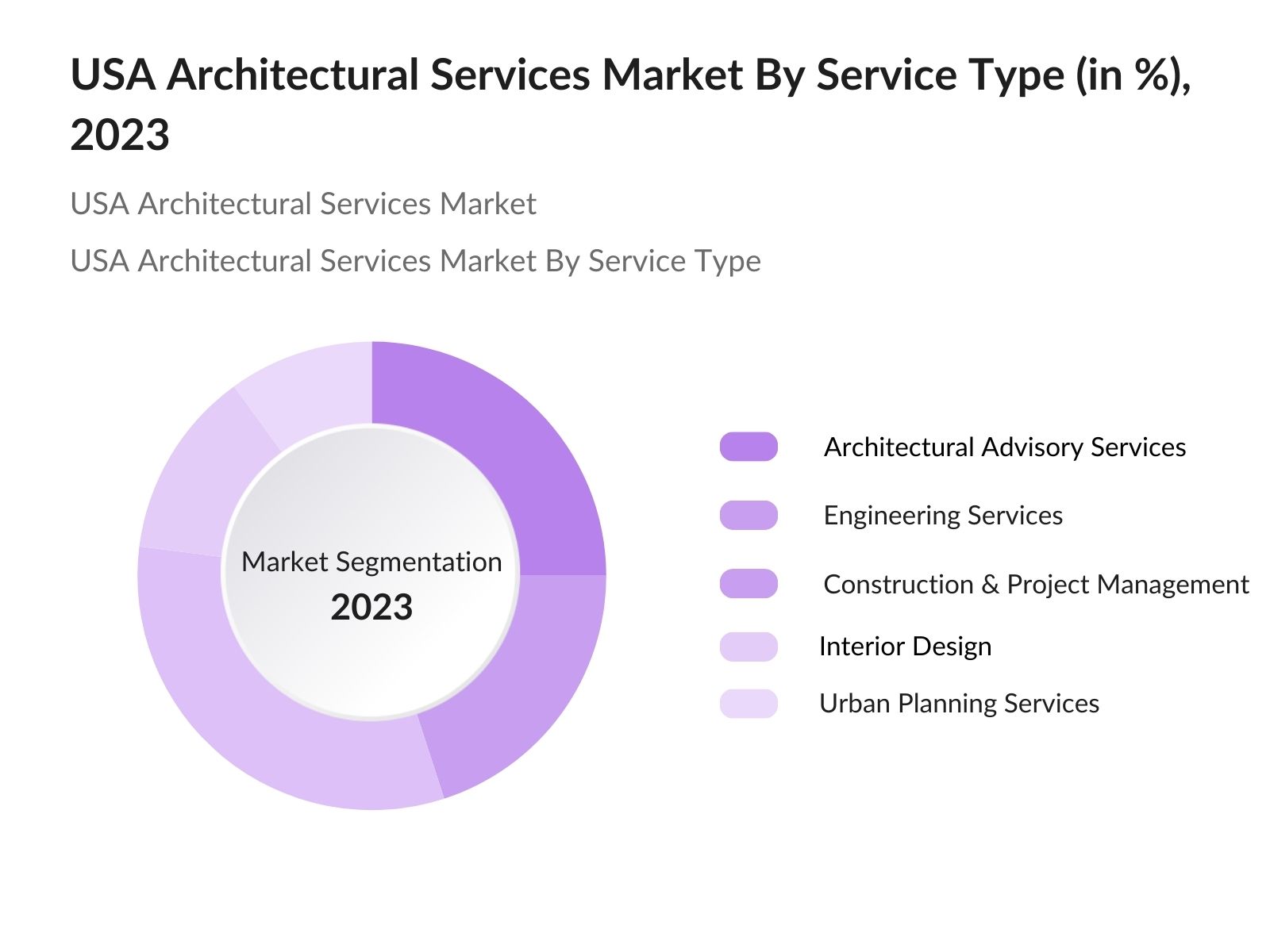

By Service Type: The USA Architectural Services Market is segmented by service type into architectural advisory services, engineering services, construction & project management, interior design, and urban planning services. Recently, construction & project management services have gained a dominant market share under this segmentation. This is due to the extensive rise in building activities, coupled with the necessity to manage project lifecycles effectively, from planning to execution.

