USA Articulated Robot Market Outlook to 2030

Region:North America

Author(s):Samanyu

Product Code:KROD7089

November 2024

85

About the Report

USA Articulated Robot Market Overview

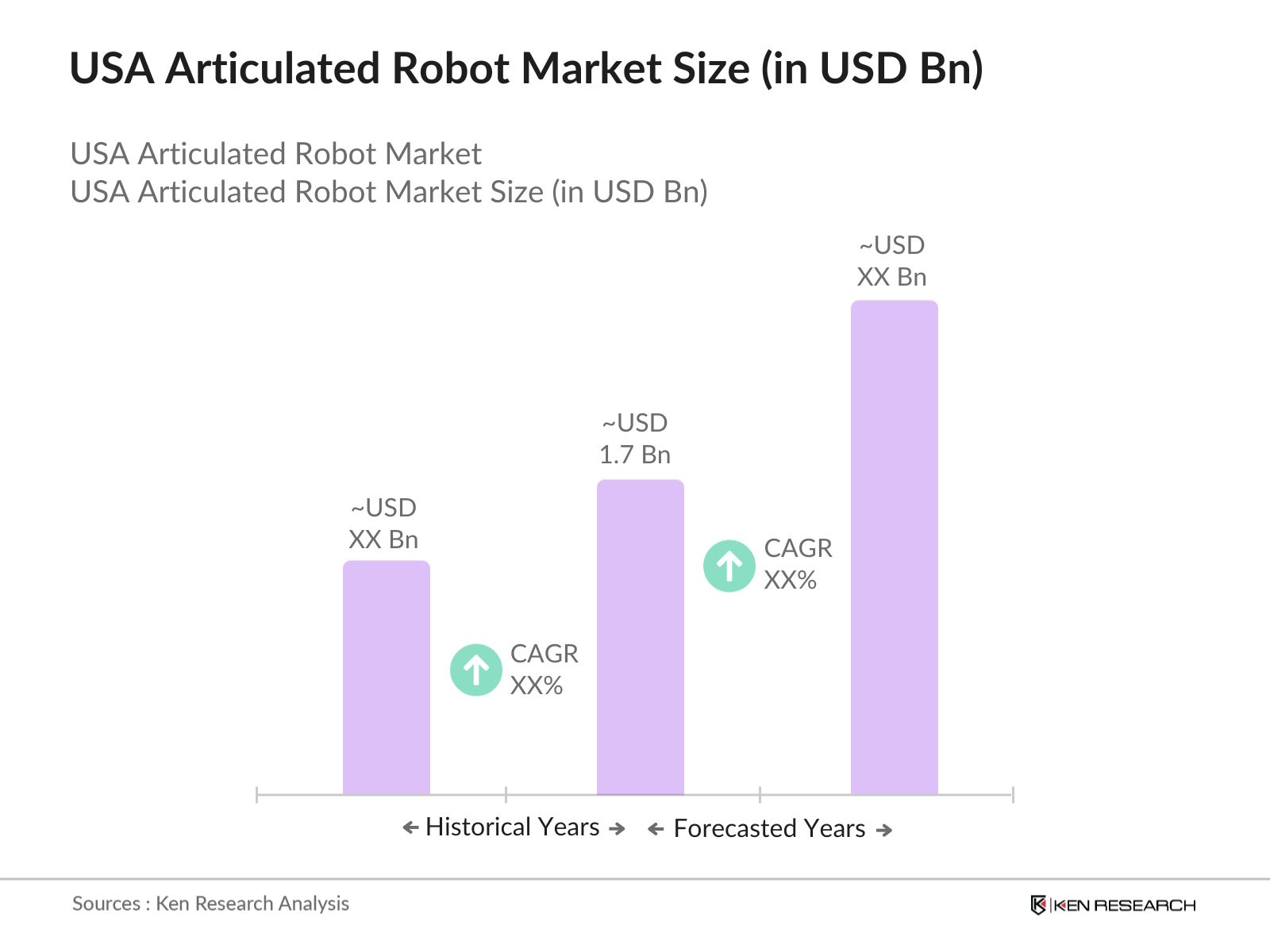

- The USA Articulated Robot market is valued at USD 1.7 Bn, based on a five-year historical analysis. The market is witnessing accelerated growth due to technological advancements, which enable more sophisticated robotic applications and increased investments in automation technologies by companies seeking efficiency and cost reduction. This transition is further supported by government initiatives promoting advanced manufacturing practices and workforce training in automation technologies.

