USA Automated Material Handling Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD3367

October 2024

81

About the Report

USA Automated Material Handling Market Overview

- The USA Automated Material Handling market is valued at USD 17 billion, driven by the rapid adoption of automation technologies across industries such as e-commerce, manufacturing, and retail. This growth is underpinned by the increasing demand for efficient material handling systems to reduce labor costs and improve operational efficiency.

- Dominant regions within the USA, such as California, Texas, and New York, lead the market due to their advanced industrial infrastructure and high automation adoption in logistics and manufacturing. California, in particular, benefits from its strong presence in e-commerce and tech-driven industries, while Texas is a logistics hub with numerous large distribution centers.

- The Bipartisan Infrastructure Law, passed in 2022, has allocated $17 billion for the modernization of ports, roads, and bridges. This funding directly supports the deployment of automated material handling systems in key logistics hubs. Ports like New York and Los Angeles are using automated cranes and robotic systems to increase throughput and reduce congestion.

USA Automated Material Handling Market Segmentation

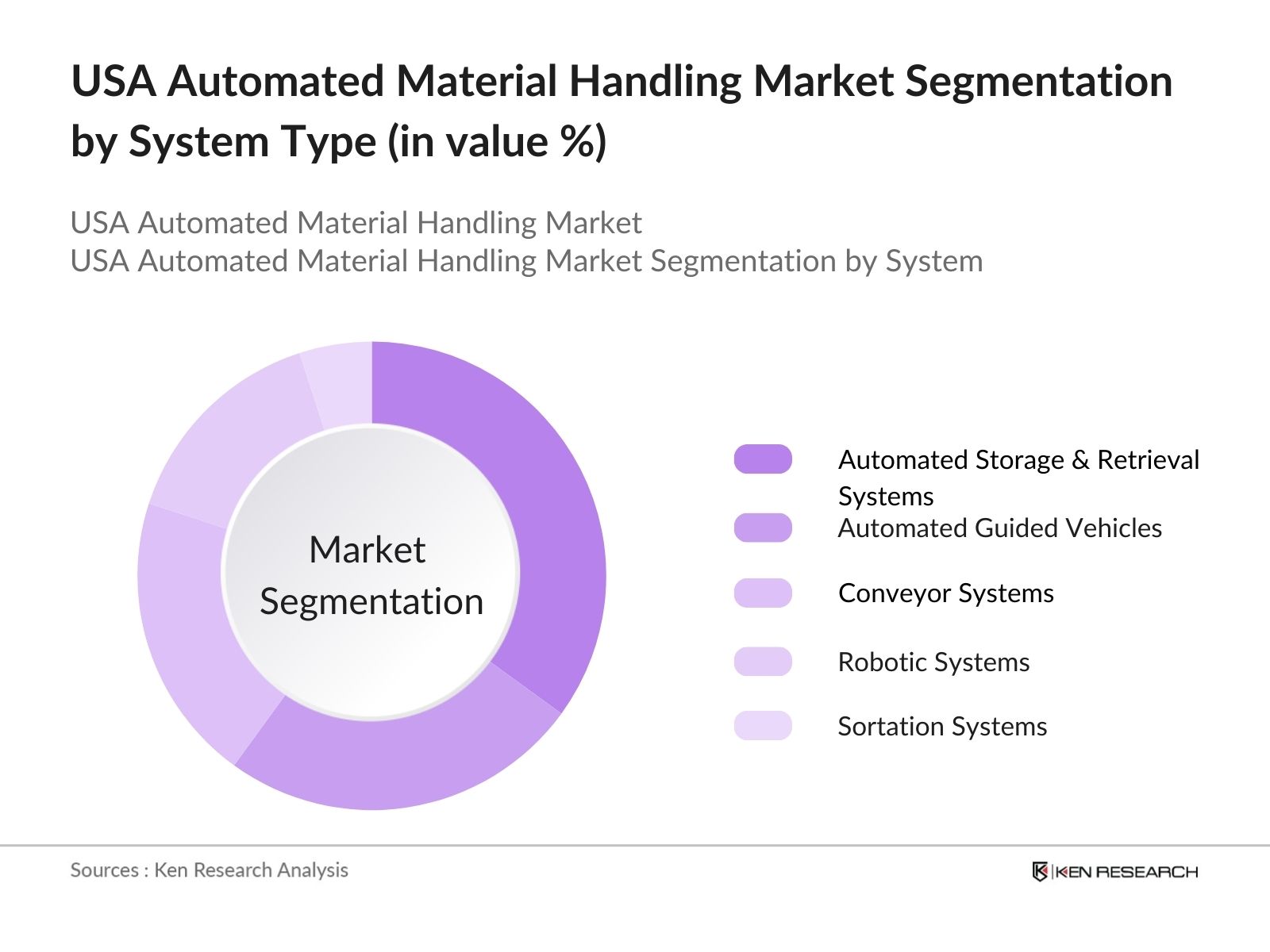

By System Type: The market is segmented by system type into Automated Storage & Retrieval Systems (ASRS), Automated Guided Vehicles (AGVs), Conveyor Systems, Robotic Systems, and Sortation Systems. Automated Storage & Retrieval Systems (ASRS) have dominated the market due to their efficiency in optimizing warehouse space and reducing human intervention in material handling tasks.

