USA Atmospheric Water Generator Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7931

December 2024

81

About the Report

USA Atmospheric Water Generator Market Overview

- The USA Atmospheric Water Generator (AWG) Market is currently valued at USD 204 million, based on a five-year historical analysis. This market is driven by increasing demand for clean water solutions amidst the growing concerns of water scarcity, especially in drought-affected regions. The rapid depletion of groundwater and declining surface water sources are key drivers propelling the adoption of AWGs. Additionally, technological advancements have made these systems more energy-efficient, further supporting market expansion.

- In the USA, California, Texas, and Arizona are dominant regions for atmospheric water generators due to their frequent drought conditions and growing urban populations. These states have implemented stringent water conservation regulations, pushing industries and municipalities to invest in sustainable water generation technologies. Additionally, the favorable climatic conditions, especially in regions with high humidity, make AWGs a viable option for water generation.

- The U.S. government offers renewable energy incentives that benefit AWG systems powered by solar or wind energy. In 2024, federal tax credits for renewable energy systems were extended, allowing businesses to claim up to 30% of installation costs for solar-powered AWGs. Additionally, states like California and Arizona have implemented water usage regulations that favor technologies promoting water conservation. AWGs are being recognized as part of broader water management policies, encouraging their adoption in areas with strict water conservation measures.

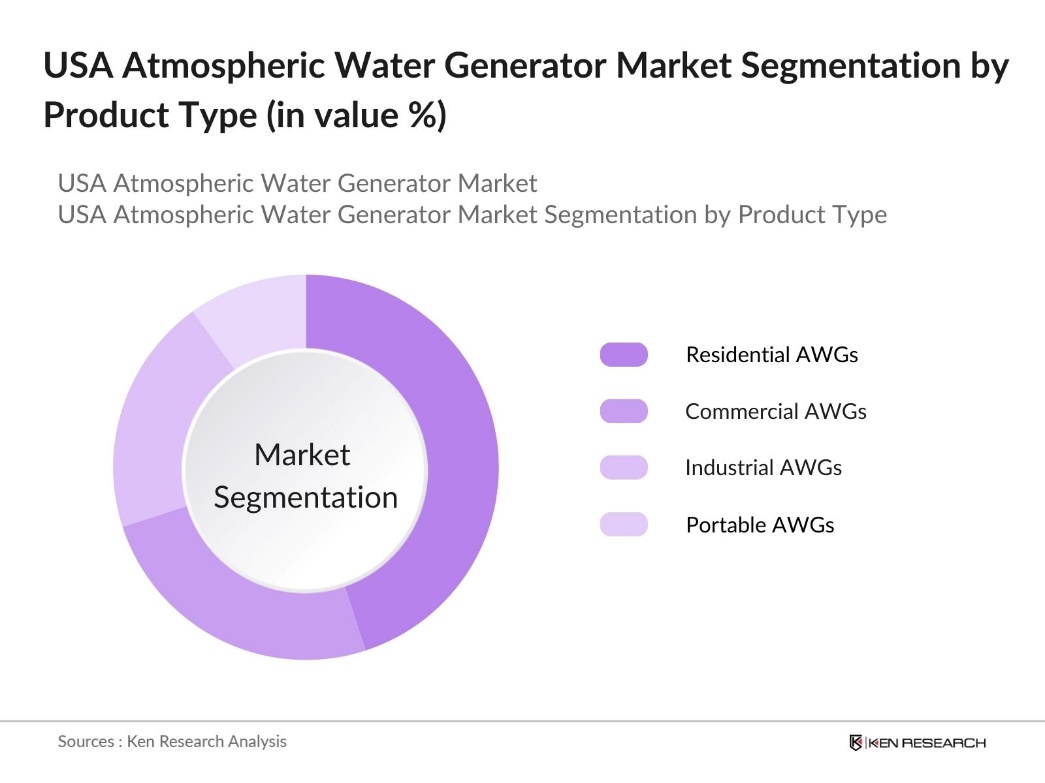

USA Atmospheric Water Generator Market Segmentation

By Product Type: The USA Atmospheric Water Generator market is segmented by product type into residential AWGs, commercial AWGs, industrial AWGs, and portable AWGs. The Residential atmospheric water generators dominate the product type segment, as more households are adopting these devices to ensure access to clean drinking water, especially in areas where traditional water supply systems are unreliable or compromised. The rising awareness among homeowners regarding water scarcity and the cost savings associated with these systems further bolster this segment's dominance.