- Cities such as Detroit, Los Angeles, and Houston are key players in the articulated robot market due to their robust manufacturing sectors. Detroit's automotive industry, for instance, has embraced robotic automation to enhance production efficiency, while Los Angeles is a hub for technology and logistics, driving demand for articulated robots in warehouse automation. These urban centers are characterized by a high concentration of industries that leverage robotics to maintain competitive advantages and streamline operations.

- Customization is becoming a key trend in manufacturing, driven by consumer demand for personalized products. In 2023, about 40% of manufacturers reported a shift toward more customized production processes. Articulated robots enable manufacturers to adapt quickly to changing consumer preferences, allowing for flexible production lines capable of handling varying product designs. The ability to implement automated systems that can easily reconfigure for different tasks will enhance efficiency and reduce downtime. As customization continues to rise, the demand for articulated robots that support diverse manufacturing capabilities will become increasingly critical to meet market needs.

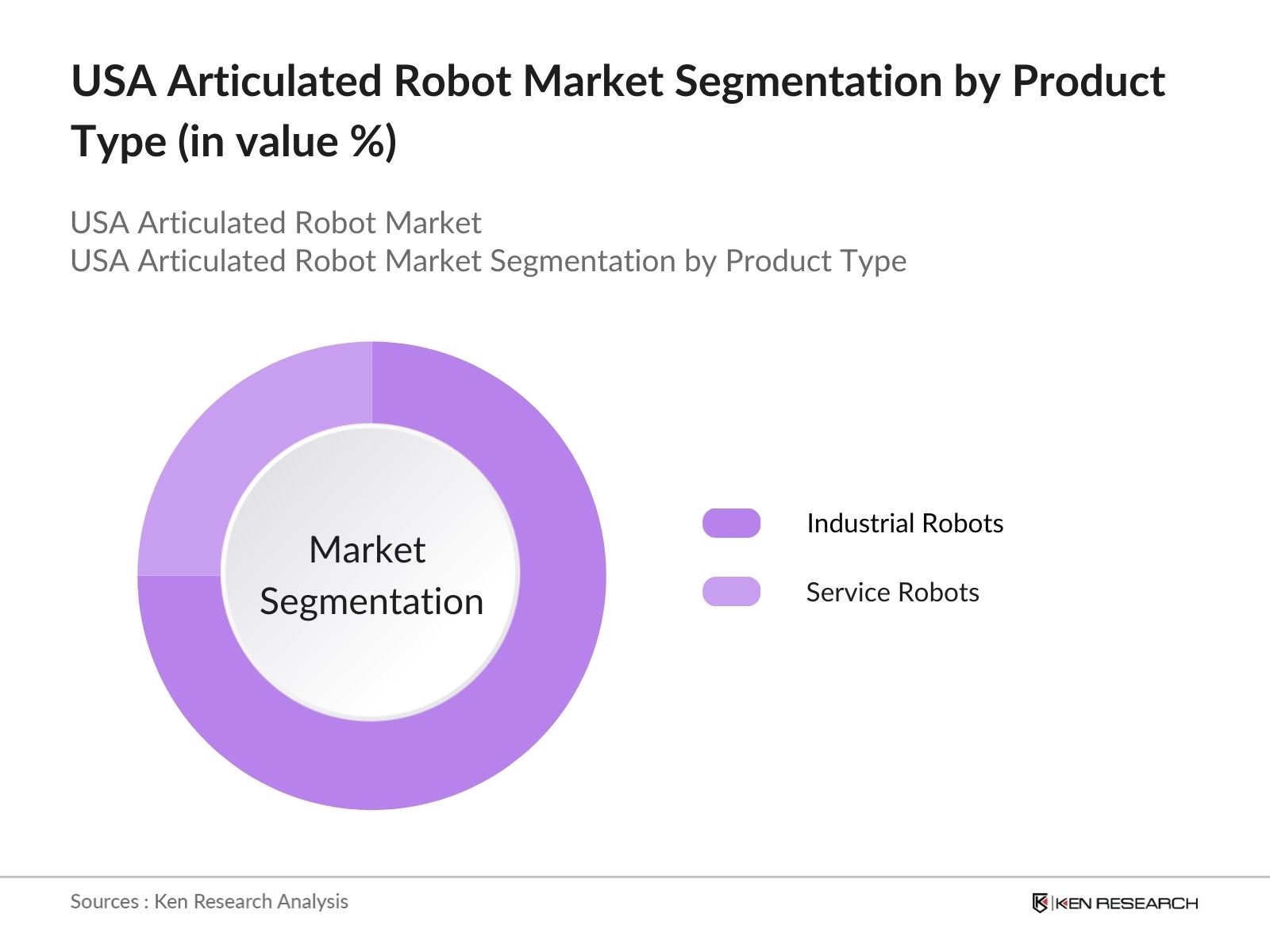

USA Articulated Robot Market Segmentation

By Product Type: The market is segmented by product type into industrial robots and service robots. Industrial robots have a significant market share, representing huge market share. The dominance of this segment is primarily attributed to the widespread adoption of robots in manufacturing processes, particularly in the automotive and electronics industries. Industrial robots enhance production efficiency, reduce labor costs, and ensure high precision, making them indispensable in modern manufacturing.

