USA Automotive Infotainment Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD2570

November 2024

88

About the Report

USA Automotive Infotainment Market Overview

- The USA Automotive Infotainment market is valued at USD 3.5 billion, according to credible industry sources. The market is primarily driven by increasing consumer demand for in-car connectivity, entertainment systems, and safety solutions that utilize advanced technologies such as 5G, IoT, and AI. The rising integration of voice-activated assistants and over-the-air (OTA) updates also contribute to the robust demand for infotainment systems, allowing manufacturers to enhance the driving experience while improving customer satisfaction and retention.

- Several cities and regions dominate the automotive infotainment market due to their established automotive industries and innovation hubs. Cities such as Detroit, Michigan, and Silicon Valley, California, play a significant role, with Detroit being home to leading automotive manufacturers and Silicon Valley contributing to technological advancements in software and AI integration. These regions excel because of their strong ecosystem of automotive OEMs, software developers, and high-tech research facilities.

- The National Highway Traffic Safety Administration (NHTSA) has updated its 5-Star Safety Ratings Program for 2023, aiming to enhance vehicle safety by incorporating more rigorous crash tests and evaluation procedures. The initiative includes assessing advanced driver assistance systems (ADAS) such as automatic emergency braking and lane-keeping assistance. This helps consumers make informed decisions about vehicle safety while encouraging automakers to integrate safer technologies into their designs.