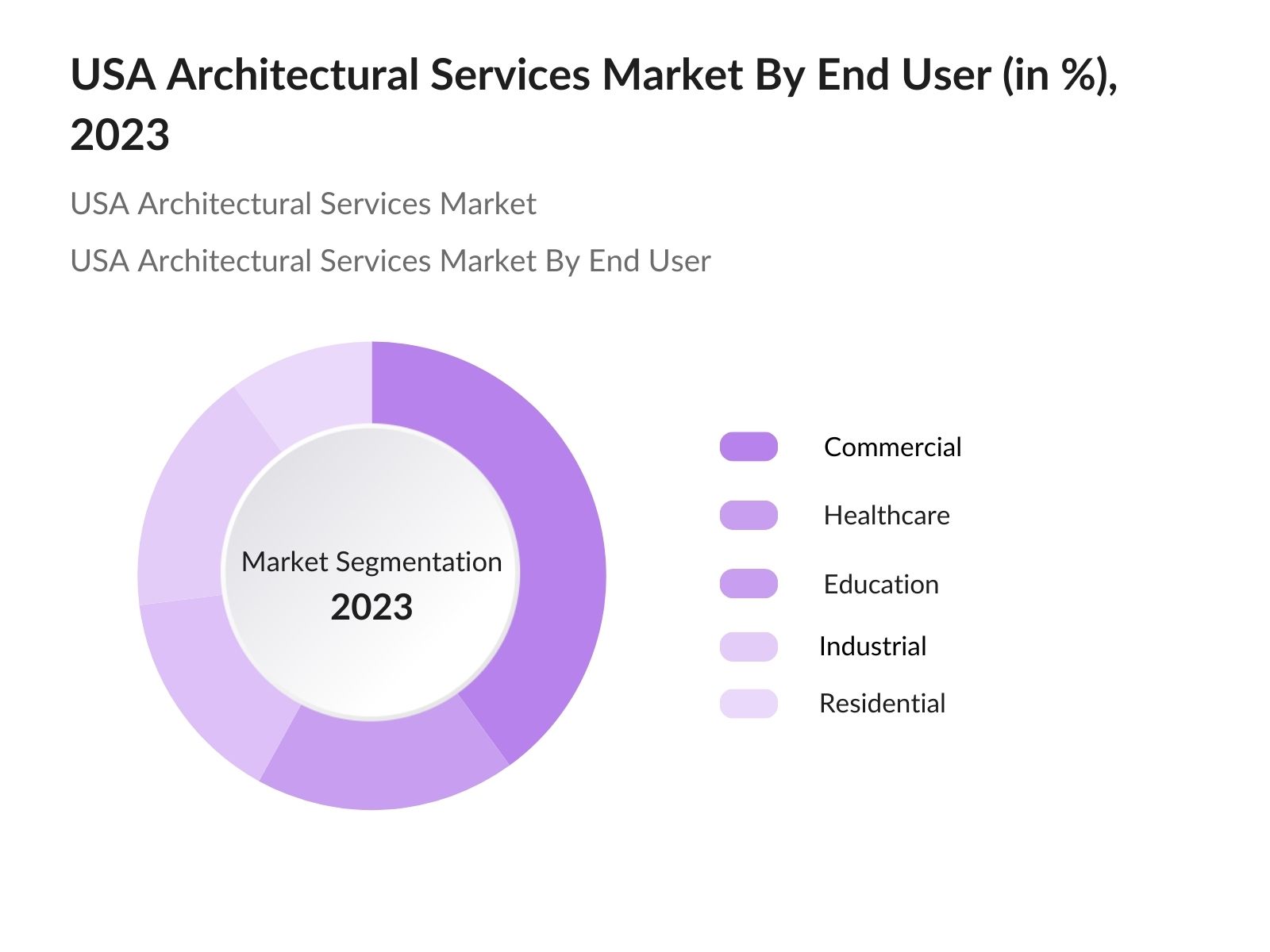

By End User: The market is also segmented by end-use into commercial, healthcare, education, industrial, and residential sectors. The commercial segment has a dominant market share in 2023, driven by rapid commercial real estate development and urbanization. With the increasing demand for innovative, functional, and aesthetically pleasing office spaces and retail environments, commercial construction projects require specialized architectural services.

USA Architectural Services Market Competitive Landscape