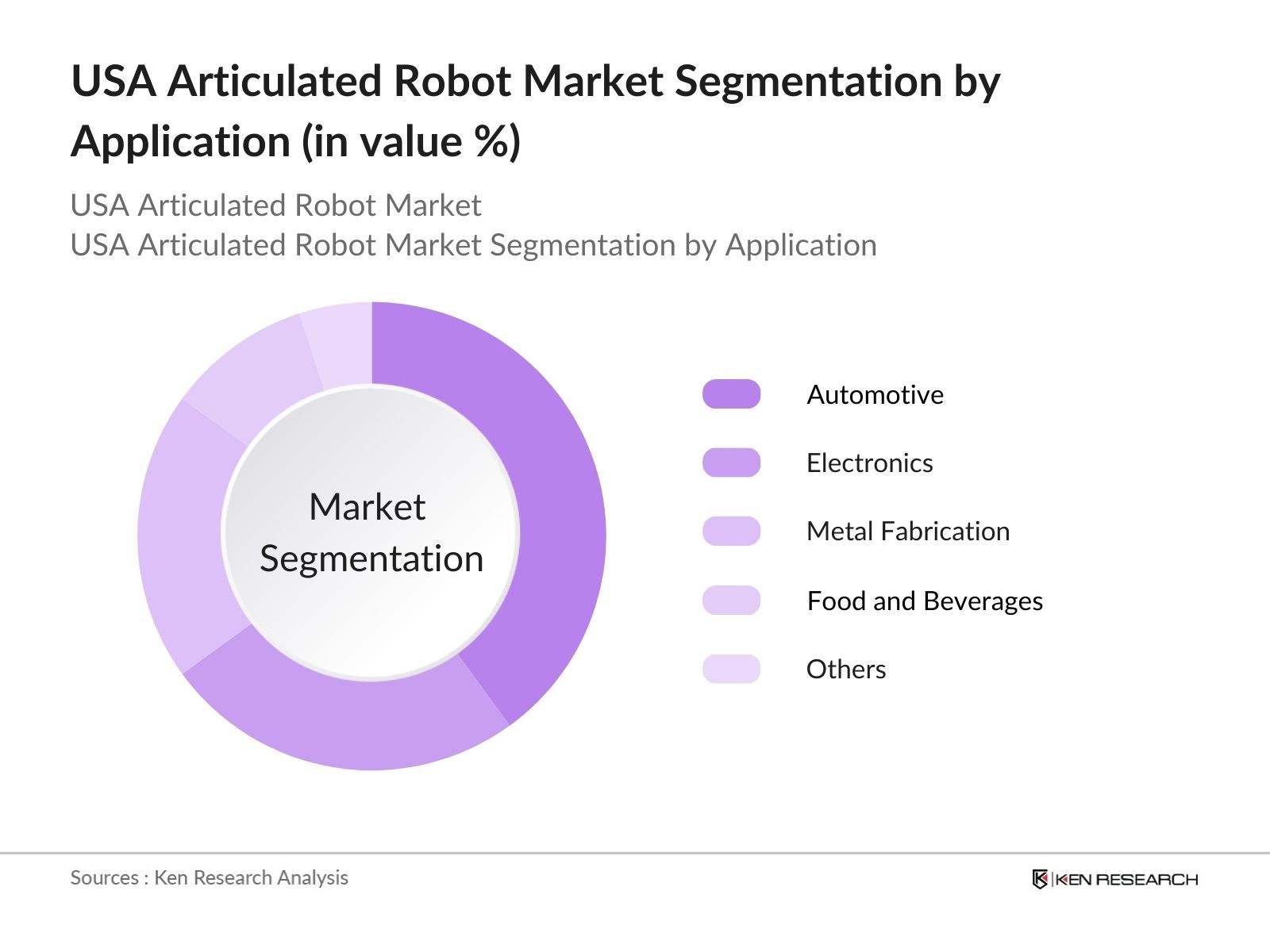

By Application: The market is also segmented by application into automotive, electronics, metal fabrication, food and beverages, and others. The automotive segment dominates this market. This is due to the automotive industry's reliance on articulated robots for tasks such as welding, painting, and assembly, which demand high precision and consistency. As electric vehicle production increases, the demand for articulated robots in this segment is expected to further escalate.

USA Articulated Robot Market Competitive Landscape

The USA articulated robot market is characterized by a mix of established global players and emerging local manufacturers. Key players include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation. The consolidation among these major companies reflects their strong brand presence, extensive product portfolios, and significant investments in research and development, enabling them to maintain a competitive edge in the rapidly evolving robotics landscape.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Partnerships |

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

||||||

|

FANUC Corporation |

1956 |

Oshino, Japan |

||||||

|

KUKA AG |

1898 |

Augsburg, Germany |

||||||

|

Yaskawa Electric Corp. |

1915 |

Kitakyushu, Japan |

||||||

|

Mitsubishi Electric Corp. |

1921 |

Tokyo, Japan |

USA Articulated Robot Industry Analysis

Growth Drivers

- Rising Demand for Automation: The demand for automation in the U.S. manufacturing sector is projected to increase significantly, driven by the need for improved efficiency and reduced labor costs. In 2022, the manufacturing sector contributed $2.4 trillion to the U.S. economy, accounting for about 8% of the GDP. The U.S. manufacturing output has been growing steadily, with a value of around $2.38 