USA Automated Storage and Retrieval Systems Market Outlook to 2030

Region:North America

Author(s):Mukul Soni

Product Code:KROD603

July 2024

98

About the Report

USA Automated Storage and Retrieval Systems Market Overview

- In recent years, the USA automated storage and retrieval systems market has experienced substantial growth, this is reflected by the global automated storage and retrieval systems market reached a valuation of USD 8.77 billion in 2023.

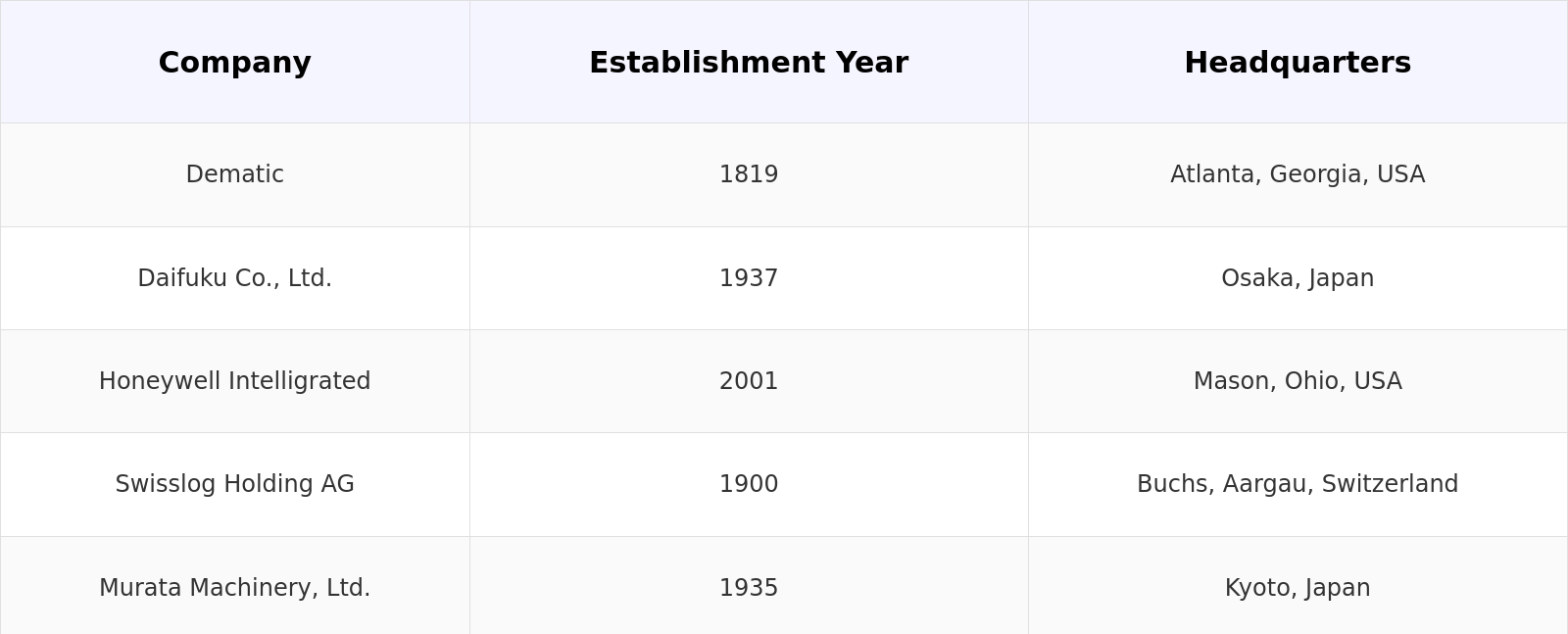

- The key players in the USA automated storage and retrieval systems market include companies such as Dematic, Daifuku Co., Ltd., Honeywell Intelligrated, Swisslog Holding AG, and Murata Machinery, Ltd. These companies are leaders in providing innovative ASRS solutions, offering a wide range of systems tailored to meet the needs of various industries.

- In 2023, Honeywell Intelligrated announced the launch of its new AI-driven ASRS solution, which significantly improves the efficiency and accuracy of order fulfillment processes. This development underscores the ongoing innovation within the market and highlights the importance of advanced technologies in driving growth.

- The state of California dominates the USA automated storage and retrieval systems market, primarily due to its large number of warehouses and distribution centres. The high demand for automation in these facilities, coupled with the state's strong technology infrastructure, has driven the widespread adoption of ASRS solutions.

USA Automated Storage and Retrieval Systems Market Segmentation

The USA automated storage and retrieval systems market can be segmented based on several factors. Like Product, Industry, and Region.