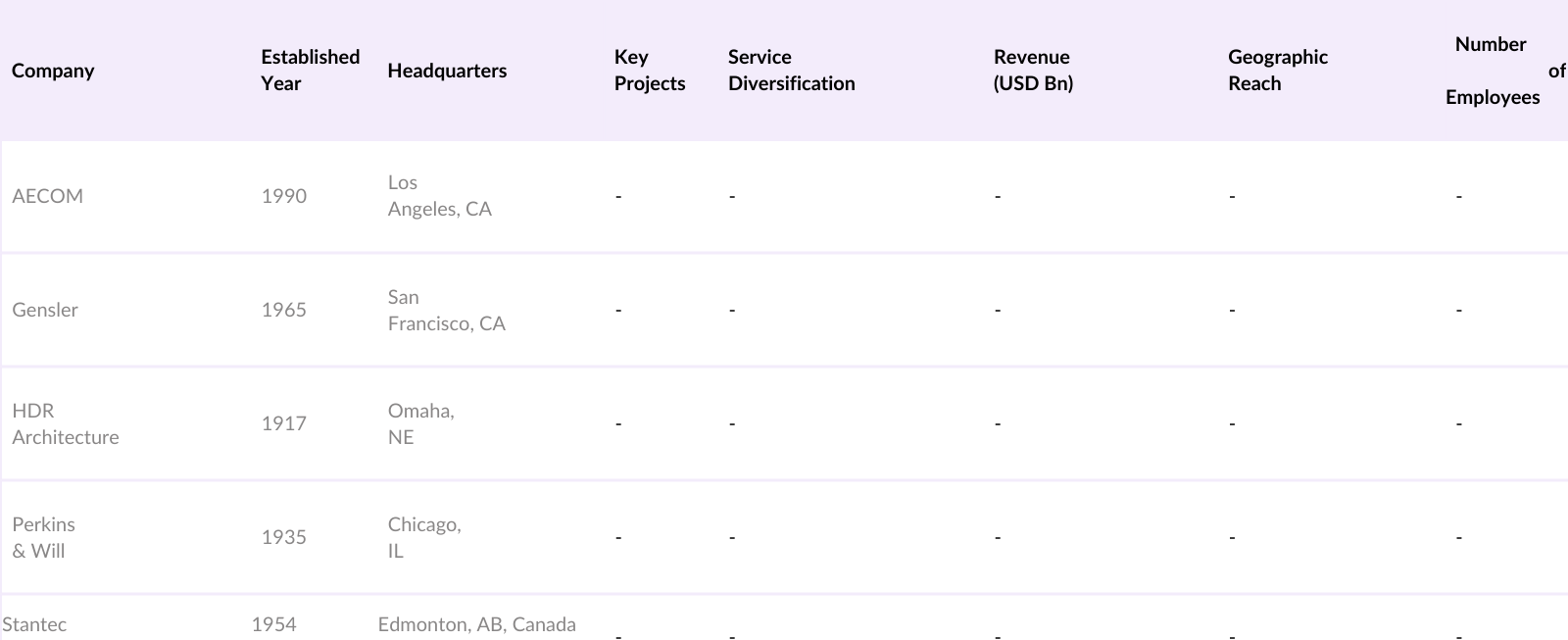

The USA Architectural Services Market is highly competitive, with the presence of numerous prominent players such as AECOM, Gensler, and HDR Architecture, Inc. These companies hold a strong position in the market due to their diverse service offerings, extensive experience, and large project portfolios. The competitive environment is characterized by frequent mergers and acquisitions, partnerships, and expansions, as firms seek to enhance their market presence and leverage synergies.