trillion in 2022, showcasing a robust recovery post-pandemic. As companies look to streamline operations, investments in automation technologies are expected to surge, supported by the U.S. Bureau of Labor Statistics predicting a continued decline in manufacturing employment, leading firms to adopt robotic solutions for increased productivity.

- Increased Investment in Industrial Automation: Investment in industrial automation in the U.S. reached approximately $200 billion in 2023, reflecting a strong commitment to modernizing manufacturing processes. The National Association of Manufacturers (NAM) reported that around 70% of manufacturers planned to increase their automation investments in 2023. This trend is bolstered by government initiatives aimed at fostering innovation and productivity within the manufacturing sector. The U.S. economy is anticipated to witness a growth rate of 2.1% in 2024, further incentivizing manufacturers to automate operations to maintain competitive advantage, streamline production, and reduce operational costs.

- Government Incentives for Advanced Manufacturing: U.S. government initiatives are promoting advanced manufacturing through financial incentives and grants. The Manufacturing USA initiative has allocated over $1 billion to support advanced manufacturing technologies, including robotics and automation, in the past few years. Additionally, the CHIPS and Science Act provides $52 billion for semiconductor research and manufacturing, indirectly enhancing the automation landscape as companies seek to optimize production lines. The Biden administrations goal of achieving 500,000 new manufacturing jobs by 2025 further underscores the commitment to fostering a conducive environment for automated systems, highlighting the critical role of articulated robots in future manufacturing strategies.