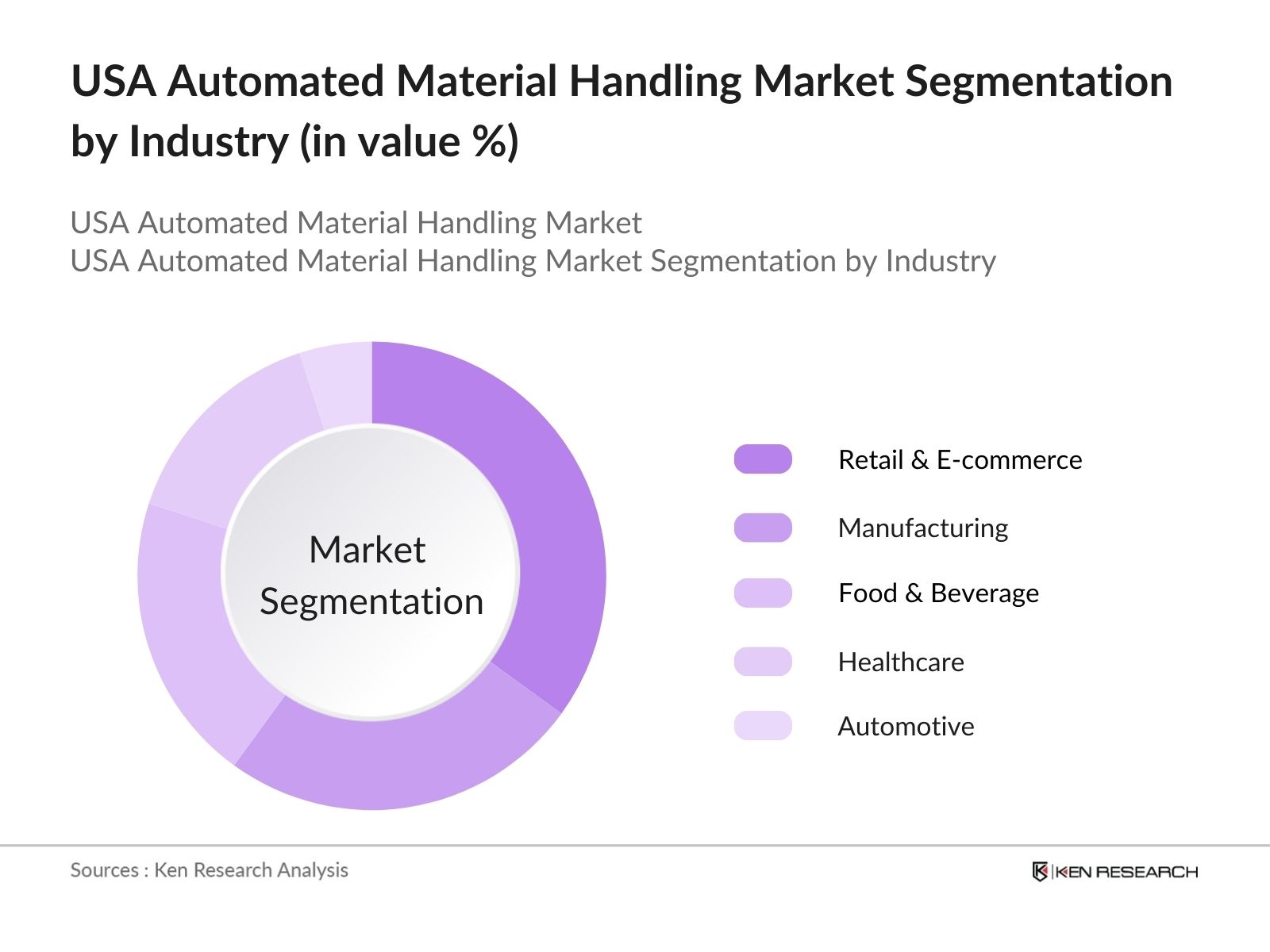

By Industry: The market is further segmented by industry into Retail & E-commerce, Manufacturing, Food & Beverage, Healthcare, and Automotive. Retail & E-commerce is the leading segment in this category, driven by the increasing need for efficient warehouse management solutions in online retail. The rise in consumer demand for fast delivery times has pushed e-commerce players to adopt automated systems, including robots and conveyor belts, to streamline order fulfillment processes.

USA Automated Material Handling Market Competitive Landscape

The market is dominated by a few key players, including Daifuku Co. Ltd, Honeywell Intelligrated, and Swisslog, which have established strong presences in the market. These companies, alongside global leaders like Toyota Industries Corporation and Dematic, have set the standard in technological innovation and efficient system implementation.

|

Company |

Establishment Year |

Headquarters |

R&D Spending |

Revenue |

System Specialization |

Global Reach |

Customer Support |

Innovation in Robotics |

|

Daifuku Co. Ltd |

1937 |

Japan |

||||||

|

Honeywell Intelligrated |

2001 |

United States |

||||||

|

Swisslog |

1900 |

Switzerland |

||||||

|

Toyota Industries |

1926 |

Japan |

||||||

|

Dematic |

1819 |

United States |

USA Automated Material Handling Market Analysis

Market Growth Drivers

- Rising E-Commerce Activities: The increase in e-commerce activities in the U.S. has been a driver for the automated material handling market. According to the U.S. Census Bureau, retail e-commerce sales in the United States reached $1.10 trillion in 2023, pushing logistics companies to adopt automated handling systems for enhanced operational efficiency. Warehouses are implementing automation solutions such as Automated Guided Vehicles (AGVs) and robotic sorting systems to manage the increasing flow of goods, reduce processing times, and ensure faster deliveries to customers.

- Labor Shortages in Logistics: The ongoing labor shortages in the U.S. logistics sector are driving the need for automation. The U.S. Bureau of Labor Statistics reports that there are over 300,000 unfilled positions in the logistics and warehousing sectors as of 2024, a trend exacerbated by an aging workforce and lack of skilled workers. To mitigate these shortages, companies are increasingly investing in automated material handling systems like robotic palletizers and conveyor belts, which enhance productivity and minimize the reliance on human labor.

- Increasing Automation in Food and Beverage Industry: The U.S. food and beverage industry has seen a substantial increase in automation as companies seek to comply with stringent health and safety standards. In 2024, the U.S. Food and Drug Administration (FDA) tightened regulations surrounding food safety, pushing companies to adopt automated material handling systems to reduce human contact and ensure sanitary handling of goods. Major food distributors have adopted automated warehouse systems, with some facilities processing 1,000 pallets per day using robotic systems.

Market Challenges

- Lack of Skilled Workforce for System Maintenance: Although automation reduces reliance on manual labor, there is a significant gap in the availability of skilled workers to maintain these systems. As of 2024, the U.S. Department of Labor reports a shortage of approximately 100,000 trained professionals in automation and robotics. The complexity of these systems requires highly trained personnel for their maintenance and repair.