USA Architectural Services Industry Analysis

Growth Drivers

- Increase in Sustainable Building Practices: The focus on sustainable building practices in the United States is driven by the need for energy efficiency and reduced carbon emissions. With cities accounting for over 70% of global greenhouse gas emissions and consuming nearly two-thirds of the worlds energy, there has been a push towards sustainable construction and retrofitting initiatives in the US. Recent policies have supported the development of low-carbon buildings and green construction.

- Rise in Demand for Healthcare and Industrial Projects: The demand for healthcare facilities and industrial construction has surged due to increased investments in healthcare infrastructure and advancements in manufacturing. The US healthcare industry is currently undergoing rapid development, with the addition of new hospitals and healthcare centers to meet the growing need for medical services. Similarly, the industrial sector is expanding, driven by the rise in domestic manufacturing and production capabilities.

- Expansion of Educational Facilities: The expansion of educational infrastructure in the US is another significant growth driver. The US Department of Education has been focusing on upgrading existing educational facilities and building new institutions to accommodate the rising student population. Investments in school infrastructure, including sustainable construction methods, are increasingly prioritized to create energy-efficient and climate-resilient educational environments.

Market Challenges

- High Cost of Professional Architectural Services: The high cost of architectural services remains a challenge due to the rising expenses related to labor, compliance with sustainable building practices, and the integration of advanced technologies like 3D modeling. For instance, the World Bank highlights that infrastructure financing needs to grow globally to meet sustainable development goals. This high financial demand contributes to the elevated costs associated with professional architectural services in the US, particularly when incorporating new technologies and green building standards.

- Complex Legal and Compliance Requirements: Architectural services in the US face complex legal and compliance requirements, particularly around sustainable construction and environmental impact assessments. Compliance with standards like LEED (Leadership in Energy and Environmental Design) and adherence to federal and state-level regulations adds to the complexity and cost of projects. The World Bank notes that cities are expected to play a crucial role in climate adaptation and mitigation, which places additional regulatory burdens on new constructions.

USA Architectural Services Market Future Outlook

Over the next few years, the USA Architectural Services Market is expected to witness substantial growth driven by advancements in sustainable building technologies and rising demand for specialized architectural services across diverse sectors. Increasing investments in the healthcare and industrial segments, along with urban development initiatives, are anticipated to fuel this growth. Additionally, the integration of new technologies like 3D printing, Building Information Modeling (BIM), and artificial intelligence in architectural designs will further expand the capabilities and applications of architectural services, contributing to the market's overall expansion.

Market Opportunities

- Adoption of Advanced Architectural Software: The adoption of advanced architectural software, such as Building Information Modeling (BIM), presents significant opportunities for the architectural services market. The World Bank has been promoting digital transformation in infrastructure development, which supports the use of advanced software solutions to enhance efficiency and project management capabilities. By integrating BIM and other digital tools, firms can streamline project design and execution, reduce errors, and ensure compliance with sustainability standards.

- Urban Revitalization and Smart City Initiatives: Urban revitalization and smart city initiatives are key growth areas in the US architectural services market. The World Banks urban development strategy emphasizes the need for cities to become more sustainable, resilient, and inclusive through smart urban planning and revitalization of disinvested neighborhoods. In the US, various cities have launched initiatives to rejuvenate urban spaces, incorporate smart technologies, and develop green infrastructure.

Scope of the Report

|

Service Type |

Architectural Advisory Services |

|

End Use |

Commercial |

|

Region |

Northeast |

Products

Key Target Audience

Real Estate Developers and Contractors

Government and Regulatory Bodies (U.S. Environmental Protection Agency, U.S. Department of Housing and Urban Development)

Construction Companies

Architectural Firms

Engineering and Consulting Companies

Healthcare Infrastructure Providers

Industrial Project Developers

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

AECOM

Gensler

HDR Architecture, Inc.