Market Challenges

- Skilled Labor Shortages: The shortage of skilled labor in the U.S. is hampering the effective implementation of articulated robots. As of 2023, the U.S. manufacturing sector faced a talent gap, with about 1.4 million jobs expected to remain unfilled by 2025, according to the Manufacturing Institute. The complexity of operating and maintaining robotic systems requires a skilled workforce, yet the education and training programs are not producing enough qualified technicians. This skilled labor deficit can delay automation projects, as companies struggle to find personnel who can effectively manage robotic technology, thus impacting the overall growth trajectory of the articulated robot market.

- Integration Complexities: Integrating articulated robots into existing manufacturing processes presents significant challenges. As companies adopt new robotic technologies, they often encounter issues related to system compatibility, requiring extensive adjustments to legacy systems. In 2023, it was reported that nearly 30% of manufacturers faced difficulties in integrating automation due to these complexities. The National Institute of Standards and Technology (NIST) highlighted that misalignment between existing processes and new automation solutions can lead to inefficiencies, hindering productivity gains. Consequently, these integration challenges may discourage companies from investing in articulated robots, stunting market growth.

USA Articulated Robot Market Future Outlook

Over the next five years, the USA articulated robot market is expected to experience growth, driven by ongoing technological advancements, increasing demand for automation in various industries, and enhanced efficiency in manufacturing processes. Continuous government support for advanced manufacturing, coupled with an expanding application base for articulated robots across sectors such as automotive, healthcare, and logistics, will likely fuel market expansion.

Future Market Opportunities

- Advancements in AI and Robotics: The ongoing advancements in artificial intelligence (AI) and robotics are set to redefine the articulated robot market. In 2023, the global AI market was valued at approximately $200 billion and is expected to reach around $300 billion by 2025. These technologies enhance the capabilities of articulated robots, allowing for greater precision, adaptability, and efficiency in manufacturing processes. With AI integration, robots can learn from their environments, optimizing performance in real-time. As industries adopt these advanced systems, the demand for sophisticated articulated robots will rise, providing ample growth opportunities for manufacturers in the U.S. market.

- Growth of Collaborative Robots (Cobots): The increasing popularity of collaborative robots (cobots) is driving new growth opportunities within the articulated robot market. As of 2023, the cobot market was estimated at $1.1 billion and is projected to experience substantial growth, driven by the demand for safer, more flexible automation solutions. These robots are designed to work alongside human operators, enhancing productivity without the need for extensive safety measures. As U.S. manufacturers focus on creating more collaborative work environments, the demand for articulated cobots is expected to rise significantly, further bolstering the overall articulated robot market.

Scope of the Report

|

By Product Type |

Industrial Robots Service Robots |

|

By Application |

Automobile Electronics Fabrications Food and Beverages Others |

|

By Payload |

Up to 16 Kg 16 to 60 Kg 60 to 225 Kg More than 225 Kg |

|

By Function |

Handling Welding Dispensing Assembling |

|

By Type |

4-Axis or Less 5-Axis 6-Axis or More |

|

By Component |

Controllers Arms End Effectors |

|

By End User |

Automotive Electrical and Electronics Chemicals, Rubber, and Plastics Pharmaceuticals and Cosmetics |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automation Solution Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Labor, OSHA)

Supply Chain and Logistics Companies

System Integrators

Banks and Financial Institutes

End User Industries

Industry Associations (Robotics Industries Association)

Research and Development Institutions

Companies

Major Players

ABB Ltd.

FANUC Corporation

KUKA AG

Yaskawa Electric Corporation

Mitsubishi Electric Corporation

Denso Corporation

Kawasaki Heavy Industries Ltd.

Universal Robots

Omron Adept Technology

Seiko Epson Corporation

Nachi-Fujikoshi Corp.