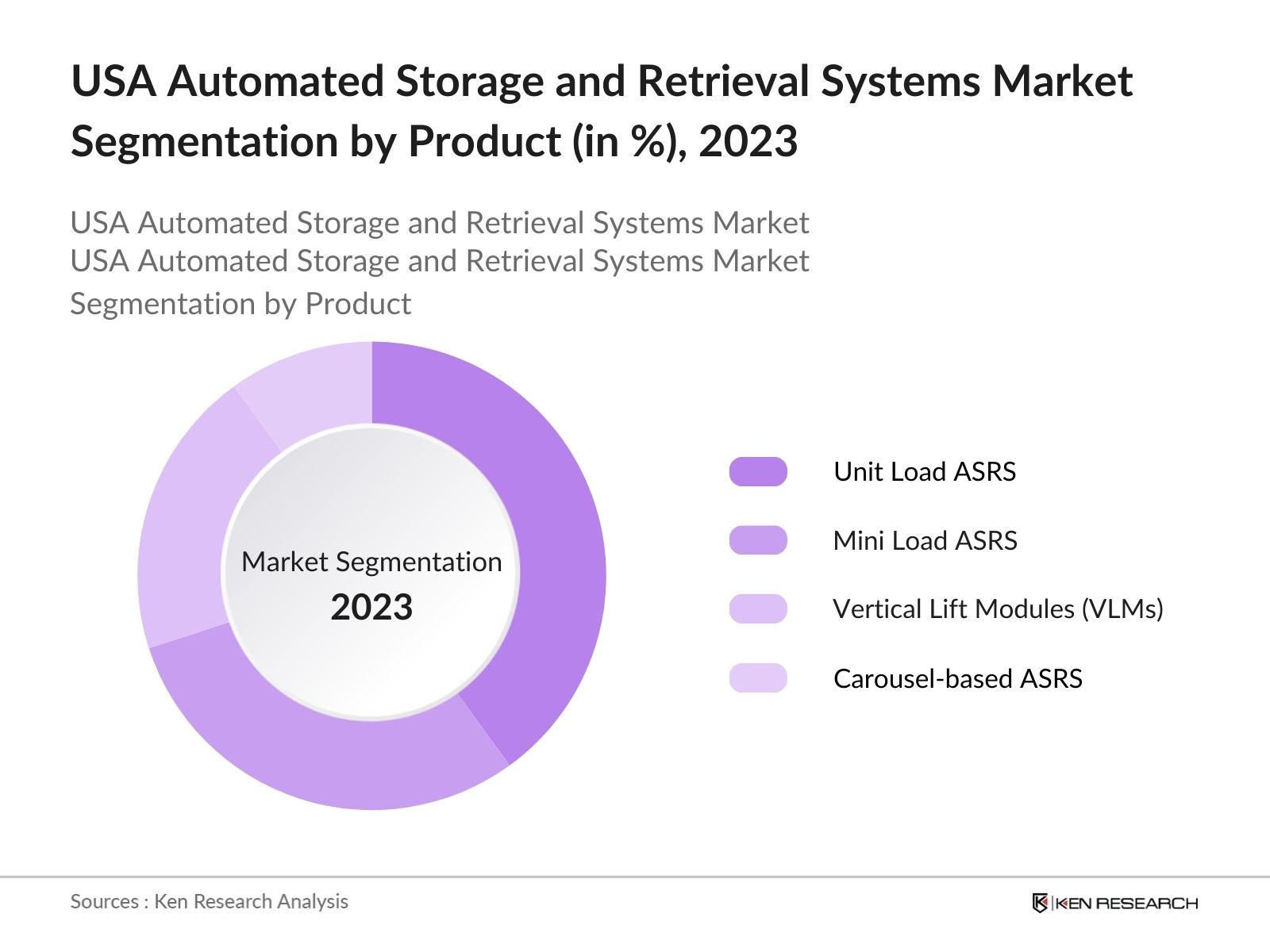

By Product Type: The USA automated storage and retrieval systems market is segmented by product type into Unit Load ASRS, Mini Load ASRS, Vertical Lift Modules (VLMs), and Carousel-based ASRS. In 2023, Unit Load ASRS dominated the market due to their ability to handle large and heavy loads, making them suitable for industries such as automotive and aerospace. These systems are designed to store and retrieve palletized loads, offering high-density storage and efficient space utilization.