- Integration Challenges with Legacy Systems: Many U.S. companies still operate legacy infrastructure in their warehouses and logistics centers, making the integration of modern automated material handling systems a challenge. The U.S. International Trade Administration (ITA) reports that nearly 30% of firms face difficulties in integrating new automated systems with their existing technology. These issues lead to inefficiencies, delays, and additional costs for companies looking to adopt automation.

USA Automated Material Handling Market Future Outlook

Over the next five years, the USA Automated Material Handling industry is projected to experience growth, driven by increased demand for automation solutions in industries such as e-commerce, manufacturing, and healthcare. The rapid technological advancements in robotics, artificial intelligence, and machine learning will further enhance the efficiency of material handling processes.

Future Market Opportunities

- Increased Adoption of Autonomous Vehicles: The next five years will see a surge in the use of autonomous vehicles for material handling, particularly in high-traffic logistics hubs. The U.S. Department of Transportation forecasts that by 2029, nearly 25% of all goods will be transported using autonomous trucks. These vehicles, equipped with advanced navigation systems, will streamline the transportation of goods across long distances, reducing delivery times and minimizing labor costs in the logistics sector.

- Integration with 5G Networks: The deployment of 5G networks across the U.S. will revolutionize the automated material handling market. The Federal Communications Commission (FCC) projects that by 2028, over 85% of logistics operations will be integrated with 5G, enabling real-time data transfer and faster decision-making in automated systems. This integration will improve communication between automated devices, reducing downtime and enhancing the overall efficiency of material handling processes in warehouses and distribution centers.

Scope of the Report

|

System Type |

Automated Storage & Retrieval Systems (ASRS) Automated Guided Vehicles (AGVs) Conveyor Systems Robotic Systems Sortation Systems |

|

Component |

Hardware Software Warehouse Control System Services |

|

Industry |

Retail and E-commerce Manufacturing Food & Beverage Healthcare Automotive |

|

Function |

Storage Transportation Assembly Sorting Packaging |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce companies

Manufacturing companies

Food & beverage industries

Government and regulatory bodies (OSHA, Department of Transportation)

Investments and venture capitalist firms

Healthcare and pharmaceutical industries

Private Equity Firms

Companies

Players Mentioned in the Report:

Daifuku Co. Ltd

Honeywell Intelligrated

Swisslog

Toyota Industries Corporation

Dematic

BEUMER Group

TGW Logistics Group

KION Group

SSI Schaefer

Knapp AG

Bastian Solutions

Vanderlande Industries

Murata Machinery

Mecalux

Jungheinrich AG

Table of Contents

1. USA Automated Material Handling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Automated Material Handling Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Automated Material Handling Market Analysis

3.1. Growth Drivers

3.1.1. Increase in e-commerce and omnichannel retailing

3.1.2. Labor shortages and rising wages in the logistics sector

3.1.3. Advances in robotic automation technologies

3.1.4. Demand for enhanced warehouse efficiency and productivity

3.2. Market Challenges

3.2.1. High initial investment costs

3.2.2. Integration with legacy systems

3.2.3. Cybersecurity risks in automated systems

3.3. Opportunities

3.3.1. Integration of AI and machine learning

3.3.2. Growth in the 3PL (third-party logistics) sector

3.3.3. Expansion into untapped industries like pharmaceuticals and healthcare

3.4. Trends

3.4.1. Adoption of Industry 4.0 technologies

3.4.2. Emergence of mobile robots and AMRs (Autonomous Mobile Robots)

3.4.3. Increase in modular and scalable solutions

3.5. Government Regulations

3.5.1. Occupational safety regulations and automation

3.5.2. Trade and import tariffs on automation equipment

3.5.3. Data privacy regulations impacting automation systems

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. USA Automated Material Handling Market Segmentation