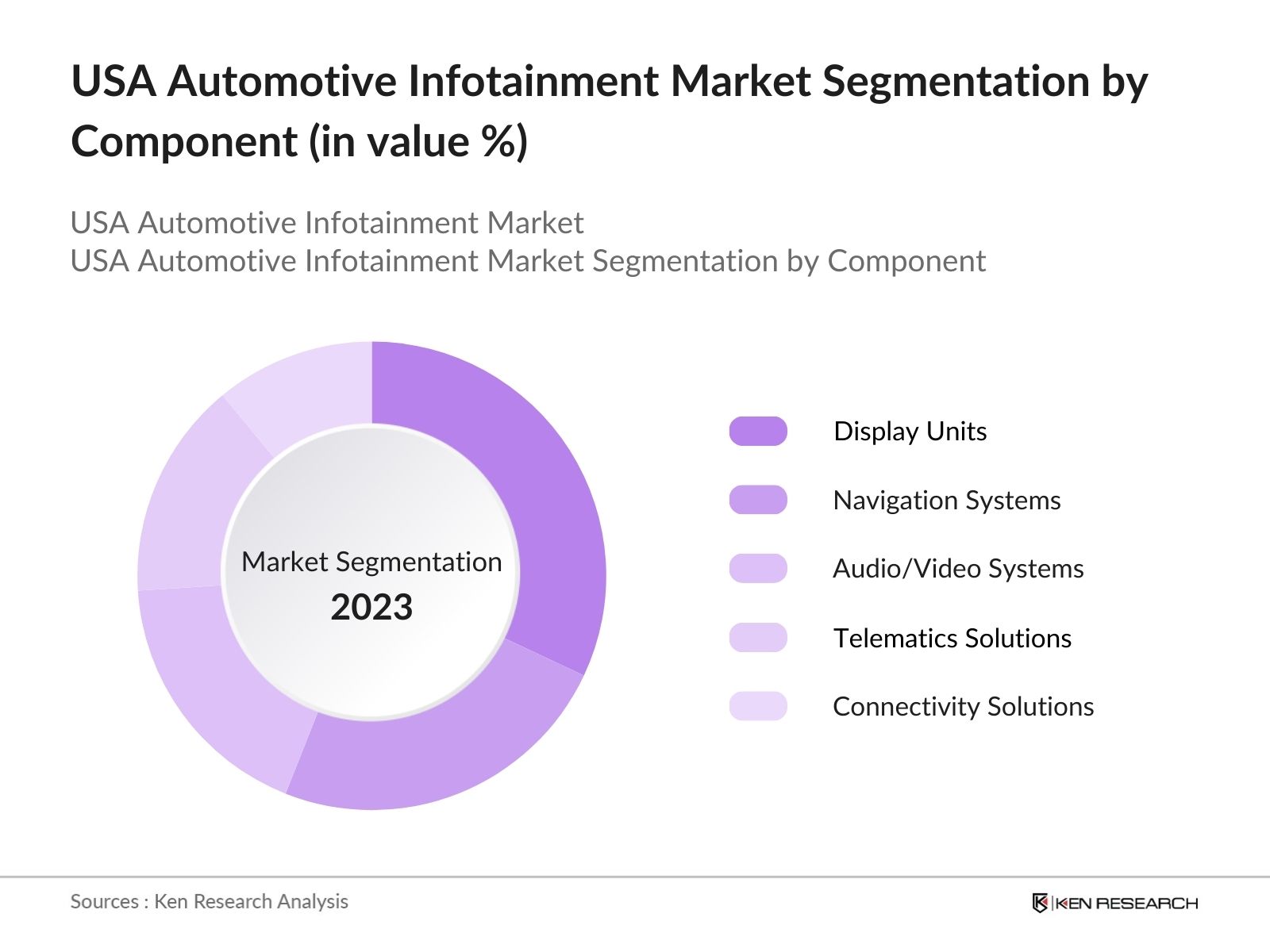

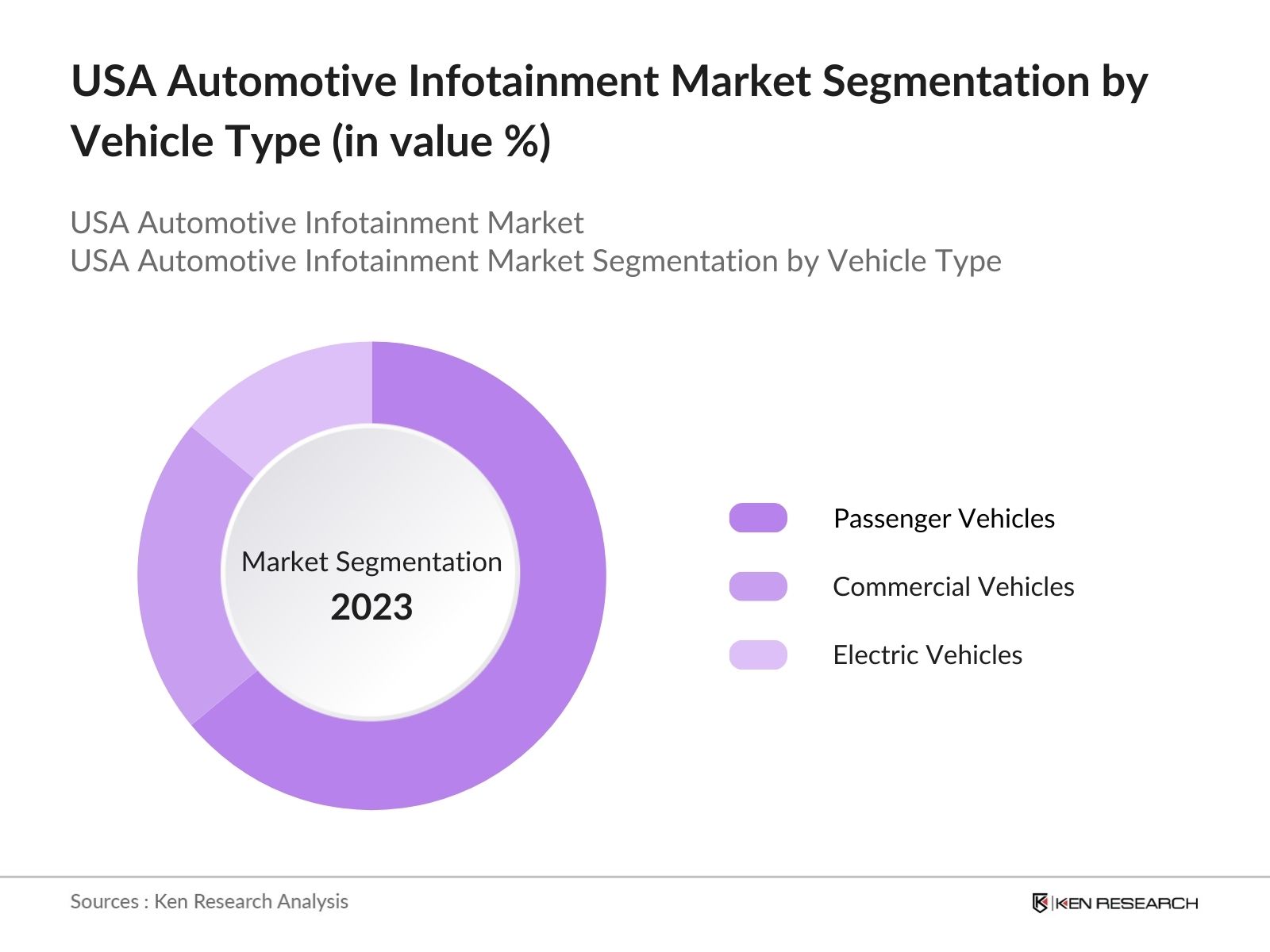

USA Automotive Infotainment Market Segmentation

By Component: The USA Automotive Infotainment market is segmented by component into display units, navigation systems, audio/video systems, telematics solutions, and connectivity solutions. Display units hold a dominant market share due to their evolving role in enhancing user interface and safety through advanced heads-up displays (HUDs) and digital dashboards. The shift towards electric and autonomous vehicles has further increased the demand for large, high-resolution displays integrated with real-time data, which enhances driver experience.

By Vehicle Type: The USA Automotive Infotainment market is segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles (EVs). Passenger vehicles dominate this segment because of the increasing consumer focus on enhanced driving experience, convenience, and the growing integration of infotainment features such as music streaming, voice commands, and navigational aids. The rise in demand for luxury vehicles with high-end infotainment systems is also contributing to this dominance.

USA Automotive Infotainment Market Competitive Landscape

The USA Automotive Infotainment market is dominated by several major players who have established themselves through innovation, strategic partnerships, and strong distribution networks. Global brands such as Harman International and Panasonic Corporation hold substantial influence over the market, while companies like Visteon Corporation and Aptiv PLC are gaining traction through technology advancements in autonomous driving systems and connected vehicle platforms.

|

Company Name |

Established |

Headquarters |

Technology Focus |

Strategic Partnerships |

Annual Revenue (USD) |

Infotainment Units Shipped |

Innovation Initiatives |

Number of Patents |

Global Presence |

|

Panasonic Corporation |

1918 |

Osaka, Japan |

Partnerships with OEMs |

62 billion |

10 million |