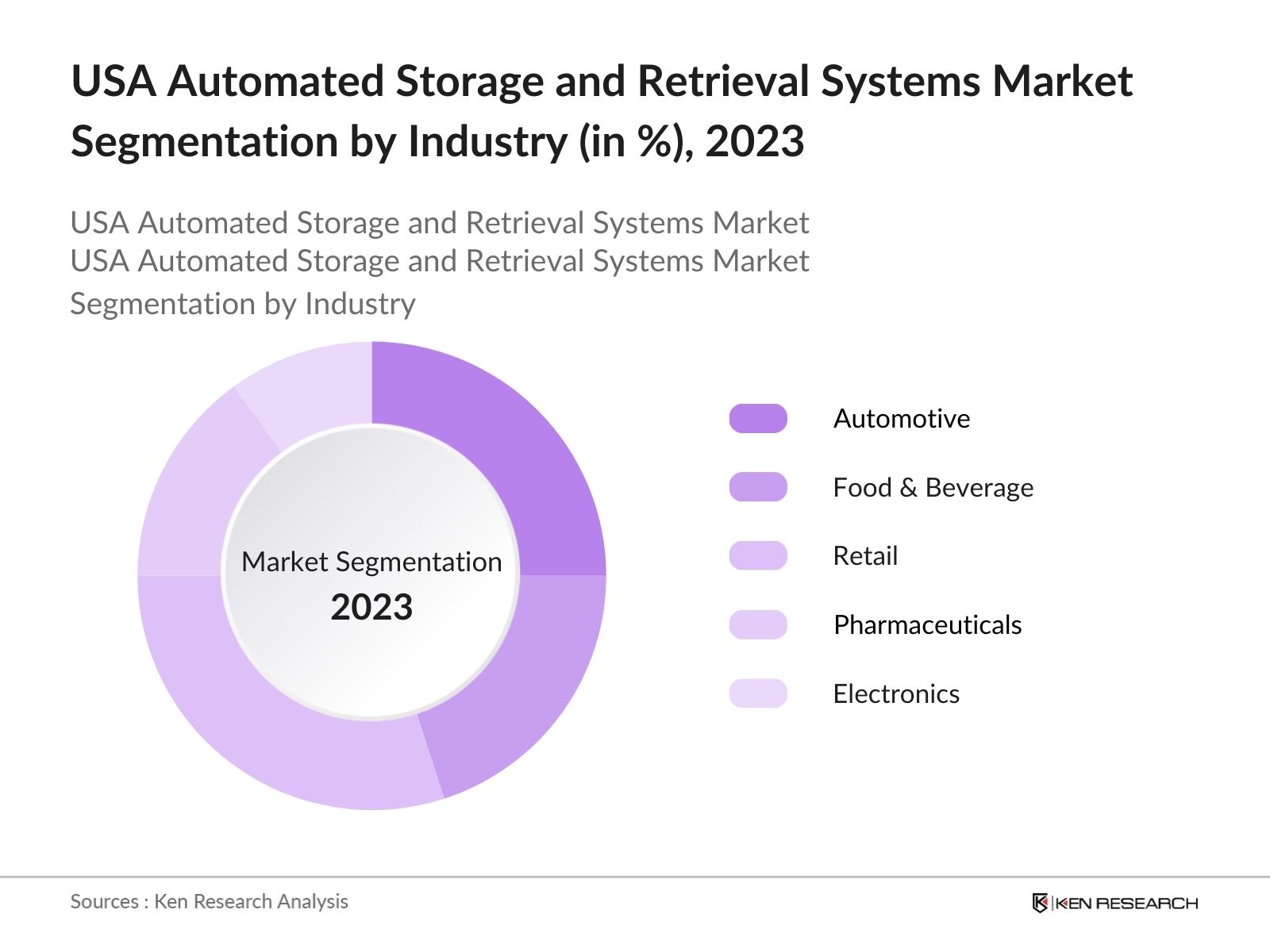

By Industry: The USA automated storage and retrieval systems market is segmented by industry into Automotive, Food & Beverage, Retail, Pharmaceuticals, and Electronics. In 2023, automotive dominated the market, driven by the need for efficient inventory management and just-in-time (JIT) manufacturing processes. ASRS systems help automotive manufacturers streamline their supply chains and reduce lead times.

By Region: The USA automated storage and retrieval systems market is segmented by region into North, South, East, and West. In 2023, north region dominated the market due to the presence of large distribution centres and manufacturing hubs. The demand for efficient storage solutions in these industrial areas has driven the adoption of automated storage and retrieval systems market

USA Automated Storage and Retrieval Systems Market Competitive Landscape

- In 2024, Murata Machinery, Ltd. introduced a new robotic ASRS system designed to handle hazardous materials in the pharmaceutical and chemical industries. This innovation addresses safety concerns and ensures compliance with regulatory requirements, showcasing the adaptability of ASRS technology.