Aurotek Corporation

Nimak GmbH

Rethink Robotics

Stubli Robotics

Table of Contents

1. USA Articulated Robot Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Market Segmentation, Classification)

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview (Key Metrics)

2. USA Articulated Robot Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Articulated Robot Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Automation

3.1.2. Increased Investment in Industrial Automation

3.1.3. Government Incentives for Advanced Manufacturing

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Skilled Labor Shortages

3.2.3. Integration Complexities

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Advancements in AI and Robotics

3.3.3. Growth of Collaborative Robots (Cobots)

3.4. Trends

3.4.1. Increased Use in E-commerce and Logistics

3.4.2. Customization in Manufacturing

3.4.3. Sustainability Initiatives

3.5. Regulatory Landscape

3.5.1. Safety Standards (ISO, ANSI)

3.5.2. Compliance Requirements

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape Overview

4. USA Articulated Robot Market Segmentation

4.1. By Payload (In Value %)

4.1.1. Up to 16 Kg

4.1.2. 16 to 60 Kg

4.1.3. 60 to 225 Kg

4.1.4. More than 225 Kg

4.2. By Function (In Value %)

4.2.1. Handling

4.2.2. Welding

4.2.3. Dispensing

4.2.4. Assembling

4.3. By Type (In Value %)

4.3.1. 4-Axis or Less

4.3.2. 5-Axis

4.3.3. 6-Axis or More

4.4. By Component (In Value %)

4.4.1. Controllers

4.4.2. Arms

4.4.3. End Effectors

4.5. By End-Use Industry (In Value %)

4.5.1. Automotive

4.5.2. Electrical and Electronics

4.5.3. Chemicals, Rubber, and Plastics

4.5.4. Pharmaceuticals and Cosmetics

4.6 By Product Type (In Value %)

4.6.1 Industrial Robot

4.6.2 Service Robot

4.7 By Application (In Value %)

4.7.1 Automobile

4.7.2 Electronics

4.7.3 Fabrications

4.7.4 Food and Beverages

4.7.5 Others

5. USA Articulated Robot Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. FANUC Corporation

5.1.3. KUKA AG

5.1.4. Mitsubishi Electric Corporation

5.1.5. Yaskawa Electric Corporation

5.1.6. Denso Corporation

5.1.7. Kawasaki Heavy Industries Ltd.

5.1.8. Omron Adept Technology

5.1.9. Seiko Epson Corporation

5.1.10. Nachi-Fujikoshi Corp.

5.1.11. Aurotek Corporation

5.1.12. Nimak GmbH

5.1.13. Universal Robots

5.1.14. Stubli Robotics

5.1.15. Rethink Robotics

5.2. Cross Comparison Parameters (Market Share, Revenue, Number of Employees)

5.3. Strategic Initiatives and Innovations

5.4. Mergers and Acquisitions

5.5. Investment Analysis (Venture Capital, Private Equity)

6. USA Articulated Robot Market Regulatory Framework

6.1. Environmental and Safety Regulations

6.2. Compliance Requirements for Manufacturers

6.3. Certification Processes

7. USA Articulated Robot Market Future Outlook

7.1. Future Market Size Projections (In USD Bn)

7.2. Key Factors Driving Future Growth

8. Future Market Segmentation

8.1. By Payload (In Value %)

8.2. By Function (In Value %)

8.3. By Type (In Value %)

8.4. By Component (In Value %)

8.5. By End-Use Industry (In Value %)

8.6 By Product Type (In Value %)

8.7 By Application (In Value %)

9. Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Strategic Positioning Recommendations

9.3. Market Penetration Strategies

9.4. Technology Adoption Roadmap

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA articulated robot market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the USA articulated robot market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple articulated robot manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA articulated robot market.

Frequently Asked Questions

01. How big is the USA Articulated Robot Market?

The USA articulated robot market is valued at USD 1.7 billion, driven by rising automation demand and increasing investments in advanced manufacturing technologies.

02. What are the challenges in the USA Articulated Robot Market?

Challenges in the USA articulated robot market include high initial costs, a shortage of skilled labor, and integration complexities. Companies must navigate these hurdles to leverage robotic solutions effectively.

03. Who are the major players in the USA Articulated Robot Market?

Key players in the USA articulated robot market include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation. These companies dominate due to their extensive product offerings and technological innovations.

04. What are the growth drivers of the USA Articulated Robot Market?

The USA articulated robot market is propelled by factors such as increasing automation in manufacturing, advancements in robotics technology, and government initiatives supporting advanced manufacturing practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.