By Technology: The USA Atmospheric Water Generator market is segmented by technology into cooling condensation technology, wet desiccation technology, and hybrid systems. The Cooling condensation technology is the leading sub-segment under technology, mainly due to its widespread use in both residential and commercial applications. This technology is favored for its efficiency and ability to generate significant volumes of water, even in regions with low humidity. With innovations aimed at reducing energy consumption, cooling condensation technology continues to hold the largest market share.

USA Atmospheric Water Generator Market Competitive Landscape

The USA Atmospheric Water Generator market is dominated by both domestic and international players who have established a strong presence in the market. The competition is characterized by innovations in technology, energy efficiency, and product scalability. Other prominent players like EcoloBlue and Drinkable Air Technologies focus on affordable and energy-efficient products, catering to the growing demand from the residential sector.

|

Company Name |

Establishment Year |

Headquarters |

No. of Patents |

Product Range |

Water Output |

Energy Efficiency |

Market Penetration |

Pricing Strategy |

Innovation Index |

|

Watergen Inc. |

2009 |

USA |

|||||||

|

EcoloBlue, Inc. |

2007 |

USA |

|||||||

|

Drinkable Air Technologies |

2010 |

USA |

|||||||

|

Dewpoint Manufacturing |

2012 |

Canada |

|||||||

|

SkyWater Air Water Machines |

2013 |

USA |

USA Atmospheric Water Generator Industry Analysis

Growth Drivers

- Rising Demand for Sustainable Water Solutions: In the USA, water scarcity is becoming a critical issue, especially in states like California, Texas, and Arizona. According to the U.S. Drought Monitor, 168 million Americans were living in drought-affected areas as of mid-2024. This drives demand for atmospheric water generators (AWGs) as a sustainable solution to address the growing need for potable water. AWGs are being increasingly adopted in areas where traditional water sources, such as groundwater and reservoirs, are depleting.

- Climate Impact on Groundwater and Surface Water Depletion: The National Oceanic and Atmospheric Administration (NOAA) reported that prolonged droughts and reduced rainfall in 2022 led to significant surface water depletion in the USA, particularly in the Colorado River Basin. With the rivers flow decreasing by 20% in the last decade, AWG technology offers an alternative by capturing moisture from the air. The U.S. Geological Survey (USGS) also highlights groundwater depletion in over 40 states as a major concern for water availability.

- Growing Industrialization and Urbanization (Urban Areas, Industrial Applications): Growing urbanization in U.S. cities is intensifying water shortages, particularly in industrial sectors. As populations rise and industries expand, traditional water sources are strained, prompting the need for alternatives like atmospheric water generators (AWGs). AWGs are being utilized for industrial processes such as cooling and manufacturing, offering a sustainable solution to produce large quantities of water independently from municipal supplies, helping to meet increasing urban and industrial water demands.

Market Challenges

- High Initial Investment Costs: A major barrier to adopting atmospheric water generators (AWGs) is the high upfront cost of the equipment, especially for commercial and industrial applications. The cost of these systems, along with the necessary infrastructure for large-scale deployment, presents a significant challenge for many. While government subsidies may help, the initial investment remains a notable obstacle for individual households and smaller businesses, limiting broader adoption.

- Energy Efficiency and Power Consumption Challenges: AWGs require considerable electricity to condense water from the air, which can lead to high operating costs, particularly in regions with expensive energy rates. The energy demand of these systems is a critical challenge, and ongoing efforts to enhance their efficiency are essential. Reducing power consumption is key to making AWGs more economically viable and environmentally sustainable in the long term.