- Swisslog Holding AG announced a partnership with Walmart company in 2023 to implement an advanced ASRS solution in their new distribution center. This initiative is part of Walmart's broader strategy to create a more resilient and transparent supply chain, with the new system aiming to handle significant volumes of orders to meet consumer demand​

USA Automated Storage and Retrieval Systems Industry Analysis

USA Automated Storage and Retrieval Systems Market Growth Drivers:

- E-commerce Expansion: The U.S. e-commerce market experienced significant growth from $281.58 billion in Q4 2021 to $299.12 billion in Q4 2022, marking an increase of 6.2%. This growth is driven by the rising demand for efficient inventory management and rapid order fulfilment, necessitating the adoption of Automated Storage and Retrieval Systems (ASRS) in e-commerce warehouses and distribution centres.

- Labor Shortages: The specific employment figure for warehousing and storage was reported at 1,771,500 in June 2024, reflecting a 2.3% decrease from June 2023. This ongoing labour shortage has accelerated the adoption of automation technologies, including ASRS, which help mitigate the impact by automating repetitive tasks and reducing the reliance on manual labour.

- Innovations in ASRS Systems: The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into ASRS systems has significantly enhanced their efficiency and accuracy. According to the U.S. National Institute of Standards and Technology (NIST), the implementation of AI in ASRS can improve order picking accuracy by up to 99.5%.

USA Automated Storage and Retrieval Systems Market Challenges:

- High Initial Investment Costs: The high upfront costs associated with implementing automated storage and retrieval systems solutions pose a significant barrier for small and medium-sized enterprises (SMEs). The average cost of installing an ASRS system ranges from USD 500,000 to USD 5 million, depending on the system's complexity and size. This substantial investment can be prohibitive for smaller businesses with limited capital.

- Integration Complexities: Integrating automated storage and retrieval systems (AS/RS) with existing warehouse management systems (WMS) and enterprise resource planning (ERP) systems can be challenging. This complexity arises due to the need for seamless communication between different software platforms, ensuring that data flows accurately and efficiently.

USA Automated Storage and Retrieval Systems Market Government Initiatives:

- Department of Energy's (DOE) Smart Manufacturing Innovation Institute: The DOE's Clean Energy Smart Manufacturing Innovation Institute (CESMII), part of the Manufacturing USA network, focuses on advancing smart manufacturing technologies, including automated storage and retrieval systems (ASRS). CESMII aims to enhance the integration of these systems into manufacturing processes to improve efficiency and reduce costs. The institute has received renewed funding, including an initial $6 million, with potential for further funding over the next four years, totalling up to $60 million when combined with industry contributions

- Advanced Manufacturing Partnership (AMP) 2.0: The U.S. government continued its AMP 2.0 program in 2024, investing USD 500 million to promote the adoption of advanced manufacturing technologies. This program supports the integration of ASRS in manufacturing facilities to improve production efficiency and supply chain management.

USA Automated Storage and Retrieval Systems Future Market Outlook

The USA automated storage and retrieval systems market is expected to grow significantly by 2028, along with a respectable CAGR during the period of 2023-2028, driven by increasing technological advancements and expansion of e-commerce.

Future Market Trends:

- Increased Adoption of AI and Machine Learning: Over the next five years, the integration of AI and machine learning in ASRS systems is expected to become more widespread. These technologies will enable predictive maintenance, optimizing system performance and reducing downtime. According to a report by NIST, AI-driven ASRS solutions are projected to substantially reduce operational costs by 2028.

- Growth in Omnichannel Retailing: The rise of omnichannel retailing will drive the adoption of ASRS systems in fulfilment centres. Retailers are increasingly investing in ASRS to manage inventory across multiple channels and ensure quick and accurate order fulfilment. The U.S. Census Bureau projects a significant increase in the number of omnichannel retailers using ASRS by 2028, driven by the need for seamless integration of online and offline sales channels.

Scope of the Report

|

By Product Type |

Unit Load ASRS Mini Load ASRS Vertical Lift Modules (VLMs) Carousel-based ASRS |

|

By Industry |

Automotive Food & Beverage Retail Pharmaceuticals Electronics |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by subscribing this report:

Warehouse and Distribution Centres

E-commerce Companies

Manufacturing Companies

Logistics Service Providers

Retail Chains

Government Agencies (e.g., U.S. Department of Commerce)

Investment and Venture Capitalist Firms

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Dematic

Daifuku Co., Ltd.