Perkins and Will

Perkins Eastman

Stantec

HKS, Inc.

HOK

Foster + Partners

CannonDesign

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Architectural Services Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Architectural Services Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Sustainable Building Practices

3.1.2. Rise in Demand for Healthcare and Industrial Projects

3.1.3. Expansion of Educational Facilities

3.2. Market Challenges

3.2.1. High Cost of Professional Architectural Services

3.2.2. Complex Legal and Compliance Requirements

3.3. Opportunities

3.3.1. Adoption of Advanced Architectural Software

3.3.2. Urban Revitalization and Smart City Initiatives

3.4. Trends

3.4.1. Integration of 3D Design and Building Information Modeling (BIM)

3.4.2. Focus on Green Architecture and Energy Efficiency

3.5. Government Regulations and Standards

3.5.1. Compliance with Green Building Standards (LEED, BREEAM)

3.5.2. Adoption of Federal and State-Level Sustainability Regulations

3.6. SWOT Analysis

3.7. Industry Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Stakeholder Ecosystem

4. USA Architectural Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Architectural Advisory Services

4.1.2. Engineering Services

4.1.3. Construction and Project Management

4.1.4. Interior Design

4.1.5. Urban Planning Services

4.2. By End Use (In Value %)

4.2.1. Commercial

4.2.2. Healthcare

4.2.3. Education

4.2.4. Industrial

4.2.5. Residential

4.3. By Region (In Value %)

4.3.1. Northeast

4.3.2. Midwest

4.3.3. South

4.3.4. West

5. USA Architectural Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AECOM

5.1.2. Gensler

5.1.3. HDR Architecture, Inc.

5.1.4. Perkins and Will

5.1.5. Perkins Eastman

5.1.6. Stantec

5.1.7. HKS, Inc.

5.1.8. HOK

5.1.9. Foster + Partners

5.1.10. CannonDesign

5.1.11. Jacobs Engineering Group

5.1.12. Arcadis IBI Group

5.1.13. LMN Architects

5.1.14. ZGF Architects

5.1.15. CallisonRTKL

5.2. Cross Comparison Parameters (Company Size, Market Reach, Service Diversification, Revenue Share, Growth Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, Partnerships, Expansions)

5.5. Investment Analysis (Venture Capital, Private Equity)

5.6. Funding and Grants

6. USA Architectural Services Market Regulatory Framework

6.1. Environmental Standards and Certifications

6.2. Compliance Requirements for Green Architecture

6.3. Federal and State Regulations

7. USA Architectural Services Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Architectural Services Market Segmentation Forecast

8.1. By Service Type

8.2. By End Use

8.3. By Region

9. USA Architectural Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Architectural Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the USA Architectural Services Market is compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple architectural firms to acquire detailed insights into service segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Architectural Services Market.

Frequently Asked Questions

01. How big is the USA Architectural Services Market?

The USA Architectural Services Market is valued at USD 73 billion, according to a recent report, and this value is influenced by the increased demand for green building practices and sustainable architectural designs.

02. What are the challenges in the USA Architectural Services Market?

The USA Architectural Services market challenges include navigating complex legal and compliance requirements, high costs associated with professional architectural services, and the integration of new technology in traditional design processes.

03. Who are the major players in the USA Architectural Services Market?

Key players in the USA Architectural Services market include AECOM, Gensler, HDR Architecture, Inc., Perkins and Will, and Stantec. These companies dominate due to their extensive project portfolios, market reach, and strong service offerings.

04. What are the growth drivers of the USA Architectural Services Market?

The USA Architectural Services market is propelled by the rising demand for green and energy-efficient buildings, increased construction activities in the commercial and healthcare sectors, and advancements in design technology such as 3D modeling and BIM.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.