4.1. By System Type (In Value %)

4.1.1. Automated Storage & Retrieval Systems (ASRS)

4.1.2. Automated Guided Vehicles (AGVs)

4.1.3. Conveyor Systems

4.1.4. Robotic Systems

4.1.5. Sortation Systems

4.2. By Component (In Value %)

4.2.1. Hardware (Sensors, Controllers, Motors, Actuators)

4.2.2. Software (Warehouse Management System (WMS), Warehouse Control System (WCS))

4.2.3. Services (Consulting, Maintenance, Installation)

4.3. By Industry (In Value %)

4.3.1. Retail and E-commerce

4.3.2. Manufacturing

4.3.3. Food & Beverage

4.3.4. Healthcare

4.3.5. Automotive

4.4. By Function (In Value %)

4.4.1. Storage

4.4.2. Transportation

4.4.3. Assembly

4.4.4. Sorting

4.4.5. Packaging

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. USA Automated Material Handling Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dematic

5.1.2. Daifuku Co. Ltd

5.1.3. Honeywell Intelligrated

5.1.4. Murata Machinery

5.1.5. Swisslog

5.1.6. SSI Schaefer

5.1.7. BEUMER Group

5.1.8. KION Group (Linde Material Handling)

5.1.9. Jungheinrich AG

5.1.10. Knapp AG

5.1.11. Toyota Industries Corporation

5.1.12. TGW Logistics Group

5.1.13. Mecalux

5.1.14. Vanderlande Industries

5.1.15. Bastian Solutions

5.2. Cross Comparison Parameters (Revenue, System Types, Industry Specialization, Geographic Presence, R&D Spending, Innovation Capabilities, Customer Support, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. USA Automated Material Handling Market Regulatory Framework

6.1. Safety Standards for Automation Equipment

6.2. Compliance with Environmental Regulations

6.3. Labor Laws Related to Automation

6.4. Certification Processes

7. USA Automated Material Handling Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Automated Material Handling Future Market Segmentation

8.1. By System Type (In Value %)

8.2. By Component (In Value %)

8.3. By Industry (In Value %)

8.4. By Function (In Value %)

8.5. By Region (In Value %)

9. USA Automated Material Handling Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping the major stakeholders in the USA Automated Material Handling market. This involves conducting extensive desk research to define the critical variables influencing market dynamics, such as market penetration, technological advancements, and operational efficiencies.

Step 2: Market Analysis and Construction

Historical data from reliable sources, including industry reports and government publications, is analyzed to assess the penetration of automated material handling systems. This phase includes evaluating revenue generated across various segments and examining trends shaping the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the analysis are validated through direct interviews with key industry players and experts. These insights help refine the market data and ensure that revenue projections and growth forecasts are accurate and reliable.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all the research findings, combining data-driven insights with qualitative assessments. This phase also involves engaging with top manufacturers to validate key metrics, ensuring a robust, credible final output.

Frequently Asked Questions

01. How big is the USA Automated Material Handling Market?

The USA Automated Material Handling market is valued at USD 17 billion, primarily driven by advancements in robotics and artificial intelligence, along with the growing need for efficient warehouse management systems across industries.

02. What are the challenges in the USA Automated Material Handling Market?

The main challenges in the USA Automated Material Handling market include high initial investment costs, integration issues with legacy systems, and the need for skilled labor to manage advanced technologies. Cybersecurity risks also pose a challenge as automation systems become increasingly connected.

03. Who are the major players in the USA Automated Material Handling Market?

Key players in the USA Automated Material Handling market include Daifuku Co. Ltd, Honeywell Intelligrated, Swisslog, Toyota Industries Corporation, and Dematic. These companies dominate due to their innovation in system technologies and global reach.

04. What are the growth drivers of the USA Automated Material Handling Market?

The USA Automated Material Handling market is driven by the increasing demand for warehouse automation in e-commerce, advancements in robotic technologies, and the need to improve operational efficiency across industries. Rising labor costs and shortages further push businesses toward automation.

05. What trends are shaping the USA Automated Material Handling Market?

Key trends in the USA Automated Material Handling market include the adoption of Industry 4.0 technologies, such as AI and machine learning, the use of autonomous mobile robots (AMRs), and an increasing focus on sustainability through energy-efficient material handling solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.