Honeywell Intelligrated

Swisslog Holding AG

Murata Machinery, Ltd.

SSI Schaefer

Vanderlande Industries

Bastian Solutions

Mecalux

System Logistics

Beumer Group

Kardex Group

Knapp AG

Westfalia Technologies, Inc.

Automha

TGW Logistics Group

Toyota Advanced Logistics

Table of Contents

1. USA Automated Storage and Retrieval Systems Market Overview

1.1 USA Automated Storage and Retrieval Systems Market Taxonomy

2. USA Automated Storage and Retrieval Systems Market Size (in USD Bn), 2018-2023

3. USA Automated Storage and Retrieval Systems Market Analysis

3.1 USA Automated Storage and Retrieval Systems Market Growth Drivers

3.2 USA Automated Storage and Retrieval Systems Market Challenges and Issues

3.3 USA Automated Storage and Retrieval Systems Market Trends and Development

3.4 USA Automated Storage and Retrieval Systems Market Government Regulation

3.5 USA Automated Storage and Retrieval Systems Market SWOT Analysis

3.6 USA Automated Storage and Retrieval Systems Market Stake Ecosystem

3.7 USA Automated Storage and Retrieval Systems Market Competition Ecosystem

4. USA Automated Storage and Retrieval Systems Market Segmentation, 2023

4.1 USA Automated Storage and Retrieval Systems Market Segmentation by Product Type (in value %), 2023

4.2 USA Automated Storage and Retrieval Systems Market Segmentation by Industry (in value %), 2023

4.3 USA Automated Storage and Retrieval Systems Market Segmentation by Region (in value %), 2023

5. USA Automated Storage and Retrieval Systems Market Competition Benchmarking

5.1 USA Automated Storage and Retrieval Systems Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters, and advanced analytics)

6. USA Automated Storage and Retrieval Systems Future Market Size (in USD Bn), 2023-2028

7. USA Automated Storage and Retrieval Systems Future Market Segmentation, 2028

7.1 USA Automated Storage and Retrieval Systems Market Segmentation by Product Type (in value %), 2028

7.2 USA Automated Storage and Retrieval Systems Market Segmentation by Industry (in value %), 2028

7.3 USA Automated Storage and Retrieval Systems Market Segmentation by Region (in value %), 2028

8. USA Automated Storage and Retrieval Systems Market Analysts’ Recommendations

8.1 USA Automated Storage and Retrieval Systems Market TAM/SAM/SOM Analysis

8.2 USA Automated Storage and Retrieval Systems Market Customer Cohort Analysis

8.3 USA Automated Storage and Retrieval Systems Market Marketing Initiatives

8.4 USA Automated Storage and Retrieval Systems Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

01 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

02 Market Building:

Collating statistics on the USA Automated Storage and Retrieval Systems (ASRS) Market over the years, analyzing the penetration of ASRS solutions in various industries, and computing revenue generated for the USA Automated Storage and Retrieval Systems (ASRS) Industry. Reviewing service quality statistics and operational efficiency metrics to ensure the accuracy of the data points shared.

03 Validating and Finalizing:

Building market hypotheses and conducting CATIs (Computer-Assisted Telephone Interviews) with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

04 Research Output:

Our team will approach multiple ASRS industry companies to understand the nature of product segments, sales, consumer preferences, and other parameters. This approach will help validate the statistics derived through a bottom-to-top approach from ASRS industry companies.

Frequently Asked Questions

01. How big is the USA Automated Storage and Retrieval Systems Market?

In recent years, the USA automated storage and retrieval systems market has experienced substantial growth, this is reflected by the global automated storage and retrieval systems market reached a valuation of USD 8.77 billion in 2023

02. What are the challenges in the USA Automated Storage and Retrieval Systems Market?

Challenges in the USA automated storage and retrieval systems market include high initial investment costs, integration complexities with existing systems, maintenance and downtime issues, and a skill gap in the workforce. These factors can hinder the adoption and efficient use of ASRS solutions.

03. Who are the major players in the USA Automated Storage and Retrieval Systems Market?

Key players in the USA automated storage and retrieval systems market include Dematic, Daifuku Co., Ltd., Honeywell Intelligrated, Swisslog Holding AG, and Murata Machinery, Ltd. These companies lead the market due to their innovative solutions, extensive product portfolios, and strong customer relationships.

04. What are the growth drivers of the USA Automated Storage and Retrieval Systems Market?

The USA automated storage and retrieval systems market is driven by the exponential growth of e-commerce, labor shortages, rising warehousing costs, and technological advancements. The adoption of AI and machine learning, along with the integration of autonomous mobile robots, is also propelling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.