Advanced AI |

500 |

Global |

|

|

Harman International |

1980 |

Stamford, U.S. |

Partnered with Samsung |

8 billion |

15 million |

Voice Assistance |

300 |

Global |

|

|

Continental AG |

1871 |

Hanover, Germany |

Collaborations with OEMs |

40 billion |

12 million |

5G Integration |

200 |

Global |

|

|

Bosch Group |

1886 |

Gerlingen, Germany |

Connectivity |

AI Partnerships |

70 billion |

18 million |

Autonomous Driving |

400 |

Global |

|

Tesla, Inc. |

2003 |

Palo Alto, U.S. |

Full-Stack Software |

Own Proprietary Systems |

81 billion |

5 million |

OTA Updates |

100 |

U.S. Focused |

USA Automotive Infotainment Industry Analysis

Growth Drivers

- Technological Integration (5G, AI, IoT): Technological advancements, particularly the integration of 5G, AI, and IoT, are transforming the automotive infotainment landscape. With the rollout of 5G networks covering more than 50% of urban areas in the USA, high-speed data transfer enables real-time updates, enhanced GPS navigation, and interactive applications. AI-driven personalization is increasingly being incorporated into infotainment systems, optimizing user preferences based on behavioral patterns. IoT devices integrated within vehicles provide seamless communication between external and in-car devices, further boosting the infotainment ecosystem's potential in 2024.

- Increasing Demand for In-Car Connectivity: The demand for enhanced infotainment systems is driven by consumer preferences for intuitive interfaces, such as the Uconnect and Kia UVO systems, which offer seamless smartphone integration and personalization options. The rise of voice assistance technologies like Amazon Alexa and Google Assistant is also boosting user engagement. Automakers are integrating larger, high-resolution screens, like Cadillacs 38-inch OLED display, to improve vehicle functionality and consumer satisfaction. These advancements highlight the increasing demand for user-friendly, tech-forward in-car systems.