USA Atmospheric Water Generator Market Future Outlook

The USA Atmospheric Water Generator market is poised for significant growth in the coming years, driven by the increasing scarcity of freshwater resources and the government's focus on clean water initiatives. Technological advancements in energy-efficient AWGs, combined with increased awareness about water scarcity in arid regions, will likely drive further market adoption. Additionally, regulatory frameworks that encourage sustainable water solutions are expected to push the adoption of AWGs across various sectors.

Market Opportunities

- Integration of Renewable Energy (Solar, Wind-Powered Systems): The integration of renewable energy, such as solar or wind, with atmospheric water generators (AWGs) offers a valuable opportunity to reduce operational costs and lower carbon emissions. Using renewable power sources enables AWGs to function independently of the electrical grid, making them a sustainable solution for remote areas. This combination of AWG technology with renewable energy enhances its environmental benefits and long-term viability.

- Expansion into Arid and Semi-Arid Regions: AWG technology holds great potential for expansion into arid and semi-arid regions where traditional water sources are limited. These areas are particularly suited for the deployment of AWGs, which can provide a reliable source of water for both residential and commercial use. The technology offers a sustainable solution to address the ongoing water challenges faced by these drought-prone regions.

Scope of the Report

|

Product Type |

Residential Commercial Industrial Portable |

|

Technology |

Cooling Condensation Wet Desiccation Hybrid Systems |

|

Application |

Residential Commercial Industrial Military |

|

Water Output Capacity |

Below 100 Liters/day 100-500 Liters/day 500-1,000 Liters/day Above 1,000 Liters/day |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Renewable Energy Companies

Industrial Water Management Companies

Hospitality Sector

Mining and Extraction Companies

Construction Companies

Government and Regulatory Bodies (EPA, US Water Partnership)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Watergen Inc.

EcoloBlue, Inc.

Drinkable Air Technologies

Dewpoint Manufacturing

SkyWater Air Water Machines

Ambient Water Corporation

Atmospheric Water Solutions (AWS)

Island Sky Corporation

Aquovum LLC

PlanetsWater Ltd.

Table of Contents

1. USA Atmospheric Water Generator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Atmospheric Water Generator)

1.4. Market Segmentation Overview (Product Type, Technology, Application)

2. USA Atmospheric Water Generator Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Technological Advancements, Policy Shifts)

3. USA Atmospheric Water Generator Market Analysis

3.1. Growth Drivers (Water Scarcity, Climate Change, Government Incentives)

3.1.1. Rising Demand for Sustainable Water Solutions

3.1.2. Climate Impact on Groundwater and Surface Water Depletion

3.1.3. Government Subsidies and Policies Supporting Clean Water Technology

3.1.4. Growing Industrialization and Urbanization (Urban Areas, Industrial Applications)

3.2. Market Challenges (Cost of Equipment, Energy Consumption, Environmental Impact)

3.2.1. High Initial Investment Costs

3.2.2. Energy Efficiency and Power Consumption Challenges

3.2.3. Limited Awareness in Remote Regions

3.2.4. Environmental Concerns Linked to Energy Usage

3.3. Opportunities (Technological Advancements, Hybrid Energy Systems)

3.3.1. Integration of Renewable Energy (Solar, Wind-Powered Systems)

3.3.2. Expansion into Arid and Semi-Arid Regions

3.3.3. Innovations in Atmospheric Water Generation for Residential Use

3.3.4. Collaboration with Government Programs for Drought Relief

3.4. Trends (Portable Units, Integration with Smart Systems)

3.4.1. Development of Portable Atmospheric Water Generators

3.4.2. Integration with Smart Monitoring Systems for Efficient Water Usage

3.4.3. Increasing Adoption in Commercial and Industrial Sectors

3.4.4. Rising Interest in Off-Grid Water Solutions

3.5. Government Regulation (Environmental Compliance, Water Safety Standards)

3.5.1. Federal Guidelines on Water Safety and Quality (EPA Standards)

3.5.2. Renewable Energy Incentives and Water Usage Regulations

3.5.3. Regional Drought Mitigation Programs

3.5.4. Public-Private Partnerships for Water Resource Management

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Government Agencies)