- Integration Complexity: The complexity of integrating various components such as AI, IoT, and 5G into a cohesive infotainment system poses a challenge for automakers. Many manufacturers are struggling to harmonize these systems across different models and platforms, leading to system failures and glitches. According to the J.D. Power 2023 U.S. Multimedia Quality and Satisfaction Study, vehicle infotainment issues account for25% of all multimedia problems, making it a significant area of concern for consumers.

Market Restraints

- High System Costs: The high cost of advanced infotainment systems remains a significant challenge, especially for mid-tier and economy vehicles. Premium features like augmented reality heads-up displays and advanced audio systems increase vehicle prices, making these systems less accessible. Additionally, the complexity of installing these systems further drives up assembly costs, limiting their adoption across budget models. As a result, manufacturers face difficulties in balancing innovation with affordability.

- Cybersecurity Risks: With increasing vehicle connectivity, cybersecurity concerns have grown. Infotainment systems in modern vehicles are vulnerable to cyber-attacks, which pose significant risks to driver safety. These threats highlight the need for robust cybersecurity measures in vehicles, hindering seamless integration of advanced infotainment technologies.

USA Automotive Infotainment Market Future Outlook

Over the next five years, the USA Automotive Infotainment market is expected to witness robust growth, fueled by advancements in autonomous driving technology, increasing adoption of electric vehicles, and heightened consumer demand for advanced in-car connectivity. Government initiatives focusing on vehicle safety and emission reduction are likely to drive further investments in infotainment systems that promote driver and passenger convenience while maintaining compliance with stringent regulations. Additionally, the integration of artificial intelligence and 5G technology will unlock new opportunities for real-time services and improved data management within vehicles.

Market Opportunities

- Growing Demand for Cloud-Based Services: The demand for cloud-based services in automotive infotainment is growing rapidly, enabling real-time data sharing, software updates, and improved navigation. Automakers are increasingly leveraging cloud technology for over-the-air updates, which reduces the need for physical maintenance and allows for better user experiences. This trend opens up significant opportunities for automakers and service providers to collaborate on cloud-based solutions that enhance vehicle functionality and infotainment systems.

- Collaborations with OEMs: Collaborations between infotainment providers and original equipment manufacturers (OEMs) are becoming key drivers of innovation in the market. Automakers are working with tech firms to develop advanced infotainment systems with better user interfaces, connectivity, and AI-driven personalization tools. These partnerships are contributing to a highly competitive market for next-generation in-car technologies.

Scope of the Report

|

Component |

Display Units Navigation Systems Audio/Video Systems Telematics Solutions Connectivity Solutions |

|

Vehicle Type |

Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) |

|

Operating System |

Android Automotive OS Linux-Based Systems Apple CarPlay QNX |

|

Connectivity |

Bluetooth Wi-Fi 4G/5G Connectivity |

|

Distribution Channel |

OEMs Aftermarket |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Component Suppliers

Telematics Service Providers

Technology Solution Providers

Automotive Dealerships

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (NHTSA, FCC)

Electric Vehicle (EV) Manufacturers

Companies

Major Players

Harman International

Panasonic Corporation

Visteon Corporation

Continental AG

Aptiv PLC

Bosch Group

Alpine Electronics

Denso Corporation

Pioneer Corporation

Clarion (Faurecia)

JVCKenwood Corporation

Sony Corporation

Garmin Ltd.

Mitsubishi Electric

NXP Semiconductors

Table of Contents

1. USA Automotive Infotainment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Automotive Infotainment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Automotive Infotainment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for In-Car Connectivity

3.1.2. Rise of Electric Vehicles and Autonomous Driving

3.1.3. Technological Integration (5G, AI, IoT)

3.1.4. Enhanced Consumer Experience Demands

3.2. Market Restraints

3.2.1. High System Costs

3.2.2. Cybersecurity Risks

3.2.3. Integration Complexity

3.3. Opportunities

3.3.1. Growing Demand for Cloud-Based Services

3.3.2. Collaborations with OEMs

3.3.3. Expanding Consumer Demand for Personalized Services

3.4. Trends

3.4.1. Integration of Voice Assistance (Amazon Alexa, Google Assistant)

3.4.2. Adoption of Over-the-Air (OTA) Updates

3.4.3. In-Vehicle Infotainment as a Subscription Service

3.5. Government Regulation

3.5.1. Regulatory Policies on Data Privacy

3.5.2. Automotive Safety Regulations

3.5.3. Emission Standards Influencing Infotainment Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, OEMs, Consumers)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. USA Automotive Infotainment Market Segmentation

4.1. By Component (In Value %)

4.1.1. Display Units

4.1.2. Navigation Systems

4.1.3. Audio/Video Systems

4.1.4. Telematics Solutions

4.1.5. Connectivity Solutions

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles (EVs)

4.3. By Operating System (In Value %)

4.3.1. Android Automotive OS

4.3.2. Linux-Based Systems

4.3.3. Apple CarPlay

4.3.4. QNX

4.4. By Connectivity (In Value %)

4.4.1. Bluetooth

4.4.2. Wi-Fi

4.4.3. 4G/5G Connectivity

4.5. By Distribution Channel (In Value %)

4.5.1. OEMs

4.5.2. Aftermarket

5. USA Automotive Infotainment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Panasonic Corporation

5.1.2. Harman International (Samsung)

5.1.3. Continental AG

5.1.4. Bosch Group

5.1.5. Alpine Electronics

5.1.6. Denso Corporation

5.1.7. Pioneer Corporation

5.1.8. Aptiv PLC

5.1.9. Clarion (Faurecia)

5.1.10. JVCKenwood Corporation

5.1.11. Visteon Corporation

5.1.12. Sony Corporation

5.1.13. Garmin Ltd.

5.1.14. Mitsubishi Electric

5.1.15. NXP Semiconductors

5.2. Cross Comparison Parameters (Inception Year, Revenue, Market Share, No. of Products, Tech Innovations, Partnerships, Regional Presence, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Partnership and Collaboration Strategy

5.8. Government Incentives for Innovation

6. USA Automotive Infotainment Market Regulatory Framework

6.1. National Highway Traffic Safety Administration (NHTSA) Guidelines

6.2. Federal Communications Commission (FCC) Regulations on Connectivity

6.3. Data Privacy Regulations (CCPA, GDPR Compliance)

6.4. Automotive Industry Standards (SAE)

7. USA Automotive Infotainment Market Future Projections (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Automotive Infotainment Market Future Segmentation

8.1. By Component (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Operating System (In Value %)

8.4. By Connectivity (In Value %)

8.5. By Distribution Channel (In Value %)

9. USA Automotive Infotainment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Recommendations for OEMs and Suppliers

9.3. Market Positioning Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involved mapping the entire automotive infotainment ecosystem in the USA, identifying key variables like market growth, technology adoption, and end-user preferences. The research team used industry reports, proprietary databases, and public sources to gather relevant information.

Step 2: Market Analysis and Construction

Historical data were analyzed to assess key trends in the USA Automotive Infotainment market, focusing on the role of technological developments and consumer demand. This phase also included evaluating market penetration and growth of infotainment systems across different vehicle types.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from OEMs, component suppliers, and technology providers were consulted through telephone interviews and surveys. This consultation was instrumental in validating market hypotheses and providing insights into the current market scenario.

Step 4: Research Synthesis and Final Output

The final phase involved a detailed synthesis of data, incorporating inputs from industry stakeholders. The result was a comprehensive report detailing the current and future market trends, growth opportunities, and key challenges in the USA Automotive Infotainment market.

Frequently Asked Questions

01. How big is the USA Automotive Infotainment Market?

The USA Automotive Infotainment Market is valued at USD 3.5 billion, driven by rising demand for in-car connectivity, safety features, and entertainment solutions.

02. What are the challenges in the USA Automotive Infotainment Market?

Challenges in USA Automotive Infotainment Market include high system costs, cybersecurity risks, and complexity in integrating advanced infotainment systems with existing vehicle platforms.

03. Who are the major players in the USA Automotive Infotainment Market?

Major players in USA Automotive Infotainment Market include Harman International, Panasonic Corporation, Visteon Corporation, Continental AG, and Aptiv PLC, dominating due to their technological advancements and partnerships with leading OEMs.

04. What are the growth drivers of the USA Automotive Infotainment Market?

Key growth drivers in USA Automotive Infotainment Market include the rise of electric vehicles, advancements in autonomous driving technology, and increasing consumer demand for connected car experiences and infotainment solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.