3.8. Porters Five Forces (Supply Chain, Bargaining Power, Competition)

3.9. Competition Ecosystem (Competitors and Emerging Players)

4. USA Atmospheric Water Generator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Residential Atmospheric Water Generators

4.1.2. Commercial Atmospheric Water Generators

4.1.3. Industrial Atmospheric Water Generators

4.1.4. Portable Atmospheric Water Generators

4.2. By Technology (In Value %)

4.2.1. Cooling Condensation Technology

4.2.2. Wet Desiccation Technology

4.2.3. Hybrid Systems (Combination Technologies)

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Military

4.4. By Water Output Capacity (In Value %)

4.4.1. Below 100 Liters per Day

4.4.2. 100-500 Liters per Day

4.4.3. 500-1,000 Liters per Day

4.4.4. Above 1,000 Liters per Day

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Atmospheric Water Generator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Watergen Inc.

5.1.2. EcoloBlue, Inc.

5.1.3. Drinkable Air Technologies

5.1.4. Dewpoint Manufacturing

5.1.5. SkyWater Air Water Machines

5.1.6. Ambient Water Corporation

5.1.7. Atmospheric Water Solutions (AWS)

5.1.8. Island Sky Corporation

5.1.9. Aquovum LLC

5.1.10. PlanetsWater Ltd.

5.1.11. Water from Air

5.1.12. Watair, Inc.

5.1.13. Genaq Technologies S.L.

5.1.14. Air2Water, Inc.

5.1.15. Ray Agua Systems

5.2. Cross Comparison Parameters (No. of Patents, Product Range, Water Output, Energy Efficiency, R&D Investment, Market Penetration, Pricing Strategy, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Atmospheric Water Generator Market Regulatory Framework

6.1. Environmental Compliance Requirements

6.2. Certification Processes for Water Safety

6.3. Energy Consumption Regulations

6.4. State-level Water Resource Management Guidelines

7. USA Atmospheric Water Generator Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Atmospheric Water Generator Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Water Output Capacity (In Value %)

8.5. By Region (In Value %)

9. USA Atmospheric Water Generator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the entire AWG market ecosystem, identifying key stakeholders such as manufacturers, suppliers, and end-users. Secondary research was conducted using proprietary databases and reliable industry reports to define market variables such as water output, energy consumption, and technology trends.

Step 2: Market Analysis and Construction

Historical market data was analyzed to establish growth patterns in the USA AWG market. Data regarding market penetration, water demand, and technology adoption were assessed to project future growth. Insights into service quality and reliability of various AWG systems were also evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through interviews with industry experts from leading AWG companies. These consultations provided practical insights into market trends, technological challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final analysis combined data from primary and secondary sources, offering a comprehensive overview of the USA AWG market. Detailed insights into product segmentation, pricing strategies, and market competition were validated through industry inputs.

Frequently Asked Questions

01. How big is the USA Atmospheric Water Generator market?

The USA AWG Market is valued at USD 204 million, driven by increasing concerns over water scarcity and the rising demand for sustainable water solutions, particularly in arid and drought-prone areas.

02. What are the challenges in the USA Atmospheric Water Generator market?

Challenges in USA AWG Market include high initial setup costs for industrial-grade AWGs, energy consumption concerns, and limited public awareness in certain regions, which can hinder market growth.

03. Who are the major players in the USA Atmospheric Water Generator market?

Key players in the USA AWG Market include Watergen Inc., EcoloBlue, Inc., Drinkable Air Technologies, Dewpoint Manufacturing, and SkyWater Air Water Machines, which dominate due to their technological innovations and extensive product offerings.

04. What are the growth drivers of the USA Atmospheric Water Generator market?

The USA AWG Market growth drivers include the increasing need for clean water in drought-affected regions, government incentives for sustainable water solutions, and technological advancements that have improved the energy efficiency of AWG systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.